Understanding DSCR (Debt Service Coverage Ratio) loans can significantly impact your real estate investment strategy. This comprehensive guide delves into the definition, key features, and eligibility criteria of DSCR loans, elucidating why they are a preferred choice for many investors.

From max LTV to special provisions for foreign nationals, this article provides critical insights and practical tips for maximizing your returns with DSCR loans. Dive in to explore the numerous benefits and strategic advantages these loans offer.

Understanding DSCR Loans: A Comprehensive Guide

Definition and Importance of DSCR Loans

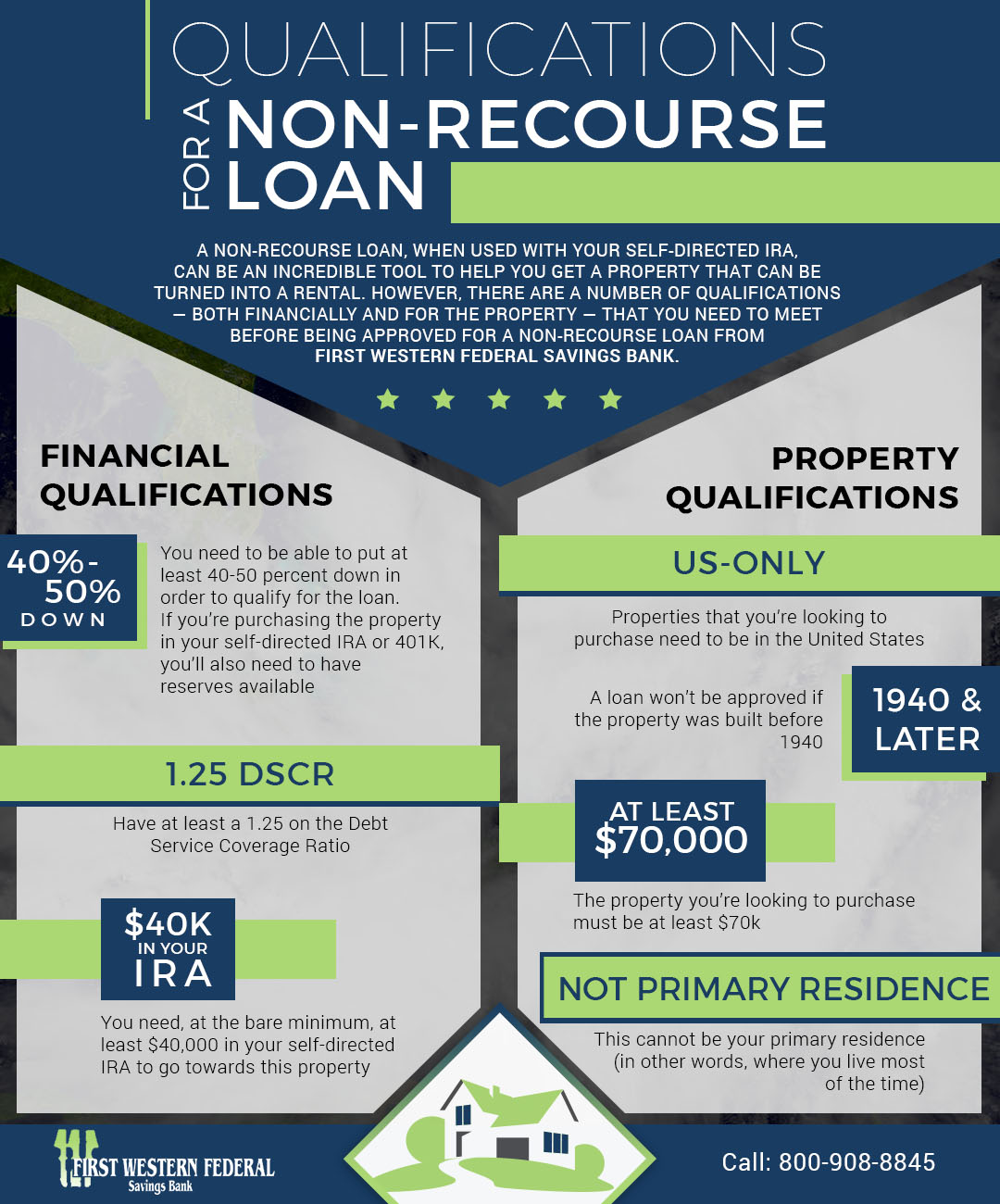

Debt Service Coverage Ratio (DSCR) loans represent a specialized financing option geared predominantly towards experienced real estate investors. The DSCR is a metric used to evaluate an investment’s ability to generate sufficient income to cover its debt obligations. Specifically, it is calculated as the ratio of monthly rental income from an investment property to the property’s total monthly expenses, which include principal, interest, taxes, insurance, and HOA fees.

Why are DSCR loans important in the realm of real estate investment? These loans play a crucial role by providing an alternative to traditional mortgage loans, especially for individuals or entities that might not meet conventional lending criteria. Key advantages include the flexibility to qualify based solely on property cash flows, without requiring detailed income verification or employment status.

To illustrate, consider an investor unable to qualify for a traditional mortgage due to insufficient personal income documentation. With a DSCR loan, as long as the property’s rental income covers the housing expenses, the investor gains access to necessary financing. This makes the DSCR loan an attractive option in mitigating the risks associated with fluctuating personal incomes or complex financial circumstances.

“The DSCR program is the most popular Non-QM product in house mortgage loans,” reflecting its widespread acceptance and reliability among investors.

Ultimately, DSCR loans serve as a financial tool that not only simplifies the borrowing process but also opens up opportunities for a broader range of investors. How might this impact your investment strategy?

Importantly, understanding the definition and importance of DSCR loans allows real estate investors to navigate the complexities of property financing with greater ease and confidence.

Key Features of DSCR Loans

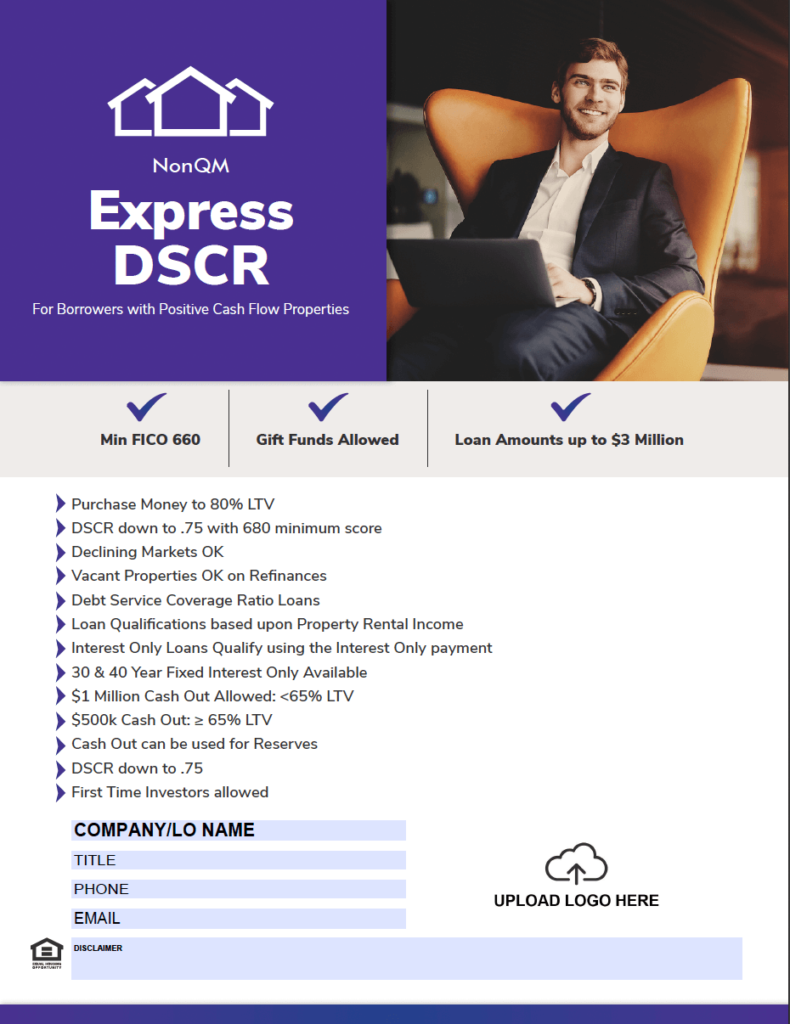

One of the most compelling features of DSCR loans is their focus on rental income. Unlike traditional loans, these do not require borrowers to prove their personal income or employment status, making them accessible to a diverse group of investors.

Another significant attribute is the “No Ratio DSCR” option. This means that even if the rental income is relatively low or negligible, it does not automatically disqualify the borrower. Such flexibility can be crucial for properties with high appreciation potential despite lower initial rental income.

- Minimal Documentation: No need for extensive income verification, simplifying the application process.

- Low DSCR Threshold: Loans can be approved with a DSCR as low as zero, allowing financing even when rental income is minimal.

- Foreign National Eligibility: DSCR loans are available to foreign nationals, including those with F1 visas.

Moreover, DSCR loans offer various product options, including interest-only payment plans and the ability to qualify properties with up to four units. These features provide investors with the financial flexibility to manage their properties more effectively.

For instance, an investor purchasing a multi-unit property can leverage DSCR loans to maximize their investment potential without the burden of traditional income proof. Can this adaptability enhance your real estate portfolio?

It is crucial to note that, the distinguishing features of DSCR loans make them a suitable choice for investors aiming to streamline their investment process and expand their opportunities in the real estate market.

Eligibility Criteria

To qualify for a DSCR loan, applicants must meet specific criteria designed to ensure the property’s viability as a reliable income source. These criteria focus less on the borrower’s personal financial situation and more on the property’s potential to cover its debt obligations.

Key criteria include:

- Property Type: Must be an investment property, typically including single-family residences and properties with up to four units.

- DSCR Calculation: The property’s rental income must adequately cover the mortgage’s principal, interest, taxes, and insurance (PITI).

- Credit Score: Minimum credit score requirements often apply, usually around 620 or higher.

Interestingly, DSCR loans cater to first-time investors as well as seasoned professionals. This inclusivity is vital for diversifying the investment landscape. Furthermore, loans can be made to entities rather than individuals, enhancing privacy and flexibility in property management.

Gift funds are also acceptable, providing additional avenues for meeting down payment requirements without tapping into personal reserves. Additionally, appraisal transfers are often acceptable, ensuring that the property value assessments are current and accurate.

Can these criteria streamline your path to successful property investment?

Understanding and meeting the eligibility criteria for DSCR loans can significantly enhance your ability to secure financing for promising real estate investments.

Benefits of Choosing DSCR Loans

Opting for a DSCR loan offers numerous advantages that can significantly impact your real estate investment strategy. One of the most notable benefits is the simplified approval process. With a heavy emphasis on the income generated from the property rather than the borrower’s personal income, obtaining a DSCR loan can be much quicker and less cumbersome.

Additionally, the flexibility in documentation requirements means that borrowers do not need to provide extensive proof of income or employment, making the process more streamlined. This can be especially beneficial for those with complex financial situations or fluctuating personal incomes.

- Quicker Loan Closures: Less paperwork leads to faster loan processing times.

- Higher Loan Amounts: Financing options available from $150K up to over $30 million.

- Interest-Only Options: Allows for lower initial payments, freeing up cash flow for other investments.

For instance, an investor with multiple rental properties can benefit from DSCR loans by leveraging the rental income of one property to secure financing for another, thereby expanding their portfolio without the traditional hurdles of income verification.

Moreover, DSCR loans welcome foreign nationals and first-time investors, further broadening their applicability. This inclusiveness ensures that a more diverse pool of investors can access the funding they need to grow their real estate ventures.

Have you considered how these benefits can optimize your investment strategy?

In essence, the myriad benefits of DSCR loans make them an advantageous option for real estate investors looking to maximize their investment potential while minimizing the complexities associated with traditional loan qualifications.

Key Highlights of the DSCR Loan Program

Max LTV and Loan Amount

One of the key features of the DSCR loan program is the maximum loan-to-value (LTV) ratio. This ratio determines the highest loan amount that can be borrowed relative to the property’s appraised value. For DSCR loans, the maximum LTV can reach up to 80%, making it an attractive option for investors looking to finance a significant portion of their property without a substantial down payment.

Another essential aspect is the maximum loan amount. DSCR loans typically allow for high loan amounts, which can be beneficial for investors interested in high-value properties. These loans can often go up to several million dollars, providing flexibility and potential for larger-scale investments.

For many real estate investors, the ability to borrow a higher amount with a favorable LTV ratio can significantly enhance their investment strategy and opportunities.

Understanding these figures is crucial. A higher LTV means less initial capital outlay, which might be more manageable. However, it also implies higher loan amounts over time, so balancing immediate needs with long-term financial health is essential.

Moreover, the terms of LTV and loan amounts can vary by lender. Therefore, investors must compare offers to identify the most advantageous conditions aligning with their investment goals.

Importantly, the combination of high LTV ratios and substantial loan amounts makes DSCR loans a robust financing solution for ambitious real estate investments.

FICO Score Requirements

The DSCR loan program also considers the borrower’s creditworthiness, typically assessed through FICO scores. Generally, a higher FICO score indicates lower risk, resulting in better loan terms.

In many instances, DSCR loan programs may have more lenient credit requirements compared to traditional loans. This can be particularly advantageous for investors who might not have a stellar credit history but still possess the financial acumen to manage income-generating properties.

DSCR loans often provide a pathway for investors who might struggle with conventional loan applications due to less-than-perfect credit scores.

For example, while traditional loans might require a FICO score of 700 or higher, DSCR loans can sometimes be accessible to borrowers with scores in the mid-600s. This flexibility expands opportunities for a broader range of investors.

However, it is important to note that a higher credit score can still offer advantages, such as lower interest rates and more favorable terms. So, while accessing DSCR loans might be easier, maintaining good credit is still beneficial.

Rental Income Qualification

A unique feature of the DSCR loan program is how it qualifies rental income. This program primarily focuses on the property’s cash flow rather than the borrower’s income, providing a significant benefit for real estate investors.

With DSCR loans, the property’s rental income must cover the debt service, meaning monthly rental income should be equal to or greater than the loan’s monthly payment. This method ensures that the property can sustain itself financially without relying on the borrower’s other income sources.

This focus on rental income aligns well with the investment strategy of those who rely on property income to manage loan payments.

For example, an investor with multiple rental properties can qualify for DSCR loans based on the performance of each property. The emphasis on rental income over personal income allows for greater leverage and scalability in building a real estate portfolio.

Investors should ensure their rental properties are well-managed and consistently generate sufficient income, as this will be a critical factor in securing and maintaining a DSCR loan.

Special Provisions for Foreign Nationals

Another noteworthy aspect of the DSCR loan program is its special provisions for foreign nationals. These provisions allow non-U.S. citizens to access financing for real estate investments, which can be more challenging with traditional loans.

DSCR loans often have tailored criteria that consider the unique circumstances of foreign investors, such as different documentation and credit evaluation processes. This inclusivity opens the U.S. real estate market to a global audience, providing opportunities for international investors to diversify their portfolios.

For foreign nationals, DSCR loans offer a streamlined and accessible way to invest in U.S. real estate, leveraging the stable and potentially lucrative market conditions.

However, foreign investors should be aware of additional requirements or restrictions that might apply, such as higher down payment requirements or specific legal and tax considerations.

Engaging with knowledgeable financial advisors and legal experts is recommended to navigate these complexities and optimize investment outcomes.

- Documentation: May include international credit reports, passport identification, and proof of residency.

- Down Payments: Often higher to mitigate perceived risk, typically ranging from 30% to 50%.

- Legal Considerations: Understanding U.S. real estate laws and tax obligations to ensure compliance and favorable conditions.

Eligibility and Qualification Criteria for DSCR Loans

Income and Employment Status

Understanding the **income and employment status** requirements is crucial for qualifying for a DSCR loan. Unlike traditional loans, DSCR loans focus less on personal income and more on the **cash flow** generated by the property.

Borrowers need to demonstrate that the property’s income can cover its debt obligations. This means providing **evidence of rental income**, often through lease agreements or **rental history**. Accurate and up-to-date financial records can make or break your application.

Are you self-employed or part-time? These factors might influence your eligibility, but they are not necessarily disqualifying. The emphasis remains on the **debt service coverage ratio (DSCR)**, not your job status.

Further, some lenders may require a **minimum employment period** if personal income is considered. However, it’s important to note that **strong rental income** often outweighs personal employment factors.

“The property’s ability to generate sufficient rental income to cover debt payments is the cornerstone of DSCR loan qualification.” – Financial Advisor

Consider using **financial advisors** or **loan officers** to ensure your income documentation aligns with DSCR loan standards.

- Lease Agreements: Provide copies of current and past lease agreements to prove consistent rental income.

- Rental History: A detailed rental history report can illustrate the property’s income stability.

- Financial Records: Keep accurate and updated financial statements to support your application.

Tax Return Requirements

Tax returns play a pivotal role in the eligibility assessment for DSCR loans. They provide a window into the financial health of the **borrower and the property**.

Lenders typically review the last 2-3 years of tax returns. This helps verify income sources, including rental income. Are there discrepancies or inconsistencies in your filings? Such issues can lead to application denial.

Are you aware that tax deductions can impact your eligibility? High deductions may be viewed unfavorably, as they can lower your perceived income. It’s a delicate balance between optimizing tax savings and maintaining strong income visibility for lenders.

Honesty is essential. Misrepresenting tax information can lead to severe repercussions, including loan denial or legal issues. Transparency with your accountant can ensure that your tax returns are prepared accurately.

“Clear and consistent tax returns are integral to demonstrating financial credibility and securing a DSCR loan.” – Certified Public Accountant

Be meticulous with your records and consult professionals if needed.

- Consistent Filings: Ensure there is consistency in your tax filings over the past few years.

- Income Verification: Use tax returns to verify income, particularly from rentals.

- Professional Consultation: Consult with accountants to accurately prepare your tax documentation.

Minimum FICO Score

A minimum FICO score is a common criterion for DSCR loan eligibility. This score reflects your creditworthiness and reliability in repaying debt.

Generally, lenders require a **minimum FICO score of 620**. However, higher scores can significantly benefit you, often leading to more favorable loan terms and interest rates.

Why does your credit score matter? It indicates your financial responsibility and ability to manage debt. A higher score can inspire greater confidence in lenders.

It’s wise to review your credit report for any errors or negative marks. Addressing these issues before applying can enhance your eligibility.

“A strong FICO score not only meets DSCR loan requirements but also opens doors to better loan conditions.” – Credit Analyst

Maintaining good financial habits, such as timely payments and managing credit utilization, can help improve your FICO score.

- Credit Report Review: Regularly review your credit report to identify and correct any inaccuracies.

- Timely Payments: Ensure all debt payments are made on time to maintain or improve your FICO score.

- Financial Management: Practice good financial habits to keep your credit score high.

Property Types Eligible

Qualifying for a DSCR loan also involves ensuring that the property type meets lender criteria. **Eligible property types** often include various forms of residential and commercial real estate.

Residential properties such as **single-family homes**, multifamily units, and condos are typically eligible. Commercial properties, including **office buildings**, retail spaces, and mixed-use properties, may also qualify.

The property’s primary requirement is its ability to generate sufficient rental income. Therefore, properties in high-demand locations with stable rental markets are preferred.

“Choosing the right property type is essential for meeting DSCR loan eligibility and ensuring profitable investments.” – Real Estate Consultant

Have you considered the location and market demand? These factors significantly affect rental income and, consequently, loan qualification.

Conduct thorough **market research** and consult with real estate professionals to ensure your property aligns with DSCR loan requirements.

- Residential Properties: Single-family homes, multifamily units, and condos are commonly eligible for DSCR loans.

- Commercial Properties: Office buildings, retail spaces, and mixed-use properties can qualify if they generate rental income.

- Market Demand: Properties in high-demand areas with stable rental markets are favored by lenders.

Benefits of DSCR Loans for Real Estate Investors

No Income Verification

DSCR loans are particularly appealing because they do not require traditional income verification. While most loans require detailed documentation of the borrower’s income, DSCR loans focus on the cash flow generated by the property.

For real estate investors, this means avoiding the lengthy process of gathering pay stubs, tax returns, and other financial documents. The emphasis is placed on the property’s ability to cover the loan payments, which can be a huge benefit for those with complex financial situations.

“Instead of scrutinizing personal income, DSCR loans rely on the property’s Debt Service Coverage Ratio, making it easier for investors to qualify based on the income the property generates.”

Imagine not having to present your last two years of tax returns or employment verification. This streamlined process significantly reduces the time and effort required to secure financing.

Which investor wouldn’t want a quicker and simpler financing process?

This feature makes DSCR loans especially attractive to those who own multiple properties or have varied income streams.

By focusing on cash flow from the property, DSCR loans eliminate the need for tedious income documentation, enabling faster and often easier approval.

Ultimately, the no income verification approach aligns with the interests of real estate investors looking to expand their portfolios efficiently.

Low DSCR Minimums

Another significant advantage of DSCR loans is the low Debt Service Coverage Ratio (DSCR) minimums. This metric compares the property’s income to its debt obligations, giving lenders insight into its profitability.

For investors, having a low DSCR threshold means that even properties with modest income can qualify for financing. This opens up opportunities to invest in a wider range of properties.

In many cases, lenders may offer DSCR loans with minimum ratios as low as 1.0 or 1.1.

Consider a property that just breaks even after expenses. Traditional lenders might view this as a risky investment, but with low DSCR requirements, it can still qualify for financing under a DSCR loan.

For savvy investors, this flexibility can be the key to acquiring undervalued properties that have the potential for increased profitability.

Why limit your investment options due to stringent income requirements when DSCR loans offer a more accommodating approach?

Low DSCR minimums are beneficial, particularly for those looking to invest in properties that need a little renovation or improvement to boost their income.

“Low DSCR minimums allow investors to secure financing for properties with potential, focusing on future profitability rather than current income.”

Flexibility for Foreign Nationals

The flexibility of DSCR loans extends to foreign nationals, making it easier for international investors to enter the U.S. real estate market. Traditional loans often require extensive documentation, including proof of income and credit history, which can be challenging for foreign nationals to provide.

DSCR loans, on the other hand, primarily consider the income generated by the property. This approach simplifies the process for foreign investors who may not have a U.S. credit history or conventional income verification.

Why let borders limit your investment opportunities?

Foreign nationals can take advantage of DSCR loans to invest in lucrative U.S. markets without the usual hurdles associated with traditional financing.

By focusing on the property’s cash flow, lenders can extend financing to a broader range of investors, facilitating global investment in U.S. real estate.

Imagine bypassing the usual barriers and accessing new markets with ease.

This flexibility not only broadens investment opportunities but also attracts diverse investors, contributing to a more dynamic real estate market.

“DSCR loans provide a unique advantage for foreign nationals, eliminating many of the conventional documentation requirements and focusing on the property’s income potential.”

Suitable for High Liability Borrowers

Lastly, DSCR loans are particularly suitable for high liability borrowers, who might find it challenging to secure traditional financing due to their debt levels. High liabilities can deter conventional lenders, but DSCR loans offer a different perspective.

For these borrowers, the emphasis on the property’s income rather than personal financial health can mean the difference between securing a loan and being turned down.

Why let high liabilities prevent you from seizing investment opportunities?

With DSCR loans, investors can demonstrate the property’s ability to support its debt obligations, even if their personal financial situation is less than ideal.

This approach enables borrowers with significant liabilities to leverage the cash flow of their investment properties to secure needed financing.

High liability doesn’t have to be a barrier to investment success.

Consider the potential benefits of focusing on the property’s performance rather than personal financial constraints.

“For investors with high liabilities, DSCR loans offer a lifeline by shifting the focus to the property’s income, making it easier to secure financing.”

This feature can be particularly advantageous for real estate investors who are already heavily leveraged but looking to expand their portfolios.

How to Calculate DSCR for Your Investment Property

Understanding DSCR Calculation

The Debt Service Coverage Ratio (DSCR) is a crucial metric that allows investors to evaluate the financial performance of an investment property. To calculate DSCR, we need to divide the property’s net operating income (NOI) by its total debt service.

Net Operating Income is the total income generated from the property, minus the operating expenses. This includes rent, parking fees, and other income sources.

Total debt service encompasses all the debt obligations, including principal and interest payments on loans.

For instance, a property with an NOI of $100,000 and annual debt service of $80,000 would have a DSCR of 1.25.

But why is this important? A higher DSCR indicates that the property generates sufficient income to cover its debt obligations.

In essence, DSCR is a reflection of a property’s ability to sustain its debt through generated income.

Do you see how a lower DSCR can spell risk? It means the property is closer to its income barely covering its debt obligations.

Expenses Included in DSCR

When calculating DSCR, it’s essential to accurately account for all relevant expenses. What are these expenses?

Operating expenses encompass the costs necessary to manage and maintain the property. This includes:

- Property Taxes: Annual taxes levied on the property by the government.

- Insurance: Premiums paid to protect the property against risks.

- Utilities: Costs for electricity, water, gas, and other essential services.

- Maintenance and Repairs: Regular upkeep and unexpected repairs.

- Property Management Fees: Fees paid to a management company for overseeing the property.

Excluding any relevant expense from your DSCR calculation can lead to inaccurately high ratios, which may affect your investment decisions.

Impact of DSCR on Loan Approval

DSCR plays a pivotal role in the loan approval process for investment properties. Banks and lenders consider DSCR as a measure of risk. How does a low DSCR influence their decisions?

Most lenders prefer a DSCR of at least 1.25. A lower DSCR indicates a higher risk of loan default, making lenders hesitant to approve such loans.

“A property with a DSCR below 1 might not generate enough income to cover its debt, posing a risk to both the investor and the lender.”

Conversely, a higher DSCR reassures lenders of the property’s ability to meet its debt obligations, facilitating loan approval.

Understanding the crucial role of DSCR in loan approvals can help you better prepare for financing discussions and improve your investment strategies.

Examples of DSCR Calculations

Let’s walk through a few examples to better understand how to calculate DSCR for an investment property.

Consider a scenario where an investor owns a multi-family property that generates an annual NOI of $150,000. The total debt service for the same period is $100,000.

- Calculate NOI: Add up all income sources and subtract operating expenses.

- Determine Total Debt Service: Sum up all principal and interest payments.

- Divide NOI by Total Debt Service:

$150,000 ÷ $100,000 = 1.5

In this case, the DSCR is 1.5, indicating that the property’s income is 1.5 times its debt obligations.

How about a smaller property? If a single-family rental generates $50,000 in NOI and has a debt service of $40,000, the DSCR would be calculated similarly:

- Calculate NOI: Determine the total income and subtract expenses.

- Determine Total Debt Service: Calculate all debt-related payments.

- Divide NOI by Total Debt Service:

$50,000 ÷ $40,000 = 1.25

Such examples aid in understanding the practicality of DSCR in evaluating the financial health of investment properties.

Maximizing Real Estate Investments with DSCR Loans

Strategies for Using DSCR Loans

When evaluating strategies for utilizing DSCR loans, investors must first understand the Debt Service Coverage Ratio itself. This metric measures the property’s ability to cover its debt obligations with its net operating income.

It’s important to select properties with a high DSCR, typically above 1.25, to ensure the property generates more income than the debt it services. This minimizes risk and maximizes cash flow.

“A property with a DSCR of 1.5 or higher indicates robust income relative to debt obligations, providing a cushion against vacancies or market downturns.”

Investors should also consider refinancing existing properties with favorable DSCR. This can lower interest rates and increase cash flow.

Engaging in thorough market research is another critical strategy. Identifying markets with strong rental demand and limited supply can enhance the property’s income potential, thereby improving its DSCR and investment attractiveness.

- High DSCR Properties: Focus on properties with DSCRs above 1.25 to ensure positive cash flow.

- Refinancing Opportunities: Refinance existing loans to take advantage of lower interest rates and improve cash flow.

- Market Research: Conduct thorough research to find high-demand, low-supply markets that support strong rental income.

Lastly, leveraging professional networks and financial advisors can provide additional insights and opportunities that may not be apparent without specialized expertise.

Case Studies

Examining real-world examples can provide concrete insights into the benefits and challenges of DSCR loans. Consider an investor who purchased a multifamily property with a DSCR of 1.3 in an emerging market.

This investor utilized DSCR loans to finance 75% of the purchase price, minimizing their capital outlay. The property’s strong rental income covered debt payments and allowed for reinvestment in other opportunities.

“By leveraging a DSCR loan, the investor achieved a 12% annualized return, significantly higher than traditional financing methods would have allowed.”

Another case study involved refinancing a commercial property. The investor improved the property’s DSCR from 1.1 to 1.5 by refinancing at a lower interest rate, increasing net cash flow by 20%.

- Multifamily Property Investment: Used DSCR loans to finance 75% of the purchase, achieving a high annualized return.

- Commercial Property Refinancing: Improved DSCR through refinancing, boosting net cash flow significantly.

- Office Space Acquisition: Strategically used DSCR loans to minimize cash outlay and maximize investment return.

These case studies illustrate the versatility and potential of DSCR loans in various real estate contexts, underscoring their value in strategic investment planning.

Long-term Benefits

The long-term benefits of utilizing DSCR loans include enhanced financial stability and increased investment returns. By ensuring properties have adequate income to cover debt, investors can mitigate risks associated with market fluctuations.

Furthermore, properties with high DSCRs tend to be more attractive to future buyers or refinancers, potentially increasing the property’s resale value.

“Higher DSCRs not only ensure consistent rental income but also make properties more marketable and valuable in the long run.”

Another long-term benefit is the potential for portfolio diversification. Using DSCR loans effectively can free up capital, allowing investors to expand into new markets or property types.

- Financial Stability: Properties with secure income streams enhance overall investment stability.

- Resale Value: High DSCRs can make properties more attractive to future buyers, increasing potential resale value.

- Portfolio Diversification: Freeing up capital through DSCR loans enables investors to diversify into new markets or property types.

Ultimately, implementing a strategic approach to DSCR loans can lead to sustained growth and financial security for real estate investors.

Risk Management

Proper risk management is crucial when leveraging DSCR loans. Investors must continuously monitor property performance and market conditions to ensure DSCR remains favorable.

It is advisable to maintain a DSCR cushion, ideally above 1.25, to hedge against unexpected expenses or market downturns.

“Maintaining a DSCR cushion can provide a safeguard against unforeseen financial challenges, ensuring the property remains viable through varying market conditions.”

Investors should also diversify their property portfolios to spread risk. By investing in various property types and markets, investors can reduce the impact of any single property’s underperformance.

- Monitor Performance: Regularly assess property and market performance to ensure DSCR remains favorable.

- Maintain DSCR Cushion: Aim for a DSCR above 1.25 to safeguard against financial uncertainties.

- Diversify Portfolio: Invest in different property types and markets to mitigate overall risk.

Regularly reviewing loan terms and conditions is also essential. Keeping abreast of interest rates and refinancing options can provide opportunities to enhance financial performance.

Effective risk management ensures the sustainability and profitability of real estate investments utilizing DSCR loans.

Special Considerations for Foreign Nationals Using DSCR Loans

Eligibility for Foreign Nationals

Understanding eligibility is crucial when considering DSCR loans as a foreign national. While many lenders offer these loans to non-residents, specific criteria must be met. For instance, lenders often require proof of income and a feasible debt service coverage ratio (DSCR).

Income verification might include salary slips, bank statements, or tax returns from your home country. Lenders need to see a reliable source of income.

Another essential factor is the DSCR. This ratio helps lenders assess the borrower’s ability to repay the loan. Typically, a DSCR of 1.25 or higher is preferred, indicating that the property’s income sufficiently covers its debt.

“Lenders need to see a reliable source of income.”

Moreover, some lenders may impose residency restrictions or require a U.S.-based co-signer. It’s vital to research and confirm these prerequisites before proceeding with your application.

Are there any specific visa statuses required? Generally, having a work visa or permanent residency can increase your chances of loan approval, but each lender has its policies.

What if you don’t meet these criteria? Consulting with a specialized mortgage broker can provide insights and possibly alternative solutions tailored to your situation.

Benefits for International Investors

DSCR loans offer several advantages for international investors. Firstly, they allow access to the lucrative U.S. real estate market without requiring a green card or citizenship.

These loans can be used for various property types, including single-family homes and multi-family units, offering flexibility in investment choices.

- Diversification: Investing in U.S. real estate can diversify your portfolio, spreading risk across different markets.

- Potential for High Returns: The U.S. real estate market often provides attractive returns on investment.

- Property Appreciation: Many U.S. markets have shown stable property appreciation trends, contributing to long-term gains.

Additionally, DSCR loans are structured to consider rental income, making it easier to qualify based on the property’s cash flow potential rather than personal income alone.

How do these benefits translate to practical advantages? By leveraging a DSCR loan, you can invest in high-demand areas and potentially yield significant rental income.

Investing in U.S. real estate can diversify your portfolio.

Moreover, there’s potential for tax benefits, depending on your home country’s treaties with the United States, which can enhance net returns.

Required Documentation

Preparing the necessary documentation is a fundamental step in securing a DSCR loan. This documentation helps prove your eligibility and financial stability to lenders.

Identity Verification: Passport, visa, or any other government-issued ID will be required.

Proof of Income: This usually includes salary slips, tax returns, and bank statements from your home country. Lenders will scrutinize these documents to ensure consistent income.

- Credit History: A credit report that may need translation to English if initially in a different language.

- Property Details: Information about the property you wish to invest in, including rental income estimates.

- Tax Documentation: Any tax documents that depict your financial obligations and history.

Additionally, some lenders may require a co-signer or additional guarantors, particularly if you lack a U.S. credit history.

Are there any country-specific requirements? Sometimes, lenders request additional documents based on your home country’s regulations or bilateral agreements.

Ensuring all documents are accurate and up-to-date can expedite the loan approval process, mitigating unnecessary delays and complications.

Ensuring all documents are accurate and up-to-date can expedite the loan approval process.

Common Challenges and Solutions

Foreign nationals face distinct challenges when applying for DSCR loans, but these can be overcome with the right strategies.

One common issue is income verification. If your income documentation is not in English, obtaining certified translations can resolve this problem.

Credit history might also be a hurdle, as U.S. lenders prefer domestic credit reports. To address this, some international credit agencies convert foreign credit scores to their U.S. equivalents.

Lack of a Social Security Number (SSN) is another challenge. Many lenders offer solutions for ITIN (Individual Taxpayer Identification Number) holders, allowing foreign nationals to apply without an SSN.

- Research Lenders: Identify lenders experienced in working with foreign nationals to increase your chances of approval.

- Documentation Readiness: Keep all required documents organized and translated, if necessary.

- Professional Advice: Engaging with a mortgage broker specializing in foreign national loans can provide tailored advice and solutions.

What about navigating different tax rules? Consulting with a tax advisor familiar with both U.S. and international tax laws can help optimize your tax obligations and identify potential deductions.

Engaging with a mortgage broker specializing in foreign national loans can provide tailored advice and solutions.

By addressing these challenges proactively, foreign nationals can successfully navigate the DSCR loan process and achieve their real estate investment goals.

Conclusion

Choosing DSCR loans can be a game-changer for real estate investors seeking flexibility and financial leverage. With no income verification and low DSCR minimums, these loans cater to a variety of investor profiles, including those with high liabilities and foreign nationals. Understanding the key features and eligibility criteria ensures you can make informed decisions, optimizing your investment strategies effectively.

Grasping the nuances of DSCR calculations and their impact on loan approval is crucial. By mastering these details, you can better navigate the financial landscape, ensuring your properties generate sustainable income and long-term growth. Our guide has elucidated how to leverage DSCR loans, from understanding eligibility to strategizing for maximized returns.

Don’t miss the opportunity to harness the potential of DSCR loans in your real estate ventures. Delve deeper into the intricacies outlined in this comprehensive guide, and take proactive steps towards enhancing your investment portfolio today. Explore further to unlock the full benefits of DSCR loans and elevate your financial success.

Frequently Asked Questions

What is a good ratio for a DSCR loan?

A good DSCR (Debt Service Coverage Ratio) for a loan is typically 1.25 or higher, indicating the property’s income comfortably covers its debt obligations.

What is a good DSCR for rental property?

A DSCR of 1.25 or above is generally considered good for rental properties, showing the property generates sufficient income to cover loan payments.

Who is eligible for a DSCR loan?

Eligibility for DSCR loans typically includes real estate investors, self-employed individuals, and foreign nationals meeting specific criteria.

What are the cons of a DSCR loan?

Cons of a DSCR loan can include higher interest rates and stricter property income requirements compared to traditional loans.

How is DSCR calculated for my investment property?

DSCR is calculated by dividing the property’s Net Operating Income (NOI) by its total debt service, including principal and interest payments.

What property types are eligible for DSCR loans?

Eligible property types for DSCR loans include residential, multi-family, and certain commercial properties, subject to lender criteria.