Mastering the Debt Service Coverage Ratio (DSCR) is crucial for making informed rental property investments. As a key metric, DSCR assesses a property’s ability to cover its debt, directly influencing investment decisions.

This article delves into the significance of DSCR, offering a step-by-step guide to accurate calculation and insights on leveraging DSCR calculators. Explore practical strategies to interpret DSCR results, understand financing options, and enhance your investment decisions with DSCR insights.

Understanding DSCR: The Key Metric for Rental Property Investments

Definition and Importance of DSCR

The Debt Service Coverage Ratio (DSCR) is a crucial metric in real estate finance, particularly for rental properties. It measures a property’s cash flow against its debt obligations, providing insight into financial health.

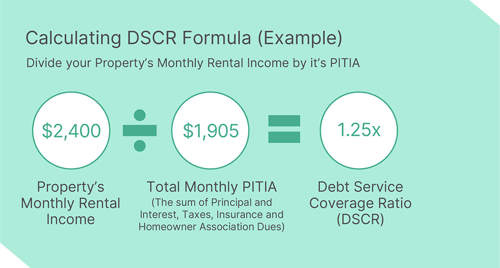

Simply put, DSCR is calculated by dividing the Net Operating Income (NOI) by the total debt obligations. For example, if a property’s NOI is $1 million and its debt obligations are $850,000, the DSCR would be 1.18x.

DSCR = Net Operating Income ÷ Debt Obligations

This ratio is essential because it helps investors and lenders understand whether a property generates enough income to cover its debt payments. A DSCR of 1.0 means the property can just cover its debt, while a higher DSCR indicates surplus income.

In commercial lending, DSCR is favored over personal credit scores. Lenders focus on the property’s projected cash flows, ensuring borrowers won’t default on their loans.

- High DSCR: Indicates strong financial health, attracting potential lenders and investors.

- Low DSCR: Suggests potential risk, making it harder to secure loans.

Understanding DSCR is vital for anyone involved in real estate investments, as it directly impacts financing and profitability.

Role of DSCR in Rental Properties

DSCR plays a pivotal role in the success and sustainability of rental properties. For real estate investors, it provides a clear picture of whether a property can generate enough income to cover its expenses and debt obligations.

Consider a scenario where an investor is eyeing a multifamily property. They need to ensure the rent collected will be sufficient to cover the mortgage payments, maintenance costs, and other expenses. Here, DSCR becomes a reliable indicator of financial viability.

Commercial loan programs often have minimum DSCR requirements. Typically, a DSCR of 1.25 or higher is required, indicating that the property generates 25% more income than necessary to cover its debts.

For property managers, maintaining a healthy DSCR is critical. It reflects their ability to manage properties efficiently, ensuring steady cash flows and minimal risk of default.

“Managing a property with a high DSCR means enhanced financial stability and attractiveness to investors.”

Ultimately, DSCR aids in determining the feasibility of investment properties, influencing decisions on buying, selling, and refinancing.

Benefits of a High DSCR

A high Debt Service Coverage Ratio offers numerous advantages to real estate investors and property managers. One of the primary benefits is the increased likelihood of securing favorable financing terms. Lenders are more inclined to offer loans with lower interest rates to properties with high DSCRs, reducing the overall cost of borrowing.

Moreover, a high DSCR demonstrates financial robustness, making properties more attractive to investors. It signifies that the property is generating sufficient income not only to cover its debt but also to provide a return on investment.

- Enhanced Loan Approval: Properties with high DSCRs are more likely to get approved for loans swiftly.

- Lower Interest Rates: Lenders view such properties as low-risk, often resulting in better interest rates.

- Investor Confidence: High DSCR instills confidence among investors, ensuring steady cash inflows.

- Financial Cushion: Provides a safety net, allowing properties to weather economic downturns.

For example, a DSCR of 1.50 means the property generates enough income to cover debt obligations and still has 50% surplus income, ensuring financial stability.

“A high DSCR is synonymous with financial security and investment attractiveness.”

Overall, maintaining a high DSCR is beneficial for long-term profitability and sustainability in the rental property market.

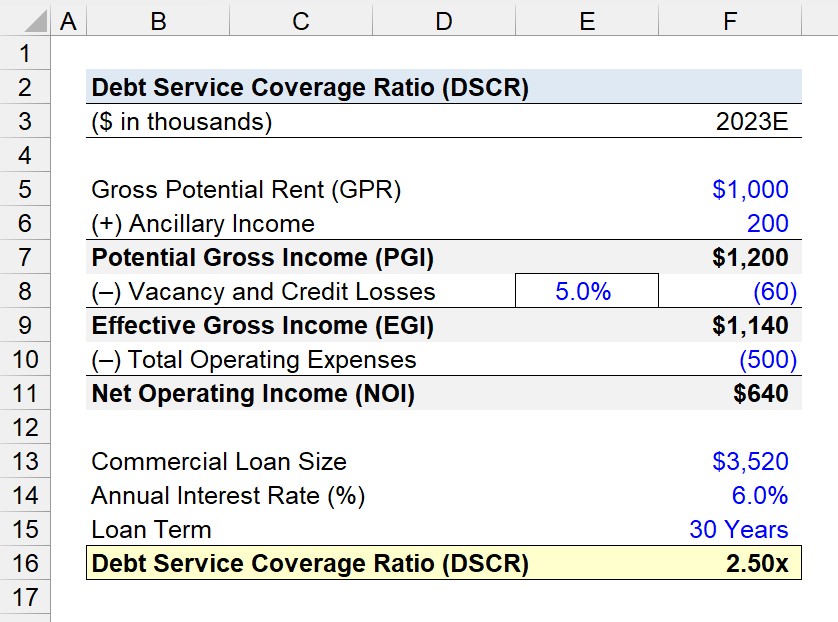

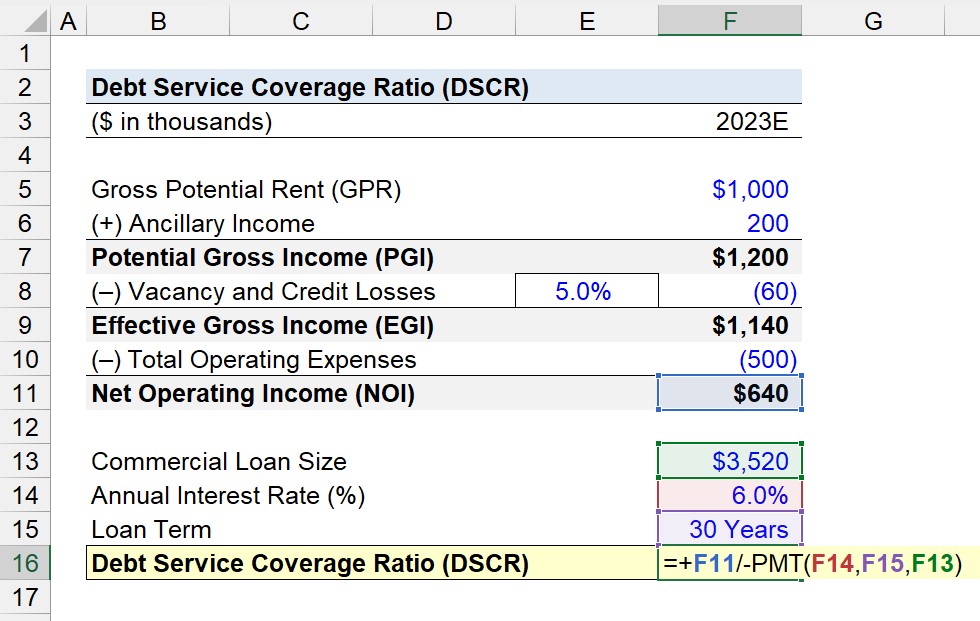

How to Accurately Calculate DSCR for Rental Properties

Step-by-Step Guide to DSCR Calculation

Understanding the nuances of the Debt Service Coverage Ratio (DSCR) is imperative for real estate investors, property managers, and financial analysts. The steps involved in calculating DSCR are straightforward yet precise.

Firstly, establish the Net Operating Income (NOI). This represents the monthly earnings from rental income after deducting all operating expenses. The equation for NOI is:

NOI = Gross Income – (Expenses + Vacancy Rate)

After obtaining the NOI, the next step is to determine your monthly debt service. This refers to the total amount paid each month towards settling debts, including mortgage payments.

The final step is to apply the DSCR formula:

DSCR = NOI / Debt Service

For example, if your NOI is $10,000 and your monthly debt service is $8,000, the DSCR would be:

DSCR = $10,000 / $8,000 = 1.25

This indicates that the income covers the debt obligations by 1.25 times, a critical metric for assessing financial health.

Essential Components: NOI and Debt Obligations

Accurate calculation of DSCR hinges on two essential components: Net Operating Income (NOI) and Debt Obligations.

To calculate NOI, start by determining the Gross Income (GI). This is the total monthly rent collected from tenants. Next, subtract the Operating Expenses, which include maintenance, repairs, and cleaning costs.

- Gross Income (GI): Monthly rent paid by tenants

- Operating Expenses: Costs for maintenance, repairs, and cleaning

- Vacancy Rate: The percentage of time the property remains unoccupied

After calculating the NOI, it’s crucial to accurately account for Debt Obligations. These are the monthly payments made towards outstanding debts.

- Mortgage Payments: Regular payments towards the property’s mortgage

- Loan Repayments: Additional debts incurred for property improvements or acquisitions

Combining these components correctly ensures a precise DSCR calculation, vital for financial analysis and decision-making.

Common Mistakes to Avoid

Avoiding common pitfalls can significantly enhance the accuracy of your DSCR calculations.

Initially, ensure that all operating expenses are accounted for. Overlooking maintenance or repair costs can inflate the NOI, leading to a misleading DSCR.

Another common error is miscalculating the vacancy rate. This figure must reflect realistic scenarios where the property may remain unoccupied, affecting the gross income.

- Underestimating Expenses: Ensure all operating costs are included.

- Ignoring Vacancy Rates: Accurate vacancy rates are essential for precise NOI calculations.

- Misreporting Debt Service: Accurately document all debt-related payments.

Lastly, accurately documenting debt service is crucial. Any omitted or misreported debts can distort the DSCR, impacting financial assessments and decisions.

Adhering to these guidelines will ensure a fair and accurate determination of the DSCR, providing valuable insights into the financial health of rental properties.

Leveraging DSCR Calculators for Rental Property Success

Choosing the Right DSCR Calculator

Understanding the specific needs of your real estate investment is crucial when selecting a Debt Service Coverage Ratio (DSCR) calculator. Each investor’s requirements can vary, and finding a tool that aligns with these needs can significantly impact decision-making.

For instance, some calculators emphasize detailed financial projections, while others focus on providing quick, snapshot views of your property’s income versus debt obligations.

Consider whether you need a complex tool with extensive features or a simpler, more intuitive one that offers straightforward calculations. Identifying your comfort level and familiarity with financial analysis will help in this decision.

“Choosing the right tool can make or break the efficiency of your investment strategy.” – Real Estate Analyst

Evaluating different options and reading user reviews can also provide insights into the functionality and reliability of various DSCR calculators. Online forums and investment groups often discuss the pros and cons of different tools, which can further aid in your selection process.

Once you’ve chosen a calculator, the next step is to understand how to effectively utilize it to meet your investment goals. But first, let’s explore what features make these tools effective.

Features of Effective DSCR Calculators

Effective DSCR calculators share common features that enhance their utility in rental property investment. Key features to look for include:

- Accuracy: A reliable DSCR calculator should provide precise calculations to aid in making informed decisions.

- User-Friendly Interface: The tool should be easy to navigate, allowing users to input data and interpret results efficiently.

- Comprehensive Reports: Generating detailed financial reports is crucial for understanding various aspects of your property’s performance.

In addition, calculators that offer scenario analysis capabilities can be particularly beneficial. This feature allows investors to model different financial scenarios and assess how changes in income or expenses impact the DSCR.

“The ability to test various ‘what-if’ scenarios can provide invaluable foresight and risk management in property investments.”

Moreover, integration with other financial tools and platforms can streamline the overall investment management process. For instance, calculators that sync with accounting software or property management systems can enhance data accuracy and operational efficiency.

Having these features in mind can help you select a DSCR calculator that meets your investment analysis needs, ensuring you make well-informed decisions.

Practical Examples and Use Cases

It is beneficial to see how DSCR calculators are applied in real-world scenarios. Let’s consider a practical example:

A property manager is evaluating the purchase of a multi-family rental property. By inputting the projected rental income, operating expenses, and debt obligations into a DSCR calculator, the manager can quickly assess whether the property’s income sufficiently covers its debt payments. This insight helps in making a sound purchasing decision.

In another scenario, a financial analyst uses a DSCR calculator to monitor the performance of an existing property portfolio. Regularly calculating the DSCR for each property helps identify underperforming assets that may require operational adjustments or refinancing to maintain financial health.

“Practical application of DSCR calculations can highlight both opportunities and risks within a property portfolio.”

- Initial Purchase Decisions: Assessing financial viability before committing to a purchase.

- Ongoing Performance Monitoring: Ensuring properties maintain healthy income-to-debt ratios.

- Strategic Planning: Utilizing scenario analysis to plan for future investments and financial contingencies.

These practical examples underscore the importance of incorporating DSCR calculators into your investment strategy. Whether you’re a real estate investor, property manager, or financial analyst, leveraging these tools effectively can drive successful rental property investments.

Interpreting DSCR Results: What Your Numbers Mean

Understanding DSCR Thresholds

The Debt Service Coverage Ratio (DSCR) is a crucial metric for evaluating the financial health of rental properties. It measures the ability to cover debt obligations through net operating income (NOI). A DSCR threshold indicates the minimum acceptable ratio for financial stability.

A common threshold is 1.25. This means the property generates 25% more income than required to cover its debt.But why is this important? Because a ratio below this threshold might signify insufficient income to meet debt obligations, increasing financial risk.

“DSCR thresholds are essential benchmarks. They provide a clear indicator of whether a property can sustain its debt load,” – Financial Expert Jane Doe.

The interpretation of these thresholds can vary among lenders and investors. For instance, a DSCR of 1.0 means the property generates just enough to cover debt payments. Any value below 1.0 indicates a deficit.

- DSCR above 1.25: Signals strong financial health, attracting positive lender and investor interest.

- DSCR at or below 1.0: Indicates potential financial distress, warning signs for both current and prospective owners.

Ultimately, understanding DSCR thresholds helps investors make informed decisions about the viability and risk associated with rental properties. Are your properties meeting these critical financial benchmarks?

Implications of High vs. Low DSCR

How does a high or low DSCR impact your rental property investments? To start, high DSCR values are particularly favorable.

A high DSCR, such as 1.5 or above, suggests the property has a strong NOI relative to its debt obligations. This indicates:

- Financial Stability: High DSCR values denote surplus income after covering debt, enabling reinvestment or savings.

- Lower Risk: Lenders may offer better terms, reflecting the property’s ability to comfortably manage its debt.

- Investment Appeal: High DSCR properties are attractive to investors seeking reliable returns.

On the other hand, a low DSCR (below 1.25) can signal financial challenges. Such properties may struggle to meet debt obligations, increasing the risk of default. Low DSCR values can deter lenders and investors due to perceived instability.

What does this mean for your property management strategy? Regularly monitoring and interpreting DSCR values allows for proactive financial planning, ensuring properties maintain or achieve desirable ratios.

Are your properties consistently demonstrating strong DSCR values, or are they at risk of slipping below critical thresholds?

Strategies for Improving DSCR

What can be done if your property’s DSCR is below the desired threshold? Improving your DSCR involves either increasing your NOI or reducing debt obligations.

Here are practical strategies to consider:

- Increase Rental Income: Review and adjust rent to market rates, considering upgrades that justify higher rent.

- Enhance Operational Efficiency: Minimize operational costs through energy-efficient installations, bulk purchasing, and negotiated service contracts.

- Refinance Debt: Seek refinancing options to secure lower interest rates or extend loan terms, reducing monthly debt obligations.

- Reduce Vacancy Rates: Implement aggressive marketing and tenant retention strategies to maintain full occupancy.

Each strategy aims to boost your NOI or lower your debt service, directly impacting your DSCR. How have these strategies been effective for other properties in similar situations?

“By systematically increasing rental income and decreasing operating expenses, we improved our DSCR from 1.1 to 1.4 within a year,” – Experienced Property Manager John Smith.

Proactively managing DSCR ensures the long-term financial health of your rental properties, enhancing overall investment performance.

DSCR Loans: Financing Options for Rental Properties

Types of DSCR Loans

When exploring financing options for rental properties, it’s essential to understand the different types of DSCR loans available. **DSCR (Debt Service Coverage Ratio) loans** are designed to assess a property’s ability to cover its debt obligations, making them highly relevant for real estate investors and financial analysts.

- Traditional DSCR Loans: These loans require a standard DSCR calculation, typically above 1.25, indicating the property generates sufficient income to cover debt payments.

- Stated Income DSCR Loans: Designed for investors who may not have verifiable income but have high DSCRs, showcasing their property’s profitability.

- Interest-Only DSCR Loans: These loans offer lower initial payments by allowing borrowers to pay only the interest for a set period, improving cash flow.

Understanding these loan types helps investors and property managers choose the best financing option that aligns with their financial strategy and property investment goals.

“Knowing the various DSCR loan types ensures you can select the appropriate financing for your rental properties, ultimately maximizing your investment’s potential.”

Eligibility Criteria

Eligibility for DSCR loans is determined by several critical factors. **Lenders** primarily focus on the property’s ability to generate income relative to its debt obligations.

- DSCR Requirement: Most lenders require a minimum DSCR of 1.25. This means the property must generate 25% more income than its debt payments.

- Property Type: Residential, commercial, and mixed-use properties can qualify, but the DSCR threshold may vary.

- Borrower’s Credit Score: While DSCR loans focus on the property’s income, a good credit score remains essential for securing favorable terms.

Eligibility criteria are stringent to ensure that the investment is sound and can continuously generate sufficient cash flow. This serves as a safeguard for both the borrower and lender, minimizing the risk of default.

Adhering to these criteria can significantly impact your ability to secure the best possible terms for your DSCR loan, directly influencing your investment’s success.

Benefits and Drawbacks

Like any financial product, DSCR loans come with their own set of benefits and drawbacks. Evaluating these can help investors make informed decisions.

- Benefits:

- **Improved Cash Flow:** DSCR loans assess rental property income, ensuring the property can cover its debt, which helps maintain positive cash flow.

- **Flexibility:** Various types of DSCR loans, such as interest-only options, provide flexibility in managing payments and cash flow.

- **Stated Income Options:** These loans can be beneficial for investors with non-traditional income sources, making it easier to secure financing.

- Drawbacks:

- **Higher Interest Rates:** DSCR loans may come with higher interest rates, reflecting the risk associated with rental property investments.

- **Stringent Eligibility Criteria:** Meeting the minimum DSCR requirements and credit score thresholds can be challenging for some borrowers.

- **Property Income Dependency:** The focus on property income means that any fluctuations in rental income can impact loan approval and terms.

Analyzing these benefits and drawbacks is crucial for making well-informed investment decisions. It enables property managers and financial analysts to anticipate potential challenges and leverage the advantages effectively.

“Evaluating the pros and cons of DSCR loans helps balance investment strategies and maximize returns while mitigating risks.”

Common Challenges and Solutions in DSCR Calculation for Rental Properties

Identifying Common Calculation Errors

Common calculation errors frequently arise during the computation of Debt Service Coverage Ratio (DSCR) for rental properties. These errors can significantly impact the financial assessment and investment decisions.

One notable mistake is misidentifying revenue streams. Investors sometimes overestimate potential income by including unreliable sources, such as unconfirmed rental income or speculative future raises in rent. Misinterpreting operating expenses, including maintenance and management fees, can also skew the calculations.

Another frequent error involves incorrectly calculating net operating income (NOI). This often occurs due to neglected expenses. For instance, property taxes, insurance costs, and unexpected maintenance expenses might be omitted from calculations, leading to an inflated NOI.

Misestimating loan terms and interest rates can be equally problematic. Often, irregular loan structures or variable interest rates are not adequately factored into DSCR calculations, leading to erroneous results.

Accurate DSCR requires precise identification and validation of both income and expenses, adjusting for variability and uncertainties.

- Revenue Misidentification: Ensure all income sources are genuine and verified before inclusion in DSCR calculations.

- Expense Overlooking:

- Loan Terms Miscalculation:

- Loan Terms Miscalculation:

By diligently verifying all data inputs, errors in DSCR calculations can be minimized, thus enhancing investment reliability.

Addressing Data Inaccuracies

Data inaccuracies are a significant challenge in DSCR calculations. Inaccurate data can stem from outdated records, incorrect manual entries, or reliance on estimations instead of actual figures.

One primary source of inaccuracy is relying on outdated financial information. Rental markets can fluctuate, and using historical data without adjustments for current conditions can lead to miscalculations.

Manual data entry introduces the risk of human error. Typographical mistakes, misread figures, or incorrect spreadsheet formulas can all skew results.

Estimations and assumptions also pose risks. Relying on approximations for revenue or expense figures can introduce significant variance. For instance, assuming a catch-all percentage for maintenance costs rather than verifying actual past expenditure can misrepresent net operating income.

Ensuring accurate data involves a rigorous approach to data gathering, verification, and continual updates to reflect current market conditions.

- Update Regularly:

- Automate Entry:

- Verify Assumptions:

- Automate Entry:

Addressing these inaccuracies at the source can lead to more reliable and actionable DSCR calculations, aiding in sound investment decisions.

Best Practices for Accurate DSCR Calculation

Implementing best practices can significantly enhance the accuracy of DSCR calculations. By adopting systematic approaches, investors and analysts can ensure more reliable financial assessments.

First, it is essential to use standardized calculation methods. Adhering to consistent formulas and methodologies ensures comparability and reliability across different properties and portfolios.

Regular audits of financial data and calculations can catch discrepancies early. By periodically reviewing and validating income and expense figures, errors can be identified and corrected promptly.

Embracing technology can also streamline DSCR calculations. Utilizing financial software and automated calculation tools reduces manual entry errors and improves efficiency.

Consistent methodology, regular audits, and embracing technology are key practices to ensure accurate DSCR calculations.

Additionally, maintaining a detailed and transparent record of all assumptions and data sources can facilitate easier revision and verification processes.

- Standardize Calculations:

- Audit Financial Data:

- Utilize Technology:

- Audit Financial Data:

By adhering to these best practices, investors and analysts can improve the reliability of their DSCR calculations, leading to more informed and effective financial decision-making.

Enhancing Investment Decisions with DSCR Insights

Using DSCR for Informed Decision Making

One of the primary benefits of using the Debt Service Coverage Ratio (DSCR) is its ability to facilitate informed decision-making. By evaluating a property’s DSCR, investors can gauge whether a property can generate sufficient income to cover its debt obligations. This is particularly crucial for rental properties where the primary income source is rent collected from tenants.

DSCR provides a clear snapshot of financial health. For example, a DSCR of 1.5 indicates that the property generates 1.5 times the income needed to cover its debt payments. This not only ensures that the property is likely to remain solvent but also provides a buffer for unexpected expenses.

The importance of DSCR extends to securing favorable financing. Lenders commonly use DSCR as a criterion to assess the risk associated with lending. A higher DSCR could result in more competitive loan terms, which can significantly impact overall profitability.

Consider the impact of cash flow analysis using DSCR. By regularly monitoring DSCR, investors can identify trends and make proactive adjustments to their investment strategy. For instance, if the DSCR shows signs of declining, it might be time to revisit rental rates or operational expenses.

“Utilizing DSCR allows investors to not only assess current financial stability but also to anticipate and mitigate future financial challenges,” says Jane Doe, a financial analyst.

Moreover, DSCR helps in balancing portfolios. By comparing the DSCRs of various properties, investors can make strategic decisions to balance high-risk investments with more stable ones, thus optimizing their overall portfolio performance.

- Risk Assessment: DSCR aids in evaluating the risk associated with a property investment.

- Financing Terms: Investors can leverage higher DSCRs to negotiate better loan conditions.

- Cash Flow Management: Regular DSCR monitoring helps in effective cash flow management.

Case Studies of Successful Investments

Examining case studies of successful investments can provide valuable insights into how DSCR can be effectively utilized. For example, Property A in downtown Manhattan had a DSCR of 2.0. This high DSCR allowed the investor to secure a low-interest loan, significantly enhancing the property’s cash flow and overall profitability.

Another example is Property B, a multifamily unit in Austin, Texas. Here, the investor noticed a decreasing DSCR trend. Prompt adjustments like increasing rent and optimizing property management expenses reversed the trend, leading to a more stable financial outlook.

“Real-life examples highlight the practical application and benefits of DSCR in real estate investments,” notes John Smith, a seasoned property manager.

- Property A: High DSCR led to securing favorable loan terms.

- Property B: Adjustments based on DSCR trends stabilized financial health.

- Property C: Strategic use of DSCR insights facilitated portfolio balancing.

These case studies underscore the importance of proactive management. By leveraging DSCR insights, investors can make timely decisions that enhance both short-term and long-term investment outcomes.

Furthermore, cross-analysis of multiple properties within a portfolio using DSCR can highlight which properties are underperforming and require immediate attention, thus ensuring overall portfolio health.

Future Trends in DSCR Utilization

As the real estate market evolves, so does the application of DSCR. One emerging trend is the integration of advanced analytics and technology. Modern software solutions can automate DSCR calculations and provide real-time insights, greatly enhancing decision-making precision.

Another future trend is the expansion of DSCR application beyond traditional real estate investments. For instance, DSCR is increasingly being used in evaluating mixed-use developments where rental income from residential units is coupled with commercial leases.

Additionally, we anticipate that regulatory frameworks will increasingly incorporate DSCR metrics. This could potentially standardize the use of DSCR across different investment types, providing a more uniform measure of financial health.

“The future of DSCR utilization will be characterized by increased automation and integration with other financial metrics,” predicts financial analyst Alan Brown.

- Advanced Analytics: Use of technology to automate and enhance DSCR calculations.

- Mixed-Use Developments: Applying DSCR in evaluating diverse property types.

- Regulatory Integration: Potential standardization of DSCR metrics in financial regulations.

The ability to leverage these emerging trends will position investors favorably in a competitive market. By staying ahead of these trends, investors can ensure they are making well-informed and strategic decisions that optimize their investment returns.

It is crucial to note that, the evolving landscape of DSCR utilization promises to offer new opportunities for informed and effective investment decision-making.

Conclusion

Mastering the Debt Service Coverage Ratio (DSCR) is pivotal for anyone involved in rental property investments. By understanding and accurately calculating DSCR, you not only gauge your property’s financial health but also unlock better financing options and investment strategies. With high DSCR, investors can leverage more favorable loan terms, ensuring long-term success and stability.

Effective use of DSCR calculators and a thorough interpretation of results enable more informed decision-making. This translates to smarter investments and improved financial outcomes. By staying vigilant against common calculation errors and adopting best practices, you can maintain an accurate and reliable DSCR that reflects your property’s true potential.

Embrace DSCR insights to navigate the rental property market with confidence. As you enhance your investment decisions with these crucial metrics, you’ll be better positioned to capitalize on future opportunities and trends. Take the next step in your investment journey and delve deeper into leveraging DSCR for optimal property management and growth.

Frequently Asked Questions

How to calculate DSCR for rental property?

To calculate DSCR, divide the Net Operating Income (NOI) by the total debt obligations. DSCR = NOI / Total Debt Service.

How to calculate loan based on DSCR?

Estimate the maximum loan amount by ensuring the loan payments fit into the desired DSCR ratio. Rearrange DSCR formula to solve for debt obligations.

How to calculate 1.25 DSCR?

To achieve a 1.25 DSCR, the Net Operating Income (NOI) must be 1.25 times the annual debt obligations. Calculate using: 1.25 = NOI / Debt Obligations.

What is a reasonable DSCR ratio?

A DSCR ratio above 1.25 is generally considered reasonable, indicating the property generates sufficient income to cover debt payments.

What are the essential components for DSCR calculation?

Key components include the Net Operating Income (NOI) and total debt obligations. Accurate inputs are crucial.

What are the common mistakes to avoid in DSCR calculation?

Common mistakes include inaccurate income or expense estimates and neglecting to include all debt obligations. Consistency and thoroughness are vital.