Understanding DSCR loans is crucial for real estate investors aiming to maximize their financial leverage and investment returns. This article offers an in-depth exploration of DSCR loans, highlighting their key features, eligibility criteria, and the necessary documentation for applications.

We’ll also delve into the types of properties eligible for DSCR loans, the benefits they offer to investors, and the application process. Through this comprehensive guide, you’ll gain valuable insights into how DSCR loans can be a game-changer for your real estate investments.

Understanding DSCR Loans: A Comprehensive Overview

What is a DSCR Loan?

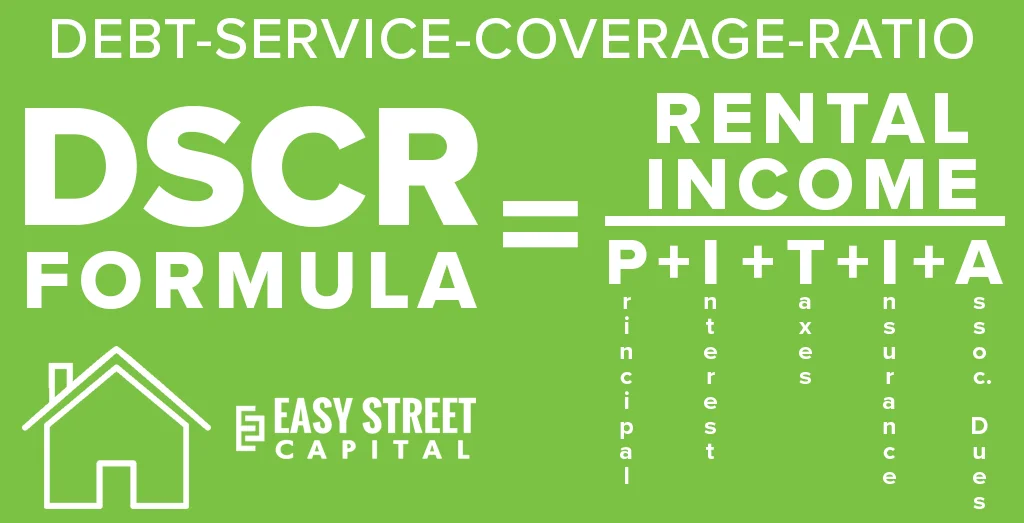

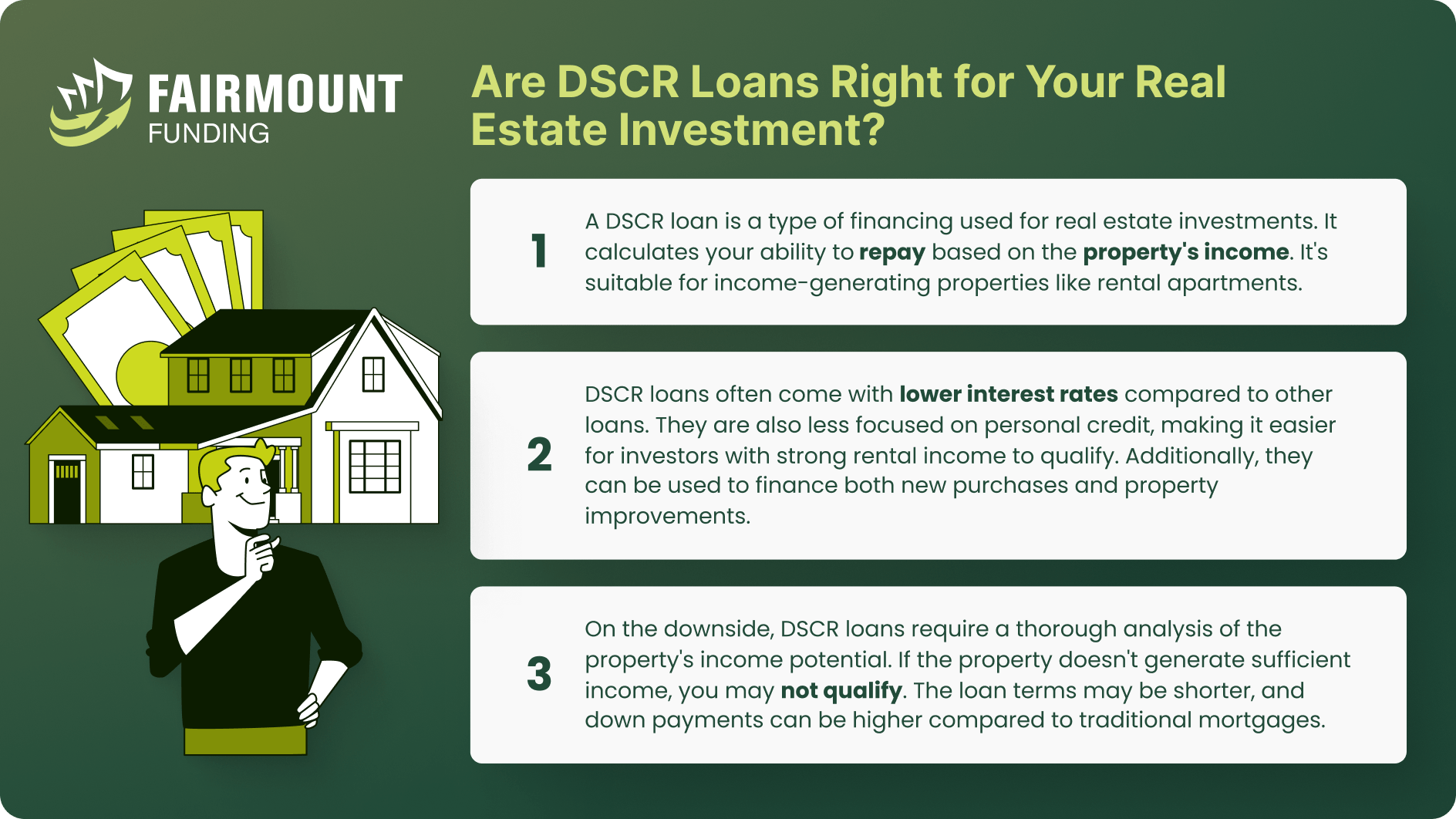

A DSCR Loan, which stands for Debt Service Coverage Ratio Loan, is a unique financing product tailored specifically for real estate investors. Unlike conventional loans, which heavily scrutinize the borrower’s personal financial history, DSCR loans prioritize the income-generating potential of the property being financed. This makes DSCR loans particularly attractive to investors with complex or non-traditional income streams, such as those who are self-employed.

In essence, DSCR loans provide an alternative route for funding investment properties by focusing on the property’s ability to cover its own debt obligations. This is determined by calculating the Debt Service Coverage Ratio (DSCR), a key metric lenders use to assess the feasibility of the loan. A strong DSCR indicates that the property can generate sufficient cash flow to cover its loan payments.

For example, a property with a Net Operating Income (NOI) of $100,000 and annual debt obligations of $80,000 would have a DSCR of 1.25, meaning it generates 25% more income than is needed to cover its debt.

DSCR loans come with more flexible underwriting criteria compared to traditional mortgages, which often have rigid qualification requirements dictated by government programs. This flexibility allows lenders to approve borrowers based on the potential of their investment rather than their personal financial circumstances.

“A DSCR loan looks at how much money the property will make, not the buyer’s income or credit history. It’s great for people who want to buy property but have complex finances,” according to the provided transcript.

Understanding these unique characteristics can help investors determine if DSCR loans are the right fit for their real estate financing needs.

Key Features of DSCR Loans

DSCR loans offer several notable features, making them an appealing option for real estate investors seeking financing. One of the standout features is the speed of funding. Since lenders do not require an exhaustive review of personal finances, the approval process for DSCR loans is often faster than that of conventional mortgages.

Another key feature is the variety of loan options available. DSCR loans can be structured with fixed or variable rates, and they often offer the potential for cash-out refinances or interest-only payments for part of the loan term. This flexibility allows investors to tailor their financing according to their specific investment strategies.

Additionally, DSCR loans boast flexible underwriting criteria. Lenders are not constrained by stringent guidelines like those governing other types of mortgages. As a result, they have more freedom to approve borrowers who might not qualify for conventional loans.

- Fast Funding: DSCR loans generally offer quicker approval times since they focus on property income rather than personal financial scrutiny.

- Diverse Loan Options: Investors can choose between various structures, including fixed or variable rates and interest-only payments.

- Flexible Underwriting: Less rigid qualification criteria make it easier for investors with non-traditional income or multiple properties to secure financing.

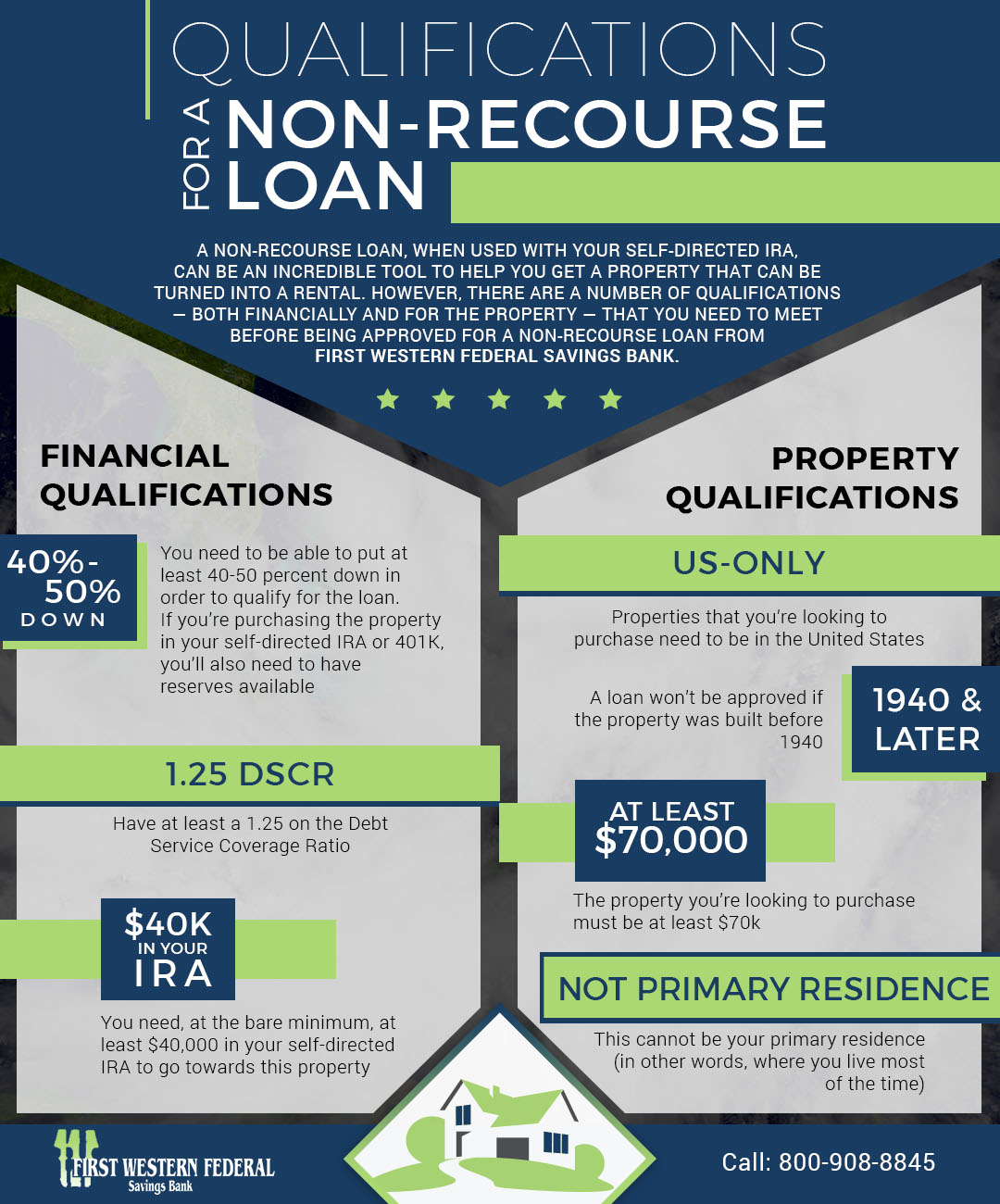

However, it is important to note some of the requirements and limitations associated with DSCR loans. Lenders typically require borrowers to have three to six months of cash reserves and a minimum down payment, usually between 15% and 25% of the property’s purchase price. Additionally, DSCR loans are designed exclusively for investment purposes and cannot be used for owner-occupied properties.

Differences Between DSCR and Conventional Loans

While both DSCR and conventional loans serve as financing mechanisms for real estate purchases, they differ significantly in their qualification processes, requirements, and suitability for certain types of borrowers.

The primary distinction lies in the assessment criteria: Conventional loans rely heavily on the borrower’s personal financial history, including credit score, income, and tax returns. To qualify, borrowers must often provide extensive documentation of their financial stability, which can be a barrier for those with complex or irregular income streams.

In contrast, DSCR loans focus on the income potential of the property itself. Lenders evaluate the property’s ability to generate rental income sufficient to cover its debt obligations. This makes DSCR loans more accessible to investors with non-traditional income or those who already hold multiple mortgages.

Moreover, DSCR loans typically offer more flexible loan structures, including interest-only payment options and longer loan terms, whereas conventional loans usually have more rigid repayment schedules and limited flexibility.

- Qualification Criteria: Conventional loans focus on borrower’s financial history, whereas DSCR loans emphasize property income.

- Documentation Requirements: Conventional loans require extensive personal financial documentation, while DSCR loans necessitate property-related income documentation.

- Loan Flexibility: DSCR loans often offer more flexible repayment options and terms compared to conventional loans.

Another important difference is the use case: Conventional loans can be used for both owner-occupied and investment properties, making them a versatile choice for different types of buyers. In contrast, DSCR loans are intended exclusively for investment properties, which limits their applicability but makes them highly specialized for real estate investors.

These distinctions underscore the importance of selecting the right type of loan based on individual circumstances and investment goals. By understanding the key differences between DSCR and conventional loans, real estate investors can make informed decisions that best align with their financial strategies.

Eligibility Criteria for DSCR Loans

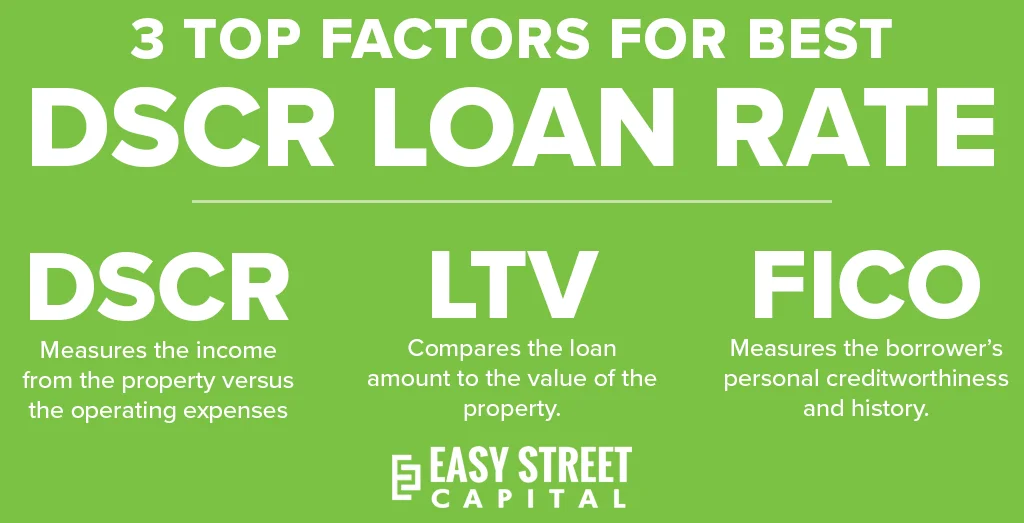

Debt Service Coverage Ratio (DSCR)

One of the most pivotal factors in qualifying for a DSCR loan is the Debt Service Coverage Ratio (DSCR). This ratio essentially measures the cash flow available to pay current debt obligations from the rental income generated by the property. A typical DSCR required by lenders ranges between 1.2 to 1.5.

For instance, if your property generates $150,000 in annual rental income and has operating expenses of $100,000, your DSCR would be 1.5. This would be sufficient for most lenders as it indicates that the property’s income not only covers the operating expenses but also leaves a surplus for loan repayments.

Lenders use the DSCR to evaluate the risk associated with the loan. Higher DSCR values signify that the property has a robust income stream, reducing the risk for lenders. Therefore, ensuring your property meets or exceeds the DSCR requirement is crucial for loan approval.

“The higher the DSCR, the better the chances of loan approval and potentially more favorable loan terms.”

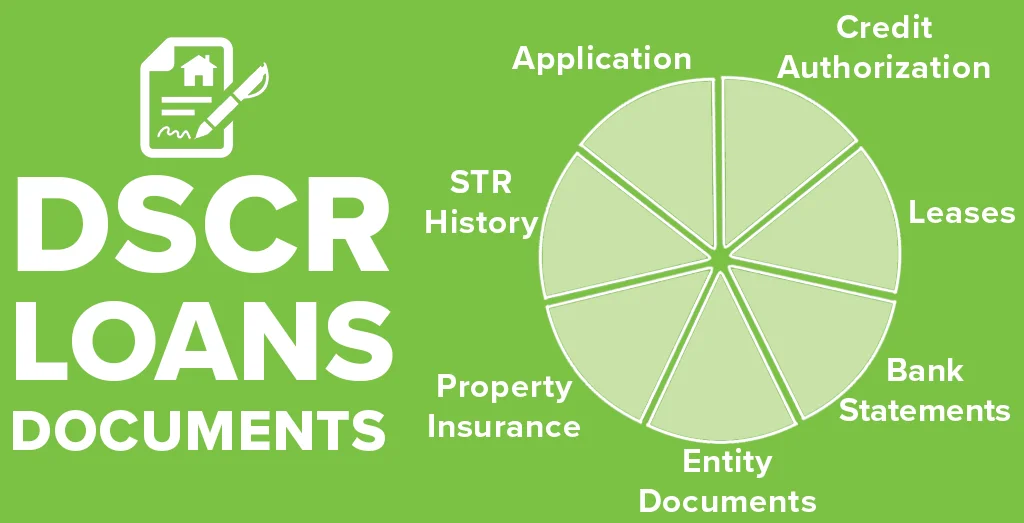

Required Documentation

Gathering the right documentation is another significant step in the DSCR loan application process. Unlike traditional loans, the focus here is not on personal finances but on the property’s potential to generate rental income. Here are some key documents you will need:

- Property’s Financial Statements: These include income statements, rent rolls, and operating expenses.

- Property Appraisal: An appraisal that determines the current market value of the property.

- Loan Terms: Documentation outlining the terms, loan amount, fees, and repayment schedules.

- DSCR Calculation: A detailed calculation demonstrating the property’s DSCR, which shows its capability to cover debt obligations.

Once all relevant paperwork is submitted, the loan underwriting process begins. This involves a rigorous assessment of the property’s financial health and its ability to meet the DSCR requirements.

Property Types Eligible

DSCR loans are primarily designed for investment properties. These can range from residential multi-family units to commercial properties. It’s essential to understand which property types are eligible to ensure that your investment aligns with the loan criteria.

Here are some typical property types that qualify for DSCR loans:

- Multi-family Properties: Buildings with multiple residential units.

- Commercial Properties: Office buildings, retail spaces, warehouses, etc.

- Mixed-use Properties: Combining residential and commercial spaces.

Each property type may have specific requirements and varying DSCR benchmarks. It is advisable to review the specific criteria for your property type with your lender to ensure compliance.

“Evaluating the specific property types eligible for DSCR loans can help streamline your application process and improve your chances of loan approval.”

Required Documentation for DSCR Loan Applications

Bank Statements and Leases

Obtaining a DSCR loan requires meticulous attention to documenting your financial status. Among the first documents you will need are bank statements and leases. These play a critical role in demonstrating your cash flow.

Bank statements provide a transparent view into your financial health. Lenders typically request statements from the past six to twelve months. This helps them assess your consistent income and expenditure patterns. It’s imperative to have a clean record, as discrepancies could delay the approval process.

Leases are equally important, especially for those with rental properties. They serve as proof of your income from tenants. Providing recent and signed lease agreements can fortify your application by showing reliable and steady rental income.

“Lenders are keen to see evidence of continuous rental income, which your lease agreements substantiate,” says Jane Doe, a financial advisor.

Do irregular deposits or withdrawals appear on your statements? Address these with explanatory notes. Transparency fosters trust and speeds up the verification process.

- Monthly Statements: Submit detailed monthly bank statements for a clearer picture of your financial activities.

- Rental Income: Ensure all rental income is thoroughly documented within your leases.

- Consistent Records: Maintain consistent records, avoiding large, unexplained transactions.

Without comprehensive and clean bank statements and leases, your DSCR loan application may face unnecessary hurdles. Always double-check for accuracy before submission.

Property Appraisal

Property appraisal is another crucial document in the DSCR loan process. This involves a professional assessment of the property’s market value, condition, and potential rental income.

The appraisal must be conducted by a certified appraiser, recognized by the lending institution. They will evaluate the property based on several factors, including location, size, and comparable properties in the area.

Wondering how the appraisal affects your loan? The assessed value helps in determining the loan amount, as lenders use it to ensure the property’s value supports the loan requested. If your property’s value is lower than expected, it could impact the terms of your loan.

“A thorough appraisal not only protects the lender but also ensures you are not borrowing more than the property is worth,” explains John Smith, an appraiser.

To prepare for an appraisal, make sure the property is well-maintained. Any visible damages or needed repairs should be addressed beforehand to avoid a lower valuation.

- Certification: Ensure the appraisal is conducted by a certified professional.

- Comparable Properties: Provide information on similar properties to aid in the assessment.

- Property Condition: Keep your property in excellent condition to secure a favorable appraisal.

Accurate property appraisals facilitate smoother loan approval processes, reflecting the true market value and income potential of the property.

Credit Report and Reserves

Lastly, lenders will require your credit report and proof of reserves. These documents help assess your ability to manage debt and maintain loan payments over time.

Your credit report reveals your credit history, including past loans, repayment patterns, and current indebtedness. Lenders look for a credit score that reflects reliability and financial stability. Is your credit score less than ideal? Work on improving it before applying, as a higher score can lead to better loan terms.

Reserves are funds set aside to cover future payment obligations. For a DSCR loan, having adequate reserves reassures lenders of your financial preparedness. These usually include cash in savings accounts, stocks, and other liquid assets.

“Sufficient reserves signal to lenders that you can weather financial difficulties without defaulting on the loan,” notes financial expert, Sarah Johnson.

Prepare for your DSCR loan application by gathering the following:

- Detailed Credit Report: Obtain a comprehensive report from major credit bureaus.

- Documentation of Reserves: Provide evidence of savings, stocks, or other liquid assets.

- Credit Score Improvement: If necessary, take steps to raise your credit score before applying.

A meticulous approach to documenting your credit history and reserves can significantly enhance your application’s strength, ensuring lenders see you as a low-risk borrower.

Types of Properties Eligible for DSCR Loans

Single-Family Homes

Single-family homes are a popular choice for many real estate investors. These properties, designed to house one family, are often easier to manage and maintain compared to larger units.

Investors favor single-family homes due to their consistent demand in the rental market. These properties are usually more accessible and affordable, particularly for first-time investors.

When financing these homes with a Debt Service Coverage Ratio (DSCR) loan, it is important to note that the standards are quite accommodating. For instance, the transcript indicates that a 30-year fixed DSCR loan can be used for these types of properties.

“The interest rate for such a loan starts at 7.5%, with a term of 30 years, making it a stable and predictable option for many investors.”

The origination fees range from 2-3%, and the loan-to-value ratio can be up to 80%, providing a generous amount of leverage for purchasing the property.

Moreover, the minimum FICO score requirement is 660, which is relatively accessible for most investors. The loan amounts range widely from $150,000 to $3,000,000, accommodating both small and large investment budgets.

- Interest Rate: Starts at 7.5%

- Origination Fee: 2-3%

- Loan To Value: Up to 80%

- Term: 30-year fixed rate

- Minimum FICO: 660

With these flexible terms, single-family homes present a viable investment opportunity for both novice and seasoned investors.

Multifamily Properties

Multifamily properties, which include duplexes, triplexes, and fourplexes, also qualify for DSCR loans. These properties can generate multiple streams of rental income, often enhancing the overall return on investment.

Investors looking into multifamily properties often appreciate the economies of scale. Managing several rental units within one building can be more cost-effective and efficient compared to handling multiple single-family homes.

“A DSCR loan can finance up to four residential units, providing ample opportunities for diversified income sources.”

The loan parameters for multifamily properties are similar to those for single-family homes. Interest rates start at 7.5%, with an origination fee of 2-3%, and a loan-to-value ratio of up to 80%.

The term for these loans remains fixed for 30 years, offering stability and long-term planning for investors. The minimum FICO score is also set at 660, ensuring accessibility for a broad range of investors.

- Loan To Purchase Price: Up to 80%

- Maximum Loan Amount: $3,000,000

- Minimum Loan Amount: $150,000

Multifamily properties financed through DSCR loans cater to those seeking to maximize rental income and build a robust real estate portfolio.

Mixed-Use Properties

Mixed-use properties, combining residential and commercial units, also qualify for DSCR loans. These properties offer investors a unique blend of income sources, potentially increasing revenue and reducing risks.

Investing in mixed-use properties can be an effective strategy for diversifying an investment portfolio. With residential rentals on one side and commercial tenants on the other, a balance can be struck to mitigate market fluctuations.

When financing mixed-use properties with a DSCR loan, the loan parameters remain attractive. An interest rate starting at 7.5% and a 30-year fixed term offers both predictability and stability.

The origination fees are set between 2-3%, with a loan-to-value ratio of up to 80%. These terms allow for significant leverage, enabling investors to finance larger, potentially more lucrative projects.

The minimum FICO score requirement of 660 ensures that these loans are accessible to a broad range of investors. The loan amounts, ranging from $150,000 to $3,000,000, accommodate a variety of investment sizes and scopes.

- Term: 30-year fixed rate

- Minimum DSCR: None

- Maximum Loan Amount: $3,000,000

- Minimum Loan Amount: $150,000

Mixed-use properties, with their blend of residential and commercial components, offer investors a dynamic and potentially profitable investment opportunity with the backing of flexible DSCR loan terms.

Benefits of DSCR Loans for Real Estate Investors

Flexible Terms and Competitive Rates

DSCR loans offer flexible terms and competitive rates that appeal to many real estate investors. Why choose a more rigid financing option when you can have flexibility? These loans adapt to the unique needs of real estate investments, making them a practical choice.

Most traditional loans require detailed documentation and have stringent eligibility criteria. DSCR loans, however, look at the potential income of your property instead of personal income. This flexibility opens doors for a wider range of investors, especially those who are self-employed.

Furthermore, competitive interest rates make DSCR loans an attractive option. If the property generates consistent income, the risk for the lender is lower, often resulting in better rates for investors.

“Lenders often look for a DSCR of at least 1.25, but preferably 1.5 or more, as this decreases the risk for both parties.” – Industry Expert

This means that even if the property faces occasional vacancies or unexpected expenses, the investor can still cover the debt comfortably. Is there a better way to secure your investment?

- No personal income requirements: Ideal for self-employed investors

- Risk-based interest rates: Ensures competitive borrowing costs

- Adaptable repayment terms: Tailors to the cash flow of the property

Overall, these terms and rates provide a financially sound and pragmatic approach to real estate investment financing, enabling investors to grow their portfolios with confidence.

Simplified Application Process

The application process for DSCR loans is notably straightforward. Traditional loans often require extensive documentation, but DSCR loans assess the income-earning potential of the property itself.

Instead of focusing on personal financial statements, tax returns, or employment history, lenders evaluate the property’s cash flow. Does this simplify the process for investors? Absolutely.

- Property income assessment: Lenders focus on rental income over personal income

- Less documentation: Streamlines the application process

- Quick approvals: Speeds up financing, allowing investors to act swiftly on opportunities

This simplified process is particularly beneficial for real estate investors who may not have a traditional income structure, such as freelancers or self-employed individuals. By prioritizing the property’s earnings, DSCR loans remove barriers that could otherwise delay or hinder real estate investments.

Investors can appreciate how this straightforward approach saves time and effort, allowing them to focus on maximizing their investment opportunities instead of being bogged down by paperwork.

Higher Loan Amounts

A significant advantage of DSCR loans is the potential for higher loan amounts. Did you ever think higher loan limits could make a difference to your investment strategy?

Because the eligibility is based on the property’s income, lenders can often offer larger loan amounts than they would with traditional mortgages. The logic is simple: a property with high rental income can support a larger loan.

- Income-based eligibility: Focuses on property earnings to determine loan amount

- Potential for larger investments: Enables purchase of higher-value properties

- Broadening investment portfolio: Opportunities to invest in multiple properties

Consider an investor purchasing a high-value rental property. A DSCR loan allows them to leverage the property’s future income to secure a substantial loan, making it feasible to acquire premium assets and expand their portfolio.

“In order to earn rental income, however, you first have to buy a property, and that can be expensive. DSCR loans offer a solution.” – Real Estate Analyst

Ultimately, the ability to secure higher loan amounts can significantly enhance an investor’s capacity to grow their real estate investments. This advantage positions DSCR loans as a valuable tool for current and prospective real estate investors looking to maximize their returns.

How to Apply for a DSCR Loan

Finding the Right Lender

Choosing the right lender can significantly impact your experience when applying for a DSCR loan. It’s critical to compare different lenders based on their terms, interest rates, and customer reviews. This ensures that you select a reputable institution that aligns with your financial needs and goals.

Why should we focus on finding the right lender? A well-chosen lender will offer competitive rates and favorable terms, making the loan more affordable and manageable over time. Additionally, good customer service can streamline the application process and provide helpful guidance along the way.

“The first step in the DSCR loan application process is to research and select a lender that meets your specific needs and requirements.”

It may be beneficial to consult with financial advisors or real estate professionals who have experience with DSCR loans. They can provide insights into which lenders have a strong track record and can meet your financing needs effectively.

- Compare Rates: Look at the interest rates offered by different lenders to ensure you get the best deal.

- Customer Reviews: Read reviews to understand other applicants’ experiences with the lender.

- Terms of Loan: Examine the terms and conditions to ensure they are favorable and flexible.

Utilizing online resources, such as comparison websites, can also be a valuable step in finding the right lender. These platforms often provide detailed information and ratings, simplifying the decision-making process.

After identifying a few potential lenders, contact them directly to discuss your needs and verify important details. This ensures that you select a lender who is not only reputable but also genuinely interested in assisting you.

Once you have made your choice, proceed to the next stage of the application process with confidence, knowing that you have secured a reliable partner for your financial journey.

Initial Information Gathering

The initial information gathering phase is crucial in preparing your application for a DSCR loan. Proper preparation and documentation can make this process smoother and more efficient.

Begin by collecting all necessary financial documents, such as income statements, tax returns, and balance sheets. These documents will provide a clear picture of your financial health and help the lender assess your eligibility.

What specific documents are required? Commonly requested documents include:

- Income Statements: Detailed records of your earnings, typically over the past two years.

- Tax Returns: Copies of your most recent tax filings, usually for the previous two years.

- Balance Sheets: A financial statement summarizing your assets, liabilities, and equity.

In addition to these documents, it’s important to prepare a comprehensive business plan if you are applying for a DSCR loan for a business purpose. This plan should outline your investment strategy, projected income, and other pertinent details.

“A well-prepared application with complete and accurate information increases the likelihood of a successful DSCR loan approval.”

It’s advisable to create a checklist to ensure you gather all required documents and information. Being organized can help prevent delays and streamline the application process.

Reach out to your chosen lender to confirm any additional documents they may require. This proactive approach ensures you are fully prepared and minimizes the chances of missing critical information.

Once you have gathered all necessary documents, review them carefully to ensure accuracy. This step is essential as any discrepancies can result in delays or even rejection of your application.

Submitting a comprehensive and accurate file will enhance your credibility and demonstrate your diligence to the lender, increasing your chances of approval.

Loan Closing Process

The loan closing process is the final step in securing your DSCR loan. This phase involves finalizing the loan agreement, signing documents, and ensuring all conditions are met.

What does the loan closing process entail? Typically, this process includes several key steps:

- Loan Agreement Review: Carefully review the loan agreement to understand all terms and conditions.

- Document Signing: Sign all necessary documents, which may include the promissory note, deed of trust, and other legal forms.

- Funding: Once all documents are signed, the lender will fund the loan, and the funds will be disbursed to you.

It’s essential to read the loan agreement thoroughly and ask questions if any terms or conditions are unclear. Understanding your obligations and rights as a borrower is crucial to avoiding future issues.

“Closing the loan is a critical milestone where you formalize the agreement with the lender and receive the funds you need.”

During the closing process, you may need to pay closing costs, which can include fees for appraisal, legal services, and other expenses. Ensure you have sufficient funds available to cover these costs.

Coordinate with the lender and any involved parties to schedule the closing meeting. This meeting is usually the final step where all parties sign the necessary documents and finalize the loan.

Once the documents are signed, and the loan is funded, you will officially have access to the funds. It’s important to keep copies of all signed documents for your records.

Completing the loan closing process successfully marks the culmination of your efforts and the beginning of your financial endeavors with the DSCR loan.

Common FAQs About DSCR Loans

Ideal DSCR Ratio

Understanding the Debt Service Coverage Ratio (DSCR) is crucial for real estate investors and potential borrowers. The ideal DSCR ratio often depends on the lender’s requirements and the type of property being financed.

Typically, lenders look for a DSCR of at least 1.25. This figure indicates that the property generates 25% more income than the debt service obligations, providing a cushion for investors.

However, some may require a higher ratio, especially for commercial properties or larger loans. Why is this important?

Lenders view a higher DSCR as a sign of lower risk. The more income a property generates relative to its debt, the less likely the borrower will default on the loan.

In contrast, a DSCR lower than 1 means that the property does not generate enough income to cover its debt obligations. This scenario is generally unattractive to lenders.

In practice, the acceptable DSCR may vary. For instance:

- Residential Properties: Frequently, a DSCR around 1.25 is acceptable.

- Commercial Properties: Ideal ratios might rise to 1.4 or higher due to higher risk.

- Multifamily Units: These often fall somewhere in between, with a DSCR requirement typically above 1.3.

Investors should always aim to meet or exceed the lender’s DSCR requirements to secure favorable loan terms.

Prepayment Penalties

When considering DSCR loans, prepayment penalties play a significant role. These penalties discourage early loan payoff, protecting the lender’s expected interest income.

Prepayment penalties can vary, but they generally fall into three categories:

- Percentage of Remaining Balance: A common method where the penalty is a percentage of the outstanding loan amount.

- Flat Fee: A set fee regardless of the remaining balance or time left on the loan.

- Sliding Scale: Decreases over time, reducing the penalty as the loan matures.

Why do lenders impose these penalties?

Prepayment penalties compensate lenders for the potential loss of interest income they would have earned had the loan reached full term.

Borrowers should weigh the pros and cons carefully. While accelerating debt repayment can save on interest, the prepayment penalty could offset those savings.

It’s vital to scrutinize any loan agreement for prepayment terms. Common structures include:

- Soft Prepayment Penalty: Applies if the loan is refinanced but not if the property is sold.

- Hard Prepayment Penalty: Applies in all instances of early repayment, whether through sale or refinance.

By understanding these terms, investors can make informed decisions and avoid unexpected costs.

Loan-to-Value Ratios

Another critical factor for DSCR loans is the Loan-to-Value (LTV) ratio. This ratio compares the loan amount to the value of the property.

Lenders use the LTV ratio to assess the risk of the loan. A lower LTV ratio generally signifies lower risk. For DSCR loans, the maximum LTV typically ranges from 65% to 80%.

What makes LTV ratios so crucial?

A lower LTV ratio means the borrower has more equity in the property, reducing the lender’s exposure and potential loss in the event of default.

An ideal LTV ratio for different property types might include:

- Single-Family Residences: Usually, an LTV of up to 80% is acceptable.

- Multifamily Units: Often require a lower LTV, around 75% or less.

- Commercial Properties: These might necessitate even lower LTV ratios, potentially 70% or less.

Higher LTV ratios imply greater risk for lenders, leading to stricter terms and potentially higher interest rates.

Borrowers should aim to strengthen their equity position to secure more favorable DSCR loan terms.

Conclusion

Understanding DSCR loans opens a gateway to strategic real estate investments, with their flexible terms, competitive rates, and simplified application process. As you delve deeper into the specifics—whether it’s grasping the essential eligibility criteria, comprehending the required documentation, or recognizing the benefits for real estate investors—you’ll find DSCR loans to be a robust tool in your investment arsenal.

By focusing on properties like single-family homes, multifamily properties, and mixed-use properties, DSCR loans cater to varied investment strategies. Armed with this knowledge, it’s time to take actionable steps: identify the right lender, start gathering initial information, and prepare for the loan closing process. Explore the potential of DSCR loans and elevate your real estate ventures to new heights. Let this comprehensive overview be your guide and take the first step towards informed investment decisions today.

Frequently Asked Questions

What are the requirements to qualify for a DSCR loan?

You need a strong Debt Service Coverage Ratio (DSCR), sufficient documentation, and eligible property types.

How hard is it to get a DSCR loan?

It varies based on your financial health and DSCR, but generally, it’s easier than conventional loans due to flexible criteria.

How much do you need down for a DSCR loan?

Typically, you need a down payment ranging from 20% to 30% of the property’s value.

What are the cons of a DSCR loan?

Potential cons include higher interest rates and prepayment penalties compared to conventional loans.

What is the ideal DSCR ratio for a DSCR loan?

The ideal DSCR ratio is usually 1.25 or higher, indicating strong cash flow to cover debt payments.

Are there any prepayment penalties for DSCR loans?

Yes, prepayment penalties may apply if you repay the loan early.