Understanding DSCR loans is crucial for investors eyeing stable returns on investment properties. These loans, centered on the Debt Service Coverage Ratio (DSCR), offer unique benefits including no income verification and low down payment options, making them an attractive choice for savvy investors.

In this article, we’ll delve into the essential aspects of DSCR loans—how they’re calculated, their importance in loan approvals, and strategies to maximize loan amounts. We’ll also compare DSCR loans with other financing options and tackle common challenges through real-life success stories.

Understanding DSCR Loans: Key Financial Metric for Investors

What is DSCR?

The Debt Service Coverage Ratio (DSCR) stands as a pivotal financial metric used to assess a borrower’s capacity to repay loans. It is specifically crucial in the realm of real estate investments, where understanding and managing debts is paramount.

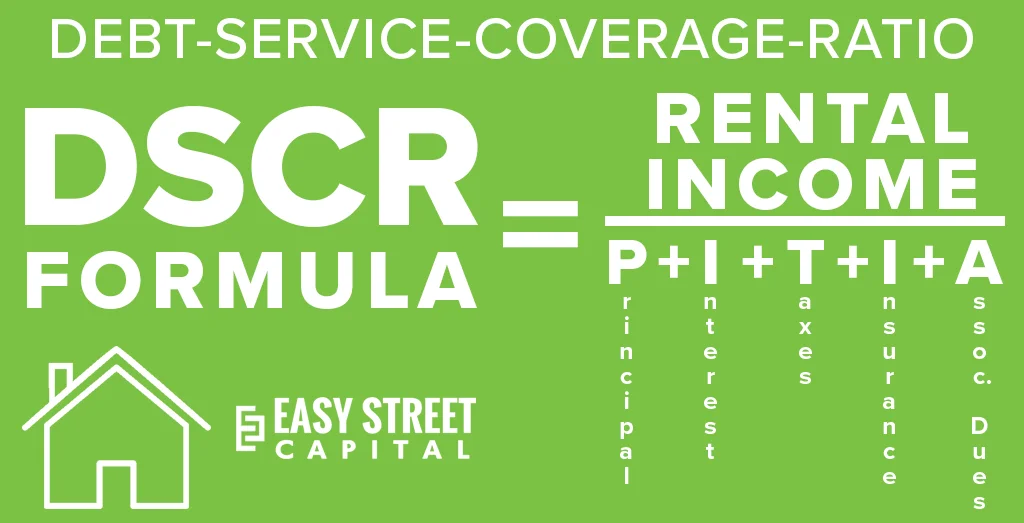

DSCR is calculated by dividing a property’s net operating income (NOI) by its total debt service payments. The result indicates whether a property generates sufficient income to cover its debt obligations. A DSCR of 1.0, for instance, signifies that the property’s income precisely matches its debt payments, while a DSCR above 1.0 suggests a surplus.

“A high DSCR is desirable for lenders as it indicates that a borrower is likely to have the ability to cover their loan payments, while a low DSCR suggests that a borrower may not have the resources to meet their financial obligations.”

In the context of DSCR loans, typical properties include rental units and commercial real estate. Investors use these loans due to their flexibility and advantageous terms, such as lower interest rates and extended loan periods, which help maximize cash flow from the property.

Mortgage loans specifically catering to DSCR are designed to leverage the income generated from investment properties, providing financial relief and beneficial terms to investors. These loans often require minimal documentation compared to traditional loans, making them an attractive option for many.

How DSCR is Calculated

Calculating DSCR involves a straightforward yet crucial formula: Net Operating Income (NOI) divided by the total annual debt service. This calculation is essential for both lenders and investors as it encapsulates the financial health of a property.

- Net Operating Income (NOI): This figure represents the income generated by a property after deducting all necessary operating expenses but before deducting taxes and interest payments.

- Annual Debt Service: The total amount of money required to cover the property’s debt obligations in a given year, including principal and interest payments.

For example, if a property has a net operating income of $120,000 and annual debt service payments of $100,000, its DSCR would be calculated as follows:

- NOI: $120,000

- Debt Service: $100,000

- DSCR Calculation: $120,000 / $100,000 = 1.2

Thus, a DSCR of 1.2 indicates that the property generates 20% more income than needed to cover its debt obligations, which is an encouraging sign for potential lenders.

When assessing DSCR, lenders implement specific criteria to ensure consistent evaluation. They might apply a 5% to 7% vacancy rate, annual proformas for income and expenses, and industry-standard management fees, among other measures. This thorough process guarantees an accurate reflection of a property’s financial stability.

Importance of DSCR in Loan Approval

The significance of DSCR in loan approval cannot be overstated. It serves as a vital indicator of a borrower’s financial health and a property’s income-generating potential, influencing lenders’ decisions significantly.

“Lenders analyze the DSCR when evaluating a loan application to assess a borrower’s creditworthiness and determine their capacity to repay the loan.”

A higher DSCR is favorable as it demonstrates the borrower’s solid financial position and the property’s ability to generate adequate income. Conversely, a lower DSCR might raise red flags regarding the borrower’s capacity to meet debt obligations, impacting the loan approval process negatively.

Advantages of maintaining a high DSCR include:

- Increased Loan Approval Chances: A higher ratio increases the likelihood of loan approval as it signals to lenders that the borrower is less likely to default.

- Better Loan Terms: Borrowers with high DSCRs often secure loans with favorable terms, such as lower interest rates and longer repayment periods.

- Greater Investment Confidence: Investors can proceed with confidence, knowing that their property generates sufficient income to cover debts and provide returns.

In the end, the DSCR is an invaluable tool for lenders to gauge their risk when granting a loan. It not only reflects the borrower’s potential to meet their financial obligations but also aligns with the investor’s goal of securing a stable and profitable real estate investment.

Advantages of DSCR Loans for Investment Properties

Flexible Qualification Requirements

One of the most significant advantages of DSCR loans is their flexible qualification requirements. Traditional loans often require detailed personal financial information, but DSCR loans focus on the income-generating potential of the property itself.

For property investors, this means less stringent criteria and a greater likelihood of securing financing. Analyzing the property’s debt service coverage ratio (DSCR) allows lenders to assess whether the property can cover its debt obligations.

Why would you need stringent personal financial scrutiny when the property can speak for itself?

Moreover, the emphasis on the property’s income potential rather than personal credit scores or income levels makes these loans accessible to a broader range of investors.

DSCR loans facilitate investment opportunities, especially for those with a robust property portfolio but varying personal income streams.

Investors with past credit issues or unconventional income sources can benefit significantly from this approach.

Ultimately, the flexible qualification criteria allow real estate agents to assist a larger pool of clients in securing the necessary investment financing.

This dynamic opens avenues for growth and diversification within their portfolios, enabling investors to tap into lucrative property markets that they might otherwise miss.

No Income Verification Needed

Another critical benefit of DSCR loans is the absence of income verification requirements. Traditional loans usually require detailed tax returns, pay stubs, and other income verification documents.

Property investors often have fluctuating income streams, making traditional verification methods burdensome. However, DSCR loans eliminate this barrier by focusing on the property’s income-generating potential.

How much easier could it be if your investment property itself proves its worth?

Avoiding the need for income verification streamlines the application process, saving both time and effort for investors and their agents.

- Simplified Process: Without income verification, the documentation and approval process becomes significantly more straightforward.

- Speedier Approvals: Less paperwork and less verification can lead to quicker loan approvals, allowing investors to move faster on lucrative property deals.

- Greater Accessibility: Investors with varying income types, including freelancers and business owners, find it easier to qualify.

Furthermore, this approach ensures that the focus remains on the property’s potential profitability, which is the primary concern for investment purposes.

Real estate agents can confidently guide their clients through the DSCR loan application, knowing that dealing with fluctuating personal incomes is no longer a significant hurdle.

Low Down Payment Options

DSCR loans also stand out due to their low down payment options, making them highly attractive to property investors.

Unlike conventional loans that may require substantial down payments, DSCR loans often offer more lenient terms.

With lower investment upfront, investors can maintain liquidity and spread their capital across multiple properties. Does it not make sense to leverage these low down payment options to diversify your investment portfolio?

This financial flexibility can be particularly advantageous in fast-moving markets where opportunities must be seized quickly.

Real estate agents can use this selling point to attract clients looking to maximize their resources.

- Increased Buying Power: By using DSCR loans, investors can stretch their capital further, acquiring more properties with the same amount of initial investment.

- Enhanced Cash Flow: Lower down payments mean less capital tied up in individual properties, resulting in better overall cash flow management.

- Opportunity to Diversify: Investors can diversify their portfolios across various property types and locations, mitigating risk.

The ability to invest with minimal upfront costs makes DSCR loans an attractive option for both seasoned investors and those new to the market.

It is crucial to note that, the combination of flexible qualification requirements, no income verification, and low down payment options makes DSCR loans a powerful tool for property investors. By focusing on the potential income of the property itself, these loans provide unique opportunities for growth and expansion in the real estate market.

How to Qualify for a DSCR Loan with 90% LTV

Qualification Criteria

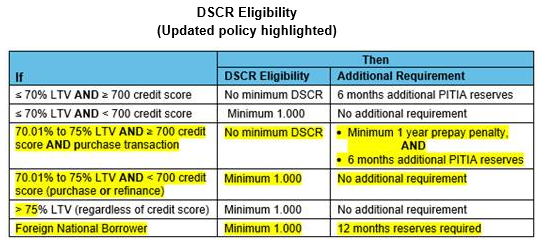

Qualifying for a DSCR loan with a 90% loan-to-value (LTV) ratio involves several stringent criteria. Understanding these can help set clear expectations.

First, investors must demonstrate strong cash flow from the property. The DSCR, or Debt Service Coverage Ratio, measures this cash flow relative to debt obligations.

Additionally, lenders typically look for a minimum DSCR of 1.25. This indicates the property generates 25% more income than the debt payments.

Properties with a DSCR below 1.25 may struggle to secure financing due to perceived higher risk.

Creditworthiness is another critical factor. A high credit score generally around 700 or above, gives lenders confidence in the borrower’s financial responsibility.

Lenders also evaluate property value and location. Prime real estate in stable markets tends to receive more favorable loan terms.

Properties in volatile market areas might necessitate additional scrutiny or lower LTV ratios.

- Experience: Seasoned investors with a proven track record are viewed more favorably.

- Liquidity: Sufficient reserves to cover unexpected expenses or vacancies are required.

- Business Plan: A detailed plan showing how the property will generate income over time.

Ultimately, meeting these criteria increases the likelihood of qualifying for a high LTV DSCR loan.

Documentation Requirements

Submitting comprehensive documentation is crucial for the DSCR loan application process. Missing or incomplete documents can delay or jeopardize approval.

Foremost, investors must present detailed financial statements. These include income statements, balance sheets, and cash flow statements, reflecting the property’s financial health.

Tax returns from the past two to three years are typically required. These documents help lenders verify the borrower’s income consistency.

Discrepancies in reported income and tax returns can raise red flags for lenders.

Moreover, a current rent roll detailing tenant information and lease terms is essential. Ensuring tenants are reliable and leases are up to date reassures lenders of stable income.

- Property Appraisal: An independent appraisal provides an unbiased estimation of the property’s value.

- Credit Report: A comprehensive credit report enables lenders to assess the borrower’s creditworthiness.

- Insurance Documentation: Proof of adequate insurance coverage for the property is mandatory.

Lenders also require a detailed business plan outlining the intended use of the loan and the property’s projected financial performance.

Lastly, legal documents such as property deeds, titles, and any existing loan agreements must be included to provide a complete picture of the property’s standing.

Tips for Approval

Securing approval for a DSCR loan with a 90% LTV ratio can be a meticulous process, but certain strategies can enhance the chances of success.

Firstly, maintaining accurate and organized records is essential. Lenders appreciate clarity and precision in the documentation provided.

Additionally, having a robust financial standing before applying is beneficial. Reducing personal debt and improving credit scores can make a significant difference.

Engaging a financial advisor or consultant can offer valuable insights and help navigate potential pitfalls in the application process.

Professional guidance ensures compliance with lender requirements and strengthens the application.

Furthermore, establishing a solid relationship with lenders can be advantageous. Demonstrating reliability and trustworthiness fosters confidence in the borrower’s ability to manage the loan responsibly.

- Pre-approval: Seek pre-approval to identify potential issues early and address them proactively.

- Transparency: Be forthright about financial conditions and property details to avoid surprises during the lender’s review.

- Market Knowledge: Demonstrate a thorough understanding of the local real estate market to bolster credibility.

Another effective tactic is to present a compelling business plan that clearly outlines the property’s income potential and growth strategies.

Lastly, ensuring the property itself is in excellent condition and market-ready can positively influence the lender’s decision.

Properties that require minimal immediate investment are more likely to receive favorable loan terms.

Maximizing Loan Amounts with DSCR Loans

Improving DSCR

Investors aiming to maximize loan amounts through Debt Service Coverage Ratio (DSCR) loans should begin with strategies to improve their DSCR. One effective method involves increasing the revenue generated by the investment property. This could be achieved by adjusting rental rates to match or exceed market standards. Are your rental rates competitive?

Another approach is to enhance operational efficiency. By reducing operational costs, investors can improve their net operating income, which, in turn, positively impacts the DSCR. Initiating regular maintenance schedules to prevent costly repairs later on can be a wise move. Moreover, adopting energy-efficient systems can significantly cut down utility expenses.

Let’s not forget the importance of accurate financial tracking. Ensuring that all income and expenses are meticulously documented can help present a clearer and often more favorable financial picture to lenders.

“A higher DSCR not only makes the loan application more attractive to lenders but also provides a buffer for loan repayment.”

Regular financial audits can highlight areas of improvement, enabling prompt corrective actions.

- Increase rental income: Renovate units to justify higher rents, implement market-competitive rates.

- Reduce operational costs: Implement energy-saving measures, negotiate better terms with service providers.

- Accurate financial tracking: Use property management software for precise tracking of income and expenses.

These strategies can collectively enhance the DSCR, making it easier for investors to secure larger loan amounts.

Managing Expenses

Effective expense management is crucial for maximizing loan amounts via DSCR loans. Lowering the debt obligation is a primary step. Consider refinancing existing high-interest debts into loans with more favorable terms. This will reduce monthly debt payments, thereby improving the DSCR.

Engaging in bulk purchasing for supplies and services can also lead to significant cost savings. How can we leverage economies of scale in property management?

Regularly review and renegotiate contracts with service providers to ensure optimal terms. Contracts that were favorable five years ago may no longer be the best deals available in the current market.

“Reducing expenses doesn’t mean cutting corners but finding smarter ways to operate.”

Implement cost-efficient property management practices. For instance, using technology for routine tasks can save time and money. Automated rent collection systems reduce the manual effort involved and minimize errors.

- Refinance high-interest debts: Shift to loans with lower interest rates to reduce monthly payments.

- Bulk purchase agreements: Buy supplies in bulk to take advantage of discounts.

- Renegotiate contracts: Regularly update contracts with services for better rates.

Through these measures, investors can significantly lower their expenses, thus improving the DSCR and enabling higher loan amounts.

Choosing the Right Loan Terms

Selecting the appropriate loan terms can greatly influence the loan amount available through DSCR loans. Longer loan terms, for instance, spread out the debt repayment over an extended period, thereby reducing monthly payments and enhancing the DSCR.

Should we opt for interest-only loans? These can lower initial payments, improving the DSCR temporarily and allowing for a larger loan. However, one must consider the long-term implications before making a decision.

Adjustable-rate mortgages (ARMs) might offer initial lower interest rates compared to fixed-rate mortgages. Evaluate the potential risks and benefits to determine if ARMs are suitable for your investment strategy.

“Selecting the right loan terms involves balancing lower payments now with potential future costs.”

Moreover, working with knowledgeable loan officers can provide investors with insights tailored to their specific financial situations. What expert advice can we leverage to optimize our loan terms?

- Longer loan terms: Lower monthly payments improve DSCR, enabling larger loans.

- Interest-only loans: Temporarily lower payments to enhance DSCR, but consider long-term impacts.

- Adjustable-rate mortgages: Initially lower rates, but assess future risk.

By carefully choosing the right loan terms, investors can optimize their DSCR and maximize the loan amounts they can obtain.

Comparing DSCR Loans to Other Financing Options

DSCR vs. Hard Money Loans

When considering funding options for real estate investments, it’s essential to understand the differences between Debt Service Coverage Ratio (DSCR) loans and hard money loans. These financing methods serve unique purposes and come with distinct features.

We might ask ourselves, why would one opt for a DSCR loan over a hard money loan? A DSCR loan is typically utilized by investors who are looking for long-term financing solutions. This type of loan assesses the property’s ability to generate income to cover debt obligations. In contrast, hard money loans are short-term loans provided by private lenders, usually based on the property’s value rather than the borrower’s creditworthiness.

Consider the flexibility in repayment terms: DSCR loans often offer more favorable and extended repayment schedules compared to hard money loans. Why is this significant? Longer repayment periods can reduce monthly payment amounts, making it easier for the investor to manage cash flow.

Hard money loans are often preferred for quick, short-term investment opportunities due to their faster approval process and lower documentation requirements.

However, DSCR loans generally have lower interest rates compared to hard money loans, which can significantly impact the overall cost of financing a property. Lower rates mean less interest paid over the lifetime of the loan, which can add up to substantial savings for the investor.

- Application Process: DSCR loans usually involve a more rigorous approval process compared to hard money loans.

- Loan Terms: DSCR loans often have longer terms, while hard money loans are short-term.

- Interest Rates: DSCR loans typically offer lower interest rates.

Ultimately, the choice between DSCR and hard money loans depends on the investor’s specific needs and the nature of the investment project. Which one aligns better with your investment strategy?

DSCR vs. Traditional Mortgages

Understanding the contrast between DSCR loans and traditional mortgages can be particularly insightful for real estate investors. Both have their merits, but they cater to different aspects of property financing.

Traditional mortgages are what most people think of when they consider home loans. They rely heavily on the borrower’s credit score, income, and debt-to-income ratio. In contrast, DSCR loans emphasize the property’s income generation potential. Why does this matter?

DSCR loans are often favored by investors who may not meet the stringent credit requirements of traditional mortgages but have properties with strong income streams.

When it comes to approval criteria, DSCR loans focus on the property’s ability to generate sufficient income to cover the debt, making them a preferred choice for investors with multiple or high-value income-generating properties. Traditional mortgages involve in-depth scrutiny of personal financial details, which can be a hurdle for some investors.

- Income Requirements: Traditional mortgages require proof of personal income, while DSCR loans require proof of property income.

- Credit Score: Higher credit scores are needed for traditional mortgages, whereas DSCR loans place less emphasis on personal credit scores.

- Documentation: DSCR loans typically require less personal financial documentation compared to traditional mortgages.

Consider also the speed of approval and disbursement. DSCR loans can sometimes be processed more quickly than traditional mortgages, which is a crucial factor for investors needing fast financing to secure profitable deals.

Hence, for investors prioritizing the property’s income potential over personal financial history, a DSCR loan might be the optimal choice. Is this approach aligned with your financial strategy?

Pros and Cons

When deliberating between DSCR loans and other real estate financing options, it is vital to weigh the pros and cons carefully. Each financing method has inherent advantages and disadvantages that can significantly impact an investment strategy.

Starting with the pros of DSCR loans, they primarily offer more flexibility in terms of eligibility since the emphasis is on the property’s income rather than the borrower’s creditworthiness. This can be particularly beneficial for investors with multiple properties or varied income sources.

DSCR loans tend to have more favorable interest rates and terms compared to hard money loans, making them a cost-effective long-term financing solution.

On the flip side, DSCR loans can have a more complicated and time-consuming approval process compared to hard money loans, which are known for their quick turnaround.

- Pros of DSCR Loans:

- Eligibility: Easier approval based on property income.

- Interest Rates: Generally lower compared to hard money loans.

- Repayment Terms: Longer and more manageable.

- Cons of DSCR Loans:

- Approval Process: More stringent and time-consuming.

- Documentation: Requires extensive property income documentation.

Considering traditional mortgages, their pros include relatively lower interest rates and stability due to stringent regulatory standards. However, the rigorous approval criteria and need for high credit scores can be significant barriers.

Hard money loans, while advantageous for quick financing needs, come with higher interest rates and shorter terms, which can strain cash flow if the investment does not generate returns swiftly.

Ultimately, the decision rests on the specific needs and financial situation of the investor. Which financing method aligns with your investment goals and risk tolerance?

Common Challenges with DSCR Loans and How to Overcome Them

Understanding Low DSCR

One of the fundamental challenges that borrowers may encounter is a low Debt Service Coverage Ratio (DSCR). This ratio measures the cash flow available to pay current debt obligations. A low DSCR can indicate that the property is not generating sufficient income.

Borrowers often struggle to maintain a healthy DSCR due to various factors, including seasonal income fluctuations or unexpected expenses. Maintaining a robust cash flow becomes essential to meet debt obligations without complications.

To improve your DSCR, consider the following strategies:

- Increase Revenue: Enhancing the income from your property can significantly boost your DSCR. This can be achieved by adjusting rental rates or introducing additional services for tenants.

- Reduce Expenses: Cutting down on unnecessary expenses can improve your net operating income. Regularly reviewing your expenses and identifying areas for cost-saving is crucial.

- Refinance Existing Debt: Refinancing your loans under more favorable terms can lower your debt service payments, consequently improving your DSCR.

Moreover, regularly monitoring your financial performance and making adjustments as needed can help maintain a strong DSCR, ensuring smoother loan repayment processes.

Would you not agree that proactive financial management could mitigate the risks associated with low DSCR?

Dealing with High Interest Rates

High interest rates present another significant challenge for DSCR loan borrowers. Elevated rates can lead to increased monthly payments, which in turn, can strain your cash flow and negatively impact your DSCR.

To address this issue, several strategies can be employed:

- Negotiate Better Terms: It’s possible to negotiate more favorable terms with lenders. This might include securing a lower interest rate or extending the loan term to reduce monthly payments.

- Consider Interest Rate Caps: Some loans offer an interest rate cap, which limits how much the interest rate can increase. This can provide a safeguard against steep rate hikes.

- Opt for Fixed-Rate Loans: Fixed-rate loans can offer stability, as the interest rate remains constant over the loan term, protecting you from market fluctuations.

“Securing a fixed-rate loan can provide peace of mind, as you won’t be affected by rising interest rates,” explains John Doe, a financial expert.

Additionally, comparing different loan offers and selecting the one that best fits your financial situation is essential. Wouldn’t it be beneficial to explore various options before committing to a loan?

Ultimately, staying informed about market trends and being proactive in managing your loans can help mitigate the effects of high interest rates.

Navigating Loan Terms

Navigating the complex terms associated with DSCR loans can be daunting for both current and prospective borrowers. Understanding these terms is crucial to avoid unexpected challenges down the line.

One common issue is the confusion surrounding prepayment penalties. Prepayment penalties can incur significant costs if you decide to pay off your loan early.

To effectively navigate loan terms, consider the following:

- Thoroughly Review Loan Agreements: Carefully reading and understanding the loan agreement can prevent unpleasant surprises. Pay close attention to terms like prepayment penalties, loan-to-value ratios, and amortization schedules.

- Seek Professional Advice: Consulting with a financial advisor or legal expert can provide clarity on complex loan terms and help you make informed decisions.

- Plan for the Long Term: When crafting your loan strategy, consider potential future changes in your financial situation and how they might affect your ability to meet loan terms.

Why not take a proactive approach to understand loan terms? This can prevent misunderstandings and financial pitfalls.

A deliberate and informed approach to loan management can help ensure that borrowers can meet their obligations without unnecessary stress or financial strain.

Real-Life Success Stories: Investing with DSCR Loans

Case Study 1: Rental Property Success

In this case study, we delve into the triumph of a real estate investor who used a DSCR (Debt Service Coverage Ratio) loan to transform a modest rental property into a profitable venture.

The investor secured a DSCR loan with favorable terms, enabling the purchase of a multi-family property in a burgeoning neighborhood. The low-interest rates and reasonable repayment schedule were decisive factors in this deal.

“Taking advantage of the DSCR loan was a game-changer,” the investor stated. “It allowed me to scale my investments without jeopardizing my cash flow.”

The strategic location of the property played a crucial role. Its proximity to schools, shopping centers, and public transportation made it highly attractive to potential renters.

- Vacancy Rate: The property maintained a low vacancy rate, thanks to its prime location and well-maintained facilities.

- Rental Income: The rental income steadily increased, further boosting the property’s profitability.

- Renovation Strategy: Smart renovations, such as updated kitchens and bathrooms, enhanced tenant satisfaction and retention.

Within two years, the investor reported a substantial increase in cash flow, attributing much of this success to the initial DSCR loan. The ability to cover the loan payments comfortably allowed for further investments and business scaling.

Case Study 2: Commercial Real Estate Growth

Our second case study highlights a savvy entrepreneur who expanded his commercial real estate portfolio using a DSCR loan. This endeavor began with the acquisition of a small office building.

The entrepreneur was drawn to the DSCR loan due to its focus on the income-generating potential of the property rather than personal creditworthiness. This approach provided an opportunity to invest without stringent personal financial scrutiny.

“The DSCR loan’s structure enabled me to focus on properties with strong income potential, which was pivotal for my investment strategy,” shared the entrepreneur.

The office building, located in a bustling business district, attracted diverse tenants, ensuring high occupancy rates from the start. Key factors that contributed to this success included:

- Location: The strategic location in a thriving economic area reduced vacancy risks.

- Tenant Mix: A diverse tenant mix, including both startups and established businesses, provided a stable income stream.

- Property Management: Effective property management practices ensured tenant satisfaction and timely rent collection.

Over time, the consistent revenue from the property allowed the entrepreneur to refinance the DSCR loan, securing better terms and lower interest rates. This refinancing facilitated further expansion, adding more commercial real estate properties to the portfolio.

Lessons Learned

These case studies offer valuable insights for potential investors considering DSCR loans. Here are key takeaways:

- Leveraging DSCR Loans: Using DSCR loans can significantly enhance investment opportunities, especially when focusing on income-generating properties.

- Location is Key: Strategic property locations that attract reliable tenants are crucial for maintaining high occupancy rates and steady income.

- Diversification: Diversifying the tenant mix or property types can mitigate risks and ensure a stable income flow.

- Effective Management: Good property management practices are essential for tenant satisfaction and retention, thereby supporting ongoing revenue generation.

By learning from these real-life success stories, investors can gain the confidence to pursue their own real estate ventures using DSCR loans. What potential success awaits you in the realm of real estate investment?

Conclusion

Unlocking the potential of DSCR loans provides a robust pathway for investors seeking flexible, high-leverage financing solutions. Understanding the nuances of DSCR—from its calculation to its critical role in loan approval—serves as a foundational pillar for smart investment decisions. The advantages, including flexible qualification requirements and low down payment options, make DSCR loans particularly enticing for those eager to maximize their investment properties.

For those wanting to leverage the benefits of a 90% LTV DSCR loan, meeting qualification criteria and crafting a compelling documentation package are essential. By improving DSCR, managing expenses, and selecting optimal loan terms, investors can significantly enhance their borrowing power. Armed with the insights from comparing DSCR loans to other financing options and overcoming common challenges, your next step in real estate investment is clear. Dive deeper into the dynamic world of DSCR loans and turn financial strategies into successful investments. Explore your options today and set the stage for real estate growth.

Frequently Asked Questions

What is the maximum LTV for a DSCR loan?

The maximum Loan-to-Value (LTV) for a DSCR loan typically goes up to 90%, depending on the lender’s requirements and the borrower’s qualifications.

What is the maximum LTV ratio for non-QM loans?

The maximum LTV ratio for non-QM (Non-Qualified Mortgage) loans can reach around 90%, similar to DSCR loans, varying by lender.

What is a good ratio for a DSCR loan?

A good Debt Service Coverage Ratio (DSCR) for a loan is generally 1.25 or higher, indicating sufficient income to cover debt obligations.

What is maximum DSCR ratio?

There is no maximum DSCR ratio; higher ratios are favorable as they demonstrate greater net operating income relative to debt payments.

How do you calculate DSCR for a loan?

DSCR is calculated by dividing Net Operating Income (NOI) by Total Debt Service (principal and interest payments).

What are the key advantages of DSCR loans for investment properties?

DSCR loans offer flexible qualification requirements, no income verification, and low down payment options, making them attractive for investors.