Unlocking the potential of DSCR loans for investment properties is crucial for savvy real estate investors. These specialized loans, designed to measure a property’s cash flow against its debt obligations, offer unique advantages and considerations compared to conventional financing methods.

Understanding the nuances of DSCR loans, from calculating the Debt Service Coverage Ratio to meeting eligibility criteria, can significantly impact your investment strategy. Dive into our comprehensive guide to master the intricacies and maximize your chances of loan approval.

Understanding DSCR Loans for Investment Properties

Definition and Purpose of DSCR Loans

Debt Service Coverage Ratio (DSCR) loans are an alternative financing option designed specifically for real estate investors. Unlike conventional loans that focus on the borrower’s personal financial situation, DSCR loans are underwritten based on the projected cash flow of the property. This means that the income generated by the property is the primary factor in determining loan eligibility.

For investors aiming to purchase rental properties, DSCR loans can be particularly attractive. They offer a streamlined application process, emphasizing the cash flow of the investment property rather than requiring extensive documentation of personal income.

Why is this significant? In traditional financing, personal income and employment history are heavily scrutinized. DSCR loans, however, bypass this, focusing solely on the property’s ability to cover its debt obligations. This approach can be particularly beneficial for investors who may have irregular income streams or who prefer to separate their personal finances from their investment activities.

“DSCR loans are tailored to meet the needs of investors, focusing on property income rather than personal finances,” a real estate financing expert notes.

DSCR loans are intended for rental properties, covering both short-term and long-term rentals. They can also be used to construct new properties or renovate existing ones, making them a versatile option for a variety of investment strategies.

- Projected Cash Flow: The primary qualifying factor for DSCR loans is the income potential of the property.

- Rental Properties: Both new construction and existing rental properties can qualify.

- Flexible Use: DSCR loans can be used for purchasing, renovating, or constructing rental properties.

Ultimately, the purpose of DSCR loans is to provide real estate investors with a financing option that aligns with their unique needs and business models, allowing them to focus on the cash flow potential of their properties.

Key Features of DSCR Loans

What distinguishes DSCR loans from other financing options? A key feature is that they do not require income verification. This means borrowers do not need to provide tax returns, pay stubs, or employment information to qualify.

Furthermore, DSCR loans allow for flexibility in the types of properties that can be financed. Whether it’s a single-family home, a multi-family property, or even a commercial rental, as long as the property generates sufficient income to cover its debt obligations, it can qualify for a DSCR loan.

Another notable feature is the absence of a limit on the number of loans an investor can take out. Conventional loans often impose such limits, but DSCR loans enable investors to expand their portfolios more freely.

- No Income Verification: Streamlined process without the need for personal financial documentation.

- Diverse Property Types: Applicable to various types of rental properties.

- No Limit on Loans: Investors can obtain multiple DSCR loans, facilitating portfolio expansion.

The underwriting process of a DSCR loan is also worth mentioning. Because it focuses on property-level cash flow, the approval process can be faster and less cumbersome compared to traditional loans.

“DSCR loans expedite the financing process, allowing investors to act quickly in competitive markets,” says a leading DSCR lender.

These characteristics make DSCR loans an attractive option for investors seeking quick, flexible financing solutions that are aligned with their investment goals.

Differences Between DSCR Loans and Conventional Loans

How do DSCR loans stand apart from conventional loans? The primary distinction lies in the qualifying criteria. While conventional loans require detailed documentation of the borrower’s financial history, DSCR loans focus on the property’s income potential.

This fundamental difference means that DSCR loans do not necessitate employment verification. For many investors, particularly those who are self-employed or have variable income streams, this can be a significant advantage.

Additionally, conventional loans often have limits on the number of rental properties an individual can finance. In contrast, DSCR loans offer greater flexibility in this regard, making them ideal for investors looking to grow their portfolios without such constraints.

- Qualifying Criteria: Conventional loans require personal income verification, whereas DSCR loans focus on property income.

- Employment Verification: DSCR loans do not require proof of employment, streamlining the application process.

- Loan Limits: Conventional loans impose limits on the number of financed properties; DSCR loans generally do not.

The speed of the approval process is another difference. DSCR loans often have shorter closing times due to reduced documentation requirements. This can be crucial in a competitive real estate market, where access to timely financing can make or break an investment opportunity.

“For real estate investors, the ability to quickly secure financing is critical,” explains an experienced broker. “DSCR loans facilitate this by simplifying the approval process.”

Furthermore, DSCR loans can be used for various purposes beyond purchasing rental properties, such as renovating or constructing new properties. This versatility is not always available with conventional loans, which can be more restrictive in their approved uses.

It is crucial to note that, the key differences between DSCR loans and conventional loans revolve around qualifying criteria, documentation requirements, and flexibility in loan usage—all of which can significantly impact an investor’s financing strategy.

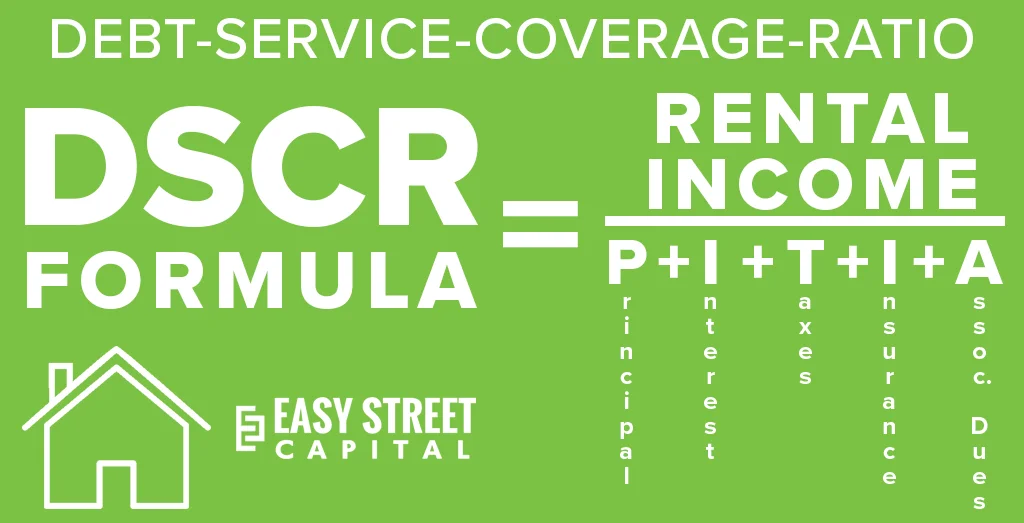

Calculating the Debt Service Coverage Ratio (DSCR)

Steps to Calculate DSCR

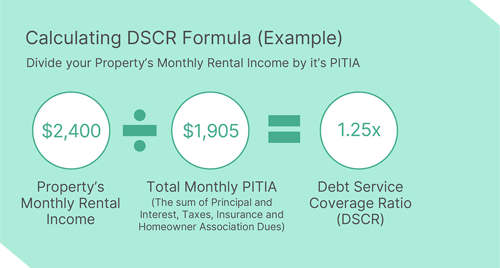

To effectively calculate the Debt Service Coverage Ratio (DSCR), begin by identifying the annual net rental income of the property. This net income is the property’s total rental revenue minus operational expenses, excluding debt obligations such as loan payments.

Next, determine the annual debt obligations associated with the property. These obligations typically include principal, interest, taxes, insurance (often abbreviated as PITI), and any association dues like HOA fees.

Once these figures are obtained, use the following formula to calculate the DSCR:

DSCR = Annual Net Rental Income / Annual Debt Obligations

For instance, if a rental property generates $50,000 in annual net rental income and has $40,000 in annual debt obligations, the calculation would be:

DSCR = $50,000 / $40,000 = 1.25

This ratio of 1.25 indicates that the property generates 25% more income than what is needed to cover its debt payments.

To further illustrate, consider Joe, a real estate investor. He found a property projected to bring in $65,000 in annual gross income. His debt obligations amount to $31,861 annually.

By applying the DSCR formula:

DSCR = $65,000 / $31,861 = 2.04

This ratio of 2.04 signifies that the property generates more than twice the income needed to cover its debt, indicating strong financial health.

- Gather Net Rental Income: Identify the total annual income minus operational expenses.

- Calculate Annual Debt Obligations: Sum up all debt-related expenses, including PITI and HOA fees.

- Apply the DSCR Formula: Divide the net rental income by the annual debt obligations.

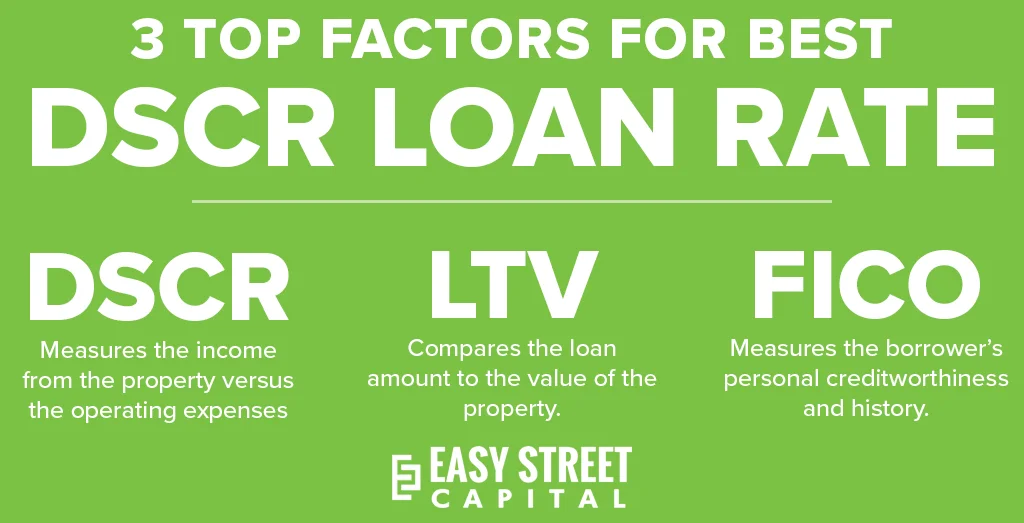

Importance of DSCR in Loan Approval

The DSCR is a crucial metric for lenders as it provides insight into a property’s ability to generate sufficient cash flow to cover its debt obligations. A higher DSCR indicates a lower risk to lenders, as it shows that the property can comfortably handle its debt payments.

Lenders rely heavily on the DSCR to assess the creditworthiness of a borrower. They typically look for a minimum DSCR of between 1.2 and 1.25, ensuring that there’s a cushion to cover unexpected expenses or vacancies.

A higher DSCR often translates to more favorable loan terms. For instance, a DSCR of 2.0 is considered very strong, potentially leading to lower interest rates and less stringent qualification requirements. This can make a significant difference in the overall cost and terms of borrowing.

“A debt service coverage ratio higher than 1.0 shows that a property is making money and can pay its debts.”

Investors with higher DSCRs may also experience advantages when negotiating loan terms. Lenders are likely to offer better interest rates and potentially approve higher loan amounts, providing more leverage for property investments.

- Assess Borrower Creditworthiness: Lenders use DSCR to evaluate a property’s financial health.

- Determine Loan Terms: Higher DSCRs can lead to better loan conditions and lower interest rates.

- Mitigate Risk: Ensuring that properties generate sufficient income reduces risk for lenders.

Examples of DSCR Calculations

Understanding DSCR through practical examples can help clarify its application and significance. Consider the following scenarios to see how DSCR is computed and interpreted:

- Example 1: A property generates $100,000 in annual net rental income and has $80,000 in annual debt obligations. The DSCR calculation is:

- Example 2: Another property has an annual net rental income of $120,000 and annual debt obligations of $60,000. The DSCR calculation is:

- Example 3: Suppose a property has $75,000 in net annual income and $100,000 in annual debt obligations. The DSCR calculation is:

DSCR = $100,000 / $80,000 = 1.25

This indicates the property generates 25% more income than needed for debt payments.

DSCR = $120,000 / $60,000 = 2.0

This strong ratio shows the property generates twice the income required to cover its debt.

DSCR = $75,000 / $100,000 = 0.75

This ratio below 1.0 indicates the property does not generate enough income to cover its debt, posing a higher risk for lenders.

These examples demonstrate how calculating DSCR provides essential insights into a property’s financial viability. A higher DSCR generally translates to lower risk for lenders and more favorable loan terms for borrowers.

Real estate investors should aim for higher DSCRs to secure better loan terms and ensure their investments generate sufficient income to cover debts.

Pros and Cons of DSCR Loans for Real Estate Investors

Advantages of DSCR Loans

One of the primary advantages of DSCR loans is their flexibility in allowing investors to finance multiple properties simultaneously. Unlike traditional mortgages, which often limit investors to a single property at a time, DSCR loans enable the pursuit of multiple investment opportunities up to the investor’s exposure limit.

DSCR loans can also be beneficial for real estate investors looking to refinance with a cash-out option, providing the necessary funds to purchase additional properties. This makes it easier for investors to grow their portfolio and maximize their income potential.

Moreover, these loans are particularly advantageous for income-generating properties. Investors focusing on rental income, either through long-term tenants or short-term rental platforms like Airbnb, can find DSCR loans to be a strategic financial tool. This is due to the ability to qualify based on the property’s income potential rather than personal income documentation.

“With a DSCR loan, investors can focus on the revenue potential of their investment properties, rather than their personal income or employment status.”

Another significant benefit is the streamlined documentation process. DSCR loans do not require proof of income through tax returns or pay stubs, which is highly advantageous for investors with complex tax returns or those that rely heavily on business deductions.

- No income requirement: Ideal for self-employed investors with less than two years of self-employment history.

- Quick closing process: Faster application and approval times compared to conventional loans.

- Flexibility: Suitable for those buying properties through an LLC or in a business name.

Finally, the ability to quickly close on a loan is a notable advantage. The reduced paperwork and lack of need for employment verification expedite the process, allowing investors to seize opportunities more rapidly.

Disadvantages of DSCR Loans

While DSCR loans offer numerous advantages, potential drawbacks exist. One major disadvantage is higher interest rates compared to conventional loans. This higher cost can impact the overall profitability of the investment.

Investors must also consider the minimum DSCR requirement. If the property’s income does not meet the lender’s specified ratio, it may be challenging to qualify for the loan. This can limit options for properties with lower initial income streams.

Additionally, DSCR loans might have more restrictive terms and conditions. Lenders may impose restrictions on property types or dictate specific income documentation rules, which can limit an investor’s flexibility.

Moreover, fees and closing costs associated with DSCR loans can be higher than those of conventional loans. These costs can add up quickly, potentially reducing the funds available for property acquisition or other investments.

“Higher fees and interest rates can create additional financial burdens for investors, affecting the overall cost-effectiveness of DSCR loans.”

The documentation process for some aspects, such as verifying the property’s income potential, can be intricate and time-consuming, despite the initial promise of streamlined paperwork.

- Higher interest rates: Can affect the net return on investment due to increased borrowing costs.

- Minimum income requirements: Properties must meet specific DSCR ratios, potentially disqualifying some investments.

- Higher fees: Closing costs and additional fees can add financial strain.

Lastly, the emphasis on property income means that investors must be confident in their property management and rental income projections to ensure loan qualification and repayment capacity.

Comparing DSCR Loans to Other Financing Options

When weighing financing options, real estate investors often compare DSCR loans to traditional mortgages and other non-conventional loans. One significant difference is the qualification criteria. Whereas traditional loans require detailed personal income documentation, DSCR loans focus on the income-generating capability of the property.

In comparison to traditional financing, DSCR loans offer more flexibility for those with complex or inconsistent income profiles. They are particularly beneficial for investors who cannot source or document their down payment funds through conventional means.

“DSCR loans provide a viable alternative for investors with non-traditional income streams, enabling them to continue expanding their real estate portfolio.”

However, the higher interest rates and fees associated with DSCR loans may render them less attractive when compared to traditional mortgages’ lower rates. Investors must carefully assess the long-term cost implications of opting for a DSCR loan.

Other non-conventional financing options, such as hard money loans, may offer similar flexibility but come with even higher interest rates and shorter loan terms. This can pose a risk for investors needing more extended repayment periods.

- Traditional Mortgages: Lower interest rates but require extensive income verification.

- Hard Money Loans: Fast access to funds with higher costs and shorter terms.

- DSCR Loans: Balance between flexibility and cost, focusing on property income rather than personal income.

Ultimately, the choice between DSCR loans and other financing options depends on the investor’s financial situation and investment strategy. Investors must weigh the pros and cons of each to determine the most suitable solution for their unique needs.

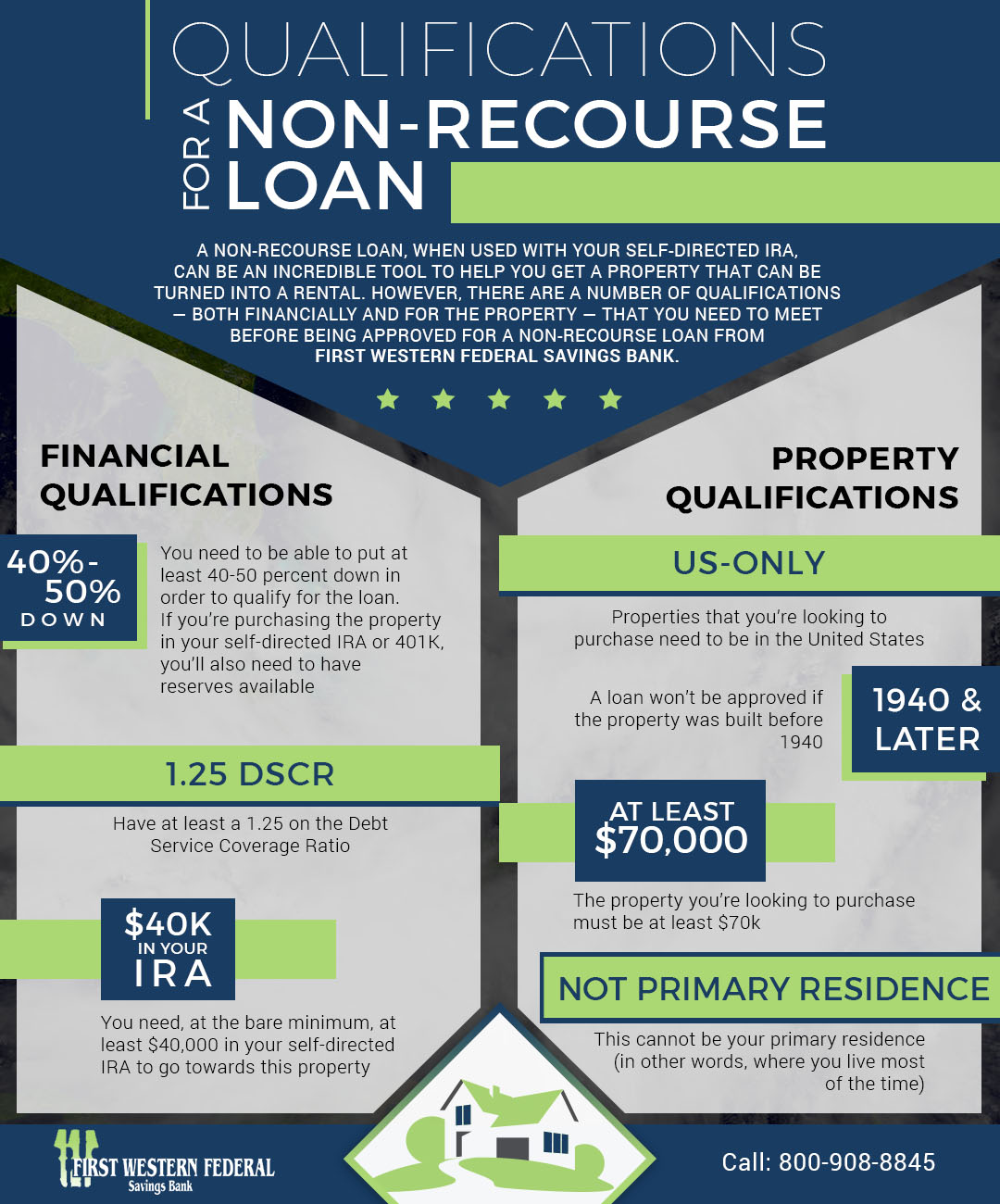

Requirements for Securing a DSCR Loan

Minimum DSCR Thresholds

When considering a DSCR loan, it’s crucial to understand the minimum Debt Service Coverage Ratio (DSCR) thresholds required by lenders. The DSCR represents the ratio of a property’s annual net operating income to its annual mortgage debt service. Generally, lenders require a DSCR of at least 1.25 to ensure that the property generates sufficient income to cover the loan payments.

Why is this ratio important? It provides a measure of the property’s ability to sustain its debt, which is a critical factor for lenders. A higher DSCR indicates a lower risk for the lender, potentially leading to more favorable loan terms.

“The DSCR is a fundamental metric that assesses a property’s financial health and its capacity to meet debt obligations,” explains a loan officer.

Different lenders may have varying thresholds, but a DSCR of 1.25 is a common benchmark. Properties with a DSCR below this threshold may face difficulties in securing financing or may be subject to higher interest rates.

For instance, consider a property with an annual net operating income (NOI) of $75,000 and annual debt service of $60,000. The DSCR would be calculated as follows:

DSCR = NOI / Debt Service = $75,000 / $60,000 = 1.25

- NOI: Net Operating Income; a measure of a property’s profitability after operating expenses.

- Debt Service: The total of all principal and interest payments made over a specified period.

Achieving a sufficient DSCR is paramount for securing a DSCR loan and demonstrating the investment’s profitability and sustainability.

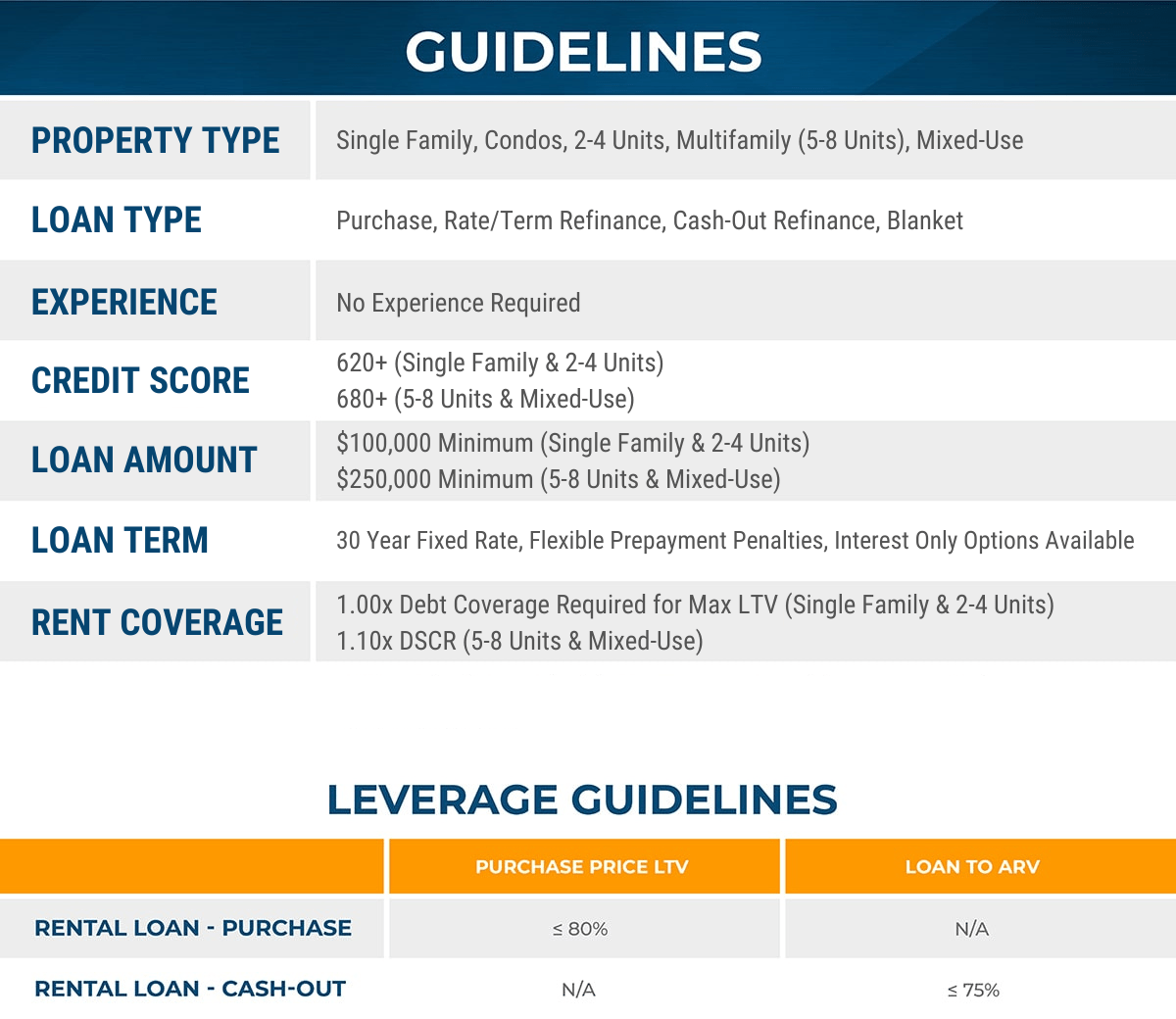

Credit Score and Down Payment Requirements

Potential borrowers must meet specific credit score and down payment requirements to qualify for a DSCR loan. Unlike conventional loans, DSCR loans often have more lenient credit score requirements, making them accessible to a broader range of investors.

Typically, a minimum credit score of 640 is required. However, some lenders might have more stringent criteria, demanding higher credit scores for better loan terms. A higher credit score can result in lower interest rates and more favorable loan conditions, reflecting the investor’s reliability.

Regarding down payments, DSCR loans usually require a down payment of 20-25% of the property’s purchase price. This substantial initial investment reduces the lender’s risk and demonstrates the borrower’s commitment to the investment.

“A higher down payment not only reduces lender risk but also showcases the borrower’s confidence in the property’s potential,” notes a real estate expert.

For example, if you’re purchasing a property valued at $500,000, a 25% down payment would be:

$500,000 x 0.25 = $125,000

Investors should be prepared for these financial commitments, as they play a crucial role in securing a DSCR loan and attaining favorable loan terms.

Necessary Documentation

Obtaining a DSCR loan requires a specific set of documentation, distinct from conventional mortgage requirements. Notably, lenders do not necessitate income documents like paystubs, W2 statements, or tax returns. However, other documents are imperative:

- Loan Application: A formal application providing details about the borrower and the loan.

- Credit Report: A report detailing the borrower’s credit history and score.

- Bank Statements: Typically, two months of bank statements are required to show reserve funds ranging from three to twelve months, depending on the lender.

- Homeowner’s Insurance: An annual insurance policy for the property.

- Entity Documentation: For investors purchasing under an LLC, Articles of Organization and an Operating Agreement are necessary.

- Appraisal Report: Ordered by the lender during underwriting, including a 1007 Rent Schedule to determine property cash flow.

- Title Work: Title insurance and a deed search to verify property ownership and ensure it is free of liens or encumbrances.

These documents collectively ensure that the property is a sound investment, free of legal issues, and capable of generating enough income to meet debt obligations.

“The documentation process, while thorough, protects both the lender and the borrower by verifying the property’s financial viability,” states a DSCR loan specialist.

It is crucial to note that, preparing the necessary documentation is a critical step in the DSCR loan application process, ensuring smooth and efficient processing and approval.

Using DSCR Loans for Different Types of Rental Properties

Short-Term vs. Long-Term Rentals

Investors weigh the pros and cons of short-term versus long-term rentals when considering real estate investments. One pivotal factor is how financing options, particularly DSCR loans, can support each strategy.

Short-term rentals, such as vacation homes or Airbnb properties, often yield higher nightly rates compared to long-term rentals. However, they may experience variable occupancy rates. DSCR loans can be an excellent fit for these properties, as they focus on the rental income generated rather than the investor’s personal income.

Long-term rentals typically offer more stable and predictable income streams. DSCR loans are well-suited here too, ensuring that the rental income sufficiently covers the debt obligations. This model reassures lenders that the property will maintain consistent cash flow.

“A DSCR can be used to finance many investment properties, including vacation rentals and long-term tenant properties.”

The flexibility of DSCR loans allows investors to choose between fixed-rate, adjustable-rate, or interest-only options, optimizing their investment strategy to maximize cash flow. Have you considered how these terms can benefit your rental plans?

Examining both rental types through the lens of DSCR loan flexibility, investors can make informed decisions that align with their financial goals. How can DSCR loans enhance your real estate portfolio?

Financing Multi-Unit Properties

Multi-unit properties, such as duplexes, triplexes, and fourplexes, offer unique investment opportunities. DSCR loans cater to these properties, focusing on their collective income generation potential.

Investors benefit from the diversified income streams inherent in multi-unit properties. Even if one unit remains vacant, others can continue generating revenue, maintaining the property’s financial stability. Does this resilience align with your investment strategy?

DSCR loans support financing for 1-4 unit multifamily properties, ensuring that the rental income covers the debt service. This can simplify the approval process and provide favorable terms for financing.

“We work with several investors that may allow financing on multifamily properties (1-4 Units).”

Such financing options can be tailored to the investor’s needs, offering various terms to enhance monthly cash flow. How do these options fit into your investment plans?

- Evaluate potential rental income: Assess each unit’s rental potential to understand overall revenue.

- Consider occupancy rates: Analyze vacancy risks and plan for financial stability.

- Explore loan terms: Choose terms that maximize cash flow and align with investment goals.

Financing multi-unit properties with DSCR loans can provide a strategic advantage, leveraging the property’s income to secure favorable lending terms.

Special Considerations for Airbnb Investments

Investing in properties for short-term rental platforms, like Airbnb, requires special considerations. DSCR loans offer tailored solutions for these unique investment opportunities.

Short-term rentals often face fluctuating demand, influenced by seasonal trends and market conditions. DSCR loans assess the property’s rental income, mitigating personal income verification requirements. How does this benefit your Airbnb investment strategy?

Non-warrantable condos, which may not meet conventional loan criteria, can also be financed through DSCR loans. This expands investment opportunities in desirable locations typically avoided by traditional lenders.

“There are variations regarding warrantable or non-warrantable condos and multiplex properties.”

- Higher yields: Short-term rentals can generate higher income, especially in peak seasons.

- Flexible terms: DSCR loans offer flexible terms tailored to short-term rental income patterns.

- Expanded options: Financing non-warrantable condos opens up more investment avenues.

Ultimately, the flexibility of DSCR loans supports the dynamic nature of Airbnb investments, providing robust financing solutions tailored to these lucrative opportunities. Can you leverage DSCR loans to expand your short-term rental portfolio?

Tips for Maximizing Your Chances of DSCR Loan Approval

Improving Your DSCR

Achieving a favorable Debt Service Coverage Ratio (DSCR) is paramount for increasing your chances of loan approval. A higher DSCR indicates to lenders that your property generates ample income to cover its debt obligations, thus reducing their risk.

First, focus on increasing rental income. Consider leasing to reliable tenants and ensuring your property is well-maintained to justify higher rent. Additionally, analyze rental market trends to price your units competitively yet profitably.

“Lenders often consider a ‘good’ DSCR to be 1.25 or higher because it shows that the property generates 25% more profit than expenses and has a positive cash flow as long as it stays occupied.”

Next, minimize your operating expenses. Evaluate current expenses and identify areas where you can reduce costs without compromising the quality of service. Efficient property management and regular maintenance can decrease unexpected expenditures.

It is also beneficial to restructure existing debt to lower interest rates or extend loan terms. This can reduce monthly payments, thereby improving your DSCR.

Another strategy is increasing property value through renovations and upgrades. Enhancing the property’s appeal can attract higher-paying tenants, subsequently boosting rental income.

- Regular maintenance: Keeps property attractive and minimizes repair costs.

- Energy-efficient upgrades: Decrease utility bills and appeal to environmentally-conscious tenants.

- Modern amenities: Justify higher rents and increase tenant satisfaction.

Finally, ensure that you factor in any potential future expenses such as property taxes or insurance premiums. Having reserves to cover these will demonstrate financial stability to lenders.

Preparing Your Documentation

Well-prepared documentation is crucial for a smooth loan application process. Begin by compiling detailed records of the property’s rental history. Lenders like to see proof of consistent rental income, so gather lease agreements and any gross rental payout histories.

Your credit authorization is another vital aspect. A strong credit score can significantly enhance your approval chances. Ensure to maintain a minimum score as required by your lender, typically around 680, though some may accept lower.

“Lenders will require authorization to pull a credit report to check your history. Some lenders will approve you for a loan with a credit score of 620, but they often want to see a score of at least 680.”

Additionally, organize your property appraisal documents. An appraisal that includes rental income data for comparable properties helps the lender assess the investment’s potential. If rental history isn’t available, the appraiser’s estimated rent will be crucial.

- Appraisal report: Provides a comprehensive evaluation of property value.

- Comparable sales: Highlights similar properties to establish market value.

- Income projection: Estimates expected rental income if current data is unavailable.

Moreover, verify your funds availability. Lenders will want to see evidence that you can cover the necessary down payment and have sufficient reserves. Include recent bank statements, retirement accounts, or stock portfolios as proof.

Don’t forget to compile your property insurance information. Adequate insurance coverage reassures lenders that their investment is protected. If the property is in a flood zone, specific flood insurance may be required.

Choosing the Right Lender

Finding the right lender who understands your investment strategy is essential. Start by researching different lenders and comparing their terms, rates, and loan-to-value (LTV) requirements. A favorable LTV, typically 75% or higher, can enhance your leverage and reduce out-of-pocket expenses at closing.

Assess the lender’s experience with DSCR loans. Lenders well-versed in DSCR financing will be more familiar with the specific needs and challenges of real estate investors, providing more tailored advice and solutions.

“Every lender offers different terms for a DSCR loan, so it is imperative to find the right one for you.”

Consider the lender’s pre-approval process. Efficient pre-approval can streamline your loan application, helping you act quickly on investment opportunities. Ensure they can process credit and asset documentation promptly.

- Initial Consultation: Discuss your investment goals and loan needs.

- Pre-Approval Application: Submit necessary documents for review.

- Approval Notification: Receive confirmation and proceed with the investment.

Examine the lender’s customer service and support. Reliable communication and support throughout the loan process can alleviate stress and ensure you have all the information you need to make informed decisions.

Finally, ensure the lender has a positive reputation. Reading reviews and testimonials from other real estate investors can provide insight into their reliability, flexibility, and overall service quality.

Frequently Asked Questions About DSCR Loans

Common Misconceptions

Many potential borrowers and real estate investors often hold several misconceptions about DSCR loans. These can create unnecessary confusion and hesitation.

Misconceptions might arise due to the complexity of the terms or the varying policies of different lenders. For instance, some believe that DSCR loans are exclusively for commercial properties.

This is not true. DSCR loans can be utilized for residential properties under certain conditions, expanding their applicability.

The idea that these loans require an extraordinarily high credit score is another common fallacy. While credit scores matter, they are not the sole determining factor.

Moreover, the perception that DSCR loans have exorbitant interest rates compared to traditional loans needs clarifying. Interest rates can vary, but they are within reasonable limits.

It’s also vital to understand that not all hard money lenders operate with the same level of transparency and professionalism. Selecting a lender who is honest and experienced significantly impacts the loan process.

DSCR loans offer flexible financing solutions for both commercial and residential real estate investors.

Real estate investors should note that these loans are not just for large corporations; individual investors also qualify.

By addressing these misconceptions, we can better gauge the suitability of DSCR loans for diverse investment needs.

Clarifying Eligibility Criteria

Understanding the eligibility criteria for DSCR loans is crucial for borrowers and investors. These loans have specific requirements that differ from conventional loans.

One primary factor is the Debt Service Coverage Ratio (DSCR) itself. This ratio measures a property’s cash flow relative to its debt obligations.

The minimum DSCR required can vary but typically needs to be above 1.0. This means the property must generate enough income to cover its debt payments.

Additionally, while credit scores are considered, they are not the primary focus. Lenders look at the property’s income-generating potential more than the borrower’s creditworthiness.

Documentation requirements are generally less stringent compared to traditional loans. However, borrowers must still provide proof of income and ownership details.

Another significant criterion is the property type. Both commercial and certain residential properties can qualify for DSCR loans.

DSCR loans focus on the property’s ability to generate income rather than the borrower’s financial history.

Understanding these eligibility criteria enables investors to better prepare their applications and improve their chances of approval.

Additionally, knowing what lenders look for can help borrowers select properties that align with DSCR loan requirements.

Addressing Investor Concerns

Investors often have various concerns when considering DSCR loans. Addressing these concerns can help them make informed decisions.

One common concern is the complexity of the loan application process. While it may seem daunting at first, many lenders offer support to simplify the process.

Another worry is about the interest rates. Compared to traditional loans, DSCR loans might have slightly higher rates, but they are justified by the reduced emphasis on credit scores and the quicker approval process.

Investors might also question the flexibility of DSCR loans. These loans are designed to be flexible, accommodating different property types and investment strategies.

There is also a concern regarding the transparency of fees. It’s crucial to choose lenders who disclose all costs upfront, ensuring no hidden charges.

Moreover, the perceived risk of default might deter investors. However, the structure of DSCR loans, which focuses on income-generating properties, inherently mitigates some of this risk.

Choosing a reputable and experienced lender can significantly alleviate many of these concerns.

Additionally, investors should thoroughly research and understand the terms of the loan, asking questions and seeking clarifications wherever necessary.

By addressing these concerns proactively, investors can confidently navigate the DSCR loan process and leverage these loans for their real estate ventures.

Conclusion

Understanding DSCR loans is pivotal for real estate investors seeking tailored financing solutions for investment properties. These loans offer unique benefits like flexibility in income verification and the ability to leverage rental income for loan approval. However, they also come with specific requirements such as minimum DSCR thresholds and thorough documentation, which demand careful planning and preparation.

Calculating the Debt Service Coverage Ratio accurately and ensuring a robust credit profile can significantly enhance your chances of securing a DSCR loan. Whether investing in short-term rentals or multi-unit properties, knowing what lenders look for can set you apart in a competitive market. Comparing DSCR loans to other financing options will help you make informed decisions that align with your investment goals.

For those serious about maximizing their investment potential, it’s time to delve deeper into DSCR loans and consult with financial advisors to craft a winning strategy. Explore additional resources and connect with lenders who specialize in DSCR loans to take the next step in your real estate investment journey.

Frequently Asked Questions

What is a good DSCR for rental property?

A good DSCR for rental property is typically 1.25 or higher. This indicates that the property’s income sufficiently covers its debt obligations.

How much down payment is required for a DSCR loan?

The down payment for a DSCR loan generally ranges from 20% to 25%. The exact amount may vary based on the lender and property type.

Who qualifies for a DSCR loan?

Individuals with a minimum DSCR threshold, good credit score, and sufficient down payment qualify for DSCR loans. Lenders consider income and property performance.

What are the cons of a DSCR loan?

Cons include higher interest rates, stricter DSCR requirements, and potentially larger down payment requirements compared to conventional loans.

Are DSCR loans available for both short-term and long-term rentals?

Yes, DSCR loans can be used for both short-term and long-term rental properties, including Airbnb investments.

What documentation is necessary for securing a DSCR loan?

Necessary documentation includes financial statements, income proof, tax returns, property performance records, and credit history.