Understanding DSCR loans in California is crucial for savvy investors aiming to maximize their returns. This article dives into the intricacies of DSCR loans, highlighting their definition, importance, and unique benefits compared to conventional loans.

Learn about the flexible terms and fees tailored for Californian investors, and discover the simplified approval process that prioritizes cash flow over personal income. With insights on qualification criteria and the overall loan process, you’ll be equipped to navigate DSCR loans with confidence.

Unlock the potential for high ROI in California’s booming rental market. From application steps to market trends, this guide provides a comprehensive roadmap for leveraging DSCR loans to boost your investment portfolio.

Understanding DSCR Loans in California

Definition and Importance of DSCR

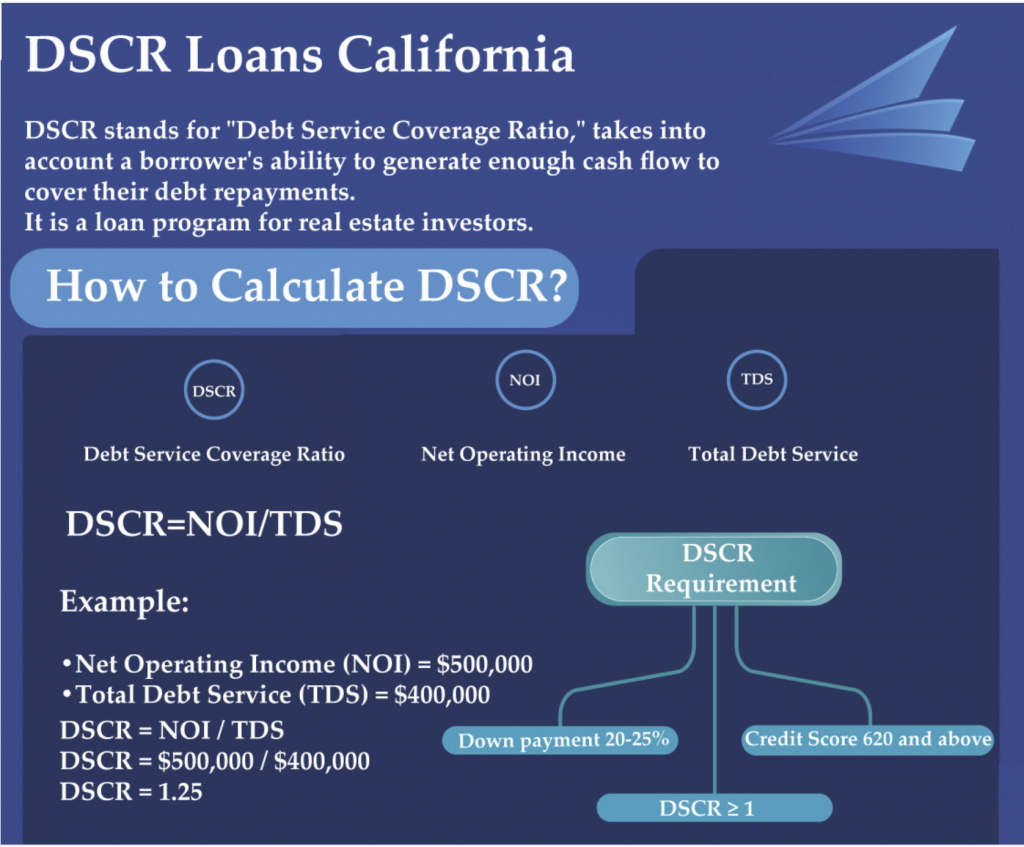

DSCR, or Debt Service Coverage Ratio, loans are a specialized financial product designed to assess the income a property generates relative to its debt obligations. In California, where property values are high and demand is constant, understanding DSCR is crucial for investors.

The importance of DSCR lies in its ability to evaluate a property’s cash flow, rather than relying on the borrower’s personal income. This makes it an attractive option for investors with multiple income streams or those managing several properties. Essentially, lenders look at the property’s income potential to decide loan approval.

“By focusing on the property’s income, DSCR loans offer a unique advantage for investors, especially in high-demand markets like California.” – Joshua Holt, Mortgage Loan Originator

But why is this significant for Californian investors? California’s real estate market is robust, with high property prices and a stable rental market. The Debt Service Coverage Ratio ensures that the property can generate enough income to cover its debt, reassuring both the lender and the investor of the investment’s viability.

Moreover, DSCR loans remove the burden of stringent personal qualifications, opening doors for those with varying or unconventional income sources. This flexibility is particularly useful in California, where the cost of living and property prices can be prohibitively high.

Imagine a scenario where an investor wants to purchase an apartment complex in Los Angeles. Traditional loans might scrutinize the investor’s personal income, but a DSCR loan will focus on the rental income the complex can generate, making the loan process smoother and more accommodating.

Key Benefits for Investors

Several key benefits make DSCR loans particularly appealing to real estate investors in California. Firstly, they offer a simplified approval process compared to conventional loans. By focusing on the property’s income, investors can secure financing even if their personal income is variable or unconventional.

Another benefit is the ability to diversify investments. With DSCR loans, investors can finance multiple properties, allowing them to spread their investments across different neighborhoods or cities within California. This strategy not only enhances their portfolio but also mitigates risk.

- Flexible financing: DSCR loans provide options such as fixed-rate, adjustable-rate, or interest-only mortgages, enabling investors to choose terms that best fit their financial strategy.

- Quick approvals: In a state where property values fluctuate rapidly, the speed at which DSCR loans are approved (often within weeks) can give investors a competitive edge.

- High potential for returns: With demand for rental properties in California remaining strong, the ability to generate positive cash flow from investments is significant.

Consider the example of an investor targeting short-term rentals in San Francisco. A DSCR loan allows them to leverage the high tourist traffic to maximize rental income, making the investment more profitable and sustainable.

Differences from Conventional Loans

While conventional loans typically rely heavily on a borrower’s personal income and credit score, DSCR loans shift the focus to the property’s performance. This fundamental difference makes DSCR loans a distinct and advantageous choice for real estate investors.

Conventional loans often come with stringent qualification criteria, requiring extensive documentation of income, employment, and credit history. In contrast, DSCR loans streamline this process by evaluating the debt service coverage ratio, which measures the property’s ability to cover its debt through generated income.

This shift in focus allows investors to qualify for loans they might not otherwise obtain through traditional mortgage routes. For instance, a successful entrepreneur with fluctuating income might face challenges securing a traditional loan but could easily qualify for a DSCR loan if their investment property demonstrates strong income potential.

- Qualification criteria: DSCR loans prioritize property income over personal income, easing the qualification process for many investors.

- Approval speed: While conventional loans may take months to process, DSCR loans are typically approved in a matter of weeks.

- Investment scope: Conventional loans may limit the number of properties financed, whereas DSCR loans can be used to finance multiple properties, enhancing portfolio growth.

For California investors, where real estate opportunities are abundant but often expensive, these differences can be game-changers, enabling them to tap into lucrative markets with greater ease and flexibility.

Common Misconceptions

There are several misconceptions surrounding DSCR loans that need to be addressed. One common fallacy is that DSCR loans are only suitable for investors with high credit scores. While a decent credit score is beneficial, the primary focus remains on the property’s income, not the investor’s personal creditworthiness.

Another misunderstanding is that DSCR loans are only for large-scale commercial properties. In reality, they are also applicable for single-family homes, multi-family units, and other residential properties, making them versatile for various investment strategies.

- High credit scores: DSCR loans prioritize property income, making them accessible even to those with less-than-perfect credit.

- Commercial-only misconception: Suitable for residential investments too, DSCR loans offer flexibility across property types.

- Misunderstood approval process: Many believe the process is lengthy, but DSCR loans typically offer quicker approvals than conventional loans.

Moreover, some investors incorrectly assume that DSCR loans are difficult to qualify for due to the property income requirements. However, the robust rental market in California often means that properties can generate the necessary income to meet DSCR thresholds.

“The versatility and focus on property income make DSCR loans an excellent choice for a wide range of investors, debunking many misconceptions about their accessibility and scope.” – Victor Flynn, Investment Property Expert

As we can see, understanding the true nature of DSCR loans can unlock a world of opportunities for real estate investors in California, providing the necessary tools to thrive in a competitive market.

How DSCR Loans Differ from Conventional Loans

Focus on Cash Flow vs. Personal Income

DSCR loans emphasize cash flow from the property rather than the investor’s personal income. This approach can be more attractive for real estate investors who own multiple properties and have complex financial situations.

In contrast, conventional loans focus significantly on the debt-to-income ratio (DTI). This ratio evaluates whether the investor’s personal income is sufficient to cover their debts. For investors with multiple mortgaged rentals, meeting the DTI requirements can be challenging, even if their income history is strong.

For example, consider an investor with ten rental properties. Their total income may be high, but their personal income might not cover all the debt of multiple loans.

DSCR loans solve this by calculating the Debt Service Coverage Ratio (DSCR) through a simple formula: DSCR = Gross Rent / Total Payment. This method evaluates the property’s income potential rather than the investor’s finances.

“DSCR loans emphasize property income, making it easier for investors with significant rental incomes but less impressive personal income histories to qualify.”

Relying on the property’s cash flow offers investors more flexibility and allows them to grow their portfolios without the burden of proving substantial personal income.

Simplified Approval Process

The approval process for DSCR loans is more straightforward compared to conventional loans. With DSCR loans, there is no need for prior tax returns or income verification. Instead, these loans are underwritten based on the property’s income potential and the investor’s credit score.

Conversely, conventional loans require extensive documentation, such as pay stubs, bank statements, and tax returns. This requirement can be cumbersome and time-consuming for investors, particularly those with multiple properties or complex income structures.

“By eliminating the need for prior tax returns or income verification, DSCR loans expedite the approval process, making it more efficient for investors to secure financing.”

Consider that, with a conventional loan, an investor might spend weeks gathering and submitting all the necessary documentation, only to face further scrutiny and delays. In contrast, DSCR loans streamline this process, focusing on the property’s cash flow and minimizing the paperwork involved.

This simplified process can be a significant advantage for busy investors who need a faster and less stressful way to secure financing.

Key Qualification Criteria

When it comes to qualifications, DSCR loans and conventional loans have distinct criteria. For DSCR loans, the primary factors are the property’s income potential and a minimum credit score. This means investors do not need to provide extensive financial history or personal income details.

On the other hand, conventional loans require a comprehensive evaluation of the investor’s personal finances, including income verification, credit scores, and the debt-to-income ratio (DTI). Meeting these stringent criteria can be a hurdle for many investors, especially those with complex financial situations.

- DSCR Loans: Focus on property income and minimum credit score.

- Conventional Loans: Require personal income verification, detailed financial history, and debt-to-income ratio analysis.

These criteria illustrate the ease with which investors can qualify for DSCR loans as opposed to conventional loans, making them a more accessible option for many.

Benefits for Self-Employed Investors

Self-employed investors often face unique challenges when seeking financing. Traditional lenders scrutinize personal income and require extensive documentation, which can be difficult to provide consistently for self-employed individuals.

DSCR loans offer a distinct advantage for self-employed investors. These loans do not rely on personal income verification, making them more suitable for individuals whose income might vary from year to year.

“For self-employed investors, DSCR loans simplify the qualification process by focusing on property income rather than personal income.”

This focus allows self-employed investors to leverage their rental property income and secure financing without the traditional hurdles associated with conventional loans.

By eliminating the need for extensive personal financial documentation, DSCR loans provide a more flexible and accessible option for self-employed investors looking to expand their portfolios.

Flexible Terms and Fees of DSCR Loans in California

30-Year Terms and No Balloons

When evaluating the flexibility of DSCR loans, one of the standout features is the **availability of 30-year terms without balloon payments**. These longer terms provide investors with lower monthly payments, easing cash flow management and enhancing long-term investment stability.

Unlike traditional loans that may require a balloon payment at the end of the term, DSCR loans eliminate this concern. This means you can enjoy the stability of predictable payments without the looming worry of a significant lump sum due at the end.

Think of it like having a reliable vehicle that doesn’t require a massive overhaul after a few years. You get to spread out the cost, making it more manageable. This is particularly advantageous for long-term property investors.

“The absence of balloon payments in DSCR loans significantly reduces financial stress and planning complexity for investors,” notes financial expert John Smith.

The consistency in payment structure is a key factor. It allows for better financial planning and investment analysis, ensuring that your cash flow remains robust and uninterrupted.

This term flexibility ensures you can focus on maximizing your property’s income potential rather than worrying about a future lump-sum payment. As an investor, wouldn’t you prefer a clear and predictable financial path?

Moreover, these terms are quite **appealing in volatile markets**, providing a cushion against potential economic downturns. The fixed nature of the 30-year terms can act as a safeguard.

- No balloon payments: This prevents unexpected large expenses.

- Lower monthly payments: Achieved through longer amortization periods.

- Better cash flow management: Consistent payment schedules aid financial planning.

Interest Only Loans

DSCR loans also offer the option for **interest-only payments**. This option allows investors to significantly reduce their monthly obligations during the initial years of the loan, freeing up capital to invest in other areas or improve property cash flow.

Interest-only loans can be particularly beneficial during the initial property stabilization period. During this phase, it’s crucial to have as much available cash flow as possible.

Consider it akin to focusing on the most critical components of a business first—ensuring operational efficiency before tackling larger financial commitments.

“Interest-only periods in DSCR loans provide a strategic advantage, especially for properties undergoing renovation or other value-add strategies,” says Jane Doe, a real estate finance expert.

However, it is essential to remember that while interest-only loans offer reduced payments initially, they do not lower the overall loan balance during this period. It’s a short-term relief strategy that should be used wisely.

Investors can take advantage of this option to facilitate smoother project completions and better financial maneuvering.

- Initial lower payments: Frees up cash flow for other investments or expenses.

- Stabilization period benefits: Particularly useful for properties in development stages.

- Strategic financial planning: Opportunity for investors to manage other financial commitments.

Rate and Prepayment Penalty Buy Downs

DSCR loans in California also offer flexibility with **rate and prepayment penalty buy-downs**. These options allow investors to potentially lower their interest rates or reduce penalties for early repayment, providing financial flexibility.

By buying down the rate, investors can lock in lower interest rates, which can have a significant impact on the overall cost of the loan. This is similar to negotiating a better deal upfront to save money in the long run.

Additionally, prepayment penalty buy-downs allow for greater financial maneuverability. This means if you decide to sell the property or refinance, you won’t be hit with hefty penalties for repaying the loan early.

“Rate and prepayment penalty buy-downs offer a tailored financial approach, making DSCR loans adaptable to various investment strategies,” comments Sarah Johnson, a seasoned real estate investor.

These options can be particularly beneficial in a fluctuating market where interest rates are unpredictable. Locking in a lower rate can provide stability and predictability for your investment’s financial outlook.

- Lower interest rates: Achieved through rate buy-downs.

- Reduced prepayment penalties: Facilitates easier property sale or refinancing.

- Financial predictability: Stabilizes long-term investment planning.

Customizable Loan Structures

Finally, the **customizable loan structures** of DSCR loans offer a high degree of personalization to fit individual investment needs. This flexibility can be compared to tailoring a suit; you get a fit that’s just right for you.

Borrowers can work with lenders to adjust various aspects of the loan, including term lengths, interest rate types (fixed or variable), payment schedules, and more. This customization ensures that the loan structure aligns perfectly with an investor’s financial strategy.

Flexibility in loan structuring can cater to both conservative and aggressive investment approaches, providing the ability to balance risk and reward effectively.

“Customizable loan structures are like having a toolkit that you can modify as your project demands. It’s about having the right tool for every job,” explains Michael Richards, a real estate developer.

Investors can also adjust their loans to accommodate property-specific requirements, such as renovations or expansions. This level of customization is rarely found in traditional loan products.

This approach enhances the attractiveness of DSCR loans for a diverse range of investment opportunities, from residential properties to large commercial projects.

- Term length adjustments: Aligns with investment timelines.

- Variable payment schedules: Supports different revenue cycles.

- Interest rate flexibility: Choose between fixed or variable rates based on risk preference.

Qualifying for a DSCR Loan in California

Minimum Credit Score Requirements

One of the key factors in qualifying for a Debt-Service Coverage Ratio (DSCR) loan is the minimum credit score requirement. Generally, a higher credit score is viewed favorably by lenders and can lead to better loan terms. For most lenders, a minimum credit score of 680 or higher is necessary. However, it’s important to note that lower credit scores may still be considered, but with additional financial requirements.

For instance, if your credit score falls below 680, you might be required to provide a larger down payment or face higher interest rates and fees. This is because a lower credit score is often associated with higher risk, and lenders mitigate this risk by adjusting the financial conditions of the loan.

“Credit score is a critical component; lower scores often require larger down payments and higher rates.”

Potential DSCR loan applicants should aim for a higher credit score to improve their chances of securing favorable loan terms. Regularly monitoring your credit report and addressing any discrepancies can be beneficial in maintaining or improving your score.

What steps can you take to boost your credit score? Consider reducing outstanding debt, making timely payments, and avoiding new credit inquiries. These actions can positively influence your creditworthiness over time.

Loan Amounts and LTV

When applying for a DSCR loan, understanding the loan amounts and Loan-to-Value (LTV) ratios is essential. Most DSCR loans have a minimum loan amount of $75,000 and can go up to $2 million. This range allows for flexibility depending on the size and value of the property investment.

The LTV ratio represents the fraction of the property’s value that can be financed through the loan. Typically, a strong property can secure an LTV ratio of up to 80%. However, for cash-out loans, the minimum LTV typically drops to 75%. A higher LTV ratio can be advantageous as it means less money out-of-pocket for the borrower.

Moreover, down payment requirements are influenced by the LTV ratio. A down payment of at least 25% is recommended, though providing a higher down payment can result in better loan terms.

“Loan amounts vary significantly; higher LTV ratios mean less cash upfront.”

Would it be beneficial to aim for the maximum LTV ratio? It depends on your financial situation and investment goals. Striking a balance between the loan amount and the down payment can optimize your investment returns.

DSCR Requirements

The Debt-Service Coverage Ratio (DSCR) indicates the relationship between the property’s rental income and the mortgage payment. It is a vital metric for qualifying for a DSCR loan. Generally, a minimum DSCR of 1.2 is required, which signifies that the rental income sufficiently covers the mortgage obligations.

Interestingly, some lenders offer No DSCR loans in particularly lucrative markets where rental prices have not yet aligned with home prices. These specialized programs can be advantageous but often come with stricter terms and conditions.

How does a higher DSCR benefit borrowers? A higher DSCR can result in better rates, lower fees, and reduced down payment requirements. This is because a higher DSCR demonstrates a property’s ability to generate income over and above the mortgage payments, reducing the lender’s risk.

- DSCR > 1.0: Entails better rates and lower down payments.

- DSCR between 0.75 and 1.0: May still qualify but with potentially higher costs.

- DSCR < 0.75: Often requires additional qualifications or is subject to higher scrutiny.

“Higher DSCR values represent a lower financial risk for lenders.”

Can you achieve a higher DSCR? Increasing rental income or reducing operating expenses can positively impact your DSCR, making your loan application more attractive to lenders.

Additional Qualification Criteria

Besides credit score, loan amounts, and DSCR, there are other critical criteria to consider. For instance, the type and condition of the property play a significant role. DSCR loans typically cater to residential investment or rental properties that are in fair to good condition. Properties in poor condition may qualify if accompanied by a renovation plan.

Gross rental income is another factor. For vacant units, market rents determined by an appraiser are used, while actual rents from leases are considered for occupied units. This helps lenders gauge the profitability of the investment property.

Lenders may also require a property appraisal to ascertain the value and condition of the property. The appraisal must support the purchase price and the desired loan-to-value ratio.

“Appraisals ensure that the property value aligns with the loan amount.”

Another requirement includes maintaining cash reserves, often equal to six full housing or property payments. These reserves act as a safety net for lenders, providing assurance that the borrower can manage unexpected expenses or income disruptions.

- Legal and Compliance: The property must comply with local zoning and building codes, and any legal issues must be resolved.

- Reserve Requirements: Lenders may require cash reserves, usually amounting to six housing or property payments.

- Property Payment: The total of principal, interest, property taxes, insurance, and HOA dues, if applicable, is considered.

Does your property meet these criteria? Ensuring compliance with all qualification standards is vital for a successful DSCR loan application.

The DSCR Loan Process in California

Application Steps

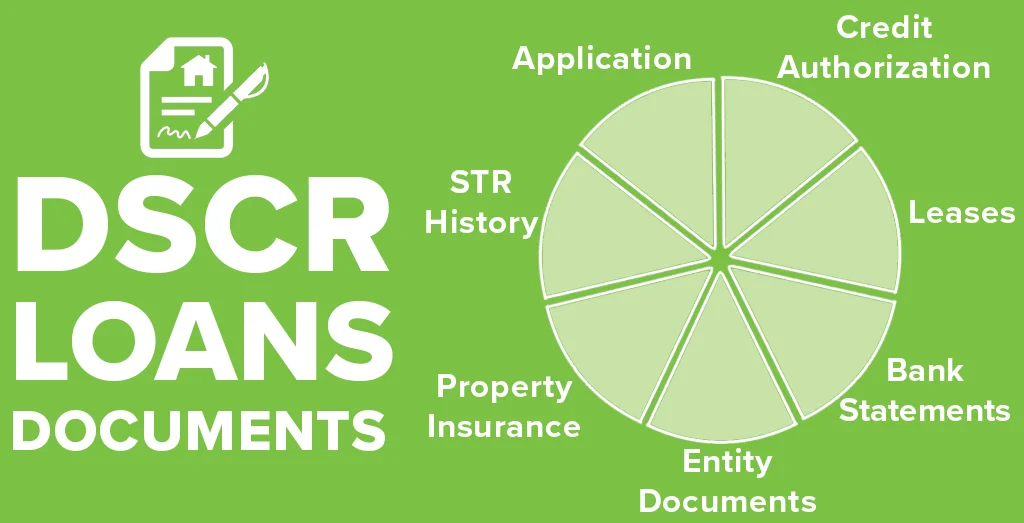

Applying for a DSCR loan involves a few straightforward steps. Initially, one must complete the DSCR loan application. This application is vital as it provides the lender with necessary initial information.

During this stage, an appraisal fee must be paid. An appraisal assesses the property’s value, ensuring it aligns with the lender’s requirements. This valuation is critical in determining the loan amount.

Your loan officer will evaluate your credit to ensure it meets the minimum credit score qualifications.

The evaluation of your credit is typically the next step. Although credit score requirements might differ among lenders, having a good credit score can facilitate a smoother application process.

- Form Completion: Ensure all parts of the DSCR loan application form are accurately completed.

- Credit Evaluation: Your credit score is checked to determine eligibility.

- Appraisal Payment: Pay the necessary fees for property appraisal.

Processing and Underwriting

Once the application is submitted, the DSCR loan progresses into the processing stage. During this phase, the emphasis is on the rental property’s quality and rental income potential. No need to provide tax returns, pay stubs, or personal income history.

Why is this important? Processing focuses on assessing whether the property can generate sufficient rental income to cover the loan payments, reflecting the Debt Service Coverage Ratio (DSCR).

DSCR mortgage processing is straightforward since the primary concern is the rental property quality and income potential.

Following processing, the loan enters the underwriting stage. Underwriting involves a comprehensive review to ensure that all aspects of the loan meet the lender’s guidelines and criteria.

- Processing Stage: Evaluation of the property’s rental income potential.

- Underwriting: Detailed examination of the loan application against set guidelines.

Closing and Funding

The final steps in securing a DSCR loan are closing and funding. After the loan application clears underwriting, the next stage is closing.

During closing, borrowers are required to pay the down payment and any closing costs. These costs can include fees for title insurance, legal services, and other administrative expenses.

- Down Payment: A percentage of the property value paid upfront.

- Closing Costs: Various fees associated with finalizing the loan.

What happens next? Once these payments are made, the loan is funded. This means that the lender provides the agreed loan amount, which can be used to purchase the rental property.

After closing, the funds are disbursed, allowing you to complete your property purchase.

Tips for a Smooth Process

For a seamless DSCR loan process, consider several critical tips. Firstly, ensuring that all application forms are accurately completed is essential. Missing information can lead to unnecessary delays.

Furthermore, maintaining good communication with your loan officer can help address any issues promptly. Regular updates and prompt responses can prevent avoidable setbacks.

- Complete Applications: Ensure every section of the application is filled out correctly.

- Stay Informed: Keep regular contact with your loan officer for updates.

- Prepare Documentation: Have all necessary documents ready to avoid processing delays.

Additionally, staying organized and keeping track of all documents and communications related to your loan application can significantly contribute to a smoother process.

Ensuring a well-organized documentation system can prevent miscommunications and delays.

Applying these tips can streamline your DSCR loan process, making it efficient and hassle-free.

Maximizing ROI with DSCR Loans in California

High ROI Cities

In California, identifying cities with high return on investment (ROI) potential is crucial for maximizing gains with DSCR loans. Investors often look at metropolitan areas where the economic activity is robust and demand for housing is consistent.

For instance, cities like San Francisco, Los Angeles, and San Diego consistently rank high due to their strong economies, cultural attractions, and high demand for rental properties.

Another excellent example is San Jose, which attracts tech professionals due to its proximity to Silicon Valley. This influx of high-income renters increases the potential ROI significantly.

“The more dynamic the economy of a city, the higher the potential for stable and lucrative rental income.”

However, investors should not overlook emerging cities such as Sacramento and Fresno. These areas offer lower property prices with increasing demand, presenting a strong opportunity for high ROI.

- Los Angeles: A vast rental market with diverse economic drivers.

- San Diego: High demand from both military personnel and tourists.

- Sacramento: Growing popularity due to affordability and quality of life.

Careful analysis of city-specific data can lead to informed decisions, ultimately enhancing returns on investment.

Rental Market Insights

Understanding the rental market is fundamental when using DSCR loans to their full potential. This encompasses analyzing rental yields, vacancy rates, and tenant demographics.

In California, the rental market is diverse and dynamic. Coastal cities like Santa Monica and Laguna Beach offer high rental yields, especially for vacation properties.

Meanwhile, urban centers such as Los Angeles and San Francisco have lower vacancy rates due to the perpetual influx of new residents.

“Rental yield is the backbone of any profitable real estate investment.”

Demographics also play a vital role. Cities with a high proportion of young professionals, like San Francisco, or students, like Berkeley, tend to experience stronger rental demand.

- Assess rental yield: Investigate average rental incomes versus property prices.

- Analyze vacancy rates: A lower rate indicates higher demand and stable income.

- Understand tenant demographics: Tailor properties to meet the needs of the predominant renter group.

By diving deep into these metrics, investors can optimize their property portfolios for maximum returns.

Property Value Trends

Monitoring property value trends is critical for investors aiming to capitalize on DSCR loans. Historical appreciation rates and future value projections inform strategic buying decisions.

In California, property values have exhibited consistent growth, particularly in tech hubs and coastal cities. For example, properties in areas like Palo Alto have seen immense appreciation due to demand from tech professionals.

Additionally, revitalization projects in cities like Oakland have spurred property value increases, presenting lucrative opportunities for early investors.

- Palo Alto: Benefiting from tech industry growth.

- Oakland: Rapid development and gentrification driving up prices.

- Downtown Los Angeles: Revitalization projects enhancing property values.

“Historical and projected property value trends can significantly influence investment profitability.”

Understanding these trends can also help in timing the market. For instance, investing in areas on the verge of growth can result in significant ROI as the property values climb.

Investors should consistently review data on property appreciation to stay ahead of market shifts and maximize their financial gains.

Investment Strategies

Effective investment strategies are essential for leveraging DSCR loans to maximize ROI. This involves selecting the right properties, optimizing financing, and managing expenses efficiently.

Firstly, identifying undervalued properties in high-demand areas can offer substantial ROI. These properties often require minimal improvements to yield high rental incomes.

“Strategic property selection lays the foundation for high ROI.”

Aligning with financial strategies like refinancing can also enhance returns. Taking advantage of low-interest rates to refinance existing loans can reduce overall costs.

- Property Selection: Target undervalued properties with high growth potential.

- Financing Optimization: Refinance to secure lower interest rates.

- Expense Management: Minimize operational costs to increase net income.

Furthermore, proactive property management is imperative. Ensuring high occupancy rates and maintaining the property well can attract premium tenants willing to pay higher rents.

By combining these strategies, investors can effectively use DSCR loans to achieve significant ROI in California’s competitive real estate market.

The Growing Popularity of DSCR Loans in California

Market Trends

California’s real estate market has seen dynamic changes, fueled by investor behavior and economic factors. Understanding these changes is critical to grasping the popularity of DSCR loans.

Increased property prices and rental yields have made traditional loans less attractive to investors. Instead, they seek alternative financing that aligns with current market dynamics.

What are the key market indicators that suggest a shift towards DSCR loans? Tracking metrics like rental income growth and property value appreciation can provide insights.

“The surge in property values has outpaced income growth, making DSCR loans a preferable option for many investors,” notes a leading market analyst.

Moreover, market stability and fewer volatility concerns have encouraged more investors to enter the market, further driving demand for DSCR loans.

Examining these trends helps to predict future movements and identify investment opportunities, making it essential for market analysts and investors.

Ultimately, the shift in market standards and investor requirements has significantly contributed to the rise of DSCR loans in California.

How does this align with broader economic trends? By comparing local data with national statistics, we can better understand this phenomenon.

Benefits Driving Popularity

DSCR loans offer several advantages over traditional financing options, making them particularly attractive to investors. Let’s delve into these benefits.

Firstly, DSCR loans typically feature less stringent eligibility criteria, focusing primarily on rental income rather than personal credit scores.

Why is this significant? Investors with varied income streams or those who prefer leveraging property income find these loans more accessible.

- Flexibility: DSCR loans provide greater flexibility in terms of loan terms and usage.

- Lower Risk: They often present lower risk compared to high-leverage traditional loans.

- Higher Loan Amounts: Based on property performance, investors can secure higher loan amounts.

These benefits align closely with the needs of sophisticated investors looking to maximize returns while managing risks.

Additionally, the emphasis on property performance rather than borrower credentials makes these loans ideal for seasoned real estate investors.

Consider the case of an investor holding multiple properties: DSCR loans can streamline the process, leveraging existing assets for further growth.

Ultimately, these benefits not only drive the popularity of DSCR loans but also reshape investment strategies in the California market.

Non-QM Loan Growth

Non-QM (Non-Qualified Mortgage) loans, such as DSCR loans, have grown steadily, addressing gaps left by traditional lending practices.

Why are non-QM loans becoming more prevalent? These loans cater to borrowers with unique financial profiles that traditional loans often overlook.

The rise of gig economy workers, freelancers, and real estate investors underscores the need for financial products that recognize non-conventional income.

- Diverse Borrower Base: Non-QM loans appeal to a wider range of income earners.

- Customized Solutions: Lenders can tailor these loans to meet specific borrower needs.

- Market Adaptation: These loans adapt to the evolving economic landscape.

Understanding these factors helps analysts forecast loan performance and identify emerging opportunities within the market.

Moreover, lenders focusing on non-QM loans have seen substantial growth, making it a critical segment for investors to watch.

What is the impact of this growth on the broader lending landscape? It’s reshaping credit risk assessment and underwriting standards.

Importantly, the proliferation of non-QM loans reflects a broader trend towards diversified financial products, accommodating a dynamic and diverse borrower base.

Future Outlook

The future of DSCR loans in California appears promising, driven by continuous market demand and evolving financial products.

What trends should investors watch for? Monitoring regulatory changes and economic indicators will be key.

Additionally, technological advancements in fintech could further streamline the lending process, making DSCR loans even more accessible.

Anticipated growth in the rental market will likely sustain the demand for these loans, providing lucrative opportunities for investors.

“As the real estate market evolves, DSCR loans will continue to be a pivotal tool for savvy investors,” predicts a seasoned real estate expert.

Moreover, the adaptability of DSCR loans to various property types and investment strategies ensures their relevance.

Examining data on loan performance and market trends can help refine investment strategies, ensuring optimal returns.

What are the risks? Market analysts must consider potential market downturns and their impact on property values and rental incomes.

Ultimately, staying informed and strategically leveraging DSCR loans can lead to sustained success in the California real estate market.

Conclusion

DSCR loans in California stand out as a powerful tool for investors looking to maximize their returns. These loans, with their emphasis on cash flow rather than personal income, offer an accessible and flexible solution, particularly appealing to self-employed investors. The potential for high returns in thriving rental markets and investment-friendly cities further magnifies their attractiveness.

Understanding the nuances and leveraging the benefits of DSCR loans can transform investment strategies in a highly competitive real estate market. By thoroughly evaluating key qualification criteria and staying informed about market trends, investors can capitalize on the unique advantages of DSCR loans. Explore these opportunities to enhance your portfolio and achieve substantial financial growth in California’s dynamic real estate landscape.

Frequently Asked Questions

Is it hard to get a DSCR loan?

Qualifying for a DSCR loan is generally easier than conventional loans due to its focus on property cash flow rather than personal income.

How much do you need to put down on a DSCR loan?

Typically, a minimum down payment of 20-25% is required for a DSCR loan in California.

How to get a DSCR loan in California?

To get a DSCR loan in California, follow these steps: complete an application, undergo processing and underwriting, and then proceed to closing and funding.

What are the cons of a DSCR loan?

Some cons include potentially higher interest rates and prepayment penalties compared to conventional loans.

What is the minimum credit score required for a DSCR loan?

A minimum credit score of around 620 is typically required to qualify for a DSCR loan.

How do DSCR loans benefit self-employed investors?

DSCR loans benefit self-employed investors by focusing on the property’s cash flow rather than personal income, simplifying the approval process.