Delving into the intricacies of DSCR loans is essential for savvy real estate investors. This comprehensive guide unravels the fundamental aspects, benefits, and unique features of DSCR loans, highlighting their significance in today’s financial landscape.

From understanding loan approval processes to comparing DSCR to traditional loans, this article provides a clear, step-by-step explanation. Learn about eligibility criteria, pros and cons, and discover when DSCR loans are the optimal choice for your investment strategy.

Understanding DSCR Loans: A Comprehensive Guide

What is a DSCR Loan

A DSCR loan, which stands for Debt Service Coverage Ratio loan, is a type of financing specifically designed for real estate investments. Unlike traditional loans, DSCR loans focus on the income-generating potential of the property being purchased or refinanced rather than the borrower’s personal finances or credit history.

To qualify for a DSCR loan, lenders look at the ratio of the property’s net operating income (NOI) to its total annual debt service. This measurement, the DSCR, determines if the property generates sufficient income to cover the loan payments. Typically, a DSCR of 1.25 or higher is considered favorable.

“DSCR loans provide a way to finance investments without relying on personal credit, making them accessible to a wider range of investors.”

Because DSCR loans depend on the property’s income, they can be ideal for self-employed individuals or those with multiple investment properties. They are popular among real estate investors who want to grow their portfolios without the stringent requirements of conventional mortgages.

Key Features of DSCR Loans

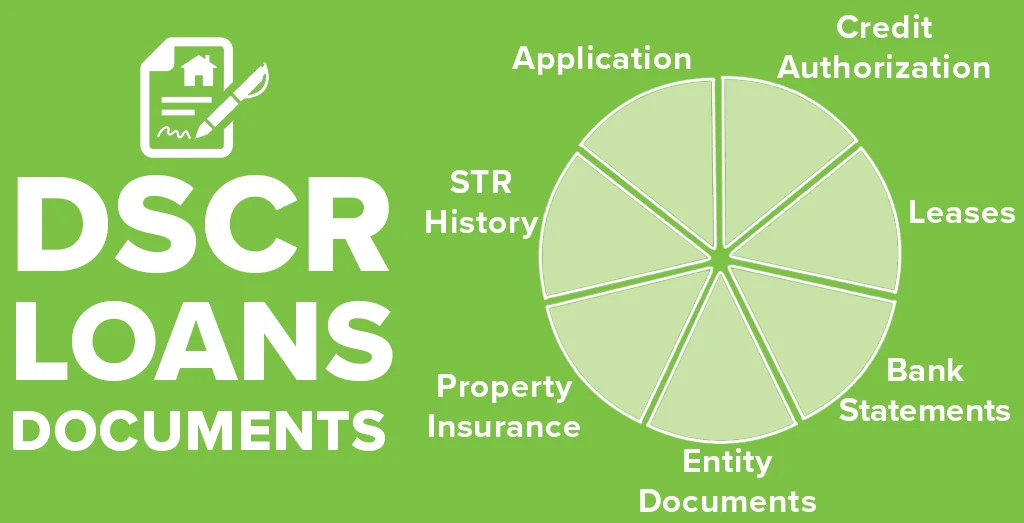

DSCR loans possess several unique characteristics that distinguish them from other types of loans. Key features include:

- Income-Based Qualification: Approval is based on the property’s income rather than the borrower’s personal financials.

- Higher Loan-to-Value (LTV) Ratios: Borrowers can finance a larger portion of the property’s value compared to traditional loans.

- Flexible Underwriting: Lenders have more freedom in approving loans, which means faster processing times and fewer documentation requirements.

- Lower Interest Rates: Typically, DSCR loans offer competitive interest rates, potentially saving borrowers money over the life of the loan.

- Diverse Loan Options: These loans can be structured with fixed or variable rates and can include interest-only payment options.

Given these features, DSCR loans are especially appealing to those looking for flexibility and efficiency in their real estate investment financing.

Why DSCR Loans Matter

DSCR loans play a vital role in the real estate investment landscape for several reasons. They provide a viable option for financing when traditional loans are out of reach due to personal credit limitations or other financial constraints.

One of the primary benefits is the ability to leverage the income from investment properties to acquire additional assets or make improvements to existing ones. This leverage can help investors expand their portfolios and increase their overall return on investment (ROI). For example, an investor with multiple properties may find that conventional lenders are unwilling to approve additional mortgages. In this scenario, a DSCR loan can provide the necessary financing based on the income-generating power of the existing properties.

Moreover, DSCR loans often have fewer restrictive covenants than traditional loans, offering investors more operational flexibility. This freedom allows for more strategic and potentially profitable decision-making regarding property management and upgrades.

Additionally, because these loans focus on the income potential of the property, they can be particularly beneficial for self-employed individuals who might struggle to meet the income verification standards of conventional loans. This inclusivity makes DSCR loans an attractive option for a diverse group of real estate investors.

“By focusing on property income rather than personal financials, DSCR loans open doors for investors to continue growing their real estate portfolios.”

Importantly, DSCR loans are an essential tool for real estate investors seeking flexible and efficient financing options. They allow investors to capitalize on the income potential of their properties while offering competitive terms and operational flexibility.

How DSCR Loans Work: A Step-by-Step Explanation

Income-Based Loan Approval

Unlike traditional mortgage loans that heavily rely on the borrower’s credit score and income, Debt Service Coverage Ratio (DSCR) loans primarily focus on the property’s income-generating capacity. The approval process for DSCR loans centers around the ability of the property to cover its debt obligations through its income.

DSCR loans offer an alternative to conventional mortgages, providing more flexibility for investors who may not meet the stringent requirements imposed by government programs. For example, a prospective real estate investor with a less-than-ideal credit score can still secure a DSCR loan if the property in question has a strong rental history and potential.

Most of the common mortgage types have strict qualification requirements dictated by government programs; DSCR loans, on the other hand, aren’t bound by these ironclad rules.

Lenders consider various factors, including the Loan-to-Value (LTV) ratio, typically at 80% or less, the type of property, which often includes 1-4 unit residential properties, and the investor’s experience in the market. An investor with a credit score of 680 or higher stands a better chance of qualifying for a DSCR loan.

The emphasis on the property’s income rather than the borrower’s creditworthiness allows for a more inclusive approach. For those aiming to expand their real estate portfolio, DSCR loans present an attractive financing option.

- LTV ratio: 80% or less

- Loan use: 1-4 unit residential properties, non-owner-occupied

- Credit score: 680 or higher

- Loan amount: $175,000 or more

- Investor experience: Stricter eligibility criteria for new, inexperienced investors

But what happens if the borrower defaults? While DSCR loans do not typically show up on a credit report, a default might appear as a delinquent account, impacting the borrower’s credit score.

Calculating DSCR

The Debt Service Coverage Ratio is a key metric used in assessing DSCR loans. It is calculated by dividing the property’s Net Operating Income (NOI) by its total debt service, which includes principal and interest payments. But how does this calculation work in practice?

Suppose a property generates a Net Operating Income of $100,000 annually, and the total debt service amounts to $80,000. The DSCR in this scenario would be calculated as follows:

DSCR = Net Operating Income / Total Debt Service

Using our example: DSCR = $100,000 / $80,000 = 1.25

A DSCR of 1.25 indicates that the property generates 25% more income than required to cover its debt obligations. Most lenders set a minimum DSCR threshold to ensure sufficient income to support loan payments. A DSCR of at least 1.2 is often required to qualify for a DSCR loan.

- Net Operating Income (NOI): The income generated from the property after deducting operating expenses.

- Total Debt Service: The total amount of principal and interest payments on the loan.

- DSCR Threshold: The minimum DSCR required by the lender, often around 1.2.

Why is this ratio so important? It provides a clear picture of whether the property can sustain its debt payments, minimizing the risk for lenders and ensuring the borrower doesn’t face financial strain.

Comparison with Traditional Loans

DSCR loans differ significantly from traditional mortgage loans in several crucial ways. One key difference is the qualification criteria. While traditional loans prioritize the borrower’s credit history, DSCR loans focus on the property’s income potential. This fundamental contrast offers unique advantages for certain investors.

For instance, a traditional loan might require a high credit score, extensive financial documentation, and proof of stable income. In comparison, DSCR loans simplify the process by assessing the income-generating capacity of the property, making it easier for investors with varied financial backgrounds to qualify.

Another distinction lies in the loan terms and conditions. Traditional mortgages often come with standardized terms dictated by federal regulations, whereas DSCR loan terms can be more flexible, as lenders have the liberty to set their own criteria. This flexibility can lead to more favorable terms for borrowers, especially those looking to finance multiple investments.

DSCR loans do not show up on a credit report because they are not based on the borrower’s credit score or credit history.

Moreover, while DSCR loans are tailored for non-owner-occupied properties, traditional loans are often used for both owner-occupied and investment properties. This specificity helps streamline the process for investors whose primary focus is rental income rather than personal residence.

In essence, the flexibility, focus on income potential, and tailored terms make DSCR loans a valuable tool for real estate investors seeking to expand their portfolios with properties that promise strong rental returns.

Eligibility Criteria for DSCR Loans

Credit Score Requirements

Understanding the credit score requirements for a DSCR loan is crucial for potential borrowers and real estate investors. Generally, lenders have different thresholds depending on the risk they are willing to take.

Typically, a credit score of 620 or higher is preferred by most lenders. However, certain programs, like the one discussed in our transcript, prioritize the cash flow generated by the property over traditional credit metrics.

Why is a credit score important? A good credit score often signifies that the borrower is financially responsible and poses a lower risk to the lender. For investors, this can mean better loan terms and interest rates.

Our DSCR loan program emphasizes property cash flow but understanding credit score implications can still play a role in securing favorable terms.

Several factors can influence your credit score:

- Payment History: Timeliness in paying past debts can heavily impact your score.

- Credit Utilization: The ratio of your current revolving credit to the total available credit.

- Length of Credit History: Longer credit histories can improve your score.

In the context of DSCR loans, even though the focus is on cash flow, maintaining a good credit score can still be advantageous.

What steps can be taken to improve your credit score? Regularly monitoring credit reports, ensuring timely payments, and reducing overall debt can be beneficial.

Ultimately, while the emphasis for DSCR loans might be on property income, a strong credit score remains a valuable asset for any borrower.

Property Income Requirements

The cornerstone of DSCR loans is the income generated by the property. So, what do lenders look for when considering property income?

Income documentation is paramount. As highlighted, our program involves using rental income for qualification purposes, specifically through a 1007 appraisal form. This form provides a market rent estimate and helps lenders understand the potential income of the property.

Why is this crucial? The DSCR (Debt Service Coverage Ratio) reflects the property’s ability to cover its debt obligations with its income. A ratio of 1 or higher indicates the property generates enough income to cover its debts.

The DSCR loan program can accommodate properties with a ratio as low as 0, meaning even properties not generating income yet can be considered, focusing on future income potential.

Here are key components to consider regarding property income:

- Rental Income: As exemplified, the rental income serves as the primary qualifying factor.

- Reserve Requirements: Our program requires only three months of reserves, ensuring borrowers have some financial cushion.

- Cash-Out Options: Up to 70% Loan-to-Value (LTV) allows investors to leverage the property’s value.

How can potential investors ensure their property meets these requirements? Accurate record-keeping of rental agreements, consistent tenant payments, and maintaining property upkeep are essential.

The DSCR loan’s unique approach of focusing on property income rather than borrower income makes it an attractive option for real estate investors.

Investor Experience

Does experience matter when applying for a DSCR loan? Absolutely. Most lenders favor borrowers with a proven track record in real estate investment.

The DSCR loan program assists both new and experienced investors, but having prior experience can expedite the approval process.

Why is this the case? Experienced investors often have a better understanding of property management, market trends, and potential risks, making them a safer bet for lenders.

For LLCs, lenders will perform background checks on the guaranteeing members, ensuring they meet certain criteria and have a sound investment history.

Key aspects that showcase investor experience include:

- Past Investments: A portfolio of previously managed properties.

- Market Knowledge: Understanding of local real estate markets and trends.

- Risk Management: Demonstrated ability to handle and mitigate investment risks.

Investors new to the market should consider partnering with experienced professionals or seeking mentorship to build credibility.

What steps can new investors take to increase their chances? Education, thorough market research, and starting with smaller investments can pave the way for successful loan applications.

Ultimately, while the DSCR loan program is designed to be inclusive, demonstrating experience can significantly enhance one’s eligibility and approval chances.

Pros and Cons of DSCR Loans

Advantages of DSCR Loans

DSCR loans, geared specifically towards real estate investors, offer several unique benefits. First and foremost, these loans do not rely on personal income for approval. Instead, they focus on the property’s potential to generate income.

“Securing financing can be difficult for full-time real estate investors and can put a stopper on business growth. But with loan programs like the DSCR loan, built specifically for investors, there is always a creative solution for financing the next deal.”

This focus on property income makes it easier for investors with multiple projects or fluctuating personal incomes to access necessary funds. Traditional loans often require extensive documentation, but DSCR loans simplify the process by emphasizing the property’s income potential.

Another advantage lies in the flexibility of DSCR loans. They often allow for higher loan amounts, which can be essential for large-scale projects. This flexibility extends to repayment terms, which can be more accommodating for investors’ unique financial situations.

- No Personal Income Requirement: Approval is based on property income, not personal finances.

- Higher Loan Amounts: More suitable for larger investments.

- Flexible Repayment Terms: Accommodates the investor’s cash flow and business model.

Investors also benefit from streamlined processes. The documentation and approval process for DSCR loans is often less cumbersome compared to traditional loans, reducing the waiting time to secure financing.

All these advantages can significantly impact an investor’s ability to scale their business swiftly and efficiently, ensuring continuous growth and expansion opportunities.

Potential Drawbacks

While DSCR loans present numerous benefits, they are not without limitations. One significant drawback is the interest rates. These loans often come with higher interest rates compared to traditional financing options.

Why do interest rates matter? Higher interest rates mean increased costs over the life of the loan, which can affect the overall profitability of an investment. Investors must carefully assess whether the benefits outweigh these additional costs.

Another potential downside is the requirement for a high DSCR. Lenders usually require a DSCR of at least 1.25 or higher, meaning the property must generate 25% more income than the debt payments. This can be challenging for properties in less stable markets or for those just starting to generate income.

- Higher Interest Rates: Increased overall costs due to higher interest rates compared to traditional loans.

- High DSCR Requirement: Lenders often require a DSCR of 1.25 or higher, limiting suitability for some properties.

- Market Sensitivity: Property income must be stable and sufficient to meet stringent DSCR requirements.

Additionally, DSCR loans can be more complex to navigate, particularly for novice investors. Understanding the specific nuances and requirements of these loans requires a certain level of expertise and familiarity with real estate financing.

Given these potential drawbacks, it is crucial for investors to weigh the pros and cons carefully and consider how DSCR loans fit into their overall financial strategy.

Situations Where DSCR Loans Shine

DSCR loans can be particularly advantageous in certain scenarios. One such situation is when an investor has multiple properties and complex financials. Traditional loans might struggle to account for various sources of income, but DSCR loans focus on the property’s income potential, simplifying the approval process.

For example, an investor with a portfolio of rental properties might find DSCR loans beneficial due to their flexibility and property-centered assessment.

- Multiple Properties: Ideal for investors managing several properties with complex financials.

- Large-Scale Projects: Suitable for significant investments requiring substantial capital.

- Income-Focused Assessment: Approval based on property income rather than personal financials.

Another scenario where DSCR loans excel is in high growth markets. In markets where property values are rapidly increasing, the potential for higher rental income can meet or exceed the DSCR requirements, making it easier to secure financing.

Furthermore, these loans are beneficial for experienced investors who have a deep understanding of the real estate market. Their knowledge and experience can help navigate the complexities of DSCR loans and leverage them effectively for business growth.

Ultimately, DSCR loans are a powerful tool for real estate investors when appropriately utilized, offering the potential to unlock significant opportunities and foster long-term success.

When to Consider a DSCR Loan for Your Real Estate Investment

Ideal Scenarios for DSCR Loans

DSCR loans are particularly useful in specific scenarios that real estate investors frequently encounter. For instance, investors looking to expand their portfolio without the hassle of traditional income verification processes may find DSCR loans advantageous. These loans focus on the property’s cash flow rather than the borrower’s personal income, making them ideal for those with complex financial situations.

Another scenario where DSCR loans shine is when acquiring properties that generate consistent rental income. Since the loan evaluation hinges on the property’s ability to cover debt, properties with high and stable rental yields are prime candidates. Picture an apartment complex with long-term tenants—this setup ensures a steady cash flow that meets DSCR criteria.

DSCR loans are an excellent choice for seasoned investors who understand the market dynamics and have properties with reliable cash inflows.

Moreover, if you are an investor eyeing a property with significant cash flow potential but lacking adequate documentation for traditional loans, a DSCR loan could streamline the acquisition process. The flexibility it offers can be a game-changer in competitive markets.

- High Cash Flow Properties: Perfect for properties with high rental yields.

- Portfolio Expansion: Ideal for investors seeking to grow without traditional income verification.

- Competitive Markets: Beneficial in fast-paced markets where quick acquisitions are crucial.

Finally, properties in areas with high demand and low vacancy rates often meet DSCR loan requirements effortlessly. These scenarios demonstrate the potential for a consistent revenue stream, thereby justifying the loan.

Self-Employed Borrowers

For self-employed individuals, securing traditional financing can often be a challenge due to the fluctuating nature of their income. DSCR loans can be particularly beneficial in these situations. Since these loans emphasize the property’s income-generating potential instead of the individual’s personal income, they align well with the financial realities of self-employment.

Imagine a freelance graphic designer looking to invest in real estate. Traditional loans may require extensive documentation and verification of steady income, which can be problematic. In contrast, a DSCR loan would focus on the rental income the property can generate, simplifying the process.

DSCR loans cater to the unique financial circumstances of self-employed borrowers, making real estate investments more accessible.

Moreover, self-employed individuals often have irregular income streams. DSCR loans, by assessing the property’s net operating income relative to its debt obligations, provide a realistic pathway to financing without the usual hurdles.

- Fluctuating Income: Suitable for those with varying monthly income.

- Simplified Documentation: Requires less personal income verification.

- Property Focused: Emphasizes the revenue potential of the property rather than personal earnings.

In essence, self-employed investors can leverage the flexibility of DSCR loans to build their portfolios, using properties that generate rental income as the basis for loan approval. This approach opens up new avenues for investment without the stringent requirements of traditional financing.

Multi-Property Investors

For investors with multiple properties, managing loans can be an arduous task, especially with traditional lenders who scrutinize each asset and require comprehensive income documentation. DSCR loans present an attractive alternative, focusing on the cash flow each property generates.

Consider an investor who owns several rental properties. The cumulative rental income from these properties can effectively meet DSCR loan criteria, making it easier to secure financing for additional investments. This focus on cash flow allows investors to scale their portfolios efficiently.

DSCR loans enable multi-property investors to leverage their existing assets to finance further acquisitions seamlessly.

Additionally, these loans often come with streamlined approval processes, reducing the time and effort required for each new investment. This efficiency is especially beneficial in dynamic real estate markets where swift decision-making is crucial.

- Streamlined Processes: Easier and quicker approval compared to traditional loans.

- Portfolio Leveraging: Ability to use income from multiple properties as loan criteria.

- Scalability: Facilitates the expansion of investment portfolios.

Ultimately, for multi-property investors, DSCR loans offer a practical solution to finance growth, focusing on the performance of their assets rather than exhaustive personal financial scrutiny. This approach not only saves time but also provides the flexibility needed to thrive in competitive real estate markets.

Calculating the Debt Service Coverage Ratio (DSCR)

Formula for DSCR

The fundamental equation for calculating the Debt Service Coverage Ratio (DSCR) is:

DSCR = Net Operating Income (NOI) / Debt Service

Essentially, this formula compares the net operating income generated from a property to the total debt service obligations. By understanding this calculation, we can assess a property’s ability to generate sufficient income to cover its debt payments.

The DSCR is crucial for investors and analysts because it indicates the financial health of an investment. A DSCR of 1.0 means that the income exactly matches the debt obligations. However, financial stability is better represented by a DSCR above 1.2, which provides a buffer for unexpected expenses.

“A DSCR ratio of 1.2 signifies a 20% cushion over the debt service obligations,” as indicated in financial guidelines.

It’s important to note that this ratio is not static; it can change based on variations in income and expenses. Consistent monitoring and recalculating help maintain an accurate financial picture.

For instance, if a property generates an NOI of $120,000 and has annual debt payments of $100,000, the DSCR calculation would be:

DSCR = $120,000 / $100,000 = 1.2

Given this example, the property generates enough income to cover its debt obligations with an additional 20% margin.

Understanding Net Operating Income

Net Operating Income (NOI) is the cornerstone of the DSCR calculation. But what exactly does NOI encompass?

NOI is the total income from the property, which includes revenues from rents, parking fees, and other income sources. From this total, we subtract all the operating expenses directly associated with the property. These expenses typically include:

- Property Taxes: Annual taxes levied on the real estate.

- Insurance: Premiums paid for property’s insurance coverage.

- Repairs and Maintenance: Costs incurred for upkeep and repairs.

- Property Management Fees: Fees paid to property management companies.

However, it is critical to note that NOI is calculated before deducting any loan payments. This distinction is vital because it ensures the income used in the DSCR calculation is purely from property operations, not influenced by financing terms.

Why is understanding NOI essential? Because it represents the property’s ability to generate income from its operations alone, making it a key metric for assessing investment viability.

“Net Operating Income reflects the true profitability of a property, free from the impacts of financing structures,” financial advisors often remark.

Thus, investors should meticulously calculate and forecast NOI to ensure it accurately reflects potential income and expenses.

Practical Calculation Examples

Let’s dive into some practical examples to solidify our understanding of DSCR calculations:

Example 1:

- Net Operating Income: $2,000 per month

- Monthly Debt Service: $1,500

Calculation:

DSCR = $2,000 / $1,500 = 1.33

With a DSCR of 1.33, the property generates 33% more income than its debt payments, indicating a healthy financial state.

Example 2:

- Net Operating Income: $2,000 per month

- Monthly Debt Service: $2,100

Calculation:

DSCR = $2,000 / $2,100 = 0.95

In this scenario, the DSCR is 0.95, meaning the property fails to generate enough income to cover its debt obligations. Such a ratio would be a red flag for lenders and investors.

Through these examples, it becomes evident that a DSCR below 1.0 indicates insufficient income, while a DSCR above 1.2 is generally desired for securing commercial real estate loans.

Importantly, regular DSCR analysis can assist in making informed investment decisions, ensuring financial stability and loan approval.

Frequently Asked Questions About DSCR Loans

Common Queries and Answers

One of the most frequently asked questions is, “What is a DSCR loan?” A Debt Service Coverage Ratio (DSCR) loan is a type of financing used primarily in real estate investment. It measures the cash flow available to pay current debt obligations, ensuring that borrowers have enough income to cover their debts.

Another common query is “How is DSCR calculated?” The DSCR formula is simple: net operating income (NOI) divided by total debt service. This ratio helps lenders assess a borrower’s ability to repay the loan.

“What is a good DSCR ratio?” is another key question. Generally, a ratio above 1.25 is considered strong. It indicates that the borrower generates enough income to cover 125% of their debt payments.

Questions also arise around eligibility requirements. Borrowers often ask, “What do I need to qualify for a DSCR loan?” Lenders typically look for stable income, a healthy DSCR ratio, and a good credit score.

“Can DSCR loans be used for residential properties?” Yes, they can. While DSCR loans are more common for commercial real estate, they are also used in residential property investments.

- Loan Amounts: Borrowers often inquire about the typical loan amounts for DSCR loans. These can vary significantly based on the lender and the value of the property.

- Interest Rates: Another frequent question is about interest rates. Rates can be higher than traditional loans due to the increased risk for lenders.

- Repayment Terms: Borrowers want to know about the repayment period, which can range from 5 to 30 years depending on the agreement.

Misconceptions About DSCR Loans

There are several misconceptions about DSCR loans that often lead to confusion. One prevalent myth is that these loans are only available for large commercial properties. In reality, they are accessible for both small and large investments.

Another common misunderstanding is that a high DSCR always guarantees approval. While a good DSCR ratio is crucial, lenders also consider other factors such as credit history and market conditions.

Many believe that DSCR loans are too complicated to obtain. However, with proper guidance and preparation, the process can be straightforward.

People also misinterpret the effect of interest rates on DSCR loans. It’s essential to understand that higher interest rates can impact the DSCR by increasing the debt service, but it doesn’t necessarily make the loan unaffordable.

There’s a notion that DSCR loans have no flexibility. On the contrary, many lenders offer flexible terms tailored to the borrower’s needs.

- Application Process: Some think the application process is overly complex. While detailed, it is manageable with the right documentation.

- Collateral Requirements: Another misconception is that these loans always require substantial collateral. Depending on the lender, this might not be the case.

- Market Limitations: It’s also falsely believed that DSCR loans are limited to certain markets. They are, in fact, available in various regions.

Expert Tips

For prospective borrowers and real estate investors, we offer a few expert tips to navigate the DSCR loan landscape successfully. First, it’s crucial to understand your financial standing. Knowing your net operating income and debt obligations will help you determine your DSCR.

Second, consider working with experienced professionals who can guide you through the loan application process. Their expertise can be invaluable in securing favorable terms.

Maintaining a good credit score is another significant factor. A higher credit score can improve your chances of approval and result in better interest rates.

Additionally, having thorough documentation ready can expedite the approval process. Lenders appreciate borrowers who come prepared with all necessary financial statements and records.

When assessing properties, ensure they generate sufficient income to cover debts. This will not only help with loan approval but also ensure long-term investment stability.

- Regular Monitoring: Keep a close eye on your DSCR over time. This ongoing assessment can help you make necessary adjustments to stay financially healthy.

- Market Trends: Stay informed about market trends. Understanding shifts in the real estate market can help you make better investment decisions.

- Loan Terms: Carefully review loan terms before signing. Ensure you understand all aspects, including interest rates, repayment schedules, and any penalties.

Conclusion

The allure of DSCR loans lies in their unique ability to offer investors flexible financing options based on a property’s financial performance. This guide has underscored the importance of understanding the key features and mechanics of DSCR loans, from calculating the Debt Service Coverage Ratio to comparing these loans with traditional financing methods. For real estate investors, particularly those who are self-employed or manage multiple properties, DSCR loans present an invaluable tool for sustainable growth.

By meeting essential eligibility criteria—such as credit score requirements and property income benchmarks—investors can capitalize on the distinct advantages that DSCR loans provide. However, it’s crucial to weigh potential drawbacks to ensure this financing method aligns with your investment strategy.

Ready to dive deeper into DSCR loans? Explore our in-depth resources and expert tips to master the intricacies of this powerful financing option. Embrace the opportunity to make informed decisions for your real estate investments and achieve your financial goals with confidence.

Frequently Asked Questions

What is DSCR in a loan?

DSCR, or Debt Service Coverage Ratio, measures a property’s ability to cover its debt obligations from its operating income.

Do DSCR loans require 20% down?

DSCR loans typically require a down payment of around 20%, but this can vary by lender and borrower qualifications.

Is a DSCR loan good?

DSCR loans can be advantageous for investors as they focus on property income rather than personal income for qualification.

How hard is it to get a DSCR loan?

Obtaining a DSCR loan can be easier for properties with strong income and borrowers with good credit, but it may be challenging for those with limited financial history or weaker properties.

What are the key features of DSCR loans?

Key features include income-based approval, higher emphasis on property cash flow, and less stringent personal income requirements.

When should investors consider a DSCR loan?

Investors might consider a DSCR loan when they have strong property income, are self-employed, or own multiple investment properties.