-

Table of Contents

- A Simple Guide to Purchasing Your First (or Next) Small Multifamily Property

- Understanding Small Multifamily Properties

- Step-by-Step Guide to Purchasing a Small Multifamily Property

- 1. Define Your Investment Goals

- 2. Research the Market

- 3. Analyze Potential Properties

- 4. Secure Financing

- 5. Conduct Due Diligence

- 6. Make an Offer

- 7. Close the Deal

- Case Study: Successful Small Multifamily Property Investment

- The Smith Family’s Investment Journey

- Common Challenges and How to Overcome Them

- 1. Property Management

- 2. Financing Hurdles

- 3. Market Fluctuations

- Key Takeaways

- Conclusion

A Simple Guide to Purchasing Your First (or Next) Small Multifamily Property

Investing in real estate can be a lucrative venture, and small multifamily properties offer a unique blend of benefits that make them an attractive option for both novice and seasoned investors. This guide will walk you through the essential steps and considerations for purchasing your first (or next) small multifamily property, providing valuable insights, examples, and statistics to help you make an informed decision.

Understanding Small Multifamily Properties

Small multifamily properties typically refer to residential buildings with two to four units. These properties strike a balance between single-family homes and larger apartment complexes, offering several advantages:

- Increased Cash Flow: Multiple rental units generate more income compared to a single-family home.

- Risk Diversification: Vacancy in one unit doesn’t mean zero income, as other units can still generate revenue.

- Financing Flexibility: Small multifamily properties often qualify for residential loans, which can be easier to obtain than commercial loans.

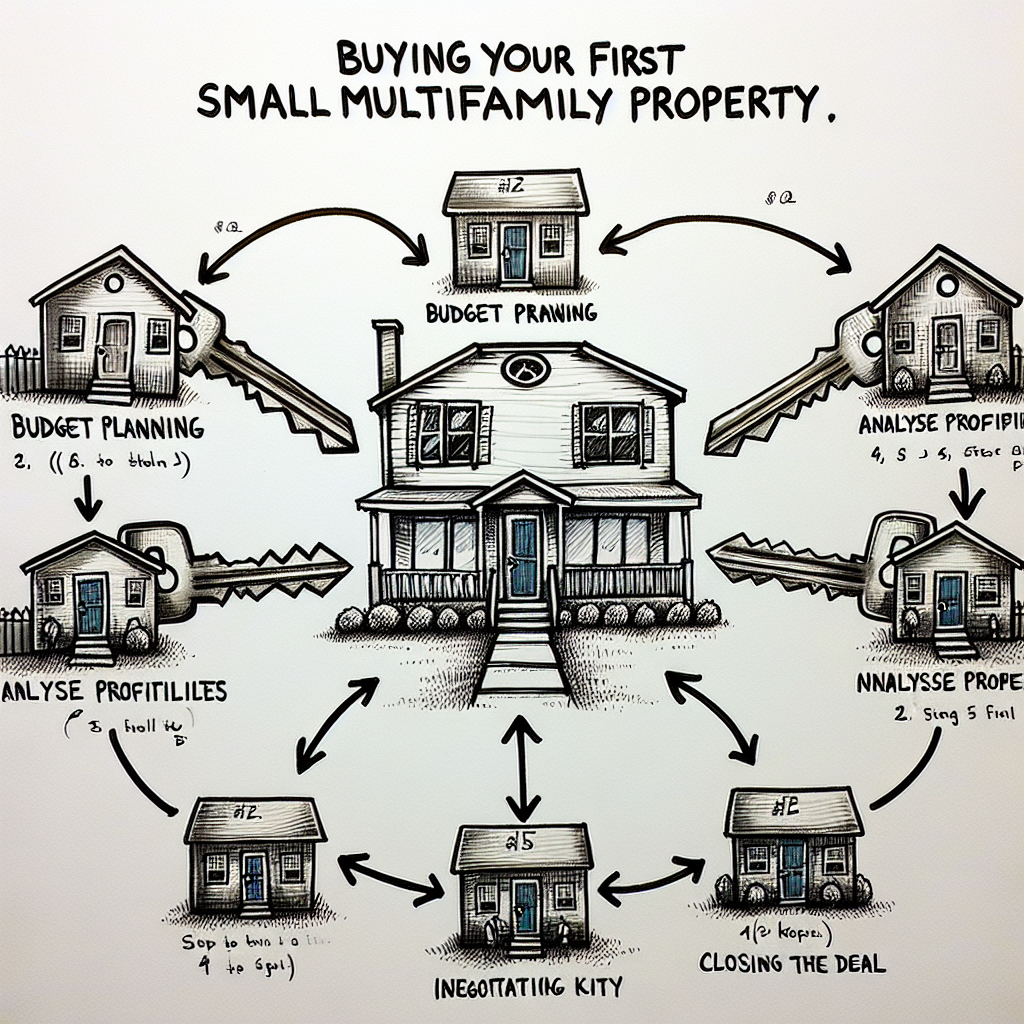

Step-by-Step Guide to Purchasing a Small Multifamily Property

1. Define Your Investment Goals

Before diving into the market, it’s crucial to define your investment goals. Are you looking for long-term appreciation, immediate cash flow, or a combination of both? Understanding your objectives will help you narrow down your property search and make informed decisions.

2. Research the Market

Conduct thorough research on the real estate market in your target area. Look for neighborhoods with strong rental demand, low vacancy rates, and potential for property value appreciation. Utilize online resources, local real estate agents, and market reports to gather data.

3. Analyze Potential Properties

Once you’ve identified potential properties, perform a detailed analysis to assess their viability. Key factors to consider include:

- Location: Proximity to amenities, schools, public transportation, and employment centers.

- Condition: Evaluate the property’s physical condition and estimate potential repair and maintenance costs.

- Rental Income: Calculate the expected rental income based on current market rates and occupancy levels.

- Expenses: Account for property taxes, insurance, utilities, and other operating expenses.

4. Secure Financing

Financing is a critical aspect of purchasing a small multifamily property. Explore different financing options, such as conventional loans, FHA loans, and VA loans. Each option has its own requirements and benefits:

- Conventional Loans: Typically require a higher credit score and down payment but offer competitive interest rates.

- FHA Loans: Backed by the Federal Housing Administration, these loans have lower down payment requirements and are accessible to first-time buyers.

- VA Loans: Available to veterans and active-duty military personnel, offering favorable terms and no down payment.

Work with a mortgage broker or lender to determine the best financing option for your situation.

5. Conduct Due Diligence

Before finalizing the purchase, conduct thorough due diligence to ensure the property meets your expectations. This includes:

- Property Inspection: Hire a professional inspector to assess the property’s condition and identify any potential issues.

- Appraisal: Obtain an appraisal to determine the property’s market value and ensure you’re paying a fair price.

- Title Search: Verify that the property’s title is clear of any liens or encumbrances.

6. Make an Offer

Once you’re satisfied with your due diligence, it’s time to make an offer. Work with a real estate agent to draft a competitive offer that reflects the property’s value and market conditions. Be prepared to negotiate with the seller to reach a mutually beneficial agreement.

7. Close the Deal

After your offer is accepted, you’ll enter the closing process. This involves signing the necessary paperwork, transferring funds, and officially taking ownership of the property. Ensure you have all required documents and funds ready to avoid any delays.

Case Study: Successful Small Multifamily Property Investment

To illustrate the potential benefits of investing in small multifamily properties, let’s examine a real-life case study:

The Smith Family’s Investment Journey

The Smith family, first-time real estate investors, decided to purchase a duplex in a growing suburban neighborhood. Here’s how they navigated the process:

- Investment Goals: The Smiths aimed for a balance of cash flow and long-term appreciation.

- Market Research: They identified a neighborhood with strong rental demand, good schools, and proximity to public transportation.

- Property Analysis: The duplex was in good condition, with minor repairs needed. The expected rental income was $2,500 per month, while expenses were estimated at $1,200 per month.

- Financing: The Smiths secured an FHA loan with a 3.5% down payment, making the purchase more affordable.

- Due Diligence: They conducted a thorough inspection, appraisal, and title search, ensuring the property met their expectations.

- Offer and Closing: The Smiths made a competitive offer, which was accepted. They successfully closed the deal and began renting out the units.

Within a year, the Smiths saw a positive cash flow of $1,300 per month and a 5% increase in property value, demonstrating the potential of small multifamily property investments.

Common Challenges and How to Overcome Them

While investing in small multifamily properties can be rewarding, it’s essential to be aware of potential challenges and how to address them:

1. Property Management

Managing multiple rental units can be time-consuming and complex. Consider hiring a professional property management company to handle tenant screening, rent collection, maintenance, and other tasks. This allows you to focus on growing your investment portfolio.

2. Financing Hurdles

Securing financing for a small multifamily property can be challenging, especially for first-time investors. Improve your chances by maintaining a strong credit score, saving for a substantial down payment, and exploring different loan options.

3. Market Fluctuations

Real estate markets can be unpredictable, with fluctuations in property values and rental demand. Mitigate this risk by diversifying your investment portfolio, conducting thorough market research, and maintaining a financial cushion for unexpected expenses.

Key Takeaways

Investing in small multifamily properties offers numerous benefits, including increased cash flow, risk diversification, and financing flexibility. By following a structured approach and conducting thorough research, you can make informed decisions and achieve your investment goals. Remember to:

- Define your investment objectives.

- Research the market and analyze potential properties.

- Secure appropriate financing and conduct due diligence.

- Be prepared to manage the property or hire a professional management company.

With careful planning and execution, purchasing your first (or next) small multifamily property can be a rewarding and profitable venture.

Conclusion

Purchasing a small multifamily property is a significant step in building a robust real estate investment portfolio. By understanding the market, analyzing potential properties, securing financing, and conducting due diligence, you can make informed decisions that align with your investment goals. The journey may present challenges, but with the right approach and resources, you can navigate them successfully and reap the benefits of increased cash flow and long-term appreciation. Whether you’re a first-time investor or looking to expand your portfolio, this guide provides a comprehensive roadmap to help you achieve your real estate investment aspirations.