Navigating the complexities of real estate investment can be daunting, especially in a dynamic market like Florida. DSCR Loans offer a streamlined approach, providing vital flexibility and efficiency for savvy investors.

In this comprehensive guide, we decode the nuances of DSCR Loans, highlighting their significant benefits, simplified processes, and strategic advantages for Florida’s vibrant real estate sector. Uncover how these loans can transform your investment strategy today.

Understanding DSCR Loans in Florida: A Comprehensive Guide

Definition and Importance of DSCR Loans

Debt Service Coverage Ratio (DSCR) loans offer a unique financing solution for real estate investors, particularly in Florida. These loans are based on the property’s cash flow rather than the borrower’s personal income. The DSCR is determined by dividing the monthly rental income by the property’s monthly debt obligations, which include principal, interest, taxes, insurance, and association dues (PITIA).

This focus on cash flow is what makes DSCR loans especially attractive for investors with large portfolios or those who are self-employed. The calculation of DSCR provides a clear indicator of the borrower’s ability to repay the loan. Most lenders require a minimum DSCR of 1.2, indicating the property generates more income than its debt obligations.

As a result, DSCR loans eliminate the need for traditional income verification methods, such as tax returns and employment history. This can streamline the loan application process, making it faster and less cumbersome for investors aiming to expand their holdings.

What is the significance of this? By focusing on the property’s ability to generate income rather than the borrower’s financial history, DSCR loans open up opportunities for a wider range of investors, particularly those who may not qualify for conventional loans.

Furthermore, DSCR loans are termed as “Non-QM loans” (Non-Qualified Mortgages) or “No Income Verification Investor Loans”. Despite having higher interest rates compared to traditional loans, their unique nature makes them an invaluable tool for financing investment properties under certain conditions.

“The Debt Service Coverage Ratio loan makes financing investment properties much easier for real estate investors.”

The importance of DSCR loans in real estate investment cannot be overstated. They provide a means for investors to leverage property income, thus enabling the purchase and management of multiple properties efficiently.

Key Differences from Traditional Loans

A primary distinction between DSCR loans and traditional loans is the documentation required. Traditional loans typically mandate extensive documentation, including tax returns, employment history, and income verification. DSCR loans, on the other hand, are primarily concerned with the property’s rental income.

Traditional lenders often cap the number of loans a borrower can have, with some setting the limit at ten loans. DSCR loans do not impose such restrictions, thereby offering more flexibility for professional investors looking to build substantial real estate portfolios.

Another notable difference lies in the qualification criteria. While conventional loans rely heavily on the borrower’s creditworthiness and income levels, DSCR loans focus on the net operating income (NOI) of the property. This means that even if an investor has a complex financial situation or inconsistent income, they can still qualify for a DSCR loan if the property’s income exceeds its debt obligations.

Moreover, DSCR loans can finance up to 20 properties, with loan amounts potentially reaching as high as $2.5 million. This scalability is a key advantage for investors seeking to expand their portfolio significantly.

Emerging investors often face a common roadblock: securing sufficient financing. By opting for DSCR loans, they can bypass many of the stringent requirements associated with traditional loans.

Despite these benefits, DSCR loans typically have higher interest rates, reflecting the increased risk perceived by lenders. The higher rates, however, can usually be offset by the rental income generated by the property.

The flexibility provided by DSCR loans, including options like interest-only payments and the ability to close loans in a business name, further enhances their appeal to investors. This makes DSCR loans a more tailored solution for real estate investors compared to traditional financing methods.

“Less documentation makes the underwriting process significantly easier.”

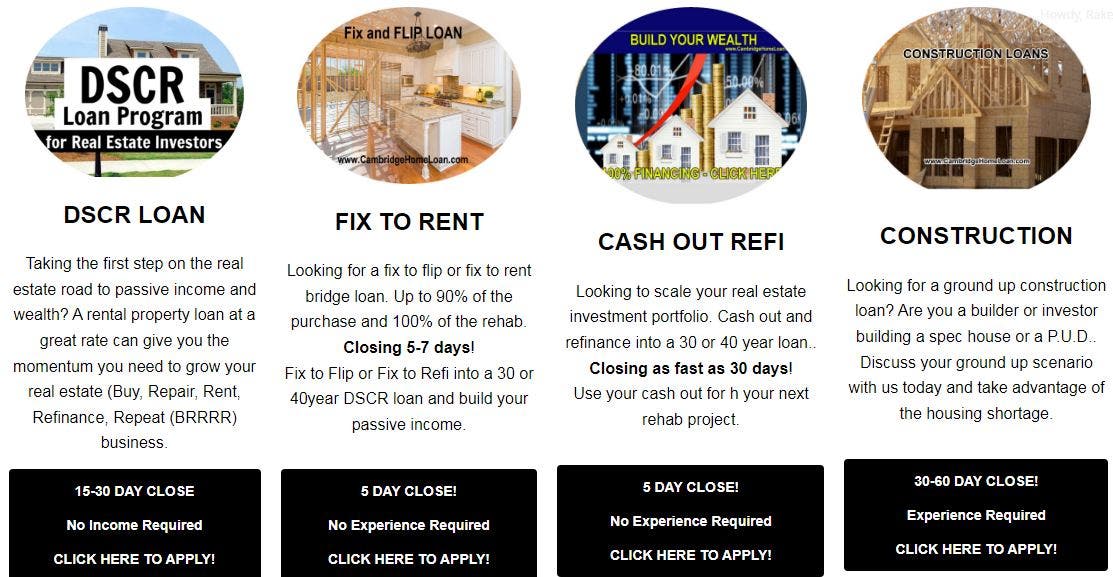

Benefits for Real Estate Investors

Real estate investors in Florida stand to gain various benefits from DSCR loans. First and foremost, these loans provide an efficient financing option for those looking to expand their rental property portfolio without the hassle of extensive documentation.

DSCR loans enable investors to close loans in the name of a business entity, such as an LLC, offering an added layer of protection and flexibility. This is particularly advantageous for those managing multiple properties.

The eligibility criteria for traditional loans often exclude self-employed individuals or those with irregular income. DSCR loans, however, rely on the property’s cash flow, thus providing a viable financing option for these investors.

- Increased Loan Limits: With DSCR loans, investors can access higher loan amounts, up to $2.5 million, allowing for significant investment opportunities.

- Scalability: The ability to finance up to 20 properties opens doors for substantial portfolio growth.

- Flexibility in Loan Terms: Options such as interest-only payments and customizable rate structures cater to diverse investment strategies.

- Quick and Simple Process: The reduced documentation requirement speeds up the loan approval process, enabling investors to act swiftly on lucrative property deals.

Furthermore, DSCR loans often come with longer terms, such as full 30-year terms with no balloons. This long-term financing can provide stability and predictability, essential for strategic planning and portfolio management.

In essence, the features of DSCR loans align perfectly with the needs of real estate investors. The focus on rental income, higher loan limits, and the flexibility of terms make them an ideal choice for those aiming to optimize their investment potential.

“For the professional investor looking to build a large real estate portfolio, a DSCR program is ideal.”

Common Misconceptions

There are several misconceptions surrounding DSCR loans that can deter potential investors. One common myth is that DSCR loans are only suitable for high-income individuals. In reality, these loans are designed for properties that generate sufficient rental income, regardless of the borrower’s personal income.

Another misconception is that DSCR loans are only applicable for long-term rental properties. While they are indeed popular for such properties, DSCR loans are also suitable for vacation rentals and other types of investment properties, provided they meet the income criteria.

Some investors believe that the higher interest rates of DSCR loans outweigh their benefits. While DSCR loans do have higher rates, the income generated by the property typically offsets these costs, making them a financially viable option.

It is also a common belief that DSCR loans are too complex due to the alternative qualification criteria. In fact, the opposite is true. By focusing on cash flow rather than personal financial history, DSCR loans simplify the application process, making it more accessible to a wider range of investors.

Additionally, there is a notion that DSCR loans cannot be used for diverse property types. On the contrary, these loans can finance various property types, including single-family homes, townhomes, condos (both warrantable and non-warrantable), and multifamily properties.

Lastly, some may think that DSCR loans are less advantageous compared to conventional loans due to the lack of tax return requirements. However, this feature is a significant advantage for investors, as it streamlines the process and eliminates potential hurdles related to complicated income verification.

Understanding and dispelling these misconceptions can help potential investors make informed decisions about utilizing DSCR loans to their advantage.

“DSCR loans provide a means for investors to leverage property income, thus enabling the purchase and management of multiple properties efficiently.”

It is crucial to note that, while DSCR loans may come with higher interest rates and specific criteria, their benefits in terms of flexibility, scalability, and streamlined processes make them an effective tool for real estate investment in Florida.

How DSCR Loans Simplify the Lending Process in Florida

No Income Verification Needed

Unlike traditional mortgages, DSCR loans do not require verification of personal income. This can be particularly beneficial for self-employed individuals and investors who may have fluctuating or less predictable income. Without the need for pay stubs or tax returns, the process is streamlined significantly.

For instance, imagine trying to prove income consistency when you have multiple properties, each generating different rental incomes. DSCR loans eliminate the hassle of presenting detailed income documentation, making it easier for investors to qualify.

The simplicity of the DSCR loan process is well-captured in a direct comparison:

“The DSCR loan process is much simpler than the conventional mortgage process.”

Could anything be more straightforward for an investor juggling multiple income sources?

In essence, the focus shifts from personal income to the performance of the investment property itself, allowing for a more practical assessment.

Simplified Documentation Requirements

With DSCR loans, documentation is markedly simplified. Traditional loans often require a plethora of documents, including:

- Tax Returns: Detailed documentation of tax filings over several years.

- Employment History: Verification that may not align with the self-employed.

- Pay Stubs: Regular income proof that might not be applicable for investors.

In contrast, the application for a DSCR loan mainly focuses on the investment property and its rental income potential:

- Complete the DSCR loan application: This step includes appraising the property and evaluating its expected market rent.

- Move into processing: Evaluation of the property quality and rental income potential without the burden of personal financial documents.

- Close and get funds: The process moves smoothly into underwriting and quality control before funding.

Doesn’t this sound like a relief for busy investors?

Faster Underwriting Process

The underwriting process for DSCR loans is significantly faster. Traditional loans can drag due to extensive income verification and complex documentation. However, DSCR loans streamline this step by focusing solely on the investment property.

Consider an investor with several properties looking to expand their portfolio quickly. Traditional underwriting could delay opportunities due to its length. The speed of DSCR loans ensures that the window of opportunity is not missed.

The process is straightforward:

“Once your application is complete, your DSCR mortgage will move into processing… the lender is mostly looking at the investment property quality and rental income potential.”

A faster underwriting process means quicker access to funds, enabling investors to act swiftly and with confidence.

Common Sense Evaluation Criteria

DSCR loans employ evaluation criteria grounded in common sense. Traditional loans often hinge on personal financial stability, which may not reflect the borrower’s actual ability to manage investment properties effectively.

Instead, DSCR loans emphasize:

- Property Quality: The condition and potential of the investment property.

- Rental Income Potential: Expected income generation from the property.

This approach aligns more closely with the realities faced by investors and self-employed individuals. For instance, an investor with multiple properties and varying income streams would find this method far more practical.

Isn’t it logical to base a loan on the property’s potential rather than the borrower’s personal financial fluctuations?

It is crucial to note that, DSCR loans simplify the lending process by focusing on relevant, practical criteria that make sense for real estate investors in Florida.

Key Benefits of DSCR Loans for Florida Real Estate Investors

Flexible Terms and Fees

Investors, whether seasoned or just starting out, will find DSCR loans offer remarkably flexible terms and fees. This flexibility is ideal for tailoring loan conditions to match your specific investment strategies.

It’s important to note that these flexible terms can include varying repayment schedules, accommodating the unique cash flow patterns of different properties. For instance, a multifamily property might have different income stability compared to a single-family rental.

By adjusting the term lengths and types of fees, investors can manage their finances more effectively. Wouldn’t it be great if you could choose terms that best suit your investment timeline?

Flexible terms and fees enable investors to align their loan conditions with their investment plans, ensuring a more customized borrowing experience.

Additionally, the range of fee structures offered under DSCR loans can include fixed or variable interest rates. This allows for strategic planning according to the market conditions. Why limit yourself to a one-size-fits-all approach?

This adaptability in terms and fees often means reduced upfront costs, making it easier for investors to get started with their projects. As variable fees can adjust over time, this can be a strategic advantage in a fluctuating market.

Consider a scenario where the market interest rates are expected to decrease—opting for variable fees could lead to substantial cost savings over the loan period.

Flexible terms also mean that investors can opt for early repayment options without hefty penalties, allowing the freedom to exit loans sooner and reinvest in other ventures.

Ultimately, the ability to choose and modify loan terms gives investors the control they need to succeed in the dynamic real estate market in Florida.

Higher Loan Limits

One of the most compelling advantages of DSCR loans is the provision of higher loan limits. This benefit is particularly crucial for investors looking to finance larger or multiple properties.

Higher loan limits mean that investors can scale their portfolios more rapidly. Imagine being able to purchase a high-value commercial property or several residential units without the constraints of traditional loan caps.

For instance, a real estate investor aiming to develop a mixed-use property would find that DSCR loans provide the necessary capital, enabling more ambitious projects.

Higher loan limits empower investors to undertake more significant and often more profitable ventures, driving substantial growth in their portfolios.

This feature is especially beneficial for seasoned investors who have identified lucrative opportunities but require substantial funding to proceed. Having access to larger sums simplifies the process of acquiring high-value assets.

In addition, these limits often come with competitive interest rates, making DSCR loans a financially wise choice for large-scale investments. Why settle for less when you can secure more substantial funding?

By financing more expensive properties, investors can achieve greater income potential. This, in turn, enhances their overall return on investment (ROI) and boosts their financial stability.

A practical example could be an investor acquiring a well-located apartment complex. The higher loan limits of DSCR loans make such investments feasible, resulting in higher rental income streams.

The opportunity to access more substantial funds genuinely sets DSCR loans apart from other financing options, giving Florida real estate investors an edge in a competitive market.

Interest-Only Options

DSCR loans often feature interest-only options, providing investors with a strategic way to manage their cash flow during the initial phases of property investment.

Interest-only payments mean that for a specified period, investors only pay the interest on the loan, not the principal. This can significantly reduce monthly payments, freeing up capital for other pursuits.

For novice investors, this feature can be particularly beneficial as it allows them time to stabilize their rental income before fully committing to higher payments. Isn’t it helpful to have lower initial financial pressure?

Interest-only options offer a valuable tool for managing cash flow, especially during the early stages of property investment, allowing investors to allocate resources more effectively.

For seasoned investors, interest-only loans can facilitate the renovation of properties, as they can invest the saved capital into property improvements and increase the property’s value.

Moreover, by utilizing interest-only payments, investors can increase their liquidity, which is critical for seizing new investment opportunities quickly. Why tie up all your capital in monthly payments?

This option can also align with the cash flow characteristics of specific properties. For example, properties expected to appreciate rapidly or those undergoing significant improvements can benefit from initial lower payments.

Furthermore, interest-only loans can ease the financial burden during economic downturns, providing a safety net for investors when rental incomes might fluctuate.

Ultimately, the flexibility of interest-only options under DSCR loans enables investors to manage their investments more strategically and push for higher profitability.

Ability to Finance Multiple Properties

DSCR loans also offer the ability to finance multiple properties, which is a significant advantage for both novice and experienced real estate investors.

This feature allows investors to build their property portfolios with greater ease and efficiency. Imagine being able to secure financing for several properties under one loan product.

By financing multiple properties, investors can diversify their investments, reducing risk and increasing potential returns. Wouldn’t diversification be a smart move in a dynamic market?

For instance, an investor may choose to purchase a combination of residential and commercial properties, balancing different income streams and market volatilities.

The ability to finance multiple properties provides investors with the opportunity to diversify their portfolio, thereby optimizing risk management and enhancing income potential.

Additionally, this option simplifies the management of a real estate portfolio. Rather than juggling multiple loans with different terms and repayment schedules, investors can consolidate their financing.

This consolidation can result in more straightforward financial planning and bookkeeping, allowing investors to focus more on growing their portfolios and less on administrative tasks.

Moreover, financing multiple properties can maximize the use of the loan limits provided by DSCR loans, effectively leveraging their higher limits for greater investment returns.

Wouldn’t it be beneficial to have one loan covering various investments, thereby reducing the complexity of managing multiple funding sources?

Importantly, the ability to finance multiple properties is a robust feature of DSCR loans, providing Florida real estate investors with the tools they need to grow and thrive in a competitive market.

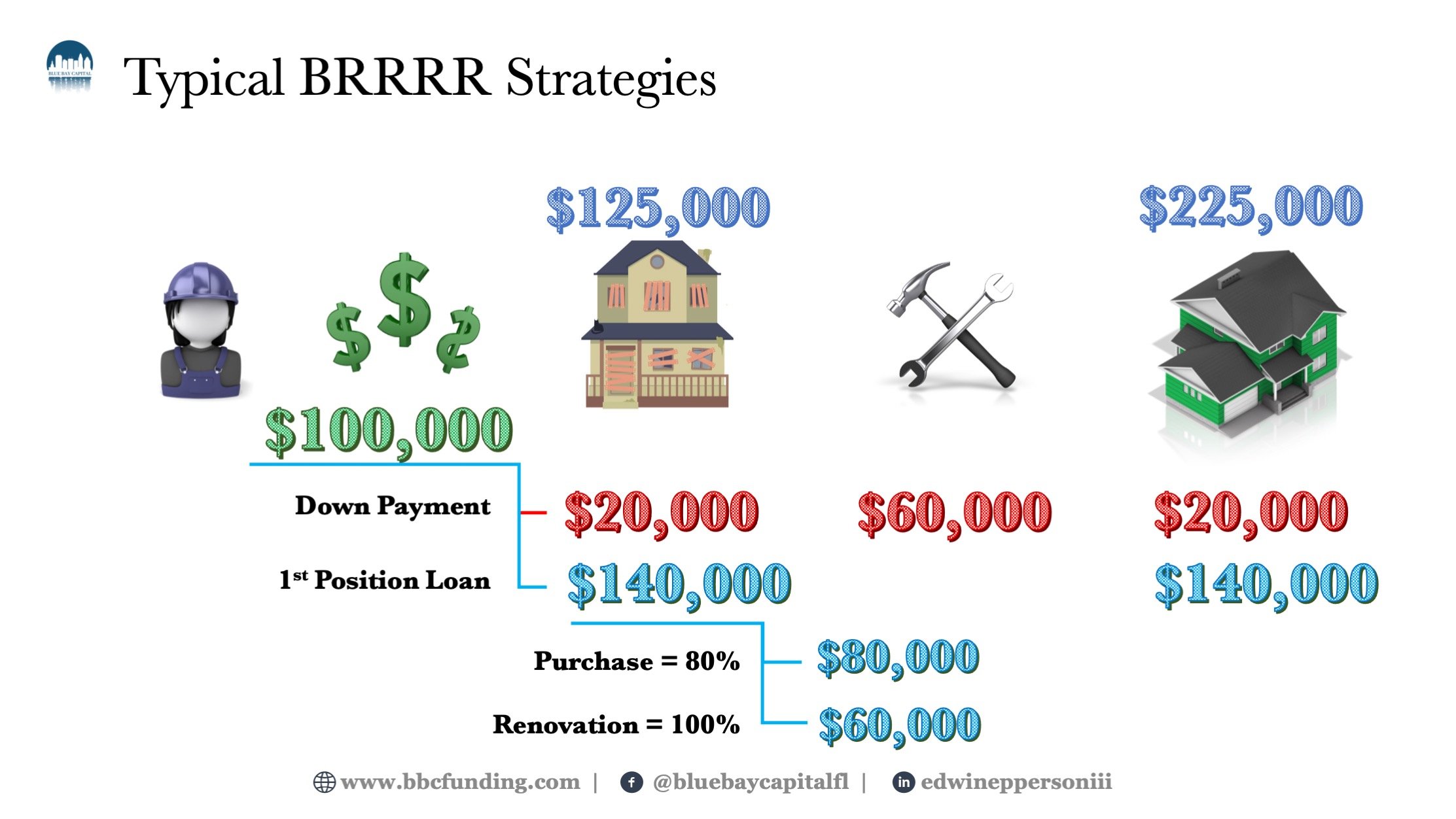

Calculating and Optimizing Your DSCR Ratio for Florida Investments

Step-by-Step Calculation Guide

Understanding how to calculate your Debt-Service Coverage Ratio (DSCR) is essential for making informed investment decisions. The DSCR can be calculated using a straightforward formula:

DSCR = Rent / PITIA

This formula compares the property’s rental income to its mortgage expenses, which encompass principal, interest, taxes, insurance, and any applicable association fees (PITIA). Let’s break this down step-by-step:

- Determine the monthly rental income: This is the gross rent you receive from your property.

- Calculate your total monthly expenses: Sum up your principal, interest, taxes, insurance, and association fees.

- Apply the DSCR formula: Divide the rental income by the total expenses to get your DSCR.

For example, if your monthly rental income is $2,950 and your total monthly expenses are $2,000, your DSCR would be:

DSCR = $2,950 / $2,000 = 1.475

A DSCR of 1.475 indicates a good cash flow as it is above 1, meaning the property generates more income than it costs to maintain.

Importance of a Good DSCR Ratio

A strong DSCR ratio is crucial for securing loans and ensuring long-term profitability. A DSCR of 1 implies that the property’s income exactly covers its expenses, leaving little room for error. Conversely, a higher DSCR ratio signifies a buffer, reflecting healthier cash flow.

Why is this important? Lenders often require a DSCR of 1.2 or higher before approving a loan. This ratio provides confidence that the property can continue to cover its mortgage payments even if unexpected expenses arise or rental income fluctuates.

- Loan Approval: A higher DSCR improves your chances of getting favorable loan terms.

- Financial Stability: A higher DSCR reduces the risk of negative cash flow.

- Investment Appeal: Properties with high DSCRs are more attractive to investors due to their lower risk.

Wouldn’t you prefer investments that offer peace of mind and stable returns?

Strategies to Improve DSCR

If your DSCR is lower than desired, several strategies can optimize it. Here are practical methods to enhance your DSCR:

- Increase Your Down Payment: By increasing your down payment, you can reduce your loan amount, thereby lowering your monthly mortgage payments and improving your DSCR.

- Negotiate Property Taxes and Insurance: Lowering these expenses can significantly impact your DSCR. Consider contesting your property tax assessment or shopping around for better insurance rates.

- Buy Down Your Rate: Some lenders allow you to pay upfront to lower your interest rate. Although this increases your closing costs, it will reduce your monthly payments, raising your DSCR.

- Increase Rents: Higher rental income directly improves your DSCR. Evaluate market rates regularly and adjust rents accordingly.

- Provide Upsells: Offering additional services such as renting to pet owners or providing furnished rentals can increase your rental income, thus improving your DSCR.

Implementing these strategies can transform an initially risky investment into a stable and profitable one.

Tools and Resources for Investors

Investors need access to the right tools and resources to manage and optimize their DSCR effectively. Here are some valuable tools:

- DSCR Calculators: Online calculators simplify the process of determining your DSCR. Tools like Zillow’s DSCR Calculator can be very effective.

- Financial Management Software: Software such as QuickBooks can help track expenses and income, providing a clear picture of your cash flow.

- Professional Services: Consider consulting with a property management company or a financial advisor who specializes in real estate to get personalized advice.

- Market Analysis Reports: Regularly reviewing market trends and rental rates through platforms like Realtor.com can help you stay competitive.

Wouldn’t it be beneficial to leverage these resources to make well-informed decisions and maximize your investment returns?

Exploring Popular Florida Markets for DSCR Loan Investments

Top Cities for Real Estate Investment

Recently, we have observed significant activity in various Florida markets. For instance, Tampa has seen a cash-out refinance with a loan amount of $343,000. This indicates a robust real estate market, attracting considerable investments.

In Kissimmee, a city known for its proximity to Orlando and major theme parks, we processed a purchase loan of $622,400. Investors are drawn to this city due to its high tourism rate and growing population.

Miami continues to remain a top choice for many investors. The city secured a $600,000 purchase loan, showcasing its continuous appeal. Miami’s real estate market is buoyed by international investments and a vibrant urban lifestyle.

“Miami’s real estate market is buoyed by international investments and a vibrant urban lifestyle.”

Market Trends and Demographics

Florida’s market trends reveal some interesting patterns. Tampa’s growth is driven by its expanding tech industry and high quality of life. The demographic shift towards younger, tech-savvy professionals is pushing up property values.

Kissimmee is benefiting from an influx of both tourists and new residents. The increasing population combined with a stable tourist economy makes it a lucrative market.

Miami’s demographic is diverse and dynamic. It attracts a mix of international buyers and local investors, ensuring a steady demand for properties.

- Tampa: Tech industry growth, younger population

- Kissimmee: Tourist-driven economy, growing population

- Miami: International investments, diverse demographics

Rental Income Potential

Investors often seek markets where rental income can provide steady returns. Tampa, for instance, offers excellent rental yields due to its vibrant job market and influx of young professionals.

Kissimmee’s rental market is bolstered by short-term vacation rentals. With its close proximity to Disney World, properties here enjoy high occupancy rates, particularly during peak seasons.

Miami’s rental market thrives on both short-term and long-term rentals. The city’s appeal to tourists and business professionals alike makes it a prime location for generating significant rental income.

- Tampa: High rental yields, vibrant job market

- Kissimmee: Vacation rental hotspot, high occupancy rates

- Miami: Diverse rental market, strong demand

Future Growth Projections

Future growth projections for these cities are promising. Tampa is expected to see continued growth due to its strategic investments in technology and infrastructure. As the city grows, property values are likely to rise.

Kissimmee is set to benefit from ongoing tourism developments and residential projects, ensuring sustained growth. The city’s plan to expand its amenities and infrastructure will further drive property appreciation.

Miami’s future growth is underpinned by its status as an international hub. The city remains a magnet for global investments, promising long-term real estate value.

“The city remains a magnet for global investments, promising long-term real estate value.”

Types of Properties Eligible for DSCR Loans in Florida

Residential Properties

Investors can explore financing options with DSCR loans for a variety of residential properties. These properties often include single-family homes, which are a common choice due to their stability and ease of management.

In addition, townhouses and condominiums also fall under eligible residential properties. These options provide the flexibility to cater to different market demands and tenant preferences.

Another viable option for DSCR loans is duplexes. These properties allow the investor to generate income from two rental units within a single building, optimizing the return on investment.

Single-family homes, townhouses, condominiums, and duplexes represent core eligible residential property types for DSCR loans.

Investors might also consider multi-unit residential buildings, typically those with up to four units. These properties offer increased rental income potential while still being classified under the residential category for financing purposes.

How do these various property types benefit real estate investors? They provide diverse opportunities to match investment strategies with market conditions and personal goals.

Vacation Rentals

Florida’s popularity as a tourist destination makes vacation rentals a lucrative option for DSCR loan financing. Properties used for short-term rentals can generate substantial income, especially during peak tourist seasons.

Examples of eligible vacation rental properties include beachfront homes and holiday villas. These properties attract premium rates due to their desirable locations and amenities.

How can investors determine if a vacation rental is a good fit for DSCR financing? Consider the property’s location, demand for short-term rentals in the area, and available amenities.

Another factor to consider is the management of vacation rentals. Professional management services can help maintain high occupancy rates and positive guest experiences, thus ensuring a steady income stream.

Investing in vacation rentals through DSCR loans can provide significant returns, leveraging Florida’s thriving tourism market.

Commercial and Multifamily Properties

Beyond residential options, DSCR loans also cater to commercial and multifamily properties. These properties typically yield higher rental incomes compared to single-family homes.

Commercial properties eligible for DSCR loans include small office buildings and retail spaces. These properties provide stable income through long-term leases with businesses.

Investors looking into larger ventures can consider multifamily properties with five or more units. These properties benefit from economies of scale and generally have lower vacancy rates.

Commercial and multifamily properties offer DSCR loan opportunities for robust income and diversified investment portfolios.

Another advantage of multifamily properties is the spread of risk. With multiple rental units, the impact of any single vacancy is minimized, ensuring consistent cash flow.

Commercial spaces also present opportunities for mixed-use developments, where residential units are combined with commercial or retail spaces, enhancing the property’s overall value and appeal.

Ineligible Property Types

While DSCR loans cover a broad spectrum of property types, some are not eligible. Understanding these exclusions is crucial for aligning investment strategies appropriately.

Raw land and unimproved lots fall under ineligible properties. These do not generate rental income, which is fundamental for DSCR loan qualification.

Another ineligible category includes timeshares. Due to their unique ownership structures and inconsistent rental income, they do not meet DSCR loan requirements.

- Raw Land: Does not produce the rental income needed for DSCR loan qualification.

- Unimproved Lots: Similar to raw land, these lack the revenue generation necessary for eligibility.

- Timeshares: Their ownership complexities make them unsuitable for DSCR financing.

Knowing which properties are ineligible helps investors focus on viable options for DSCR loan financing.

How does being informed about ineligible property types benefit investors? It ensures they target properties aligned with DSCR loan criteria, optimizing their investment potential and avoiding unnecessary pitfalls.

Steps to Qualify for a DSCR Loan in Florida

Minimum Credit Requirements

Understanding the minimum credit requirements is crucial when applying for a DSCR loan in Florida. Lenders often look for a reliable credit history to gauge the borrower’s ability to manage debt responsibly. A higher credit score generally indicates better financial health and a lower risk for lenders.

Most lenders require a minimum credit score of 620 for DSCR loans. However, some may set higher thresholds based on their risk tolerance and the specific loan terms. A strong credit score can not only improve your chances of approval but also secure more favorable interest rates.

Borrowers with a credit score above 700 typically receive more competitive offers from lenders. Those with scores below the minimum requirement might need to work on improving their credit before reapplying or consider alternative financing options.

It’s advisable to review your credit report and address any inaccuracies or outstanding issues before applying for a DSCR loan. Paying down current debts and maintaining timely payments can positively impact your score.

“A high credit score is often a key determinant in obtaining favorable loan terms and approval for DSCR loans.”

Regularly monitoring your credit score can help you stay on track and make necessary improvements swiftly. Financial advisors can also provide personalized strategies to enhance your credit profile.

Down Payment Expectations

The down payment is a significant aspect to consider when qualifying for a DSCR loan. Lenders require a substantial initial investment to mitigate their risks. The down payment amount can vary based on the property type, loan amount, and lender policies.

Typically, lenders expect a minimum down payment of 20-25% of the property’s purchase price. This requirement ensures that the borrower has a substantial stake in the investment, aligning their interests with the lender’s.

For instance, if you are looking to purchase a property valued at $500,000, you would need a down payment of at least $100,000 to $125,000. This sizable investment demonstrates your commitment and ability to manage your finances effectively.

- Conventional Properties: Often require around 20% down payment.

- Commercial Properties: May necessitate up to 25% down payment.

- Multi-family Units: Could have varying requirements based on the number of units.

It’s beneficial to save diligently and explore various financing options to meet these down payment expectations. Some borrowers may also consider leveraging equity from other properties or tapping into their savings and investments.

Property Cash Flow Potential

When applying for a DSCR loan, the property’s cash flow potential is a critical factor that lenders evaluate. The Debt Service Coverage Ratio (DSCR) measures the property’s ability to generate enough income to cover its debt obligations.

A higher DSCR indicates a stronger cash flow, increasing the likelihood of loan approval. Lenders typically look for a minimum DSCR of 1.25 or higher, indicating that the property’s income exceeds its debt payments by at least 25%.

For example, if a property generates $12,500 in monthly income and has $10,000 in debt obligations, its DSCR would be 1.25. Properties with higher DSCR values present lower risk to lenders and are more likely to be approved for financing.

- Evaluate Rental Income: Ensure the property can consistently generate rental income to cover mortgage payments.

- Assess Operating Expenses: Include maintenance, taxes, insurance, and other operating costs in your calculations.

- Review Market Conditions: Analyze the local rental market to gauge demand and potential income increases.

By conducting thorough due diligence and projecting realistic cash flow scenarios, borrowers can present a strong case to lenders, enhancing their chances of securing a DSCR loan.

Simplified Application Process

The application process for a DSCR loan can be more streamlined compared to traditional mortgages, focusing primarily on the property’s income-generating potential rather than the borrower’s personal income.

Borrowers typically need to provide detailed documentation of the property’s financial performance, including rental income statements, lease agreements, and expense reports. Lenders use this information to assess the property’s DSCR and overall viability.

“A well-prepared application package with comprehensive financial documentation can significantly expedite the approval process for a DSCR loan.”

Additionally, lenders may require an appraisal to determine the property’s market value and ensure it meets their lending criteria. This appraisal helps verify that the property can generate sufficient income to cover the loan payments.

Creating a compelling loan application involves:

- Organizing Financial Records: Compile all relevant income and expense documentation.

- Preparing a Property Analysis: Highlight the property’s strengths and income-generating capabilities.

- Communicating with Lenders: Understand the specific requirements and preferences of different lenders.

A streamlined, well-documented application not only simplifies the process but also enhances the likelihood of loan approval, enabling borrowers to secure financing with confidence.

Conclusion

Understanding DSCR loans unveils a beacon of opportunity for real estate investors in Florida. With their unique benefits—such as no income verification, simplified documentation, and flexible terms—DSCR loans stand out as an advantageous financial tool. Key aspects, such as higher loan limits and the ability to finance multiple properties, pave the way for scaling your investment portfolio effectively.

Exploring Florida’s diverse markets, from residential properties to commercial ventures, highlights the expansive potential that DSCR loans offer. By refining your DSCR ratio and leveraging market trends, investors can maximize rental income and foresee future growth. Ready to dive deeper into Florida’s real estate landscape? Now is the time to harness the power of DSCR loans and transform your investment strategy. Explore further, optimize your financial approach, and make informed decisions to elevate your real estate ventures.

Frequently Asked Questions

How do I qualify for a DSCR loan in Florida?

To qualify, you typically need a minimum credit score, a sufficient down payment, and property cash flow potential that meets the lender’s criteria.

How much do you need down for a DSCR loan?

Down payment requirements can vary but generally range from 20% to 25% of the property’s purchase price.

Is it hard to get a DSCR loan?

No, DSCR loans are designed to simplify the lending process, making them more accessible than traditional loans.

What are the cons of a DSCR loan?

Cons include higher interest rates and potentially stricter property cash flow requirements compared to traditional loans.

What types of properties are eligible for DSCR loans in Florida?

Eligible properties include residential properties, vacation rentals, and commercial and multifamily properties.

Why are DSCR loans beneficial for real estate investors?

They offer flexible terms, higher loan limits, and the ability to finance multiple properties.