-

Table of Contents

- Avoid These 5 Common Mental Traps in Investment Decisions

- 1. Confirmation Bias

- Understanding Confirmation Bias

- Case Study: The Dot-Com Bubble

- How to Avoid Confirmation Bias

- 2. Overconfidence

- Understanding Overconfidence

- Case Study: The 2008 Financial Crisis

- How to Avoid Overconfidence

- 3. Herd Mentality

- Understanding Herd Mentality

- Case Study: Bitcoin Mania

- How to Avoid Herd Mentality

- 4. Loss Aversion

- Understanding Loss Aversion

- Case Study: The 2000-2002 Bear Market

- How to Avoid Loss Aversion

- 5. Anchoring

- Understanding Anchoring

- Case Study: The Housing Market

- How to Avoid Anchoring

- Conclusion

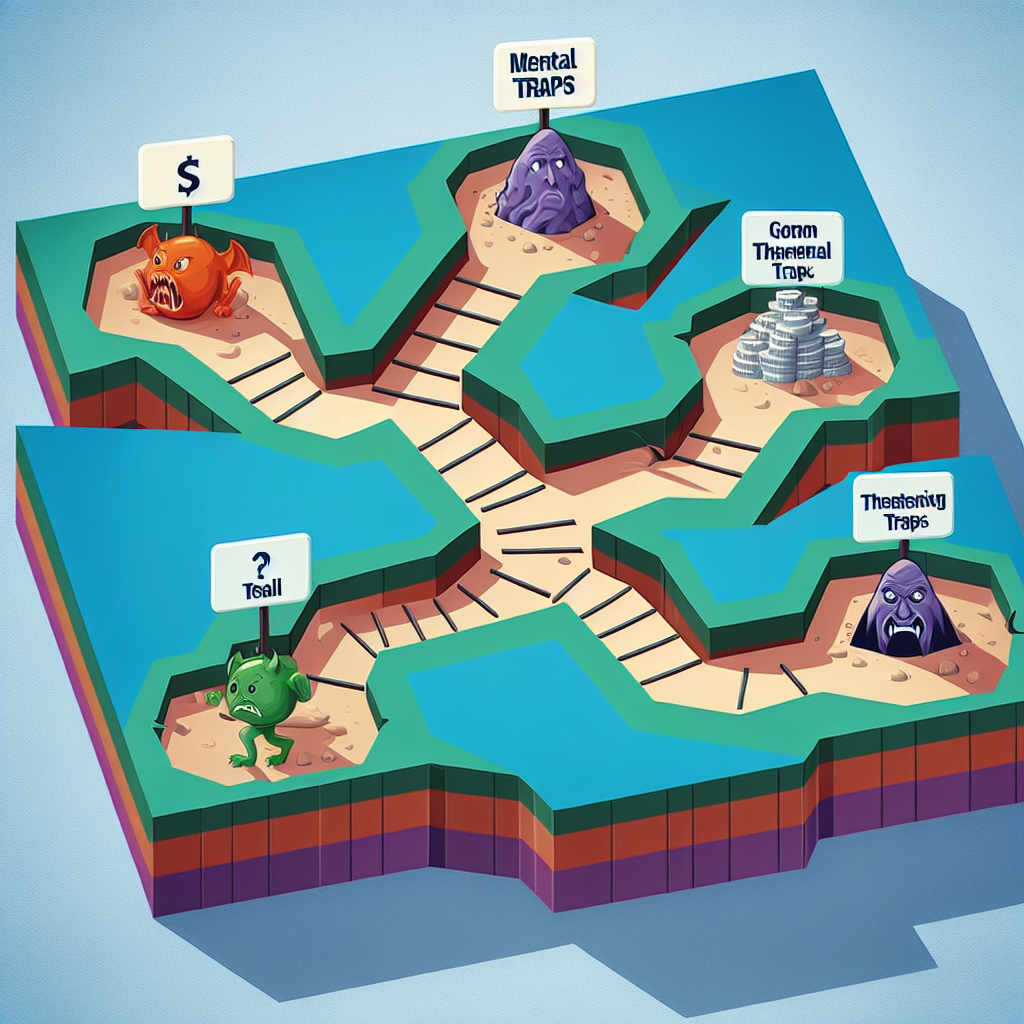

Avoid These 5 Common Mental Traps in Investment Decisions

Investing is as much a psychological game as it is a financial one. The decisions you make can be heavily influenced by mental traps that cloud your judgment and lead to suboptimal outcomes. Understanding these traps and learning how to avoid them can significantly improve your investment performance. In this article, we will explore five common mental traps that investors often fall into and provide strategies to avoid them.

1. Confirmation Bias

Confirmation bias is the tendency to search for, interpret, and remember information in a way that confirms one’s preconceptions. This bias can be particularly detrimental in investing, where objective analysis is crucial.

Understanding Confirmation Bias

When investors have a preconceived notion about a stock or market trend, they often seek out information that supports their view while ignoring or downplaying evidence to the contrary. This can lead to overconfidence and poor decision-making.

Case Study: The Dot-Com Bubble

During the late 1990s, many investors believed that internet companies would continue to grow exponentially. This belief was reinforced by media hype and the success of early internet companies. Investors ignored warning signs and negative information, leading to the infamous dot-com bubble burst in 2000.

How to Avoid Confirmation Bias

- Actively seek out information that challenges your views.

- Consult multiple sources and perspectives before making a decision.

- Consider using a devil’s advocate approach to test your assumptions.

2. Overconfidence

Overconfidence is the tendency to overestimate one’s abilities, knowledge, and predictions. In investing, overconfidence can lead to excessive risk-taking and poor portfolio management.

Understanding Overconfidence

Overconfident investors often believe they can predict market movements or identify winning stocks with greater accuracy than they actually can. This can result in taking on too much risk or failing to diversify adequately.

Case Study: The 2008 Financial Crisis

Many investors and financial institutions were overconfident in their ability to manage risk, particularly in the housing market. This overconfidence contributed to the widespread use of complex financial instruments and excessive leverage, ultimately leading to the 2008 financial crisis.

How to Avoid Overconfidence

- Regularly review and assess your investment performance objectively.

- Set realistic expectations and be aware of your limitations.

- Diversify your portfolio to mitigate risk.

3. Herd Mentality

Herd mentality, or the bandwagon effect, is the tendency to follow the actions of a larger group, often without independent analysis. This can lead to irrational investment decisions and market bubbles.

Understanding Herd Mentality

Investors influenced by herd mentality may buy or sell assets simply because others are doing so, rather than based on their own research. This can result in buying at inflated prices or selling during market panics.

Case Study: Bitcoin Mania

In 2017, the price of Bitcoin skyrocketed as more and more investors jumped on the bandwagon. Many bought Bitcoin without fully understanding the technology or the risks involved, driven by the fear of missing out (FOMO). The subsequent crash in 2018 left many investors with significant losses.

How to Avoid Herd Mentality

- Conduct your own research and analysis before making investment decisions.

- Be skeptical of market trends that seem too good to be true.

- Develop a long-term investment strategy and stick to it.

4. Loss Aversion

Loss aversion is the tendency to prefer avoiding losses over acquiring equivalent gains. This can lead to overly conservative investment strategies and missed opportunities for growth.

Understanding Loss Aversion

Investors who are loss-averse may hold onto losing investments for too long, hoping to avoid realizing a loss. Conversely, they may sell winning investments too early to lock in gains, missing out on potential further appreciation.

Case Study: The 2000-2002 Bear Market

During the bear market following the dot-com bubble burst, many investors held onto their tech stocks, hoping for a rebound that never came. This reluctance to realize losses resulted in even greater financial pain as stock prices continued to decline.

How to Avoid Loss Aversion

- Set predefined exit strategies for both gains and losses.

- Regularly review your portfolio and be willing to make adjustments.

- Focus on long-term goals rather than short-term fluctuations.

5. Anchoring

Anchoring is the tendency to rely too heavily on the first piece of information encountered (the “anchor”) when making decisions. In investing, this can lead to biased judgments and suboptimal choices.

Understanding Anchoring

Investors may anchor to a stock’s initial purchase price, a recent high, or a specific market forecast. This can result in holding onto investments that no longer align with their strategy or failing to recognize new opportunities.

Case Study: The Housing Market

Homebuyers and investors often anchor to the price they paid for a property or its peak value. During the 2008 financial crisis, many were reluctant to sell properties at a loss, even when it was clear that prices would not recover quickly. This anchoring led to prolonged financial distress for many.

How to Avoid Anchoring

- Regularly reassess your investments based on current information and market conditions.

- Avoid fixating on past prices or forecasts.

- Be open to new data and willing to adjust your strategy accordingly.

Conclusion

Investing is a complex endeavor that requires not only financial acumen but also psychological resilience. By understanding and avoiding common mental traps such as confirmation bias, overconfidence, herd mentality, loss aversion, and anchoring, investors can make more informed and rational decisions. Remember to conduct thorough research, remain objective, and stay focused on your long-term goals. By doing so, you can navigate the psychological pitfalls of investing and improve your chances of achieving financial success.