Dive into the world of DSCR loans and uncover essential insights tailored for real estate investors. Delve into what DSCR loans are, their unique benefits, and how they stack up against conventional loans.

Explore top lenders like New Silver Lending and Kiavi, and learn about key requirements such as minimum DSCR ratios and credit scores. Understand the nuances of DSCR loans compared to hard money loans, and discover strategies to optimize your DSCR for better loan approval.

Understanding DSCR Loans: Key Insights for Real Estate Investors

What is a DSCR Loan?

A Debt Service Coverage Ratio (DSCR) loan is tailored to real estate investors with complex financial situations. It is particularly beneficial for those who cannot secure traditional financing due to extensive property portfolios or self-employment.

In essence, a DSCR loan allows investors to obtain funding based on the cash flow generated by their rental properties. This means the loan approval process emphasizes the property’s income potential rather than the borrower’s personal financial information.

Eligibility for DSCR loans typically includes various types of properties such as single-family homes, condos, multi-family units, and commercial properties. The key factor is that the property must generate enough rental income to cover the loan repayments.

One of the primary advantages of DSCR loans is that they do not require income and employment verification. This makes them an appealing option for self-employed individuals or those with multiple investment properties.

Investors can leverage DSCR loans to finance properties that promise strong cash flow, thus expanding their real estate portfolios without the need to disclose personal income.

DSCR loans focus on the property’s ability to produce enough income to cover its own debt obligations. This allows real estate investors to concentrate on acquiring profitable rental properties.

Benefits of DSCR Loans

Real estate investors often seek DSCR loans due to the numerous benefits they offer. These loans simplify the borrowing process and provide flexibility that traditional loans do not.

One significant advantage is the expedited loan application and closing processes. Since personal income verification is not required, investors can benefit from a quicker approval timeline.

- Unlimited Properties: DSCR loans allow investors to purchase an unlimited number of properties, providing more opportunities for portfolio growth.

- Simultaneous Purchases: Investors can buy multiple properties simultaneously, streamlining their investment strategies.

- Less Documentation: The reduced documentation requirements make the loan process simpler and faster.

For new investors, DSCR loans offer an accessible entry point into the real estate market. The simplified approval process makes it easier to secure the necessary financing.

Additionally, DSCR loans often come with customizable terms, including interest-only options and rate buy-downs. This flexibility allows investors to tailor their loan terms to their specific investment strategies.

Borrowers can adapt the terms of their DSCR loans to fit their long-term or short-term investment goals, making these loans highly versatile.

Overall, DSCR loans provide a streamlined and flexible financing solution for real estate investors looking to optimize their investments and expand their portfolios.

Differences Between DSCR and Conventional Loans

The primary difference between DSCR loans and conventional loans lies in the approval criteria. DSCR loans focus on the property’s income potential, whereas conventional loans emphasize the borrower’s personal financial situation.

Conventional loans require extensive documentation, including pay stubs, bank statements, and tax returns. They also heavily weigh the borrower’s debt-to-income ratio (DTI), which can be a significant hurdle for investors with multiple properties.

In contrast, DSCR loans simplify the approval process by eliminating the need for personal income verification. Instead, the lender assesses the property’s ability to generate sufficient income to cover the loan payments.

- Documentation Requirements: Conventional loans require detailed personal financial records, while DSCR loans focus on the property’s cash flow.

- Loan Approval: DSCR loans are approved based on the debt service coverage ratio, making them ideal for investors with complex financial situations.

- Flexibility: DSCR loans offer more flexible terms, such as interest-only options, which are often not available with conventional loans.

This difference in focus makes DSCR loans more accessible to self-employed investors or those with extensive property portfolios.

Furthermore, traditional lenders typically limit the number of loans an investor can have, whereas DSCR loans do not impose such restrictions, enabling expansive portfolio growth.

DSCR loans remove the barriers that conventional loans impose, offering real estate investors greater freedom and flexibility in their investment strategies.

The streamlined approval process and tailored loan terms make DSCR loans an attractive option for savvy real estate investors looking to maximize their potential returns.

Top DSCR Lenders You Should Consider

New Silver Lending

New Silver Lending offers a variety of features that cater specifically to real estate investors. Their loan programs are designed to provide quick and efficient funding, enabling investors to seize opportunities promptly.

One of the standout features of New Silver Lending is their fast financing. Real estate investors often need to act quickly to secure profitable deals. With New Silver Lending, you can expect a streamlined process that gets you the funds you need in a timely manner.

Furthermore, they offer interest-only loans, which can be extremely beneficial for investors looking to minimize their monthly payments initially. This feature can aid in maximizing cash flow during the early stages of property investment.

“New Silver Lending is known for its ability to provide quick financing solutions, allowing investors to move fast and secure profitable deals.”

Their loan programs are versatile, supporting both long-term and short-term rental property investments. This flexibility can be crucial for investors with diverse portfolios.

- Quick Financing: Streamlined processes for timely funding.

- Interest-Only Loans: Lower initial payments to maximize cash flow.

- Versatile Programs: Suitable for both long-term and short-term rentals.

Kiavi

Kiavi stands out in the DSCR lending market by offering a range of loan products designed to meet the needs of seasoned real estate investors. Their emphasis on technology-driven solutions provides a unique advantage.

With a focus on innovation, Kiavi leverages advanced technology to deliver a seamless borrowing experience. This approach not only speeds up the loan application process but also ensures transparency and efficiency.

Kiavi offers competitive interest rates, which can significantly lower the cost of borrowing. For investors, this means higher returns on their investment properties.

“Leveraging technology, Kiavi provides a streamlined and efficient borrowing experience, making it an attractive option for real estate investors.”

In addition to competitive rates, Kiavi provides personalized customer service. Their team of experts is readily available to assist investors, ensuring that all questions and concerns are addressed promptly.

- Technology-Driven Solutions: Efficient and transparent loan processes.

- Competitive Interest Rates: Lower borrowing costs for higher returns.

- Personalized Customer Service: Expert assistance tailored to investors’ needs.

Griffin Funding

Griffin Funding is another top DSCR lender, known for offering tailored loan products that meet the specific needs of real estate investors. Their commitment to providing flexible loan terms sets them apart.

Griffin Funding’s loan programs are designed to accommodate various investment strategies. Whether you are investing in residential or commercial properties, their flexible terms cater to diverse real estate portfolios.

One of Griffin Funding’s key features is customizable repayment options. Investors can choose repayment plans that align with their cash flow and financial goals.

“Griffin Funding’s tailored loan products and flexible terms make it an excellent choice for both residential and commercial real estate investors.”

Their loan programs also offer low down payment requirements, which can be particularly advantageous for investors looking to minimize upfront costs while expanding their portfolios.

- Flexible Loan Terms: Accommodates various investment strategies.

- Customizable Repayment Options: Aligns with investors’ financial goals.

- Low Down Payment: Minimizes upfront costs for portfolio expansion.

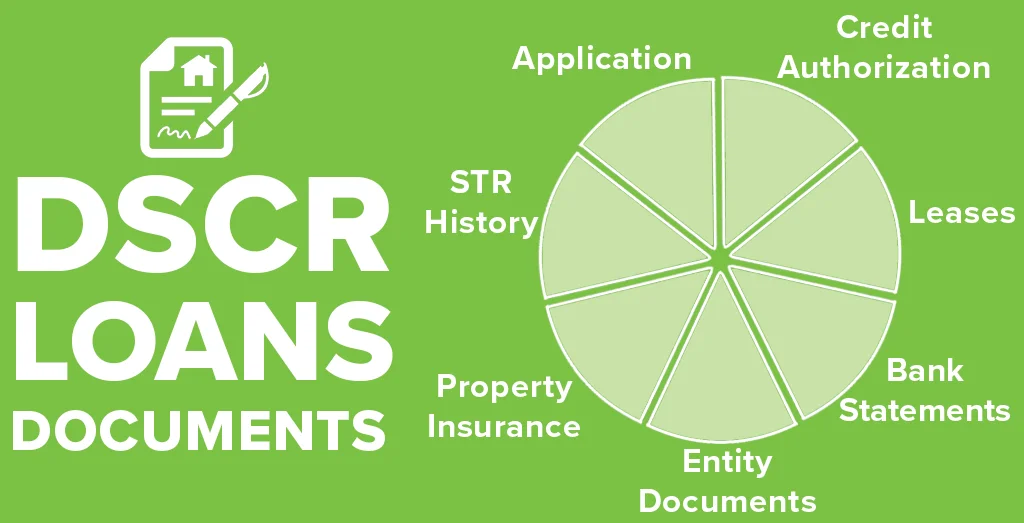

Key Requirements for DSCR Loans

Minimum DSCR Ratios

The Debt Service Coverage Ratio (DSCR) is a crucial factor in assessing a borrower’s ability to repay a loan. Interestingly, for the 30-year fixed DSCR loan mentioned in the transcript, there is no minimum DSCR requirement. This flexibility can be particularly advantageous for prospective applicants with varying cash flow situations.

Why is DSCR important? It generally measures the cash flow available to pay current debt obligations. A DSCR of 1.0 means the property generates enough income to cover its debt payments. Typically, lenders might set a minimum DSCR to ensure borrowers can manage loan repayments comfortably.

“Minimum DSCR requirements can often dictate the feasibility of a loan for many applicants. Not having this restriction opens up more opportunities for a broader range of borrowers.”

In essence, the absence of a minimum DSCR requirement significantly enhances accessibility for many applicants. However, it’s still prudent for borrowers to have a clear understanding of their financial situation to ensure they can manage loan repayments.

Eligible Properties

Understanding what types of properties qualify for a DSCR loan is essential. According to the transcript, the type of property eligible for this DSCR loan includes residential properties with 1-4 units. This encompasses single-family homes, duplexes, triplexes, and fourplexes.

How does the property type impact loan eligibility? Lenders often prefer properties that are likely to generate stable rental income, as this ensures a steady cash flow to cover the loan payments.

- Single-Family Homes: Typically straightforward to manage and maintain, making them a popular choice for individual investors.

- Duplexes: Provide the benefit of having two rentable units in a single property.

- Triplexes and Fourplexes: Offer even more rental units, which can enhance income potential but may come with increased management responsibilities.

Knowing the range of eligible properties helps prospective applicants evaluate their options and choose the best fit for their investment goals.

Credit Score Requirements

Credit scores are a critical component of the loan application process, reflecting a borrower’s creditworthiness. As per the transcript, the minimum FICO score required is 660. This score serves as a benchmark for lenders to assess the risk associated with lending to a borrower.

What does a FICO score of 660 indicate? Typically, a FICO score between 660 and 719 is considered fair to good, suggesting that the borrower has a responsible credit history and is likely to manage their financial obligations reliably.

- Credit History: A higher FICO score often indicates a more extensive and positive credit history, showcasing the borrower’s ability to manage credit responsibly.

- Risk Assessment: Lenders use credit scores to assess the potential risk of default. A minimum score of 660 suggests a relatively lower risk, making the application more favorable.

- Approval Likelihood: Meeting the minimum credit score requirement significantly increases the likelihood of loan approval, provided other qualifications are met.

For prospective DSCR loan applicants, maintaining or improving their credit score can enhance their eligibility and potentially secure better loan terms.

Comparing DSCR Loans to Hard Money Loans

Definition of Hard Money Loans

Hard money loans are a type of financing typically secured by real estate. These loans are primarily used for short-term funding needs.

A key characteristic is that they are backed by the property’s value rather than the borrower’s creditworthiness.

Unlike traditional loans, hard money loans are usually sourced from private lenders or companies rather than banks.

Quick approvals are a hallmark of hard money loans, often closing within a few days.

This speed makes them a popular choice for real estate investors needing fast capital.

“Hard money loans offer a practical solution for property flippers and developers,” says John Doe, a seasoned real estate investor.

The repayment period for these loans is relatively short, typically ranging from six months to a few years.

Interest rates on hard money loans are higher than traditional mortgages, reflecting the increased risk to lenders.

- Collateral-Based: The loan amount is determined by the property’s value.

- Rapid Funding: Ideal for quick deals and unexpected expenses.

- Higher Interest Rates: To offset the risk, lenders charge more than conventional loans.

Differences in Terms

When comparing DSCR loans to hard money loans, the terms of each loan type provide significant distinctions.

Debt Service Coverage Ratio (DSCR) loans focus on the income generated by the property to cover the loan payments.

This means investors must demonstrate that the property generates enough income to cover the debt service.

Conversely, hard money loans are asset-based, relying on the property’s value rather than its income.

Term length is another key difference. DSCR loans typically offer longer terms, ranging from 15 to 30 years.

“The long-term nature of DSCR loans can provide stability for rental property investors,” remarks Jane Smith, a financial advisor.

Interest rates on DSCR loans are generally lower, reflecting the stability of income-based repayments.

Hard money loans, with their shorter terms and higher interest rates, cater to investors focusing on quick property flips.

- Income vs. Collateral: DSCR relies on property income, while hard money relies on property value.

- Term Length: DSCR loans offer long-term stability, hard money provides short-term solutions.

- Interest Rates: DSCR loans have lower rates due to lower perceived risk.

Suitability for Different Investors

Determining which loan type best suits an investor requires an understanding of their investment strategy and goals.

Real estate investors focused on long-term rental properties might prefer DSCR loans for their stability and lower interest rates.

These loans are ideal for investors planning to hold onto properties and generate steady rental income.

On the other hand, hard money loans are tailored for short-term investments.

Investors aiming to flip properties quickly often benefit from the fast approval and funding process of hard money loans.

“For quick turnaround projects, hard money loans are invaluable for seizing opportunities,” notes Michael Brown, a real estate developer.

The flexibility of hard money loans can also be appealing to those with less-than-perfect credit.

Investors need to weigh factors such as term length, interest rates, and the nature of their investment when choosing between these loan options.

- Long-Term Investors: DSCR loans provide stability and lower costs.

- Short-Term Flippers: Hard money loans offer speed and flexibility.

- Credit Considerations: Hard money loans can be accessible to those with lower credit scores.

Types of Properties Eligible for DSCR Loans

Single-Family Homes

When considering single-family homes for financing through DSCR loans, it’s essential to understand their unique benefits. Single-family homes are standalone properties, typically inhabited by one family. These properties often provide investors with steady rental income and relatively low vacancy rates.

A significant advantage of single-family homes is their market appeal. They attract various tenants, including families, young professionals, and retirees. This broad tenant base can lead to more consistent occupancy.

Another benefit is the ease of management. Managing a single-family home is often simpler compared to multi-family properties or commercial buildings. Maintenance and tenant issues are usually more straightforward to handle.

DSCR loans are particularly advantageous for single-family home investors due to their flexibility and the typically lower DSCR requirements.

Investors can also benefit from appreciation potential. Single-family homes tend to appreciate steadily over time, providing both rental income and long-term capital gains.

- Steady Rental Income: Single-family homes offer reliable rental income, appealing to families and professionals.

- Ease of Management: Managing a single property is straightforward and less time-consuming.

- Market Appeal: These homes attract a wide range of tenants, ensuring consistent occupancy.

It is crucial to note that, single-family homes are a viable option for real estate investors looking to leverage DSCR loans for their investment portfolios. Their market appeal, ease of management, and steady appreciation make them a sound investment choice.

Multi-Family Properties

Multi-family properties, ranging from duplexes to large apartment complexes, are another excellent option for DSCR loan financing. These properties house multiple families under one roof, providing diversified rental income.

One of the primary advantages of multi-family properties is the income stability they offer. With multiple units, the risk of total vacancy is significantly reduced. Even if one unit is vacant, the others can still generate income.

Another benefit is economies of scale. Operating and maintaining several units within one building can be more cost-effective compared to managing multiple single-family homes scattered across different locations.

Multi-family properties often meet DSCR loan requirements more easily due to their higher potential for rental income and lower per-unit operational costs.

Furthermore, these properties often come with better financing terms. Lenders may offer more favorable terms for multi-family properties because they perceive reduced risk compared to single-family homes.

- Income Stability: Multiple units reduce the risk of total vacancy and ensure continuous income.

- Economies of Scale: Managing multiple units within one building is more cost-effective.

- Better Financing Terms: Lenders offer favorable terms due to perceived lower risk.

Multi-family properties can be an excellent choice for investors seeking to minimize risk while maximizing rental income through DSCR loans.

Commercial Properties

Commercial properties, including office buildings, retail spaces, and industrial warehouses, are also eligible for DSCR loan financing. These properties differ significantly from residential ones and come with unique advantages.

One major benefit of commercial properties is the higher rental income potential. These properties often command higher rents compared to residential properties due to their size and the businesses they attract.

Commercial properties also offer longer lease terms. Tenants in commercial spaces typically sign longer leases, providing investors with more predictable and stable rental income.

Lenders favor commercial properties for DSCR loans due to their typically higher rental income and longer lease agreements.

Another advantage is the diversification of investment. By including commercial properties in their portfolios, investors can spread their risk across different types of properties and tenant categories.

- Higher Rental Income: Commercial properties often generate more rent due to their size and tenant type.

- Longer Lease Terms: Businesses typically sign longer leases, offering stable and predictable income.

- Diversification: Investing in commercial properties helps spread risk across various property types.

Commercial properties present a robust investment opportunity for those looking to finance through DSCR loans, offering higher income potential and stability through longer lease terms.

Optimizing Your Debt Service Coverage Ratio (DSCR)

Calculating DSCR

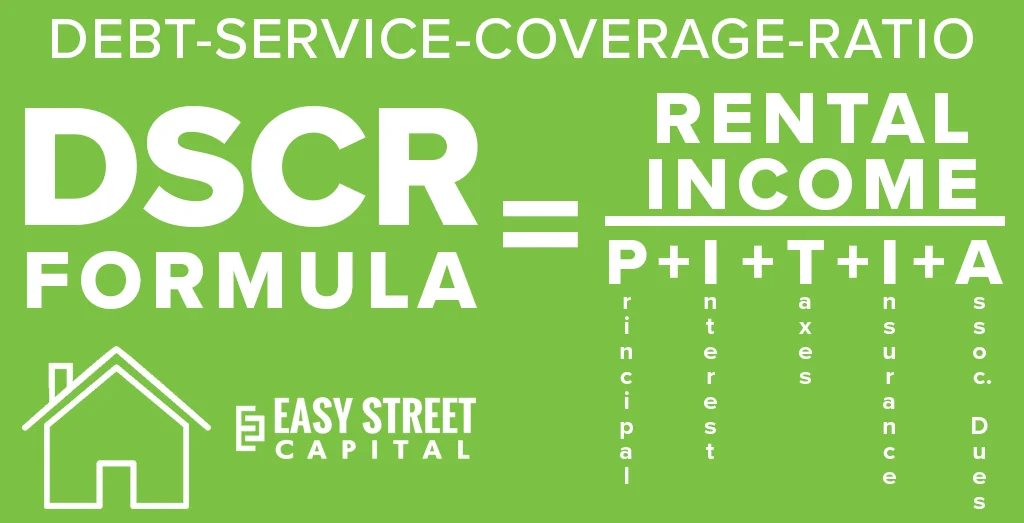

When calculating the Debt Service Coverage Ratio (DSCR), we must consider both the income generated by the property and the expenses incurred. The formula to calculate DSCR is relatively straightforward:

DSCR = Rent / Principal, Interest, Taxes, Insurance, Association Dues (PITIA)

A DSCR ratio of 1 indicates that the monthly rental income is equal to the total monthly expenses. For example, if your rental income is $1,820 per month and your expenses also total $1,820, your DSCR is 1, meaning you are breaking even.

“A good DSCR ratio is 1.2 or higher, indicating to lenders that you have a sufficient margin to cover debt obligations.”

This ratio is critical in showcasing to lenders your ability to repay the loan. A higher DSCR is more favorable as it signifies better financial health and lower risk for the lender.

To optimize your DSCR, understanding how to accurately calculate it is the first step. Assess your rental income and ensure that you account for all expenses, including any additional fees or dues.

By keeping a precise and updated calculation, you can make informed decisions on how to further enhance your DSCR, thus improving your chances of securing a loan.

Strategies to Improve DSCR

Improving your DSCR is essential for increasing your loan approval chances. Several strategies can help in achieving this goal:

Increase Your Down Payment: One of the simplest and most effective ways to improve your DSCR is by raising your down payment. This lowers your loan amount, subsequently reducing your monthly principal and interest payments.

Buy Down Your Interest Rates: Some lenders offer the option to buy down your interest rate. Although this increases your closing costs, it significantly reduces your monthly payments, thereby improving your DSCR.

- Raise Rents: Enhancing the cash flow of your property by increasing rents can directly boost your DSCR. A higher rental income elevates your DSCR, making your financial profile more attractive to lenders.

- Offer Upsells: Providing additional amenities or services, such as renting to pet owners or offering furnished rentals, can increase rental rates and consequently improve your DSCR.

Implementing these strategies can considerably elevate your DSCR, thus enhancing your loan approval prospects. It’s about finding a balance between increasing income and managing expenses effectively.

Importance of DSCR for Loan Approval

The importance of a high DSCR cannot be overstated when it comes to loan approval. A robust DSCR serves as a testament to your ability to manage and repay debt, making you a less risky borrower in the eyes of lenders.

Lenders predominantly look for a DSCR of 1.2 or higher as it indicates a comfortable margin between income and expenses. This buffer reassures lenders that you are capable of covering all debt obligations even during unforeseen financial difficulties.

Having a high DSCR showcases prudent financial planning and management, both of which are crucial for securing favorable loan terms and conditions.

Lenders use the DSCR as an indicator of the overall health and stability of your investment. Therefore, maintaining a strong DSCR is not only beneficial for loan approval but also for the long-term sustainability of your investment.

“A high DSCR indicates strong financial health and lowers the risk for lenders, thereby increasing the likelihood of loan approval.”

Ensuring that your DSCR is consistently above the required threshold will thereby put you in a favorable position with potential lenders, enhancing your chances of loan approval and setting you up for financial success.

Choosing the Right DSCR Lender for Your Needs

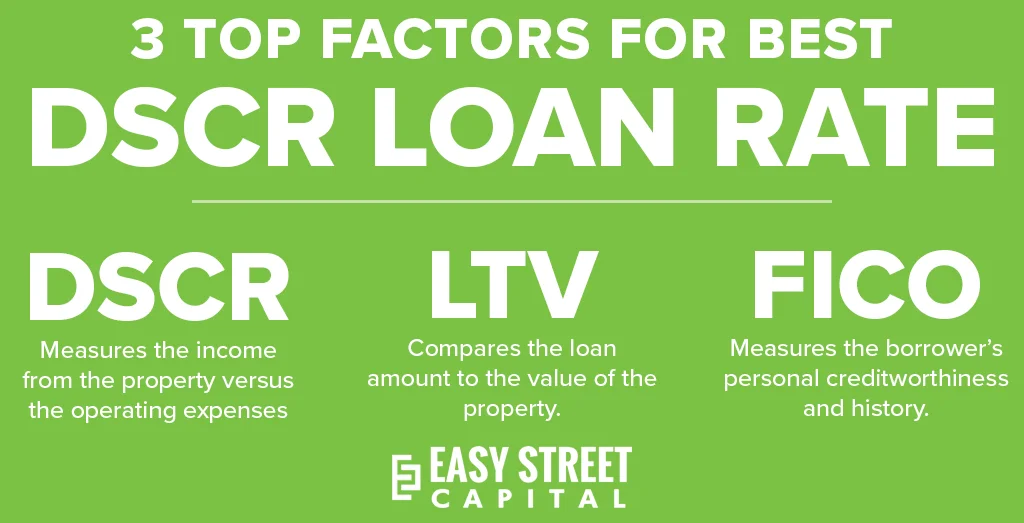

Factors to Consider

When evaluating DSCR lenders, several critical factors must be taken into account. First, the lender’s interest rates can significantly impact your investment’s profitability over time. Lower rates generally translate to higher returns.

Another important aspect is the loan-to-value (LTV) ratio. This ratio determines the maximum loan amount you can receive relative to the property’s value. Lenders offering higher LTV ratios can provide you with greater leverage.

Additionally, consider the lender’s underwriting criteria. These criteria can vary significantly between lenders and affect your ability to secure a loan. Factors such as your credit score, property type, and income may be weighed differently.

Fees and closing costs are other crucial elements. Lenders may charge various fees, including origination fees, appraisal fees, and more. It is essential to compare these costs to avoid any surprises at closing.

Think about the lender’s flexibility in terms of loan terms and structures. Some lenders may offer more flexible repayment options, which can be vital if you anticipate variations in your cash flow.

“The flexibility of a lender’s terms can make or break your investment strategy,” notes John Smith, a seasoned real estate investor.

Lastly, consider the lender’s customer service and support. A lender that is easy to communicate with and provides robust support can simplify the loan process and offer peace of mind.

- Interest rates: Evaluate how competitive the lender’s interest rates are.

- Loan-to-Value (LTV) ratio: Determine the maximum loan amount in relation to the property’s value.

- Underwriting criteria: Understand the lender’s requirements for securing a loan.

- Fees and closing costs: Compare the various fees charged by different lenders.

- Flexibility: Look for lenders offering adaptable loan terms and structures.

- Customer service: Assess the quality of support and ease of communication.

Comparing Loan Terms

It’s essential to compare the loan terms offered by different DSCR lenders. Start by examining the loan duration. Shorter loan terms typically result in higher monthly payments but lower interest costs over the loan’s life.

On the other hand, longer loan terms may offer lower monthly payments but can accumulate more interest. Consider what aligns best with your cash flow expectations and investment horizon.

Next, analyze the interest rate type—fixed or variable. Fixed rates provide stability as your rate remains the same throughout the term, while variable rates can fluctuate based on market conditions.

Prepayment penalties are another critical factor. Some lenders may charge a fee for repaying the loan early. If you anticipate the possibility of an early payoff, choosing a lender without such penalties could be beneficial.

Review the lender’s amortization schedule. This schedule dictates how your loan payments are applied to interest and principal. Understanding this can help you anticipate your loan balance over time.

Consider the lender’s recourse vs. non-recourse policies. Recourse loans allow the lender to claim additional assets if you default, whereas non-recourse loans limit the lender’s claim to the collateral property only.

Lastly, check if the lender offers interest-only payment options. This can be advantageous during the initial phase of the investment, allowing you to manage cash flow more efficiently.

- Loan duration: Consider the length of time over which the loan is to be repaid.

- Interest rate type: Decide between fixed or variable rates based on your risk tolerance.

- Prepayment penalties: Verify if the lender imposes any fees for early repayment.

- Amortization schedule: Understand how your payments are distributed over time.

- Recourse vs. non-recourse: Assess the level of risk you’re willing to accept in case of default.

- Interest-only options: Explore if interest-only payments are available and beneficial for your situation.

Evaluating Lender Reputation

The reputation of a DSCR lender is paramount. Start by researching the lender’s history in the industry. A lender with a long-standing presence is likely to be more reliable.

Investigate customer reviews. Positive feedback from other investors can indicate a lender’s credibility and reliability. Pay close attention to any recurring issues highlighted in negative reviews.

Consult with industry professionals. Real estate brokers, financial advisors, and fellow investors can offer valuable insights into a lender’s reputation and performance.

“A lender’s reputation often reflects their commitment to supporting investors through the lending process,” says Jane Doe, a financial advisor.

A lender’s portfolio can also provide clues. Examine the types of projects they have funded. A diverse portfolio with successful projects can be a good indicator of a lender’s capabilities.

Membership in industry associations is another positive sign. Lenders who are members of professional organizations often adhere to higher standards and best practices.

Check for any regulatory actions or disputes involving the lender. This information can be found through financial regulatory bodies and can alert you to potential issues.

Finally, consider the lender’s financial stability. A lender with strong financial health is more likely to offer consistent support throughout your loan term.

- Industry presence: Look for lenders with extensive experience and a solid track record.

- Customer reviews: Analyze feedback from other investors to gauge the lender’s reliability.

- Professional insights: Seek recommendations from industry experts.

- Project portfolio: Review the lender’s history of funded projects.

- Industry associations: Identify lenders who are part of professional organizations.

- Regulatory actions: Investigate any disputes or actions taken against the lender.

- Financial stability: Ensure the lender’s financial health is robust.

Conclusion

The intricacies of DSCR loans make them an indispensable tool for savvy real estate investors seeking to maximize their portfolio’s potential. By understanding the core concepts and benefits, such as the pivotal role of DSCR ratios and the advantages over conventional loans, investors can make informed decisions that align with their financial goals. Exploring top lenders like New Silver Lending, Kiavi, and Griffin Funding reveals varied options tailored to unique investment needs.

Grasping the key requirements and eligibility criteria, from minimum DSCR ratios to credit scores, provides a competitive edge in the application process. Comparing DSCR loans with hard money loans clarifies their suitability for different investment strategies. With actionable insights on optimizing your DSCR and selecting the right lender, you’re well-equipped to navigate the real estate landscape strategically. Take the next step by diving deeper into DSCR loans and unlocking new opportunities for growth and success in your investments.

Frequently Asked Questions

How hard is it to get a DSCR loan?

Obtaining a DSCR loan generally requires a solid DSCR ratio and a good credit score, but it can be easier than conventional loans for investors with strong rental income.

What credit score do you need for a DSCR?

A minimum credit score of around 620-680 is typically required for a DSCR loan, though this can vary by lender.

What is the current DSCR loan rate?

DSCR loan rates fluctuate based on market conditions, typically ranging from 4% to 8%. Check with individual lenders for current rates.

How do I find my DSCR loan?

You can find DSCR loans by researching lenders that specialize in real estate investment loans or by consulting mortgage brokers.

What are the benefits of DSCR loans?

DSCR loans offer easier qualifications based on rental income and can be ideal for real estate investors.

What properties are eligible for DSCR loans?

Eligible properties include single-family homes, multi-family properties, and commercial properties.