-

Table of Contents

- Deciding Between Paying Off Your Rental Property, Reinvesting, or Expanding in 2024

- Understanding Your Financial Goals

- Immediate Cash Flow

- Long-Term Wealth Accumulation

- Balanced Approach

- Paying Off Your Rental Property

- Benefits of Paying Off Your Rental Property

- Drawbacks of Paying Off Your Rental Property

- Reinvesting Your Profits

- Benefits of Reinvesting Your Profits

- Drawbacks of Reinvesting Your Profits

- Expanding Your Portfolio

- Benefits of Expanding Your Portfolio

- Drawbacks of Expanding Your Portfolio

- Case Studies and Examples

- Case Study 1: Paying Off a Rental Property

- Case Study 2: Reinvesting Profits

- Case Study 3: Expanding the Portfolio

- Key Considerations for 2024

- Market Conditions

- Interest Rates

- Tax Implications

- Personal Financial Situation

- Conclusion

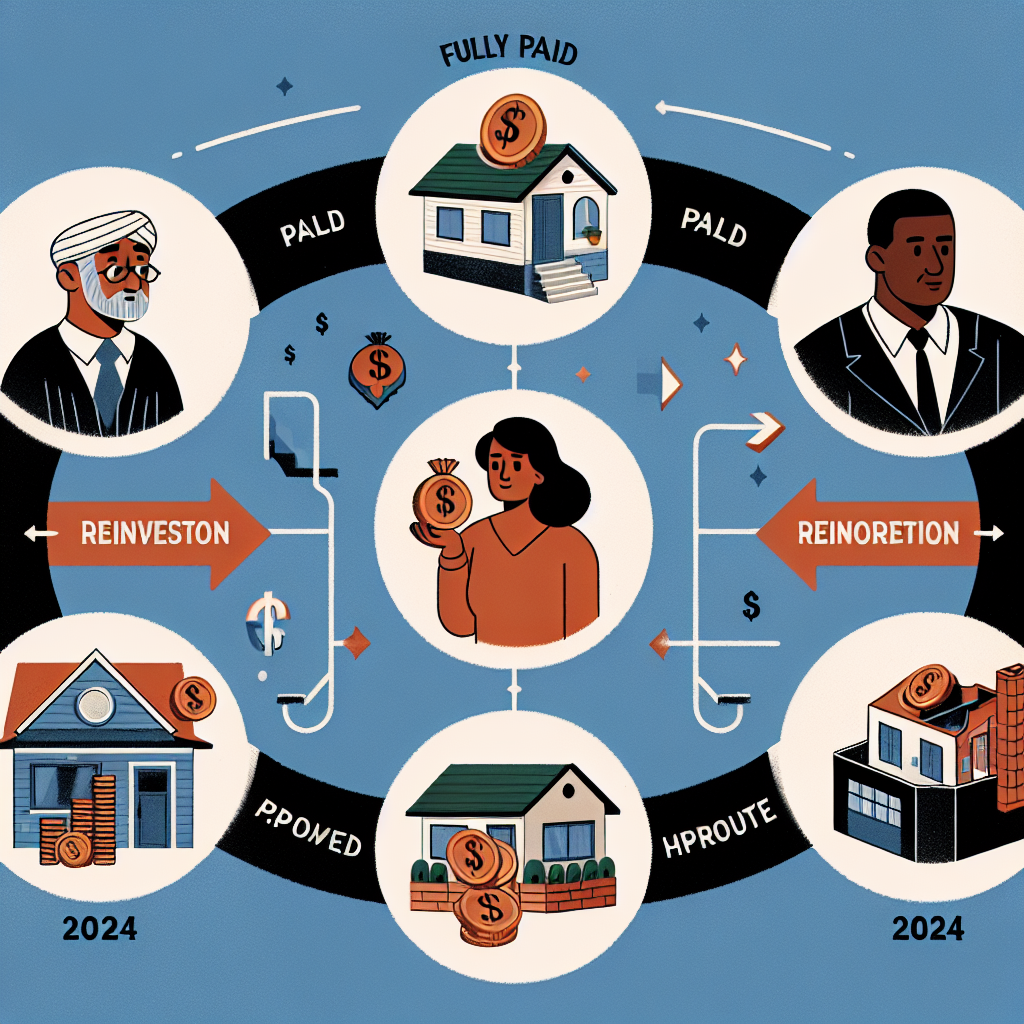

Deciding Between Paying Off Your Rental Property, Reinvesting, or Expanding in 2024

As we approach 2024, real estate investors face a critical decision: should they pay off their rental properties, reinvest their profits, or expand their portfolios? Each option has its own set of advantages and challenges, and the best choice depends on individual circumstances, market conditions, and long-term goals. This article will explore these three strategies in depth, providing valuable insights and examples to help you make an informed decision.

Understanding Your Financial Goals

Before diving into the specifics of each strategy, it’s essential to understand your financial goals. Are you looking for immediate cash flow, long-term wealth accumulation, or a balanced approach? Your goals will significantly influence your decision-making process.

Immediate Cash Flow

If your primary goal is to generate immediate cash flow, you might lean towards reinvesting or expanding your portfolio. These strategies can increase your rental income and provide more liquidity.

Long-Term Wealth Accumulation

For those focused on long-term wealth accumulation, paying off your rental property might be more appealing. Owning a property outright can provide financial security and reduce risk.

Balanced Approach

A balanced approach involves a mix of paying down debt, reinvesting profits, and expanding your portfolio. This strategy can offer a blend of immediate cash flow and long-term wealth accumulation.

Paying Off Your Rental Property

Paying off your rental property involves using your rental income or other funds to pay down the mortgage principal. This strategy has several benefits and drawbacks.

Benefits of Paying Off Your Rental Property

- Reduced Risk: Owning a property outright eliminates the risk of foreclosure and reduces financial stress.

- Increased Cash Flow: Without a mortgage payment, your rental income becomes pure profit, increasing your monthly cash flow.

- Financial Security: A paid-off property can serve as a financial safety net during economic downturns.

- Tax Benefits: While mortgage interest is tax-deductible, owning a property outright can still offer significant tax advantages through depreciation and other deductions.

Drawbacks of Paying Off Your Rental Property

- Opportunity Cost: The funds used to pay off the mortgage could be invested elsewhere for potentially higher returns.

- Liquidity Issues: Real estate is not a liquid asset, and tying up funds in a property can limit your financial flexibility.

- Inflation Risk: Paying off a fixed-rate mortgage early might not be the best use of funds in an inflationary environment.

Reinvesting Your Profits

Reinvesting your rental income involves using the profits from your rental property to invest in other assets, such as stocks, bonds, or additional real estate. This strategy can offer diversification and potential for higher returns.

Benefits of Reinvesting Your Profits

- Diversification: Investing in different asset classes can reduce risk and provide a more balanced portfolio.

- Higher Returns: Reinvesting in high-growth assets can potentially yield higher returns than paying off a mortgage.

- Liquidity: Investments in stocks and bonds are generally more liquid than real estate, providing easier access to funds if needed.

- Tax Efficiency: Certain investments, such as retirement accounts, offer tax advantages that can enhance your overall returns.

Drawbacks of Reinvesting Your Profits

- Market Risk: Investments in stocks and bonds are subject to market volatility and can result in losses.

- Management Complexity: Managing a diversified portfolio requires time, knowledge, and effort.

- Potential for Lower Cash Flow: Reinvesting profits might not provide immediate cash flow, depending on the investment type.

Expanding Your Portfolio

Expanding your portfolio involves using your rental income or other funds to purchase additional rental properties. This strategy can increase your rental income and build long-term wealth.

Benefits of Expanding Your Portfolio

- Increased Cash Flow: Additional rental properties can generate more rental income, boosting your cash flow.

- Economies of Scale: Managing multiple properties can lead to cost savings and operational efficiencies.

- Appreciation Potential: Real estate tends to appreciate over time, providing long-term capital gains.

- Tax Benefits: Owning multiple properties can offer significant tax advantages through deductions and depreciation.

Drawbacks of Expanding Your Portfolio

- Increased Risk: More properties mean more exposure to market fluctuations, tenant issues, and maintenance costs.

- Higher Debt Levels: Financing additional properties can increase your debt levels and financial risk.

- Management Complexity: Managing multiple properties requires more time, effort, and resources.

- Liquidity Issues: Real estate is not a liquid asset, and expanding your portfolio can tie up significant funds.

Case Studies and Examples

To illustrate these strategies, let’s look at a few case studies and examples.

Case Study 1: Paying Off a Rental Property

John owns a rental property with a remaining mortgage balance of $100,000. He receives $1,500 in monthly rental income and has $50,000 in savings. John decides to use his savings and rental income to pay off the mortgage within three years. As a result, he eliminates his monthly mortgage payment of $800, increasing his cash flow to $1,500 per month. John now enjoys financial security and reduced risk, but he misses out on potential investment opportunities.

Case Study 2: Reinvesting Profits

Sarah owns a rental property that generates $2,000 in monthly rental income. Instead of paying off her mortgage, she decides to reinvest her profits in a diversified portfolio of stocks and bonds. Over five years, her investments grow at an average annual rate of 7%, significantly increasing her net worth. While Sarah benefits from higher returns and diversification, she faces market volatility and potential losses.

Case Study 3: Expanding the Portfolio

Mike owns two rental properties and decides to expand his portfolio by purchasing a third property. He uses his rental income and a mortgage to finance the new purchase. The additional property generates $1,800 in monthly rental income, increasing his total rental income to $5,400 per month. Mike benefits from increased cash flow and potential appreciation, but he also faces higher debt levels and management complexity.

Key Considerations for 2024

As you decide between paying off your rental property, reinvesting, or expanding in 2024, consider the following factors:

Market Conditions

Real estate and financial markets are influenced by various factors, including interest rates, economic growth, and housing demand. Stay informed about market trends and adjust your strategy accordingly.

Interest Rates

Interest rates play a crucial role in real estate financing. Low-interest rates can make borrowing more attractive, while high-interest rates might encourage paying off debt.

Tax Implications

Each strategy has different tax implications. Consult with a tax professional to understand the potential tax benefits and drawbacks of each option.

Personal Financial Situation

Your personal financial situation, including your income, expenses, and risk tolerance, will influence your decision. Ensure that your chosen strategy aligns with your financial goals and circumstances.

Conclusion

Deciding between paying off your rental property, reinvesting, or expanding in 2024 is a complex decision that requires careful consideration of your financial goals, market conditions, and personal circumstances. Each strategy has its own set of benefits and drawbacks, and the best choice depends on your unique situation.

Paying off your rental property can provide financial security and increased cash flow but may limit investment opportunities. Reinvesting your profits offers diversification and potential for higher returns but comes with market risk and management complexity. Expanding your portfolio can boost rental income and long-term wealth but involves higher debt levels and management challenges.

By understanding your financial goals and considering key factors such as market conditions, interest rates, tax implications, and your personal financial situation, you can make an informed decision that aligns with your long-term objectives. Whether you choose to pay off your rental property, reinvest, or expand, a well-thought-out strategy will help you achieve financial success in 2024 and beyond.