In the dynamic realm of real estate investing, understanding DSCR loans is crucial for maximizing financial strategies. These loans, focusing on the Debt Service Coverage Ratio, offer a nuanced avenue for investors eyeing property acquisitions. With key metrics highlighting their practical benefits, DSCR loans enhance portfolio diversification.

Real estate investors can leverage DSCR loans’ unique advantages, such as no personal income verification and quick approval processes. However, it’s essential to weigh these benefits against potential drawbacks like higher interest rates and prepayment penalties, ensuring informed decision-making.

Comparing DSCR loans with conventional options reveals distinct eligibility criteria and documentation requirements. By identifying ideal candidates and investment scenarios, this guide helps investors navigate the application process and stay ahead of future market and regulatory trends.

Understanding DSCR Loans: A Detailed Overview

Definition and Purpose of DSCR Loans

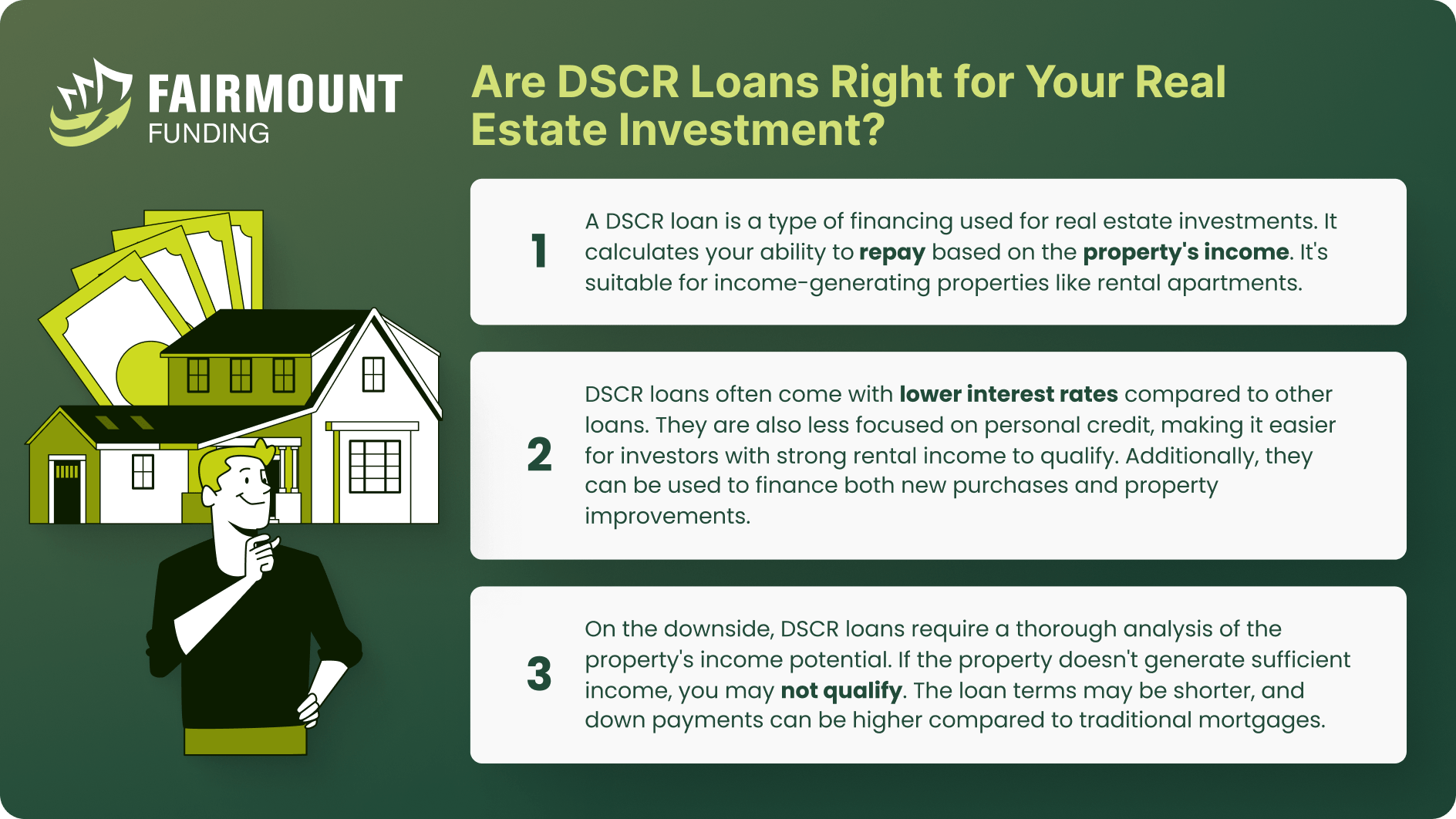

A Debt Service Coverage Ratio (DSCR) loan represents an innovative financing option tailored for real estate investors. Unlike traditional loans, which evaluate a borrower’s personal income, DSCR loans gauge the property’s cash flow to determine eligibility. The primary purpose of these loans is to facilitate investment in income-generating properties.

DSCR loans provide an avenue for investors to secure financing based on the revenue the property can generate, rather than their individual income. This unique approach focuses on the investment’s performance, thereby simplifying the application process for those with fluctuating incomes or less favorable credit histories.

Such loans are crucial for investors seeking to bolster their portfolios with rental properties. By relying on the property’s net operating income (NOI) to cover loan obligations, lenders can assess the financial health of the investment more accurately.

“A DSCR loan prioritizes the property’s ability to generate sufficient income to cover debt payments, making it a vital tool for real estate investors.”

The flexibility and accessibility offered by DSCR loans come with certain considerations. Investors must carefully evaluate the property’s cash flow potential to ensure it aligns with the loan’s requirements, as this will determine their capacity to manage the debt.

In essence, DSCR loans enable real estate investors to leverage the financial performance of their properties, presenting opportunities for growth and expansion within the sector.

Key Metrics and Calculations

Understanding the key metrics and calculations involved in DSCR loans is essential for real estate investors and financial advisors. The cornerstone of these loans is the Debt Service Coverage Ratio (DSCR) itself, a critical measure of property performance.

The DSCR is calculated by dividing the property’s annual net operating income (NOI) by its annual debt obligations, specifically the principal and interest payments. For instance, if a property’s NOI is $120,000 and the annual debt service is $100,000, the DSCR would be 1.2.

Significantly, a DSCR of 1.2 or higher is often preferred by lenders as it indicates the property generates adequate income to cover the debt and have surplus funds. Conversely, a ratio below 1 suggests that the property’s income may not suffice to meet debt obligations, posing a higher risk.

“Lenders typically seek a DSCR of 1.2 or more, signaling that the property can comfortably cover its debt service and possibly yield additional income.”

Other key calculations include:

- Net Operating Income (NOI): This is the total income from the property minus operating expenses, excluding taxes and interest payments.

- Annual Debt Service: The total amount required to cover all principal and interest payments over a year.

By focusing on these metrics, investors can better assess the viability of their investments and determine appropriate financing strategies.

These calculations not only help in securing DSCR loans but also play a pivotal role in ongoing financial management and decision-making for real estate investments.

Importance for Real Estate Investors

DSCR loans hold significant importance for real estate investors, providing an alternative financing route that prioritizes property performance over personal financial standing. This method can be particularly advantageous for investors with variable incomes or those looking to expand their portfolios swiftly.

For real estate investors, the ability to qualify for a loan based on the property’s income-generating potential rather than personal income or credit scores opens up numerous opportunities. It allows them to leverage high-performing assets to secure favorable loan terms and interest rates.

Additionally, DSCR loans offer flexibility in property acquisition and refinancing, enabling investors to capitalize on market conditions and investment opportunities without being constrained by traditional financing limitations.

“Real estate investors benefit from DSCR loans as they can secure financing based on property cash flow, facilitating portfolio growth even with variable personal incomes.”

Despite the advantages, investors should be aware of the associated costs, such as higher interest rates and larger down payments. These factors reflect the lender’s risk and must be factored into the overall investment strategy.

The ability to manage and mitigate risks associated with property performance is essential. Investors must diligently evaluate potential properties, ensuring they can consistently generate sufficient income to meet debt obligations, thereby maximizing the benefits of DSCR loans.

Ultimately, the importance of DSCR loans lies in their capacity to empower real estate investors, providing the financial tools necessary to expand and manage investment portfolios effectively.

Advantages of DSCR Loans for Real Estate Investors

No Personal Income Verification

One significant advantage of DSCR loans is the absence of personal income verification. For real estate investors, particularly those who are self-employed or have complex income structures, this is a substantial benefit. Traditional loans often require W2 forms, tax returns, and extensive income documentation. With DSCR loans, such requirements are minimal or nonexistent.

Instead of focusing on the investor’s personal financial situation, these loans assess the cash flow potential of the property in question. This approach streamlines the application process and enhances accessibility for a broader range of investors.

For example, imagine an investor who owns several rental properties and generates significant income from them. However, due to the nature of real estate investments, their personal income on paper may not appear substantial. DSCR loans enable such investors to qualify for financing based on the revenue generated by their properties, rather than their personal income.

“DSCR loans are based on the cash flow potential of the rental property. If the income can cover debt payments, taxes, insurance, and HOA fees, the loan will likely qualify.”

Additionally, this feature is particularly appealing to full-time real estate investors who no longer have W-2 income. By relying on the performance of their real estate portfolios, they can continue expanding their investments without the obstacles posed by traditional loan requirements.

- No W2 Forms Required: Eliminates the need for traditional employment verification.

- Simplified Approval Process: Streamlines the application process focusing solely on property income.

- Ideal for Self-Employed Investors: Reduces the burden of providing complex income documentation.

Flexibility in Property Types

DSCR loans offer remarkable flexibility when it comes to the types of properties they can finance. This flexibility is crucial for real estate investors who pursue diverse investment strategies. Unlike conventional loans that may have stringent criteria, DSCR loans can be used for a variety of property types.

From long-term rental properties to short-term rentals like Airbnb, and even commercial properties, DSCR loans provide the versatility that investors need. This allows them to expand their portfolios without being constrained by the limitations of traditional financing methods.

Consider an investor who wants to diversify their holdings by acquiring both residential rental properties and commercial buildings. With DSCR loans, they can seamlessly finance these different property types within the same loan framework, providing a significant strategic advantage.

“DSCR loans can be used for various property types, including short-term rental properties like Airbnb, long-term rentals, and commercial property.”

Furthermore, the capability to invest in multiple property types simultaneously enables investors to maximize their income potential and spread their risk across different market segments. This is especially beneficial in dynamic real estate markets where the performance of different property types can vary significantly.

- Long-Term Rentals: Suitable for standard rental properties with steady income.

- Short-Term Rentals: Ideal for properties listed on platforms like Airbnb.

- Commercial Properties: Allows for the acquisition and financing of commercial real estate.

Quick Approval Process

The quick approval process associated with DSCR loans is a significant selling point for real estate investors. The streamlined procedure, stemming from minimal paperwork and a focus on property cash flow, facilitates faster loan approvals compared to conventional loans.

In traditional loan applications, the extensive documentation and personal financial assessment can lead to delays. DSCR loans, however, prioritize the property’s income-producing potential, expediting the approval timeline. This swift process is particularly advantageous in competitive real estate markets, where opportunities can be fleeting.

For instance, if an investor identifies a high-potential property that they wish to acquire quickly, the ability to secure financing without prolonged waiting periods is crucial. DSCR loans offer this speed and certainty, enabling investors to seize opportunities as they arise.

“The underwriting process for a DSCR loan often moves faster because it focuses more on the income-producing potential of the property rather than the borrower’s personal financial situation.”

Moreover, the shorter processing time reduces the risk associated with changing credit environments and lending guidelines, which is a common concern with lengthy approval processes. Investors can lock in their financing terms promptly, minimizing potential disruptions caused by market fluctuations.

- Minimal Documentation: Reduces the time required for loan processing.

- Property-Centric Evaluation: Focuses on the property’s income, expediting approvals.

- Reduced Risk of Changing Guidelines: Faster approvals mitigate the risk of guideline changes during the process.

Drawbacks of DSCR Loans: What Investors Need to Know

Higher Interest Rates

When considering a DSCR loan, one critical aspect to understand is the higher interest rates compared to conventional mortgages. DSCR loans often carry rates between 7% and 9%, which can significantly impact your monthly payments and overall loan cost.

Think about it: A standard mortgage might have an interest rate of about 3% to 4%. With DSCR loans, you could be looking at paying twice as much in interest annually. Why is this the case?

It largely comes down to the risk assessment by lenders. Since DSCR loans are typically used for investment properties, they are viewed as inherently riskier. Therefore, lenders compensate for this risk with higher interest rates.

“Higher rates can make it challenging for investors to meet their financial goals, especially if the rental income does not significantly exceed the mortgage payment,” – a finance expert highlights.

In practical terms, if your investment property is in an area with variable rental income, the higher interest rates could wipe out a large portion of your potential profits. Would you be comfortable with such a scenario?

Additionally, these higher rates imply a greater financial burden. Imagine planning your finances every month, knowing that a significant chunk is going towards interest payments. This could limit your ability to reinvest or handle unexpected expenses.

Larger Down Payments

The requirement for larger down payments is another critical factor potential borrowers should consider. Typically, DSCR loans demand down payments of 20% or more, which can be a substantial amount for many investors.

This can be contrasted with some retail real estate loans, which might only require 0%-3% down. For DSCR loans, having a 20%-30% down payment is not uncommon. This requirement provides a layer of security for the lender but could be financially burdensome for the borrower.

- Liquid Assets: Not every investor has a large sum of liquid assets readily available, making it difficult to meet these requirements.

- Skin-in-the-Game: The high down payment acts as a “skin-in-the-game” measure, ensuring borrowers are committed to the investment.

The substantial upfront cost can also serve as a barrier to entry, preventing smaller or less affluent investors from tapping into the potential benefits of DSCR loans. Would this financial strain be manageable for you?

Potential Prepayment Penalties

Another downside to DSCR loans is the potential for prepayment penalties. Unlike conventional loans where you can typically pay off the loan early without any extra charges, DSCR loans may include penalties for early repayment.

Prepayment penalties are designed to protect the lender from facing reinvestment risk. If you pay off your loan early, the lender has to find another investment opportunity, often at a lower interest rate, thereby losing expected future income.

For investors, this means you might face additional costs if you decide to pay off your loan ahead of schedule. Consider this: if interest rates drop, you might want to refinance to get a better rate. The prepayment penalty could negate the benefits of refinancing, leaving you in a financial conundrum.

These penalties vary depending on the lender and the loan terms. Some lenders offer flexibility but at the cost of higher initial interest rates. Would such terms align with your investment strategy?

“Understanding the full scope of prepayment penalties is crucial for long-term financial planning,” advises a seasoned real estate investor.

Ultimately, while DSCR loans can offer valuable opportunities, these potential downsides emphasize the importance of thorough research and financial planning before proceeding.

Comparing DSCR Loans with Conventional Loans

Eligibility Criteria

The eligibility criteria for DSCR loans and conventional loans vary significantly, which can impact borrowing decisions.

DSCR loans often require a minimum credit score. This is essential to mitigate the lender’s risk, ensuring borrowers demonstrate creditworthiness. Typically, a credit score of at least 620 is required, although some lenders might demand higher scores.

In contrast, conventional loans also require creditworthiness, but lenders may be more flexible with credit score requirements, especially if other financial metrics are strong.

Another critical factor is the loan-to-value (LTV) ratio. DSCR loans usually have LTV ratios that range from 75% to 80%, indicating the loan’s value relative to the property value. Achieving the minimum DSCR of 1.25 to 1.5, which assesses property income against debt obligations, is another common requirement.

Some forward-thinking lenders offer DSCR loans with no minimum DSCR, making them more accessible to investors with varied income profiles.

For conventional loans, the LTV ratios are similar, but additional criteria such as steady income, employment history, and existing debt obligations are rigorously evaluated.

Real estate investors might find DSCR loans appealing if they can demonstrate robust property income, while conventional loans may be better suited to those with less stringent investment profiles.

Documentation Requirements

Documentation plays a pivotal role in assessing loan eligibility. For DSCR loans, the focus is primarily on the rental income of the property and the borrower’s creditworthiness.

Key documents typically required include:

- Property Income Statements: These detail the rental income, vacancy rates, and operational expenses, crucial for calculating the DSCR.

- Credit Reports: Reflecting the borrower’s credit history and financial health.

- Property Appraisals: An independent assessment of the property’s market value.

It’s essential to remember that most DSCR lenders require a minimum DSCR ratio of 1.25 to 1.5 as part of the documentation process.

Conversely, conventional loans demand more extensive documentation. This includes:

- Income Verification: Pay stubs, W-2s, or tax returns to confirm steady income.

- Credit Reports: Assessing the borrower’s credit score and history.

- Asset Statements: Evidence of savings, investments, and other assets.

- Employment Verification: Additional proof of stable employment and income.

The comprehensive documentation for conventional loans ensures a clearer picture of the borrower’s financial stability, making it suitable for risk-averse lenders.

Interest Rates and Terms

Interest rates and loan terms can significantly influence the total cost and feasibility of a loan. DSCR loans generally have higher interest rates compared to traditional mortgages. These rates account for the perceived risk associated with investment properties and can be a decisive factor for investors.

- Higher Interest Rates: Typical of DSCR loans due to non-federal regulation and perceived risk.

- Loan Origination Fees: Additional fees charged by DSCR lenders, increasing the overall cost.

Conventional loans offer more competitive interest rates, often linked to market conditions and borrower creditworthiness. These loans benefit from federal consumer protection regulations, leading to potentially lower rates and fewer additional fees.

Another consideration is the loan limits. DSCR loans often have a cap, ranging between $2 million and $5 million. This cap ensures manageable risk for lenders but might limit financing options for large-scale projects.

Such limits can make DSCR loans less attractive for investors planning extensive developments or requiring substantial capital.

Conventional loans typically offer higher loan limits, making them suitable for both small and large-scale investments. The terms can also be more flexible, with options for longer repayment periods, which can reduce monthly payments and improve cash flow.

For real estate investors and financial planners, understanding these nuances is crucial. Does the higher cost of DSCR loans outweigh the benefits of potentially easier qualification criteria? Comparing both options helps tailor the financing strategy to the specific investment goals.

Who Should Consider a DSCR Loan?

Ideal Candidates

Identifying the ideal candidates for a DSCR loan is crucial for both lenders and borrowers. These loans are specifically designed for certain types of individuals and businesses.

First and foremost, **real estate investors** who are looking to finance rental properties are prime candidates. DSCR loans focus on the property’s income to determine loan eligibility, making them a viable option for those with substantial rental portfolios.

**Self-employed individuals** also find DSCR loans appealing. Traditional financing often requires extensive personal income documentation, which can be cumbersome for self-employed people. DSCR loans, instead, consider the income generated by the investment property, simplifying the process significantly.

DSCR loans are tailored for those whose income is primarily derived from their property investments rather than a traditional salary.

- Real estate developers: Professionals who develop properties for rental purposes can benefit from DSCR loans, as these loans are based on the property’s income, not the developer’s personal income.

- Property managers: Individuals or companies that manage multiple investment properties can utilize DSCR loans to expand their portfolios efficiently.

- Seasoned landlords: Experienced landlords with a history of successful property management are ideal candidates, as they can demonstrate consistent rental income.

Can first-time investors qualify for DSCR loans? Certainly, they can if they can demonstrate the prospective income of the property.

Investment Scenarios

Which investment scenarios are most suitable for DSCR loans? The answer lies in the nature and goals of the investment.

**Multi-family properties** are a perfect match. These investments typically generate steady income due to the multiple rental units involved.

**Commercial real estate** investments, such as office buildings or retail spaces, also stand to benefit. The rental income from commercial tenants can adequately meet the debt service coverage ratio required by these loans.

Investing in vacation rental properties can be a lucrative scenario for utilizing a DSCR loan, especially in high-demand tourist areas.

- Multi-family units: These properties offer multiple streams of rental income, making it easier to meet DSCR requirements.

- Commercial properties: Steady rental income from businesses can help maintain a favorable DSCR.

- Vacation rentals: High turnover but potentially high income can meet DSCR criteria, especially in popular locations.

Mixed-use developments also catch the eye of DSCR lenders, blending residential and commercial units, thereby diversifying income streams.

Long-term Benefits

What are the long-term benefits of opting for a DSCR loan? Understanding these benefits can help investors make informed decisions.

One major benefit is **financial flexibility**. By focusing on the property’s income rather than personal income, DSCR loans provide flexibility in managing personal finances.

**Portfolio growth** is another advantage. Investors can reinvest rental income into new properties, expanding their portfolio without the need for extensive income verification.

Using DSCR loans to scale investment portfolios allows for ongoing growth and diversification, which are key factors in long-term success.

- Financial stability: By leveraging property income, investors can maintain personal financial stability while growing their investments.

- Tax advantages: DSCR loans can help optimize tax strategies, as the focus is on property income.

- Increased leverage: Investors can leverage their rental income to secure additional properties, enhancing their investment reach.

Finally, the ability to **build equity** in multiple properties over time can lead to substantial financial gains, positioning investors for future opportunities.

Navigating the Application Process for DSCR Loans

Required Documentation

We must begin by gathering all necessary documentation before starting the application process. The income-producing potential of the property will be a crucial factor in securing a DSCR loan.

First, ensure your property documentation is in order, including property title, occupancy certifications, and any relevant rental agreements. These documents provide lenders with a clear picture of the property’s revenue capabilities.

Second, prepare a detailed financial statement for the property. This should include historical and projected income and expenses.

Third, while personal financial details are less critical, having your credit score and personal financial summary can still be beneficial. Even though DSCR loans emphasize property income, poor personal credit can affect loan terms and interest rates.

“It is possible to qualify for a DSCR loan with a low personal credit score since the loan approval is primarily based on the income-producing potential of the property.”

Ensure you have your tax returns ready. Although DSCR loans often do not require income verification via W2s or tax returns, these documents can still strengthen your application.

Finally, gather any current loan statements if you have existing mortgages. This information helps lenders assess your overall financial situation.

Steps to Apply

Applying for a DSCR loan involves several key steps. Let us walk through them to ensure a smooth application process.

First, research potential lenders. Look for those specializing in DSCR loans. A competitive DSCR lender can make a significant difference in your application process.

“If you’re working with a competitive DSCR lender, it will be hard to find reasons to not use DSCR loans to finance your rental properties and grow your portfolio.”

Next, submit a preliminary loan application. This initial step typically involves providing basic information about yourself and your property.

Once your preliminary application is reviewed, the lender will request additional documentation. Ensure all required documentation is ready to avoid delays.

- Property Appraisal: Lenders will often require a professional appraisal to validate the property’s income potential.

- Underwriting: The lender’s underwriting team will review all documents to assess the loan’s risk and determine the terms.

- Loan Approval: Upon successful underwriting, you will receive an offer. Review the terms carefully before accepting.

Finally, complete the closing process. Sign the necessary documents, and the funds will be disbursed to finalize your purchase or refinance.

Tips for a Successful Application

How can you optimize your chances of a successful DSCR loan application?

Work with experienced professionals. Engage with lenders and brokers who specialize in DSCR loans. Their expertise can navigate you through complexities.

- Research the Market: Understanding market dynamics and current DSCR loan trends can help you make informed decisions.

- Prepare Thoroughly: Detailed documentation and clear financial records enhance the credibility of your application.

- Highlight Property Income: Emphasizing the property’s revenue-generating potential can outweigh weaker personal financial metrics.

Moreover, consider property management. Effective management can enhance property value and income, strengthening your application.

Also, stay organized. Keeping a well-organized record of all communication and documentation ensures nothing is overlooked.

Lastly, maintain a proactive approach. Follow up consistently with your lender and address any requests promptly to keep the application process on track.

Future Trends and Considerations for DSCR Loans

Market Trends

Recent trends in the market indicate a growing preference for Debt Service Coverage Ratio (DSCR) loans among both seasoned and novice investors. This is largely due to the flexibility DSCR loans offer, allowing investors to leverage rental income to qualify for larger loan amounts.

In addition, we have observed a shift towards more aggressive investment strategies. Investors are increasingly using DSCR loans to capitalize on higher-yield properties, which has contributed to a rise in property prices in certain markets.

An interesting development is the rising interest in secondary and tertiary markets. Investors, seeking better returns, are moving away from saturated primary markets to these emerging regions. How will this impact the long-term stability of these areas?

Secondary markets are becoming the new frontier for real estate investors, driven by the search for higher yields and lower entry costs.

Technological advancements also play a pivotal role in shaping market trends. The integration of data analytics and AI in property management and investment decision-making enhances the strategic use of DSCR loans.

- Data-Driven Investments: Investors now utilize market data to predict trends and make informed decisions, leveraging DSCR loans to their advantage.

- AI in Property Management: AI tools streamline property management, making DSCR loans even more attractive by ensuring consistent rental income.

As market conditions continue to evolve, staying abreast of these trends is crucial for any real estate investor aiming to maximize returns through DSCR loans.

Regulatory Changes

Regulatory frameworks surrounding DSCR loans are continuously evolving. Keeping an eye on these changes is essential for investors and market analysts. Recent adjustments in loan-to-value (LTV) ratios and debt-to-income (DTI) requirements have impacted how DSCR loans are underwritten.

Additionally, new regulations aimed at ensuring fair lending practices and borrower protection are influencing the DSCR loan landscape. What implications will these changes have on the accessibility of DSCR loans for different investor profiles?

An example is the implementation of stricter guidelines for property appraisals. Regulators are pushing for more comprehensive assessments to ensure that the income projections used for DSCR loan qualifications are realistic and reliable.

- Appraisal Standards: Enhanced standards ensure that property valuations are accurate, affecting the amount and terms of DSCR loans.

- Fair Lending Practices: Regulations are promoting transparency and fairness, potentially making DSCR loans accessible to a broader range of investors.

Furthermore, tax policies are an area to watch. Changes in real estate taxation could alter the attractiveness of DSCR loans, either by increasing the profitability of real estate investments or by adding additional financial burdens.

Importantly, keeping pace with regulatory changes is vital to navigate the complexities of DSCR loans effectively.

Future Opportunities

Looking ahead, there are numerous opportunities for investors leveraging DSCR loans. The focus on sustainable and green properties presents a significant growth area. How can investors capitalize on this trend?

Investing in energy-efficient buildings not only meets growing regulatory requirements but also attracts environmentally-conscious tenants, ensuring a steady rental income stream.

- Green Investments: Energy-efficient properties provide long-term savings and appeal to a broad tenant base, enhancing DSCR loan performance.

- Technological Integration: Smart home technologies increase property value and rental appeal, aligning with DSCR loan strategies.

Another opportunity lies in expanding into international markets. With the global real estate sector becoming increasingly interconnected, DSCR loans offer a viable option for investors seeking to diversify their portfolios across borders.

Global diversification through DSCR loans opens up new markets and opportunities, reducing risk and enhancing returns.

Lastly, the continued development of real estate fintech platforms offers innovative ways to manage DSCR loans. These platforms provide tools for better tracking, analysis, and optimization of real estate investments.

By understanding and leveraging these opportunities, investors can effectively position themselves to benefit from the evolving landscape of DSCR loans.

Conclusion

Grasping the intricacies of DSCR loans can be pivotal for real estate investors aiming for strategic growth. With no personal income verification and the flexibility in property types, DSCR loans present a compelling alternative to conventional loans. Though they come with higher interest rates and larger down payment requirements, the advantages often outweigh these considerations for the right investor.

Understanding the eligibility criteria, documentation, and steps involved can streamline the application process, making it more efficient. Real estate investors who can navigate these elements may find DSCR loans to be a valuable tool in their investment arsenal, particularly in a dynamic market.

As market trends evolve and regulatory landscapes shift, staying informed and adaptable ensures investors can capitalize on future opportunities. For those seeking to expand their portfolios, delve deeper into DSCR loans and consider how they might fit into your long-term investment strategy.

Frequently Asked Questions

What is the benefit of a DSCR loan?

DSCR loans offer flexibility, no personal income verification, and quick approval processes for real estate investors.

How much down payment is needed for a DSCR loan?

Typically, a DSCR loan requires a larger down payment, often around 20-30%.

What is the average interest rate for a DSCR loan?

The average interest rate for a DSCR loan is generally higher than conventional loans, often around 5-7%.

Who should consider a DSCR loan?

Ideal candidates for DSCR loans are real estate investors looking for flexible financing options without personal income verification.

What types of properties can be financed with a DSCR loan?

DSCR loans can finance various property types, including residential, commercial, and mixed-use properties.

What documentation is required for a DSCR loan application?

Required documentation typically includes property financials, rent rolls, and detailed appraisal reports.