Discover how Debt Service Coverage Ratio (DSCR) loans are transforming real estate investment in Texas. From understanding the basics to leveraging these loans for a robust rental portfolio, this comprehensive guide uncovers everything investors need to know.

Whether you’re a self-employed investor or seeking flexible financing terms, DSCR loans offer unique advantages. Learn how to optimize your DSCR and identify top Texas markets for maximum returns.

Understanding DSCR Loans in Texas: A Comprehensive Guide

What is a DSCR Loan?

A Debt Service Coverage Ratio (DSCR) loan is a specific type of financing used to purchase rental properties. Unlike traditional loans, DSCR loans focus on the property’s ability to generate income rather than the borrower’s personal financial situation. This makes it an attractive option for real estate investors.

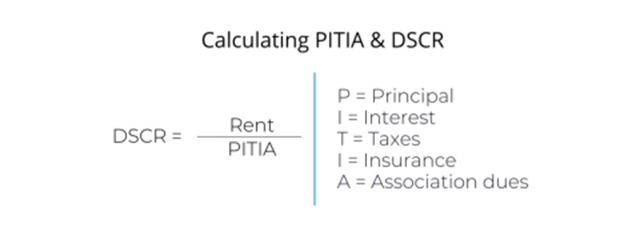

DSCR is calculated by dividing the property’s monthly rental income by its monthly debt obligations, including mortgage payments, taxes, insurance, and association dues. A DSCR of 1.0 indicates that the property breaks even, covering all its expenses with the rental income generated. A ratio higher than 1.0 shows profitability, while a ratio lower than 1.0 means the property is not generating enough income to cover its mortgage payments.

For example, if a rental property generates $5,000 in monthly rental income and has $4,000 in monthly debt obligations, its DSCR would be 1.25. This indicates that the property generates 25% more income than needed to cover its debt obligations, making it a sound investment.

Private lenders favor DSCR loans because they bypass the need for extensive financial documentation like tax returns and bank statements. This leads to faster approval times and a wider range of potential borrowers, including self-employed individuals, foreign nationals, and LLCs.

DSCR loans streamline the borrowing process by focusing on the property’s income, making them ideal for investors with diverse financial backgrounds.

In essence, DSCR loans offer a flexible and efficient way to finance rental properties, allowing investors to leverage their property’s income potential for growth and expansion.

Key Benefits of DSCR Loans

One of the main advantages of DSCR loans is their ability to provide quick and straightforward approval. Since these loans do not require traditional financial documentation, they can be processed and approved in a matter of weeks, allowing investors to act quickly in competitive markets.

Another significant benefit is the flexibility in repayment options. Many lenders offer various loan structures, including adjustable-rate, fixed-rate, and interest-only mortgages. This flexibility enables investors to choose a repayment plan that aligns with their financial strategy and investment goals.

DSCR loans also allow investors to finance multiple properties under a single loan. This feature is particularly beneficial for those looking to build a diversified real estate portfolio. By investing in various properties across different cities, investors can spread their risk and capitalize on different market opportunities.

- Quick Approval: DSCR loans do not require extensive financial documentation, allowing for faster processing and approval times.

- Flexible Repayment Options: Investors can choose from adjustable-rate, fixed-rate, and interest-only mortgages to suit their financial strategy.

- Portfolio Financing: DSCR loans can be used to finance multiple properties, enabling investors to build a diversified real estate portfolio.

Furthermore, DSCR loans are particularly advantageous for investors in Texas due to the state’s robust rental market. With a population of 29.5 million and a thriving tourism industry, rental properties in major cities like Houston, San Antonio, and Dallas offer significant income potential.

Investors in Texas can leverage DSCR loans to tap into the state’s lucrative rental and tourism markets, maximizing their return on investment.

How DSCR Loans Differ from Traditional Loans

DSCR loans and traditional loans differ significantly in their approval processes and requirements. Traditional loans typically require detailed financial documentation, including W-2s, tax returns, and proof of income. These stringent requirements can be a barrier for self-employed individuals, small business owners, and investors with complex financial situations.

In contrast, DSCR loans focus solely on the rental property’s income-producing potential. Lenders calculate the DSCR to determine if the property can generate enough income to cover its debt obligations. This streamlined approach allows for faster approval times and greater flexibility in borrower eligibility.

Another key difference is the flexibility in loan terms. While traditional loans often have fixed repayment structures, DSCR loans offer various options, including adjustable-rate, fixed-rate, and interest-only mortgages. This flexibility allows investors to tailor their loan terms to match their financial strategy and investment goals.

- Approval Process: Traditional loans require extensive financial documentation, while DSCR loans focus on the property’s rental income.

- Borrower Eligibility: DSCR loans are accessible to self-employed individuals, small business owners, and investors with complex financial situations.

- Loan Terms: DSCR loans offer flexible repayment options, including adjustable-rate, fixed-rate, and interest-only mortgages.

Additionally, DSCR loans can be used to finance multiple properties under a single loan, providing investors with the opportunity to build a diversified real estate portfolio. This is a significant advantage over traditional loans, which typically require separate financing for each property.

By focusing on the property’s income potential and offering flexible loan terms, DSCR loans provide a more accessible and adaptable financing option for real estate investors.

Who Should Consider a DSCR Loan?

DSCR loans are an excellent option for real estate investors looking to purchase rental properties, particularly those who may not meet the stringent requirements of traditional loans. Self-employed individuals, small business owners, and investors with complex financial situations can benefit from the simplified approval process of DSCR loans.

Investors seeking to build a diversified real estate portfolio should also consider DSCR loans. The ability to finance multiple properties under a single loan allows for greater flexibility and risk management. By investing in various properties across different markets, investors can capitalize on different income opportunities and reduce their overall risk.

DSCR loans provide an ideal financing solution for investors looking to diversify their real estate portfolios and manage their investment risk effectively.

DSCR loans are particularly beneficial for those investing in Texas, a state with a robust rental market and a thriving tourism industry. With major cities like Houston, San Antonio, and Dallas offering significant rental income potential, investors can leverage DSCR loans to capitalize on these opportunities.

Moreover, DSCR loans are suitable for investors looking for flexible repayment options. Whether you prefer adjustable-rate, fixed-rate, or interest-only mortgages, DSCR loans offer various structures to suit your financial strategy and investment goals.

- Self-Employed Individuals: The simplified approval process makes DSCR loans accessible to those with non-traditional income sources.

- Investors with Complex Finances: DSCR loans bypass the need for extensive financial documentation, making them ideal for investors with diverse financial situations.

- Portfolio Builders: The ability to finance multiple properties under a single loan allows investors to build and diversify their real estate portfolios.

It is crucial to note that, DSCR loans are a versatile and accessible financing option for real estate investors, offering numerous benefits and flexibility to meet various investment needs.

How DSCR Loans Can Expand Your Rental Portfolio in Texas

Advantages for Self-Employed Investors

Self-employed investors often face unique challenges when seeking traditional financing. Lenders typically require extensive documentation of income, which can be cumbersome for individuals with fluctuating earnings.

With DSCR loans, this process is streamlined. Instead of focusing heavily on personal income, lenders evaluate the property’s potential rental income. This shift allows self-employed investors to acquire funding even with irregular financial histories.

Imagine a scenario where a self-employed graphic designer desires to invest in multiple rental properties. Traditional financing might scrutinize their variable income, hindering loan approval. However, with a DSCR loan, the focus shifts to the rental income of the investment, making it significantly easier to obtain financing.

“DSCR loans have transformed how we invest,” says a Texas-based consultant who successfully used DSCR loans to expand their rental portfolio.

Ultimately, DSCR loans provide a lifeline for self-employed investors, offering a more pragmatic approach to financing.

Simplified Approval Process

The approval process for DSCR loans is notably simplified compared to traditional loans. This efficiency stems from the emphasis on the property’s cash flow over the borrower’s personal income.

- Income Documentation: Minimal income verification is required, reducing paperwork and processing time.

- Credit Requirements: While creditworthiness is still considered, it is not the primary factor for approval.

- Property Value: The potential income from the property plays a crucial role, making approval straightforward if the property can generate sufficient cash flow.

For instance, a freelance writer looking to invest in rental properties may find traditional loans daunting due to income inconsistencies. DSCR loans, however, simplify the process by focusing on the rental income potential, accelerating the approval process.

In a competitive market like Texas, where quick action can make a significant difference, this streamlined approval can be a critical advantage.

Building a Large Portfolio

Expanding a rental portfolio can be a daunting task, especially when managing multiple properties. DSCR loans cater specifically to investors looking to scale their investments.

These loans allow investors to acquire multiple properties with fewer financial restrictions, making it easier to build a substantial rental portfolio. For example, a real estate investor in Austin might want to acquire several properties but faces traditional financing barriers due to income verification. DSCR loans remove these barriers, focusing on the income potential of each property.

- Expand Efficiently: Investors can quickly purchase additional properties, leveraging rental income to secure more loans.

- Reduce Personal Financial Risk: By basing approvals on property income, investors can protect their personal assets.

- Maximize Returns: With the ability to invest in more properties, the potential for higher returns increases significantly.

Thus, DSCR loans facilitate the growth of a larger, more profitable rental portfolio by aligning financial evaluations with the real-world income potential of the properties.

Case Studies of Successful Investments

Real-world examples can best illustrate the benefits of DSCR loans. Numerous investors have successfully expanded their rental portfolios using these loans.

Consider Visio Lending, headquartered in Austin, Texas. With over a decade of experience, Visio has helped countless investors build extensive rental portfolios. The company has closed more than 1150 DSCR loans in Texas, totaling over $256 million.

“Our experience with DSCR loans through Visio Lending was seamless. We quickly expanded our portfolio and saw substantial returns,” a satisfied client shares.

One notable case involves a Texas-based investor who transitioned from a small portfolio of three properties to over twenty within five years. The investor leveraged DSCR loans to continuously reinvest rental income into new properties, exemplifying the power and efficiency of these loans in fostering portfolio growth.

Through case studies, it becomes evident that DSCR loans are a powerful tool for any investor aiming to expand their rental property investments efficiently.

Flexible Terms and Fees of Texas DSCR Loans

30-Year Terms with No Balloons

One of the standout features of Texas DSCR loans is the availability of 30-year terms with no balloon payments. This means borrowers are not faced with a large, lump-sum payment at the end of the loan term, offering a stable and predictable repayment schedule.

For property investors, this is a significant benefit. Imagine the peace of mind knowing that you have a consistent monthly payment over the life of the loan, without the worry of refinancing or selling under pressure.

These long-term, fixed-rate options are particularly advantageous for those planning to hold their properties as long-term investments. By locking in an interest rate for three decades, you can mitigate the risks associated with fluctuating interest rates.

“With a 30-year fixed-rate DSCR loan, you avoid the potential financial stress of balloon payments and enjoy a stable, predictable repayment plan.”

Moreover, these terms can be crucial for cash flow planning. Knowing your exact monthly obligations allows you to manage your rental income more effectively, ensuring your investment remains profitable.

It is comforting to know that you can rely on a stable repayment schedule without the disruptive balloon payments. But what if you prefer flexibility in your monthly payments? That’s where interest-only loan options come in handy.

Interest-Only Loan Options

In addition to 30-year terms, many Texas DSCR loans offer interest-only loan options. These loans allow you to pay only the interest for a specified period, usually between 5 to 10 years, before starting to pay off the principal.

This option can be particularly beneficial for investors in the initial stages of property ownership, providing the flexibility to maximize cash flow during the interest-only period.

Consider an investor who has just acquired a new property and is in the process of making renovations. An interest-only DSCR loan would allow them to keep their initial costs low, freeing up capital for improvements that can increase the property’s value and rental income.

- Initial Cash Flow Management: Reduces monthly payments during the initial period.

- Investment Flexibility: Enables reinvestment of funds into property enhancements.

- Strategy Execution: Supports strategic planning around property management.

However, it is essential to plan for the transition to higher payments once the interest-only period ends. By the time the principal payments start, your property should ideally be generating sufficient income to cover the increased costs.

Next, let’s explore rate buy downs and prepayment penalties, which offer further customization for your DSCR loan.

Rate Buy Downs and Prepayment Penalties

Rate buy downs and prepayment penalties are additional features that offer significant flexibility with DSCR loans in Texas. Understanding these can help you tailor your loan to fit your financial strategies and investment timeline.

A rate buy down allows you to pay an upfront fee to secure a lower interest rate on your loan. This can be especially beneficial if you plan to hold onto the property for an extended period, as the savings from the lower interest rate can outweigh the initial cost.

“Opting for a rate buy down can result in significant long-term savings, making it a wise choice for investors with a long-term horizon.”

On the other hand, prepayment penalties are fees charged if you pay off your loan early. While this might seem like a drawback, many lenders offer prepayment penalty buy downs, where you can pay a fee to reduce or eliminate these penalties.

For example, if you anticipate selling the property or refinancing before the loan term ends, reducing the prepayment penalties can provide more flexibility in managing your investment.

- Lower Long-Term Costs: Rate buy downs reduce interest expenses over time.

- Flexibility for Early Payoff: Prepayment penalty buy downs offer more freedom in financial planning.

These options allow you to align your loan terms with your investment strategy, whether you are focused on long-term holding or short-term gains.

Now, let’s delve into how DSCR loans can be tailored specifically to meet diverse investment needs.

Tailoring Loans to Investment Needs

One of the most compelling aspects of DSCR loans is the ability to tailor the loan terms to meet individual investment needs. Different investors have varied objectives, whether it’s long-term property holding, short-term sales, or portfolio diversification.

For instance, investors who plan to hold their property long-term might prefer fixed-rate loans despite higher upfront costs. This approach ensures stability in their interest payments over the life of the loan.

Conversely, those intending to sell the property in the next few years might opt for adjustable-rate mortgages (ARMs). These typically start with lower interest rates, making them cost-effective in the short term.

“Tailoring your DSCR loan allows you to align your financing options with your specific investment strategies and timelines.”

By choosing the right loan features, you can optimize your financial outcomes. For example, an interest-only loan can maximize cash flow during the renovation phase, while a rate buy down can lower long-term costs for a rental property.

Additionally, customizing your loan can help manage risk. If you foresee needing to refinance soon, buying down the prepayment penalty can provide the flexibility you need without incurring significant costs.

- Investment Strategy Alignment: Choose terms that fit your property investment plans.

- Risk Management: Customize terms to minimize financial risks.

- Cost Optimization: Select options that reduce overall expenses.

Ultimately, the flexibility of DSCR loans in Texas allows you to configure the terms to best suit your investment goals, providing a customizable approach to real estate financing.

Optimizing Your Debt Service Coverage Ratio (DSCR)

Simple DSCR Calculation Formula

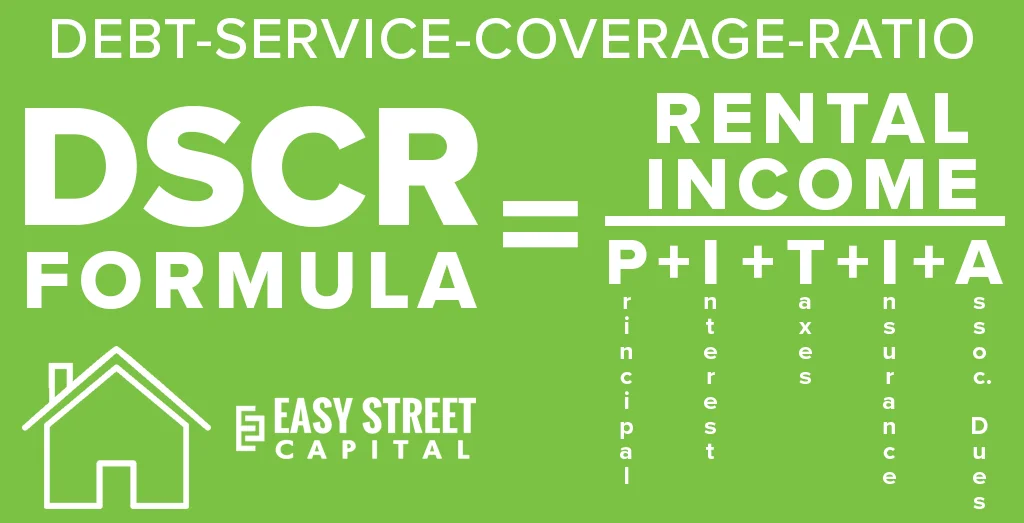

To calculate your Debt Service Coverage Ratio (DSCR), utilize this straightforward formula:

DSCR = Rent / PITIA

Here, PITIA stands for Principal, Interest, Taxes, Insurance, and Association fees. A DSCR of 1 indicates that your property’s rental income precisely matches its monthly expenses, essentially breaking even.

For example, if your monthly property expenses are $1,800 and your tenant pays $1,800, your DSCR would be 1. This means you are covering your costs without any surplus or deficit.

Understanding the inputs that lenders use to calculate DSCR is crucial. This knowledge allows us to screen investment opportunities effectively and set realistic expectations about loan-to-value (LTV), closing costs, and cash returns.

“Some DSCR lenders may include specific maintenance amounts in your calculations, such as a $500 or $1,000 annual maintenance expense, impacting your DSCR slightly.”

Using a DSCR calculator can help determine the loan amount your rental property qualifies for, factoring in elements like the appraisal report and market rents.

Increasing Your Down Payment

Raising your down payment is a straightforward strategy to improve your DSCR. By doing so, you can lower your interest rate, which in turn decreases your monthly expenses.

Consider this analogy: When purchasing a home, more significant upfront payments reduce the amount financed, leading to lower monthly mortgage payments. This principle applies equally to real estate investments.

Lower monthly payments positively impact your DSCR, enhancing your ability to secure favorable loan terms.

Additionally, increasing your down payment demonstrates financial stability to lenders, potentially improving your negotiating position.

- Lower Interest Rates: A higher down payment often translates to lower interest rates, reducing your overall financial burden.

- Increased Equity: More equity in the property enhances your financial security and investment appeal.

- Lower Monthly Expenses: As a result of reduced financing needs, your monthly outlay decreases, thereby positively affecting DSCR.

Negotiating Taxes and Insurance

Another effective method to optimize your DSCR is by negotiating your property taxes and insurance premiums.

When considering real estate investments, it’s important to explore ways to minimize these expenses. For instance, disputing your property tax assessment can sometimes result in lower tax obligations, thereby reducing your monthly payments.

- Property Tax Reduction: Engage with your local tax assessor’s office to re-evaluate your property’s assessed value, potentially lowering your tax bill.

- Insurance Premium Adjustment: Shop around for better insurance rates or re-negotiate your current policy to find a more favorable deal.

These adjustments can significantly lower your PITIA, resulting in an improved DSCR.

“By fighting your property taxes and lowering your insurance payments, you can bring down your debt-service coverage ratio, ultimately enhancing your loan terms.”

Buying Down Your Rate

Buying down your interest rate is another practical approach to enhance your DSCR. While this increases your upfront closing costs, the long-term benefits often outweigh the initial expense.

This process, known as purchasing points, involves paying extra at closing in exchange for a reduced interest rate on your mortgage. For example, paying an additional $2,000 at closing could lower your interest rate by 0.25%, consequently reducing your monthly mortgage payments.

Reduced Monthly Payments: Lower interest rates result in smaller monthly payments, positively impacting your DSCR.

Increased Loan Eligibility: An improved DSCR can enhance your eligibility for higher loan amounts or better terms from lenders.

- Initial Cost vs. Long-Term Savings: Although buying down your rate incurs higher initial costs, it leads to long-term savings on interest payments.

- Enhanced Financial Stability: Lower monthly payments contribute to more stable cash flow and reduced financial stress.

- Better Negotiating Power: An improved DSCR strengthens your position when negotiating with lenders.

Isn’t it worth considering if it means better loan terms and enhanced investment profitability?

Top Texas Markets for DSCR Loans: Where to Invest

Houston: High Rental Demand

Houston’s rental market is driven by its robust economy and diverse population. Investors looking for high-potential markets will find this city a valuable option.

With a population exceeding 2 million, Houston offers a substantial tenant base. The city’s consistent job growth, particularly in the energy sector, attracts a continuous influx of renters.

What makes Houston even more attractive? The presence of numerous amenities and infrastructure. Schools, hospitals, and recreational facilities are abundant, providing renters with everything they need.

Houston is a market where rental demand remains consistently high due to its strong economy and well-developed infrastructure.

Moreover, the city’s diverse industries include energy, healthcare, manufacturing, and technology. This diversification shields investors from economic downturns in any one sector.

- Diverse Economy: Sectors like energy, healthcare, and tech ensure stability.

- Population Growth: Continuous growth translates to sustained rental demand.

- Amenities: Abundant facilities make it a renter’s paradise.

Are you considering where to invest in Texas? With high rental demand and robust infrastructure, Houston stands out as a prime market for DSCR loan investments.

Austin: Tech Hub and Cultural Center

Austin’s reputation as a tech hub has only grown over the years. The city attracts a younger, professional demographic seeking rental properties.

The presence of major tech companies like Google, Apple, and Dell has turned Austin into a hotspot for innovation and employment opportunities.

Additionally, Austin’s vibrant cultural scene, with music festivals, art galleries, and culinary delights, makes it appealing to a broad range of renters.

Austin’s combination of a thriving tech industry and rich cultural offerings makes it an attractive market for investment.

Why should investors focus on Austin? The city’s steady population increase and demand for housing offer promising returns. The influx of professionals and students boosts the rental market.

- Tech Industry: Major tech companies provide jobs, attracting renters.

- Cultural Scene: Festivals and arts contribute to a lively community.

- Population Growth: A steady influx of new residents fuels housing demand.

Investing in Austin using DSCR loans can be a lucrative move. The city’s rental market is booming, making it a top pick for investors.

San Antonio: Historical Appeal

San Antonio offers a unique appeal with its rich history and cultural heritage. The city’s historic sites draw tourists and potential renters alike.

The economy is diverse, with military, tourism, and healthcare sectors leading the way. This economic mix provides a stable foundation for rental property investors.

Additionally, San Antonio’s cost of living is relatively lower compared to other major Texas cities, making it a desirable place to live for many.

San Antonio’s blend of history, culture, and affordability makes it a solid choice for DSCR loan investments.

The city’s infrastructure supports its residents well, with ample schools, hospitals, and public services. This infrastructure attracts families and individuals looking for rental housing.

- Historical Sites: Attractions like the Alamo increase the city’s draw.

- Economic Diversity: Military, tourism, and healthcare sectors provide stability.

- Affordable Living: Lower cost of living appeals to a broad demographic.

Are you seeking a market with cultural depth and economic stability? San Antonio is an excellent option for DSCR loan investments.

Dallas: Growing Economy

Dallas is known for its rapidly growing economy, driven by finance, technology, and commerce. This growth translates to consistent rental demand.

The city boasts a diverse population and a thriving job market, making it an attractive destination for many professionals and families.

Dallas’s infrastructure, including its schools, healthcare facilities, and public transportation, supports its growing population effectively.

Dallas’s robust economy and well-developed infrastructure make it a prime market for rental property investments.

Why does Dallas stand out? The city’s strong economic fundamentals and quality of life make it a favored spot for renters.

- Economic Growth: Finance, tech, and commerce sectors drive expansion.

- Diverse Population: Attracts a broad range of renters.

- Quality Infrastructure: Schools and healthcare facilities ensure a high quality of life.

Looking for a market with economic vitality and rental demand? Dallas offers a compelling case for DSCR loan investments.

Types of Properties Eligible for DSCR Loans in Texas

Single-Family Residential

Single-family residential properties are often the most common type of property eligible for DSCR loans in Texas. These include 1-4 unit residential properties, such as detached homes, duplexes, triplexes, and fourplexes. Investors typically find these properties attractive due to their stability and ease of management.

Townhomes and condominiums also fall under this category, provided they meet certain criteria. Townhomes are classified as individual houses within a multiple-housing unit where each owner has their own entrance and sometimes a small yard. Condominiums, on the other hand, can be further categorized into warrantable and non-warrantable condos.

Non-warrantable condos are those that do not meet conventional lending standards due to various factors, such as high renter occupancy or litigation involving the condo association.

Understanding the nuances of these property types can be crucial for investors aiming to maximize their returns on DSCR loans.

Vacation or Short-Term Rentals

Vacation or short-term rentals constitute another property type eligible for DSCR loans. These properties, often listed on platforms like Airbnb and VRBO, offer short-term leasing opportunities that can yield higher rental incomes compared to long-term rentals.

However, the eligibility of these properties is contingent upon various factors, including local zoning laws and homeowners’ association rules. Hence, it is vital for investors to conduct thorough due diligence before committing to such investments.

Short-term rentals can provide higher returns but may also come with increased management responsibilities and variability in rental income.

Investors must weigh these factors to ensure that the property will generate the necessary income to meet the DSCR requirements.

Commercial or Multifamily Properties

Commercial properties and multifamily residential buildings are also viable options for DSCR loans. Multifamily properties generally include apartment buildings that house multiple families under one roof. These properties provide a steady rental income, making them attractive to investors.

Commercial properties eligible for DSCR loans can range from retail spaces to office buildings, provided they meet specific criteria. It is essential to evaluate the rental income potential and vacancy rates of these properties to ensure they meet DSCR standards.

Commercial properties can be more complex investments, but they offer the potential for significant financial returns.

By understanding the dynamics of commercial and multifamily properties, investors can make informed decisions on their DSCR loan applications.

Ineligible Property Types

While many properties qualify for DSCR loans, several types do not. Understanding these exclusions is equally important. Generally, rural properties and those with less than 750 square feet are not eligible.

Other excluded property types include condotels, which are condominium-hotel hybrids, and manufactured housing, which refers to prefabricated homes.

- Dome homes: Unconventional in architecture, these homes are not typically funded through DSCR loans.

- Log cabins: While appealing for vacation purposes, these properties usually do not meet DSCR loan criteria.

By steering clear of these ineligible property types, investors can focus on securing financing for properties that meet the DSCR loan requirements.

Partnering with Visio Lending for Your Texas DSCR Loan

Why Choose Visio Lending?

Partnering with Visio Lending for your Texas DSCR loan can transform the way you approach real estate investments. With a focus on investor needs, they provide tailored solutions that match your financial goals and investment strategy.

Their commitment to transparency and efficiency ensures that your loan application process is smooth and straightforward. Visio Lending has built a reputation for being responsive and accessible, qualities that are essential in the fast-paced world of real estate investing.

Moreover, their deep understanding of the market and extensive experience in DSCR loans means you get expert guidance at every step. They are not just a lender but a partner who is vested in your success.

Does your current lender offer the same level of service and expertise? With Visio Lending, you have a partner who is focused on helping you achieve your investment goals.

- Transparency: Clear communication and no hidden fees make for a more predictable investment process.

- Efficiency: Streamlined application processes mean faster approvals and funding, helping you seize opportunities quickly.

- Responsive Support: Dedicated support teams ensure your questions and concerns are addressed promptly.

These qualities make Visio Lending a standout choice for investors seeking reliable DSCR loan solutions in Texas.

Experience and Expertise

Visio Lending’s experience in the industry provides a solid foundation for their services. With years of market knowledge, they have honed their skills in offering customized loan options that cater to diverse investor needs.

Their team comprises seasoned professionals who understand the intricacies of DSCR loans. This expertise translates into practical advice and tailored solutions that align with your investment strategy.

Have you ever wondered how crucial expertise is in securing the right loan? Imagine navigating complex loan structures without a knowledgeable partner; it can be daunting.

“Our goal is to provide not just loans, but strategic solutions that empower investors to maximize their returns.” – Visio Lending

Visio’s extensive track record in closed loans stands as a testament to their capability. Their ability to handle various loan scenarios with precision and professionalism makes them a dependable partner for serious investors.

- In-depth Market Knowledge: Visio’s understanding of the Texas real estate market ensures that their loan offerings are relevant and competitive.

- Tailored Advice: The team’s experience allows them to offer advice that is both strategic and practical.

- Proven Track Record: Numerous successful loan closures highlight their expertise and reliability.

When you choose Visio Lending, you tap into a wealth of knowledge and experience that can significantly enhance your investment outcomes.

Recent Closed Loans

One of the compelling reasons to partner with Visio Lending is their proven success record. They have a robust portfolio of recently closed loans that demonstrate their ability to deliver results consistently.

Investors find confidence in a lender who can point to real-world examples of their efficacy. These closed loans showcase Visio’s competence in handling varied and complex loan situations, reinforcing their reputation in the market.

Why trust abstract promises when you can rely on concrete evidence? Analyzing their recent closed loans provides insights into their operational efficiency and customer satisfaction.

- Loan #1: A multifamily property in Austin, demonstrating Visio’s proficiency in handling large-scale investments.

- Loan #2: A single-family rental in Dallas, highlighting their flexibility in managing diverse property types.

- Loan #3: A commercial property loan in Houston, showcasing their capability in securing substantial funding for significant projects.

Every closed loan tells a story of successful collaboration and mutual benefits. These examples underscore Visio Lending’s commitment to excellence and investor satisfaction.

Investor-Friendly Loan Programs

Visio Lending offers a variety of loan programs designed with investors in mind. These programs are structured to provide maximum flexibility and convenience, ensuring that your investment strategies are well-supported.

With Visio, investors can access loans tailored to their unique needs. Whether you are looking to refinance an existing property or acquire new investments, their programs cater to diverse requirements.

Consider the value of a loan program that adapts to your investment strategy rather than one that forces you to conform. Visio’s investor-friendly approach ensures that their loans are a perfect fit for your portfolio needs.

Key features of their programs include:

- Flexible Terms: Options that allow you to choose terms that best match your investment goals.

- Competitive Rates: Attractive interest rates that enhance your return on investment.

- Customized Loan Structures: Tailored solutions that address specific financial situations and investment strategies.

These programs underscore Visio’s commitment to supporting investor success through innovative and adaptable loan offerings. With Visio Lending, you have access to tools and resources that can elevate your investment potential.

Conclusion

Understanding DSCR loans in Texas opens a world of opportunities for savvy investors. These loans provide flexibility, simplified approval processes, and tailored financial solutions, making them a prime option for expanding rental portfolios. By leveraging the key benefits, such as interest-only options and 30-year terms, investors can optimize their debt service coverage ratio and strategically grow their investments.

Texas offers rich markets like Houston, Austin, San Antonio, and Dallas, each presenting unique investment advantages. Whether you’re a seasoned self-employed investor or new to the market, DSCR loans cater to various property types, from single-family homes to multifamily properties. Partner with Visio Lending for their expertise and investor-friendly loan programs, and take the next step towards maximizing your rental income. Explore the comprehensive benefits of DSCR loans today, and unlock your potential in the thriving Texas real estate market.

Frequently Asked Questions

Can you do a DSCR loan in Texas?

Yes, DSCR loans are available for investors seeking to finance properties in Texas.

How do I qualify for a DSCR loan?

Qualification typically involves demonstrating a property’s income can cover its debt, often requiring a DSCR of 1.25 or higher.

How much do you have to put down on a DSCR loan?

Down payments for DSCR loans generally range from 20% to 25% of the property’s purchase price.

What are the cons of a DSCR loan?

Cons include potentially higher interest rates and strict requirements for rental income coverage.

Is a DSCR loan hard money?

No, DSCR loans are not hard money loans; they differ in terms of approval process and interest rates.

What is the current DSCR loan rate?

The current DSCR loan rates vary but are typically higher than conventional loan rates, reflecting the increased risk to lenders.