Ah, Florida! The Sunshine State, where the oranges are as juicy as the real estate deals. If you’re a self-employed Floridian, you might find that...

Discover a curated list of HUD-approved online courses, designed to fit your schedule and provide the necessary certification to access Down Payment Assistance...

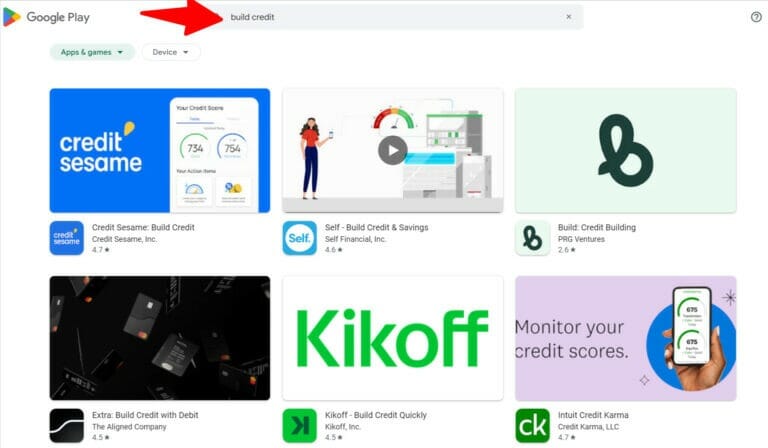

Navigating the credit landscape in today’s digital age can be a maze, but with the emergence of innovative platforms, building or rebuilding credit has...

When it comes to managing your credit, having reliable resources at your fingertips can make all the difference. However, with so many options available,...

Credit repair: you’ve likely heard the term, but what does it really mean? And more importantly, what does it mean for you and your financial health?

Simply...

When it comes to improving your credit score, one often overlooked resource is rent reporting services. These services allow your regular rent payments...

Temporary interest rate buy downs are a financial strategy that allows borrowers to reduce their monthly mortgage payments by paying an upfront fee to...

Bank Statment Mortgages – an Overview

Bank statement mortgages, also known as statement loans, are a type of mortgage loan that enables self-employed...

Are you thinking about buying a house or refinancing your mortgage? If so, you’ve probably heard of mortgage points. But what exactly are they, and...