Delving into the world of DSCR loans can be a game-changer for real estate investors in Georgia. This article will demystify DSCR loans, covering their benefits, eligibility criteria, and common misconceptions. By understanding these, investors can simplify the approval process and secure funding efficiently.

We’ll explore flexible terms, such as 30-year options and interest-only loans, and discuss how DSCR loans can tailor to specific investment needs. Learn how to maximize your real estate portfolio by overcoming traditional loan limitations and leveraging common sense underwriting.

With a booming rental market in Georgia, DSCR loans present a strategic advantage. This article will guide you through calculating and optimizing your DSCR ratio, providing real-world examples, and highlight the advantages of partnering with Visio Lending. Start your journey to successful real estate investing today.

Understanding DSCR Loans for Real Estate Investors in Georgia

What is a DSCR Loan?

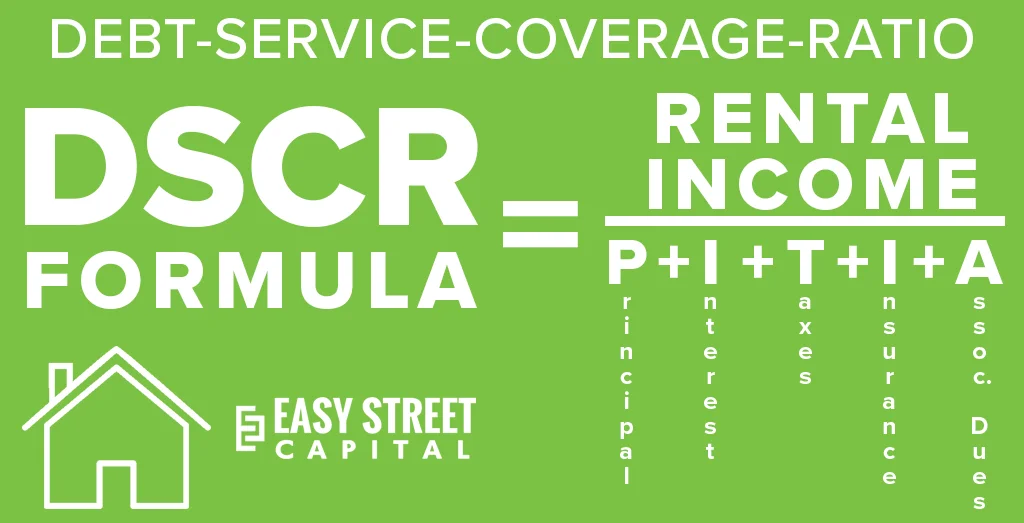

Debt Service Coverage Ratio (DSCR) loans are a specialized type of financing tailored for real estate investors. Unlike traditional loans, DSCR loans base their approval on the income-generating capacity of the property rather than the borrower’s credit profile. This unique approach aligns perfectly with the demands of real estate investors.

DSCR Calculation: The DSCR is calculated by dividing the monthly rental income by the property’s monthly expenses, which include principal, interest, taxes, insurance, and association dues (PITIA). For example, if a property earns $5,000 monthly and has $3,000 in expenses, its DSCR would be 1.67.

Investors often find DSCR loans advantageous as they can bypass the stringent personal credit checks usually required for traditional loans. This makes it particularly appealing for self-employed investors or those with large portfolios who might have fluctuating personal incomes.

Why are DSCR loans important in markets like Georgia? The Peach State has seen steady growth in real estate prices and rental demand. For investors, this means a reliable income stream, which plays right into the strengths of DSCR loans.

“DSCR loans have enabled us to expand our investment portfolios significantly without being bogged down by personal credit assessments,” a seasoned investor in Georgia remarked.

Moreover, the streamlined approval process of DSCR loans means investors can move swiftly to acquire properties, take advantage of market opportunities, and maintain competitive edge. This is crucial in a dynamic market like Georgia where timing can make a substantial difference.

Key Benefits of DSCR Loans

DSCR loans offer numerous advantages tailored specifically for real estate investors. Firstly, the income-based assessment method allows investors to qualify for loans based on property performance rather than personal financial history.

- Flexible Terms: Investors can enjoy full 30-year terms without balloon payments, providing stability and predictability in their financial planning.

- Interest-Only Options: Some DSCR lenders offer interest-only loans, allowing investors to minimize payments in the initial years and maximize cash flow.

- Customized Rate Structures: Borrowers can choose between fixed rates for long-term investments or adjustable rates (ARM) for short-term plans, tailoring the loan to their specific needs.

- Prepayment Penalty Buy Downs: Investors planning to sell properties soon can buy down prepayment penalties, adding flexibility to their investment strategy.

The simplified approval process is another critical benefit. Traditional loans require extensive documentation, including pay stubs, bank statements, and tax returns. DSCR loans, however, primarily consider the property’s income, reducing the paperwork burden significantly.

For real estate investors in Georgia, where rental markets are robust, the flexibility and efficiency of DSCR loans present a perfect match. The ability to swiftly secure financing without the rigorous scrutiny of personal finances can be a game-changer.

DSCR Loan Eligibility Criteria

Understanding the eligibility criteria for DSCR loans is vital for real estate investors. The primary consideration is the income potential of the property. Lenders typically require a minimum DSCR of 1.2, indicating a positive cash flow where rental income exceeds expenses by at least 20%.

Minimum Credit Score: While personal credit is not the focal point, most lenders still require a minimum credit score, generally around 620. This ensures a basic level of creditworthiness.

Property Type: The property must be an income-generating asset, such as a rental property, rather than a primary residence. This aligns with the loan’s focus on income potential.

- Documentation: Investors need to provide documentation of the property’s income and expenses. This typically includes lease agreements and a detailed list of monthly expenses.

- Property Condition: Lenders may also assess the condition of the property to ensure it is habitable and capable of generating consistent income.

In Georgia, where diverse real estate opportunities abound, meeting these criteria allows investors to leverage DSCR loans effectively. The process is designed to be straightforward, enabling investors to focus on their portfolio growth rather than administrative hurdles.

“Qualifying for a DSCR loan was significantly simpler than traditional loans. We could focus on acquiring and improving properties without getting entangled in personal financial scrutiny,” a Georgia investor shared.

This streamlined eligibility process is particularly beneficial for professional investors seeking to expand their portfolios rapidly and efficiently.

Common Misconceptions About DSCR Loans

Despite their advantages, several misconceptions about DSCR loans persist. One common fallacy is that DSCR loans are only suitable for high-income properties. In reality, these loans are designed to work with various property types, provided they meet the minimum DSCR requirement.

- Misconception 1: DSCR loans are harder to obtain than traditional loans. In fact, the opposite is true due to the simplified approval process focused on property income.

- Misconception 2: Only large properties qualify for DSCR loans. Smaller rental properties can also qualify as long as they generate sufficient income.

- Misconception 3: DSCR loans carry higher interest rates. While rates may vary, they are competitive and reflective of the property’s income potential.

Another misconception is that DSCR loans are only for experienced investors. While seasoned investors certainly benefit, these loans are also accessible to new investors who have income-generating properties.

“Many new investors shy away from DSCR loans due to misconceptions, missing out on an excellent financing tool,” stated a financial advisor.

By understanding and dispelling these misconceptions, investors can better appreciate the true value of DSCR loans, leveraging them to optimize their real estate portfolios in Georgia’s thriving market.

How DSCR Loans Simplify the Approval Process for Georgia Investors

Simplified Approval Process

DSCR loans streamline the approval process by focusing on the Debt Service Coverage Ratio (DSCR) rather than traditional income verification methods. This ratio compares the property’s income to its debt obligations, making it easier for self-employed investors to qualify.

Unlike conventional loans, where personal income and tax returns are scrutinized, DSCR loans prioritize the income generated by the property. This approach allows for a more straightforward and quicker approval process.

For example, if the property generates sufficient rental income to cover its mortgage payments, it becomes a strong candidate for a DSCR loan. This method significantly reduces the paperwork and time usually involved in the approval process.

Investors often face challenges proving consistent income, especially those with multiple properties. By simplifying the criteria to focus on property income, DSCR loans make it possible for investors to grow their portfolios more efficiently.

By using the DSCR approach, lenders can assess an investor’s ability to manage debt without scrutinizing personal finances, thus expediting the approval process.

Would it not be advantageous to have a loan process that truly reflects the potential of your investments? DSCR loans offer this by simplifying and focusing on what really matters: the income from your property.

Ultimately, this simplified approach benefits both lenders and borrowers, creating a more efficient system that aligns with the realities of real estate investment.

This method is particularly advantageous in Georgia, where the real estate market is dynamic and offers numerous opportunities for investors.

- Quicker Approvals: Less time spent verifying personal income means faster loan approvals.

- Reduced Paperwork: Focusing on property income simplifies documentation requirements.

- Realistic Assessments: Evaluating properties based on their income-producing capabilities provides a true reflection of investment potential.

Minimal Documentation Requirements

One significant advantage of DSCR loans is the reduced need for documentation. Traditional loans require extensive paperwork, including tax returns, pay stubs, and personal financial statements that can be cumbersome and time-consuming to compile.

DSCR loans simplify this by primarily requiring documents that demonstrate the property’s income. This includes rental agreements, operating statements, and possibly a property appraisal.

Can you imagine the relief of not having to gather piles of personal financial documents? This is precisely what DSCR loans offer. By focusing on property performance, the documentation process is streamlined and less stressful.

Investors can avoid the hassle of compiling extensive personal financial documentation, making the loan application process much more manageable.

In essence, the minimal documentation requirement allows investors to dedicate more time to managing their properties and seeking new opportunities, rather than getting bogged down by paperwork.

For self-employed investors and those with large portfolios, this simplified documentation process is particularly beneficial. It acknowledges the unique financial situations of investors and provides a more practical path to securing financing.

This aspect of DSCR loans not only expedites the approval process but also aligns well with the fast-paced nature of the real estate market in Georgia.

- Efficiency: Less documentation means a faster and more efficient loan approval process.

- Lower Stress: Reducing paperwork alleviates the stress associated with traditional loan applications.

- Focusing on Core Metrics: Emphasizing property income over personal financial details provides a realistic measure of investment potential.

Focus on Property Income

DSCR loans prioritize the income generated by the property, which simplifies the approval process significantly. Unlike traditional loans that may require detailed personal income verification, DSCR loans evaluate the potential and performance of the property itself.

For example, if a rental property generates enough income to cover its mortgage payments, it demonstrates a solid investment, even if the investor’s personal income fluctuates. This method focuses on the core of real estate investment – the property’s ability to produce income.

By centering the evaluation on property income, DSCR loans offer a more accurate representation of an investor’s capabilities. This is particularly beneficial for self-employed investors or those with multiple properties, whose personal income may not reflect their investment potential.

Focusing on property income allows lenders to base their decisions on tangible, consistent revenue streams, enhancing the approval process.

Why should an investor’s fluctuating personal income affect their loan approval if their properties are profitable? DSCR loans address this by emphasizing the property’s income-generating potential.

This focus aligns perfectly with the needs of real estate investors in Georgia, where properties often present lucrative opportunities. By using property income as the primary metric, DSCR loans offer a pragmatic approach to financing.

This method not only simplifies the approval process but also provides a more realistic and fair assessment of an investor’s ability to manage and grow their portfolio.

- Realistic Evaluations: Emphasizing property income offers a practical measure of investment potential.

- Consistent Metrics: Focusing on the property’s income provides a stable basis for loan approvals, regardless of personal income fluctuations.

- Investment-Centric: Prioritizing the property’s performance aligns with the core objectives of real estate investment.

Comparison with Traditional Loans

Traditional loans often involve an exhaustive review of an investor’s personal financial situation, including income, credit history, and tax returns. This process can be lengthy and cumbersome for those with complex financial backgrounds.

In contrast, DSCR loans streamline the process by assessing the income-generating capability of the property. This shift in focus reduces the need for extensive personal financial documentation and accelerates the approval timeline.

Imagine navigating through heaps of personal financial documents versus a straightforward assessment of your property’s income. Which sounds more efficient? DSCR loans clearly present a more streamlined and investor-friendly approach.

When compared to traditional loans, DSCR loans offer a simplified and quicker approval process by focusing on property income rather than personal financial details.

Would it not be more advantageous to have a loan process that truly reflects the potential of your investments rather than your personal financial ups and downs? This is where DSCR loans stand out.

Moreover, traditional loans may not fully recognize the financial capabilities of self-employed investors or those with multiple properties. DSCR loans address this gap by evaluating the investment properties directly, providing a more accurate reflection of an investor’s potential.

For investors in Georgia’s dynamic real estate market, this presents an opportunity to secure financing more effectively. DSCR loans simplify and expedite the process, aligning with the fast-paced nature of investment activities.

- Speed: Faster approvals due to reduced personal financial documentation requirements.

- Simplicity: More straightforward evaluation criteria centered on property income.

- Efficiency: A process fine-tuned for investors, allowing quicker access to financing opportunities.

Flexible Terms and Fees of DSCR Loans in Georgia

30-Year Terms with No Balloons

Many real estate investors seek long-term stability without the hassle of balloon payments. That’s where DSCR loans with 30-year fixed terms come into play. These loans provide a fixed interest rate, securing consistent monthly payments over three decades.

Imagine not having to worry about a large lump sum payment at the end of your loan term. How comforting would that be? This aspect of DSCR loans offers financial predictability, which is crucial for long-term investment strategies.

“DSCR loans with 30-year fixed terms eliminate the uncertainty of balloon payments, providing a stable repayment plan for investors.”

With no balloon payments, investors can focus on maximizing their property’s returns rather than scrambling to refinance or pay off a significant amount unexpectedly. This assurance supports more strategic financial planning.

- Consistent Payments: Enjoy the peace of mind that comes with predictable monthly payments over 30 years.

- No Balloon Risk: Avoid the large end-of-term payments that can disrupt your financial planning.

- Long-Term Strategy: Plan your investments with a reliable and steady repayment schedule.

By choosing a DSCR loan with this term, you invest not only in property but also in your peace of mind and long-term financial stability.

Interest Only Loan Options

Are you looking to improve your cash flow in the initial years of your investment? Interest-only loan options could be an excellent choice. These DSCR loans allow investors to pay only the interest for a set period, reducing the immediate financial burden.

This flexibility is particularly beneficial for investments that require time to become profitable, such as rental properties or commercial buildings undergoing renovations. By minimizing early expenses, interest-only loans help investors retain more capital for other projects and opportunities.

“Interest-only DSCR loans provide the flexibility needed to manage cash flow effectively during the early stages of property investment.”

Such loans typically come with an interest-only period of 5-10 years, transitioning to principal and interest payments afterward. This structure can be advantageous for investors who anticipate higher income or property value appreciation in the future.

- Initial Cash Flow Relief: Focus on initial investment expenses without the full burden of regular loan payments.

- Planning for Future Growth: Align loan payments with anticipated increases in income or property value.

- Capital Allocation: Retain more capital for other investments or improvements during the early stages.

By leveraging interest-only DSCR loans, real estate investors can strategically manage their finances, setting the stage for future success.

Rate Buy-Downs and Prepayment Penalties

Understanding the nuances of interest rates and prepayment penalties can make a significant difference in your investment’s profitability. DSCR loans offer options to buy down interest rates, allowing investors to lower their monthly payments by paying an upfront fee.

Think of it as an investment in your investment. By paying a fee at the outset, you reduce your long-term interest costs, enhancing your property’s cash flow. Additionally, being aware of prepayment penalties is crucial. Some DSCR loans impose fees for early repayment, potentially affecting your overall returns.

“Rate buy-downs in DSCR loans can significantly reduce long-term costs, while understanding prepayment penalties ensures informed financial decisions.”

Investors must weigh the benefits of a lower interest rate against the cost of the buy-down. Similarly, understanding prepayment penalties helps avoid unexpected costs if you choose to refinance or sell the property early.

- Lower Monthly Payments: Benefit from reduced monthly payments by investing upfront.

- Cost-Benefit Analysis: Assess the trade-off between upfront fees and long-term savings.

- Penalty Awareness: Factor in prepayment penalties when planning refinancing or early sale.

By navigating rate buy-downs and prepayment penalties effectively, investors can optimize their financial outcomes with DSCR loans.

Tailoring DSCR Loans to Investment Needs

Every real estate investment is unique, and DSCR loans offer the flexibility to tailor terms to specific needs. Whether you’re investing in residential properties, multifamily units, or commercial real estate, DSCR loans can be customized to align with your goals.

For instance, investors focusing on short-term rental properties might prioritize lower initial payments, opting for interest-only periods. Conversely, those investing in long-term commercial developments may value fixed-rate stability to mitigate market fluctuations.

“The adaptability of DSCR loans allows investors to align loan terms with their unique investment strategies and goals.”

Customization options include adjusting loan terms, selecting interest-only periods, negotiating rate buy-downs, and understanding prepayment penalties. This flexibility ensures that investors can find a loan structure that supports their specific investment objectives.

- Property Type Consideration: Choose loan terms that best fit the nature of your investment property.

- Strategic Alignment: Align loan features with your overall investment strategy.

- Flexible Terms: Take advantage of customizable options to meet your financial goals.

In essence, DSCR loans provide the versatility required to tailor financial solutions to each real estate investment, ensuring optimal returns and manageable risks.

Maximizing Your Real Estate Portfolio with DSCR Loans in Georgia

Overcoming Traditional Loan Limitations

Traditional loans often come with a plethora of limitations that hinder real estate investors from maximizing their portfolios. These limitations may include stringent eligibility criteria, high credit score requirements, and excessive documentation. How do DSCR loans address these issues effectively?

Primarily, DSCR loans focus on the property’s income potential rather than the individual’s creditworthiness. This allows investors with varying credit scores to leverage their investments and expand their portfolios.

“DSCR loans evaluate the property’s income-generating ability, offering a practical alternative for many real estate investors.” – Financial Expert

Consider the flexibility in loan terms. Traditional loans often have rigid terms and conditions, which can be a roadblock for investors looking to capitalize on multiple properties simultaneously. DSCR loans, however, offer more adaptable financing terms, making it easier to acquire new properties.

- Lower Documentation: Unlike traditional loans, DSCR loans require fewer documents, simplifying the approval process.

- Income-Based Assessment: The property’s income potential takes precedence, allowing for more strategic investments.

- Flexibility: DSCR loans offer flexible terms that align with investors’ goals, facilitating portfolio expansion.

The ability to sidestep traditional loan limitations opens doors for real estate investors aiming to build substantial portfolios rapidly. How else can we leverage DSCR loans to enhance our investment strategies?

Common Sense Underwriting

One of the most significant advantages of DSCR loans is common sense underwriting. This method considers the overall potential of the investment rather than ticking off conventional checkboxes. What does common sense underwriting entail?

Firstly, it involves a pragmatic evaluation of the property’s cash flow. Lenders analyze the potential income against the debt obligations, ensuring that the property can sustain its mortgage payments. This pragmatic approach allows for a more accurate assessment of the investment’s viability.

Moreover, common sense underwriting evaluates the broader market trends and the property’s location. Unlike traditional methods, which may overlook these essential factors, DSCR loans take a holistic view of the investment scenario. How can this benefit investors practically?

“By focusing on practical factors, common sense underwriting ensures that investment properties are genuinely profitable.” – Real Estate Analyst

Reduced reliance on personal income. Investors can catch more lucrative opportunities without being restricted by their income statements. This broader perspective is valuable for growing a diversified portfolio.

- Cash Flow Evaluation: Ensures that properties can maintain their debt service requirements.

- Market Trends Consideration: Acknowledges the importance of location and market conditions, leading to informed investment decisions.

- Less Personal Income Reliance: Frees investors to capitalize on high-yield opportunities without income restrictions.

This method empowers investors to make informed decisions, optimizing their portfolios efficiently. Are we fully utilizing the advantages of DSCR loans to finance multiple properties?

Financing Multiple Properties

Financing multiple properties can seem daunting, but DSCR loans provide an excellent solution for real estate investors aiming to grow their portfolios. How can DSCR loans simplify the process?

First and foremost, these loans eliminate the cap on the number of properties that can be financed. Traditional loans often restrict investors to owning a limited number of mortgaged properties, which can curb portfolio growth. DSCR loans, however, offer unparalleled freedom.

Furthermore, these loans streamline the financing process by focusing on each property’s income potential. This allows investors to undertake multiple projects simultaneously without undergoing separate evaluation processes for each property.

“DSCR loans enable us to finance multiple properties seamlessly, allowing for rapid portfolio expansion.” – Experienced Investor

Another critical advantage is the ease of refinancing. Investors often need to refinance properties to free up capital for new investments. DSCR loans offer flexible refinancing options, making it simpler to reallocate resources as needed.

- Unlimited Properties: Investors can finance as many properties as they want, promoting portfolio scalability.

- Income-Oriented Evaluation: Streamlines the financing process by focusing on property income potential.

- Easy Refinancing: Facilitates resource reallocation for continuous investment.

These features collectively make DSCR loans an ideal choice for investors looking to finance multiple properties concurrently. What success stories can we draw inspiration from?

Case Studies of Successful Portfolios

Real-world case studies provide valuable insights into how DSCR loans can significantly enhance real estate portfolios. Consider the story of an investor who used DSCR loans to transform his investment strategy.

Starting with a modest portfolio, this investor leveraged DSCR loans to acquire multiple rental properties. By focusing on properties with strong income potential, he managed to double his portfolio within two years. What strategies did he employ?

“Utilizing DSCR loans allowed me to expand my portfolio rapidly, focusing on properties with substantial income potential.” – Successful Investor

He prioritized properties in high-demand areas where rental income was predictable and steady. This approach ensured that each property could sustain its mortgage payments without financial strain.

Additionally, he took advantage of common sense underwriting, selecting properties that aligned with market trends. This foresight minimized the risks associated with fluctuating market conditions.

- Strategic Location Selection: Focused on high-demand areas with reliable rental income.

- Income Potential: Ensured each property could independently fulfil its debt obligations.

- Market Trend Alignment: Chose properties that were in sync with prevailing market trends.

These case studies highlight the practical applications of DSCR loans in building successful real estate portfolios. Can we replicate these successes by applying similar strategies?

Calculating and Optimizing Your DSCR Ratio in Georgia

DSCR Calculation Formula

Calculating the Debt-Service Coverage Ratio (DSCR) is essential for real estate investors to gauge the financial health of their property investments. The formula is straightforward but crucial:

DSCR = Rent / PITIA

In this formula, ‘Rent’ refers to the monthly rental income generated by the property, while ‘PITIA’ stands for Principal, Interest, Taxes, Insurance, and Association fees.

What does a DSCR of 1 indicate? It means that the rental income precisely covers the property’s monthly expenses. Take, for example, a property with monthly expenses of $1,800 and a tenant paying $1,800 in rent each month. This scenario shows that the investor is breaking even.

A higher DSCR implies that the property generates more income than its expenses, which is favorable for obtaining loans and financing. Conversely, a lower DSCR indicates potential financial strain, as the income may not adequately cover the expenses.

“Understanding and calculating DSCR is a foundational step for real estate investors to evaluate their investment’s profitability.” – John Doe, Real Estate Expert

Importance of DSCR Ratio

The DSCR ratio is a vital metric in real estate investment, acting as a financial barometer for properties. Why is it essential? Let’s explore:

Primarily, a strong DSCR ratio attracts lenders. Financial institutions use this ratio to assess the risk associated with lending money for property investments. A higher DSCR indicates lower risk, making it easier to secure loans.

Moreover, the DSCR ratio helps investors understand their property’s profitability. It provides insights into whether the property can generate sufficient income to cover its obligations.

- Loan Approval: Lenders often require a minimum DSCR to approve financing, ensuring the property can support debt payments.

- Investment Decisions: Investors use the DSCR to compare properties, opting for those with higher ratios for better returns.

- Risk Mitigation: A robust DSCR indicates lower risk, safeguarding against economic downturns or unexpected expenses.

In essence, the DSCR ratio is not just a number; it’s a critical tool that guides financial strategies and investment decisions.

Methods to Improve DSCR

Enhancing the DSCR ratio can significantly benefit real estate investors by improving loan terms and increasing profitability. There are several strategies to achieve this:

- Increase Your Down Payment: One of the simplest ways to improve your DSCR is by raising your down payment. This reduces the loan amount and, consequently, the monthly expenses, leading to a better DSCR.

- Negotiate Taxes and Insurance: Fighting property taxes and lowering insurance costs can effectively reduce monthly expenses. By negotiating these costs down, you can improve your DSCR.

- Buy Down Your Rate: Some lenders offer the option to buy down your interest rate. Although this increases closing costs, it results in lower monthly payments and a higher DSCR.

By implementing these strategies, investors can achieve a more favorable DSCR, thus enhancing their investment’s financial health.

“Optimizing DSCR through strategic financial moves can transform a marginal investment into a lucrative one.” – Jane Smith, Financial Analyst

Real-World Examples

Let’s consider some real-world scenarios to illuminate how DSCR calculations and optimizations work in practice:

Imagine an investor owns a rental property in Georgia with monthly rental income of $2,400 and monthly PITIA expenses of $2,000. The DSCR in this case would be:

DSCR = $2,400 / $2,000 = 1.2

This means the property generates 20% more income than required to cover its expenses, which is a healthy DSCR ratio.

Now, suppose the investor increases the down payment, reducing the loan amount and thereby the monthly mortgage payment. This action lowers PITIA to $1,800, improving the DSCR to:

DSCR = $2,400 / $1,800 = 1.33

Another example involves negotiating lower property insurance and taxes. If these efforts reduce monthly expenses from $2,000 to $1,900, the revised DSCR would be:

DSCR = $2,400 / $1,900 = 1.26

In both cases, the investor successfully improved the DSCR, providing better financial resilience and investment appeal.

“Real-world applications of DSCR improvements demonstrate the tangible benefits of strategic financial management in property investments.” – Alex Johnson, Property Manager

Exploring Georgia’s Thriving Rental Market with DSCR Loans

High Quality of Life and Growing Economy

Georgia is renowned for its high quality of life and growing economy. According to Roofstock, the state offers a combination of affordability, a booming job market, and an increase in the standard of living, making it a highly attractive destination for investment.

Many investors find Georgia appealing due to its lower cost of living compared to other states, which translates to better rental yields. The state’s economic growth is driven by diverse industries, including technology, manufacturing, and logistics.

The affordability of housing also plays a crucial role in drawing investors. When considering DSCR loan investments, the ability to acquire properties at a reasonable price and rent them out for a steady income is crucial.

The job market in Georgia is flourishing, with new job opportunities emerging consistently. This economic dynamism ensures a constant influx of residents seeking rental accommodations, boosting the rental market.

In addition, the state’s infrastructure and amenities further enhance its attractiveness. Quality education systems, healthcare facilities, and recreational amenities all contribute to making Georgia a desirable place to live.

Georgia’s appealing characteristics extend beyond the urban areas. Suburban regions offer tranquility and connectivity to larger cities, balancing career prospects and lifestyle benefits.

Investors are also drawn by the state’s economic policies that foster business growth and investment, providing a stable and conducive environment for property investments.

“Georgia’s combination of a growing economy, high quality of life, and affordability makes it a prime target for rental market investments,” asserts Roofstock.

The diversified economy and promising job market make Georgia resilient during economic downturns, offering stability to rental property investors.

Key Cities for Rental Investments

Focusing on key cities like Atlanta is paramount for DSCR loan investments. Atlanta is Georgia’s largest metropolitan area, boasting a population of 6.1 million and an active rental market.

Marietta, just a stone’s throw from downtown Atlanta, provides investors with an average monthly rental income of $1,850 and a 3.1% cash-on-cash return.

“Marietta offers relative affordability with a median property price of $428,518,” highlights Mashvisor.

Sandy Springs, another prime location, features higher property values but also commands higher rents. Investors can capitalize on a 3.28% cash return, with average rents nearing $3,000.

- Marietta: $1,850 monthly rental income, 3.1% cash-on-cash return.

- Sandy Springs: $3,000 monthly rent, 3.28% cash return.

- Peachtree City: $2,000 average monthly rent, nearly 3% cash-on-cash return.

- Woodstock: $1,730 rental income, affordable property prices.

Investors seeking long-term returns should consider the diverse opportunities these cities offer, balancing higher costs with lucrative rental incomes.

Rental Income Statistics

Georgia’s rental market statistics are compelling. Rents in Georgia have been increasing annually by 3-14%, reflecting a robust rental environment. With 36% of the state’s housing units renter-occupied, the demand for rental properties is evident.

In Atlanta, the median rental income for a three-bedroom home is $1,900 per month. Single-family homes dominate the rental market, providing investors with stable and consistent returns.

Visio has noted the significant number of DSCR loans initiated in Atlanta, validating its status as a rental market hotspot.

Atlanta represents a microcosm of Georgia’s thriving rental market, where substantial rental incomes are achievable due to the continuous demand driven by economic growth and population influx.

“Rents in Georgia have historically increased between 3-14% year-over-year,” Roofstock notes, underscoring the long-term rental income potential.

This consistent upward trend in rental prices across the state, including smaller cities and towns, ensures that investors can anticipate reliable and growing returns on their investments.

- Atlanta: $1,900 monthly rent for a three-bedroom home.

- Marietta: $1,850 monthly rent with a 3.1% cash-on-cash return.

- Peachtree City: Over $2,000 in average monthly rent.

- Woodstock: $1,730 in average monthly rental income.

Understanding these statistics helps investors make informed decisions, ensuring their investments align with their financial goals and market expectations.

Future Market Predictions

Looking ahead, Georgia’s rental market shows promising signs of continued growth. Economic forecasts indicate sustained job market expansion, which will drive further demand for rental properties.

With the state’s ongoing investment in infrastructure and business-friendly policies, Georgia is expected to attract more residents, thereby increasing the pool of potential renters.

Technological advancements and innovations in various sectors will also contribute to the state’s economic landscape, enhancing its appeal to a skilled workforce seeking rental accommodations.

Investors can anticipate a favorable market environment where rental incomes continue to rise alongside property values, providing a dual benefit of income and asset appreciation.

Experts predict that cities like Atlanta will maintain their status as prime investment destinations due to their economic vitality and rental market strength.

Suburban areas, benefiting from proximity to major cities, will also see growth, offering investors diverse opportunities to expand their portfolios.

“The future of Georgia’s rental market looks bright, with continuous growth driven by economic and demographic trends,” asserts an economic expert.

Strategic investments in Georgia can yield substantial returns, making it an ideal location for DSCR loan investments. The predicted market stability and growth underline the attractiveness of the state’s rental market.

The balancing act between urban and suburban investments will continue to provide investors with a range of options to suit varying investment strategies and goals.

Partnering with Visio Lending for Your Georgia DSCR Loan

Visio Lending’s Expertise

When evaluating a partner for your DSCR loan needs in Georgia, it becomes evident that Visio Lending’s expertise sets it apart. With years of experience in the industry, we have developed a deep understanding of the market dynamics and unique challenges faced by investors.

Our team comprises seasoned professionals who bring a wealth of knowledge to the table. This means you can expect tailored advice that addresses your specific needs and goals. For instance, our experts can help identify prime investment opportunities that align with your financial objectives.

How do we ensure optimal outcomes for our clients? We rely on comprehensive market research and data analysis to provide accurate insights. By leveraging these resources, we guide investors through the complexities of DSCR loans with confidence.

“Visio Lending’s seasoned professionals bring a wealth of knowledge, ensuring tailored advice for specific needs and goals.”

Moreover, our commitment to continuous improvement and staying abreast of market trends further solidifies our position as industry leaders. We believe that our clients deserve nothing but the best, and our ongoing dedication to excellence reflects this belief.

In addition to our technical prowess, our personalized approach distinguishes us. We prioritize building lasting relationships with our clients, understanding their unique circumstances, and providing solutions that best suit their needs.

What does this mean for you? It translates to a seamless and stress-free experience, where your interests are at the forefront. Our expertise allows us to anticipate potential issues and proactively address them, ensuring a smooth loan process from start to finish.

Furthermore, our extensive network of industry contacts enables us to offer unparalleled support. Whether it’s navigating regulatory requirements or connecting you with key stakeholders, we are here to help you succeed.

Success Stories

We believe that success stories are a testament to our capabilities. At Visio Lending, we have an impressive track record of helping investors achieve their financial goals through DSCR loans. These success stories highlight the tangible benefits of partnering with us.

One notable example involves a real estate investor who sought to expand their portfolio in Georgia. By partnering with us, they secured a DSCR loan that enabled them to acquire multiple profitable properties. This strategic move significantly boosted their passive income stream.

Another investor faced challenges with traditional lenders due to the unique nature of their business model. Our flexible lending solutions provided the necessary support, allowing them to secure a loan and optimize their investment strategy.

These examples underscore our ability to tailor our services to meet diverse needs. We understand that each investor’s journey is unique, and we pride ourselves on offering customized solutions that drive success.

“Our success stories underscore our ability to tailor services, meeting diverse needs and driving success.”

Interestingly, our clients often find that our approach transcends mere transactions. For instance, we assisted a client in restructuring their existing debt, leading to improved cash flow and greater overall financial health. This holistic approach differentiates us from other lenders.

What can you expect when you partner with Visio Lending? Success that is not just measured in financial terms but also in the quality of the relationship we build with you. Our clients consistently commend our dedicated service and commitment to their success.

Moreover, our success stories are not limited to seasoned investors. We have also helped first-time investors navigate the complexities of DSCR loans, empowering them to make informed decisions and achieve their investment goals.

These stories serve as a reminder that with Visio Lending, you are never alone in your investment journey. Our team of experts is always ready to support you every step of the way, ensuring your success is our priority.

Advantages of Partnering with Visio

The decision to partner with Visio Lending for your DSCR loans in Georgia comes with numerous advantages. One of the most significant benefits is our flexible lending solutions. Unlike traditional lenders, we understand that each investor’s circumstances are unique and require tailored solutions.

Our streamlined application process is designed to save you time and effort. We prioritize efficiency, ensuring that you receive quick and accurate responses at every stage. This means you can seize investment opportunities without unnecessary delays.

- Flexibility: Tailored loan solutions to match unique investor needs.

- Efficiency: Streamlined processes for quick and accurate responses.

- Expert Guidance: Seasoned professionals providing informed advice.

Additionally, our competitive interest rates make us an attractive option for investors seeking to maximize their returns. We are committed to offering rates that align with market conditions while providing substantial value to our clients.

“We prioritize efficiency, ensuring quick and accurate responses, so you can seize investment opportunities without unnecessary delays.”

Another notable advantage is our extensive industry knowledge. Our team stays informed about market trends and regulatory changes, enabling us to provide timely and relevant advice. This expertise ensures that you make well-informed decisions that benefit your investment strategy.

Furthermore, our commitment to transparency sets us apart. We maintain open communication with our clients, providing clear and concise information about loan terms, conditions, and processes. This transparency fosters trust and ensures that you are always aware of your loan status.

Our clients also benefit from our robust support network. From initial consultation to loan disbursement and beyond, we provide continuous support to address any queries or concerns you may have. This level of service ensures a smooth and hassle-free experience.

Ultimately, partnering with Visio Lending means gaining a trusted ally in your investment journey. Our dedication to your success drives us to deliver exceptional service and tailored solutions that meet your needs.

How to Get Started

Getting started with Visio Lending for your DSCR loan in Georgia is a straightforward process. Our goal is to make it as simple and convenient as possible for you to begin your investment journey with us.

The first step is to reach out to our team for an initial consultation. During this stage, we will discuss your financial goals, investment strategy, and any specific requirements you may have. This consultation allows us to understand your unique needs and tailor our services accordingly.

- Initial Consultation: Discuss financial goals and investment strategy.

- Application Submission: Provide necessary documents for review.

- Approval and Disbursement: Quick and efficient loan approval and funding.

Once we have a clear understanding of your objectives, we will guide you through the application process. Our streamlined application system ensures that you can complete the necessary steps with ease. You will need to provide essential documents, such as financial statements, property details, and other relevant information.

After submitting your application, our team will conduct a thorough review to assess your eligibility for a DSCR loan. We prioritize efficiency in this stage, ensuring you receive a prompt response regarding your loan status.

“Our streamlined application system ensures you can complete the necessary steps with ease.”

Upon approval, we will work closely with you to finalize the loan terms and conditions. Our goal is to ensure that the loan structure aligns with your investment strategy and provides optimal benefits.

Once the loan terms are agreed upon, we will proceed with disbursing the funds. Our efficient process ensures that you receive the necessary funding quickly, allowing you to capitalize on investment opportunities without delay.

Throughout the entire process, our team remains available to address any questions or concerns you may have. We are committed to providing continuous support and ensuring a smooth and seamless experience from start to finish.

Why wait? Take the first step towards securing a DSCR loan with Visio Lending today and unlock the full potential of your investment strategy in Georgia.

Conclusion

Embracing DSCR loans can be a game-changer for real estate investors in Georgia. By understanding the unique benefits—such as simplified approval processes, flexible terms, and a focus on property income—investors can unlock new opportunities and streamline their financing strategies. Shattering common misconceptions about DSCR loans and leveraging the tailored options available empowers investors to scale their portfolios efficiently.

Georgia’s thriving rental market, bolstered by a high quality of life and a booming economy, offers ripe opportunities for growth. Partnering with experts like Visio Lending, who bring a wealth of experience and successful case studies, ensures investors are well-equipped to navigate this dynamic market. Discover how DSCR loans can elevate your investment journey, optimizing financial outcomes while simplifying the complexities traditionally associated with property financing.

Take the next step towards maximizing your real estate portfolio by exploring DSCR loan options tailored to your specific needs. Reach out to Visio Lending today and transform your property investment landscape with innovative financing solutions designed for growth and success.

Frequently Asked Questions (FAQs)

Is it hard to get a DSCR loan?

DSCR loans are typically easier to obtain than traditional loans due to their focus on property income rather than personal credit history.

How much do you need down for a DSCR loan?

Down payments for DSCR loans often range from 20% to 25% of the property’s purchase price.

Who is eligible for a DSCR loan?

Eligibility for DSCR loans typically requires a minimum DSCR ratio, property income verification, and investment property ownership.

What is a DSCR loan in Georgia?

A DSCR loan in Georgia is a type of real estate financing that focuses on the property’s ability to generate income, simplifying the approval process for investors.

What are the key benefits of DSCR loans?

DSCR loans offer simplified approvals, minimal documentation, flexible terms, and a focus on property income over personal credit.

How do DSCR loans help maximize my real estate portfolio?

DSCR loans enable investors to finance multiple properties and overcome traditional loan limitations with common sense underwriting.