-

Table of Contents

- April Home Sales Hit Pandemic-Era Low

- Understanding the Decline in Home Sales

- Rising Interest Rates

- Economic Uncertainty

- Changing Buyer Behavior

- Impact on Stakeholders

- Buyers

- Sellers

- Real Estate Agents

- Broader Economy

- Case Studies and Examples

- Case Study: San Francisco Bay Area

- Example: Remote Work Trends

- Statistics and Data

- Future Trends and Predictions

- Stabilization of Interest Rates

- Increased Inventory

- Continued Remote Work Influence

- Technological Advancements

- Conclusion

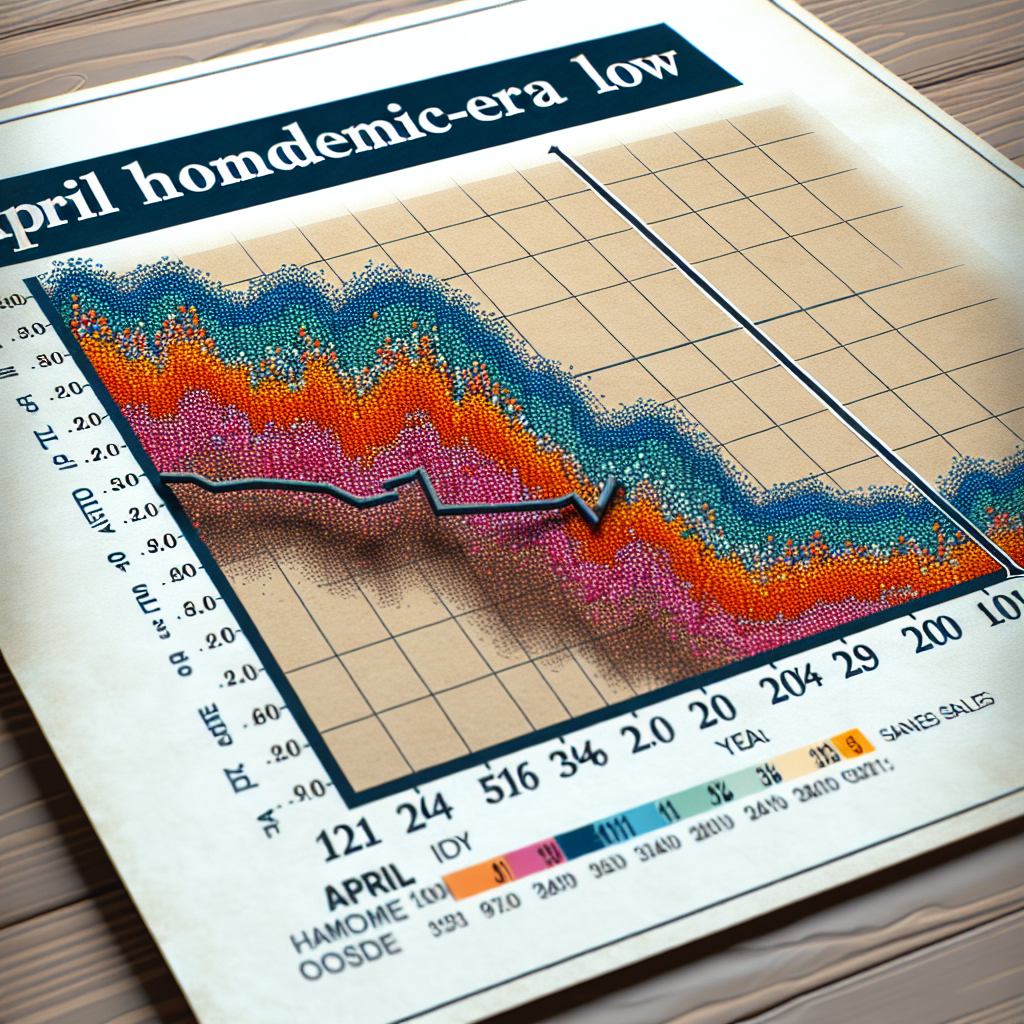

April Home Sales Hit Pandemic-Era Low

The real estate market has been a rollercoaster ride since the onset of the COVID-19 pandemic. April 2023 marked a significant downturn, with home sales hitting a pandemic-era low. This article delves into the factors contributing to this decline, examines the impact on various stakeholders, and explores potential future trends in the housing market.

Understanding the Decline in Home Sales

April 2023 saw a dramatic drop in home sales, reaching levels not seen since the early days of the pandemic. Several factors have contributed to this decline, including rising interest rates, economic uncertainty, and changing buyer behavior.

Rising Interest Rates

One of the primary drivers of the decline in home sales is the increase in interest rates. The Federal Reserve has been raising rates to combat inflation, making mortgages more expensive for potential buyers. Higher interest rates mean higher monthly payments, which can deter buyers from entering the market.

Economic Uncertainty

The broader economic landscape has also played a role in the decline. With concerns about a potential recession, many buyers are hesitant to make significant financial commitments. Job insecurity and fluctuating stock markets add to the uncertainty, causing potential buyers to adopt a wait-and-see approach.

Changing Buyer Behavior

The pandemic has fundamentally altered how people view homeownership. Remote work has become more prevalent, leading some to prioritize different features in a home, such as home offices and outdoor spaces. Additionally, the initial rush to buy homes during the early stages of the pandemic has subsided, leading to a natural cooling of the market.

Impact on Stakeholders

The decline in home sales has far-reaching implications for various stakeholders, including buyers, sellers, real estate agents, and the broader economy.

Buyers

For buyers, the current market presents both challenges and opportunities. While higher interest rates make mortgages more expensive, the slowdown in sales can lead to less competition and potentially lower home prices. Buyers who are financially stable and can secure favorable mortgage terms may find good deals in the current market.

Sellers

Sellers, on the other hand, face a more challenging environment. With fewer buyers in the market, homes may take longer to sell, and sellers may need to adjust their price expectations. Some sellers may choose to delay listing their homes until the market improves, further contributing to the decline in sales.

Real Estate Agents

Real estate agents are also feeling the impact of the slowdown. With fewer transactions, agents may see a decline in their income. However, experienced agents can still thrive by adapting to the changing market conditions and focusing on providing value to their clients.

Broader Economy

The housing market is a significant driver of the broader economy. A decline in home sales can have ripple effects, impacting industries such as construction, home improvement, and retail. Additionally, lower home sales can affect consumer confidence and spending, further influencing economic growth.

Case Studies and Examples

To better understand the current market dynamics, let’s look at some real-world examples and case studies.

Case Study: San Francisco Bay Area

The San Francisco Bay Area, known for its high home prices and competitive market, has seen a notable decline in sales. According to data from the California Association of Realtors, home sales in the Bay Area dropped by 25% in April 2023 compared to the same month last year. The combination of high prices, rising interest rates, and economic uncertainty has made it challenging for buyers to enter the market.

Example: Remote Work Trends

Remote work has significantly influenced buyer behavior. For instance, a survey by Zillow found that 75% of remote workers would consider moving to a different city if they could continue working remotely. This trend has led to increased demand in suburban and rural areas, while urban markets have seen a decline in interest. However, as companies begin to implement hybrid work models, the demand for homes in urban areas may start to rebound.

Statistics and Data

Several key statistics highlight the extent of the decline in home sales and provide insights into the current market conditions.

- According to the National Association of Realtors (NAR), existing-home sales fell by 20% in April 2023 compared to April 2022.

- The median home price in the U.S. increased by 5% year-over-year, reaching $375,000 in April 2023, according to Redfin.

- Mortgage rates averaged 5.5% in April 2023, up from 3.2% in April 2022, as reported by Freddie Mac.

- New home construction starts decreased by 10% in April 2023 compared to the previous year, according to the U.S. Census Bureau.

Future Trends and Predictions

While the current market conditions present challenges, several trends and predictions can help stakeholders navigate the future.

Stabilization of Interest Rates

Many experts predict that interest rates will stabilize in the coming months as inflationary pressures ease. A stabilization of rates could make mortgages more affordable and encourage more buyers to enter the market.

Increased Inventory

As the market cools, more homes may become available for sale. Increased inventory can provide buyers with more options and potentially lead to a more balanced market. Sellers may need to be more competitive with their pricing and marketing strategies to attract buyers.

Continued Remote Work Influence

Remote work is likely to continue influencing buyer behavior. Suburban and rural areas may remain popular, while urban markets could see a resurgence as companies adopt hybrid work models. Buyers will continue to prioritize features that accommodate remote work, such as home offices and outdoor spaces.

Technological Advancements

Technology will play an increasingly important role in the real estate market. Virtual tours, online mortgage applications, and digital closing processes can streamline transactions and make it easier for buyers and sellers to navigate the market. Real estate agents who embrace technology can provide a better experience for their clients and stay competitive in the evolving market.

Conclusion

April 2023 marked a significant downturn in home sales, reaching pandemic-era lows. Rising interest rates, economic uncertainty, and changing buyer behavior have all contributed to the decline. The impact is felt by buyers, sellers, real estate agents, and the broader economy. However, there are opportunities and trends that can help stakeholders navigate the future. Stabilizing interest rates, increased inventory, the continued influence of remote work, and technological advancements are all factors that could shape the housing market in the coming months.

As the market continues to evolve, staying informed and adaptable will be key for all stakeholders. By understanding the current dynamics and anticipating future trends, buyers, sellers, and real estate professionals can make informed decisions and thrive in the changing landscape.