Harnessing the power of Debt Service Coverage Ratio (DSCR) loans can revolutionize your investment strategy, particularly for self-employed investors and real estate partnerships. Understanding the nuances of DSCR loans, from key features to calculating formulas, is crucial for securing optimal rates and maximizing benefits.

This comprehensive guide delves into the intricacies of DSCR loans, illuminating their advantages and providing step-by-step calculations for various property types. Stay ahead in the evolving market landscape with insights on future trends and expert tips for negotiation.

Understanding DSCR Loan Programs

What is a DSCR Loan?

Debt Service Coverage Ratio (DSCR) loans are tailored specifically for real estate investors aiming to purchase properties with high debt service coverage ratios. Unlike traditional residential mortgages, DSCR loans primarily consider the cash flow generated by the property rather than the borrower’s personal income.

DSCR loans are offered by lenders specializing in commercial or investment property financing. These loans typically have more stringent underwriting requirements, focusing heavily on the property’s income potential.

Various types of DSCR loans are available, including:

- Fixed-rate loans: These loans offer stability with a constant interest rate throughout the loan term.

- Adjustable-rate loans: Initially lower interest rates that can fluctuate over time.

- Interest-only loans: Payments that cover only the interest for a set period before paying down the principal.

For a comprehensive definition, DSCR loans are secured by residential real estate turnkey properties used strictly for business purposes and are underwritten primarily based on the property’s cash flow.

“DSCR Loans are mortgage loans secured by residential real estate turnkey properties strictly used for a business purpose and underwritten primarily based on the property.”

This type of loan is ideal for investors who may not qualify for traditional mortgage financing due to their debt-to-income ratios or credit scores. DSCR loans provide a solution based on the property’s ability to generate rental income.

Key Features of DSCR Loans

DSCR loans boast several unique features that make them attractive to real estate investors:

1. Simplified Approval Process

Approval is based on the property’s income rather than the borrower’s financial situation, making the application process more streamlined.

2. Flexible Lending Guidelines

DSCR lenders are not bound by the strict guidelines of conventional lenders, allowing them to customize guidelines and even grant exceptions in certain cases.

For example, lending for short-term rentals or niche investment strategies such as the BRRRR method can be more easily accommodated with DSCR loans.

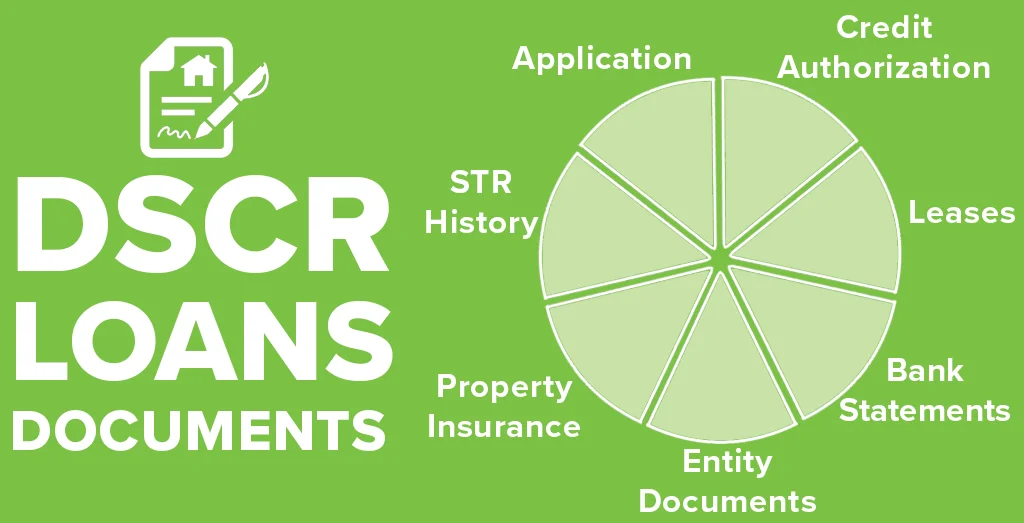

3. Lighter Documentation Requirements

These loans require fewer documents compared to traditional loans, reducing the paperwork burden for investors.

- No income verification: No need for W2s or tax returns.

- No employment verification: Perfect for self-employed or freelance individuals.

- No Debt-to-Income (DTI) ratio: Qualification is based on the property’s cash flow.

These features make DSCR loans particularly attractive for investors in various situations, from first-time investors to seasoned professionals looking to scale their portfolios.

Differences Between DSCR and Traditional Loans

DSCR loans differ significantly from traditional loans in several ways. Firstly, traditional loans require income verification, tax returns, and an analysis of the borrower’s Debt-to-Income (DTI) ratio. DSCR loans, however, focus solely on the cash flow generated by the property.

- Underwriting Criteria: Traditional loans assess the borrower’s personal financial situation, whereas DSCR loans assess the property’s financial performance.

- Documentation: Traditional loans necessitate extensive documentation, while DSCR loans require minimal paperwork.

- Flexibility: DSCR lenders often have more flexible guidelines, whereas traditional lenders follow rigid rules set by entities such as Fannie Mae and Freddie Mac.

Consider the example of a self-employed individual looking to invest in real estate. Conventional financing would demand proof of steady employment and income over two years, making it challenging to qualify. In contrast, DSCR loans do not require employment verification, basing qualification on the property’s income potential.

“Traditional lenders often have to strictly follow the guidelines from Fannie Mae and other agencies, whereas DSCR lenders can grant exceptions and customize guidelines.”

This flexibility makes DSCR loans an ideal choice for real estate investors seeking an easier and less burdensome financing option. By focusing on the property’s cash flow, DSCR loans provide a viable alternative to conventional financing methods.

Who Can Benefit from DSCR Loans?

Ideal Candidates for DSCR Loans

DSCR loans present an excellent opportunity for various types of borrowers who focus on income-generating properties. One key group that can significantly benefit from these loans is self-employed individuals. These borrowers often face challenges obtaining traditional loans due to the complexities and variability of their income.

Another ideal candidate for DSCR loans is the first-time real estate investor. Even though some lenders impose stricter requirements for novices, such as slightly lower leverage or higher minimum credit scores, many, including prominent institutions like Easy Street Capital, welcome them without significant restrictions as long as their financial profiles are robust.

Additionally, experienced real estate investors can leverage DSCR loans to expand their portfolios. Since these loans are based on the property’s cash flow rather than the borrower’s creditworthiness, seasoned investors can easily scale their investments, often securing larger loan amounts.

Importantly, investment partnerships also stand to benefit from DSCR loans. These partnerships, typically formed by multiple investors pooling resources to acquire properties, can utilize DSCR loans to bypass the need for individual income verification, streamlining the approval process and facilitating faster acquisition of properties.

Benefits for Self-Employed Investors

Self-employed individuals often find traditional loan applications burdensome due to strict income documentation requirements. DSCR loans provide a much-needed alternative. They enable self-employed investors to qualify for financing based on the property’s cash flow rather than their personal income.

No W2 or tax returns are required, making the process less intrusive and more efficient. This feature significantly reduces the paperwork and processing time typically associated with traditional loans.

Also, DSCR loans can offer lower interest rates and longer repayment terms. This is because the property itself is considered less risky, thanks to its demonstrated ability to generate sufficient cash flow to cover loan payments.

“DSCR loans allow self-employed investors to access larger loan amounts, as lenders focus on the property’s financial performance rather than the borrower’s creditworthiness.”

Moreover, these loans require a minimum DSCR, usually around 1.25 or higher, which ensures the property generates adequate income. This approach ensures that self-employed investors can manage loan repayments more comfortably, reducing financial stress and enhancing investment stability.

Advantages for Real Estate Partnerships

Real estate partnerships, where two or more parties collaborate to invest in property, can greatly benefit from DSCR loans. These loans allow partnerships to streamline the financing process by focusing on the cash flow generated by the property, rather than the income of each individual partner.

Firstly, DSCR loans bypass the need for individual income verification. This simplifies and expedites the approval process, making it easier for partnerships to secure funding. With fewer hurdles, partnerships can focus on identifying and acquiring lucrative properties.

Furthermore, the property’s financial health is the primary consideration for lenders, resulting in larger loan amounts for well-performing properties. This allows partnerships to leverage their investments, purchasing higher-value properties that may not be feasible with personal loans.

- Lower Interest Rates: Because the loans are considered less risky, partnerships can benefit from more favorable interest rates and repayment terms.

- Easier Expansion: By focusing solely on property cash flow, partnerships can more easily expand their portfolio, acquiring additional properties without the need for extensive financial documentation from each partner.

- Increased Cash Flow: With efficient property management, partnerships can ensure that the cash flow generated exceeds debt service payments, providing additional funds for further investments.

DSCR loans, therefore, offer a pragmatic solution for real estate partnerships looking to optimize their investment strategy and maximize returns.

Calculating DSCR: A Step-by-Step Guide

Understanding the DSCR Formula

The Debt Service Coverage Ratio (DSCR) is a critical **financial metric** for real estate investors, financial analysts, and loan officers. It gauges a property’s ability to generate enough income to cover its debt obligations.

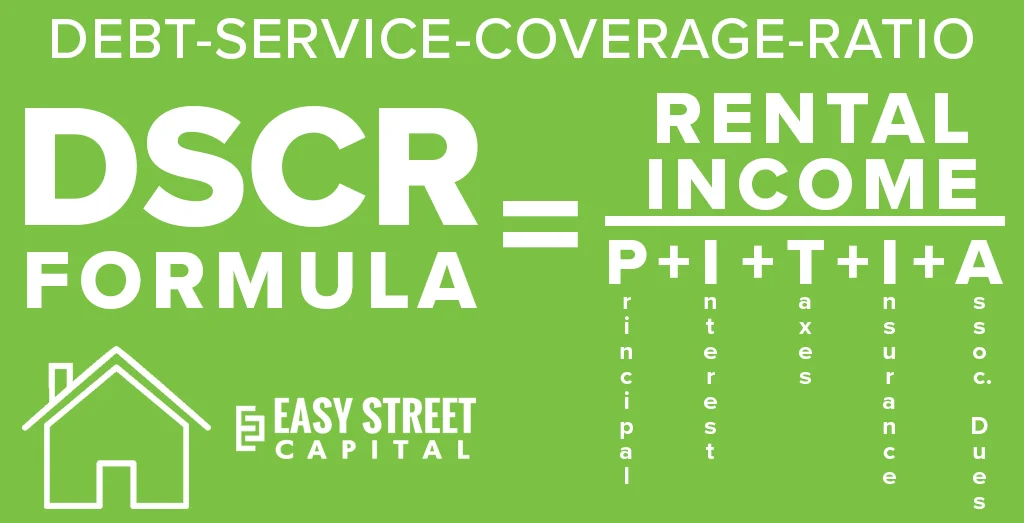

At its core, the DSCR formula involves dividing a property’s Net Operating Income (NOI) by its total debt service. The **NOI** represents the property’s annual income minus its operating expenses, which include property taxes, maintenance, and insurance.

Total debt service, on the other hand, encompasses all debt obligations of the property, such as mortgage payments, interest, and other debt-related expenses. The resulting ratio can be expressed either as a decimal or a percentage.

For instance, a DSCR of 1.25 indicates that the property generates 25% more income than is needed to cover its debt payments, which is generally considered acceptable by most lenders.

Essentially, the DSCR formula can be summarized as:

- Net Operating Income (NOI): Annual income from the property minus operating expenses.

- Total Debt Service: Sum of all debt-related expenses for the property.

By dividing the NOI by the total debt service, one can ascertain the property’s DSCR.

Key Components of DSCR Calculation

Calculating the DSCR ratio involves understanding several key components. Firstly, the **Net Operating Income (NOI)** is a pivotal figure, representing the revenue left after accounting for operating expenses.

Operating expenses include:

- Property taxes: Mandatory taxes on the property.

- Maintenance: Costs associated with keeping the property in good condition.

- Insurance: Policies to protect against property damage or loss.

The **total debt service** includes all the obligations the property has towards debt repayment. This encompasses:

- Mortgage payments: Regular payments to the lender.

- Interest: The cost of borrowing the loan amount.

- Other debts: Any additional debt-related expenses.

For DSCR loans, the calculation is slightly different. In this context, the DSCR ratio is computed by dividing the rental income by the “PITIA,” which stands for principal, interest, taxes, insurance, and association dues (if applicable).

A DSCR ratio of 1.00x signifies a break-even point where revenues equal expenses. A ratio above 1 indicates positive cash flow, whereas a ratio below 1 suggests a financial shortfall.

Practical Examples of DSCR Calculation

Understanding DSCR becomes more tangible with practical examples. Suppose a property has a net operating income (NOI) of **$50,000** and total debt payments amount to **$40,000**. The DSCR calculation would be:

DSCR = $50,000 / $40,000 = 1.25

This indicates that the property generates 25% more income than needed to cover its debt obligations, making it a relatively safe investment.

For a DSCR Loan, if a property generates rental income of **$2,500 per month** on a 12-month lease, but the market rent is determined to be **$2,000 per month**, the DSCR Lender will use the lower figure for the calculation. If the PITIA amounts to **$1,800**, then:

DSCR = $2,000 / $1,800 ≈ 1.11

In this scenario, the property still generates sufficient income to cover its debt obligations, though the margin is slimmer than in the previous example.

It’s important to note that DSCR calculations for commercial real estate differ from DSCR loans. In commercial real estate, the NOI includes property taxes and insurance, whereas for DSCR Loans, these are included in the denominator.

By examining these examples, we gain a clearer understanding of how DSCR ratios can vary based on different inputs and contexts.

Types of Properties Eligible for DSCR Loans

Residential Income-Producing Properties

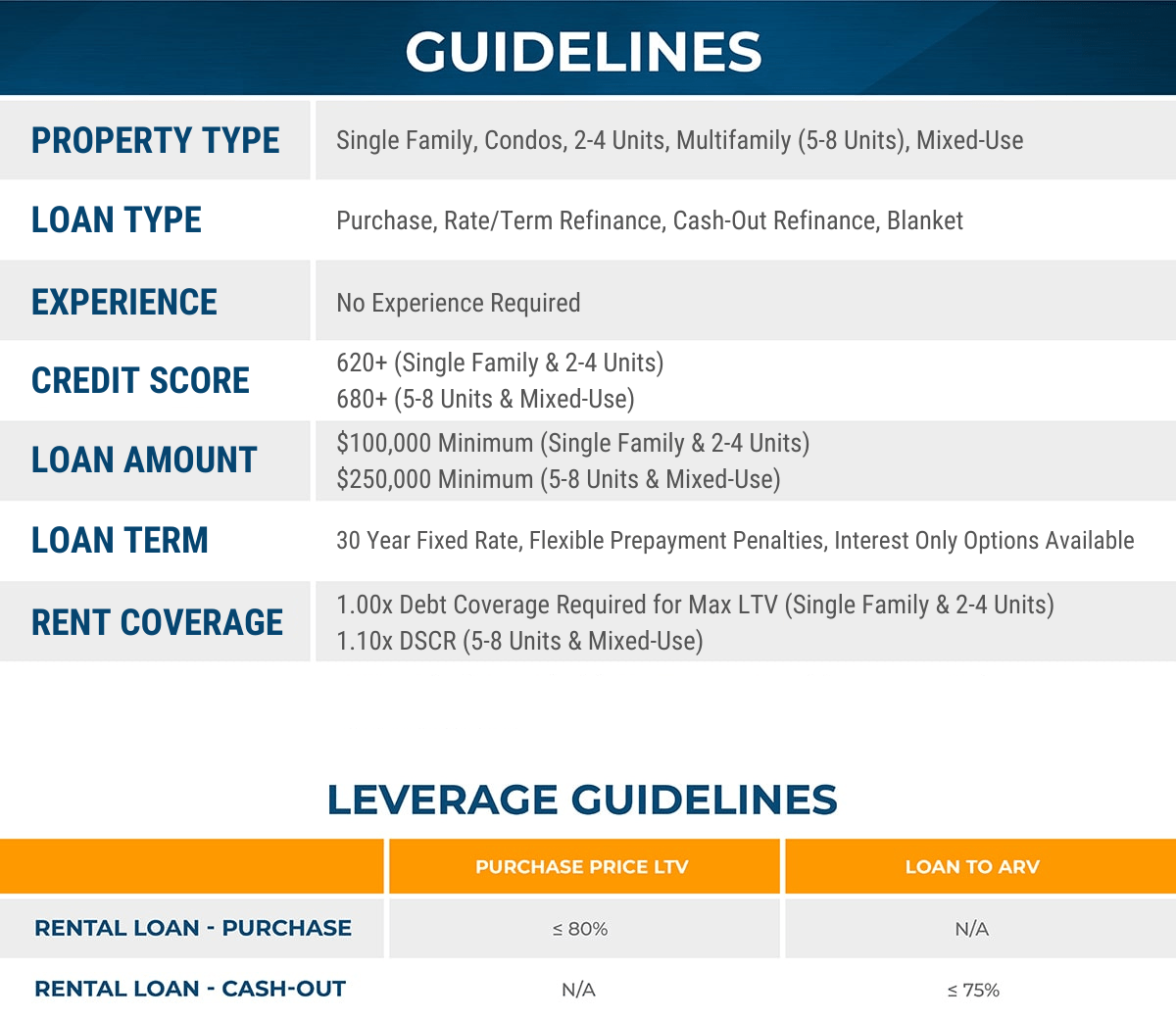

Residential income-producing properties primarily include properties where tenants reside. These properties range from single-family residences to larger multi-unit structures. Residential properties eligible for DSCR loans have traditionally been limited to those with one to four units.

In recent times, the eligibility has expanded, allowing properties with up to ten units. Increasing the number of units expands investment opportunities for real estate investors seeking to maximize their revenue potential.

Typically, single-family residences, duplexes (two units), triplexes (three units), and quadruplexes (four units) have been the primary focus. However, with the expanding DSCR loan landscape, larger residential properties like apartment buildings are now considered.

“Traditionally, DSCR Loans have been only allowed for residential properties from one to four units. However, in recent years, DSCR Loans have expanded to include residential properties up to as many as ten units!”

Moreover, condo units and townhomes can also qualify for DSCR loans. Condos and townhomes are often situated in desirable locations, attracting a significant pool of renters, making them a viable investment option.

Expanding the eligibility criteria to include properties with more units provides greater flexibility for investors, enabling them to diversify their portfolios and enhance their income streams.

How can investors leverage these loan options to maximize their returns?

By securing DSCR loans for larger residential properties, investors can increase the number of rent-paying tenants, thereby boosting their overall income.

Short Term Rentals

Short-term rentals, often facilitated through platforms like Airbnb and VRBO, have become increasingly popular among investors. These properties typically generate substantial revenue due to their rental rates per night, which can be higher than traditional long-term leases.

While not all short-term rentals may qualify for DSCR loans, there is a growing trend to include these lucrative properties within the eligibility criteria. As market conditions evolve, lenders are recognizing the stable income potential that short-term rentals can provide.

What makes short-term rentals a worthwhile investment?

The demand for vacation rentals and temporary accommodations remains high, particularly in tourist destinations, making short-term rentals an attractive option for investors looking to maximize their returns.

Investors must ensure that the property achieves consistent occupancy rates to qualify for DSCR loans, demonstrating reliable income generation.

- High Revenue: Short-term rentals often command higher rates per night compared to traditional leases.

- Flexibility: Owners can adjust rental rates based on demand, optimizing income potential.

- Market Demand: Consistent demand for vacation and temporary rentals supports steady income streams.

Multifamily and Mixed-Use Properties

Multifamily and mixed-use properties represent another significant category eligible for DSCR loans. Multifamily properties are residential buildings housing multiple families in separate units. These properties range from small apartment buildings to large complexes.

Mixed-use properties, on the other hand, comprise both residential and commercial units within a single building. They are typically situated in urban areas and can include commercial spaces like offices, shops, or restaurants on the ground floor, with residential units above.

How do these properties benefit investors?

Multifamily properties provide a steady stream of rental income from multiple units, reducing the risk associated with single-tenant properties. Mixed-use properties offer an additional revenue stream from commercial tenants.

“Recently, properties that have a “Mixed Use” designation, or feature both residential and commercial units, have qualified for DSCR Loans. Mixed Use DSCR Loans are typically secured by urban buildings.”

For a property to qualify as a mixed-use property under DSCR loan criteria, the majority of its square footage must be residential. This requirement ensures that residential income remains the primary consideration for loan qualification.

What should investors consider when exploring these properties?

Investors should evaluate the balance between residential and commercial spaces, ensuring a significant portion of the property is dedicated to residential use to meet DSCR loan requirements.

- Unit Balance: Ensure the majority of the property’s square footage is residential.

- Location: Urban areas with high demand for both residential and commercial spaces are ideal.

- Revenue Streams: Diversify income by integrating residential and commercial tenants.

How to Secure the Best Rates and Terms for DSCR Loans

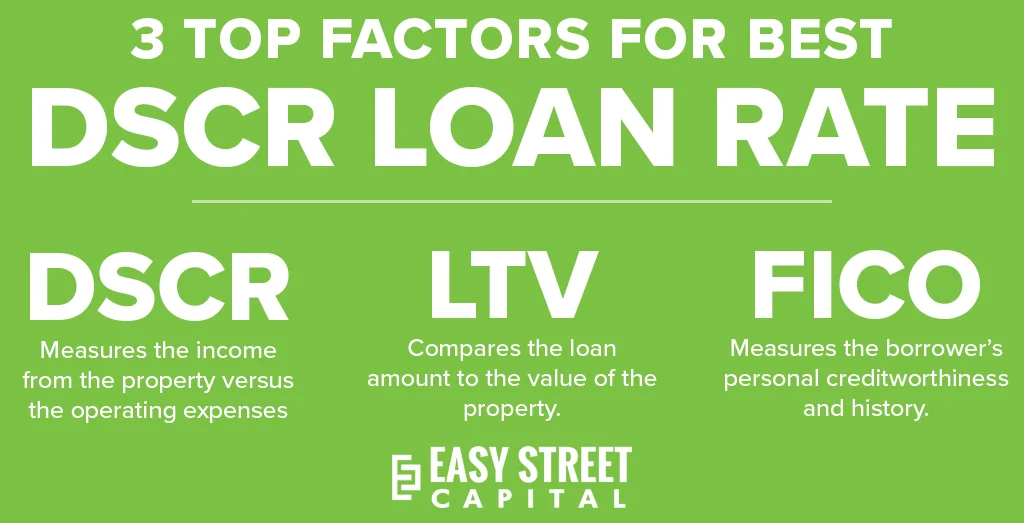

Factors Influencing DSCR Loan Rates

Securing the best rates and terms for DSCR (Debt-Service-Coverage-Ratio) loans requires careful consideration of several factors. Firstly, the DSCR itself is crucial. This metric compares the income generated by the property to its operating expenses, reflecting the investment’s profitability. A higher DSCR indicates that the property’s rent exceeds its costs, assuring lenders of reliable debt payments.

Another significant factor is the Loan-to-Value Ratio (LTV). LTV calculates the loan amount as a percentage of the property’s value. Lenders prefer a lower LTV because it reduces their risk. In the event of foreclosure, a lower LTV assures lenders that the property’s value exceeds the loan amount.

FICO scores, measuring the borrower’s creditworthiness, also influence DSCR loan rates. While DSCR loans primarily assess the property’s performance, lenders still consider the borrower’s personal credit history. Individuals with higher credit scores and a solid mortgage payment history are typically offered lower interest rates.

“For DSCR lenders, a lower LTV is much preferred. This is because the main recourse a lender has in the case a borrower fails to pay back the loan is to foreclose on the property.”

Additionally, other factors such as the property’s location, the borrower’s investment experience, and market conditions can also affect DSCR loan rates. Experienced investors with a track record of successful projects may secure better rates due to their demonstrated reliability.

Understanding these factors can significantly improve one’s ability to negotiate better terms and secure favorable loan rates, ultimately maximizing the profitability of real estate investments.

Tips for Negotiating Better Terms

When negotiating DSCR loan terms, preparation is paramount. Investors should thoroughly analyze their financials and the property’s performance. Presenting a well-documented and detailed proposal can instill confidence in lenders, potentially leading to more favorable terms.

Engaging with multiple lenders can also create competition, encouraging lenders to offer better rates. Investors can leverage offers from different lenders to negotiate the best possible terms. Demonstrating a strong understanding of market dynamics and clearly communicating investment strategies can further enhance negotiation leverage.

- Prepare Comprehensive Financial Documents: Detail your income, expenses, and projected profits to provide a clear picture of the investment’s potential.

- Engage Multiple Lenders: Obtain offers from various lenders to create competition and identify the most favorable terms.

- Communicate Investment Strategies: Articulate your plan and market understanding to build lender confidence in your project’s success.

Additionally, investors can consider buying down the interest rate by paying points upfront. This strategy can be particularly advantageous for long-term investments, as the reduced interest rate over time can offset the initial point costs.

Lastly, maintaining a high credit score and a consistent mortgage payment history can also positively influence loan negotiations. Lenders are more likely to offer better terms to borrowers who exhibit financial stability and reliability.

Common Pitfalls to Avoid

While securing the best DSCR loan rates is crucial, investors should avoid common pitfalls that can undermine their efforts. Overlooking other loan terms, such as prepayment penalties or adjustable rates, can lead to unforeseen costs and financial strain.

Failing to account for market fluctuations can also be detrimental. Interest rates and property values can shift, impacting loan affordability and investment returns. Staying informed about market trends and adjusting investment strategies accordingly is essential.

Another pitfall is underestimating the importance of property management. Efficient property management directly affects DSCR by influencing rental income and expenses. Investors should ensure robust management practices to maintain or improve their DSCR.

- Overlooking Additional Loan Terms: Ensure you understand all terms, including prepayment penalties and adjustable rates, to avoid surprises.

- Ignoring Market Fluctuations: Stay informed about market trends to adjust strategies and ensure loan affordability.

- Neglecting Property Management: Effective management is crucial for maintaining rental income and controlling expenses, impacting your DSCR.

Investors should also avoid rushing into loan agreements without thorough research and consideration. Taking the time to compare different offers and understanding the full scope of each loan’s terms can lead to better decisions and more favorable outcomes.

By being aware of these common pitfalls and proactively addressing potential challenges, investors can secure the best possible rates and terms for their DSCR loans, thereby enhancing the overall success of their real estate investments.

Innovations and Future Trends in DSCR Loans

Upcoming Changes in DSCR Loans

Numerous significant changes are anticipated to revolutionize DSCR Loans in the near future. These changes will primarily enhance flexibility and provide better support for real estate investors. One notable trend is the growing acceptance of short-term rental (STR) income projections for loan qualifications.

Traditional lenders often impose stringent criteria that can be cumbersome for investors. Consider the inflexibility regarding borrowing with an LLC. Numerous investors prefer operating through limited liability companies to mitigate risks associated with high guest turnover.

To circumvent these issues, many DSCR lenders now adapt their practices, allowing qualifications based on actual rental income from STR platforms like AirDNA. This shift marks a significant departure from conservative underwriting practices seen in conventional lending.

“Easy Street Capital, for instance, has pioneered methods that support the use of STR income projections, recognizing the actual revenue potential of these properties.”

The push towards innovation in DSCR Loans also includes a broader acceptance of properties in tertiary or vacation markets. Such locations often yield higher returns, yet conventional lenders tend to avoid them due to perceived risks.

- Flexibility with LLC Borrowing: Mitigates operational risks.

- Streamlined Income Qualification: Uses STR income projections.

- Broader Market Acceptance: Includes tertiary and vacation markets.

Innovative DSCR lenders like Easy Street Capital are setting new standards by embracing these changes. How will these innovations reshape the real estate investment landscape?

Technological Advancements

Technological advancements play a crucial role in the evolution of DSCR Loans. The integration of sophisticated data analytics from platforms such as AirDNA has transformed the qualification process for short-term rental loans.

For example, by leveraging detailed rental income data, lenders can more accurately assess a property’s earning potential. This provides a clearer picture than traditional methods, which often underestimate a property’s profitability.

Furthermore, advancements in fintech are streamlining loan applications and approvals. Automated systems reduce paperwork and expedite the entire loan process.

“We are witnessing a shift where fintech solutions are becoming integral to DSCR lending, enhancing speed and efficiency.”

Another innovative aspect is the introduction of hybrid rental strategies, such as medium-term rentals. This approach combines the benefits of both short-term and long-term rentals, offering flexibility for investors to adapt to market demands.

- Data Analytics: Utilizes platforms like AirDNA for accurate income projections.

- Fintech Integration: Automates loan applications and approvals.

- Hybrid Strategies: Supports medium-term rentals for diverse investment options.

How will these technological enhancements impact the future of DSCR loans?

Market Predictions for 2024 and Beyond

The market for DSCR loans is expected to grow substantially, with several key trends emerging. Investors can anticipate increased demand for short-term rental loans as this segment continues to outperform traditional rental markets.

Moreover, the acceptance of income projections from platforms like AirDNA will likely become a standard practice. This change will make DSCR loans more accessible to a broader range of investors.

Another trend predicted is the growth of vacation and tertiary market investments. As urban markets saturate, these areas offer lucrative opportunities that DSCR lenders are increasingly willing to support.

“Easy Street Capital’s willingness to lend in vacation markets exemplifies this shift, which will attract more investors to such high-yield areas.”

- Demand for STR Loans: Expected to rise as more investors flock to short-term rentals.

- Standardization of Income Projections: Increased use of platforms like AirDNA.

- Growth in Non-Urban Markets: More investments in vacation and tertiary markets.

Additionally, hybrid rental strategies such as medium-term rentals are predicted to gain traction, offering investors flexibility to optimize returns depending on market conditions.

What other market dynamics might influence DSCR lending in the future?

Frequently Asked Questions About DSCR Loans

Common Misconceptions

One widespread misconception about DSCR loans is that they are only available to large-scale investors. This is not true. DSCR loans can be an excellent option for small to medium-sized real estate investors as well.

Another common misunderstanding is that these loans require an abundance of documentation. While documentation is necessary, it is not as burdensome as some believe. Lenders typically require rental income statements, lease agreements, and other relevant documents.

Many investors also assume that DSCR loans only apply to long-term rental properties. However, short-term rentals and properties used in the BRRRR method can also qualify.

Additionally, it is often thought that all DSCR loans have fixed rates. In reality, DSCR loans can be either fixed or variable rate, depending on the lender’s terms.

“DSCR loans offer versatility and opportunities for diverse investment strategies, contrary to popular belief.” — Financial Advisor

- Large-Scale Only: Suitable for small to medium investors too.

- Excessive Documentation: Requires standard financial documents.

- Long-Term Rentals Only: Applicable to short-term rentals and BRRRR investments.

- Fixed Rates Only: Both fixed and variable rate options available.

Understanding these myths can better prepare investors to utilize DSCR loans effectively for their investment strategies.

Detailed Answers to Popular Questions

What exactly is a DSCR loan? A DSCR loan, or Debt Service Coverage Ratio loan, measures a property’s ability to cover its debt obligations. It is essential for both lenders and investors to assess the financial health of an investment property.

Who qualifies for DSCR loans? These loans are available to real estate investors seeking to finance income-producing properties. Eligibility criteria include a solid DSCR ratio and valid proof of rental income.

How is the DSCR calculated? DSCR is calculated by dividing the property’s net operating income (NOI) by its total debt service. A DSCR of 1.0 means the property generates enough income to cover its debt. Higher DSCR values indicate better financial health.

What documents are necessary? Investors must provide rental income statements, lease agreements, and a 1007 rent schedule as part of the application process.

“Accurate documentation is crucial to expedite the DSCR loan approval process.” — Mortgage Broker

- Step 1: Connect with a lender to discuss financing needs.

- Step 2: Submit loan application forms.

- Step 3: Provide proof of property income.

- Step 4: Lender calculates DSCR and rent schedule.

- Step 5: If approved, proceed to signing and closing.

What properties qualify? DSCR loans can finance a wide range of income-producing properties, including multifamily residences, commercial spaces, and short-term rentals. Are all DSCR lenders the same? No, lenders may have varied qualification rules, interest rates, and terms.

Expert Tips and Advice

To get the best rates and terms for a DSCR loan, it is crucial to maintain accurate and up-to-date financial records. Lenders will scrutinize the provided income statements and lease agreements. Why not make their job easier?

Regularly updating your property’s financial status and lease agreements can significantly enhance your loan application’s strength.

Understanding prepayment penalties is also essential. Some DSCR loans include penalties for early repayment, which can impact your investment strategy. Always review the loan terms carefully.

“Detailed preparation and a clear understanding of the lender’s terms can smooth the DSCR loan process significantly.” — Real Estate Investor

- Maintain Financial Records: Keep your documentation accurate and current.

- Review Loan Terms: Pay close attention to prepayment penalties.

- Regular Updates: Consistently update financial status and agreements.

- Compare Lenders: Evaluate different lenders for better terms.

Finally, consulting with financial advisors or mortgage brokers can provide valuable insights and help navigate the complexities of DSCR loans.

Conclusion

Understanding DSCR loan programs unlocks the door to significant opportunities for various investors. Unlike traditional loans, DSCR loans cater specifically to those with income-producing properties, offering flexible terms for self-employed individuals and real estate partnerships. This piece illustrates how calculating DSCR accurately can be a game-changer in securing favorable loan terms. By focusing on eligible property types, you can better strategize your investments in residential, short-term rental, multifamily, and mixed-use properties.

As the market evolves, staying informed about upcoming innovations and trends in DSCR loans becomes crucial. Leveraging technological advancements and understanding predictions for future years can position you ahead of the curve. Whether you’re a seasoned investor or exploring these loans for the first time, diving deeper into the nuances of DSCR calculations and negotiation strategies will maximize your benefits. Now is the time to take actionable steps towards securing the best rates and terms for your investments—don’t miss out on the potential growth DSCR loans offer.

Frequently Asked Questions

Who qualifies for a DSCR loan?

Individuals with income-producing properties and a favorable debt service coverage ratio (DSCR) are eligible.

Is a DSCR loan hard to get?

Approval depends on the property’s cash flow rather than personal income, making it accessible for investors with strong property performance.

How much do you need down for a DSCR loan?

Typically, a down payment of 20% to 25% is required.

What are the cons of a DSCR loan?

Higher interest rates and stricter property cash flow requirements can be drawbacks.

Can self-employed investors benefit from DSCR loans?

Yes, DSCR loans are ideal for self-employed investors due to their focus on property cash flow over personal income.

What types of properties qualify for DSCR loans?

Eligible properties include residential income-producing properties, short-term rentals, and multifamily or mixed-use properties.