Navigating the credit landscape in today’s digital age can be a maze, but with the emergence of innovative platforms, building or rebuilding credit has become a more navigable journey. Whether you’re a newcomer to the credit world, aiming to diversify your credit lines, or working to recover from a financial hiccup, alternative services provide multiple pathways.

Why Choose Alternative Services?

These services allow for a more tailored approach to credit-building. They enable users to channel regular payments, such as rent and subscriptions, into platforms that ensure positive credit history.

Bypass Traditional Credit Building Pitfalls

Instead of wading through debt or high interest rates, these new-age services offer ways to foster good financial habits, making credit building a safer and more controlled process.

Spotlight on Stellar Services

StellarFi.com StellarFi’s unique method lets users report recurring payments from platforms like Netflix and Hulu. By doing so, it ensures that even your streaming subscriptions can be a stepping stone to a better credit score. Ready to dive in? Learn More About StellarFi

Self.inc A blend of savings and credit building, Self.inc operates as a savings account that also impacts your credit. You get to save money while simultaneously building a robust credit profile. Want to know more? Discover Self.inc Today

Kikoff Kikoff operates differently from Self.inc. Instead of a savings account, they offer a simple credit-building strategy starting at just $1 a month. Their efficacy and straightforward approach make them a go-to for many aiming to uplift their credit status. Begin your journey? Explore Kikoff Now

The Big Secret

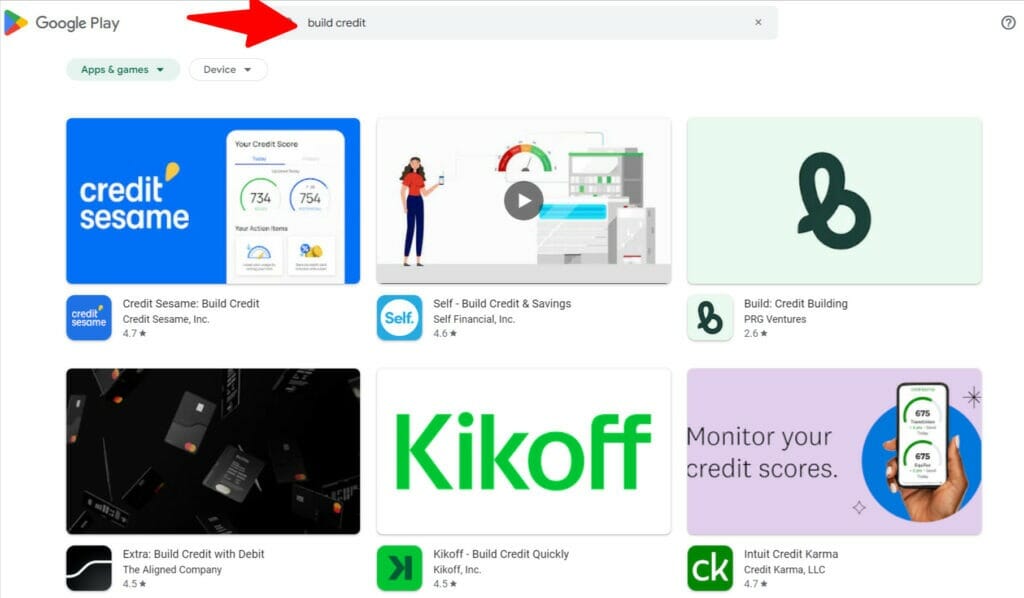

The magic lies in your app store. When hunting for credit building apps or services, key search phrases like “Build Credit” and “Bad Credit Loans” can open doors to numerous tools tailored for credit growth. Here’s a direct link to Google Play Store to start your search.

In conclusion, achieving a commendable credit score doesn’t necessitate heavy debts or exorbitant interest rates. By harnessing the power of alternative services, you set the stage for a prosperous financial future. For a more in-depth insight, make sure to watch our latest video on the topic.

Happy Credit Building!