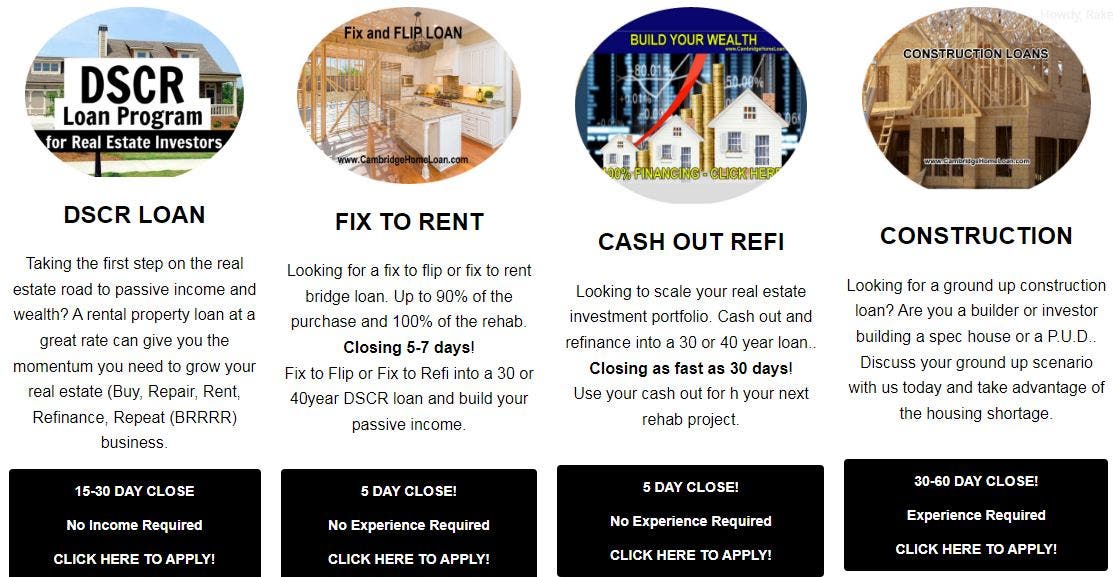

Understanding DSCR loans in Florida is crucial for investors aiming to optimize their real estate portfolio. These loans provide unique benefits, such as reduced documentation and no income verification, making the process significantly smoother compared to traditional mortgages.

With flexible terms like 30-year options and customizable rate structures, DSCR loans cater specifically to the needs of your investment strategy. Dive into this comprehensive guide to discover how these loans can simplify your financing choices and maximize your ROI in high-demand Florida markets.

Understanding DSCR Loans in Florida

What is a DSCR Loan?

Debt Service Coverage Ratio (DSCR) loans represent a financing option tailored specifically for real estate investors. These loans are evaluated based on the rental income generated by the property rather than the borrower’s personal income or credit history. Essentially, lenders assess the property’s ability to cover its own debt obligations by calculating the DSCR.

To determine the DSCR, the monthly rental income is divided by the property’s monthly debt obligations, including principal, interest, taxes, insurance, and association dues (PITIA). A ratio above 1.0 indicates that the property generates sufficient income to cover the mortgage payments.

Many lenders typically require a minimum DSCR of 1.2, indicating that the property earns enough to cover 120% of its debt obligations.

DSCR loans are highly advantageous for self-employed investors or those with substantial property portfolios. These investors often face challenges documenting their income or employment history. With DSCR loans, the focus shifts away from individual financial documentation towards the property’s cash flow potential.

Another benefit of DSCR loans is the variety of terms available. Lenders often provide options such as interest-only loans and flexible rate structures, allowing investors to tailor their loans to their specific needs. For instance, long-term investors may prefer fixed rates, while those planning to sell soon might opt for adjustable rates (ARMs).

- No Income Verification: Instead of traditional income documentation, DSCR loans rely on the rental income of the property.

- Streamlined Process: With fewer documentation requirements, the underwriting process is significantly expedited.

- Diverse Property Types: DSCR loans can finance various properties, including vacation rentals and multifamily units.

Benefits of DSCR Loans for Investors

For real estate investors in Florida, DSCR loans offer numerous benefits that make them an attractive financing option. One of the primary advantages is the ability to finance multiple properties simultaneously. Traditional lenders often impose limits, but DSCR loans provide the flexibility to expand portfolios efficiently.

Another critical benefit is that DSCR loans can close in a business name, such as an LLC. This structure not only provides potential tax benefits but also limits personal liability, which is crucial for professional investors.

Investors can also access substantial loan amounts, with some lenders offering up to $2.5 million. This makes DSCR loans particularly beneficial for those looking to invest in high-value properties or multiple units.

Visio Lending, for instance, has closed over 1,600 DSCR loans in Florida, amounting to over $411 million, demonstrating the demand and viability of these loans for real estate investors.

Interest-only options are another appealing feature. This allows investors to reduce their monthly payments initially and allocate resources towards other investments or property improvements. While DSCR loans tend to have higher interest rates due to the perceived risk, the ability to generate rental income can offset these costs.

- Portfolio Expansion: Finance up to 20 properties, enabling significant growth.

- Business Entity Flexibility: Loans can be closed in the name of an LLC or other business entities.

- Substantial Loan Amounts: Access up to $2.5 million, suitable for high-value investments.

For investors focused on long-term growth, DSCR loans offer full 30-year terms with no balloon payments. This stability allows for better financial planning and investment strategy execution. Additionally, DSCR loans support various property types, including single-family residences, vacation rentals, and commercial properties.

Key Differences Between DSCR Loans and Traditional Mortgages

While both DSCR loans and traditional mortgages provide financing for real estate investments, they differ significantly in their qualification criteria and application processes. DSCR loans are particularly suited for investors due to their unique focus on property income rather than personal income.

Traditional mortgages typically require extensive documentation, including tax returns, pay stubs, and employment history. In contrast, DSCR loans emphasize the property’s rental income, streamlining the application process by eliminating the need for personal financial documentation.

- Qualification Criteria: Traditional mortgages require personal income verification, while DSCR loans focus on the property’s cash flow.

- Documentation: DSCR loans do not need tax returns or employment history, making the underwriting process faster.

- Flexibility: DSCR loans offer more flexible terms and options, such as interest-only payments and varied rate structures.

“For real estate investors and self-employed borrowers, the DSCR program might be the ideal solution for those who have previously experienced discouraging loan processes.”

Another significant difference is the loan limit. Traditional lenders often restrict the number of mortgages an investor can hold, typically up to ten loans. DSCR loans, however, do not impose such limits, making them more suitable for building large portfolios.

Finally, DSCR loans accommodate a broader range of property types. While traditional mortgages may have stricter guidelines, DSCR loans can finance single-family residences, vacation rentals, and multifamily properties, providing greater versatility for investors.

How DSCR Loans Simplify the Loan Process

Less Documentation Required

Traditional loans typically necessitate extensive paperwork. The process involves assembling a variety of complicated income statements, such as tax returns and employment verification. Investors often find this daunting, given their diverse and complex financial situations.

In contrast, DSCR loans require significantly less documentation. The primary focus is on whether the property generates enough rental income to cover its debt obligations. This shift in focus means that there is no need to present the often cumbersome proof of income or job history.

Do you have numerous tax returns to file? Investors with vast portfolios know the struggle of managing multiple mortgaged properties. With DSCR loans, this burden is alleviated. Only the rental income potential of the property is taken into account.

Consider the time saved. Without the need to submit numerous financial documents, investors can streamline the loan application process significantly. This efficiency is particularly beneficial for investors juggling several properties at once.

For example, an investor with a diverse range of rental properties can effortlessly apply for a DSCR loan without presenting all their income streams. Instead, they focus solely on the rental income each property generates.

“The lessened documentation requirements for DSCR loans can save investors both time and effort, allowing them to focus on managing and expanding their portfolios.”

Isn’t it refreshing to skip most of the paperwork? This aspect of DSCR loans takes away much of the administrative hassle, making the loan process more efficient and investor-friendly.

Ultimately, less documentation translates to a smoother, faster process. Investors can concentrate on their primary objective—maximizing their rental income.

No Income Verification Needed

Conventional loans demand full verification of income, which can be a complex task for investors. This often involves presenting pay stubs, bank statements, and tax returns, resulting in a time-consuming process that may not accurately reflect an investor’s financial health.

DSCR loans, on the other hand, bypass the need for income verification. Instead of scrutinizing personal income, the focus is placed on the rental income generated by the property in question.

Imagine an investor who manages several rental properties. For them, verifying income through traditional means can be nearly impossible, owing to the fluctuating nature of rental income. DSCR loans simplify this by assessing the property’s ability to cover its debt.

Why complicate things with irrelevant income proof? Income verification is unnecessary for DSCR loans, allowing investors to move forward with their loan applications confidently.

An investor with an extensive property portfolio exemplifies this well. For such investors, showcasing rental income is more straightforward and relevant than proving personal income from various sources.

“The rental income-centric approach of DSCR loans eliminates the need for traditional income verification, streamlining the borrowing process for investors.”

This method makes DSCR loans particularly appealing to self-employed investors or those with non-traditional income sources. The focus is solely on the ability of the property to generate sufficient rental income.

Isn’t it easier to focus on rental income? The reduction in income verification steps not only speeds up the process but also provides reassurance to investors with complex financial pictures.

Simplified Underwriting Process

The underwriting process for conventional loans often involves strict scrutiny. Traditional lenders analyze numerous factors such as debt-to-income ratio (DTI), employment history, and credit scores. This rigorous process can be particularly challenging for investors with multiple properties.

Conversely, DSCR loans offer a simplified underwriting process. These loans are underwritten primarily based on the income potential of the property rather than the investor’s personal financial details.

For instance, an investor with multiple mortgaged rentals might face difficulties meeting traditional DTI requirements. With DSCR loans, the property’s income potential is the key underwriting criterion, making it easier for investors to qualify.

Why stress over DTI ratios when the focus can be on rental income? DSCR loans provide a more relevant measure by examining the property’s financial viability rather than personal income intricacies.

“The simplified underwriting process of DSCR loans focuses on property income, reducing the complexities associated with traditional loan underwriting.”

This streamlined approach thereby reduces the time and effort required to secure a loan. Investors can benefit from quicker approvals and less paperwork.

Additionally, the minimum credit score requirement for DSCR loans ensures that more investors can qualify. This, coupled with the property income focus, provides a straightforward path to securing financing.

Imagine skipping the rigorous traditional underwriting process. With DSCR loans, investors experience a more intuitive and less burdensome path to loan approval, making it a preferred choice for those managing large portfolios.

Flexible Terms and Fees with Florida DSCR Loans

30-Year Terms

Investors might ponder the ideal loan terms for their investment portfolio. One notable feature of DSCR loans in Florida is the 30-year term available to borrowers.

Why is this important? A 30-year term can significantly lower monthly payments, enhancing cash flow management. It allows for an extended repayment period, making it easier for investors to manage finances effectively.

Imagine the peace of mind that comes with knowing your loan terms are spread out over three decades. This extended period enables investors to focus on their property’s growth and revenue generation rather than the pressure of short-term repayments.

How does this compare to shorter terms? With shorter loan terms, monthly payments are inherently higher, which can strain cash flow. In contrast, a 30-year term spreads out the financial burden, providing a more manageable repayment structure.

“Longer repayment periods are particularly beneficial for investors seeking stability and predictable expenses,” notes financial advisor John Doe.

Despite the extended term, prepayment options are often available, allowing for loan flexibility if circumstances change. This blend of long-term security and short-term flexibility is a significant advantage.

Interest-Only Options

Another attractive feature for investors is the availability of interest-only options with Florida DSCR loans. These options can greatly benefit those looking to maximize cash flow in the early stages of property ownership or during renovations.

What exactly are interest-only options? Investors pay only the interest for a specified period, usually the first few years. This results in lower initial payments, freeing up capital for other investments or improvements.

Consider the scenario of acquiring a fixer-upper. The initial lower payments can be used to refurbish the property, thereby increasing its value before transitioning to full principal and interest payments when revenues are more substantial.

Why might an investor select this option? Interest-only payments provide greater financial flexibility and can be an excellent strategy to enhance liquidity and reinvest in high-yielding opportunities.

If your goal is to boost your property’s value, an interest-only period allows for reallocation of funds to immediate property enhancements, potentially leading to higher rental incomes or resale value.

- Enhanced Cash Flow: Lower payments initially increase available funds.

- Property Improvement: Funds saved can be used to enhance property value.

- Strategic Leveraging: Interest-only payments allow for strategic investment planning.

Customizable Rate Structures

Investors frequently seek loans that offer customizable rate structures to better align with their investment strategies. Florida DSCR loans provide this flexibility, addressing various financial goals and risk tolerances.

What does customizable rate mean? Lenders offer different interest rate options, allowing borrowers to choose between fixed and variable rates, depending on their financial strategy.

For instance, a fixed rate might be preferable for investors wanting predictable, stable payments. In contrast, a variable rate could be beneficial for those anticipating market interest rate drops, potentially lowering future payments.

How does this flexibility benefit investors? It empowers them to tailor their loan terms to their financial plan, optimizing loan performance relative to market conditions and personal risk tolerance.

Consider an investor planning to hold a property long-term with anticipated market growth. Selecting a fixed rate ensures stable payments, facilitating budget forecasting and long-term planning.

Alternatively, an investor with a short-term horizon might opt for a variable rate, capitalizing on lower initial rates and aligning with the property’s projected sale or refinancing window.

- Fixed Rate Stability: Ensures consistent payment amounts, aiding in financial planning.

- Variable Rate Flexibility: Potential for lower payments if market conditions are favorable.

- Strategic Alignment: Choice of rate structure aligns with investor’s financial goals.

This level of customization in rate structures truly exemplifies the flexibility afforded by DSCR loans in Florida, catering to diverse investment strategies and financial needs.

Calculating and Optimizing DSCR Ratios

Simple DSCR Calculation Formula

Understanding the Debt Service Coverage Ratio (DSCR) begins with a straightforward formula:

DSCR = Rent / PITIA

Where Rent is the monthly rental income and PITIA represents Principal, Interest, Taxes, Insurance, and Association fees. This concise formula allows us to gauge a property’s ability to cover its debt obligations.

Let’s illustrate with a basic example. Suppose the monthly expenses, including PITIA, are $2,000, and the rental income stands at $2,950. Using our formula:

DSCR = $2,950 / $2,000 = 1.475

This DSCR of 1.475 indicates that the property generates sufficient income to cover its monthly expenses with a surplus. Conversely, if the monthly rent is $2,000 and expenses rise to $2,950, the DSCR falls below 1, indicating a negative cash flow.

A DSCR of 1.2 or higher typically signals a healthy investment, ensuring the property’s cash flow exceeds its debt obligations. This ratio helps us identify cash flow positive properties, crucial for sustainable investments.

By mastering this simple calculation, real estate investors can make informed decisions, aligning their portfolios with financially sound properties.

Importance of DSCR Ratios

The Debt Service Coverage Ratio holds significant importance for real estate investors. Why is this so critical? Let’s delve into the reasons:

- Risk Assessment: DSCR helps us assess the risk associated with an investment. A higher ratio indicates a safer investment with less risk of default.

- Loan Approval: Lenders often use DSCR as a criterion for granting loans. A high DSCR increases the likelihood of loan approval, making it easier to acquire financing.

- Financial Health: Maintaining a good DSCR ensures the property’s income sufficiently covers its debt, indicating financial stability.

Consider a scenario where an investor evaluates multiple properties. The DSCR simplifies this process, providing a clear comparison of each property’s financial viability. We prioritize properties with higher DSCRs, reducing the chances of encountering cash flow issues.

Moreover, DSCR serves as a benchmark for ongoing financial performance. Periodic assessment of DSCR ratios can alert us to potential problems, enabling timely interventions to optimize cash flow and maintain investment health.

In essence, DSCR is a critical metric, guiding real estate investors toward profitable and secure investment decisions.

Emphasizing the importance of DSCR ratios ensures we remain vigilant, systematically evaluating and optimizing our investments for maximum returns.

Tips to Improve DSCR Ratios

Improving your DSCR ratio may seem challenging, however, simple strategies can substantially enhance it. Here are some practical tips:

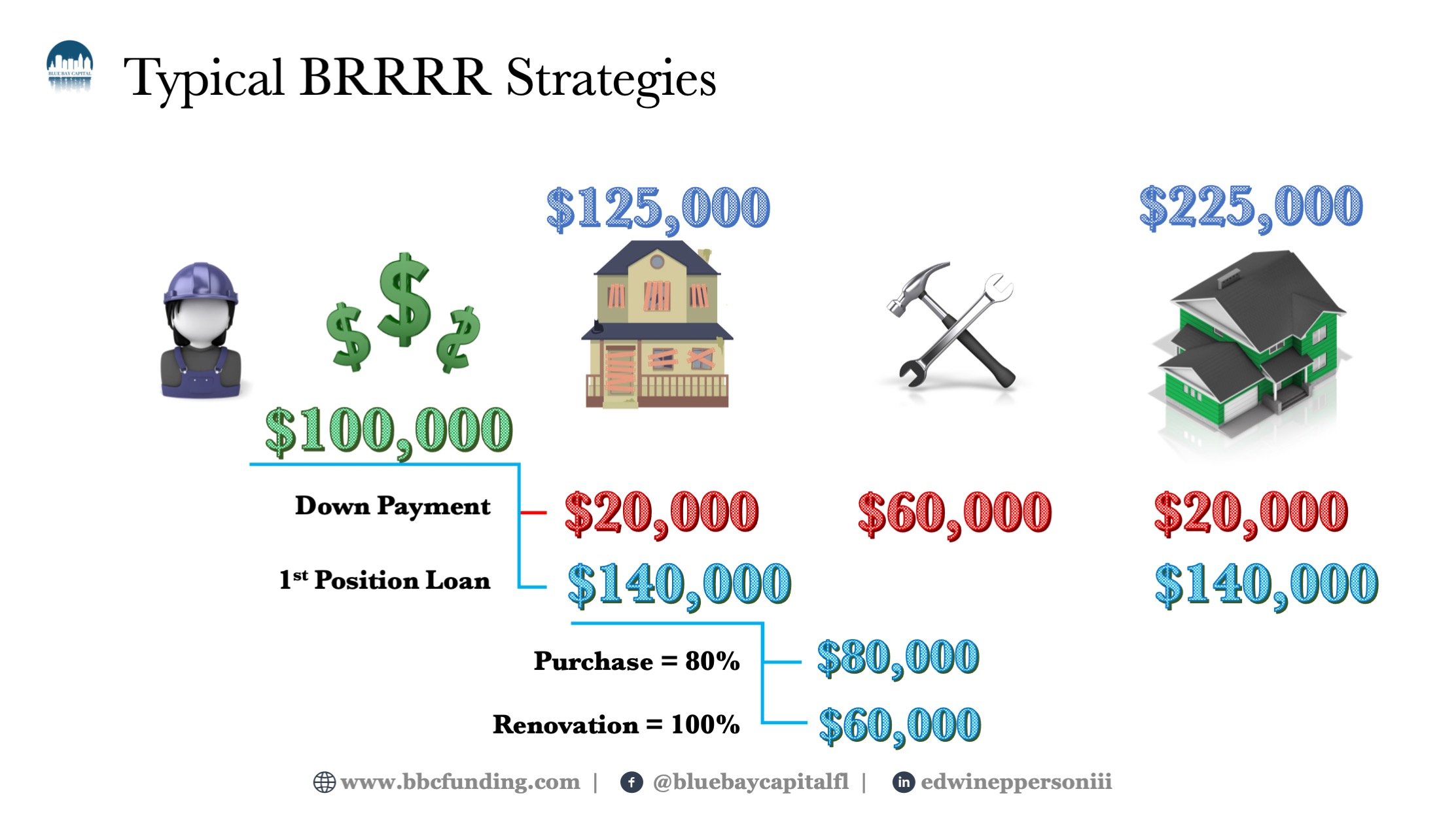

- Increase Your Down Payment: A larger down payment reduces loan amounts and monthly payments, consequently improving the DSCR. This method is straightforward and effective.

- Renegotiate Taxes and Insurance: By negotiating for lower property taxes and insurance premiums, we minimize expenses, thereby boosting the DSCR. Persistent negotiations can yield significant long-term savings.

- Buy Down Your Rate: Some lenders offer the option to buy down the interest rate, lowering the monthly mortgage payments. Though initial costs may increase, the long-term benefit to the DSCR can be substantial.

- Increase Rent: Higher rental income directly enhances the DSCR. Regular market evaluations can help us adjust rents appropriately, ensuring they align with current market conditions.

- Upsells to Increase Rental Rates: Offering additional services, such as furnished rentals or allowing pets, can justify higher rents. These upsells improve income, thus positively impacting the DSCR.

For instance, consider negotiating property taxes and insurance premiums. While the savings may seem marginal on a monthly basis, the cumulative effect over several years significantly impacts the overall DSCR, enhancing investment profitability.

Adopting these strategies creates a proactive approach to optimizing DSCR ratios, securing better loan terms, and ensuring our investments remain profitable.

Ultimately, these tips empower us to continuously refine our investment strategies, ensuring a robust and healthy cash flow.

Popular Florida Markets for DSCR Loan Investments

High-Demand Cities

Florida’s real estate market has seen substantial growth in certain high-demand cities. For investors looking to maximize their DSCR loan investments, considering markets with strong demand is crucial. Notable cities in this category include:

- Miami: Known for its vibrant culture and strong tourism sector, Miami offers high rental yields and consistent property appreciation.

- Tampa: With a diverse economy and increasing population, Tampa is an attractive market for real estate investments.

- Orlando: As a major tourist destination, Orlando provides lucrative opportunities for short-term rentals and vacation properties.

These cities not only promise high rental income but also offer potential for property value growth, making them ideal for DSCR loan investments.

ROI Potential

When considering DSCR loan investments, evaluating the return on investment (ROI) potential of various markets is vital. ROI potential can be influenced by several factors such as rental demand, property appreciation, and market stability. Let’s examine some Florida markets with notable ROI potential:

“In Florida, cities like Kissimmee have shown significant ROI due to their proximity to major tourist attractions.”

Investing in such areas can result in higher rental income and property value appreciation. The following list highlights other high-ROI potential cities:

- Jacksonville: A growing job market and affordable property prices make Jacksonville an attractive option for investors.

- Kissimmee: Proximity to Disney World and other attractions yields high rental demand.

- Fort Lauderdale: Offers a mix of luxury and affordable properties, appealing to a wide range of renters.

Understanding these factors can help investors pinpoint the best markets for maximizing their returns with DSCR loans.

Emerging Markets

While high-demand and high-ROI cities are attractive, identifying emerging markets can provide unique investment opportunities. These markets are often characterized by rapid growth, increasing property values, and untapped rental demand. Consider the following emerging markets in Florida:

- Gainesville: A growing university population drives rental demand, making it a promising market for investors.

- St. Petersburg: Urban revitalization projects have spurred property value growth in this city.

- Naples: Known for luxury real estate, Naples is witnessing rising demand from affluent renters.

Tapping into these emerging markets can offer investors the potential for significant returns as these areas continue to develop.

Importantly, identifying the ideal markets in Florida for DSCR loan investments requires a thorough understanding of high-demand cities, ROI potential, and emerging markets. By focusing on these regions, investors can make informed decisions that align with their financial goals.

Types of Properties Eligible for DSCR Loans in Florida

Eligible Residential Properties

Investors seeking to finance properties using DSCR loans should understand which residential properties qualify. These loans are often a great fit for certain residential property types under specific conditions.

First, consider single-family homes. These properties are typically straightforward investments and usually qualify for DSCR loans.

Second, townhouses and condominiums also fall under the umbrella of eligible residential properties. These types of homes often provide a good balance of affordability and potential rental income.

Another category includes duplexes, triplexes, and fourplexes. These multi-unit properties allow investors to house multiple tenants, thus increasing rental income potential.

“In the context of DSCR loans, even small residential complexes like duplexes or fourplexes can be highly beneficial.”, says John Doe, a real estate expert.

Moreover, properties intended for short-term rentals, such as vacation homes, can be financed with DSCR loans under certain conditions. This makes DSCR loans versatile for investors diversifying their portfolios within the residential real estate market.

What about manufactured homes? These can sometimes meet the DSCR loan criteria, provided they are permanently affixed to a foundation and meet other lending requirements.

Overall, residential properties present a variety of opportunities for investors utilizing DSCR loans, depending on the specific property characteristics and market conditions.

Commercial and Multifamily Properties

Commercial properties present another category eligible for DSCR loans. These include a variety of real estate types dedicated to business or professional use.

Retail spaces, such as shopping centers and strip malls, often qualify. These properties are attractive to investors due to their potential for stable, long-term leases from multiple tenants.

Office buildings, both large and small, can also be financed through DSCR loans. Such properties tend to offer steady income streams, particularly when located in busy commercial districts.

Another significant category is industrial properties. Warehouses, distribution centers, and manufacturing facilities often meet DSCR loan criteria, benefiting from consistent demand and long-term tenants.

- Retail Spaces: Shopping centers, strip malls, and stand-alone stores often qualify for DSCR loans.

- Office Buildings: Facilities used for professional services, suitable for DSCR financing.

- Industrial Properties: Warehouses and manufacturing plants, which can be excellent candidates for DSCR loans.

Beyond commercial properties, multifamily developments also stand out. These include apartment complexes and larger residential buildings designed to house multiple tenants.

Properties with five or more units, such as apartment buildings or large residential complexes, are typically well-suited for DSCR loans due to their potential for high rental income and occupancy rates.

It is crucial to note that, DSCR financing extends to a wide range of commercial and multifamily properties, offering flexibility and opportunities for investors to maximize their returns on various types of income-generating real estate.

Ineligible Property Types

Not all properties are viable candidates for DSCR loans. Investors must recognize the types that are generally deemed ineligible.

First, vacant land is usually excluded from DSCR loan programs. The absence of a revenue-generating structure makes it difficult to assess income potential.

Properties intended for speculative development also fall into the ineligible category. These are considered high-risk investments due to uncertain future income streams.

Furthermore, cooperatives, or co-ops, often don’t qualify. These properties involve shared ownership and governance structures that complicate financing through DSCR loans.

Mobile homes that are not permanently affixed may also face restrictions. DSCR lenders typically require properties to have permanent foundations to ensure stability and long-term value.

- Vacant Land: Lacks a revenue-generating structure, making it ineligible for DSCR loans.

- Speculative Developments: High risk due to uncertain future income streams.

- Cooperatives: Shared ownership structures complicate DSCR loan eligibility.

- Non-Permanent Mobile Homes: Often restricted as they lack stable, long-term value.

Another category includes properties with significant environmental or structural issues. Hazards such as contamination or severe damage can complicate financing and reduce a property’s viability for DSCR loans.

It’s essential for investors to conduct thorough due diligence to ensure the properties they are considering meet DSCR loan requirements, thereby avoiding potential pitfalls in the financing process.

Qualifying for a DSCR Loan in Florida

Credit Score Requirements

Understanding the credit score requirements is essential for qualifying for a DSCR loan. Credit scores play a pivotal role in determining loan eligibility, as they represent the borrower’s creditworthiness.

Lenders typically require a minimum credit score to consider a borrower eligible. This threshold can vary, but generally, a score of at least 620 is necessary. Some lenders might insist on higher scores, especially for larger loan amounts or more attractive terms.

Why does the credit score matter? It’s a reflection of one’s financial history. A higher score suggests a responsible borrowing and repayment record, while a lower score can signal potential risk to lenders.

“A strong credit score can significantly improve your chances of qualifying for a DSCR loan, offering more favorable terms and interest rates.”

Borrowers with scores lower than the required threshold may need to work on improving their credit. This can involve paying down existing debts, correcting errors on their credit report, or establishing a more consistent payment history.

Do lenders consider other factors besides the credit score? Absolutely. While the score is crucial, lenders also examine the borrower’s overall financial picture, including income, debt levels, and property value.

Is it possible to qualify with a lower credit score? In some cases, yes. Borrowers might offset a lower score with a larger down payment or demonstrate substantial property cash flow.

Ultimately, maintaining a good credit score is a crucial step in preparing for a DSCR loan application. Regularly checking and managing your credit can make a significant difference.

Down Payment Needs

The down payment is another critical aspect of DSCR loan qualification. Lenders usually require borrowers to make a substantial initial payment towards the property’s purchase price.

How much is typically required for a down payment? For DSCR loans, the down payment can range from 20% to 30% of the property’s value. This percentage can vary depending on the lender’s policies and the borrower’s creditworthiness.

Why such a high down payment? A larger down payment reduces the lender’s risk and demonstrates the borrower’s investment commitment. It also impacts the loan terms positively, often resulting in better interest rates.

- Down Payment Savings: Potential borrowers should start saving early to meet the down payment requirement. Setting up a dedicated savings account can be a useful strategy.

- Alternative Financing Options: Some borrowers might explore additional financing options, including personal loans or borrowing from retirement accounts, to accumulate the necessary down payment.

- Property Equity: For those refinancing, existing property equity can contribute to the down payment, reducing the need for cash outlay.

What if the borrower can’t make the full down payment? There might be options available, such as seeking a higher loan amount or exploring other loan programs that might have different requirements.

The down payment is a significant hurdle but planning and understanding your financial situation can help you navigate this requirement efficiently.

Property Cash Flow Potential

One of the unique aspects of DSCR loans is the focus on the property’s cash flow potential. Lenders use the Debt Service Coverage Ratio (DSCR) to assess whether the property generates sufficient income to cover the loan payments.

How is the DSCR calculated? It involves dividing the property’s annual net operating income (NOI) by its total debt service. A DSCR of 1 or higher typically indicates that the property can generate enough income to cover all debt obligations.

What is considered a good DSCR? Ideally, lenders prefer a DSCR of at least 1.2 to 1.5, indicating a comfortable margin of income over debt expenses.

Should potential borrowers focus on cash flow potential? Absolutely. Ensuring the property has strong rental income or other revenue sources is vital for DSCR loan approval. Positive cash flow demonstrates the ability to manage loan repayments effectively.

“A property with a higher DSCR is more appealing to lenders, as it signifies lower risk and higher income reliability.”

Strategies to improve property cash flow can include leasing to reliable tenants, minimizing vacancies, and controlling operating expenses.

Is it possible to qualify with a lower DSCR? In special cases, yes. Borrowers might need to provide additional evidence of income, commit to higher interest rates, or offer larger down payments.

Assessing and enhancing your property’s cash flow potential now can facilitate a smoother loan approval process, making it a critical consideration for DSCR loan applicants.

Conclusion

Understanding DSCR loans in Florida opens a realm of possibilities for savvy investors. With benefits including simplified underwriting, no income verification, and flexible terms, these loans stand out as a game-changer. The streamlined process and less stringent documentation requirements make it easier for investors to secure financing and focus on boosting their portfolio.

Choosing the right markets and property types can maximize returns, highlighting the importance of strategic planning and optimization of DSCR ratios. As you consider DSCR loans, remember to weigh factors like credit score and property cash flow potential. Embrace the opportunities these loans present, and take the next step towards investing in high-demand Florida markets. Explore further, optimize wisely, and unlock the potential that DSCR loans offer for your financial growth.

Frequently Asked Questions

How do I qualify for a DSCR loan in Florida?

Qualifying for a DSCR loan in Florida typically requires a good credit score, a sufficient down payment, and strong property cash flow potential.

How much do you need down for a DSCR loan?

Down payments for DSCR loans usually range from 20% to 25% of the property’s value.

Is it hard to get a DSCR loan?

DSCR loans are generally easier to obtain than traditional mortgages due to less stringent documentation and no income verification.

What are the cons of a DSCR loan?

Cons of DSCR loans may include higher interest rates and limited eligibility for certain property types.

What is a DSCR loan?

A DSCR loan is a type of mortgage that assesses a property’s cash flow to determine eligibility, rather than the borrower’s personal income.

What types of properties are eligible for DSCR loans in Florida?

Eligible properties include residential, commercial, and multifamily properties, while vacation homes and raw land are usually ineligible.