-

Table of Contents

- Conquering Panic: My 90-Day Journey to Securing My First Real Estate Deal

- Day 1-10: Laying the Foundation

- Understanding the Market

- Building a Network

- Day 11-30: Developing a Strategy

- Setting Clear Goals

- Choosing a Niche

- Day 31-60: Taking Action

- Property Search and Analysis

- Securing Financing

- Day 61-90: Closing the Deal

- Making Offers and Negotiating

- Due Diligence and Closing

- Key Takeaways

- Overcoming Panic and Building Confidence

- The Importance of Preparation and Research

- The Power of Networking

- Effective Negotiation Skills

- Conclusion

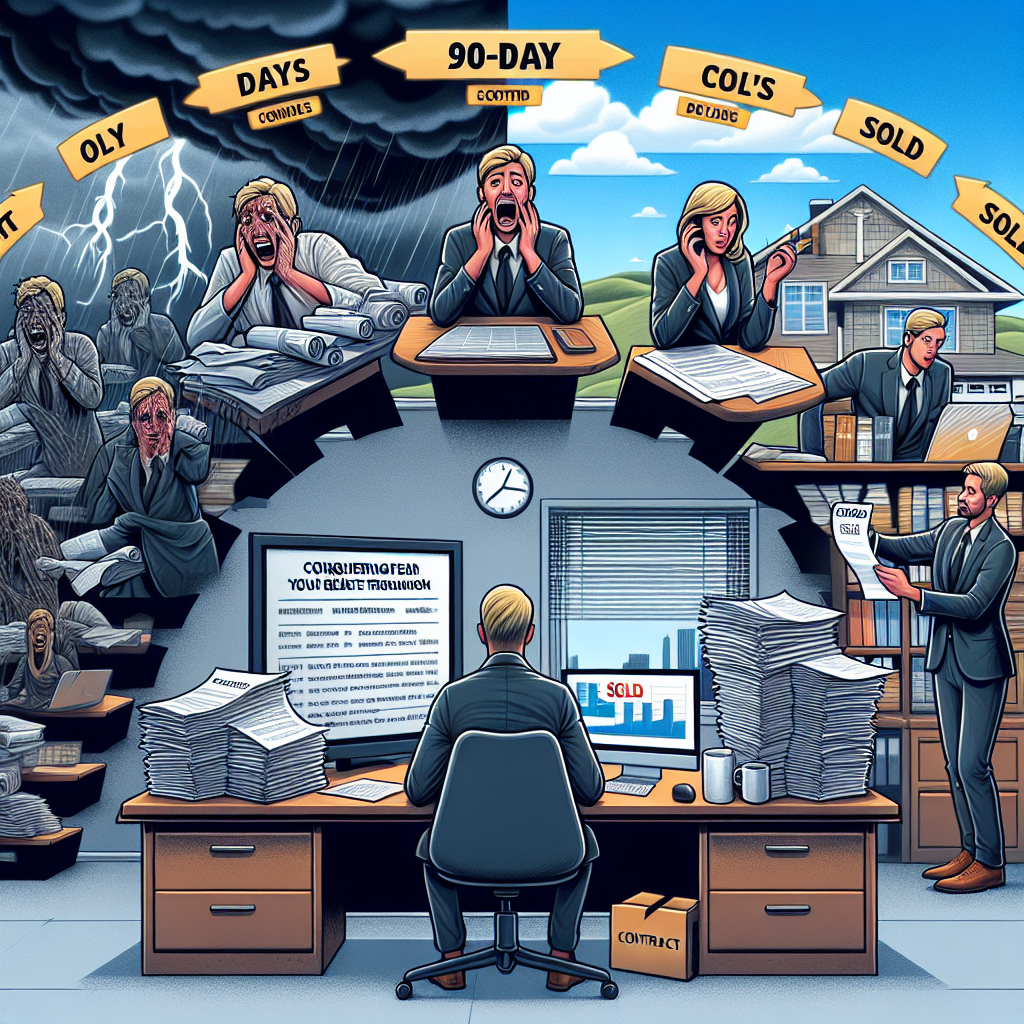

Conquering Panic: My 90-Day Journey to Securing My First Real Estate Deal

Embarking on a journey to secure your first real estate deal can be both exhilarating and daunting. The real estate market is a complex and competitive arena, and the fear of making mistakes can be overwhelming. However, with the right strategies, mindset, and support, it is possible to conquer panic and achieve success. This article chronicles my 90-day journey to securing my first real estate deal, providing valuable insights, examples, and tips for aspiring real estate investors.

Day 1-10: Laying the Foundation

Understanding the Market

The first step in my journey was to gain a comprehensive understanding of the real estate market. I spent the initial days researching market trends, property values, and economic indicators. This involved:

- Reading real estate blogs and articles

- Listening to podcasts by industry experts

- Attending webinars and online courses

According to the National Association of Realtors (NAR), understanding market trends is crucial for making informed investment decisions. By immersing myself in market research, I was able to identify potential opportunities and avoid common pitfalls.

Building a Network

Networking is a vital component of real estate investing. During the first ten days, I focused on building a network of professionals, including real estate agents, mortgage brokers, and fellow investors. I joined local real estate investment groups and attended networking events to connect with experienced individuals who could offer guidance and support.

Day 11-30: Developing a Strategy

Setting Clear Goals

With a solid understanding of the market and a growing network, I set clear and achievable goals for my real estate investment journey. My primary goal was to secure my first deal within 90 days. To achieve this, I broke down my goal into smaller, manageable tasks:

- Identify potential properties

- Analyze property values and potential returns

- Secure financing

- Make offers and negotiate deals

Choosing a Niche

Real estate investing offers various niches, including residential, commercial, and rental properties. I decided to focus on residential properties, specifically single-family homes, as they are generally easier to manage and have a broad market appeal. According to a report by Zillow, single-family homes have shown consistent appreciation in value, making them a reliable investment choice.

Day 31-60: Taking Action

Property Search and Analysis

With my strategy in place, I began actively searching for properties. I used online platforms such as Zillow, Realtor.com, and Redfin to identify potential deals. Additionally, I leveraged my network to gain access to off-market properties. During this phase, I focused on:

- Analyzing property values and comparing them to similar properties in the area

- Assessing the condition of the properties and estimating repair costs

- Calculating potential rental income and return on investment (ROI)

One of the key tools I used was the 70% rule, which suggests that an investor should pay no more than 70% of the after-repair value (ARV) of a property, minus repair costs. This rule helped me make informed decisions and avoid overpaying for properties.

Securing Financing

Financing is a critical aspect of real estate investing. I explored various financing options, including traditional mortgages, hard money loans, and private lenders. After evaluating the pros and cons of each option, I decided to secure a traditional mortgage due to its lower interest rates and favorable terms. I worked closely with a mortgage broker to get pre-approved for a loan, which gave me a competitive edge when making offers.

Day 61-90: Closing the Deal

Making Offers and Negotiating

With financing in place, I began making offers on properties that met my criteria. Negotiation is a crucial skill in real estate investing, and I relied on the following strategies to secure favorable deals:

- Conducting thorough research on the property and the seller’s motivations

- Making competitive yet reasonable offers

- Being prepared to walk away if the terms were not favorable

According to a study by the Real Estate Negotiation Institute, effective negotiation can result in significant savings and better terms for buyers. By staying informed and confident, I was able to negotiate a favorable deal on a single-family home in a desirable neighborhood.

Due Diligence and Closing

Once my offer was accepted, I entered the due diligence phase. This involved conducting a thorough inspection of the property, reviewing the title, and ensuring there were no legal issues. I hired a professional home inspector to identify any potential problems and negotiated with the seller to address necessary repairs.

After completing due diligence, I worked with my real estate agent and attorney to finalize the purchase agreement and close the deal. The closing process involved signing various documents, transferring funds, and officially taking ownership of the property.

Key Takeaways

Overcoming Panic and Building Confidence

Throughout my 90-day journey, I faced moments of panic and self-doubt. However, by staying focused on my goals, seeking support from my network, and continuously educating myself, I was able to overcome these challenges and build confidence in my abilities.

The Importance of Preparation and Research

Preparation and research were critical to my success. By understanding the market, setting clear goals, and developing a solid strategy, I was able to make informed decisions and avoid costly mistakes. Additionally, thorough due diligence ensured that I was fully aware of the property’s condition and potential risks.

The Power of Networking

Networking played a significant role in my journey. Connecting with experienced professionals provided valuable insights, support, and access to off-market deals. Building a strong network is essential for any aspiring real estate investor.

Effective Negotiation Skills

Negotiation is a key skill in real estate investing. By conducting thorough research, making competitive offers, and being prepared to walk away, I was able to secure a favorable deal. Effective negotiation can result in significant savings and better terms for buyers.

Conclusion

Securing my first real estate deal within 90 days was a challenging yet rewarding experience. By conquering panic, staying focused on my goals, and leveraging the power of preparation, research, networking, and negotiation, I was able to achieve success. For aspiring real estate investors, this journey serves as a testament to the importance of perseverance, education, and support. With the right strategies and mindset, anyone can navigate the complexities of the real estate market and achieve their investment goals.