In today’s dynamic financial landscape, understanding DSCR loan rates is crucial for real estate investors. This comprehensive guide explores the key factors influencing these rates, including economic indicators, borrower specifics, and federal policies.

We’ll also delve into the mechanics of calculating DSCR loan rates, comparing them with conventional loans, and evaluating the benefits of using a DSCR calculator. Equip yourself with the knowledge to make informed investment decisions.

Understanding Current DSCR Loan Rates

Impact of the 5 Year US Treasury

The yield on the 5 Year US Treasury is a crucial indicator that significantly influences DSCR loan rates. Real estate investors and financial analysts often track these yields to forecast borrowing costs. When the yield climbs, it suggests higher future lending rates, impacting DSCR loans directly.

For instance, if yields rise, lenders may increase the interest rates on DSCR loans to maintain their profit margins. Conversely, a decline in yields typically signals a potential reduction in loan rates. How do these fluctuations affect your investment strategies?

“The 5 Year US Treasury yield is often perceived as a barometer for economic confidence,” financial analyst Jane Doe explains. “Changes in its yield can ripple through various financial markets, including real estate lending.”

Understanding this dynamic is vital for anticipating changes in DSCR loan rates. Investors should closely monitor Treasury yields and their trends over time.

- Historical Trends: Examining past data can reveal patterns and predict future movements.

- Market Sentiment: Changes in yield often reflect broader economic sentiments, influencing investment decisions.

- Yield Curve Analysis: The shape of the yield curve can provide insights into future rate movements.

Importantly, staying informed about the 5 Year US Treasury yield equips investors with valuable foresight into the potential shifts in DSCR loan rates.

Inflation and Fed Policy

Inflation is another pivotal factor that affects DSCR loan rates. High inflation erodes purchasing power, prompting the Federal Reserve to adjust monetary policies accordingly. How does this impact real estate financing?

When inflation rises, the Fed often increases interest rates to curb spending and inflationary pressures. This, in turn, leads to higher borrowing costs for DSCR loans. On the other hand, low inflation might lead the Fed to lower rates, potentially reducing loan costs.

For example, consider the recent inflation trends and the Fed’s monetary policy response. How do these actions influence your loan decisions?

“Fed policy adjustments are closely tied to inflation metrics,” notes economic strategist John Smith. “Investors must understand these links to navigate the loan market effectively.”

Tracking inflation and anticipating Fed responses can help in forecasting DSCR loan rate changes. Analysts should focus on:

- Inflation Reports: Regular updates on inflation figures can provide early warnings of rate adjustments.

- Fed Announcements: Statements and actions by the Fed offer direct insights into future rate policies.

- Economic Indicators: Broader economic data can signal potential inflationary trends.

Thus, being vigilant about inflation and Fed policies is essential for making informed decisions regarding DSCR loans.

Economic Indicators

Several economic indicators play a role in shaping DSCR loan rates. These metrics reflect the health of the economy and help lenders determine the appropriate interest rates. What indicators should you pay attention to?

Key indicators include GDP growth, employment rates, and consumer confidence. Robust economic growth usually leads to higher demand for credit, which can increase loan rates. Conversely, economic downturns might push rates lower to stimulate borrowing.

For instance, a sudden dip in GDP might signal lenders to reduce rates to encourage investment. How do these indicators correlate with your investment outlook?

“Understanding economic indicators is fundamental for predicting loan rate trends,” says market analyst Sarah Johnson. “They provide a comprehensive view of the economic landscape.”

- Gross Domestic Product (GDP): High GDP growth often leads to higher lending rates due to increased demand for credit.

- Employment Rates: Strong employment figures can indicate a healthy economy, influencing loan rates upward.

- Consumer Confidence: High consumer confidence typically correlates with robust economic activity, impacting interest rates.

By analyzing these indicators, investors and analysts can better understand the factors driving changes in DSCR loan rates.

Regional Banking Crisis

Finally, regional banking crises can significantly impact DSCR loan rates. Financial instability within regional banks can lead to tighter credit conditions, affecting the availability and cost of loans. How do such crises influence loan rates?

During a banking crisis, lenders may become risk-averse, leading to higher interest rates to compensate for perceived risks. This scenario can make DSCR loans more expensive and harder to obtain.

Moreover, regional crises can trigger broader economic concerns, prompting shifts in Federal Reserve policies and market reactions. How prepared are you to navigate these uncertainties?

“Regional banking crises can create ripple effects across the lending market,” cautions financial expert Michael Lee. “Understanding these dynamics is crucial for strategic planning.”

Investors should consider the following when assessing the impact of banking crises:

- Credit Availability: Tightened credit conditions can restrict loan options and increase costs.

- Risk Premiums: Higher perceived risks can lead to increased interest rates on DSCR loans.

- Market Confidence: Loss of confidence in regional banks can affect broader financial stability and loan markets.

Thus, understanding the implications of regional banking crises is essential for making informed loan decisions in the real estate market.

How to Calculate DSCR Loan Interest Rates

Components of DSCR Loan Rate

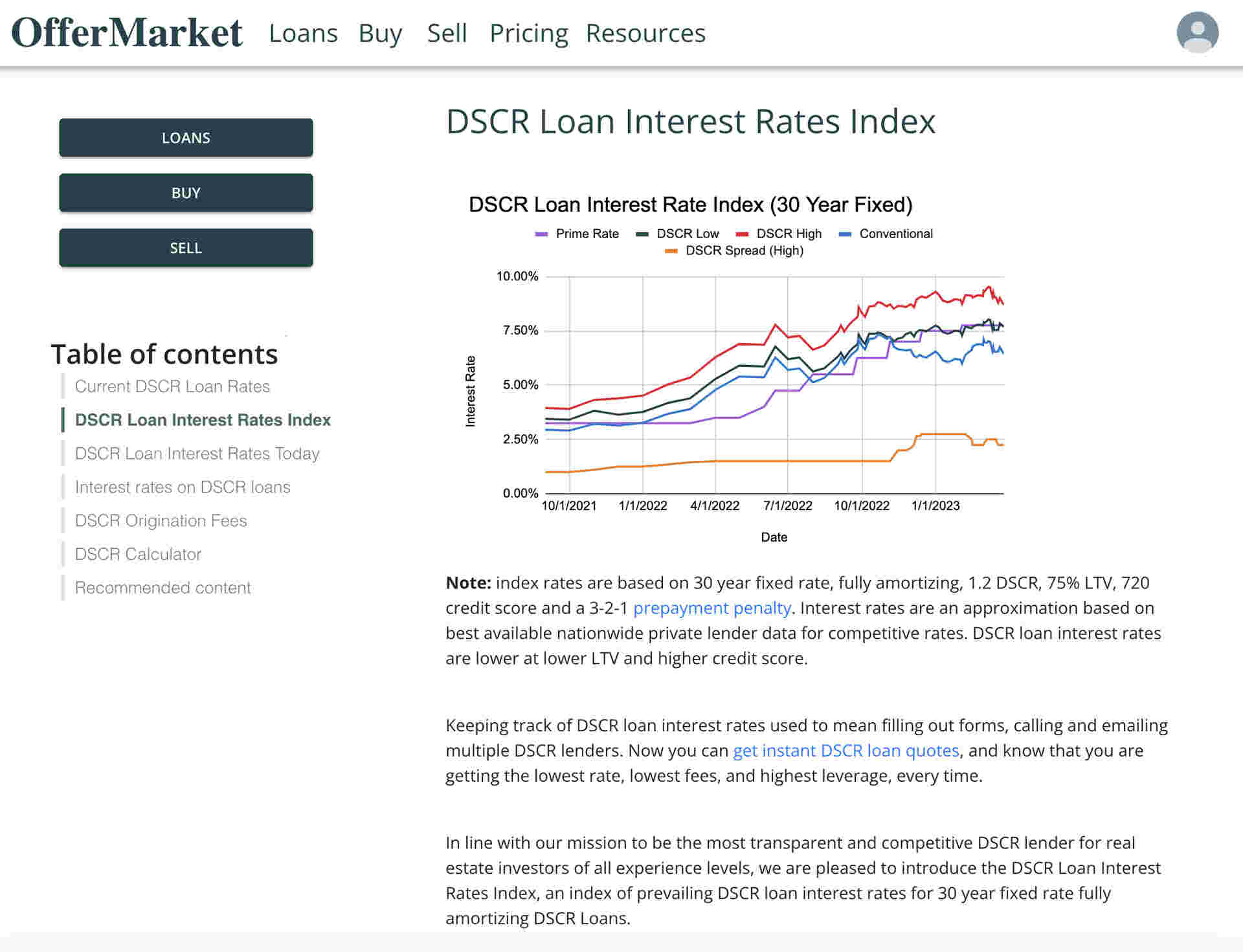

Understanding the Debt Service Coverage Ratio (DSCR) loan interest rate is essential for real estate investors and finance students. The calculation predominantly involves two main components: the 5 Year US Treasury rate and the Borrower Credit Spread.

The DSCR loan interest rate formula can be represented as:

DSCR Loan Interest Rate = 5 Year US Treasury + Borrower Credit Spread

This formula underscores the dependency on both the base rate, which is the 5 Year US Treasury, and the risk premium, which is the Borrower Credit Spread.

Factors influencing the Borrower Credit Spread include:

- Credit Score: Higher credit scores generally result in lower credit spreads.

- Loan-to-Value Ratio (LTV): Loans with lower LTV ratios tend to have lower interest rates.

- Property Type: Different types of properties carry varying levels of risk, impacting the credit spread.

- Experience: Borrower’s experience in real estate investing also affects the credit spread.

- Prepayment Penalty: The terms of prepayment penalties can alter the interest rate.

By understanding these components, investors can better evaluate and predict their potential loan interest rates.

Role of the 5 Year US Treasury

The 5 Year US Treasury rate, often referred to as the “risk-free rate,” serves as a benchmark for DSCR loan interest rates. This rate reflects the return on investment that is considered free of risk.

For example, if the current 5 Year US Treasury rate is 4.64%, this figure forms the base rate for calculating DSCR loan interest rates.

By using the 5 Year US Treasury rate, lenders can ensure that the interest rate is in line with the current economic climate, helping to mitigate risk.

Is it not crucial to consider how changes in the 5 Year US Treasury rate impact overall loan costs?

Indeed, fluctuations in the 5 Year US Treasury rate can significantly influence the overall interest rate of a DSCR loan. Thus, keeping an eye on this rate is essential for investors seeking to optimize their borrowing costs.

Borrower Credit Spread

While the 5 Year US Treasury rate provides the baseline, the Borrower Credit Spread introduces a layer of customization to the DSCR loan interest rate. This spread varies based on numerous factors specific to the borrower and the property.

For instance, a borrower with a stellar credit score and a low LTV ratio might attract a Borrower Credit Spread as low as 3.25%. Conversely, a borrower with a lower credit score and a higher LTV ratio could see spreads as high as 4.5%.

Do you see how critical borrower-specific factors are in determining the final interest rate?

Indeed, these factors are pivotal. By analyzing and improving these aspects, borrowers can negotiate more favorable terms and reduce their overall loan costs.

Example Calculation

To illustrate the calculation of a DSCR loan interest rate, consider the following example:

Assume the 5 Year US Treasury rate is 4.64% and the Borrower Credit Spread is determined to be 3.75%.

DSCR Loan Interest Rate = 4.64% (5 Year US Treasury) + 3.75% (Borrower Credit Spread)

The resulting DSCR loan interest rate in this scenario would be 8.39%.

How does this compare to conventional loan rates? According to Bankrate, the current average interest rate for conventional loans is around 7.24%. While DSCR loan rates may be higher, they offer distinct benefits for real estate investors, focusing on the property’s cash flow rather than the borrower’s personal income.

This method ensures that the property’s net operating income is sufficient to cover the debt, providing a viable financial strategy for real estate investments. By thoroughly understanding the components and factors involved, investors can make informed decisions and optimize their loan terms.

Factors Affecting DSCR Loan Rates Today

Credit Score Impact

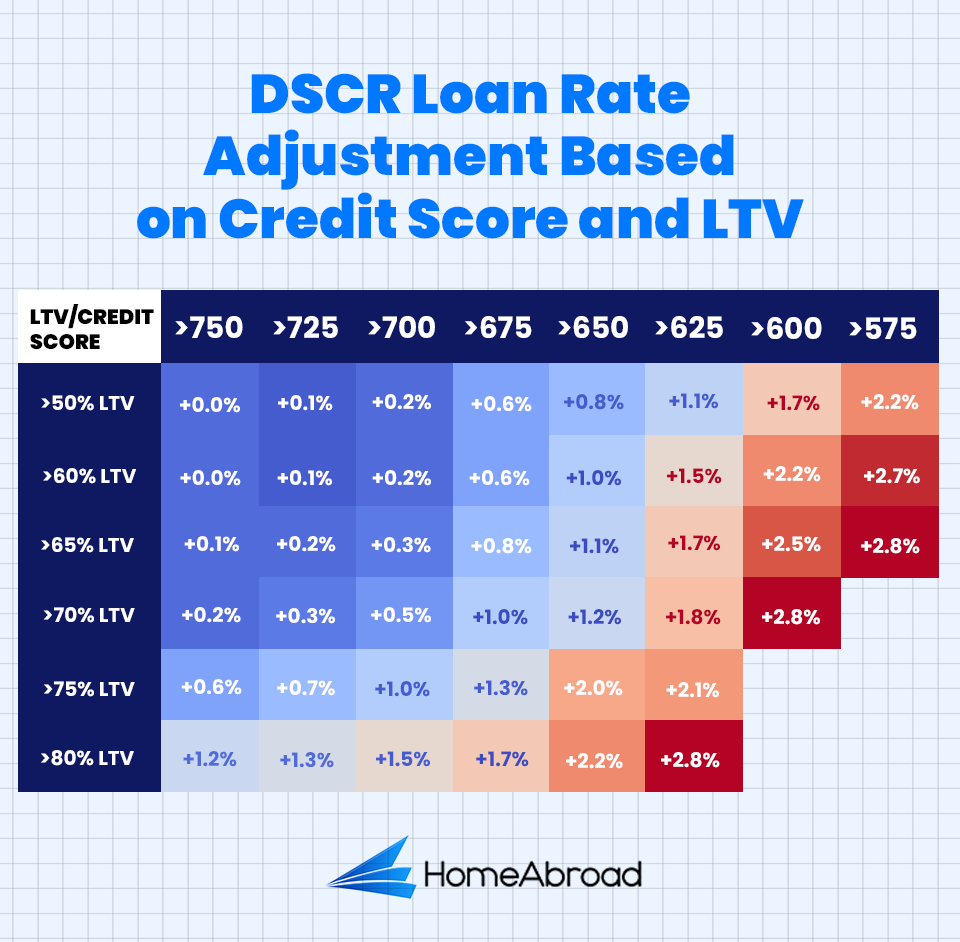

Credit scores are fundamental in determining DSCR loan rates. Lenders view a borrower’s credit score as a measure of trustworthiness and reliability. The higher the credit score, the lower the perceived risk. Consequently, prospective borrowers with excellent credit scores often secure more favorable rates. Why is this crucial?

A higher credit score signifies a history of on-time payments and responsible credit management. For instance, a borrower with a credit score above 750 might be offered a DSCR loan rate significantly lower than someone with a score below 650. This difference can translate to substantial savings over the life of the loan. In contrast, lower credit scores lead lenders to increase rates to mitigate the risk of potential default.

Factors impacting credit scores include:

- Payment History: The record of timely payments accounts for a significant portion of the score.

- Credit Utilization: The amount of credit used compared to the total available credit.

- Credit History Length: A longer history typically results in a higher score.

Understanding these elements can help borrowers take steps to improve their credit scores, thus securing more favorable DSCR loan rates.

“A high credit score denotes a lower risk for lenders, thereby reducing the interest rates offered on DSCR loans.” – Financial Analyst

Have you evaluated your credit score recently? This could be a decisive factor in your financial planning for real estate investments.

Borrower Experience

The experience of the borrower in managing rental properties significantly influences DSCR loan rates. Lenders tend to offer lower rates to experienced real estate investors, as they represent a lower risk.

Real estate investors who have managed multiple properties successfully exhibit proficiency in handling financial obligations related to property management. This competence assures lenders of the borrower’s ability to maintain a positive cash flow and manage debt repayments efficiently.

Key factors considered include:

- Number of Properties Managed: More properties reflect greater experience.

- Duration in Property Management: Longevity in the field indicates stability and expertise.

- Past Performance: A history of profitable ventures reassures lenders.

For new investors, partnering with seasoned property managers or consulting with experienced investors could mitigate the perceived risk by lenders and potentially reduce DSCR loan rates.

“Experience in rental property management reduces the borrowing risk, leading to lower DSCR loan rates.” – Real Estate Expert

How well do your current property management practices reflect your expertise? Investing in professional development could enhance your borrowing prospects.

Loan-to-Value Ratio

The Loan-to-Value (LTV) ratio is a critical factor in determining DSCR loan rates. It compares the loan amount to the appraised value of the property. A lower LTV ratio signifies less risk for the lender, often resulting in more favorable loan rates.

Lenders prefer a lower LTV ratio because it indicates that the borrower has more equity in the property. For instance, an LTV ratio of 60% versus 80% could result in a noticeable difference in interest rates. Higher equity implies that the borrower has a more significant financial stake in the property, thereby reducing the likelihood of default.

Benefits of a lower LTV ratio include:

- Reduced Risk: More equity means less risk for lenders.

- Better Rates: Lenders offer lower interest rates for lower LTV ratios.

- Higher Approval Chances: Lower ratios improve the likelihood of loan approval.

“A lower Loan-to-Value ratio significantly impacts DSCR loan rates by decreasing the lender’s risk.” – Mortgage Specialist

Have you considered how the LTV ratio of your investment could influence your financing options? Adjusting your down payment could yield better loan terms.

Loan Amount and Prepayment Penalty

The loan amount and potential prepayment penalty are additional factors influencing DSCR loan rates. Private lenders might require higher interest rates for lower loan amounts to justify the investment. Smaller loans can incur disproportionate administrative costs, prompting lenders to adjust their rates accordingly.

Prepayment penalties are fees charged if the borrower pays off the loan early. These penalties are designed to protect lenders from interest income loss. Selecting a loan with a lower prepayment penalty could offer strategic advantages for real estate investors anticipating rate drops or property value increases.

Key considerations for loan amount and prepayment penalties include:

- Loan Size: Smaller loans typically attract higher rates.

- Prepayment Terms: Negotiating favorable terms can enhance flexibility.

- Long-term Strategy: Align terms with future refinancing plans.

Real estate investors should carefully weigh the loan amount and prepayment penalty clauses when negotiating DSCR loans. By understanding these elements, they can better manage their financial strategies and potentially reduce borrowing costs.

“Both the loan amount and prepayment penalties play pivotal roles in determining DSCR loan rates.” – Lending Advisor

Are you considering the long-term implications of your loan’s prepayment terms? Strategic planning can optimize your investment’s financial health.

Comparing DSCR Loan Rates with Conventional Loans

Interest Rate Comparison

When we talk about the **interest rates** of DSCR loans compared to conventional loans, it’s essential to understand the underlying factors that influence these rates. DSCR, or Debt Service Coverage Ratio loans, often carry higher interest rates. Why is this the case?

Primarily, DSCR loans are considered riskier by lenders. **Conventional loans** typically have lower interest rates because they are based on the borrower’s creditworthiness and income stability. Lenders prefer these loans due to their lower perceived risk.

“DSCR loans may have interest rates ranging from 1% to 2% higher than those of conventional loans.”

The fluctuation in interest rates for DSCR loans can be attributed to the property’s income potential rather than the borrower’s personal income. This makes them an attractive option for seasoned real estate investors looking to acquire new properties based on their cash flow rather than their personal financial status.

- Higher risk: Lenders often see DSCR loans as more risky, leading to higher rates.

- Income-based: Rates are largely influenced by the income potential of the property.

- Borrower independence: These loans do not heavily rely on the borrower’s personal income profile.

Would you diversify your portfolio with DSCR loans, despite the higher rates? This decision hinges on various factors, including investment strategy and financial goals.

Risk Assessment

Assessing the **risk** associated with DSCR loans versus conventional loans reveals several complexities. The increased rates of DSCR loans echo the higher risk that lenders shoulder. But what specific risks are we referring to?

Unlike conventional loans, DSCR loans depend heavily on the property’s ability to generate sufficient cash flow to cover debt obligations. This reliance on rental or commercial income increases the potential for fluctuating income, which can pose risks if the property does not perform as expected.

“The risk inherent in DSCR loans is mitigated by the property’s income performance, which can be unpredictable.”

On the contrary, conventional loans have a more predictable risk profile, as they are based on the borrower’s credit score, income level, and debt-to-income ratio. This predictability translates into reduced interest rates for the borrower.

- Income volatility: DSCR loans depend on rental or commercial income, which can be unpredictable.

- Credit reliance: Conventional loans rely on the borrower’s credit stability.

- Market influence: The real estate market heavily impacts the performance of DSCR loans.

Given these factors, how do real estate investors balance higher DSCR loan rates with the potential for increased returns from rental income?

Loan Terms

The **terms** of DSCR loans also differ significantly from those of conventional loans. This divergence in terms can affect both short-term and long-term financial strategies for investors.

DSCR loans often come with variable interest rates that adjust periodically. This can lead to fluctuating monthly payments that reflect changes in market conditions. While the initial rate might be attractive, borrowers must be prepared for potential rate increases.

Conversely, conventional loans typically offer fixed-rate options, providing stability over the loan term. Fixed rates ensure predictable monthly payments, making long-term financial planning more straightforward.

- Variable rates: DSCR loans often have rates that fluctuate with market conditions.

- Fixed options: Conventional loans usually offer fixed-rate terms for predictability.

- Term length: Both loans can span similar timeframes, but the interest rate structure varies.

How might an investor’s strategy differ when choosing between a variable-rate DSCR loan and a fixed-rate conventional loan? Each option offers unique benefits and challenges.

Borrower Requirements

The **requirements** for obtaining a DSCR loan can be less stringent compared to conventional loans. DSCR loans primarily focus on the property’s income potential rather than the borrower’s personal financial profile.

This focus on property income allows investors with less-than-perfect credit scores to qualify for DSCR loans. However, lenders will scrutinize the property’s projected cash flow and demand thorough documentation to ensure the viability of the investment.

“Borrowers with lower credit scores might find DSCR loans more accessible than conventional loans, provided the property generates adequate income.”

On the other hand, conventional loans require a strong credit score, stable income, and a low debt-to-income ratio. These criteria ensure that the borrower has a solid financial foundation to repay the loan.

- Credit flexibility: DSCR loans are more lenient with credit score requirements.

- Income proof: Conventional loans need solid proof of personal income.

- Property focus: DSCR loans emphasize the property’s income over the borrower’s financial history.

What might be the implications for a real estate investor with a variable credit history? The flexibility of DSCR loans could open new opportunities, but not without their own set of challenges.

Understanding DSCR Origination Fees

Definition of Origination Fees

Origination fees, also known as “points”, are charges levied by lenders for processing a new loan application. They are typically a percentage of the loan amount.

For instance, if a private lender charges 2 points on a $200,000 loan, the origination fee would be $4,000. This fee compensates the lender for reviewing and preparing the loan.

The exact percentage can vary between lenders, and it’s crucial for borrowers to understand what these fees entail. By knowing the origination fee, borrowers can better calculate the total cost of securing a loan.

“Origination fees are essentially the cost of doing business with a lender, representing the price for their service in providing the loan.”

Origination fees are usually negotiated upfront, and they are a pivotal part of the loan agreement. Borrowers should inquire about these fees early in the loan process to avoid surprises.

Would you agree that knowing the exact amount and purpose of the fee helps in better financial planning?

Typical Fee Structure

Origination fees typically range between 2-3% of the loan amount, though this can vary based on the lender and the specifics of the loan.

For example, a 2% origination fee on a $200,000 loan would be $4,000, while a 3% fee would be $6,000. These fees are often paid at closing and can sometimes be rolled into the loan itself.

The fee structure can include several components, such as:

- Application Fee: A fee for processing the initial application.

- Documentation Fee: Charges for preparing and handling the necessary paperwork.

- Commitment Fee: A fee for reserving the funds once the loan is approved.

These components often add up, increasing the overall cost of obtaining a DSCR loan.

Wouldn’t understanding these components help you make a more informed decision?

Additional Fees to Consider

In addition to origination fees, private lenders may charge other ancillary fees. These can include:

- Underwriting Fee: A fee for the lender’s evaluation of the borrower’s creditworthiness.

- Processing Fee: Charges for handling the loan application and related documents.

- Servicing Fee: A fee for ongoing loan maintenance and administration.

These additional fees can significantly impact the overall cost of the loan. Thus, it’s essential to consider them when comparing loan offers.

Have you ever wondered why understanding all potential costs is crucial?

Borrowers should ensure they get a comprehensive breakdown of all fees from potential lenders. Transparency in these fees helps in evaluating the true cost of a loan.

Comparing Lender Fees

Comparing fees from multiple lenders is vital for getting the best deal on a DSCR loan. While a lower origination fee might seem attractive, additional hidden costs could offset the savings.

For instance, one lender might offer a lower origination fee but higher underwriting or servicing fees. Another might have higher upfront costs but lower ongoing fees.

Effective comparison involves:

- Requesting detailed fee breakdowns: Understanding each fee component.

- Evaluating the overall cost: Considering both upfront and ongoing fees.

- Researching lender reputation: Ensuring the lender’s reliability and service quality.

Wouldn’t knowing all these aspects help you choose the best lender for your needs?

Ultimately, thorough comparison can lead to significant savings and a better loan experience.

Using a DSCR Calculator for Loan Assessment

Benefits of a DSCR Calculator

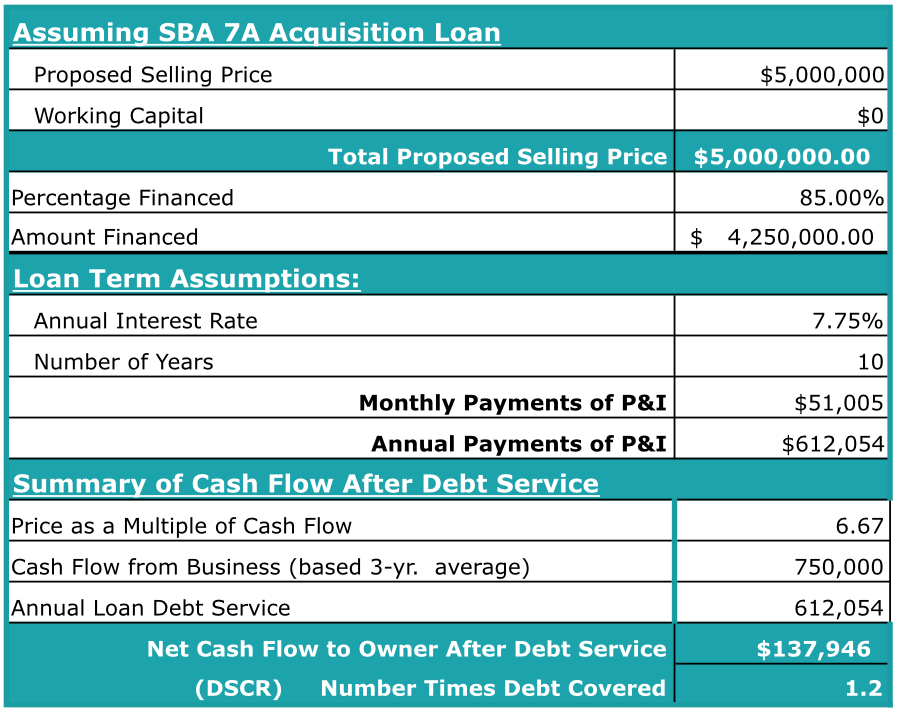

Utilizing a DSCR calculator can significantly streamline the process of assessing loans for rental properties. The Debt Service Coverage Ratio (DSCR) measures a property’s cash flow relative to its debt obligations, providing a clear picture of financial health.

For real estate investors, this tool offers a comprehensive analysis of potential investments. By inputting key variables, we can quickly determine whether a property’s income suffices to cover its loan payments.

“This DSCR Calculator makes it easy to workout DSCR Ratio, and it also estimate maximum loan amount and monthly repayments.”

Furthermore, the calculator aids in assessing the maximum loan amount and monthly repayments, making financial planning more precise. This feature is crucial when comparing different properties or evaluating refinancing options.

- Accuracy in Assessments: Ensures precise calculation of DSCR, reducing the risk of overestimating property profitability.

- Time Efficiency: Saves time by automating complex calculations, allowing investors to focus on decision-making.

- Informed Decision Making: Provides clear data, helping us to make well-informed investment choices.

Moreover, the DSCR calculator can highlight potential areas of concern, such as insufficient cash flow or high debt obligations. This allows us to address issues proactively, ensuring long-term financial stability.

Comparing different financial scenarios becomes straightforward with a DSCR calculator, making it an indispensable tool for sound investment strategies.

How to Use the Calculator

Getting started with the DSCR calculator is straightforward. Initially, we need to gather relevant financial data about the property in question.

- Input Property Income: Enter the total income generated from the rental property, including rent and any additional income sources.

- Enter Operating Expenses: Account for all expenses related to property management, maintenance, and other operational costs.

- Specify Debt Obligations: Include details about existing loans, including monthly repayment amounts.

The calculator then processes this data to compute the DSCR. We must ensure the values entered are accurate and up-to-date to achieve reliable results.

“First and foremost there must be a rental property to evaluate, but there are other DSCR Loan Requirements.”

Once the inputs are finalized, the DSCR calculator will display the ratio, indicating whether the property’s income sufficiently covers its debt repayments.

To optimize the use of this tool, we can also explore different scenarios by adjusting input values. This allows us to understand how changes in income or expenses impact the DSCR.

Key Inputs Required

Using the DSCR calculator effectively requires us to input several critical financial metrics. These inputs provide the foundation for accurate ratio calculation.

- Gross Rental Income: The total income generated by the property before deducting any expenses.

- Operating Expenses: All costs associated with running the property, such as repairs, taxes, and insurance.

- Debt Payments: Monthly amounts due for existing mortgages or loans secured against the property.

- Other Income: Any additional revenue streams related to the property, like parking fees or laundry services.

It’s essential to include all relevant expenses to avoid overestimating the property’s DSCR. Even minor costs can significantly impact the overall calculation and final decision-making process.

By carefully inputting accurate and comprehensive data, we ensure the DSCR calculator provides reliable insights, facilitating sound financial decisions.

Interpreting the Results

Once the DSCR calculator processes the inputs, interpreting the result is straightforward. The ratio indicates the property’s ability to service its debt.

A DSCR of 1.0 or higher typically signifies that the property’s income is sufficient to cover its debt obligations. Ratios below 1.0 might indicate potential financial stress, suggesting that income falls short of covering debt payments.

- DSCR Above 1.0: Indicates a healthy financial state, where income exceeds debt obligations, often considered favorable by lenders.

- DSCR Exactly 1.0: Means that the income just covers the debt, providing no margin for unexpected expenses or income fluctuations.

- DSCR Below 1.0: Signals potential risk, where income is insufficient to cover debt, requiring further scrutiny and possible intervention.

The results enable us to make informed decisions, such as negotiating better loan terms or identifying properties with inadequate cash flow.

“Some lenders are better than others. This guide reviews the Best DSCR Lenders at this moment in time.”

Overall, interpreting DSCR results allows us to gauge the financial viability of potential investments, ensuring that our decisions are based on solid financial foundations.

By understanding the implications of different DSCR values, we can strategically plan our investments, enhancing the likelihood of successful outcomes in our real estate ventures.

Why DSCR Loans are Attractive for Real Estate Investors

Advantages Over Other Financing Options

In considering various financing options for real estate investments, DSCR loans stand out for several reasons. Unlike traditional loans, which may require a stellar credit score, DSCR loans primarily focus on the property’s cash flow.

This makes them more accessible for investors who may not have an unblemished credit record but have a lucrative property in sight. By prioritizing the debt coverage ratio, lenders can better gauge the investment’s potential profitability, leading to more direct approval processes.

DSCR loans typically require a down payment contribution from the real estate investor of anywhere between 20% and 25%. This can depend on the Loan-To-Value (LTV) ratio as well.

Moreover, DSCR loans can often be obtained with higher LTV ratios than other commercial loans. This means investors might need a smaller upfront investment, allowing them to leverage their capital more effectively.

- Credit Flexibility: DSCR loans focus on property income over personal credit scores.

- Higher LTV Ratios: These loans can often be obtained with higher LTV ratios, reducing the upfront investment needed.

- Simplified Approval: By concentrating on the property’s cash flow, the approval process becomes more straightforward.

However, it should be noted that investors with no previous experience may need to make a larger down payment and could face slightly higher interest rates.

Market Health

The overall health of the real estate market greatly affects the attractiveness of DSCR loans. In strong markets, rental properties generate reliable income, which aligns well with the DSCR loan’s emphasis on cash flow.

For instance, when vacancy rates are low, and rental demand is high, the income generated from properties will typically cover or surpass the debt obligations, making DSCR loans a favorable financing option.

Some lenders may require a larger down payment for real estate investors who have no previous real estate investing experience, or for borrowers with a DSCR that is lower than 1.

A stable market also instills confidence in both investors and lenders. For those looking to enter the market, DSCR loans could be perceived as less risky compared to traditional loans since they are grounded on a property’s ability to generate income.

Conversely, during economic downturns, the inherent risks associated with rental income fluctuations become more pronounced. However, with foresight and strategic property selection, DSCR loans can still be beneficial.

- Strong Rental Demand: Ensures property income will consistently cover debt obligations.

- Economic Stability: Provides a favorable environment for investing and borrowing.

- Income Coverage: Emphasizes the importance of market conditions on loan attractiveness.

Prepayment Penalty Considerations

Like many loan types, DSCR loans often come with prepayment penalties. These penalties are designed to protect lenders from losing out on expected interest income when a borrower pays off a loan early.

Such penalties can be a significant consideration for investors who plan to refinance or sell their property before the loan term ends. Evaluating the specific terms and conditions of prepayment penalties is crucial before committing to a DSCR loan.

However, some lenders may offer reduced or no prepayment penalties, making their DSCR loan products more attractive. Striking the right balance between the loan’s advantages and its prepayment penalty terms can lead to favorable outcomes.

A higher down payment than conventional loans is required because the risk on rental properties is typically higher.

- Penalty Types: Understand the different types of prepayment penalties to make informed decisions.

- Loan Term Impact: Consider how long you plan to hold the property before committing to a DSCR loan.

- Negotiation Potential: Some lenders may offer flexible terms regarding prepayment penalties.

By carefully considering prepayment penalties, investors can better align their financing with their investment strategy, optimizing returns.

Long-Term Investment Strategy

For investors looking at long-term real estate holdings, DSCR loans can be particularly effective. The focus on income generation aligns perfectly with a strategy that seeks to hold and manage properties over a longer period.

DSCR loans enable investors to acquire properties that reliably cover their debt obligations, fostering sustainable investment growth. By prioritizing cash-flow-positive properties, investors can build a resilient portfolio.

Our DSCR loan program is designed to provide investors of all experience levels with the most competitive terms.

Long-term strategies often benefit from the stability and predictability of DSCR loans. The ability to forecast income against debt payments allows for better financial planning and asset management.

- Income Forecasting: Facilitates better financial planning through reliable income projections.

- Portfolio Resilience: Builds a robust investment portfolio by focusing on cash-flow-positive properties.

- Strategic Growth: Encourages sustainable investment growth through reliable financing terms.

By leveraging DSCR loans, real estate investors can strategically expand their portfolios while ensuring that each new acquisition contributes positively to their overall financial goals.

Conclusion

Gaining a comprehensive understanding of current DSCR loan rates is crucial for any real estate investor aiming to make informed financial decisions. By delving into the intricate relationships between the 5 Year US Treasury, inflation, and Federal Reserve policies, you can better anticipate fluctuations in these rates. Moreover, grasping the components of DSCR loan rates and using tools like a DSCR calculator will arm you with the precision needed for successful loan assessments.

The factors affecting DSCR loan rates today, such as credit score and loan-to-value ratio, underscore the importance of a meticulous approach to loan applications. Comparing DSCR loans with conventional options reveals their distinctive advantages, particularly for seasoned investors. As you navigate origination fees and other associated costs, the insights provided here should equip you with the knowledge to minimize expenses and optimize your financing strategies.

Ultimately, DSCR loans present a robust avenue for real estate investment, balancing risk and return effectively. Embrace the tools and knowledge discussed to enhance your investment portfolio. Explore detailed aspects further and consult specialized financial advisors to refine your approach and achieve long-term success in the dynamic real estate market.

Frequently Asked Questions

What is the current DSCR loan rate?

The current DSCR loan rate varies based on several factors including the 5 Year US Treasury rate, borrower credit score, and economic conditions.

Do DSCR loans require 20% down?

DSCR loans typically require a down payment of around 20%, but this may vary depending on the lender and borrower qualifications.

What are the cons of a DSCR loan?

Cons include higher interest rates compared to conventional loans, potential prepayment penalties, and stricter qualification requirements.

How hard is it to get a DSCR loan?

Obtaining a DSCR loan can be challenging due to stringent credit score requirements and the need for a reliable rental income stream.

How do economic indicators affect DSCR loan rates?

Economic indicators such as inflation, Fed policy, and the 5 Year US Treasury rate can significantly impact DSCR loan rates.

Why are DSCR loans attractive for real estate investors?

DSCR loans are attractive due to less stringent income documentation, potential for higher LTV ratios, and suitability for income-producing properties.