Debt Service Coverage Ratio (DSCR) is pivotal in commercial lending, acting as a barometer for financial health. Delve into its core components, from understanding its definition to grasping its significance in loan approvals.

This article provides a step-by-step guide on calculating DSCR, using practical examples and a specialized calculator. Discover the minimum DSCR requirements lenders seek and learn how to interpret your ratio for informed investment decisions.

Understanding DSCR: What It Is and Why It Matters

Definition and Importance of DSCR

The Debt Service Coverage Ratio (DSCR) is a paramount indicator in the realm of commercial lending, standing as a key financial metric used to evaluate a borrower’s ability to service their debt. When lenders assess commercial real estate transactions, they meticulously scrutinize the DSCR to predict whether the borrower can consistently meet their loan obligations.

DSCR is formulated by dividing the net operating income by the total debt service. A ratio of 1.25x or higher typically signals a healthy financial position, as the borrower’s income is 25% more than required to cover their debt payments. Conversely, a lower ratio suggests potential difficulties in loan repayment.

Lenders favor DSCR for its robust predictive power regarding a borrower’s repayment capability, diverging from personal credit scores which focus on individual financial behavior. DSCR provides a clearer economic viewpoint on the investment by emphasizing cash flow over credit history.

In practical terms, imagine a real estate investor purchasing an apartment building. The rents collected from tenants should not only cover the mortgage but also generate a profit. The lender’s primary concern is the inflow of cash rather than the borrower’s credit score, ensuring sustained financial health and repayment ability through projected cash flows.

The Debt Service Coverage Ratio (DSCR) is indispensable in commercial lending, offering lenders a reliable measure of financial viability based on operational income rather than personal creditworthiness.

Through rigorous DSCR evaluation, lenders determine the feasibility of investments and safeguard against defaults, highlighting its undeniable importance in commercial lending assessments.

Differences Between Commercial and Personal Loans

Commercial and personal loans, though fundamentally similar in their purpose of providing financial resources, differ distinctly in their evaluation metrics and objectives. In commercial lending, the DSCR is a crucial determinant, whereas personal loans hinge on credit scores and personal financial history.

Commercial mortgages are predominantly aimed at income generation. For instance, a real estate investor may acquire a property with the intention of renting it out. Here, the focus is on the property’s ability to generate sufficient income to cover loan payments and yield profit.

- Income Generation: Commercial loans prioritize the potential for income generation, assessing the property’s cash flow through DSCR.

- Evaluation Metric: DSCR is pivotal in commercial loans, unlike personal loans which rely heavily on individual credit scores and histories.

- Collateral Requirement: Commercial loans often require substantial collateral to secure the loan, reflecting the investment’s scale and risk.

In contrast, personal loans are more likely to consider the borrower’s credit history and personal assets. The credit score serves as a predictor of financial responsibility and repayment likelihood.

Commercial lenders focus more on projected cash flows and the viability of the investment rather than the individual borrower’s financial background, aligning assessment metrics with the business nature of the loan.

While personal loans emphasize creditworthiness, commercial loans delve into cash flow prospects, highlighting the diverging evaluation criteria between the two.

Ultimately, understanding these differences aids lenders, investors, and financial analysts in making informed decisions tailored to the specific nature and risks of the loan in question.

Key Metrics in Commercial Lending

In the sphere of commercial lending, certain key metrics are essential to establish the financial feasibility and risk associated with potential loans. Among these, the Debt Service Coverage Ratio (DSCR) stands out, but several other metrics also play a crucial role.

Loan-to-Value (LTV) Ratio: This metric measures the loan amount against the appraised value of the property. It helps lenders determine the risk level and collateral sufficiency.

Loan-to-Cost (LTC) Ratio: LTC compares the loan amount to the total cost of the project, offering insights into the borrower’s investment and financial commitment.

- Cash Flow: Evaluates the net income generated by the property, which is critical for determining DSCR.

- Global DSCR: Incorporates personal financials of the borrower, providing a comprehensive view of financial capability.

- Collateral: Assesses the value of assets pledged as security for the loan, ensuring sufficient coverage in case of default.

DSCR remains a cornerstone metric, reflecting the borrower’s ability to meet debt obligations through operating income. However, a comprehensive analysis often includes evaluating LTV, LTC, cash flow, and collateral to form a holistic financial picture.

For instance, while a multifamily property may exhibit a DSCR of 1.25x, additional scrutiny of LTV and collateral ensures that the investment is sound and the loan is secure. This multi-metric approach mitigates risk and enhances decision-making accuracy.

Combining DSCR with other metrics like LTV and cash flow offers a multifaceted view of financial health, crucial for informed lending decisions.

By meticulously analyzing these key metrics, commercial lenders can better gauge the financial viability and risk associated with loan applications, paving the way for more secure and profitable investments.

How to Calculate DSCR: Step-by-Step Guide

DSCR Formula Explained

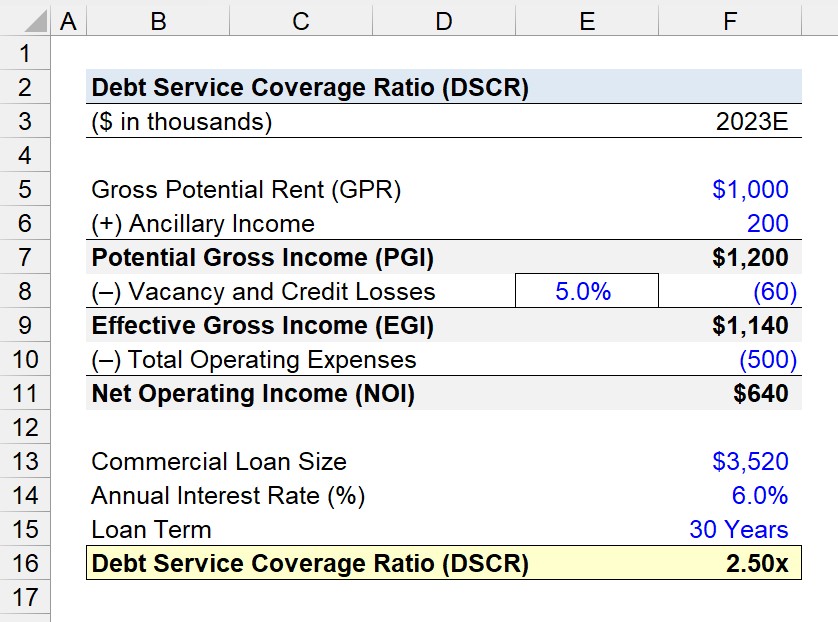

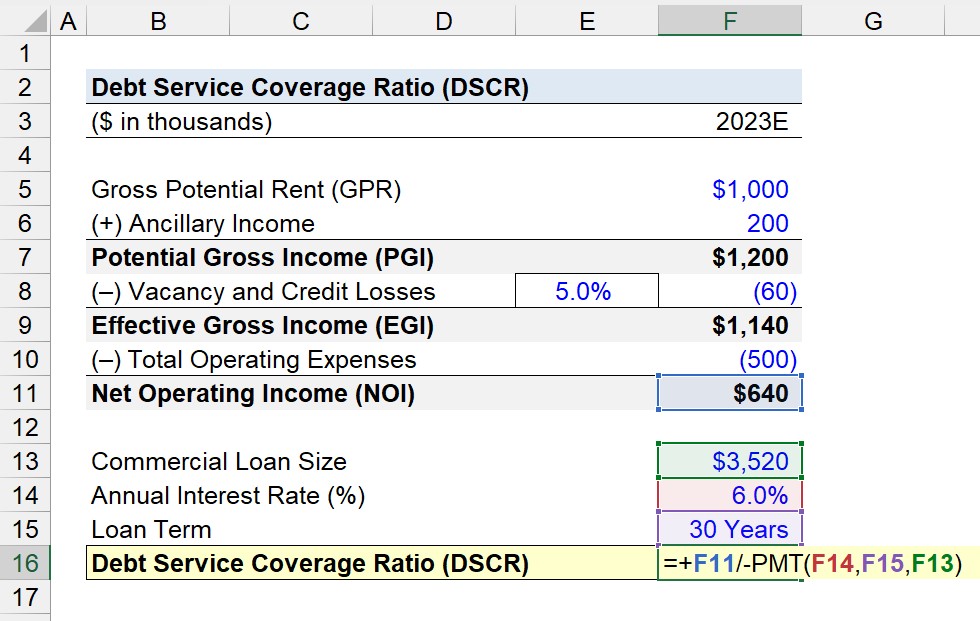

The Debt Service Coverage Ratio (DSCR) is an essential metric used by commercial lenders to evaluate a borrower’s ability to cover debt payments. The fundamental formula is:

DSCR = Net Operating Income (NOI) ÷ Debt Obligations

This formula is fairly straightforward but requires accurate input values for precise results. Essentially, the DSCR measures the proportion of a company’s cash flow that is available to meet annual debt payments.

The Net Operating Income (NOI) includes earnings before interest, taxes, depreciation, and amortization (EBITDA). It’s crucial to use the correct figures, meaning that taxes, interest, and other costs are not deducted when calculating NOI for DSCR purposes.

An accurate DSCR calculation ensures investors can determine whether a property generates enough cash flow to cover its debt obligations, thus influencing lending decisions.

Consider this: if you have a multifamily property with an NOI of $3.4 million and annual debt obligations of $2.3 million, the DSCR would be:

$3.4 million ÷ $2.3 million = 1.48x

Most lenders would view a DSCR of 1.48x favorably for many commercial real estate finance transactions.

Components of DSCR Calculation

Breaking down the components of the DSCR formula reveals the importance of accurate and comprehensive data collection. There are two critical elements:

- Net Operating Income (NOI): This is calculated based on the earnings before interest, taxes, depreciation, and amortization. In simpler terms, NOI is the income left after subtracting operating expenses from gross income.

- Debt Obligations: This includes all monthly payments towards debt, such as mortgages, maintenance costs, and insurance premiums.

For instance, if a property has a gross income of $10,000 per month, with operating expenses of $2,000 and a vacancy factor of 5%, the NOI calculation would be:

- Gross Income – Operating Expenses = $10,000 – $2,000 = $8,000

- Adjusted for Vacancy = $8,000 * 0.95 = $7,600

Next, calculate total debt service. If the monthly mortgage is $2,500, maintenance is $200, and insurance is $50, the total debt service is:

$2,500 + $200 + $50 = $2,750

Thus, the DSCR would be:

$7,600 ÷ $2,750 = 2.76

A DSCR above 1 implies that the property generates sufficient income to cover its debt obligations, which is a positive indicator for investors.

Practical Examples of DSCR Calculation

To illustrate the DSCR calculation, consider a real-world example of a property investment. Suppose a commercial building generates a monthly NOI of $20,000 and has monthly debt obligations totaling $12,000. The DSCR is calculated as follows:

$20,000 ÷ $12,000 = 1.67

This DSCR of 1.67 indicates that the property generates $1.67 in income for every $1.00 of debt, showing a strong financial position.

Another example involves a smaller property with NOI of $5,000 and debt service of $4,000. The calculation would be:

$5,000 ÷ $4,000 = 1.25

This DSCR of 1.25 is typically the minimum required by lenders to qualify for a DSCR loan, showing just enough income to cover debt obligations.

Additionally, tools like the DSCR calculator enhance accuracy by allowing users to input exact figures for NOI and debt service. These calculators often include features for detailed expense tracking and vacancy adjustments.

Understanding and calculating DSCR accurately is crucial for making informed investment decisions, ensuring that properties not only cover debts but also yield a profitable return.

Using the DSCR Commercial Loan Calculator: A Practical Tool

Features of the DSCR Calculator

The DSCR commercial loan calculator offers several key features that make it an essential tool for financial decision-making. This calculator supports business owners, real estate investors, and financial planners in their financial assessments.

Firstly, easy input fields for various financial metrics enable users to enter data seamlessly. Accurate results depend on providing precise information, so these fields are designed to be user-friendly and intuitive.

Secondly, the real-time calculation feature allows users to immediately see the impact of changes in their inputs. This dynamic response can be crucial for determining loan viability.

The real-time calculation helps users quickly adjust their strategies and understand potential financial outcomes.

Another significant feature is the graphical representation of results. Visual graphs make it easier to comprehend complex data, offering a clear overview of the financial scenario.

- Interactive graphs: These allow for better visualization and interpretation of data inputs and results.

- Report generation: Users can generate detailed reports for deeper analysis and presentations.

- Customizable settings: Tailor the calculator’s parameters to fit specific loan conditions and financial situations.

The DSCR calculator also includes a historical data comparison feature. This helps users compare current financial metrics with historical data, making trend analysis possible.

Ultimately, these features contribute to a comprehensive tool that aids in making informed financial decisions.

How to Use the Calculator

To harness the full potential of the DSCR commercial loan calculator, one must follow a structured approach. Begin by gathering all necessary financial documents and data.

Start by inputting the Net Operating Income (NOI) into the designated field. This is a crucial metric, as it forms the basis of the DSCR calculation.

Next, enter your total debt obligations. This includes principal, interest, and any other associated loan costs. The calculator will use this information to determine the DSCR.

- Input Net Operating Income (NOI): The NOI is a key metric for calculating DSCR.

- Enter total debt obligations: Include all costs such as principal and interest.

- Adjust variables as needed: Use the input fields to test different scenarios and their outcomes.

After entering the necessary data, review the real-time results provided by the calculator. Make adjustments to the inputs to see how different variables affect your DSCR.

Real-time results allow for immediate feedback, making it easier to strategize and plan financial decisions.

For a more in-depth analysis, utilize the graphical representations and report generation features. These tools can provide insights that are not immediately obvious from raw data.

Finally, save or print the generated reports for future reference or to present to stakeholders. This documentation can support your financial assessment and planning activities.

Benefits of Using the DSCR Calculator

The DSCR commercial loan calculator offers numerous benefits that can enhance financial decision-making for business owners, real estate investors, and financial planners.

One of the primary advantages is its ability to provide accurate financial assessments quickly and efficiently. This saves time and reduces the risk of human error in manual calculations.

Additionally, the calculator’s real-time feedback feature allows users to make immediate adjustments to their financial plans. This can lead to more strategic decision-making and better financial outcomes.

- Time-saving: Automated calculations streamline the assessment process.

- Enhanced accuracy: Reduces the chances of errors in manual computations.

- Strategic adjustments: Enables dynamic planning based on real-time data.

Another significant benefit is the visual representation of data. Graphs and charts make complex financial information easier to understand and communicate.

Visual tools simplify the interpretation of financial data, aiding in clearer decision-making.

The DSCR calculator also aids in risk assessment. By providing a clear picture of financial health, it helps users understand the potential risks associated with different loan scenarios.

Furthermore, the customization options allow users to tailor the calculator to their specific needs. This flexibility makes it applicable to a wide range of financial situations and loan types.

Ultimately, the DSCR calculator is a valuable tool that can significantly enhance the financial decision-making process through improved accuracy, speed, and clarity.

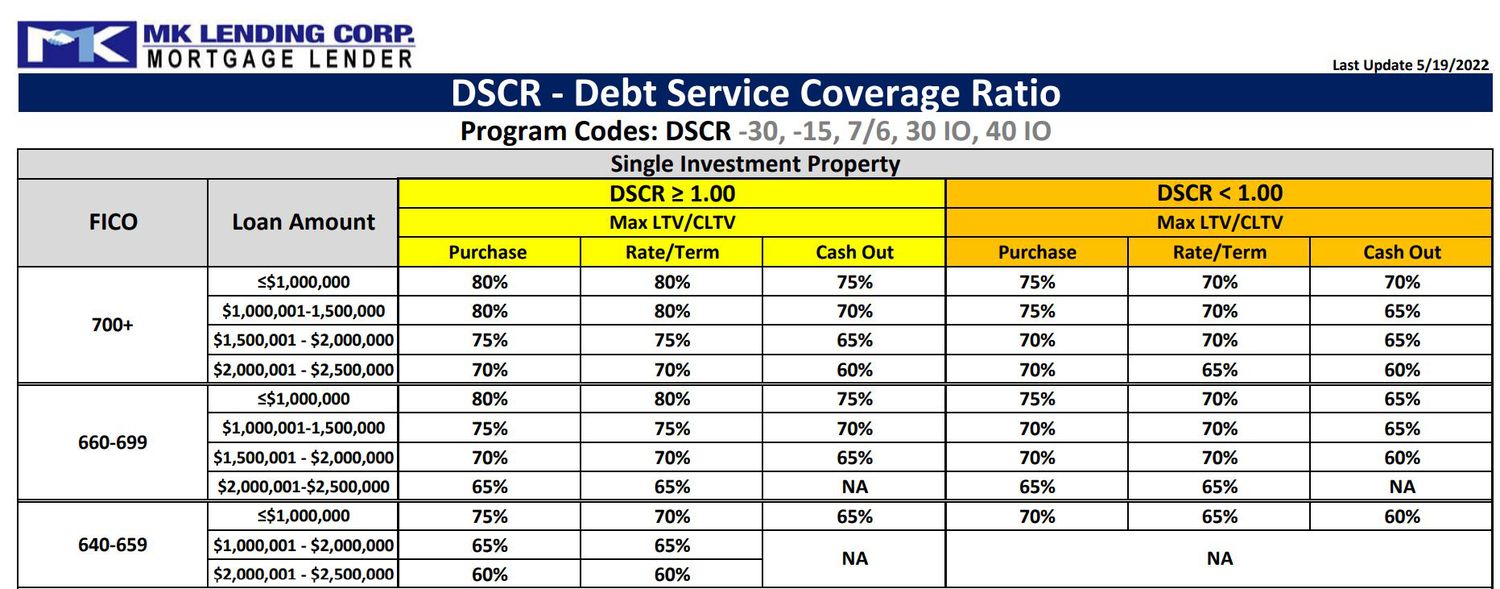

Minimum Acceptable DSCR: What Lenders Look For

Standard DSCR Requirements

In our examination of Debt Service Coverage Ratio (DSCR) requirements, it is essential to understand what constitutes a ‘good’ DSCR. Typically, a DSCR of 1.25 is considered favorable by lending institutions. Why is this particular figure so significant?

Lenders look for this ratio to ensure that borrowers are not only able to service their debt but also have a cushion for unforeseen expenses. A DSCR of 1.25 means that for every dollar of debt, there is an additional 25 cents to cover other potential financial obligations. This margin reassures lenders of the borrower’s financial stability.

Comparatively, higher DSCR values such as 1.50 illustrate an even more secure financial position. With a DSCR of 1.50, the income generated from the property not only covers the entire debt service but also leaves a significant buffer, which could be used as income or reinvested.

“A 1.50 DSCR means the income from your property will cover the total debt service and have enough left over for additional income.”

If the DSCR is exactly 1, it indicates that the borrower’s income is just enough to meet debt obligations without any surplus. This scenario is riskier for lenders.

On the other hand, a DSCR below 1 signifies that the income is insufficient to cover debt payments, thus posing a significant risk and typically resulting in loan disapproval. Simply put, lenders typically avoid borrowers with a DSCR below 1, as it suggests an inability to meet financial obligations.

Factors Influencing DSCR Thresholds

Various factors impact the DSCR thresholds lenders set. What prompts these variations in acceptable DSCR values?

- Economic Conditions: During economic downturns, lenders may require higher DSCRs to mitigate risks.

- Industry Type: Certain industries, such as real estate, may have different risk profiles influencing DSCR requirements.

- Borrower’s Financial Health: A borrower with a robust financial history might be able to secure loans with lower DSCRs.

- Loan Type: The nature of the loan, whether it’s a short-term bridge loan or a long-term mortgage, affects the DSCR expectations.

For instance, during times of economic uncertainty, lenders may become stricter with their DSCR requirements to safeguard against potential defaults. Additionally, loans secured for volatile sectors may necessitate higher DSCRs, reflecting the increased risk.

Lenders also take into account the borrower’s overall financial stability. A potential borrower with a strong credit history and substantial collateral may find it easier to negotiate favorable DSCR terms.

“Lending institutions typically want to see that you are in a good position to repay your loan and still meet any additional obligations that may come up.”

Lastly, the specific type of loan being sought plays a crucial role. For example, long-term loans might have different DSCR requirements compared to short-term financing options.

Impact of DSCR on Loan Approval

How does DSCR directly impact loan approval? The Debt Service Coverage Ratio is a critical metric in the loan approval process.

Firstly, a DSCR above the minimum threshold significantly enhances a borrower’s prospects for loan approval. Lenders view higher DSCRs as a sign of lower risk, as it indicates that the borrower can comfortably meet debt obligations.

In contrast, a borderline or low DSCR could lead to stringent loan terms or outright denial of the loan application. This is because lenders fear the likelihood of default increases when the DSCR is low.

Moreover, setting a higher DSCR than the industry standard can sometimes be advantageous. For instance, a property with a DSCR of 1.5 versus the minimum requirement of 1.25 might secure better loan conditions, such as lower interest rates or longer repayment terms, due to perceived lower risk.

Ultimately, DSCR serves as a critical determinant in assessing a borrower’s financial health and repayment capability. It not only helps in loan approval but also influences the terms and conditions attached to the loan.

- Higher DSCRs: Can lead to better loan terms and lower interest rates.

- Low DSCRs: Might result in loan denial or stricter loan conditions.

- Borderline DSCRs: May necessitate additional financial assurances or collateral.

To secure favorable loan terms, potential borrowers are encouraged to maintain a DSCR that exceeds the minimum requirements. This strategy ultimately showcases financial reliability, thereby increasing the likelihood of loan approval.

Interpreting DSCR Results: What Your Ratio Means

Understanding DSCR Values

Debt Service Coverage Ratio (DSCR) is a critical metric used by real estate investors, business owners, and financial analysts to evaluate a company’s ability to cover its debt obligations. It measures the cash available to service debt, including interest, principal, and lease payments.

A higher DSCR indicates that a company generates sufficient income to comfortably meet its debt obligations, while a lower DSCR might signal potential financial distress.

Understanding DSCR values is imperative, as it sheds light on a company’s financial health and its ability to sustain operations without jeopardizing its financial stability.

For instance, a DSCR of 1.5 means that the company has 1.5 times the income needed to cover its debt payments.

Why is this important? Because it helps in making informed investment decisions. A DSCR value can show if a business is stable and capable of growth or if it might struggle under current debt loads.

Knowing the exact DSCR value provides a clear picture, similar to having a reliable GPS while navigating through a complex city.

Moreover, different industries may have varying acceptable DSCR thresholds, which must be taken into account when interpreting these values.

To diversify one’s understanding, reviewing DSCR in conjunction with other financial metrics is advisable.

Consequently, this comprehensive approach ensures a well-rounded perspective on the company’s overall financial standing.

Implications of High and Low DSCR

DSCR values bring significant insights that can influence major financial decisions. A high DSCR generally suggests financial stability and indicates that the company can easily manage its debt commitments.

Investors might see a high DSCR as a positive sign, making them more likely to invest or lend money, as it reflects lower risk.

- High DSCR: Lower risk, indicating potential for sustained profitability and growth.

- Low DSCR: Higher risk, possibly hinting at future financial difficulties and challenges in meeting debt obligations.

On the other hand, a low DSCR could be a red flag for lenders and investors alike, as it points to possible cash flow problems.

A DSCR below 1.0 means the company doesn’t generate enough revenue to cover its debt payments, leading to increased scrutiny from potential investors and lenders.

An example would be comparing it to a soldier’s armor: a high DSCR is like full protection, while a low DSCR leaves vulnerable gaps.

Therefore, companies with low DSCR might find it difficult to obtain loans, as they are perceived as high-risk borrowers.

Understanding these implications enables stakeholders to make prudent financial decisions and mitigate potential risks effectively.

Thus, continuously monitoring DSCR values becomes essential for maintaining a robust financial footing.

Strategies to Improve DSCR

A critical aspect of managing financial health involves improving DSCR. There are several strategies to consider, aimed at either increasing income or reducing debt obligations.

- Increase Revenue: Explore new revenue streams, optimize pricing strategies, and enhance marketing efforts to boost sales.

- Reduce Expenses: Cut down unnecessary costs, streamline operations, and negotiate better terms with suppliers.

- Refinance Debt: Look for refinancing options that offer lower interest rates or extended terms to reduce monthly debt payments.

Increasing revenue can significantly boost DSCR, highlighting the importance of a dynamic sales strategy and continuous market analysis.

Moreover, reducing expenses through lean management practices and effective negotiation can also contribute to a better DSCR.

Consider refinancing existing debt as a viable option. Refinancing can lower interest rates, subsequently decreasing monthly debt service requirements.

For instance, refinancing a high-interest loan could result in reduced monthly payments, thereby improving the DSCR.

Each strategy requires careful planning and execution to ensure sustainable improvements in DSCR.

Combining these strategies can create a synergistic effect, leading to substantial enhancements in a company’s financial metrics.

Ultimately, adopting these approaches helps strengthen the financial resilience and growth potential of the business.

DSCR and Investment Decisions: Making Informed Choices

Role of DSCR in Investment Analysis

Understanding the Debt Service Coverage Ratio (DSCR) is vital for making informed investment decisions in real estate. DSCR measures the ability of a property to cover its debt obligations with its net operating income (NOI). This metric gives investors a clear picture of whether the property can generate enough cash flow to meet its debt payments.

By evaluating the DSCR, investors can assess the risk associated with a potential investment. A higher DSCR indicates a stronger ability to service debt, which translates to lower investment risk. Conversely, a lower DSCR suggests higher risk, as the property may struggle to meet debt obligations.

Commercial lenders also rely heavily on DSCR when deciding whether to approve a loan. Typically, a DSCR of 1.25 or higher is considered favorable by lenders, as it indicates a sufficient cushion to handle irregular income or unexpected expenses.

For financial planners, DSCR helps in creating investment strategies that align with the client’s risk tolerance and financial goals. By incorporating DSCR into their analysis, planners can identify properties that meet specific risk and return criteria.

“The role of DSCR in investment analysis cannot be overstated. It provides a critical measure of financial stability and risk management,” states a renowned financial analyst.

It is crucial to note that, DSCR plays a crucial role in evaluating the financial health of a real estate investment, helping investors, lenders, and financial planners make more informed decisions.

Comparing DSCR with Other Metrics

It is essential to compare DSCR with other financial metrics to gain a comprehensive view of an investment’s potential. Metrics such as the Loan-to-Value (LTV) ratio, Net Operating Income (NOI), and Capitalization Rate (Cap Rate) offer different insights into the investment’s financial standing.

LTV Ratio: This metric compares the loan amount to the property’s appraised value. While LTV focuses on the property’s value, DSCR centers on its cash flow, providing a more dynamic view of its financial health.

NOI: Net Operating Income represents the property’s total income minus its operating expenses. While NOI is a component of the DSCR calculation, it alone does not indicate the property’s ability to service debt. DSCR, incorporating NOI, offers a more comprehensive analysis.

“DSCR provides a more complete picture than NOI alone, as it incorporates debt obligations into the analysis,” explains a senior investment advisor.

Cap Rate: This metric calculates the return on investment based on the property’s net operating income and its market value. Unlike DSCR, which focuses on debt coverage, Cap Rate emphasizes the property’s profitability and return on investment.

Each of these metrics offers unique insights, but DSCR stands out by assessing the investment’s ability to cover debt, making it an indispensable tool for real estate investors.

Case Studies of DSCR in Real Estate

Examining real-world case studies can illustrate the importance of DSCR in investment decisions. Consider a commercial property with a DSCR of 1.5. This indicates the property generates 1.5 times the amount needed to cover its debt payments, exemplifying a low-risk investment.

Another case involves a residential property with a DSCR of 1.0. This suggests the property barely covers its debt obligations, making it a riskier investment. Investors might opt for such properties if they foresee potential for significant income growth or property appreciation.

- Case Study 1: A mixed-use development in a growing metropolitan area with a DSCR of 2.0. The high DSCR reflects strong cash flow, attracting investors seeking stable and profitable opportunities.

- Case Study 2: An aging commercial building with a DSCR of 0.8. The low DSCR indicates financial struggles, prompting investors to approach with caution or seek ways to boost income or reduce expenses.

- Case Study 3: A newly developed residential complex with a DSCR of 1.3. This moderate DSCR signals a balance between risk and return, appealing to investors with a moderate risk tolerance.

These case studies highlight how DSCR can reveal the financial strengths and vulnerabilities of real estate investments, guiding investors towards more informed and strategic decisions.

Advanced DSCR Analysis: Beyond the Basics

Global DSCR Explained

In terms of financial analysis, the Global Debt Service Coverage Ratio (Global DSCR) incorporates all business and personal debts under consideration. This more holistic approach provides a complete picture of an entity’s ability to cover debt obligations.

Unlike the standard DSCR, which might focus solely on a single loan or a specific segment of debt, the Global DSCR encompasses the full spectrum of financial responsibilities. This includes both existing loans and new prospective debt, offering a more comprehensive risk assessment.

Understanding the Global DSCR allows us to better predict the overall financial health of a borrower, considering all financial commitments.

Why is this important? It ensures that potential risks are mitigated and that the borrower’s true financial capacity is accurately gauged. Incorporating both personal and business liabilities can significantly impact the lending decision.

Therefore, the Global DSCR is often considered a more reliable metric for commercial lenders and advanced real estate investors looking to safeguard their investments.

- Broader Scope: By taking into account all debt obligations, the Global DSCR reduces the likelihood of overlooking any potential financial strain.

- Enhanced Accuracy: A holistic view often provides a more accurate representation of financial health.

- Risk Mitigation: Helps in identifying risks that might not be apparent when only considering isolated segments of debt.

Incorporating the Global DSCR into your analysis ensures that we are not simply scratching the surface but truly understanding the depth of financial stability and risk.

Integrating Personal Finances in DSCR

When calculating DSCR, integrating personal finances can offer a more thorough insight into the borrower’s capacity to service debt. Incorporating personal financial obligations ensures we account for all potential expenditures that might affect the borrower’s ability to meet their debt obligations.

For advanced real estate investors and financial analysts, understanding the interplay between personal and business finances is crucial. Personal debts, such as mortgages, personal loans, and other liabilities, can significantly impact the overall DSCR.

Why should we integrate personal finances? Personal financial stability directly influences business operations, especially when the borrower is a small business owner or a sole proprietor.

- Comprehensive Analysis: Provides a full view of the borrower’s financial obligations.

- Accurate Risk Assessment: Helps in identifying any potential financial stress points.

- Informed Decision-Making: Facilitates better lending and investment decisions.

By merging personal and business financial obligations, we can better assess the true financial position and cash flow of the borrower, providing a more realistic picture of their debt repayment capacity.

This integrated approach to analyzing DSCR is essential for advanced real estate investors and commercial lenders focused on mitigating risk and ensuring long-term financial health.

Advanced DSCR Calculation Techniques

Advanced DSCR calculation techniques involve detailed methodologies to accurately measure the ability to service debt. These include adjustments for non-recurring expenses, understanding seasonal income variations, and incorporating stress testing scenarios.

One advanced technique is to adjust for non-recurring expenses that might distort typical cash flow measurements. By excluding one-time costs or income spikes, we can gain a more accurate view of the borrower’s regular financial health.

Another critical technique involves accounting for seasonal income variations. For businesses with fluctuating income, such as retail or agriculture, it’s vital to average out income over a longer period to avoid seasonal distortions.

Incorporating stress testing scenarios allows us to predict how various financial strains might impact the borrower’s ability to service debt.

Stress testing involves simulating different financial scenarios, such as interest rate hikes or economic downturns, to evaluate how these changes could affect the borrower’s DSCR.

- Adjust for Non-Recurring Expenses: Remove one-time costs to reflect steady cash flow.

- Account for Seasonal Variations: Use long-term averages to smooth out seasonal income fluctuations.

- Incorporate Stress Testing: Simulate different financial scenarios to understand potential impacts on DSCR.

Advanced DSCR calculation methods allow us to create a more resilient financial model, ensuring we have a robust understanding of the borrower’s ability to meet debt obligations under various circumstances.

This deep dive into DSCR analysis techniques supports better risk management and decision-making for financial analysts, advanced real estate investors, and commercial lenders.

Conclusion

Mastering the Debt Service Coverage Ratio (DSCR) is essential for making sound financial decisions in both commercial and personal contexts. By understanding the definition, importance, and calculation of DSCR, as well as utilizing practical tools like the DSCR commercial loan calculator, you can effectively gauge loan sustainability and investment potential. Recognizing what lenders look for in a minimum acceptable DSCR further enhances your ability to secure favorable loan terms.

Engaging in advanced DSCR analysis enables investors to incorporate personal finances and adopt more sophisticated calculation techniques, thus facilitating comprehensive investment assessments. Whether you’re evaluating real estate opportunities or other investment ventures, a thorough grasp of DSCR empowers you to make informed decisions that align with your financial goals. Explore the tools and strategies discussed to optimize your DSCR, ensuring robust financial health and successful investments. Take action now and refine your approach to financial analysis.

Frequently Asked Questions

What is a good DSCR for commercial loans?

A good DSCR for commercial loans is typically 1.25 or higher. This indicates that the property’s income adequately covers the debt obligations.

Can DSCR loan be used for commercial property?

Yes, DSCR loans are commonly used for commercial properties to assess their ability to generate enough income to cover loan payments.

How to calculate DSCR for commercial real estate?

To calculate DSCR, divide Net Operating Income (NOI) by Total Debt Service (TDS). The formula is DSCR = NOI / TDS.

What is the DSCR loan calculator?

The DSCR loan calculator is a digital tool that aids in computing the Debt Service Coverage Ratio by inputting income and debt figures, simplifying financial analysis.

What are standard DSCR requirements?

Standard DSCR requirements vary but typically range from 1.2 to 1.5, depending on the lender’s risk tolerance and the type of loan.

How do you interpret DSCR values?

DSCR values above 1.0 indicate positive cash flow, while values below 1.0 suggest insufficient income to cover debt obligations.