In the intricate world of real estate investments, understanding the Debt Service Coverage Ratio (DSCR) is crucial. This comprehensive guide on DSCR loan calculators demystifies key concepts and components, ensuring you make informed investment decisions.

From calculating Net Operating Income (NOI) to understanding acceptable DSCR values, this article provides a step-by-step roadmap. Gain insights into standard DSCR requirements, implications of low DSCR, and strategies to enhance your ratio.

Leverage our expertise to navigate DSCR calculators effectively, compare investment properties, and optimize your real estate portfolio. Dive into advanced tips for maximizing accuracy and make your investments count.

Understanding DSCR Loan Calculators: A Comprehensive Guide

What is a DSCR Loan?

In the realm of commercial lending, the term Debt Service Coverage Ratio (DSCR) frequently emerges. At its core, a DSCR loan is designed to gauge the borrower’s ability to repay a loan through its generated income.

Unlike personal loans where credit scores are paramount, DSCR loans focus on the viability of the investment. For real estate investors, this often means ensuring that rental income from a property is adequate to cover the loan payments.

To put it simply, the DSCR measures how well a property’s income can cover its debt obligations, including principal and interest. It’s a critical metric for lenders when considering the risk associated with the loan.

For example, a real estate agent planning to purchase and rent out a building will need to demonstrate that the rental income from tenants will sufficiently cover the monthly loan repayments and yield some profit.

It’s worth noting that the acceptable minimum DSCR is typically 1.25. Falling below this threshold could lead to loan rejection, whereas a substantially higher DSCR might expedite loan approval.

Your lender will probably use the DSCR to decide whether you should get the loan or not.

Thus, understanding and calculating DSCR is fundamental for any real estate investor looking to secure financing for income-generating properties.

Key Components of DSCR

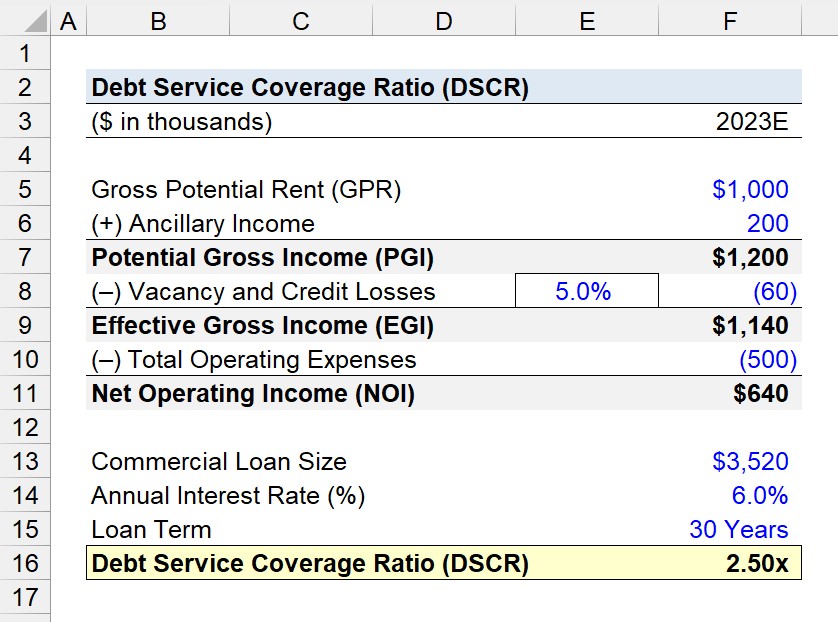

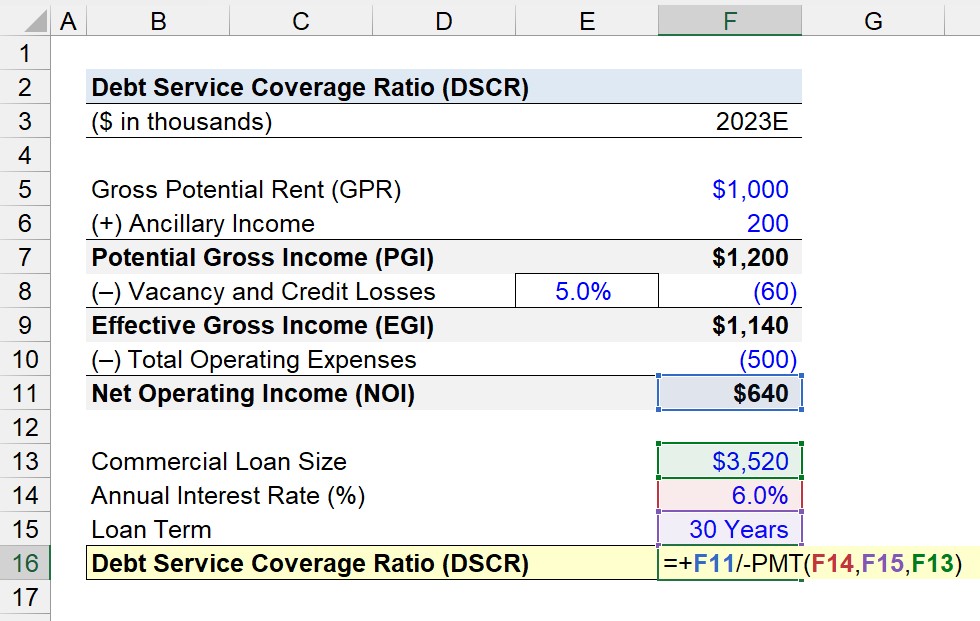

The DSCR calculation hinges on a few critical components. Firstly, one must identify the Net Operating Income (NOI), which is essentially the revenue generated from the property minus operating expenses.

Secondly, the total debt service, comprising principal and interest payments, must be determined. The formula for calculating DSCR is straightforward yet crucial:

DSCR = Net Operating Income / Total Debt Service

Both these components need to be carefully examined to ensure accurate and reliable DSCR computations. A slight miscalculation can drastically alter the perceived financial strength of the investment.

- Net Operating Income: The income generated from the property after operating expenses.

- Total Debt Service: The sum of all principal and interest payments on the loan.

Additionally, attention to detail is crucial when documenting and projecting both income and expenses. Financial analysts can often provide valuable insights and help ensure all figures are accurate.

Employing reliable debt-analysis tools, such as the debt to capital ratio calculator and the interest coverage ratio calculator, can further enhance the robustness of one’s financial assessments.

- Accurate Computation: Ensures reliable DSCR calculation.

- Additional Tools: Utilize other debt-analysis tools for comprehensive understanding.

Importance of DSCR in Real Estate Investments

The importance of DSCR in real estate investments cannot be overstated. Primarily, it serves as a risk assessment tool for lenders, providing them with a quantitative measure of the investment’s financial health.

A strong DSCR signifies that the property generates adequate income to cover debt obligations, which translates into a lower risk for lenders. Conversely, a low DSCR can be a red flag, indicating potential difficulties in meeting debt obligations.

For real estate investors, a robust DSCR can aid in securing financing under favorable terms. It not only enhances the likelihood of loan approval but can also impact the interest rates and other loan conditions.

Moreover, maintaining a healthy DSCR is crucial for long-term financial stability. It ensures the investment can sustain itself and weather financial fluctuations or unforeseen expenses.

A good DSCR coverage ratio is 1.25. This number is ideal because lending institutions typically want to see that you are in a good position to repay your loan and still meet any additional obligations that may come up.

For instance, purchasing a commercial building with a high DSCR demonstrates to lenders that the property is a sound investment. This financial prudence can ultimately lead to quicker loan approvals and potentially better loan terms.

Therefore, understanding and calculating DSCR should be a top priority for anyone looking to venture into or expand their real estate investment portfolio.

How to Calculate DSCR: Step-by-Step Instructions

Inputting Gross Rental Income

To begin the DSCR calculation process, we must first determine the gross rental income of the property. This figure represents the total monthly rent paid by tenants before any expenses are deducted. For instance, if a property has multiple units with a combined rent of $10,000 per month, this amount will serve as the gross rental income.

Gross rental income is a critical starting point as it provides the initial measure of the property’s revenue-generating capacity. It is essential to ensure this figure is accurate and up-to-date.

One might ask, why is this particular figure so important? Well, akin to assessing the gross revenue for any business, this measure offers a baseline understanding of how much money is coming in before any deductions.

- Monthly rent collection: The total rent received from all tenants in a month.

- Lease agreements: Documentation outlining the rental terms and amounts for each tenant.

- Consistent updates: Regularly ensuring that the figures reflect the latest rental adjustments or new leases.

Once the gross rental income is accurately compiled, it facilitates the next stages of the DSCR calculation, ensuring that each subsequent metric is based on solid foundational data.

Calculating Net Operating Income (NOI)

After establishing the gross rental income, the next step is to calculate the Net Operating Income (NOI). The NOI represents the property’s revenue after deducting operational expenses but before accounting for taxes and interest payments. For example, if the monthly gross rental income is $10,000 and the total operating expenses amount to $3,000, then the NOI would be $7,000.

The general formula for NOI is:

Noi = Gross Rental Income – Operating Expenses

Operating expenses include costs such as maintenance, repairs, property management fees, and utilities. These are crucial expenses that ensure the property remains in good condition and continues to generate rental income.

To illustrate further, consider a scenario where the operating expenses include:

- Maintenance: $1,200 for monthly maintenance and repairs

- Property management: $800 for property management services

- Utilities: $1,000 for water, electricity, and other utilities

In this case, the total operating expenses would amount to $3,000, leading to an NOI of $7,000 if the gross rental income is $10,000.

Understanding the NOI is pivotal as it directly influences the property’s financial health and the ability to service debt obligations. Without an accurate NOI, calculating the DSCR would be fundamentally flawed.

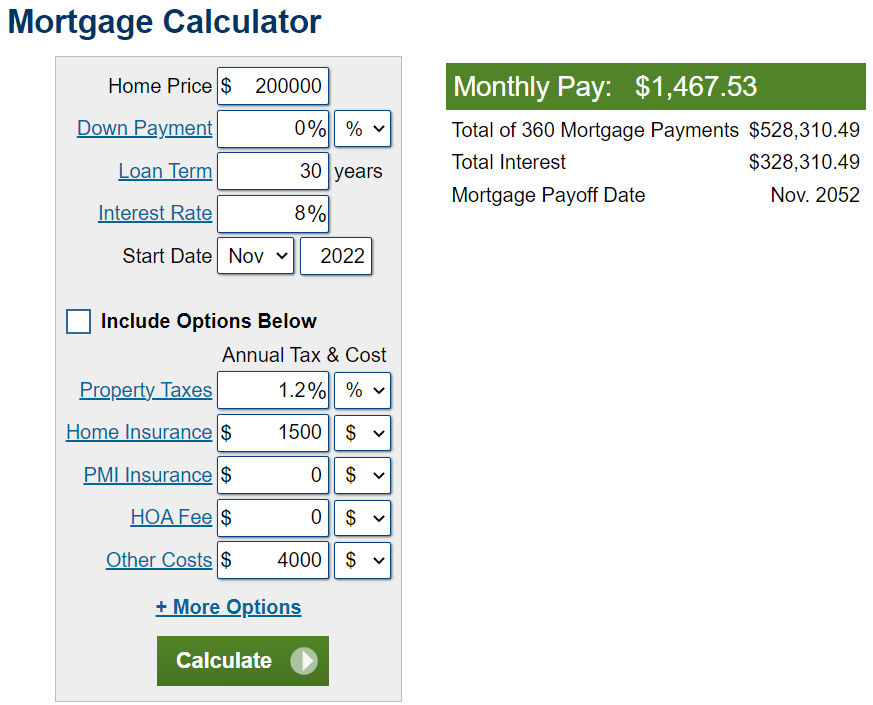

Determining Total Debt Service

With the NOI calculated, the subsequent step involves determining the Total Debt Service. This figure encompasses all monthly debt-related payments, including mortgage, insurance, and maintenance fees. Suppose the expenses might look as follows:

- Mortgage: $2,500 per month

- Maintenance: $200 per month

- Insurance: $50 per month

In this scenario, the total debt service would be $2,750 per month. It is critical to ensure that all debt-related obligations are included to get an accurate measure of total debt service.

Ensuring all debts are accounted for helps in presenting a clear picture of the property’s financial commitments. A missed debt item can significantly distort the DSCR calculation, leading to inaccurate results.

The total debt service figure is integral to the DSCR formula, which is:

DSCR = NOI / Total Debt Service

For instance, with an NOI of $5,000 and a total debt service of $2,750, the DSCR would be approximately 1.82. This ratio indicates that the property’s income is 1.82 times the total debt service, a favorable scenario for most lending institutions, which typically require a DSCR of 1.25 or higher.

Key Metrics in DSCR Loan Calculations

Net Operating Income (NOI)

The Net Operating Income (NOI) is a fundamental metric in DSCR loan calculations. NOI represents the income generated by a property after deducting operating expenses but before accounting for taxes and interest payments. This metric is critical as it reflects the property’s ability to generate cash flow.

NOI is calculated by subtracting operating expenses such as maintenance, utilities, management fees, and property taxes from the total revenue generated by the property. The formula is simple:

NOI = Total Revenue – Operating Expenses

Consider an example: if a property earns $200,000 annually in rental income and incurs $50,000 in operating expenses, the NOI would be $150,000. This figure is essential for lenders and investors to assess the property’s profitability and risk.

Why is NOI so important? Without understanding the NOI, financial analysts can’t accurately determine the cash flow potential of a property. It offers a clear view of income minus essential expenses, thus providing a realistic picture of profitability.

Debt Service

Debt Service refers to the total amount of debt payments a property must make over a specific period, usually a year. This includes both interest and principal repayments on loans. Understanding debt service is crucial for evaluating a property’s financial health and its ability to meet loan obligations.

Debt Service plays a significant role in determining the Debt Service Coverage Ratio (DSCR). The formula for debt service is:

Debt Service = Principal Repayment + Interest Payment

For instance, if a property has an annual mortgage payment (principal and interest) of $100,000, this amount represents the debt service. This figure is pivotal in assessing whether the property’s income is sufficient to cover its debt obligations.

Lenders often consider the debt service when deciding whether to approve a loan. If the debt service amount is too high relative to the NOI, it indicates a higher risk of default. Thus, having a manageable debt service is essential for maintaining financial stability.

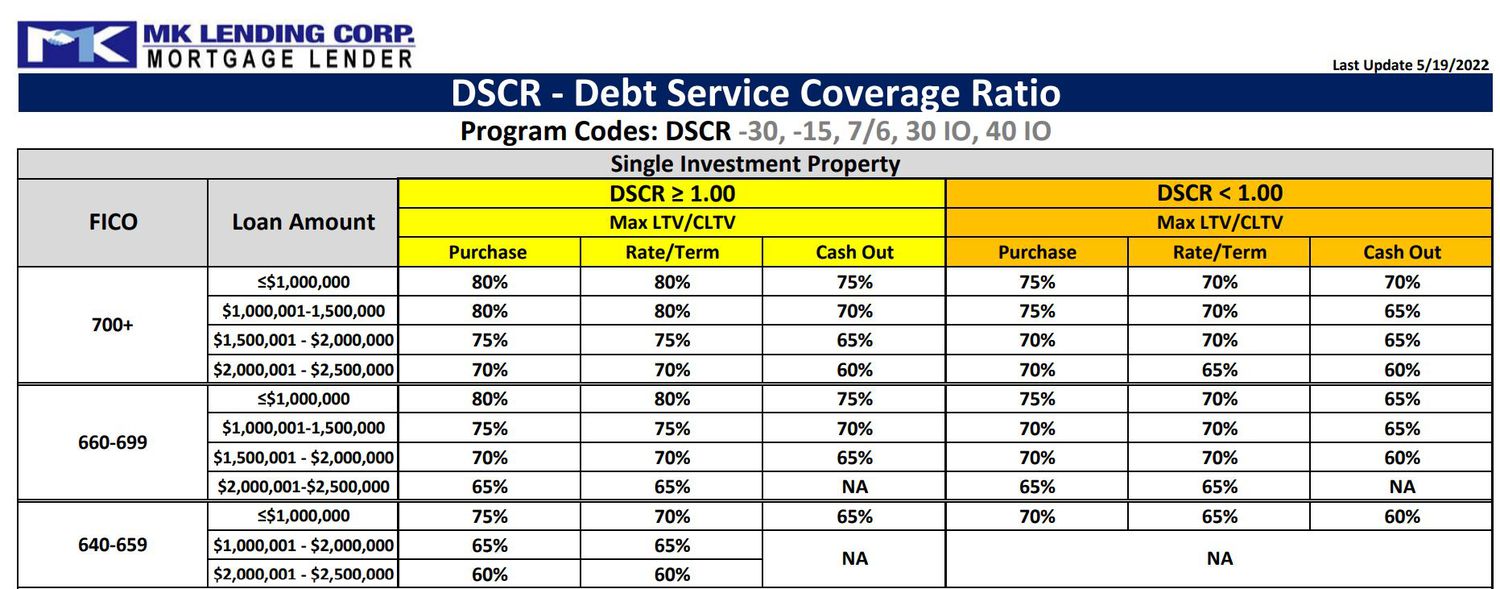

Acceptable DSCR Values

The Debt Service Coverage Ratio (DSCR) is a key metric for evaluating a property’s ability to cover its debt obligations with its net operating income. An acceptable DSCR value typically varies by lender, property type, and market conditions. However, a common benchmark is a DSCR of 1.25 or higher.

- DSCR < 1: Indicates that the property does not generate enough income to cover its debt service. This situation is risky for lenders and could lead to loan default.

- DSCR = 1: Means that the property generates just enough income to cover its debt service, offering no margin for unexpected expenses or vacancies.

- DSCR > 1: Implies that the property generates more income than needed to cover its debt service, providing a cushion for unforeseen costs.

In practice, a DSCR of 1.25 means that for every dollar of debt service, the property generates $1.25 in NOI. This ratio gives lenders confidence in the borrower’s ability to repay the loan. It also provides borrowers with some financial flexibility.

Why do acceptable DSCR values matter? By ensuring that the DSCR meets or exceeds the required benchmark, lenders and investors can mitigate risks and enhance the financial stability of their investments.

Minimum Acceptable DSCR: What You Need to Know

Standard DSCR Requirements

In the realm of commercial lending, the Debt Service Coverage Ratio (DSCR) is crucial for assessing the borrower’s ability to service debt. Lenders typically look for a DSCR of at least 1.25, which means the net operating income (NOI) should be 1.25 times the total debt service.

This benchmark ensures that the borrower generates adequate income to cover existing debts and provides a cushion for potential fluctuations in revenue. However, the specific requirements might vary depending on the lender and the type of property involved.

For instance, a property with a stable income stream, such as a fully leased office building, might have more lenient DSCR requirements compared to a property with a less predictable income, like a hotel. Therefore, understanding the standard DSCR requirements is essential for borrowers and investors alike.

“A higher DSCR indicates a greater ability to cover debt obligations, which is favorable for obtaining loan approval.”

Lenders perceive a higher DSCR as an indicator of lower risk. Consequently, loans with higher DSCRs often come with better interest rates and terms. This is because lenders have more confidence in the borrower’s capacity to make timely payments.

Conversely, a lower DSCR suggests higher risk, which might lead to stricter loan terms or even rejection of the loan application. Therefore, it is imperative for borrowers to aim for a DSCR that meets or exceeds the standard requirements.

Implications of Low DSCR

What happens when a borrower’s DSCR falls below the standard requirement? A low DSCR is an indication that the property’s income is not sufficient to cover its debt obligations comfortably. This could signal potential financial distress, leading lenders to view the loan as high risk.

For example, if a borrower has a DSCR of 1.0, they are just breaking even, with no room to absorb unexpected expenses or declines in income. In such scenarios, lenders might require additional collateral or guarantors to mitigate their risk.

- Higher Interest Rates: A low DSCR often results in higher interest rates due to the increased risk perceived by the lender.

- Stricter Terms: Loans with low DSCRs might come with more stringent terms and conditions, including shorter loan terms and increased scrutiny on the borrower’s financials.

- Reduced Loan Amount: To balance the risk, lenders might offer a lower loan amount than initially requested.

In extreme cases, lenders might outright reject a loan application with a DSCR that falls significantly below the acceptable threshold. This emphasizes the importance of maintaining a healthy DSCR for loan approval and favorable terms.

Strategies to Improve DSCR

If a borrower’s DSCR is below the desired level, there are several strategies to improve it. One common approach is to increase the property’s net operating income (NOI). This can be achieved through measures such as increasing rental rates, improving property management to reduce vacancies, or cutting operating expenses.

Increasing NOI directly boosts the DSCR, making the loan application more attractive to lenders. Another strategy is to refinance existing debt to secure lower interest rates or extended repayment terms, thereby reducing the total debt service.

- Income Generation: Enhancing property income through better lease agreements or additional revenue streams.

- Expense Management: Reducing operational costs by optimizing property management practices.

- Debt Restructuring: Refinancing to lower debt service obligations, making it easier to meet DSCR requirements.

Borrowers might also explore equity infusion, where additional capital is injected into the project to improve financial stability. By leveraging these strategies, borrowers can effectively improve their DSCR, thus enhancing their chances of securing favorable loan terms.

Using DSCR Calculators for Real Estate Investment Decisions

Benefits of DSCR Calculators

Utilizing DSCR calculators can significantly enhance the accuracy and efficiency of real estate investment decisions. But, how exactly does this tool benefit investors and financial advisors?

First, DSCR calculators streamline the analysis process. For instance, they quickly compute the ratio of a property’s cash flow to its debt obligations, saving investors countless hours compared to manual calculations.

Also, these calculators enhance decision-making by providing clear, quantifiable metrics. Investors can easily gauge the financial health of a property, determining whether it generates sufficient income to cover debt payments.

“With a reliable DSCR calculator, investors can distinguish between high-risk and low-risk properties, making informed choices that align with their financial goals.”

Furthermore, DSCR calculators offer consistent and objective analysis. Unlike subjective evaluations, these tools use fixed formulas and objective data, ensuring dependable results across multiple properties.

Another significant advantage is the reduction of investment risks. By understanding a property’s debt coverage ratio, investors can avoid properties that may jeopardize their financial stability.

This tool also aids in the negotiation process. Having a concrete DSCR figure enables investors to negotiate better terms with lenders, potentially securing more favorable loan conditions.

Moreover, DSCR calculators are valuable for long-term planning. They provide insights into future cash flows and debt obligations, helping investors strategize for sustainable growth.

- Accurate Analysis: Delivers precise financial health metrics for properties.

- Time Efficiency: Saves investors time with quick computations.

- Risk Mitigation: Helps in identifying and avoiding high-risk properties.

Comparing Investment Properties

Comparing multiple investment properties is a critical task for any real estate investor. But how can we ensure that our comparisons are both fair and precise?

One effective method is using DSCR calculators to standardize the assessment process. By evaluating each property’s debt service coverage ratio, we can objectively compare their financial performance.

For example, consider two properties with similar purchase prices but different rental incomes and mortgage payments. A DSCR calculator can highlight which property offers a healthier cash flow in relation to its debt.

This approach also helps in identifying hidden opportunities. Sometimes, a property with a lower purchase price may present a higher DSCR, indicating better investment potential over the long term.

“A consistent method of comparison, like the DSCR, removes biases and ensures investors focus on critical financial metrics.”

Furthermore, DSCR calculators can assist in portfolio diversification. By comparing the DSCRs of various properties, investors can balance their portfolios with a mix of high and stable income-generating assets.

It’s also easier to prioritize investments. Properties with higher DSCRs generally indicate less financial stress and more reliable income, guiding investors toward safer investments.

- Objective Assessment: Standardizes financial comparison across properties.

- Hidden Opportunities: Reveals lower-cost properties with better long-term potential.

- Portfolio Diversification: Helps in creating a balanced mix of investments.

Making Informed Decisions

Making informed decisions is paramount in the realm of real estate investing. How can we ensure that our choices are backed by solid data and sound analysis?

DSCR calculators are invaluable in this process. They provide critical insights into a property’s financial viability, enabling investors to make decisions based on concrete data rather than intuition.

For instance, these calculators offer a clear picture of how potential changes in rental income or interest rates might impact a property’s debt coverage. This foresight allows investors to anticipate and prepare for various scenarios.

Moreover, investors can use DSCR calculators to justify their decisions to stakeholders. A well-calculated DSCR serves as evidence of thorough due diligence, fostering trust among partners and lenders.

“Justifying investment choices to stakeholders becomes more straightforward when backed by quantitative DSCR data.”

These tools also facilitate stress testing. By inputting different variables, investors can assess how well a property can withstand financial pressures, such as economic downturns or increased expenses.

Additionally, DSCR calculators support setting realistic and achievable goals. By understanding the financial limits and potential of investments, investors can set targets that are both ambitious and attainable.

- Data-Driven Decisions: Ensures choices are based on factual financial analysis.

- Justification to Stakeholders: Provides concrete evidence for due diligence.

- Stress Testing: Allows testing of various financial scenarios for resilience.

Common FAQs About DSCR Loan Calculators

How to Qualify for a DSCR Loan

Navigating the qualification process for a Debt Service Coverage Ratio (DSCR) loan might seem daunting, but it is straightforward once broken down. The key is demonstrating the ability to generate enough rental income to cover loan payments.

To begin, potential borrowers should present their financial history. Lenders will look closely at past tax returns, profit and loss statements, and current rental income. Do you have a history of consistent rental income?

Next, it’s crucial to maintain a good credit score. While each lender has its criteria, a credit score above 620 generally meets DSCR loan requirements. How does your credit score compare?

Furthermore, proof of current rental agreements aids in the qualification process. This demonstrates ongoing income that supports your capacity to meet debt obligations.

“Having a solid rental income stream significantly enhances your chances of qualifying for a DSCR loan.”

It’s also helpful to provide a detailed operational plan for the property. This plan should include expected rental income and expenses. What does your operational plan look like?

- Financial History: Demonstrates consistent income generation.

- Credit Score: Indicates the borrower’s creditworthiness.

- Current Rental Agreements: Shows ongoing rental income.

Lastly, consider working with a knowledgeable broker. They can guide through specific lender requirements and ensure all documentation is in order. Have you considered partnering with a broker?

Understanding DSCR Ratios

The Debt Service Coverage Ratio (DSCR) is a key metric in qualifying for a DSCR loan. It measures a property’s ability to generate enough income to cover its debt obligations. But what exactly does this entail?

Simply put, DSCR is calculated by dividing the net operating income (NOI) by the total debt service. A DSCR of 1 means the property generates enough income to cover its debt. What if the DSCR is less than 1?

A DSCR above 1 indicates a positive cash flow, which suggests a healthier financial position. It reassures lenders about the borrower’s ability to meet loan obligations. Would you feel more secure with a DSCR over 1?

- Calculate NOI: Determine your net operating income from the property.

- Assess Total Debt Service: Sum up all debt obligations.

- Calculate DSCR: Divide NOI by total debt service.

Lenders typically look for a DSCR of at least 1.2, meaning the property should generate 20% more income than needed to cover debts. What is the usual DSCR requirement you encounter?

Understanding these ratios helps in strategizing property investments. Investors often aim for properties with higher DSCRs to ensure financial stability. How do DSCRs influence your investment decisions?

“A higher DSCR boosts investor confidence and lender willingness to approve loans.”

Ultimately, recognizing and calculating DSCR aids in making informed investment choices. This knowledge is crucial for both potential borrowers and real estate investors keen on leveraging DSCR loans.

Down Payment Requirements

Down payment requirements for DSCR loans can vary significantly based on the lender and the borrower’s financial profile. However, a common range is between 20% to 30% of the property’s purchase price.

Typically, a higher down payment lowers the risk for lenders, making loan approval more likely. How much are you prepared to put down?

Having sufficient liquidity to meet down payment requirements is crucial. Lenders often scrutinize bank statements to confirm the availability of funds. Are your finances in order?

Moreover, demonstrating the ability to handle property-related expenses further solidifies the borrower’s position. This aspect is essential as lenders assess overall financial health. What other expenses should you anticipate?

“A substantial down payment not only increases loan approval chances but also reduces monthly payments.”

Investment properties may have higher down payment requirements compared to primary residences. Be sure to confirm specific requirements with your lender. Are you familiar with these distinctions?

- Higher Down Payments: Reduce lender risk and monthly payments.

- Bank Statements: Validate the availability of funds.

- Investment Property: Often requires a higher down payment.

Lastly, exploring down payment assistance programs or partnering with investors can alleviate financial strain. Are there any programs or partners you can leverage?

The down payment is a critical factor in securing a DSCR loan, influencing both the approval process and the loan terms. Understanding these requirements ensures a smoother loan application experience.

Advanced Tips for Maximizing DSCR Loan Calculator Accuracy

Accurate Data Entry

Ensuring the accuracy of your Debt Service Coverage Ratio (DSCR) calculations starts with accurate data entry. Mistakes in this initial step can lead to significantly skewed results. By meticulously entering each figure, we can minimize errors.

It’s important to consistently use reliable data sources. Analyzing historical financial records and validating each data point can help ensure that the information inputted into the calculator is correct and reflective of actual figures.

Consider whether the data format aligns with the calculator’s requirements. Are you inputting annual figures when monthly data is needed?

“The accuracy of your DSCR calculations is only as good as the data entered. Every detail counts.” – Financial Expert Advice

Utilize checklists to cross-verify entered data. A second review layer can catch inconsistencies that may have been overlooked initially.

- Double-check Figures: Confirming numbers such as rental income or interest expenses avoids input errors.

- Consistent Units: Using consistent timeframes (annually, monthly) is essential for accurate calculations.

- Source Verification: Ensuring data is sourced from audited financial statements or reliable databases enhances trustworthiness.

By following these steps, we can ensure the data entered into DSCR calculators is as accurate as possible, serving as a solid foundation for subsequent calculations.

Considering All Expenses

Accurate DSCR calculations require a comprehensive understanding of the total expenses involved. Often, minor costs are overlooked, leading to inaccurate results. Thoroughly documenting every expense, including operational costs, maintenance fees, and unexpected expenses, is crucial.

For example, while major expenses like property loans are typically accounted for, ancillary costs like property management fees or marketing expenses might be missed. Are we considering every aspect?

“Every expense, no matter how small, impacts the bottom line. Overlooking even minor costs can result in skewed DSCR results.” – Industry Professional Insight

Employing detailed financial statements can highlight overlooked expenses. By systematically reviewing these statements, we ensure all costs are considered.

- Operational Costs: Include regular maintenance, management fees, and utilities.

- Incidental Costs: Unexpected repairs or vacancy-related expenses.

- Reserve Funds: Allocating for future large-scale repairs and renovations.

Being meticulous about expenses means recalculating DSCR values can provide a more realistic view of financial health, essential for making informed investment decisions.

Regular Updates and Reviews

DSCR calculations should not be a one-time activity. Regularly updating and reviewing these calculations ensures they remain relevant with the changing financial landscape. As market conditions fluctuate, so too should our approach to DSCR analysis.

Consider implementing a quarterly or bi-annual review schedule for DSCR calculations. How often are we revisiting our figures?

Examining updated financial statements, rent rolls, and expense reports should be part of a standard review process. Including these updated inputs can reflect the most current financial situation.

“Regular reviews and updates of DSCR calculations can reveal trends and highlight areas for improvement that might be missed with less frequent checks.” – Financial Analyst’s Guide

Utilizing software tools designed for real estate financial analysis can automate parts of this updating process, ensuring consistency and accuracy.

- Consistent Review Schedule: Setting a timeline for DSCR reviews keeps calculations up-to-date.

- Incorporating Market Changes: Adjusting for shifts in the market or property income/expenses.

- Use of Technology: Leveraging analytical tools for more precise and timely updates.

By adhering to a regular review process, we can ensure that our DSCR calculations remain accurate and reflective of the current financial environment, a fundamental aspect for successful real estate investment strategies.

Conclusion

The DSCR loan calculator is an indispensable tool for real estate investors aiming to make informed financial decisions. By understanding key components such as Gross Rental Income, Net Operating Income (NOI), and Total Debt Service, investors can effectively gauge the viability of potential investments. The ability to accurately calculate DSCR allows for better assessment of property performance and ensures alignment with acceptable DSCR values critical for securing loans.

Embracing the insights provided by DSCR calculators empowers investors to enhance their portfolios strategically. Regular updates and precise data entry are crucial for maximizing the accuracy of these calculations. As you delve deeper into real estate ventures, leverage the benefits of DSCR calculators to compare properties and make data-driven choices. For further mastery, explore additional resources and expert advice to refine your investment strategies. Begin today, and elevate your investment decisions with confidence.

Frequently Asked Questions

How to calculate DSCR loan?

DSCR is calculated by dividing the Net Operating Income (NOI) by the Total Debt Service.

Do DSCR loans require 20% down?

While 20% is a common requirement, the exact down payment can vary based on the lender and specific loan terms.

What is the current DSCR loan rate?

DSCR loan rates vary by lender and market conditions. Check with local lenders for the most accurate rates.

What is a good ratio for a DSCR loan?

A good DSCR is typically above 1.25, indicating sufficient income to cover debt obligations.

What is the importance of DSCR in real estate investments?

DSCR is crucial as it helps assess a property’s ability to generate enough income to cover its debt payments.

How can I improve my DSCR?

Increase rental income, reduce operating expenses, or refinance to lower your debt service.