-

Table of Contents

- Surge in Construction of Single-Family Rental Homes Across the U.S.

- Understanding the Single-Family Rental Home Market

- Historical Context

- Factors Driving the Surge

- Case Study: Invitation Homes

- Economic and Social Implications

- Impact on Homeownership Rates

- Urban vs. Suburban Dynamics

- Community and Lifestyle Changes

- Challenges and Criticisms

- Case Study: Blackstone Group

- The Future of Single-Family Rental Homes

- Technological Innovations

- Sustainable and Affordable Housing

- Policy and Regulatory Changes

- Conclusion

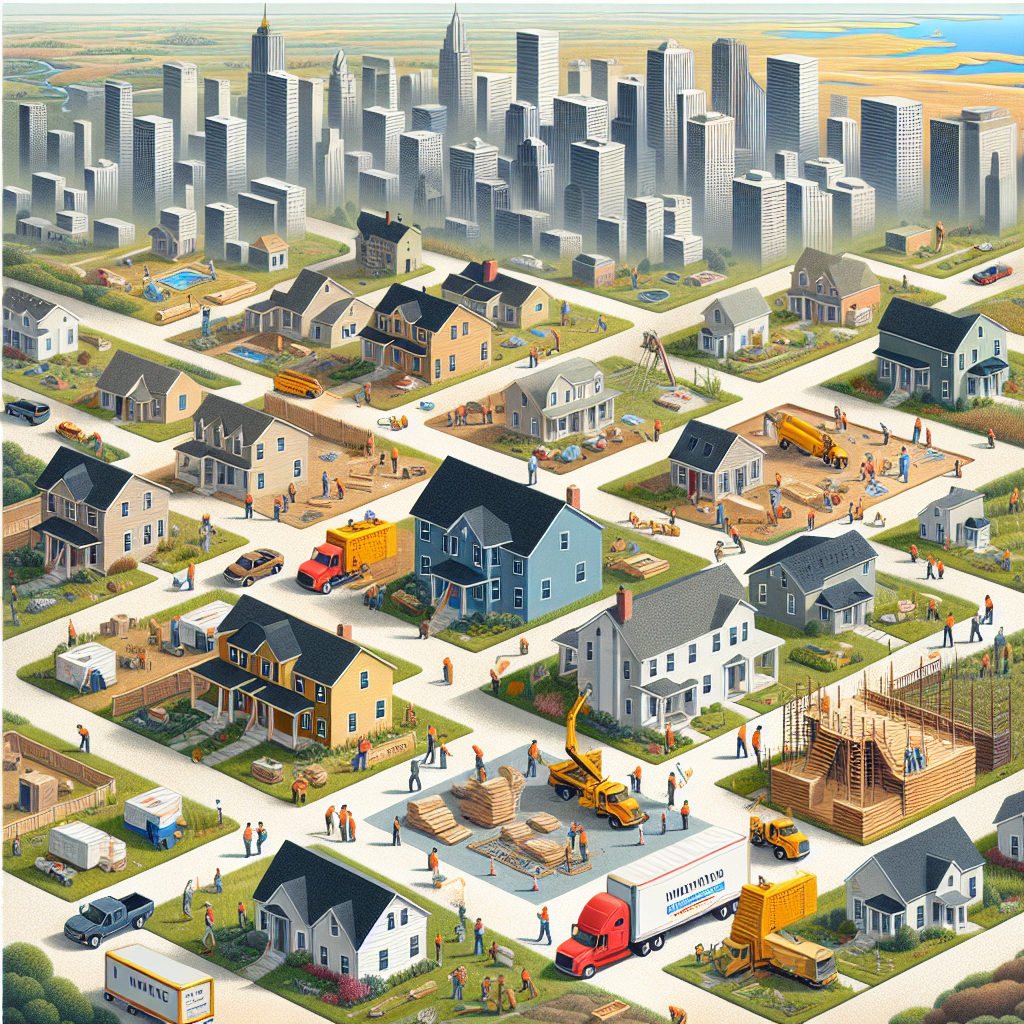

Surge in Construction of Single-Family Rental Homes Across the U.S.

The U.S. housing market is experiencing a significant shift, with a notable surge in the construction of single-family rental homes. This trend is reshaping the landscape of residential real estate, driven by various economic, social, and demographic factors. This article delves into the reasons behind this surge, its implications, and what the future might hold for the single-family rental home market.

Understanding the Single-Family Rental Home Market

Single-family rental homes are standalone properties that are rented out to tenants. Unlike multi-family units such as apartments, these homes offer more privacy, space, and often come with amenities like yards and garages. The demand for such properties has been on the rise, and developers are responding by increasing the construction of these homes.

Historical Context

Historically, single-family homes were primarily owner-occupied. However, the Great Recession of 2008 marked a turning point. The housing market crash led to a surge in foreclosures, and many of these properties were bought by investors and converted into rental homes. This trend has continued to grow, driven by changing consumer preferences and economic conditions.

Factors Driving the Surge

Several factors are contributing to the increased construction of single-family rental homes:

- Affordability Issues: Homeownership has become increasingly unaffordable for many Americans, particularly millennials. High property prices, student loan debt, and stagnant wages make renting a more viable option.

- Flexibility: Renting offers more flexibility than owning a home. This is particularly appealing to younger generations who value mobility and are less likely to stay in one place for long periods.

- Changing Demographics: The U.S. is experiencing demographic shifts, including an aging population and an increase in single-person households. These groups often prefer renting over owning.

- Investment Opportunities: Investors see single-family rental homes as a lucrative investment. The steady rental income and potential for property value appreciation make these homes an attractive asset class.

Case Study: Invitation Homes

Invitation Homes, one of the largest owners of single-family rental homes in the U.S., provides a compelling case study. The company owns over 80,000 homes across 16 markets. Their success highlights the growing demand for single-family rentals and the profitability of this market segment. Invitation Homes focuses on providing high-quality rental properties with professional management, catering to the needs of modern renters.

Economic and Social Implications

The surge in single-family rental home construction has far-reaching economic and social implications:

Impact on Homeownership Rates

The increasing preference for renting over owning is contributing to declining homeownership rates. According to the U.S. Census Bureau, the homeownership rate in the U.S. was 65.4% in 2021, down from a peak of 69.2% in 2004. This trend is expected to continue as more people opt for the flexibility and affordability of renting.

Urban vs. Suburban Dynamics

The construction of single-family rental homes is not limited to urban areas. Suburban and even rural areas are seeing increased development of these properties. This shift is driven by the desire for more space and the ability to work remotely, a trend accelerated by the COVID-19 pandemic.

Community and Lifestyle Changes

The rise of single-family rental homes is also changing community dynamics. These properties often attract a diverse mix of residents, including families, young professionals, and retirees. This diversity can enrich communities but also presents challenges in terms of community cohesion and long-term stability.

Challenges and Criticisms

While the surge in single-family rental home construction has many benefits, it is not without its challenges and criticisms:

- Affordability Concerns: Critics argue that the focus on rental properties can exacerbate affordability issues. As more investors buy up single-family homes to convert into rentals, the supply of homes for sale decreases, driving up prices.

- Quality of Life: Some argue that rental properties are not always maintained to the same standard as owner-occupied homes, potentially leading to declines in neighborhood quality.

- Regulatory Challenges: The rise of single-family rentals has prompted calls for increased regulation to protect tenants and ensure fair practices. This includes rent control measures and stricter building codes.

Case Study: Blackstone Group

The Blackstone Group, a major player in the single-family rental market, has faced criticism for its practices. The company owns thousands of rental homes across the U.S. and has been accused of raising rents excessively and neglecting property maintenance. These criticisms highlight the need for balanced regulation to protect both tenants and investors.

The Future of Single-Family Rental Homes

The future of the single-family rental home market looks promising, with several trends likely to shape its trajectory:

Technological Innovations

Technology is playing a crucial role in the evolution of the single-family rental market. Property management software, smart home technologies, and online rental platforms are making it easier for landlords to manage properties and for tenants to find and rent homes. These innovations are likely to continue driving growth in this market.

Sustainable and Affordable Housing

There is a growing emphasis on sustainable and affordable housing solutions. Developers are increasingly incorporating green building practices and energy-efficient technologies into single-family rental homes. Additionally, there is a push for more affordable rental options to address the housing affordability crisis.

Policy and Regulatory Changes

As the single-family rental market grows, policymakers are likely to introduce new regulations to ensure fair practices and protect tenants. This could include rent control measures, stricter building codes, and incentives for affordable housing development.

Conclusion

The surge in the construction of single-family rental homes across the U.S. is a significant trend with far-reaching implications. Driven by factors such as affordability issues, changing demographics, and investment opportunities, this market segment is reshaping the housing landscape. While there are challenges and criticisms, the future looks promising, with technological innovations, sustainable practices, and policy changes likely to drive further growth. As the market continues to evolve, it will be crucial to balance the needs of tenants, investors, and communities to ensure a thriving and equitable housing market.

In summary, the rise of single-family rental homes represents a dynamic shift in the U.S. housing market. By understanding the factors driving this trend and addressing the associated challenges, stakeholders can harness the potential of this market to create vibrant, diverse, and sustainable communities.