-

Table of Contents

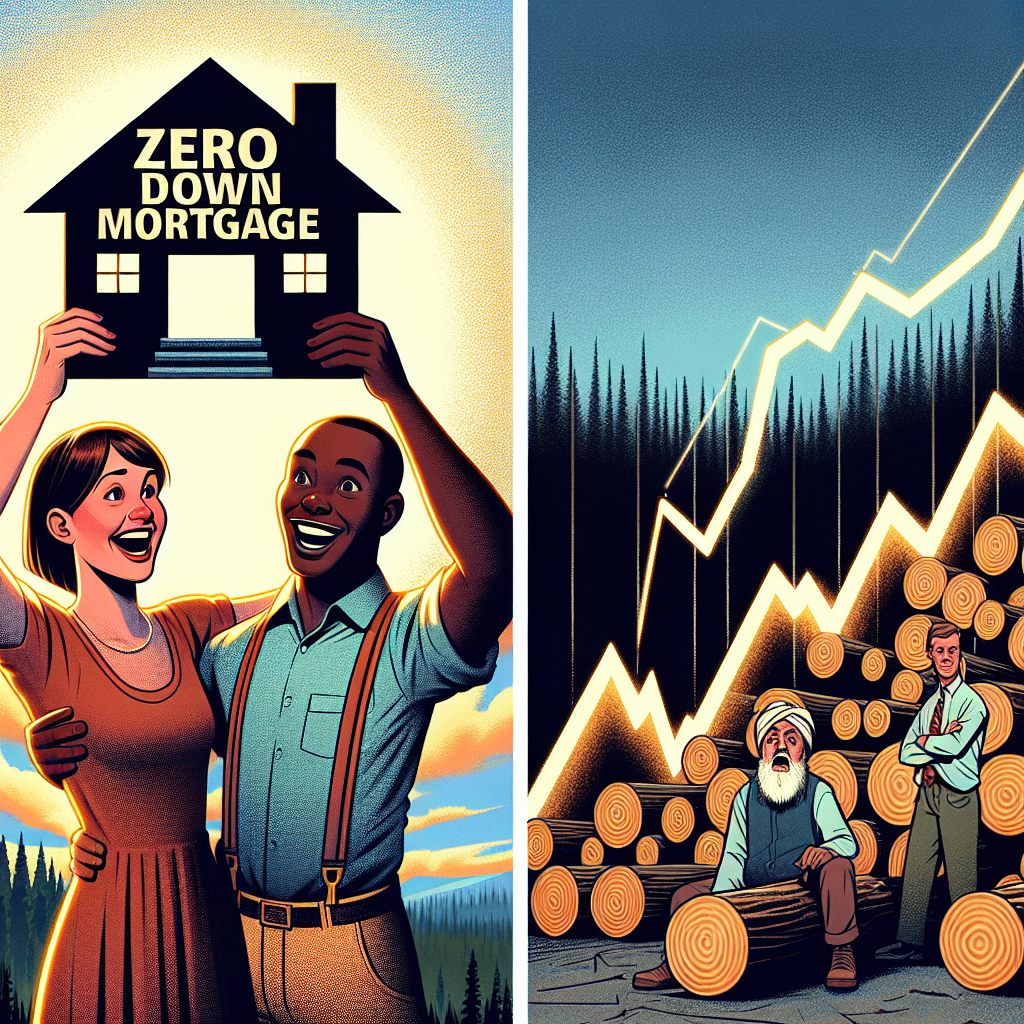

- Discover the Zero-Down Mortgage and the Decline in Lumber Prices

- Understanding Zero-Down Mortgages

- The Appeal of Zero-Down Mortgages

- Risks and Considerations

- Case Study: The Impact of Zero-Down Mortgages in Urban Areas

- The Decline in Lumber Prices

- Factors Contributing to the Decline

- Impact on the Housing Market

- Case Study: The Effect on Homebuilders

- The Interplay Between Zero-Down Mortgages and Lumber Prices

- Increased Homebuyer Activity

- Affordability and Accessibility

- Market Stability

- Conclusion

Discover the Zero-Down Mortgage and the Decline in Lumber Prices

The housing market is a dynamic and ever-changing landscape, influenced by a myriad of factors ranging from economic policies to material costs. Two significant trends have recently emerged that are reshaping the market: the rise of zero-down mortgages and the decline in lumber prices. This article delves into these trends, exploring their implications for homebuyers, builders, and the broader economy.

Understanding Zero-Down Mortgages

Zero-down mortgages, as the name suggests, allow homebuyers to purchase a property without making an initial down payment. This type of mortgage can be particularly appealing to first-time homebuyers or those who may not have substantial savings. However, it also comes with its own set of risks and benefits.

The Appeal of Zero-Down Mortgages

Zero-down mortgages offer several advantages:

- Accessibility: They make homeownership accessible to a broader range of people, particularly those who may struggle to save for a down payment.

- Immediate Homeownership: Buyers can move into their new homes more quickly without waiting to accumulate a down payment.

- Cash Flow Management: Buyers can retain their savings for other expenses, such as home improvements or emergency funds.

Risks and Considerations

Despite their appeal, zero-down mortgages come with certain risks:

- Higher Monthly Payments: Without a down payment, the loan amount is higher, leading to increased monthly mortgage payments.

- Private Mortgage Insurance (PMI): Lenders often require PMI for zero-down mortgages, adding to the overall cost.

- Market Fluctuations: In a declining market, homeowners may find themselves with negative equity, owing more on their mortgage than the home’s current value.

Case Study: The Impact of Zero-Down Mortgages in Urban Areas

In cities like San Francisco and New York, where property prices are notoriously high, zero-down mortgages have enabled more individuals to enter the housing market. For instance, a study by the Urban Institute found that zero-down mortgages accounted for 15% of all home purchases in these cities in 2022. While this has increased homeownership rates, it has also led to higher levels of household debt and financial vulnerability among new homeowners.

The Decline in Lumber Prices

Lumber prices have experienced significant volatility over the past few years, influenced by factors such as supply chain disruptions, tariffs, and changes in demand. Recently, however, there has been a notable decline in lumber prices, which has important implications for the housing market.

Factors Contributing to the Decline

Several factors have contributed to the recent decline in lumber prices:

- Increased Production: Lumber mills have ramped up production to meet the high demand, leading to an oversupply in the market.

- Supply Chain Improvements: The easing of supply chain disruptions has facilitated smoother distribution of lumber.

- Tariff Reductions: The reduction of tariffs on Canadian lumber has lowered costs for U.S. builders.

- Decreased Demand: A cooling housing market has led to reduced demand for new construction materials.

Impact on the Housing Market

The decline in lumber prices has several implications for the housing market:

- Lower Construction Costs: Builders can benefit from reduced material costs, potentially leading to lower home prices for buyers.

- Increased Profit Margins: Builders may see higher profit margins as their costs decrease while home prices remain stable.

- Boost in Renovations: Homeowners may be more inclined to undertake renovation projects due to lower material costs.

Case Study: The Effect on Homebuilders

A report by the National Association of Home Builders (NAHB) highlighted that the decline in lumber prices has led to a 10% reduction in the overall cost of building a new home. This has allowed builders to offer more competitive pricing, particularly in suburban and rural areas where land costs are lower. For example, a homebuilder in Texas reported a 15% increase in sales in 2023, attributing this growth to the lower cost of lumber and the ability to pass on savings to buyers.

The Interplay Between Zero-Down Mortgages and Lumber Prices

The trends of zero-down mortgages and declining lumber prices are interconnected in several ways, influencing the housing market dynamics.

Increased Homebuyer Activity

The availability of zero-down mortgages can lead to increased homebuyer activity, particularly among first-time buyers. This surge in demand can drive up home prices, which may offset some of the benefits of lower construction costs due to declining lumber prices.

Affordability and Accessibility

While zero-down mortgages make homeownership more accessible, the decline in lumber prices can enhance affordability by reducing the overall cost of new homes. This combination can create a more favorable environment for buyers, particularly in markets where housing affordability has been a significant issue.

Market Stability

The interplay between these trends can contribute to market stability. Lower construction costs can help mitigate the risk of housing bubbles, while zero-down mortgages can sustain demand even in a cooling market. However, it is essential to monitor these trends closely to ensure they do not lead to increased financial vulnerability among homeowners.

Conclusion

The rise of zero-down mortgages and the decline in lumber prices are two significant trends reshaping the housing market. Zero-down mortgages offer increased accessibility and immediate homeownership but come with higher monthly payments and potential financial risks. On the other hand, the decline in lumber prices has led to lower construction costs, increased profit margins for builders, and a boost in renovation activities.

The interplay between these trends can create a more favorable environment for homebuyers, enhancing affordability and accessibility. However, it is crucial to balance these benefits with the potential risks, particularly in terms of financial vulnerability and market stability. By understanding these trends and their implications, stakeholders in the housing market can make more informed decisions and navigate the evolving landscape more effectively.

In summary, the housing market is being shaped by the dual forces of zero-down mortgages and declining lumber prices. These trends offer both opportunities and challenges, and their impact will continue to unfold in the coming years. By staying informed and adaptable, homebuyers, builders, and policymakers can leverage these trends to create a more resilient and accessible housing market.