Understanding your Debt-Service Coverage Ratio (DSCR) is pivotal for assessing your financial health and securing favorable loan terms. This metric, crucial for both investors and business owners, reveals your ability to cover debt obligations with your operating income.

In this comprehensive article, we’ll delve into the components of DSCR, provide step-by-step calculation guides, and explore strategies to improve your ratio. Whether you’re aiming to enhance loan approval chances or planning for long-term growth, mastering DSCR is essential.

Understanding the Debt-Service Coverage Ratio (DSCR)

Definition and Importance

The Debt-Service Coverage Ratio (DSCR) measures a company’s cash flow against its debt obligations. This critical financial metric assesses whether a business generates enough net operating income (NOI) to cover its debt payments.

In essence, the DSCR is calculated by dividing a company’s NOI by its total debt service, which includes principal and interest payments. For example, a business with an NOI of $1 million and debt service of $200,000 would have a DSCR of 5, indicating that it can cover its debt five times over.

A clear understanding of DSCR is vital for business owners and financial managers because it provides a concrete measure of financial health. This ratio helps identify whether a company can manage its existing debt and take on additional financing without compromising its financial stability.

“The DSCR is one tool real estate investors often use when evaluating potential investment properties.”

This ratio is not only useful for internal financial analysis but also plays a crucial role in the decision-making processes of investors and lenders. They rely on DSCR to determine the financial viability of a business and its risk level.

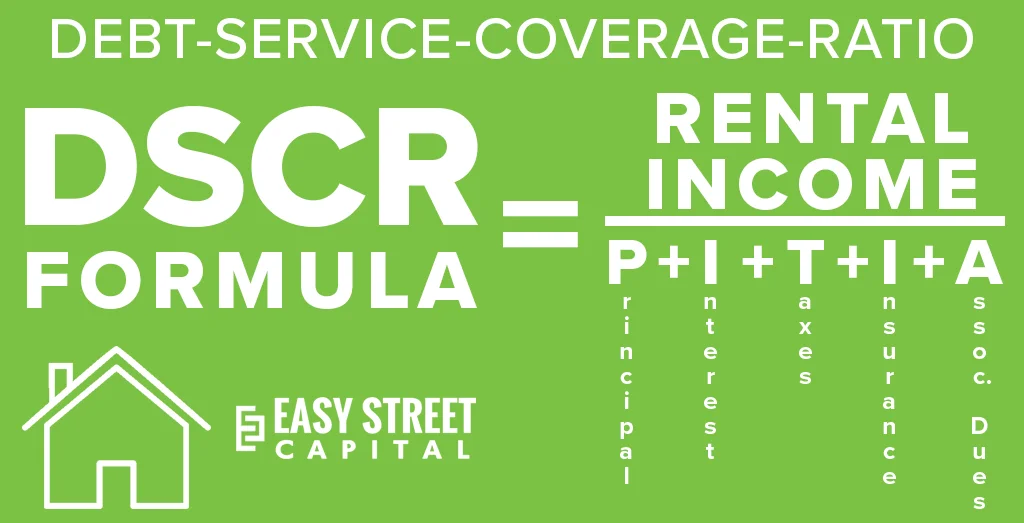

Key Components of DSCR

Understanding how to calculate and interpret DSCR involves two primary components: Net Operating Income (NOI) and Total Debt Service.

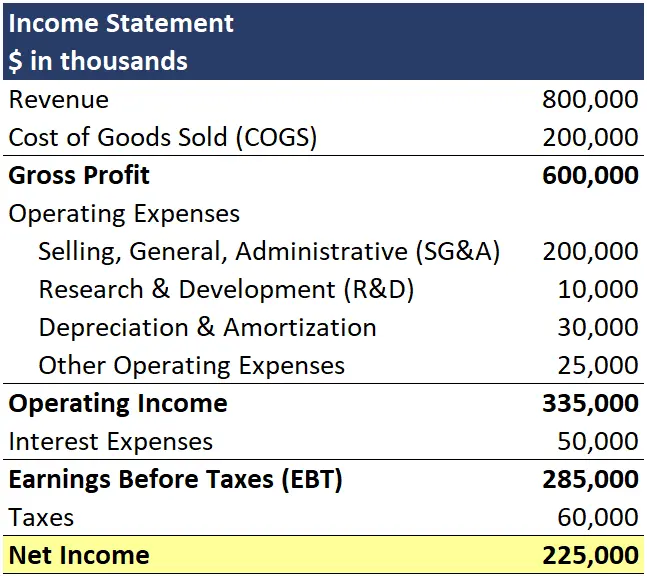

Net Operating Income (NOI): This is the company’s gross income minus its operating expenses, excluding taxes and capital expenditures. Operating expenses may include costs such as rent, utilities, and salaries but do not account for debt-related payments.

NOI differs from EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), as it excludes interest payments, making it a more precise measure for DSCR calculations.

Total Debt Service: This refers to the cash required to cover the principal and interest payments on a company’s debts over a given period.

- Principal: The initial sum borrowed as a loan.

- Interest: The cost of borrowing the principal amount.

Businesses can calculate their DSCR by dividing the NOI by the total debt service. For example, if a property has an NOI of $450,000 and debt service of $250,000, the DSCR would be 1.8. This means there is $1.80 of income for every $1 of debt service, indicating healthy debt coverage.

Benefits of Knowing Your DSCR

Maintaining a strong DSCR can offer numerous benefits for a business:

- Improved Loan Eligibility: A higher DSCR can increase the likelihood of securing loans with favorable terms. Lenders view businesses with strong DSCRs as low-risk borrowers.

- Better Financial Planning: By regularly calculating DSCR, businesses can monitor their financial health and make informed decisions to enhance cash flow.

- Enhanced Investment Decisions: Investors use DSCR to evaluate the viability of potential investments, ensuring that any new acquisitions or projects are financially sustainable.

“Finding your DSCR can help you evaluate your business’s finances and identify areas for improvement.”

Additionally, a solid DSCR demonstrates to stakeholders, including employees and shareholders, that the company is managing its debts effectively, fostering confidence and trust.

Business owners can also use DSCR to identify areas where they can increase income or reduce expenses, ultimately leading to improved financial performance and stability.

Common Misconceptions

There are several misconceptions about DSCR that can lead to improper financial assessments:

- DSCR is a One-Size-Fits-All Metric: Different industries and lenders may have varying standards for a “good” DSCR. For instance, a DSCR of 1.25 might be acceptable for some lenders, while others might require a higher ratio.

- A Higher DSCR is Always Better: While a higher DSCR is generally favorable, excessively high ratios might indicate that a business is not leveraging its financial resources efficiently to grow and expand.

- DSCR Only Matters at the Company Level: Real estate investors often need to consider DSCR both at the property and portfolio levels. This broader view helps assess the overall financial health and risk of their investments.

Understanding these nuances ensures that businesses and investors use DSCR more effectively to make well-informed financial decisions.

Do businesses recognize how improving their DSCR can lead to better financing options and overall financial health? The Debt-Service Coverage Ratio, when used correctly, becomes a powerful tool for achieving long-term financial success.

How to Calculate Your Debt-Service Coverage Ratio

Step-by-Step Calculation Guide

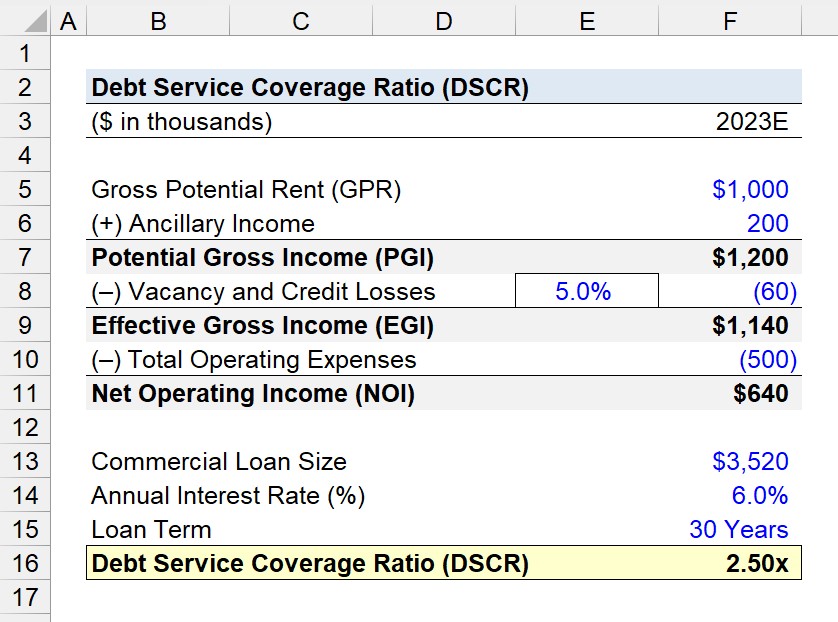

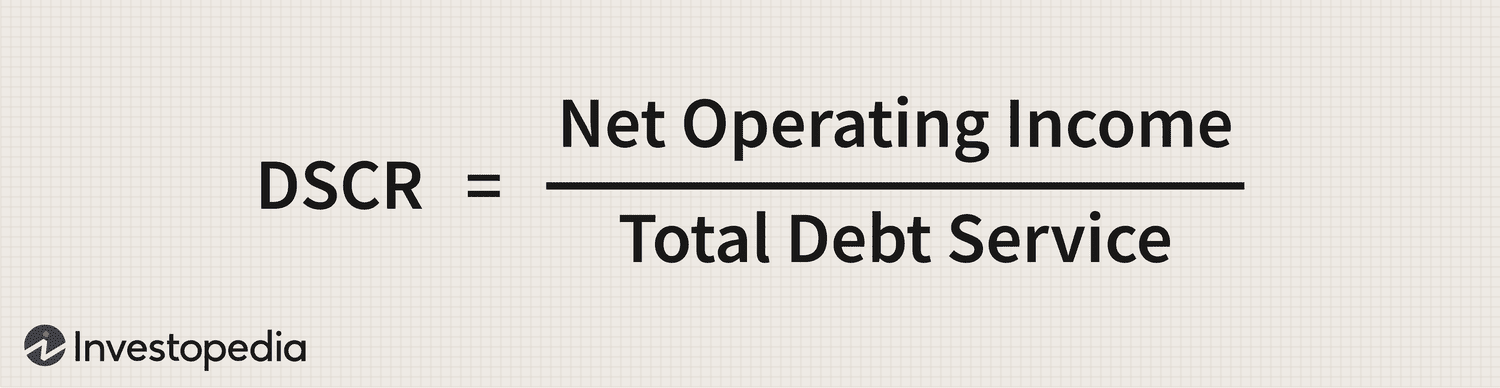

Calculating the Debt-Service Coverage Ratio (DSCR) involves understanding the formula and identifying the relevant financial metrics. The formula is straightforward:

DSCR = Net Operating Income / Debt Service

First, we need to find the net operating income. This is calculated by subtracting operating expenses from the business’s total revenue. The formula is:

Net Operating Income = Revenue – Operating Expenses

Next, we calculate the debt service, which is the total of all interest and principal payments on the company’s debt due in the same period. Combining these two components will give us the DSCR.

Using the DSCR formula accurately ensures that business owners and financial analysts can evaluate a company’s ability to cover its debt obligations.

Understanding Net Operating Income

Net operating income is a critical component in the DSCR calculation. It represents the company’s total revenue minus all operating expenses.

Operating expenses include wages, rent, and taxes. These should be subtracted from the pre-tax revenue to determine the net operating income.

An example formula looks like this:

Net Operating Income = Revenue – Operating Expenses

It is essential to ensure accuracy in this calculation, as it directly impacts the DSCR.

“Net operating income is a measure of a company’s profitability before deducting interest and taxes.” – Corporate Finance Institute

By understanding net operating income, business owners can better gauge the financial health of their company.

Breaking Down Debt Service

Debt service is the other key component of the DSCR calculation. It includes all principal and interest payments due during the evaluated period.

To calculate debt service, gather all debt-related payments such as loans, mortgages, and other forms of debt the company owes.

- Identify all outstanding debts: Make a list of all loans and debt obligations.

- Calculate total annual payments: Add up all interest and principal payments for the given period.

- Sum them up: The total represents the debt service.

Ensuring that all debt payments are accounted for is vital for an accurate DSCR.

What would happen if some debts were missed? The DSCR would be inaccurately high, leading to potential risk mismanagement.

Example Calculation

Let’s put this knowledge into practice with an example calculation. Suppose a business has:

- Annual Net Operating Income: $100,000

- Total Debt Service: $50,000

The DSCR calculation would be as follows:

DSCR = Net Operating Income / Debt Service

Plugging in the values:

DSCR = $100,000 / $50,000 = 2

This result means that the company can cover its debt obligations twice over.

“A higher DSCR indicates stronger financial health and greater ability to handle debt obligations.” – Corporate Finance Institute

Using this example clarifies the importance of accurately calculating and interpreting the DSCR for effective financial management.

Why DSCR Matters for Business Loans

Evaluating Financial Health

When discussing the Debt-Service Coverage Ratio (DSCR), it is critical to understand its role in evaluating a company’s financial health. A higher DSCR signifies that a company has sufficient income to cover its debt obligations, which is a positive indicator for lenders.

Lenders often set their own benchmarks for what constitutes a good DSCR. Generally, a DSCR of at least 1.25 is considered acceptable, but ideally, a DSCR closer to 2 is more favorable. This indicates a company’s ability to produce enough net operating income to cover its debts comfortably.

Why is this significant? A DSCR of 1 means all net operating income is used for debt repayment, leaving no room for other financial needs, which could signal financial instability.

Economic conditions also play a role. During periods of economic uncertainty, lenders may demand a higher DSCR to mitigate the risk of business defaults. This reinforces the importance of maintaining a strong DSCR, regardless of external economic factors.

“Lenders might require a higher DSCR from potential borrowers at times when the economy is rocky, and many businesses are defaulting on loans.”

Evaluating financial health through DSCR is not solely about meeting lender criteria. It also involves ensuring ongoing business stability and growth potential.

Improving Loan Approval Chances

One of the primary benefits of a robust DSCR is the increased likelihood of loan approval. Lenders view a high DSCR as a sign of reliable debt management, making them more willing to approve loan applications.

What steps can businesses take to boost their DSCR? Two main strategies include increasing revenue and reducing debt. Enhancing revenue streams ensures adequate income is available to meet debt obligations.

- Negotiating Contract Terms: Lowering net operating expenses by negotiating better terms for supplies and services can positively affect DSCR.

- Reducing Interest Rates: Refinancing existing loans at lower interest rates can significantly decrease monthly debt payments, improving DSCR.

- Paying Off Loans: Reducing the total debt load by paying off existing loans helps to enhance DSCR.

- Engaging Financial Professionals: Financial advisors can provide insights into optimizing financial statements, identifying opportunities to increase net operating income.

Each of these strategies contributes to improving loan approval chances by presenting a stronger financial profile to lenders.

Securing Better Loan Terms

Another critical aspect of maintaining a high DSCR is the ability to secure more favorable loan terms. Lenders are more inclined to offer competitive interest rates and flexible repayment schedules to businesses demonstrating strong debt coverage capabilities.

Lower interest rates reduce the overall cost of borrowing, enabling companies to allocate resources more efficiently. This can lead to substantial cost savings over the life of the loan.

Furthermore, better loan terms often include reduced fees and longer repayment periods, providing additional financial breathing room. This can be particularly advantageous for businesses looking to reinvest in growth and expansion opportunities.

Securing favorable terms is not solely about meeting minimum DSCR requirements. It often involves demonstrating holistic financial health, such as maintaining a high business credit score alongside a robust DSCR.

“A better DSCR — especially paired with other indicators of financial health, such as a high business credit score — may mean a lower interest rate.”

Thus, a higher DSCR opens the door to more advantageous loan conditions, enhancing overall business financial strategy.

Case Studies

Examining real-world examples can provide valuable insights into the importance and impact of DSCR on loan applications and terms. Let’s explore a few case studies to illustrate this point.

Consider Company A, a manufacturing firm with a DSCR of 1.3. While this DSCR meets basic lender requirements, the company’s loan application faced scrutiny due to tighter economic conditions. By working with a financial advisor, Company A negotiated better supplier contracts and refinanced existing loans, boosting their DSCR to 1.7. The result? Improved loan approval chances and more favorable terms, showcasing the practical benefits of a higher DSCR.

In another case, Company B, a technology startup, had a DSCR of 1. This raised red flags for lenders. The company strategically increased its revenue streams and paid off smaller debts, raising its DSCR to 1.5. Consequently, Company B secured a loan with a lower interest rate, illustrating how proactive financial management can enhance DSCR and loan outcomes.

These case studies underscore the tangible advantages of maintaining a strong DSCR. They offer practical lessons for businesses aiming to improve their financial health and loan prospects.

Would your business benefit from similar strategies? Analyzing these examples can guide financial decisions, leading to more successful loan applications and better terms.

What Constitutes a Good DSCR?

Industry Standards

In the realm of finance, industry standards play a critical role in determining what constitutes a good DSCR. Different industries have varying benchmarks based on their unique cash flow and risk characteristics.

For instance, the real estate sector typically demands higher DSCR because of its volatile market. A DSCR of 1.25 or higher is often considered healthy in this industry. Conversely, in industries with more predictable cash flows, such as utilities, a lower DSCR around 1.15 might still be deemed acceptable.

Understanding these standards helps businesses tailor their financial strategies to meet industry-specific expectations.

How do these benchmarks affect your business? Adhering to industry standards not only aligns your financial health with peer companies but also improves your credibility with lenders and investors.

Why is it crucial to stay informed about these standards? Standards evolve over time, influenced by economic conditions and regulatory changes. Hence, continuous monitoring and adjustment of your DSCR goals are essential.

- Real Estate: Higher DSCR due to market volatility

- Utilities: Lower DSCR acceptable due to stable cash flows

- Retail: Moderate DSCR as per typical operational cash flows

By understanding and applying industry standards, you can optimize your financial planning and ensure robust debt management strategies.

Lender Requirements

Lenders have specific requirements when it comes to DSCR, influencing your ability to secure financing. Generally, a DSCR of 1.25 or higher is preferred by most lenders.

Why do lenders favor a DSCR of 1.25 or above? It indicates that the business generates enough revenue to cover its debt obligations comfortably. This surplus acts as a buffer against financial uncertainties.

However, what happens if your DSCR is below 1.25? It does not necessarily spell disaster. Lower DSCRs might be acceptable if supported by other strong financial metrics, such as high liquidity or substantial collateral.

Are there exceptions to these requirements? Yes, startup ventures, for instance, may be accorded leniency given their growth potential. Nevertheless, such exceptions often come with stringent additional conditions.

Meeting lender requirements ensures your business’s creditworthiness, opening doors to more favorable loan terms and conditions.

It’s vital to understand these requirements and aim to meet or exceed them to enhance your business’s financial stability and growth prospects.

- General Threshold: DSCR 1.25 or higher

- Special Cases: Consideration given to startups and high-growth sectors

- Additional Metrics: Importance of liquidity and collateral

Interpreting DSCR Values

Interpreting DSCR values involves understanding the implications of different DSCR ranges on your business’s financial health. A DSCR higher than 1 indicates that the business can cover its debt obligations with its operating income.

But what does a DSCR of 1 mean? It signifies that the business’s operating income is just enough to cover its debt payments, with no room for error. This scenario might raise red flags for potential lenders and investors.

Conversely, a DSCR less than 1 indicates that the business is not generating sufficient revenue to meet its debt obligations, necessitating reliance on external funding or reserves, which could be unsustainable in the long term.

A higher DSCR not only reflects financial health but also boosts investor confidence and facilitates better loan terms.

However, what if the DSCR is too high? While generally positive, it could indicate under-leverage, suggesting that the business is not utilizing debt effectively to finance growth opportunities.

- DSCR > 1: Positive indicator of financial health

- DSCR = 1: Breaking even, potentially a warning signal

- DSCR < 1: Insufficient revenue to cover debts, critical concern

Understanding these values helps in making informed decisions about debt management and financial planning, ensuring sustainable business operations.

Examples of Good and Bad DSCR

Consider the following examples to illustrate good and bad DSCR values in different business contexts.

Example 1: A manufacturing company with a DSCR of 1.35 is considered good because it indicates they have enough income to cover their debt payments with some surplus.

Example 2: A retail business with a DSCR of 0.95 is a warning sign. It reflects that the company is not generating enough income to cover its debts, posing a risk of default.

Example 3: A technology startup with a DSCR of 1.20 may be acceptable considering its high growth potential, provided other financial metrics are strong.

These examples underscore the importance of contextualizing DSCR values within the specific industry and business circumstances.

Why does context matter? Different industries and business stages have varying risk profiles and cash flow dynamics, necessitating tailored interpretations of DSCR.

- Manufacturing: DSCR of 1.35 signifies robust financial health

- Retail: DSCR of 0.95 indicates potential financial stress

- Technology Startup: DSCR of 1.20, acceptable with strong growth potential

By examining these scenarios, business owners and financial consultants can better assess the suitability of their DSCR values and make strategic decisions accordingly.

Strategies to Improve Your DSCR

Increasing Net Operating Income

One effective way to improve your Debt-Service Coverage Ratio (DSCR) is by focusing on increasing net operating income. While it might be tempting to immediately think about boosting sales, it’s important to also consider cutting certain expenses.

For instance, instead of only targeting higher revenues, you could look at ways to reduce operating costs. Are there recurring expenses that can be trimmed without impacting your business’s productivity? This could include negotiating with vendors to lock in lower prices on supplies or services.

Additionally, consider the impact of utility expenses. Can energy-efficient solutions help you save on electricity and water bills? By lowering these costs, you effectively increase your net operating income, which positively impacts your DSCR.

“The primary goal is to find a balance between increasing income and reducing operational costs to drive net profitability.”

Moreover, think about labor costs. Are there opportunities to optimize your workforce without compromising service quality? Offering training to improve efficiency and productivity might result in reduced overtime expenses.

Utilizing modern technology is another avenue. Implementing software solutions that streamline processes can significantly cut down on labor hours and errors, further enhancing your operating income.

How else can we find balance between income and expenses? By analyzing every line item in your budget, you can identify potential savings and opportunities for greater profitability.

- Vendor negotiations: Lock in lower prices for supplies.

- Utility management: Implement energy-efficient solutions.

- Labor optimization: Increase workforce efficiency to reduce costs.

- Technology adoption: Use software to streamline operations.

Reducing Debt Service

Another strategy to enhance your DSCR is by dealing directly with reducing your debt service. The less you pay towards debt, the better your financial standing will be.

Have you considered refinancing your current loans? It might be possible to secure a lower interest rate, which can significantly lower your monthly debt service payments.

Evaluating the terms of your loans can also be beneficial. Can you extend the loan term to reduce monthly payments? While this may increase the overall amount paid due to interest, it can improve your DSCR in the short term.

Consolidating debt is another option. By combining multiple loans into one, you might be able to secure a better interest rate and reduce the complexity of managing several debt payments.

What about paying off small debts? Eliminating smaller debts can free up cash flow, allowing you to focus on larger, more impactful loans.

“Lowering the debt service burden not only improves DSCR but also enhances overall financial flexibility.”

Reviewing your financial obligations regularly can help identify opportunities to reduce debt service costs. This could involve adjusting payment schedules or negotiating new terms with creditors.

- Refinancing: Secure a lower interest rate on existing loans.

- Loan term adjustments: Extend loan terms to lower monthly payments.

- Debt consolidation: Combine multiple debts into one for better rate.

- Pay off small debts: Free up cash flow for larger loans.

Negotiating Better Terms

Effective negotiation can play a crucial role in enhancing your DSCR. What aspects of your financial agreements could be improved through negotiation?

Start by reviewing your current contracts. Are there clauses that can be modified to better suit your financial situation? For instance, negotiating with lenders to reduce interest rates or extending payment deadlines can lower immediate financial pressure.

Are there opportunities to renegotiate your lease agreements or service contracts? By securing more favorable terms, you can reduce monthly outflows, positively impacting your DSCR.

Additionally, consider approaching your suppliers. Can you negotiate bulk discounts or improved payment terms? Better terms can enhance your cash flow and financial stability.

“Successful negotiations can lead to more favorable financial conditions, directly improving DSCR.”

Make sure to prepare thoroughly before entering any negotiation. Having a clear understanding of your financial position and knowing your goals can strengthen your bargaining power.

It’s also beneficial to maintain good relationships with creditors and vendors. A collaborative approach often yields better outcomes than adversarial tactics.

- Contract reviews: Modify clauses to suit your financial needs.

- Lease renegotiation: Secure better terms for your properties.

- Supplier agreements: Obtain bulk discounts or better payment terms.

- Relationship management: Build strong, cooperative relations.

Professional Financial Advice

Lastly, seeking professional financial advice can be invaluable in improving your DSCR. Financial experts can provide tailored strategies and expert insights into your specific situation.

Have you consulted a financial advisor recently? These professionals can help you identify potential areas for improvement that you might have overlooked.

Accountants and financial planners can analyze your financial statements to uncover hidden opportunities for increasing income or reducing debt. They offer a fresh perspective that can reveal new strategies for boosting your DSCR.

“Engaging with financial experts can unlock new pathways to optimize financial health and DSCR.”

Consider also the benefits of hiring a tax advisor. Efficient tax planning can lead to significant savings, contributing to an improved net operating income.

Professional advice can also extend to legal experts who can help renegotiate contracts and provide guidance on compliance matters affecting your financial health.

Think about the long-term benefits of professional guidance. The initial investment can lead to substantial improvements in your financial stability and DSCR.

- Financial advisors: Provide tailored strategies and insights.

- Accountants: Analyze financials for hidden opportunities.

- Tax advisors: Plan taxes efficiently for greater savings.

- Legal experts: Assist with contract negotiation and compliance.

Common Pitfalls When Calculating DSCR

Mistakes to Avoid

Calculating the Debt Service Coverage Ratio (DSCR) can be complex, and it’s easy to make mistakes if we are not careful. Identifying these errors early is crucial to ensure accurate financial analysis. Some of the most common mistakes include:

- Inaccurate Financial Data: Using outdated or incorrect financial statements can lead to erroneous DSCR calculations. Always verify figures before use.

- Ignoring Seasonal Variations: Businesses with fluctuating income may need to adjust calculations to reflect true earning potential.

- Misclassifying Expenses: Not all expenses impact DSCR equally. Ensure expenses related to debt service are properly classified.

By understanding these pitfalls, we can minimize errors and make more informed financial decisions.

Misinterpreting Net Operating Income

Net Operating Income (NOI) plays a critical role in DSCR calculation. An inaccurate NOI can significantly distort the DSCR outcome. We must ensure that our NOI calculations are precise and exclude non-operational income and expenses.

Consider the following:

Net Operating Income should only include revenue and expenses directly related to the core operations of the business.

Here are common errors related to NOI:

- Including Non-Recurring Income: One-off gains should not inflate NOI.

- Omitting Operating Expenses: Failing to account for all expenses can overstate NOI.

- Misallocating Revenue: Ensure all income sources are correctly classified.

How can we avoid these pitfalls? By diligently reviewing financial statements and separating operational from non-operational transactions, we ensure our NOI is accurate.

Overlooking Debt Components

A comprehensive DSCR calculation requires a thorough understanding of all debt components. Neglecting to include certain debts can lead to inaccurate results.

We must consider:

- Principal Repayments: Exclude or include as per the context of DSCR use.

- Interest Payments: Always included in debt service calculations.

- Lease Payments: Distinguish between operating and capital leases.

Why is this important? When we overlook these elements, our DSCR reflects an incomplete financial picture, potentially leading to poor decision-making. Reviewing all debt obligations ensures accuracy.

Real-Life Examples

Learning from real-life examples can provide valuable insights into avoiding DSCR calculation errors.

Consider a company that reported an inflated DSCR due to misclassifying non-operational income. The result? They appeared more financially stable than they were.

“Companies that misallocate income sources often face challenges when seeking additional financing.”

Another example involves a business that excluded lease payments from their debt component calculation. This oversight led to an improved DSCR ratio, but it was misleading to stakeholders.

Why are these examples relevant? They highlight the critical importance of accuracy in financial reporting and the tangible consequences of errors. Through careful review and a meticulous approach, we can avoid similar pitfalls.

Next Steps After Improving Your DSCR

Reevaluating Business Goals

Upon improving your Debt-Service Coverage Ratio (DSCR), it is imperative to reevaluate your business goals. This involves assessing your current objectives and ensuring they align with your enhanced financial standing. Have your previous goals become too conservative given your newfound financial stability?

Start by reviewing your strategic plan. Reflect on whether your goals need adjustment to match your improved DSCR. Are there opportunities you overlooked due to previous financial constraints that now may be viable?

Consider how your improved DSCR can support more ambitious targets. For instance, can you now pursue expansion plans that were previously shelved? Aligning your business goals with your enhanced financial metrics can pave the way for more substantial growth.

“Reevaluating your business goals after improving your DSCR is crucial for aligning your business strategy with your financial capabilities.”

Moreover, incorporating achievable and measurable objectives can help track your progress. Have you set specific, time-bound, and realistic targets to measure success?

Lastly, involve your team in this process. Do your key stakeholders understand the new goals and their roles in achieving them? Clear communication can enhance alignment and execution.

Planning for Growth

After enhancing your DSCR, the next logical step is to plan for growth. Improved financial metrics provide a foundation for scalable expansion. How can you leverage this improvement to grow your business?

Consider conducting a market analysis to identify growth opportunities. Are there untapped markets or segments that your business can now explore due to improved financial stability?

- Capital Investments: With a better DSCR, you might have more leverage to invest in new equipment or technology. How will these investments drive productivity and efficiency?

- Product Development: Can you allocate resources to research and development for innovating new products or services?

- Talent Acquisition: Enhanced financial health can also support hiring skilled professionals, thus strengthening your team. What roles are crucial for your next phase of growth?

Additionally, it is essential to establish a scalability plan. How will your business operations scale with growth? Preparing operationally and logistically ensures sustained success as your business expands.

Consulting Financial Experts

One of the wisest steps after enhancing your DSCR is to consult financial experts. Expert advice can offer insights into effectively leveraging your new financial stance. Why risk potential pitfalls when you can gain valuable guidance?

Start by seeking a financial advisor who specializes in business growth and financial management. How can their expertise in analyzing financial data and trends help refine your business strategy?

Furthermore, these experts can provide personalized advice tailored to your specific industry and business model. Wouldn’t you agree that a customized approach is often more effective than a one-size-fits-all solution?

Consider forming a financial advisory team comprising accountants, tax advisors, and financial planners. This comprehensive approach ensures you cover all aspects of financial planning and management.

“Consulting with financial experts after achieving a better DSCR can provide tailored strategies for sustained business growth.”

Lastly, ongoing consultations can help adapt your strategies as your business grows. Have you scheduled regular check-ins with your financial advisors to stay on top of financial health and market conditions?

Long-Term Financial Strategies

Finally, developing long-term financial strategies is critical for sustaining growth after improving your DSCR. How can you ensure your financial health remains robust in the years to come?

Begin by creating a comprehensive financial plan that includes revenue forecasts, expense management, and contingency planning. Is your financial plan flexible enough to adapt to changing circumstances?

- Cash Flow Management: Efficiently managing cash flow ensures liquidity for operational needs and growth investments. Are you regularly monitoring and optimizing your cash flow?

- Debt Management: Maintaining a healthy DSCR involves prudent debt management. How are you planning to manage future debt to avoid jeopardizing your financial stability?

- Investment Strategies: Consider diversifying investments to spread risk and capitalize on different growth avenues. Are you exploring various investment opportunities to balance risk and return?

Furthermore, it is crucial to establish an emergency fund. This reserve can help navigate unforeseen challenges without disrupting business operations. Have you allocated sufficient resources for this purpose?

Lastly, continually re-evaluate and adjust your financial strategies in response to market dynamics and business performance. How will you ensure your long-term strategies remain aligned with your evolving business landscape?

Conclusion

Mastering the Debt-Service Coverage Ratio (DSCR) equips business owners with keen insights into their financial health and loan eligibility. By understanding DSCR’s definition, key components, and calculation methods, you unlock the potential to make informed financial decisions. Knowing industry standards and lender requirements further enables you to interpret your DSCR accurately, setting the stage for successful loan applications and favorable terms.

Ensuring a strong DSCR isn’t merely about numbers; it’s about strategically increasing your Net Operating Income and reducing debt service. Avoid common pitfalls by meticulously calculating each component and seeking professional financial advice when necessary. As you improve your DSCR, continually reevaluate your business goals, consult with financial experts, and plan for sustained growth. Dive deeper into this topic and transform your financial strategies, securing a prosperous future for your enterprise.

Frequently Asked Questions

What does a DSCR of 1.25 mean?

A DSCR of 1.25 indicates that a business has $1.25 in net operating income for every $1 of debt service, showing it can comfortably cover its debt obligations.

Is a 1.5 DSCR good?

Yes, a DSCR of 1.5 is considered strong, demonstrating that the business generates sufficient income to cover its debt obligations with a buffer.

How to qualify for a DSCR loan?

To qualify for a DSCR loan, ensure your DSCR meets lender requirements, typically above 1.25, and present accurate financial statements and projections.

What is the DSCR loan rate?

The DSCR loan rate varies based on lender policies and market conditions but is often influenced by the borrower’s DSCR, creditworthiness, and loan term.

How do you calculate DSCR?

Calculate DSCR by dividing your Net Operating Income by your total Debt Service. This ratio helps assess your ability to cover debt obligations.

Why is DSCR important for business loans?

DSCR is crucial for evaluating financial health and improving loan approval chances, as lenders use it to determine a business’s capacity to repay loans.