Delve into the sophisticated world of DSCR Investment Loans, an innovative financial solution tailored for savvy investors. These loans, driven by Debt Service Coverage Ratio (DSCR), offer distinctive advantages over traditional mortgages, including no personal income requirements and accelerated approval processes.

Ideal for self-employed investors and those exploring short-term rentals or the BRRRR method, DSCR loans open doors to substantial, unlimited loan potential. Discover key metrics, eligibility criteria, and strategic tips to secure the best rates, making informed, data-driven investment decisions.

Understanding DSCR Investment Loans

Definition and Concept of DSCR Loans

A DSCR loan, or Debt Service Coverage Ratio loan, is a type of mortgage specifically designed for residential income-producing properties. Unlike traditional mortgages, which require verification of personal income and tax returns, DSCR loans primarily evaluate the cash flow generated by the property itself. This makes them an attractive option for real estate investors who may not have the stable W2 income required by conventional lenders.

Generally, DSCR loans are underwritten based on the property’s income potential rather than the borrower’s personal finances. This is particularly beneficial for self-employed investors or those with complex income structures. The main criterion for qualifying is the DSCR, which measures how well the property’s income can cover its debt obligations.

Think of a DSCR loan as a way to cut through the red tape of traditional financing. If a property can generate more income than it needs to service its debt, it’s a strong candidate for a DSCR loan. This approach allows for quicker approval processes and more flexible underwriting criteria.

“DSCR Loans are mortgage loans secured by residential real estate turnkey properties strictly used for a business purpose and underwritten primarily based on the property.” – Mortgage Industry Expert

In essence, DSCR loans are geared towards investment purposes. Unlike some mortgage options, these loans do not allow for owner-occupied financing, meaning the owner cannot live in the property. Instead, the property must be used solely for generating income.

So, what makes a DSCR loan ideal for investors? It offers fast funding, diverse loan options, and less rigid underwriting processes. However, it’s crucial to understand that these loans also come with requirements such as cash reserves and down payments.

- Fast funding: Since lenders focus on the property’s income, the approval process is faster.

- Diverse loan options: DSCR loans can be used for purchase, refinance, or cash-out refinances with flexible terms.

- Flexible underwriting: Lenders can approve borrowers who might not meet the criteria for conventional mortgages.

Key Metrics for DSCR Loans

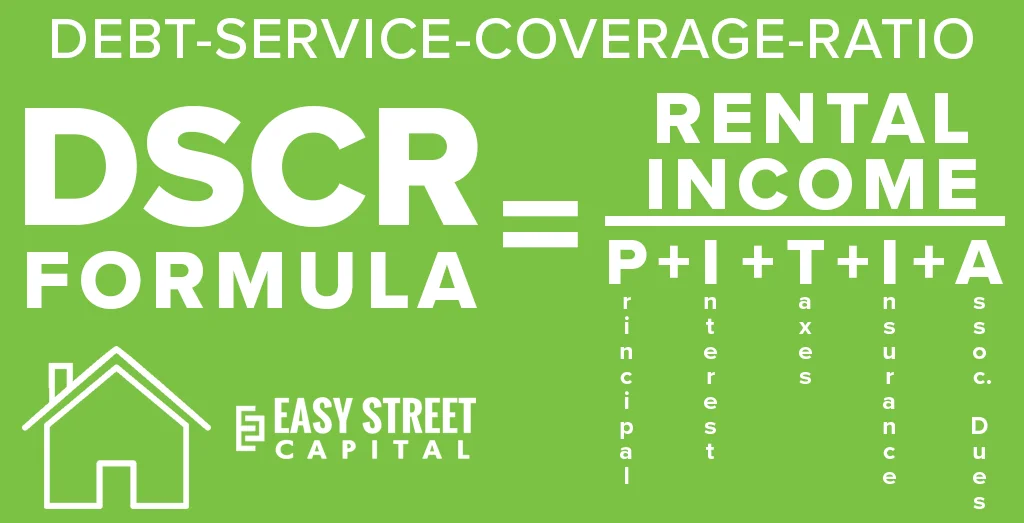

The cornerstone of a DSCR loan is the Debt Service Coverage Ratio itself. This metric is critical in assessing whether a property can generate sufficient income to cover its debt. A DSCR of 1.0 means that the property generates just enough income to cover its debt obligations.

However, most lenders require a DSCR of at least 1.25. This ensures a buffer zone for unexpected expenses or vacancies. It’s vital to understand how this ratio impacts your eligibility for a DSCR loan.

What metrics should investors focus on? Primarily, the rental income of the property and the total debt service, which includes principal and interest payments. But how does one calculate DSCR? Here’s the formula:

- Net Operating Income (NOI): This is the total income generated by the property after deducting operating expenses.

- Total Debt Service: This includes all principal and interest payments on the loan.

- DSCR Calculation: DSCR = NOI / Total Debt Service

For example, if a property generates a NOI of $150,000 and the total debt service is $120,000, the DSCR would be 1.25. This indicates a healthy income margin over the debt obligations.

Besides DSCR, other important metrics include:

- Cash Reserves: Lenders usually require three to six months of cash reserves.

- Down Payment: Typically, a down payment of 15% to 25% is required.

- Property Eligibility: Not all properties qualify; DSCR loans generally exclude agricultural lands, manufactured homes, and large multifamily units.

“Investors need to focus on the property’s income-generating capabilities rather than personal income to qualify for a DSCR loan.” – Financial Advisor

Understanding these key metrics can help investors better navigate the DSCR loan landscape and leverage this financing option to scale their portfolios effectively.

Differences from Traditional Mortgages

One of the most significant differences between DSCR loans and traditional mortgages is the basis for qualification. Traditional mortgages require extensive personal income documentation, including tax returns and proof of employment. In contrast, DSCR loans rely on the income potential of the property.

This difference makes DSCR loans particularly advantageous for investors who may have complex income scenarios. For example, self-employed individuals or those with multiple income streams may find it challenging to qualify for a traditional mortgage. A DSCR loan bypasses these hurdles by focusing on the property’s cash flow.

“DSCR loans offer a streamlined alternative to traditional mortgages, focusing on property income rather than personal financials.” – Real Estate Broker

Additionally, DSCR loans provide greater flexibility in underwriting. Conventional loans are bound by rigid guidelines set by entities like Fannie Mae and Freddie Mac. DSCR lenders have more freedom to approve borrowers based on the property’s performance rather than strict income and employment criteria.

Another notable difference is the speed of funding. Traditional mortgages often involve lengthy approval processes due to the extensive paperwork required. In contrast, DSCR loans can be approved more quickly, allowing investors to seize opportunities promptly.

However, it’s essential to note that DSCR loans come with their own set of requirements:

- Cash Reserves: Typically, lenders require substantial cash reserves to account for potential vacancies or unexpected expenses.

- Down Payment: A higher down payment of 15% to 25% is usually required.

- Non-Owner Occupancy: DSCR loans are strictly for investment purposes; the owner cannot occupy the property.

Given these aspects, DSCR loans are ideal for investors looking to scale their portfolios without the extensive documentation required by traditional mortgages. They offer a streamlined, property-focused approach, making them a valuable tool in any real estate investor’s arsenal.

To sum up, while traditional mortgages are well-suited for primary residences and straightforward income scenarios, DSCR loans cater specifically to real estate investors focusing on income-producing properties. This makes them a versatile and flexible financing option for various investment strategies.

Advantages of Choosing DSCR Loans

No Personal Income Requirement

One of the standout advantages of DSCR loans is the absence of a personal income requirement. This can be a game-changer for many real estate investors, especially those with complex tax returns or those who are newly self-employed. Traditional lenders often scrutinize personal income and debt-to-income (DTI) ratios, which can be cumbersome and restrictive.

DSCR lenders, on the other hand, focus on the income generated by the property itself rather than the investor’s personal income. This means that even if your tax returns show a loss or you have less than two years of self-employment income, you may still qualify. This flexibility can greatly simplify the financing process, making it easier to secure funding.

“Real estate investors often find that DSCR loans provide much-needed flexibility and ease compared to conventional financing methods.”

In the realm of short-term rentals, where income can fluctuate but potential earnings are significant, this feature becomes crucial. Imagine not having to prove your personal income for each property you wish to finance. It removes a significant hurdle and facilitates the growth of your real estate portfolio.

- Complex Tax Returns: No hindrance due to intricate financial statements.

- Newly Self-Employed: Freedom from the stringent requirement of proving extended employment history.

- Property Income Focus: The property’s income takes precedence over personal income.

Unlimited Loan Potential

Another substantial benefit of DSCR loans is their potential for unlimited borrowing. Traditional lending options often impose maximum limits on the number of properties or the amount that can be financed. For instance, conventional lenders, following Fannie Mae guidelines, may limit investment properties to ten.

Such limitations can stifle growth for ambitious investors looking to scale their portfolios. DSCR loans do not impose such caps, allowing you to potentially finance an unlimited number of properties. This is particularly advantageous for investors aiming to diversify their portfolios across various regions and property types.

Consider the analogy of a gardener who is free to plant as many seeds as desired, compared to one who can only plant a limited number. Which gardener is more likely to yield a more bountiful harvest? Similarly, DSCR loans offer the freedom to expand your investment horizon without the constraints of traditional loan limits.

- No Property Limit: Freedom to finance multiple properties without restriction.

- Diversified Portfolios: Ability to invest in various markets and property types.

- Increased Growth Potential: Unhindered expansion opportunities for ambitious investors.

Faster Approval Process

The speed of the approval process is another significant benefit of DSCR loans. Traditional lenders often require extensive documentation and a lengthy review period, which can delay the acquisition of investment properties. This can be particularly problematic in competitive markets where timing is critical.

DSCR lenders streamline the approval process by focusing on the income-generating potential of the property rather than the investor’s detailed financial history. This results in a faster, more efficient approval process. The ability to quickly secure financing can give investors a competitive edge, enabling them to act swiftly on lucrative opportunities.

Think of it as the difference between driving a high-speed sports car and a slow-moving vehicle. Which one would you prefer when trying to close a deal in a competitive market? The expedited approval process of DSCR loans can be that high-speed vehicle propelling your investment strategy forward.

Furthermore, in short-term rental markets, where income can be seasonal and property availability limited, the speed of financing can significantly impact profitability. By securing funds quickly, investors can capitalize on peak seasons and high-demand periods without unnecessary delays.

- Streamlined Documentation: Reduced paperwork and faster processing times.

- Competitive Edge: Ability to act quickly on investment opportunities.

- High-Speed Financing: Swift access to funds in time-sensitive markets.

Eligibility and Property Types for DSCR Loans

Eligible Property Types

DSCR loans, or Debt Service Coverage Ratio loans, offer a broad spectrum of property types that can be financed. We observe that lenders facilitate financing for various property types under this loan category. These properties include:

- Single Family Residences (SFR): These are standalone homes meant for one family.

- Condos: These include both warrantable and non-warrantable condos, giving investors flexibility.

- Townhomes: Row houses that share walls with other residences but have their own entrance.

- Multifamily Properties: Initially limited to 1-4 units, but more recently, properties up to ten units are now included.

- Mixed Use Properties: These properties combine residential and commercial units, often urban buildings with businesses on the lower floors and residences above.

Given these options, prospective investors can choose the type of property that best suits their investment strategy. This diverse range underscores the flexibility of DSCR loans, catering to different investment portfolios.

Moreover, the scope of eligible properties is expanding. As we move forward, properties like medium-term rentals, single room occupancy units, and manufactured housing are gaining traction among lenders.

“The landscape for DSCR Loans is continuing to evolve and grow, with innovative and forward-thinking lenders leading the way.”

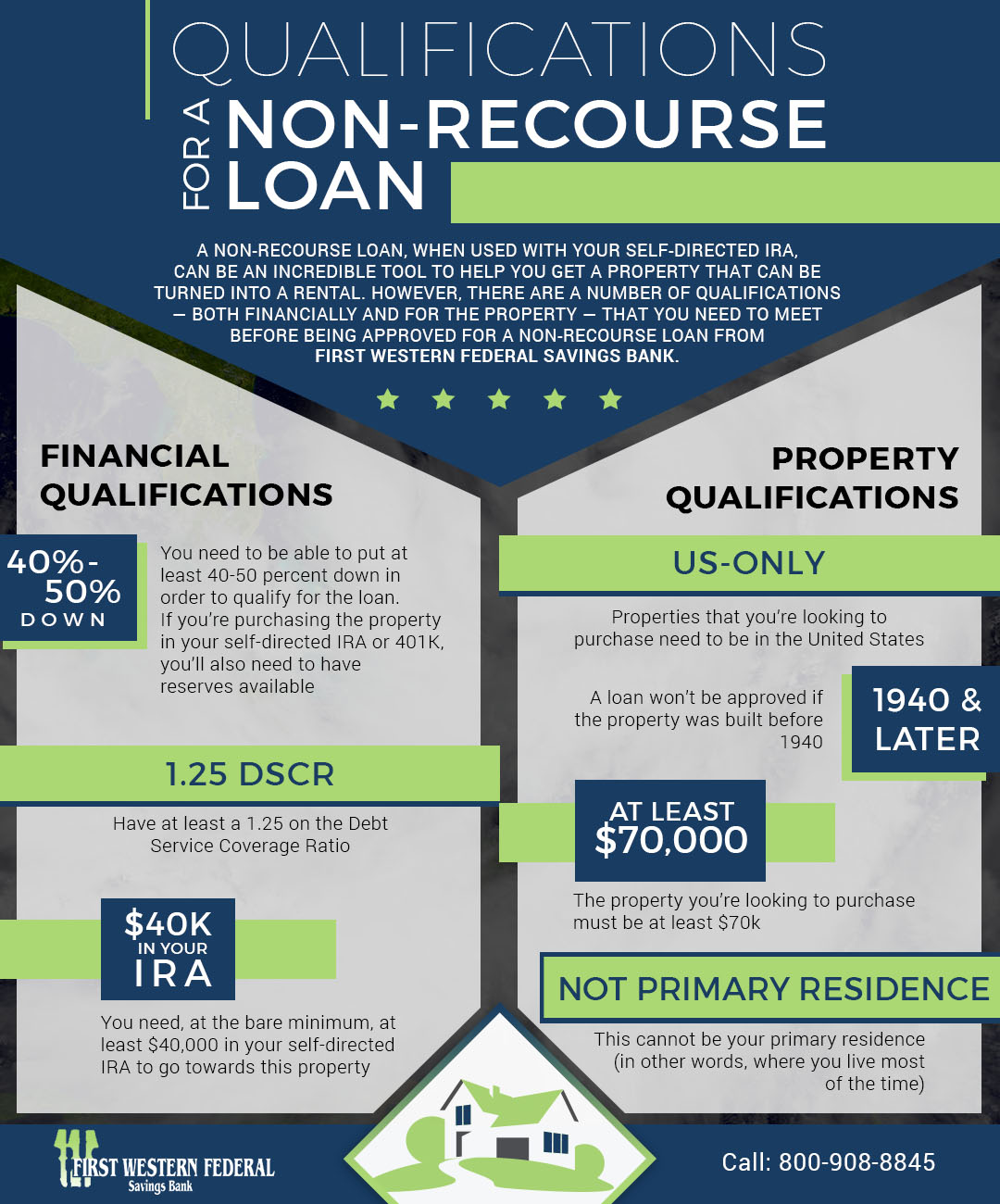

Investor Requirements

The eligibility criteria for investors under DSCR loans are distinctively tailored compared to other conventional mortgage types. These requirements are generally defined by the lenders themselves, providing some flexibility. Generally, the following are typical investor requirements:

- Credit Score: A minimum credit score of 680 is a common threshold.

- Loan Amount: Investors should seek a loan amount of $175,000 or higher.

- Experience: First-time investors often encounter stricter eligibility criteria, but many lenders still accommodate them with minor restrictions.

These criteria are less stringent compared to traditional mortgages, which makes DSCR loans appealing to a wide range of investors. Some lenders even extend DSCR loans to beginners without imposing any restrictions, particularly if the borrower’s overall financial profile is robust.

By streamlining the qualification process and eliminating the need for W2 forms, tax returns, or income verification, DSCR loans have become an attractive option for many real estate investors.

“DSCR Loans allow real estate investors to qualify with no W2, no tax returns, and no income verification required!”

Loan-to-Value Ratio

One of the crucial factors in determining the eligibility for DSCR loans is the Loan-to-Value (LTV) ratio. This ratio represents the loan amount relative to the value of the property. For DSCR loans, a typical LTV ratio is 80% or less.

Why is this important? The LTV ratio helps lenders assess the risk associated with the loan. A lower LTV ratio indicates that the borrower has more equity in the property, reducing the lender’s risk. This is especially significant for investment properties where the primary aim is to generate rental income rather than personal residence.

- 80% or Less: The standard acceptable LTV ratio for DSCR loans.

- Equity Requirement: Higher equity translates to lower risk for lenders, facilitating easier loan approval.

- Risk Mitigation: A lower LTV ratio demonstrates a higher financial commitment from the borrower.

This ratio is not only a measure of eligibility but also a tool that protects the interests of both the lender and the borrower. Prospective investors must carefully consider their down payment capabilities to meet this criterion effectively.

Thus, understanding and meeting the LTV requirements is essential for anyone aiming to secure a DSCR loan for their investment property.

“A lower LTV ratio indicates that the borrower has more equity in the property, reducing the lender’s risk.”

How to Qualify for a DSCR Loan

DSCR Ratio Calculation

Understanding and calculating the DSCR ratio is critical for real estate investors looking to secure DSCR loans. Lenders use this ratio to assess whether a property’s income can cover its debt obligations.

The formula for calculating the DSCR ratio is:

(Principal + Interest + Taxes + Insurance + HOA) / Rental Property Income = DSCR Ratio

For instance, let’s consider a property generating $50,000 in annual rental income with $40,000 in annual debt expenses. By dividing these amounts, the resulting DSCR is 1.25. This indicates the property generates 25% more income than required to repay the loan.

Why is this important? A DSCR ratio greater than 1 indicates positive cash flow, which lenders view favorably. If the DSCR is lower than 1, the property does not generate enough income to cover its debt, increasing the risk for lenders.

The appraiser’s rent schedules (1007) that form part of the property appraisal determine the estimated rental property income. This appraisal compares local rental rates for similar properties to establish the expected rental income for the subject property.

Would you trust an investment that barely covers its debt? Lenders typically prefer a DSCR above 1.2 for a cushion of safety. Understanding this ratio is crucial for navigating the qualification process successfully.

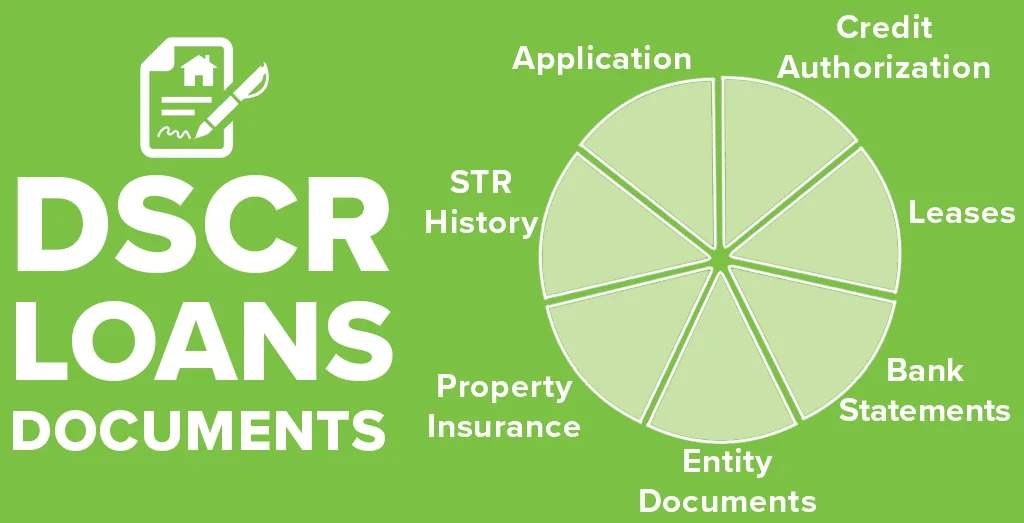

Required Documentation

Securing a DSCR loan requires careful preparation of documentation. Here is a list of essential items:

- Property Appraisal (1007): This document provides an estimate of the property’s rental income based on local market comparisons.

- Rent Rolls: Detailed records of current and past rental income, which offer insight into the property’s income stability.

- Operating Statements: Financial statements detailing income and expenses, demonstrating the property’s profitability.

- Lease Agreements: Current leases to verify rental income and tenant occupancy.

In addition to these, investors might need to supply personal financial statements and tax returns. The goal is to present a comprehensive picture of both the property’s and the investor’s financial health.

Without proper documentation, how can a lender evaluate the risk involved? Adequate and accurate paperwork simplifies the qualification process and increases the likelihood of loan approval.

Pre-Approval Process

The pre-approval process is an essential step in securing a DSCR loan. It involves the preliminary assessment of both the investor and the property’s financials.

- Initial Application: The investor submits an initial application along with basic financial information.

- Preliminary Assessment: The lender conducts a preliminary review to gauge the investor’s eligibility.

- Document Submission: The investor submits comprehensive financial documents as outlined earlier.

- Property Appraisal: The lender orders a property appraisal to determine its market value and rental income potential.

A lender’s decision hinges on this thorough review. They require confidence in both the investor’s credentials and the property’s ability to generate sufficient income.

Who wouldn’t want to know their chances of approval before going all-in? Pre-approval provides an investor with a clear understanding of their borrowing capacity, making the subsequent loan process smoother and more predictable.

Why DSCR Loans are Ideal for Self-Employed Investors

Challenges with Traditional Loans

Self-employed individuals often encounter significant obstacles when seeking traditional loans. Their income streams can be unpredictable and vary month to month, unlike the steady salaries of salaried employees. This inconsistency can make it challenging to demonstrate to lenders that they have a reliable income source.

Moreover, traditional loans typically require extensive documentation. Self-employed individuals might find it difficult to provide the necessary paperwork, such as tax returns or pay stubs, that demonstrate their income stability and creditworthiness.

Have you ever felt the overwhelming burden of gathering all the required documents? This process can be time-consuming and frustrating, particularly for those whose financial records are complex or not meticulously maintained. The complexity increases when the income from freelance or self-employment activities is spread across various sources.

Additionally, lenders often have stringent criteria that do not account for the unique financial situations of self-employed individuals. For instance, they might overlook the various deductions that self-employed individuals take on their taxes, which can lower their reported income and make loan approval more difficult.

This rigid approach can exclude many capable and responsible self-employed investors who could otherwise benefit from a loan.

Another significant challenge lies in the credit score requirements. Traditional lenders usually demand high credit scores, which can be a barrier for self-employed individuals who diversify their credit usage, impacting their scores.

- Income Verification: Traditional lenders require stable and predictable income verification, often hard to meet for freelancers.

- Documentation: Extensive documentation needs can deter the self-employed from applying.

- Credit Scores: High credit score demands can be unfavorable for those with varied credit usage.

These hurdles make the traditional financing route less accessible and flexible for self-employed individuals. However, alternative loan options like DSCR loans offer a different and potentially more achievable pathway.

Benefits of DSCR Loans

Debt Service Coverage Ratio (DSCR) loans provide a welcome alternative to traditional financing, specifically for self-employed real estate investors. Unlike conventional loans, DSCR loans focus primarily on the income generated by the property itself rather than the borrower’s income.

What makes DSCR loans stand out? The key advantage is the reliance on the property’s cash flow to determine loan eligibility. This approach allows self-employed investors to qualify based on the rental income the property will generate, not their personal income stability.

Additionally, DSCR loans typically require less extensive documentation. Self-employed borrowers can circumvent the hassle of providing comprehensive personal financial records. Instead, the emphasis is on the property’s financial performance and potential to cover the debt obligations.

By focusing on the property’s cash flow, DSCR loans facilitate a smoother and more streamlined application process for self-employed investors.

Have you ever considered the flexibility that comes with these loans? DSCR loans also tend to offer more flexible terms, which can be crucial for self-employed individuals whose income can fluctuate. The ability to tailor loan terms to better fit their financial situation can be a significant advantage.

Moreover, the approval process for DSCR loans can be quicker, which is beneficial for investors looking to seize real estate opportunities promptly. This speed can make a substantial difference in a competitive market where timing is critical.

- Property-Based Eligibility: Qualification based on property income rather than personal income.

- Reduced Documentation: Less personal financial documentation required, easing the application process.

- Flexible Terms: More adaptable loan terms catering to the unique financial situations of the self-employed.

These benefits make DSCR loans a compelling option for self-employed investors, presenting an alternative that aligns more closely with their financial realities and investment goals.

Case Examples

Consider an example of a freelance web developer, John, who wanted to invest in a rental property. With an irregular income, traditional lenders were reluctant to approve his loan application. However, with a DSCR loan, John was able to qualify based on the projected rental income of the property, bypassing the need to prove a steady personal income.

In another case, Lisa, a self-employed graphic designer, faced difficulties obtaining a traditional loan due to her varied income sources and extensive tax deductions. By leveraging a DSCR loan, she utilized the rental income of her investment property to meet the lender’s requirements, facilitating a smoother borrowing experience.

These real-life instances highlight how DSCR loans can provide practical solutions to self-employed investors struggling with traditional financing methods.

Have you ever wondered how many opportunities you might have missed due to the rigid requirements of traditional loans? These examples underscore the importance of exploring alternative financing options like DSCR loans, especially for self-employed individuals with diverse income streams.

Moreover, these investors could reinvest the income generated from their properties back into their businesses, fostering a cycle of growth and financial stability. DSCR loans can thus serve as a bridge, enabling the self-employed to capitalize on real estate investments without the constraints typically associated with traditional lending processes.

- Freelance Success: John qualified for a loan based on rental income, not personal income stability.

- Graphic Designer Milestone: Lisa bypassed traditional hurdles through rental income evaluation.

- Reinvestment and Growth: The DSCR loan facilitated continuous business reinvestment for self-employed individuals.

These cases illustrate the practical applications and significant advantages of DSCR loans for self-employed investors, promoting a more inclusive and accessible financial system for those pursuing real estate investments.

Innovative Strategies Supported by DSCR Loans

Short-Term Rentals

Short-term rentals, often synonymous with platforms like Airbnb, have surged in popularity. Their appeal lies in the high rental income potential, often surpassing that of traditional rental properties.

Investors can leverage DSCR loans to finance properties intended for short-term rental use. The flexibility and unique repayment terms associated with DSCR loans make them particularly suitable for covering the seasonal income fluctuations that characterize this market.

Consider a beach house rented out during the summer season. The income during these peak months might offset leaner times, ensuring the investment remains financially viable year-round.

“Short-term rentals can generate significantly higher returns compared to long-term leases, especially in tourist-heavy regions.”

Does the property’s location attract a steady stream of tourists? DSCR loans consider the projected cash flow from such rentals, rather than solely relying on the borrower’s personal income, making it easier for investors to qualify.

In addition, the flexibility of DSCR loans allows investors to expand their portfolios into diverse markets. They could invest in a ski lodge for winter rentals and a lakeside cabin for summer getaways, maximizing their income streams through strategic property acquisitions.

- High ROI: Short-term rentals often yield higher returns, making them attractive investments.

- Flexibility: DSCR loans support financing flexible income properties.

- Diversification: Investors can diversify across multiple high-demand locations.

How can investors minimize vacancy periods? Exploring niche markets, such as corporate housing or event-based rentals, could ensure a more consistent income flow.

BRRRR Method

The BRRRR method—Buy, Rehab, Rent, Refinance, Repeat—is a popular strategy among savvy real estate investors. It combines property flipping with rental income streams, offering a dynamic investment approach.

DSCR loans play a crucial role in funding each phase of this method. Initial financing from these loans can help purchase undervalued properties, with the expectation that post-rehabilitation, their market value will increase.

After refurbishment, properties are rented out, generating cash flow that can be used to refinance the initial loan. DSCR loans are particularly beneficial here, as the loan terms can be aligned with the property’s income, rather than the investor’s personal financial details.

“The BRRRR method allows investors to scale up quickly, leveraging one property’s success to finance the next.”

Subsequently, the inflated property value and steady rental income enable investors to refinance, pulling out their equity while securing better loan terms. This cycle can be repeated, allowing rapid portfolio expansion.

- Purchase: DSCR loans cover the initial purchase of undervalued properties.

- Rehabilitation: Funds from these loans support renovation and improvement projects.

- Rental Income: Post-rehab, rental income aids in meeting DSCR loan requirements for refinancing.

- Refinance: The improved property value facilitates refinancing, drawing out equity.

- Repeat: Investors can repeat the process with new acquisitions.

Investors benefit from this method’s scalability. How many times can they repeat the BRRRR cycle? With DSCR loans, the sky is the limit, constrained only by the investor’s ability to manage multiple properties effectively.

Partnering and Team Investments

Partnerships and team investments open avenues for real estate ventures otherwise unattainable on an individual level. Combining resources allows investors to tackle ambitious projects and share financial responsibilities.

DSCR loans are advantageous for such investments, as the loan approval process focuses on the income-producing capacity of the property rather than the individual financial standing of each partner.

Consider a group of investors pooling resources to develop a mixed-use commercial property. By leveraging DSCR loans, they could finance the project based on projected rental incomes from commercial leases and residential units.

“Collaborative investments allow for shared risk and enhanced capital access, making larger projects feasible.”

Co-investing enables diversification, as different partners may bring varied expertise and perspectives, optimizing the investment strategy and management.

- Shared Risk: Investments split among partners mitigate individual exposure.

- Increased Capital: Combined resources facilitate higher-value property acquisitions.

- Diverse Expertise: Partners contribute different skills, enhancing overall investment strategy.

How can partnerships navigate potential conflicts? Establishing clear agreements and communication channels from the outset can safeguard against misunderstandings and ensure smooth operations.

Ultimately, DSCR loans provide the financial foundation for innovative and cooperative real estate ventures, empowering investors to explore and capitalize on lucrative opportunities.

Steps to Secure the Best DSCR Loan Rates and Terms

Comparing Lenders

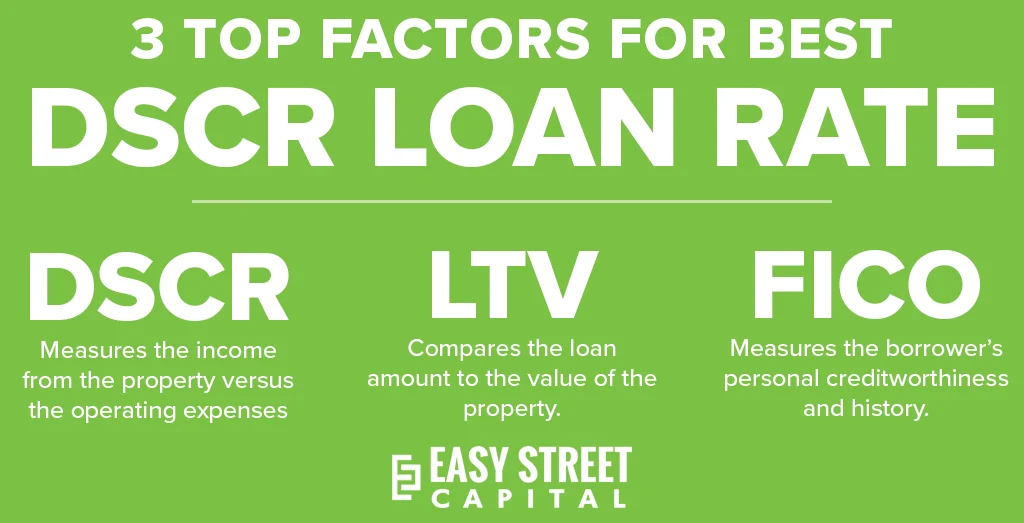

When it comes to securing the best DSCR loan rates and terms, one of the first steps we recommend is comparing different lenders. Each lender has unique criteria and conditions, which can significantly impact loan rates and terms. For instance, lenders may prioritize different metrics like DSCR, LTV, or credit scores. These metrics are essential in determining the interest rate offered.

To begin this process, gather quotes from multiple lenders. By doing so, you can compare not only the rates but also the terms and conditions of each loan. Do some lenders offer more flexibility with prepayment penalties or lower closing costs? All these factors contribute to the overall cost and benefit of the loan.

Another important aspect while comparing lenders is to consider the reputation and customer service of the lenders. A lender who is easy to communicate with can make the loan process much smoother and more efficient. Positive reviews and recommendations from other real estate investors can provide insight into a lender’s reliability.

“A lender who offers a slightly higher rate but excellent customer service may ultimately provide a better experience and facilitate smoother transactions.”

Moreover, consider the specialization of the lender. Some lenders are specifically geared toward DSCR loans and understand the unique needs of real estate investors. They might offer better terms due to their experience and niche focus.

- Interest Rates: Compare the interest rates offered by different lenders.

- Terms and Conditions: Assess the flexibility of loan terms, including prepayment penalties.

- Lender Reputation: Research the lender’s reputation through reviews and recommendations.

- Customer Service: Evaluate the quality of customer support provided by the lender.

Ultimately, thorough comparison and understanding of various lenders’ offerings can greatly affect the success of securing a favorable DSCR loan.

Improving DSCR Ratio

Improving the Debt-Service-Coverage-Ratio (DSCR) is crucial for obtaining the best loan rates. DSCR measures the income generated from the property against its operating expenses, indicating its profitability. Lenders prefer higher DSCRs because it shows a greater ability to cover debt payments.

One effective method to improve your DSCR is by increasing rental income. Can you make property upgrades that justify higher rent? For example, adding amenities or renovating units can attract higher-paying tenants.

Another important factor is reducing operating expenses. Are there ways to cut down on maintenance costs or property management fees without compromising quality? This could include negotiating better rates for services or implementing cost-saving measures.

“Increasing revenue through strategic property enhancements and reducing unnecessary costs can significantly boost your DSCR.”

Additionally, consider refinancing existing debts. Lowering your interest rates and extending repayment terms can reduce monthly expenses, thereby improving your DSCR. Optimizing your debt structure is essential for better loan conditions.

- Increase Rental Income: Enhance property value by upgrading amenities.

- Reduce Operating Costs: Implement cost-saving measures for property management.

- Refinance Debts: Opt for lower interest rates and extended repayment terms.

By focusing on these strategies, investors can present a more favorable DSCR to lenders, thereby securing better rates and terms for their loans.

Understanding Prepayment Penalties

Prepayment penalties are fees charged by lenders when a borrower pays off a loan before its term ends. Understanding these penalties is essential for real estate investors as they can affect the overall cost of a loan.

Why do lenders impose prepayment penalties? These penalties compensate lenders for the loss of interest income that would have been earned if the borrower made payments over the loan’s full term. As such, evaluating whether a loan includes prepayment penalties is crucial.

We recommend requesting a detailed breakdown of any prepayment penalties associated with the loan. Some loans might allow for partial prepayments without penalties, while others could impose hefty fees even for early pay-offs.

“Understanding the intricacies of prepayment penalties can help in making informed financial decisions.”

Additionally, consider the duration for which prepayment penalties apply. Some lenders impose penalties only within the first few years of the loan term. If you plan to hold the property long-term, these penalties might not be as significant. Conversely, if you anticipate selling or refinancing soon, a loan with fewer or no prepayment penalties could be more advantageous.

- Penalty Details: Obtain a clear explanation of the prepayment penalties.

- Penalty Duration: Determine the period during which penalties apply.

- Future Plans: Align loan choices with your property investment plans.

Thus, by thoroughly understanding and evaluating prepayment penalties, real estate investors can make better-informed decisions that could result in significant cost savings over the life of the loan.

Conclusion

Embracing DSCR investment loans presents a unique opportunity for savvy investors, especially those who are self-employed, to overcome traditional mortgage barriers. By understanding core concepts such as DSCR ratio calculation and key metrics, investors can effectively navigate the loan approval process and leverage the faster approvals and unlimited loan potential offered by DSCR loans.

The wide range of property types and the innovative investment strategies supported by DSCR loans, from short-term rentals to the BRRRR method, highlight their versatility and appeal. These benefits underscore why comparing lenders and improving your DSCR ratio are crucial steps in securing the best rates and terms. Ready to take your real estate investment to the next level? Explore DSCR loans and transform your investment strategy today.

Frequently Asked Questions

Is it hard to get a DSCR loan?

Securing a DSCR loan can be easier for investors with strong rental income, as there is no personal income requirement.

How much can you borrow on a DSCR loan?

The loan amount depends on the property’s income and expenses, with no set limit, offering potentially unlimited loan potential.

What are the cons of a DSCR loan?

Higher interest rates and strict property income documentation requirements are notable cons.

Does a DSCR loan require a down payment?

Yes, a down payment is typically required, often ranging from 20% to 30% of the property value.

What property types are eligible for DSCR loans?

Eligible properties include residential, multi-family, and some commercial properties with strong rental income.

Why are DSCR loans ideal for self-employed investors?

DSCR loans don’t rely on personal income, making them suitable for self-employed investors facing difficulties with traditional loans.