Unlock the potential of your investment strategy with a DSCR HELOC, a powerful financial tool designed to enhance your portfolio. This comprehensive guide delves into every facet, from understanding key features to navigating eligibility criteria, and exploring interest rates.

Discover how a DSCR HELOC can help you purchase additional properties, fund renovations, or provide working capital for your business. Compare it with other loan options and master the application process with our essential tips, ensuring you make the most informed decision.

Understanding DSCR HELOC: A Comprehensive Guide

What is a DSCR HELOC?

A Debt Service Coverage Ratio (DSCR) Home Equity Line of Credit (HELOC) is a specialized financial product designed for real estate investors and self-employed individuals seeking flexible financing options. Unlike traditional loans, a DSCR HELOC focuses primarily on the property’s income-generating potential rather than the borrower’s personal income documentation.

The core principle of a DSCR HELOC is to assess whether the rental income from the property can cover the debt service—the sum of the principal and interest payments on the loan. This ratio is a crucial factor in determining loan eligibility and terms. Real estate investors often find this product advantageous because it allows for easier qualification compared to conventional loans requiring extensive income verification.

How does a DSCR HELOC operate in practice? Essentially, borrowers gain access to a revolving credit line secured by the equity in an investment property. They can draw from this line of credit as needed, making it an ideal solution for those managing multiple properties or needing funds for property improvements.

“As long as the rental income covers your debt service, you’ll qualify for a DSCR HELOC,” explains Truss Financial Group.

Typically, borrowers must demonstrate a minimum DSCR to qualify. If the property’s income exceeds the debt obligations, obtaining approval becomes more straightforward. Additionally, the process does not require the same level of personal income scrutiny, making it appealing for self-employed individuals or those with complex financial structures.

What makes a DSCR HELOC stand out from other loan options? The main distinctive feature is its reliance on rental income rather than traditional income verification, offering a streamlined approval process and greater flexibility. It provides a practical funding solution for those who may not meet the stringent requirements of conventional mortgage loans.

Key Features of DSCR HELOC

Several key features distinguish a DSCR HELOC from other financial products, offering unique benefits tailored for real estate investors and self-employed individuals. Understanding these features can help in making an informed decision about utilizing this financing option.

- No Personal Income Verification: A primary advantage of DSCR HELOCs is the absence of personal income verification. Borrowers do not need to provide tax returns, pay stubs, or other traditional income documentation.

- Fixed and Variable Rates: DSCR HELOCs often offer both fixed and variable interest rate options. Investors can choose the rate type that best aligns with their financial strategy and market conditions.

- Flexible Credit Line: Borrowers have access to a revolving line of credit, allowing them to withdraw funds as needed and repay them at their convenience, similar to how a credit card operates but typically with lower interest rates.

An illustrative example of this would be a real estate investor needing funds to renovate a rental property. With a DSCR HELOC, they can draw only the amount needed for the renovation and repay it once the property starts generating higher rental income.

Additionally, DSCR HELOCs cater to a wide range of investment property types. Whether it’s single-family homes, multi-family units, or even non-warrantable condos, these loans are structured to accommodate various investment portfolios, providing flexibility that aligns with an investor’s property strategy.

Another notable feature is the potential for lower rates and fees compared to traditional hard money loans. Since the DSCR HELOC relies on the property’s income, it can often come with more favorable terms, making it a cost-effective solution for financing investment properties.

Finally, the qualification process for a DSCR HELOC is often more streamlined. With fewer documentation requirements and a focus on the property’s income, the approval process can be quicker and less burdensome, enabling investors to seize opportunities without delay.

Benefits of DSCR HELOC for Investors

A DSCR HELOC offers several benefits that make it a compelling option for real estate investors. These benefits not only provide financial flexibility but also enhance the ability to manage and grow an investment portfolio effectively.

- Access to Capital: One of the most significant advantages is the access to a revolving line of credit, which can be used for property improvements, acquisitions, or other investment opportunities.

- Flexible Repayment: Investors can draw from the credit line as needed and repay according to their financial situation, providing a level of financial control that fixed loans do not offer.

- Leverage Equity: Utilizing the equity in an existing property to finance new investments can be a strategic move, enabling investors to grow their portfolios without liquidating assets.

For instance, consider an investor who owns a rental property with substantial equity. Instead of selling the property to access cash, they can use a DSCR HELOC to tap into that equity. This approach allows them to retain ownership and continue earning rental income while simultaneously investing in new opportunities.

Furthermore, the qualification criteria for a DSCR HELOC are generally more favorable for self-employed individuals and investors with non-traditional income sources. The focus on rental income rather than personal financials simplifies the approval process and opens the door to financing options that might otherwise be inaccessible.

Additionally, the competitive rates often associated with DSCR HELOCs make them a cost-effective alternative to other high-interest financing options like hard money loans. By securing lower rates, investors can maximize their returns and reinvest savings into further property enhancements or acquisitions.

Lastly, the streamlined application process means investors can secure financing more quickly, allowing them to act swiftly on lucrative deals. In a competitive real estate market, the ability to access funds promptly can be a decisive factor in successful property investment.

Wouldn’t it be advantageous to leverage these benefits for your real estate investments? Understanding how a DSCR HELOC can fit into your financial strategy will help you make informed decisions and optimize your investment portfolio.

Eligibility Criteria for DSCR HELOC

Credit Score Requirements

When seeking a Debt Service Coverage Ratio (DSCR) Home Equity Line of Credit (HELOC), credit score requirements are a fundamental consideration. Lenders typically evaluate your credit score to gauge your creditworthiness and potential risk. A higher credit score usually translates to more favorable loan terms.

For most DSCR HELOCs, a minimum credit score of 680 is necessary. However, some lenders might require a higher score, especially if the loan amount is sizable or the borrower has other risk factors. How does your credit score measure up?

Why does your credit score matter? It is an indicator of your financial responsibility and history of dealing with debt. A higher score can mean lower interest rates and better terms. Conversely, a lower score might result in higher rates and less attractive conditions.

Maintaining a good credit score is crucial. This involves paying your bills on time, keeping your credit card balances low, and avoiding unnecessary debt. Are you taking the necessary steps to keep your score healthy?

“A strong credit score is a key element in securing favorable loan terms. It reflects financial discipline and responsibility.”

- Credit report monitoring: Regularly check your credit report for errors or fraudulent activities.

- Timely payments: Consistently pay all your bills on time to maintain and improve your credit score.

- Credit utilization: Keep your credit card balances below 30% of your credit limit.

Can you take steps today to improve your credit score and qualify for better loan terms?

Employment Status

Although DSCR HELOCs often do not require traditional income verification methods, your employment status can still influence the loan approval process. Lenders may need to understand your ability to repay the loan through your current employment status and any other sources of income.

Being self-employed or having variable income may require additional documentation. Typically, lenders will request:

- Personal and business tax returns: Providing two years of these documents helps lenders assess your financial stability.

- Profit and Loss (P&L) statement: A year-to-date (YTD) P&L statement gives a snapshot of your business’s financial health.

- Balance Sheet: This must be updated to the most recent quarter to reflect your business’s current financial position.

Even without traditional income verification, presenting a comprehensive financial picture can support your DSCR HELOC application. Are you prepared to provide the necessary documents?

For borrowers with regular employment, a letter from your employer or recent pay stubs may suffice. Self-employed individuals, however, must be ready to present a more detailed financial history.

Have you considered how your employment status could impact your eligibility?

Property Qualifications

The property used as collateral for the DSCR HELOC must meet specific criteria. Firstly, the property must be an investment property, not a primary residence. How does your property qualify?

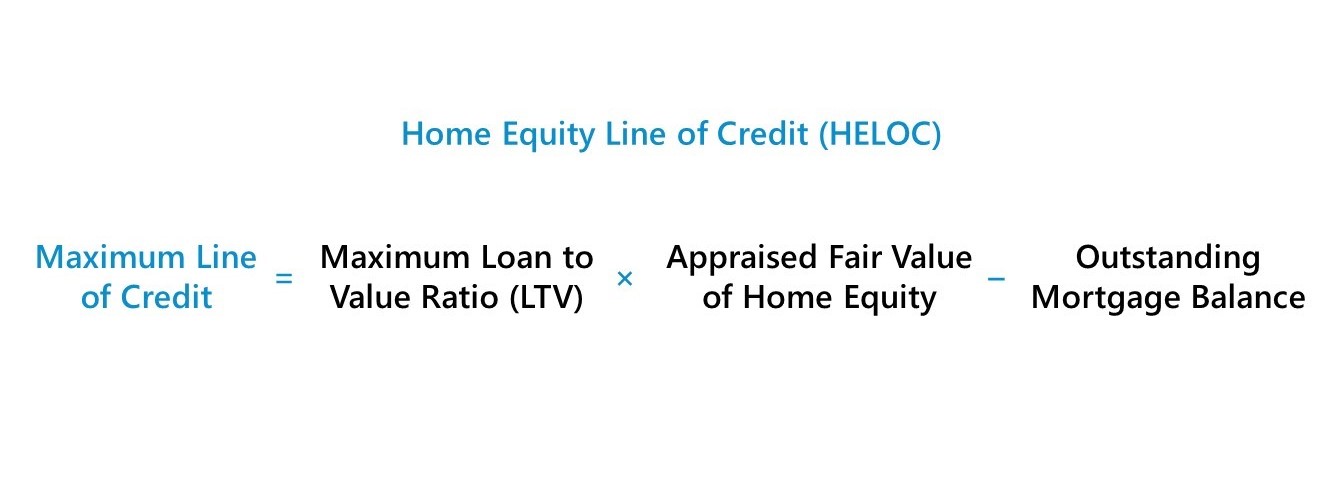

A crucial requirement is that the property must generate sufficient rental income to cover the loan payments. Lenders will calculate the Debt Service Coverage Ratio (DSCR) to determine this. Typically, a DSCR of 1.25 or higher is required, meaning the property generates 25% more income than the debt service obligations.

Other qualifications for the property may include:

- Property condition: The property should be in good condition, as poor condition could reduce its value as collateral.

- Occupancy rates: High occupancy rates can signal consistent rental income, adding to the property’s qualification strength.

- Location: Properties in economically stable and desirable areas are often more favorable to lenders.

Investors must ensure their properties meet these qualifications to secure a DSCR HELOC. Do you know if your rental property can meet these criteria?

Understanding these property requirements is essential. Each factor, from rental income to location, plays a pivotal role in your loan eligibility. Are you ready to evaluate your property?

Interest Rates and Terms for DSCR HELOC

Fixed vs Floating Rates

When discussing DSCR HELOCs, it is essential to understand the nature of fixed and floating rates. These terms define how interest is calculated and how it impacts repayment.

Fixed rates remain constant over the life of the loan. This stability can be beneficial for budgeting, as borrowers know their payments won’t change.

Floating rates, on the other hand, fluctuate based on a benchmark interest rate. They might start lower than fixed rates but can increase over time, depending on market conditions.

How do we choose between these two structures? Consider the predictability of fixed rates versus the potential savings of floating rates in a declining interest rate environment.

According to financial experts, “Floating rates can be risky but might offer savings if the market interest rates fall.”

Borrowers must weigh factors like current and projected interest rates, the stability of their income, and their risk tolerance.

Real estate professionals often advise clients who prefer stability to opt for fixed rates, while those with a higher risk appetite might consider floating rates.

Ultimately, the choice affects both monthly payment size and the total interest paid over time.

Factors Affecting Interest Rates

The interest rates for DSCR HELOCs aren’t set in a vacuum; several factors influence them. Understanding these can help borrowers make more informed decisions.

First, market conditions play a significant role. The broader economic environment, including inflation rates and central bank policies, can drive interest rate changes.

- Credit Score: A higher credit score can lead to lower interest rates, reflecting the borrower’s lower risk profile.

- Loan-to-Value Ratio: The amount of equity in the property affects rates; less equity can mean higher interest.

- Debt Service Coverage Ratio (DSCR): This critical measure of a property’s income relative to its debt obligations can influence rates. A higher DSCR often translates to lower interest rates.

Additionally, the loan amount and the borrower’s financial history can also impact the interest rates offered.

Financial planners recommend regular credit monitoring and maintaining a healthy DSCR to secure the best rates possible.

Industry insights suggest, “A proactive approach to managing your finances can significantly impact your DSCR HELOC interest rates.”

Borrowers should consult with their lenders and financial advisors to tailor their approach based on these factors.

Typical Terms and Conditions

DSCR HELOCs come with specific terms and conditions that borrowers must understand to effectively manage their loans.

The draw period is the time frame during which funds can be withdrawn. This period often lasts for 10 years, providing flexibility for borrowers.

Following the draw period is the repayment period, typically ranging from 10 to 20 years, during which the borrowed amount, along with interest, must be repaid.

Are there fees associated with DSCR HELOCs? Yes, borrowers may encounter various fees, including origination, appraisal, and annual fees.

- Origination Fees: These cover the costs of processing the loan application.

- Appraisal Fees: These fees are for determining the current value of the property securing the HELOC.

- Annual Fees: Ongoing fees to keep the line of credit open.

It is crucial to read and understand the loan agreement thoroughly. Terms may vary depending on the lender and specific circumstances of the borrower.

“Understanding the fine print can save borrowers from unexpected surprises,” notes a seasoned real estate professional.

Borrowers should ask questions and seek clarifications on any terms or conditions they find unclear.

Importantly, knowing the typical terms and conditions can help borrowers navigate their DSCR HELOC efficiently.

Credit Line Limits for DSCR HELOC

Minimum and Maximum Credit Lines

When considering a Debt Service Coverage Ratio (DSCR) Home Equity Line of Credit (HELOC), one of the primary factors to evaluate is the credit line range. The minimum credit line for an Investment Property HELOC typically starts at $25,000. This baseline ensures that investors can access a sufficient amount for smaller, yet impactful investments.

On the higher end, the maximum credit line reaches up to $500,000. This upper limit allows for substantial financial leveraging, enabling large-scale property investments and significant capital projects. Is this range sufficient for your investment goals?

Understanding these limits is crucial for effective financial planning. By knowing the minimum and maximum credit lines available, investors and financial advisors can better strategize their funding requirements. For example, a property manager looking to refurbish multiple units within a complex will find the flexibility offered by this range advantageous.

Moreover, having access to a broad range of credit ensures you can manage unforeseen expenses without substantial financial strain. The minimum threshold aids in maintaining liquidity, while the maximum limit provides extensive leverage. Would a higher limit alter your investment strategy?

These credit line limits also offer a buffer against market volatility. By having access to a high credit limit, investors can swiftly react to market opportunities or downturns, optimizing their investment portfolio’s performance. Isn’t it reassuring to have that extra financial cushion?

“Our Investment Property HELOC minimum credit line is $25,000 and maximum credit line is $500,000.” – Financial Institution Guideline

This official guideline highlights the balance between accessibility and substantial financial support. It’s essential for investors to align their credit needs within this specified range to fully leverage their DSCR HELOC benefits.

It is crucial to note that, the comprehensive range from $25,000 to $500,000 accommodates diverse financial strategies, making DSCR HELOCs versatile and valuable for various investment purposes.

Factors Influencing Credit Limits

Several factors determine the exact credit limit you may qualify for within the DSCR HELOC framework. These factors ensure that the credit lines are tailored to the specific financial circumstances and investment strategies of each applicant. What key elements impact your credit limit?

Firstly, the property’s value plays a pivotal role. Higher-valued properties generally support larger credit lines, reflecting the collateral’s worth. How does your property’s value align with these criteria?

Secondly, the borrower’s credit score significantly influences the credit limit. A higher credit score often results in a higher credit line, as it demonstrates financial reliability and lower risk to the lender. Are you confident in your credit score’s impact?

Next, the debt service coverage ratio itself is critical. Properties with higher income relative to debt obligations are more likely to secure higher credit limits, as they exhibit stronger financial performance. Does your DSCR enhance your creditworthiness?

- Property Value: The appraised value of the property determines the potential credit limit.

- Credit Score: A higher score translates to greater trust and higher credit limits.

- Debt Service Coverage Ratio (DSCR): Demonstrates the property’s income versus debt obligations.

Additionally, the overall financial health and history of the borrower are evaluated. A consistent track record of sound financial management can positively influence the credit limit offered. Have you maintained a robust financial history?

Lastly, the specific terms and conditions of the lender will also impact the credit limits. Different institutions may offer varying credit ranges based on their risk assessment models and market conditions.

By understanding these factors, investors and financial advisors can better prepare and optimize their applications to secure the most favorable credit limits within the DSCR HELOC program.

Managing Credit Lines Effectively

Once you’ve secured a DSCR HELOC, managing your credit line effectively becomes paramount to maximizing its benefits. Effective management not only ensures financial health but also enhances future borrowing potential. How can you efficiently manage your credit line?

Firstly, maintain regular monitoring of your credit line usage. Keeping track of your spending and repayment patterns helps in avoiding over-leverage and ensures that you remain within your credit limit. Would a detailed financial log aid in this process?

- Monitor Spending: Regularly track your HELOC usage to stay within limits.

- Timely Repayments: Ensure timely repayments to maintain a healthy credit score.

- Strategic Withdrawals: Use the credit line for strategic investments, not just routine expenses.

Moreover, timely repayments are crucial. Regular and on-time repayments bolster your credit score and reflect positively on your financial reliability. This, in turn, can lead to more favorable borrowing terms in the future. How do timely repayments influence your financial strategy?

It is also advisable to use the credit line strategically. Allocate the funds towards investments that yield higher returns rather than routine expenses. Does your current investment plan align with this strategy?

Additionally, communication with your lender can aid in effectively managing your credit line. Staying informed about any changes in terms or conditions and seeking advice for optimization can be highly beneficial. Have you consulted with your lender recently?

Concerning long-term management, aim to review your DSCR regularly. Ensuring that your property’s income significantly exceeds its debt obligations can provide a strong foundation for sustained financial health. Is your DSCR currently providing ample coverage?

Lastly, consider setting periodic financial goals. By having clear targets, you can better manage your credit line usage and repayments, thereby optimizing your investment potential over time.

By following these strategies, property managers, investors, and financial advisors can enhance their financial outcomes through effective DSCR HELOC management.

Utilizing DSCR HELOC for Investment Properties

Purchasing Additional Properties

One practical application of a Debt Service Coverage Ratio Home Equity Line of Credit (DSCR HELOC) is purchasing additional properties. This financial tool allows investors to leverage the equity in their existing properties to finance new acquisitions without liquidating assets.

“Investors can unlock their property’s equity, converting it into a revolving line of credit that can be used to purchase more real estate,” states a financial expert.

Consider an investor who owns a fully paid-off rental property valued at $500,000. By utilizing a DSCR HELOC, the investor can borrow against this equity to buy another income-generating property. This strategic move not only diversifies their portfolio but also maximizes their returns.

- Immediate Access to Funds: DSCR HELOC provides a revolving line of credit, offering flexibility and instant access to capital.

- Interest-Only Payments: Investors may choose to make interest-only payments, reducing initial cash flow strains and allowing further investments into property improvements.

- Portfolio Expansion: By leveraging equity, investors can continually reinvest in new properties, thus growing their portfolio steadily.

Wouldn’t expanding your property portfolio without selling off any of your prime assets be ideal? Indeed, a DSCR HELOC makes this possible, fostering growth through smart financial leverage.

Funding Renovations

Renovations often play a critical role in increasing the value and rental income of investment properties. With a DSCR HELOC, property investors can easily access funds required for substantial renovations.

Imagine an outdated apartment complex that needs modern amenities to attract higher-paying tenants. By utilizing a DSCR HELOC, the investor can finance these updates without depleting their reserves or taking out high-interest loans.

“Funding renovations through a DSCR HELOC can lead to higher property valuations and increased rental income,” remarks a seasoned investor.

This form of financing is particularly advantageous because:

- Flexibility in Usage: The revolving nature of HELOCs means investors can withdraw funds as needed for different stages of renovation.

- Control Over Costs: With a clear budget supported by available credit, renovations can be meticulously planned, ensuring costs do not spiral out of control.

- Value Enhancement: Renovated properties typically command higher rents and market prices, enhancing the return on investment.

Have you considered the impact of sleek, modern updates on tenant satisfaction and profitability? Using a DSCR HELOC for renovations not only boosts property value but also enhances tenant retention and attraction.

Working Capital for Business

A DSCR HELOC is not only beneficial for purchasing properties or funding renovations; it also serves as a reliable source of working capital for business operations. This application is especially pertinent for business owners who require liquidity to manage day-to-day operations or seize growth opportunities.

For instance, a real estate firm looking to expand its marketing efforts or hire additional staff during a rapid growth phase can draw from a DSCR HELOC. This ensures that the business operates smoothly without interruptions, thanks to the readily available capital.

“Having a DSCR HELOC as a financial backup can be crucial for maintaining operational efficiency and capitalizing on market opportunities,” a financial consultant advises.

- Operational Fluidity: Accessing a line of credit ensures that businesses can cover unforeseen expenses and maintain smooth operations.

- Opportunity Capital: Businesses can leverage these funds to take advantage of investment opportunities that require immediate capital infusion.

- Financial Buffer: A DSCR HELOC provides a financial cushion, reducing the risk of cash flow disruptions during economic downturns.

In essence, how valuable would it be to have a financial safety net that supports continuous business growth and stability? Employing a DSCR HELOC for working capital reinforces operational resilience and promotes long-term success.

Comparing DSCR HELOC with Other Loan Options

DSCR HELOC vs Traditional Loans

When comparing a **DSCR HELOC (Debt Service Coverage Ratio Home Equity Line of Credit)** to traditional loans, we need to understand the unique structures of both.

Traditional loans typically come in fixed or adjustable rates and involve a set principal and interest repayment plan. These loans require regular monthly payments over a specified period.

In contrast, a DSCR HELOC is more versatile. It allows borrowers to access home equity as needed, making it an excellent option for those who might not require a lump sum upfront. What makes the DSCR HELOC particularly appealing to **investors** is the flexibility it offers in managing cash flow.

DSCR HELOCs can provide significant advantages for investors looking to maximize their property’s income potential.

Another critical difference lies in the qualification process. Traditional loans rely heavily on credit scores and employment history. However, a DSCR HELOC focuses on the income generated by the property itself, which can be ideal for investment properties.

Would a traditional loan or DSCR HELOC better suit the needs of someone looking for flexibility?

- Fixed repayment plans: Traditional loans have consistent payment schedules.

- Income-based qualification: DSCR HELOCs focus on property income rather than personal credit.

- Access to funds: DSCR HELOCs provide flexible access to borrowed money.

Both options have their merits, but the choice will largely depend on the borrower’s specific financial situation and goals.

DSCR HELOC vs Bridge Loans

Bridge loans and DSCR HELOCs serve distinct purposes, despite both being short-term financing solutions. Bridge loans are used to “bridge” the gap between buying a new property and selling an existing one.

On the other hand, a DSCR HELOC allows homeowners to tap into their home equity and withdraw funds as needed. This makes it suitable for ongoing investments and operational expenses.

Bridge loans are often used in situations where immediate funds are necessary to secure a new property.

Bridge loans can be more expensive due to their short-term nature and higher interest rates. In contrast, DSCR HELOCs offer a revolving credit line, which can be drawn upon as required, typically at a lower interest rate.

What are the scenarios in which each type of loan shines?

- Immediate property purchase: Bridge loans are ideal for quickly securing new properties.

- Ongoing expenses: DSCR HELOCs provide flexibility for various investment needs.

- Interest rates: DSCR HELOCs generally offer more favorable rates than bridge loans.

Understanding these distinctions can help investors choose the right tool for their financial strategies.

Pros and Cons of Each Option

Every financing option comes with its own set of advantages and disadvantages. Evaluating these can help in making an informed decision.

For DSCR HELOCs, the main advantage is flexibility. Investors can access funds as needed, making it an excellent choice for unpredictable expenses. However, the interest rates may fluctuate, which can be a drawback.

Traditional loans offer stability with fixed repayment schedules and rates, making budgeting more straightforward. Yet, they lack the flexibility of DSCR HELOCs and may be harder to qualify for based on strict credit requirements.

Determining the best option requires weighing the pros and cons against your specific financial goals.

Bridge loans provide a quick influx of cash to close property deals, but their higher costs can deter some investors. They are suitable for short-term needs but not ideal for long-term financial strategies.

What are the primary pros and cons to consider for each financing option?

- DSCR HELOC: Flexible access to funds and property income-based qualification but variable interest rates.

- Traditional Loans: Fixed payments and predictable budgeting but stringent qualification criteria.

- Bridge Loans: Quick access to funds for property acquisitions but higher costs and short-term usage.

Each option serves different needs, and choosing the right one depends on the borrower’s financial situation and future goals.

Securing a DSCR HELOC: Application Process and Tips

Steps to Apply for a DSCR HELOC

Understanding the steps involved in applying for a Debt Service Coverage Ratio Home Equity Line of Credit (DSCR HELOC) is crucial for any borrower, real estate investor, or financial advisor. Let’s delve into the key stages of the application process.

First, it is essential to evaluate your financial situation. This includes assessing your credit score, income, and existing debt obligations. How prepared are you to take on additional debt?

Next, research potential lenders. Different lenders have varying terms, interest rates, and application processes. It is vital to compare these aspects to find the best fit for your financial goals.

Once a suitable lender is chosen, you will need to complete an application. This typically requires providing detailed financial information, including income, employment history, and asset details.

After submitting your application, the lender will conduct a credit check and may require a property appraisal. This helps them determine your eligibility and the amount you can borrow.

If the lender approves your application, you will receive an offer outlining the terms and conditions of your DSCR HELOC. Carefully review this offer to ensure it meets your needs.

Upon accepting the offer, the final step is to sign the necessary documents and complete any required procedures to activate your line of credit.

“The application process for a DSCR HELOC involves several critical steps, from evaluating your finances to selecting a lender and completing the necessary paperwork.” – Financial Expert

Required Documentation

Gathering the required documentation in advance can streamline the application process for a DSCR HELOC. What specific documents will you need?

First, you will need to provide proof of income. This could include recent pay stubs, tax returns, and any additional sources of income. Lenders need to verify your ability to repay the loan.

Next, prepare to submit bank statements. These statements offer a glimpse into your financial habits and stability. Most lenders require at least three months of statements.

Additionally, be ready to present a current mortgage statement. This helps the lender assess your existing debt obligations and equity in your property.

Property documentation is also essential. This might include title deeds, property tax records, and insurance documents. These records establish your ownership and the property’s condition.

For real estate investors, any documentation related to rental income should be included. This demonstrates your property’s income-generating potential, which is crucial for DSCR calculations.

Lastly, lenders often require a business plan or financial forecast for investment properties. This outlines your strategy and projected returns, providing additional assurance to the lender.

- Proof of Income: Pay stubs, tax returns, additional sources of income

- Bank Statements: Typically, three months of statements are required

- Current Mortgage Statement: Details existing obligations and equity

- Property Documentation: Title deeds, tax records, insurance documents

- Rental Income Documentation: For real estate investors, demonstrating property income

- Business Plan/Financial Forecast: For investment properties, outlining strategy and returns

Tips for a Successful Application

To enhance your chances of approval for a DSCR HELOC, consider the following tips. What strategies can make your application stand out?

First, ensure your credit score is in good standing. A higher credit score typically leads to better terms and higher approval rates. Are there errors on your credit report that need correcting?

Second, reduce existing debts as much as possible. Lenders are more likely to approve your application if your debt-to-income ratio is low. Can you pay off any smaller debts before applying?

It is also beneficial to increase your income. This might involve taking on additional work or generating passive income through investments. Higher income levels can ease the lender’s concerns about repayment ability.

Another tip is to maintain a healthy bank balance. Demonstrating financial stability through substantial savings can impress lenders and improve your application’s prospects.

Additionally, prepare a comprehensive business plan if applying for an investment property loan. This plan should highlight your strategy, projected income, and market analysis, offering lenders a clear picture of your investment’s viability.

Lastly, communicate effectively with your lender. Clear communication can resolve potential issues promptly and demonstrate your commitment and reliability.

- Maintain a Good Credit Score: Correct errors and aim for a higher score

- Reduce Existing Debts: Lower your debt-to-income ratio

- Increase Income: Explore additional work or passive income sources

- Maintain a Healthy Bank Balance: Show financial stability

- Prepare a Comprehensive Business Plan: For investment properties, outline strategy and projections

- Communicate Effectively with Lenders: Resolve issues and show commitment

Conclusion

Grasping the intricacies of the DSCR HELOC can significantly enhance your investment strategy, offering a flexible, powerful tool to leverage your property’s equity. Key features such as competitive interest rates and substantial credit limits position the DSCR HELOC as an attractive option for savvy investors. By understanding the eligibility criteria and interest rate dynamics, you can make informed decisions that align with your financial goals.

Maximizing this financial instrument for purchasing properties, funding renovations, or securing working capital underscores its versatility and potential for high returns. When compared to other loan options, the DSCR HELOC often provides unique advantages, making it a compelling choice for those looking to broaden their investment portfolio.

Embark on your journey by following the outlined application process, ensuring all documentation is in order for a smooth approval. Dive deeper into the benefits and apply today to unlock new avenues for growth and profitability. continued exploration and strategic application of DSCR HELOC can catalyze your investment success.

Frequently Asked Questions

What are the cons of a DSCR loan?

DSCR loans may have higher interest rates and require thorough documentation to prove the property’s income potential.

What is the maximum DTI for a HELOC?

HELOCs typically consider a maximum debt-to-income (DTI) ratio of 43-50%, depending on the lender.

How hard is it to get a DSCR loan?

Obtaining a DSCR loan can be challenging due to stringent qualification criteria, including a stable income-producing property.

Can I live in a home bought with a DSCR loan?

Generally, DSCR loans are intended for investment properties and not for owner-occupied residences.

What are the key features of a DSCR HELOC?

Key features include flexible credit lines, interest-only payment options, and the ability to use property income for qualification.

How do the interest rates differ in DSCR HELOC?

Interest rates for DSCR HELOCs can be fixed or floating, influenced by market conditions and borrower’s creditworthiness.