Understanding DSCR loans in Texas is crucial for real estate investors looking to maximize their returns. These loans, known for their unique qualification criteria, offer significant financial flexibility compared to traditional loans.

This guide delves into the specifics of DSCR loans, from eligibility requirements and calculation methods to top Texas markets for investment. Discover how Visio Lending can help you navigate the complexities of securing a DSCR loan effectively.

Understanding DSCR Loans in Texas: A Comprehensive Guide

What is a DSCR Loan?

A Debt Service Coverage Ratio (DSCR) loan is a specific type of financing used to purchase rental properties. Unlike traditional loans, DSCR loans focus on the property’s cash flow rather than the borrower’s personal income. This is particularly beneficial for real estate investors who may not have regular income documentation, such as self-employed individuals.

In simple terms, DSCR is a ratio that compares a property’s income to its debt obligations. The formula is straightforward: DSCR = Net Operating Income / Debt Service. For instance, if a property’s monthly rental income is $5,000 and its monthly mortgage payment is $4,000, the DSCR would be 1.25, indicating the property earns 25% more than its debt.

DSCR loans are primarily used for investment purposes. They offer a way to finance multiple properties without needing traditional income documentation. This can accelerate the process for investors looking to expand rapidly in lucrative markets like Texas.

“DSCR loans simplify the approval process, focusing on property income rather than personal finances,” explains Joshua Holt, a licensed mortgage loan originator.

Understanding the nuances of DSCR loans is crucial as they can significantly impact an investor’s portfolio strategy. Properties with DSCR values above 1.0 are generally considered profitable, which can be enticing for lenders.

Texas, with its booming real estate market and substantial rental demand, offers an ideal environment for utilizing DSCR loans. Whether you are targeting long-term rentals in urban centers or capitalizing on the state’s vibrant tourism industry for short-term rentals, DSCR loans can be a powerful tool.

Are you curious about how this type of loan can streamline your investment process? Let’s delve deeper into the specific advantages of DSCR loans.

Key Benefits of DSCR Loans

The primary advantage of DSCR loans is their reliance on property income rather than personal financial documentation. This makes the approval process faster and more accessible for different types of investors.

For instance, self-employed individuals, small business owners, and even foreign investors can easily qualify for DSCR loans without the extensive documentation required for traditional loans. This flexibility opens doors for many who otherwise might be excluded from the real estate investment market.

Moreover, DSCR loans offer significant potential for portfolio expansion. Investors can finance multiple properties under a single loan, allowing for strategic growth across diverse markets. In Texas, where rental demand is high, this can translate to substantial returns.

Another compelling benefit is the variety of repayment options available. Investors can choose from fixed-rate, adjustable-rate, or interest-only mortgages, aligning the loan terms with their investment strategy. This flexibility can help manage cash flow and mitigate risks associated with fluctuating rental income.

Why settle for less when you can optimize your returns? DSCR loans enable investors to leverage property income, creating opportunities for higher cash-on-cash returns. This is particularly advantageous in markets with strong rental yield, such as Texas.

The simplified approval process of DSCR loans also leads to quicker funding. This can be crucial for investors looking to capitalize on time-sensitive opportunities. In many cases, DSCR loans can be approved and disbursed within a few weeks, compared to the months-long process of traditional loans.

Investors looking to grow their portfolios should consider DSCR loans for their efficiency, flexibility, and potential for high returns. Are you ready to take your Texas real estate investments to the next level?

How DSCR Loans Differ from Traditional Loans

DSCR loans differ from traditional loans primarily in their qualification criteria. Traditional loans often require comprehensive personal income documentation, tax returns, and pay stubs. In contrast, DSCR loans focus solely on the income generated by the property.

This distinction means DSCR loans are not limited by the borrower’s personal financial situation. For example, an investor with fluctuating income or multiple business ventures may find it easier to qualify for a DSCR loan.

Traditional loans typically have stringent debt-to-income (DTI) ratios, which can limit the borrowing capacity of investors. DSCR loans, however, do not consider DTI ratios. Instead, they assess the property’s ability to cover its debt obligations, providing greater flexibility for investors.

- Documentation: Traditional loans require extensive personal financial documents; DSCR loans do not.

- Qualification Criteria: DSCR loans are based on property income, whereas traditional loans focus on personal income.

- Approval Time: DSCR loans often have faster approval times due to simplified documentation.

Another key difference is the loan-to-value (LTV) ratio. DSCR loans may offer higher LTV ratios, allowing investors to finance a larger portion of the property’s value. This can be particularly advantageous in competitive markets like Texas, where property prices are escalating.

DSCR loans also offer diverse repayment options, which are not typically available with traditional loans. Investors can choose terms that best suit their financial strategy, such as interest-only periods or adjustable-rate mortgages.

It is crucial to note that, DSCR loans provide a streamlined, flexible, and investor-friendly alternative to traditional loans. They are tailored to meet the unique needs of real estate investors, making them an ideal choice for portfolio expansion in Texas.

Who Should Consider a DSCR Loan?

DSCR loans are particularly suited for a variety of real estate investors. These include self-employed individuals, small business owners, and those with large or growing portfolios. The loan’s reliance on property income rather than personal income makes it accessible to many who might struggle to qualify for traditional loans.

Investors looking to purchase or refinance multiple properties can benefit significantly from DSCR loans. The ability to finance multiple properties under a single loan can streamline the management and expansion of an investment portfolio.

Have you considered the advantages of diversifying your investments? DSCR loans allow investors to explore different markets and property types, enhancing their portfolio’s resilience and return potential.

Short-term rental investors can also find DSCR loans advantageous. The loan’s flexibility and focus on property income make it ideal for those capitalizing on Texas’s booming tourism industry. Whether it’s urban apartments or vacation homes, DSCR loans provide the necessary financial support.

“By leveraging DSCR loans, investors can maximize their returns and minimize risks,” says Joshua Holt, mortgage loan originator.

Additionally, foreign investors or those investing through LLCs may find traditional loans challenging to secure. DSCR loans do not require personal income verification, making them a viable option for these investor groups.

Ultimately, any investor looking to expand their real estate portfolio quickly and efficiently should consider DSCR loans. Their unique benefits and flexibility make them an ideal financing solution in Texas’s dynamic real estate market.

Eligibility Criteria for DSCR Loans in Texas

Minimum Credit Score Requirements

When considering a DSCR loan, one of the primary criteria revolves around the applicant’s credit score. Unlike traditional loans, which demand a thorough scrutiny of your debt-to-income (DTI) ratio, DSCR loans prioritize your creditworthiness.

What constitutes a minimum credit score for a DSCR loan? Generally, lenders may require a score that reflects financial responsibility. Credit scores are crucial as they offer a snapshot of one’s borrowing history and reliability.

The importance of maintaining a good credit score cannot be overstressed. Think of your credit score as a form of trustworthiness assurance to lenders, showcasing your ability to manage and repay borrowed funds.

Despite the flexibility of DSCR loans, a minimum credit score still acts as a gatekeeper. Without meeting this bar, applicants may find it challenging to proceed further.

Why do lenders emphasize credit scores? A high credit score often correlates with lower credit risk, thus reassuring lenders of their investment security.

“Traditional loans focus heavily on debt-to-income ratio (DTI) and require substantial documentation including pay stubs, bank statements and tax returns. On the other hand, DSCR loans have qualifications based on a minimum credit score and are underwritten using the property’s income potential.”

Ensuring your credit score is above the lender’s minimum threshold is an essential step in the DSCR loan application process. This requirement helps streamline the process, making it more accessible to individuals with solid credit histories.

Property Types Eligible for DSCR Loans

The type of property you wish to finance significantly impacts DSCR loan eligibility. Not all properties qualify, making it crucial to understand which ones do.

Residential properties, specifically units intended for renting, are typically eligible. These properties generate steady rental income, aligning with the DSCR loan’s focus on income potential.

Commercial real estate, such as office buildings, retail spaces, and industrial properties, can also qualify. The income generated from these properties should be sufficient to cover the debt service.

- Multi-family units: These include apartment complexes or multi-unit buildings that generate rental income from multiple tenants.

- Single-family rentals: Standalone homes rented out to individuals or families also fit within the eligible property criteria.

- Commercial properties: Office spaces and retail outlets that maintain steady rental income streams are often considered eligible.

What if you own a mixed-use property? Properties that combine residential and commercial uses can be eligible, provided they generate the necessary income to meet loan obligations.

Understanding which properties qualify helps applicants plan their investment strategies effectively. Thus, ensuring your property type aligns with DSCR loan requirements is a crucial step forward.

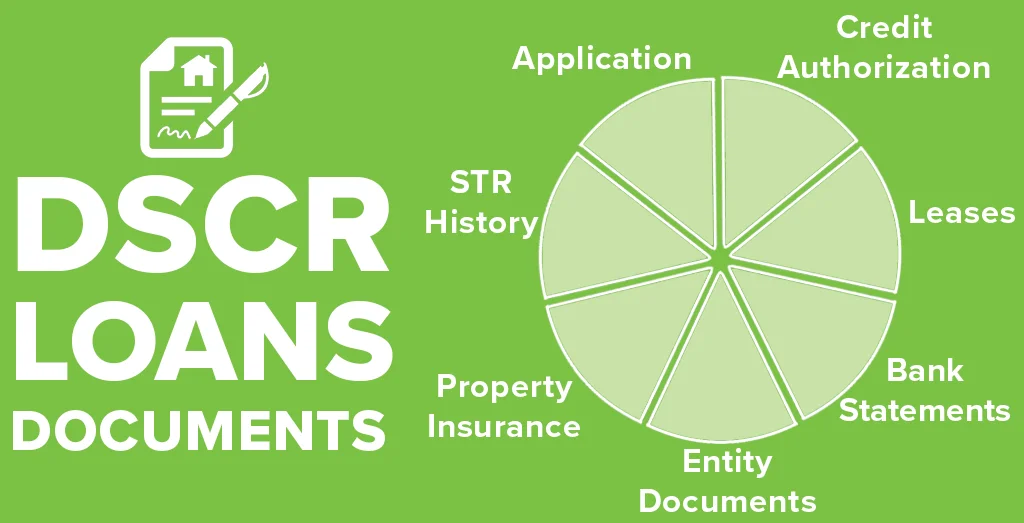

Documentation and Income Verification

Securing a DSCR loan involves specific documentation that verifies the income potential of the property rather than the borrower’s personal income.

The primary focus here lies in the property’s ability to generate enough income to cover the debt service—hence the term Debt Service Coverage Ratio (DSCR).

What documents are typically required? Unlike traditional loans where personal financial details dominate, DSCR loans necessitate property income verification documents.

Some of the key documents include:

- Rental income statements: Detailed records of rental income over a specified period.

- Lease agreements: Contracts that outline rental terms and confirm tenant occupancy and income.

- Property appraisal reports: Professional evaluations of the property’s current market value and income potential.

Why focus on property income? By prioritizing the income generated by the property, lenders assess the reliability of the investment rather than the borrower’s personal financial status.

This approach significantly simplifies the loan approval process, making it faster and more efficient. There’s no need for extensive personal documentation like pay stubs or tax returns.

The goal is straightforward: if the property’s income consistently exceeds the debt service requirements, the loan is likely to be approved.

Common Sense Limitations on Mortgaged Properties

While DSCR loans offer flexibility, certain limitations still apply to ensure sound investment practices. These limitations are grounded in practical, common-sense measures.

One significant limitation involves the property’s condition. Properties must be in good condition and compliant with safety and building codes.

Why is property condition important? Lenders need to ensure that the property will continue to generate income without requiring excessive maintenance or facing regulatory issues.

Additionally, the property’s location plays a pivotal role. Properties in high-risk areas, whether due to economic instability or natural disasters, may face stricter scrutiny.

Another limitation concerns the property’s occupancy rates. Properties with low occupancy rates or high tenant turnover may seem risky to lenders, potentially affecting loan approval.

Do lenders consider property management? Yes, proficient property management ensures steady rental income and minimal vacancies, factors that contribute positively to loan eligibility.

“On the other hand, DSCR loans have qualifications based on a minimum credit score and are underwritten using the property’s income potential.”

Such common-sense limitations are designed to safeguard both the lender’s and borrower’s interests, ensuring the property’s sustained profitability and viability.

How to Calculate and Optimize Your DSCR Ratio

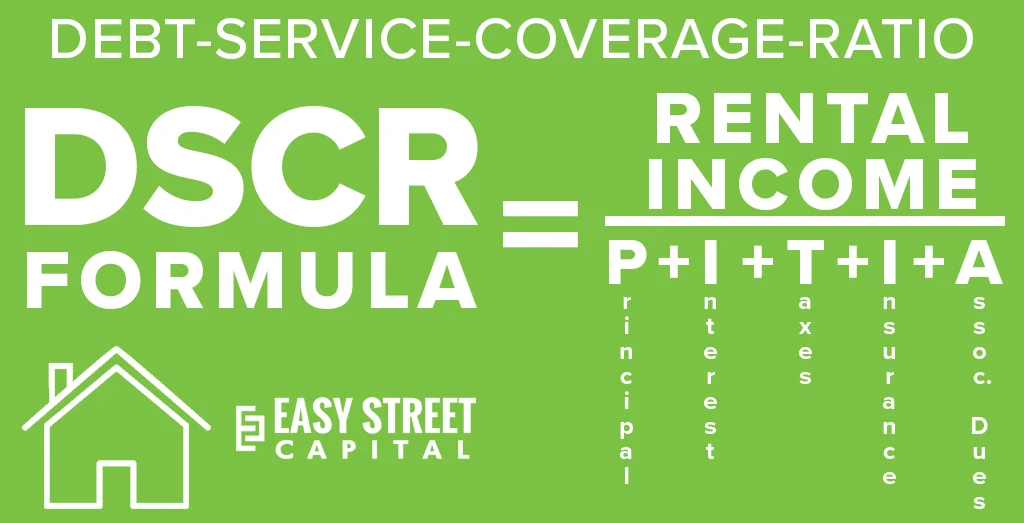

DSCR Calculation Formula

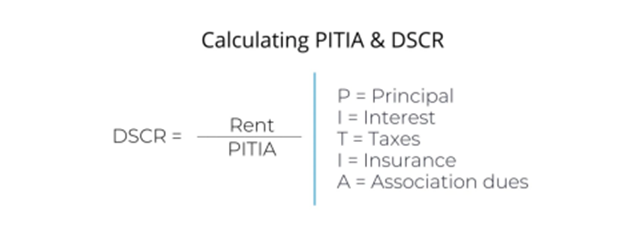

The Debt Service Coverage Ratio (DSCR) is a critical metric for real estate investors and financial planners. The calculation involves dividing the rental income by the total monthly expenses, commonly represented by the formula:

DSCR = Rent / PITIA

Here, “PITIA” stands for Principal, Interest, Taxes, Insurance, and Association dues. A DSCR of 1 indicates that these monthly expenses are equal to the rental income. For example, if your property’s monthly expenses amount to $1,800 and your tenant pays you the same amount, your DSCR is 1, signifying a breakeven point.

A DSCR calculator can simplify this process, allowing you to screen investment opportunities and set realistic expectations regarding loan-to-value (LTV), cash to close, and cash-on-cash returns.

Understanding the DSCR formula helps in evaluating loan eligibility for rental property purchases or refinances. By accurately calculating your DSCR, you can better strategize your investments and optimize your financial outcomes.

What if the rent exceeds the monthly expenses? This scenario would result in a DSCR greater than 1, indicating a profitable venture. Conversely, a DSCR less than 1 would highlight a shortfall, warranting immediate attention and corrective measures.

Thorough knowledge of these calculations empowers investors to make informed decisions, ensuring financial stability and growth.

Importance of DSCR Ratio

The DSCR ratio holds significant importance in real estate investment and financial planning. It serves as a measure of a property’s ability to generate sufficient income to cover debt obligations. Why is this metric so crucial?

A healthy DSCR demonstrates the property’s financial viability and appeals positively to lenders, increasing the chances of loan approval. Additionally, it helps in assessing the risk associated with the investment. A higher DSCR indicates lower risk and greater profitability.

For instance, a DSCR of 1.25 means that the property generates 25% more income than required to cover the debt payments, offering a safety cushion for investors.

Furthermore, maintaining a favorable DSCR ratio can influence the loan terms, including interest rates and loan-to-value ratios. Lenders are more likely to offer competitive rates to properties with robust DSCRs, reflecting lower financial risk.

Are you aware of the impact of DSCR on your long-term investment strategy? A strong DSCR not only ensures immediate financial health but also contributes to sustainable growth and profitability.

By focusing on optimizing the DSCR ratio, investors can enhance cash flow, reduce the risk of default, and secure better financing options, paving the way for successful real estate ventures.

Strategies to Improve DSCR

Optimizing the DSCR ratio is vital for securing favorable financing and ensuring the profitability of your investment. Several strategies can help improve this metric effectively.

Firstly, consider increasing your down payment. A higher down payment reduces the loan amount, leading to lower monthly debt obligations and, consequently, a better DSCR.

For example, raising the down payment from 20% to 25% can significantly lower the monthly expenses and improve the DSCR ratio.

Another effective strategy is to negotiate your property taxes and insurance rates. Lowering these costs can directly impact the monthly expenses, enhancing the DSCR ratio. Are there opportunities to reduce these expenses in your current portfolio?

Additionally, some lenders offer the option to buy down your interest rate. Although this increases the closing costs, it reduces the monthly mortgage payments, positively affecting the DSCR.

Exploring ways to increase your rental income can also prove beneficial. Can you make property improvements or introduce amenities to command higher rents? This approach can drive up your income, thereby improving the DSCR.

Investors should also be cautious of promises of high LTV ratios from lenders. Ensure that the terms are realistic and sustainable to avoid financial pitfalls.

By implementing these strategies, investors can optimize their DSCR ratios, securing better financing terms and ensuring the long-term success of their real estate investments.

Tools and Resources for DSCR Calculation

Leveraging the right tools and resources can streamline the DSCR calculation process, making it more accurate and efficient.

One of the primary resources is a DSCR calculator. These online tools simplify the calculation by allowing you to input the necessary figures, such as rental income and monthly expenses, to determine the DSCR ratio.

- Mortgage Calculators: These tools can help estimate monthly mortgage payments, incorporating principal, interest, taxes, and insurance.

- Property Management Software: Comprehensive property management platforms often include financial modules that assist in calculating and tracking DSCR ratios.

- Financial Advisors: Consulting with a financial advisor can provide personalized insights and strategies for improving DSCR and optimizing financial health.

Additionally, real estate investment analysis software offers extensive features for detailed financial modeling and DSCR calculation. These tools can factor in various elements, such as vacancy rates and maintenance costs, providing a holistic view of the investment’s financial performance.

For example, software like RealData or PropertyMetrics can aid in thorough financial analysis, ensuring precise DSCR calculations.

Utilizing these tools and resources enables investors to make informed decisions, enhancing their ability to calculate and optimize DSCR ratios effectively.

Are you making the most of these available resources? Incorporating these tools into your investment strategy can significantly improve your financial planning and investment outcomes.

By leveraging these tools, investors can ensure accurate calculations, optimize their DSCR ratios, and achieve long-term financial success in their real estate ventures.

Exploring DSCR Loan Terms and Fees in Texas

Loan Term Options

When considering DSCR loans in Texas, we need to understand the variety of loan term options available. Loan terms can significantly influence the financial commitment and flexibility the borrower experiences. These terms typically range from short-term to long-term, offering choices to suit different investment strategies.

Short-term loans, generally between one to five years, provide quick turnaround for investors looking to flip properties or refinance swiftly. These loans might come with higher interest rates due to the shorter repayment period. Short-term options can be attractive for those aiming for rapid capital appreciation.

Conversely, long-term loans extend over 10 to 30 years, offering stability through predictable monthly payments. They often come with lower interest rates, making them suitable for investors focused on long-term rental income. A longer term may appeal to those seeking to minimize monthly expenses and stabilize cash flow.

Given the variety of terms, it is crucial to evaluate how each duration affects your overall investment strategy. Long-term stability versus short-term gains is a key consideration in deciding the appropriate term for your DSCR loan.

Choosing the right loan term is akin to selecting the right tool for a job—each has its unique benefits and potential drawbacks depending on your objectives.

Adding complexity to these choices, some DSCR loans offer interest-only periods at the beginning of the term. This feature can further influence cash flow and investment returns, depending on your financial goals.

It is crucial to note that, the flexibility in loan term lengths can help tailor the DSCR loan to fit your specific needs and investment timeline. The decision should take into account both the short-term financial impact and long-term investment returns.

Interest-Only Loans

Interest-only loans represent a particular type of DSCR loan where the borrower only pays interest on the principal balance for a designated period. This period can range from a few years to nearly a decade, depending on the loan agreement. Once this period concludes, the borrower must start repaying both the interest and principal.

Interest-only loans can initially reduce monthly payments, freeing up cash flow for other investments or operational needs. This benefit can be particularly appealing in the early stages of property investment when cash flow might be limited.

However, there is a trade-off. While the initial payments are lower, the subsequent payments will be higher once the interest-only period ends. It is essential to prepare for this financial shift and ensure that your investment strategy accommodates these future increased payments.

Additionally, interest-only loans can introduce greater financial risk. The assumption is that the property value will increase, allowing for profitable refinancing or sale. Thus, these loans may be more suitable for investors confident in property appreciation or income growth.

Why might an investor opt for an interest-only loan despite the risks? The primary advantage is enhanced cash flow flexibility. Increasing liquidity can allow for further investments, renovations, or other financial maneuvers that could potentially boost the property’s value and income.

“The primary advantage of an interest-only loan is that it enhances cash flow flexibility, akin to opening a new financial avenue for other investments or immediate financial needs.”

Importantly, interest-only DSCR loans can offer strategic benefits but require careful planning and risk management. It’s vital to consider the long-term implications of these loans within your overall investment strategy.

Rate Buy Downs and Prepayment Penalties

When we discuss rate buy downs and prepayment penalties, we delve into specific aspects of DSCR loans that can significantly affect the total cost and flexibility of the borrower’s financial commitment.

Rate buy downs involve paying an upfront fee to lower the interest rate on your loan. This fee is often referred to as “points,” where one point equals one percent of the loan amount. By buying down the rate, borrowers can reduce their monthly payments and enhance their cash flow stability.

For example, paying points upfront might decrease your interest rate from 5% to 4%, substantially lowering your monthly obligations. This strategy can be advantageous if you plan to hold the property for an extended period, as the savings over time can outweigh the initial cost.

Conversely, prepayment penalties are fees charged for paying off the loan early, either partially or in full. These penalties are designed to compensate lenders for the loss of interest they would have earned over the loan term.

In Texas, common prepayment structures include the 3-year 3-2-1 and the 5-year 5-4-3-2-1. A 3-2-1 structure means the penalty decreases over three years: 3% in the first year, 2% in the second, and 1% in the third. A 5-4-3-2-1 structure follows a similar pattern but over five years.

The 3-year 3-2-1 and the 5-year 5-4-3-2-1 prepayment penalty structures are common, providing a gradual reduction in penalties, thus offering increasing flexibility over time.

Prepayment penalties can limit your ability to refinance or sell the property without incurring extra costs. As such, it is essential to consider your investment horizon and potential need for financial flexibility when evaluating these penalties.

In essence, the interplay between rate buy downs and prepayment penalties requires strategic planning. Understanding these terms allows borrowers to optimize their loan’s cost structure while maintaining desired financial flexibility.

Fee Structures for DSCR Loans

Understanding the fee structures associated with DSCR loans is paramount for borrowers. These fees can significantly impact the overall cost and must be meticulously considered during the loan selection process.

Common fees associated with DSCR loans encompass origination fees, underwriting fees, and closing costs. Origination fees are charged by lenders for processing the loan application. Underwriting fees cover the cost of evaluating the borrower’s financial status and the property’s value. Closing costs are incurred at the completion of the loan transaction and may include appraisal fees, title insurance, and recording fees.

- Origination Fees: These fees compensate the lender for initiating and processing the loan application. They are typically a percentage of the total loan amount.

- Underwriting Fees: These fees cover the cost of the lender’s due diligence, ensuring the borrower and property meet the criteria for loan approval.

- Closing Costs: These are comprehensive fees, including appraisal, title insurance, and recording expenses, paid at the transaction’s conclusion.

Additional fees may include service fees for maintaining the loan, late payment penalties, and fees for any adjustments or amendments to the loan terms post-closure. Each fee can add to the overall cost, impacting the loan’s affordability and financial viability.

Why are these fees crucial to understand? They directly affect your upfront costs and ongoing financial obligations. Knowing these costs aids in accurate financial planning, ensuring you are not caught off guard by unexpected expenses.

Moreover, fee structures can vary significantly between lenders. It is prudent to compare different loan offers, scrutinizing the detailed fee breakdowns to identify the most cost-effective option. Negotiating these fees can sometimes lead to reduced costs, providing better financial terms.

Importantly, comprehending the detailed fee structures of DSCR loans empowers borrowers to make informed decisions. It is a critical step in the loan evaluation process that can significantly influence the overall investment’s success and profitability.

Top Texas Markets for DSCR Loan Investments

Houston: A Prime Market

Houston stands out as one of the most appealing markets for DSCR loan investments in Texas. **Its robust and diverse economy** makes it a magnet for real estate investors. The city is known for its strong job market, driven by industries like energy, healthcare, and aerospace.

Moreover, **Houston’s population growth** consistently ranks among the highest in the nation, ensuring a steady demand for rental properties. This consistent demand translates to reliable rental income, crucial for meeting DSCR loan requirements.

Houston’s vibrant economy and growing population make it an attractive market for DSCR loan investments.

With an abundance of **suburban areas** that meet DSCR criteria, Houston offers plenty of opportunities for investors. These areas are typically well-developed with the necessary infrastructure, such as schools, hospitals, and shopping centers.

Additionally, the city’s affordability and high rental yields provide a favorable environment for investors looking to maximize their returns. **Low property prices** combined with high rental rates increase the likelihood of a positive cash flow.

As an example, neighborhoods like **The Woodlands** and **Sugar Land** exemplify suburban areas in Houston that are ideal for DSCR loans. These locales offer a blend of affordability, infrastructure, and rental demand.

Overall, Houston’s economic stability and growth potential create a promising landscape for any real estate investor.

Austin: The Growing Tech Hub

In Austin, real estate investors find a rapidly growing market, boosted by the influx of tech companies and startups. **Austin’s reputation as the “Silicon Hills”** has attracted talent and businesses alike, leading to a boom in the housing market.

The city’s thriving tech sector fuels job growth, which in turn drives demand for rental properties. **Workers relocating to Austin** seek housing, creating a steady stream of potential tenants.

Coupled with its vibrant cultural scene, Austin remains a popular destination for young professionals and families. **Neighborhoods like Round Rock** exemplify suburban areas with excellent infrastructure and amenities, making them perfect for DSCR loans.

Austin’s tech-driven growth and popular suburban neighborhoods make it a prime candidate for DSCR loan investments.

Moreover, Austin’s **population growth** supports a healthy rental market. The continuous influx of residents ensures that real estate investors will have no shortage of tenants.

The city’s regulatory environment is also favorable for investors. **Local policies encourage development**, making it easier to acquire and manage rental properties.

What sets Austin apart is its appeal to a younger demographic, which tends to favor renting over homeownership. This trend further solidifies the city’s position as a lucrative market for DSCR loans.

Investors should consider Austin’s dynamic economy and growing tech presence when looking to diversify their real estate portfolio.

San Antonio: Historical and Economic Appeal

San Antonio offers a unique blend of historical charm and economic growth, making it another top market for DSCR loan investments. **The city’s rich cultural heritage** attracts both tourists and new residents, fostering a strong rental market.

With a diverse economy anchored by **military, healthcare, and tourism**, San Antonio provides a stable environment for real estate investment. These industries ensure steady employment, supporting demand for rental properties.

Neighborhoods like **Alamo Heights** offer the suburban characteristics needed for DSCR loans, with excellent infrastructure and community amenities.

San Antonio’s historical significance and economic diversity create a stable rental market suitable for DSCR loan investments.

Furthermore, San Antonio’s cost of living remains lower compared to other major Texas cities. This affordability attracts a wide range of tenants, from young professionals to retirees.

The city’s commitment to infrastructure development, illustrated by projects like the **San Antonio River Walk**, enhances its appeal to both residents and investors.

In addition to its economic stability, San Antonio’s **population growth rates** contribute to a thriving rental market. Investors can expect consistent rental income due to the continuous demand for housing.

By considering properties in well-established neighborhoods with solid infrastructure, investors can maximize their DSCR loan benefits in San Antonio.

Dallas: A Thriving Metropolis

Dallas is undeniably one of the most dynamic markets for DSCR loan investments in Texas. **The city’s booming economy**, driven by finance, technology, and manufacturing sectors, creates an environment ripe for real estate investment.

The city’s substantial **population growth** ensures a robust demand for rental properties. As more people move to Dallas for job opportunities, the need for rental housing increases, making it easier to meet DSCR loan criteria.

Dallas’s burgeoning economy and high demand for rental properties make it an ideal market for DSCR loan investments.

Suburban areas such as **Plano** and **Frisco** highlight Dallas’s potential for DSCR loans. These neighborhoods offer high-quality infrastructure, including schools, healthcare facilities, and shopping centers, meeting lender requirements.

Additionally, Dallas’s real estate market offers an attractive combination of **affordable property prices** and high rental yields. This balance helps investors achieve the cash flow needed for DSCR loans.

The city’s diverse economy provides stability, protecting investors from market volatility. Whether investing in residential or multi-family units, Dallas offers numerous opportunities.

Investors can also benefit from Dallas’s **business-friendly environment**, which promotes real estate development and investment. Local policies support growth, creating a positive climate for rental property management.

Given its economic strengths and rental demand, Dallas stands out as a top choice for savvy real estate investors looking to utilize DSCR loans effectively.

Types of Properties Eligible for DSCR Loans in Texas

Single-Family Residential Properties

For prospective DSCR loan applicants and real estate investors, single-family residential properties, inclusive of 1-4 unit homes, serve as a prime option. These property types also encompass townhomes as well as both warrantable and non-warrantable condos.

Why are these properties attractive? They often offer a steady rental income, which is critical for meeting the Debt Service Coverage Ratio (DSCR) requirements. Townhomes, with their low-maintenance needs, provide a viable alternative to traditional homes.

Single-family residential properties provide consistent rental income, making them a solid choice for DSCR loans.

Warrantable condos, those meeting specific criteria, are less risky for lenders. Non-warrantable condos, on the other hand, while eligible, may come with higher interest rates due to increased risk factors.

Considering a 1-4 unit home can be particularly strategic. The minimal number of units reduces complexity, but multiple units can increase rental revenue potential. How does one choose?

The decision between warrantable and non-warrantable condos ultimately hinges on factors such as location, the condition of the property, and anticipated rental income. This complexity highlights the importance of careful selection and thorough research.

- Warrantable Condos: Lower risk, potentially better loan terms.

- Non-warrantable Condos: Higher risk, possibly higher interest rates.

- Townhomes: Lower maintenance, steady income.

Vacation or Short-Term Rentals

Vacation homes and short-term rentals are another property category eligible for DSCR loans in Texas. These properties, often situated in desirable tourist areas, can generate substantial rental income, especially in peak seasons.

Advantages of vacation rentals include the potential for high rental rates and the flexibility to use the property personally. However, what about off-peak seasons?

Short-term rentals can yield high returns, yet prospective investors must account for seasonal fluctuations.

Investors should be mindful of the seasonal nature of vacation rentals. Off-peak periods may result in lower occupancy rates, affecting overall revenue. It’s essential to evaluate the annual income potential rather than focusing solely on peak earnings.

Moreover, the management of vacation rentals can be more intensive due to frequent tenant turnover. Investors often enlist property management services, which can handle everything from marketing to maintenance. Is this cost-effective?

- High Rental Rates: Significant income during peak seasons.

- Personal Use: Flexibility to enjoy the property.

- Management Services: Necessary for frequent turnover, but added cost.

Commercial or Multifamily Properties

Commercial and multifamily properties present robust opportunities for DSCR loan pursuits. What makes these properties attractive? The diverse tenant base and steady cash flow stand out as primary benefits.

Commercial properties, ranging from office spaces to retail buildings, often feature long-term leases. These leases provide a predictable income stream, crucial for DSCR calculations. Additionally, commercial properties typically have higher rental yields compared to residential properties.

Commercial and multifamily properties offer stable and diversified income streams, appealing to DSCR loan applicants.

Multifamily properties, including apartment complexes, bring the advantage of multiple tenants. This diversity reduces the risk associated with vacancies. How does one maximize these benefits?

Investors should focus on properties in thriving markets with high occupancy rates. Renovations and upgrades can also enhance property value and rental income potential. Ensuring the property meets local regulations and standards is equally important.

- Diverse Tenant Base: Reduces vacancy risk.

- Long-Term Leases: Provides income stability.

- High Rental Yields: Greater potential returns.

Non-Eligible Property Types

While several property types qualify for DSCR loans, certain categories typically do not. Understanding these exclusions is vital for avoiding wasted efforts and resources.

Rural properties, for instance, often fail to meet DSCR loan criteria due to their lower income potential and higher vacancy risks. Small properties, those under 750 square feet, are also generally ineligible due to limited rental income capabilities.

Condotels, blending condos and hotel services, pose higher financial and operational risks, leading to their frequent exclusion. Manufactured housing, dome homes, and log cabins similarly fall into non-eligible categories.

Certain property types are excluded from DSCR loans due to their higher risks and lower income potentials.

Investors should be aware of these restrictions to streamline their property search and focus on viable options. Why waste time on ineligible properties?

- Rural Properties: Higher vacancy risks, lower rental income.

- Small Properties: Under 750 square feet, limited income potential.

- Condotels: Higher financial and operational risks.

- Manufactured Housing: Often excluded due to valuation concerns.

- Dome Homes and Log Cabins: Not typically supported by lenders.

Partnering with Visio Lending for Your Texas DSCR Loan

Why Choose Visio Lending?

We provide numerous benefits that set us apart from other lenders. For instance, at OfferMarket, our commitment is to help you build wealth through real estate.

The cornerstone of our service is delivering the best possible terms for every single quote, every single loan, and every single time.

Imagine securing a loan with lower interest rates and lower origination fees. Such terms significantly increase your potential profit margins.

Another crucial aspect of our offering is the provision of a higher Loan-to-Value (LTV) ratio. A higher LTV allows you to leverage more funds, enabling you to invest in more lucrative properties.

When it comes to service, we pride ourselves on delivering a superior experience. Our clients benefit from better service levels, tailored to ensure their needs are met promptly and efficiently.

We also leverage advanced technology to streamline the lending process. This means you get better technology options that simplify your investment journey.

Faster time to close is another key benefit. Imagine finalizing your loan quickly and smoothly, letting you focus on your investment.

Lastly, you benefit from a no seasoning requirement, which means you can get started on your investment without unnecessary delays.

Success Stories and Testimonials

Our clients’ experiences highlight the advantages of partnering with us. Investors often share their success stories, underlining how our loan terms and service quality have contributed to their profitability.

For example, one investor mentioned, “Partnering with Visio Lending was a game-changer. The lower interest rates and quick processing times made all the difference.”

These testimonials aren’t just words; they reflect genuine experiences and successful outcomes.

“I managed to close my loan faster than anticipated, thanks to Visio Lending’s efficient processes. It allowed me to seize a great investment opportunity!”

Another satisfied client stated, “The higher LTV was incredibly beneficial, allowing me to leverage more and invest in a prime property.”

Do real stories matter more than vague promises? Absolutely. They provide concrete evidence of our commitment to your success.

Moreover, consistent positive feedback underscores our dedication to offering unmatched service and terms.

So, why not join the ranks of investors who have prospered by working with Visio Lending?

Loan Programs Offered by Visio Lending

Our variety of loan programs are tailored to meet diverse investment needs. Whether you are a seasoned investor or just starting, we have options to suit your strategy.

- Short-term rental loans: Ideal for investors looking for properties that yield high returns in a short period.

- Long-term rental loans: Designed for those seeking steady, long-term rental income with favorable terms.

- Fix-and-flip loans: Perfect for investors who buy properties to renovate and sell quickly for a profit.

How do these options enhance your investment strategy? By offering flexible terms and specialized loan products, you can tailor your approach to fit your investment goals.

Additionally, our team of experts is always available to help you choose the loan program that aligns with your investment strategy.

Are you looking to maximize returns or secure stable income? Our diverse loan programs ensure you can achieve either or both.

How to Apply for a DSCR Loan with Visio

Applying for a DSCR loan with us is straightforward and efficient. We aim to make the process as seamless as possible.

First, gather all necessary documents, such as your property details and financial credentials.

- Initial Inquiry: Contact us to discuss your investment goals and loan requirements.

- Documentation: Submit the required documents for initial review and assessment.

- Approval Process: Our team will quickly review your application and provide terms tailored to your needs.

Can you imagine a simpler way to secure a loan? Our streamlined process ensures you can focus on what really matters.

Additionally, our expert team is always at hand to guide you through each step, answering any questions you may have.

Ready to take the next step in your investment journey? With Visio Lending, securing a DSCR loan has never been easier.

Conclusion

Understanding the nuances of DSCR loans in Texas can unlock significant opportunities for real estate investors. The distinct advantages, such as flexible eligibility criteria and potential for higher returns, make DSCR loans a compelling choice. By focusing on key markets like Houston, Austin, San Antonio, and Dallas, investors can strategically position themselves for success in diverse and thriving locales.

Optimizing your DSCR ratio is critical, and leveraging tools and resources can streamline this process. Partnering with Visio Lending offers tailored loan programs and reliable support, ensuring a seamless application experience. As you navigate the complexities of DSCR loans, informed decision-making will be your greatest asset.

Ready to take the next step? Explore more about Visio Lending’s offerings and start your DSCR loan journey today. Investing in Texas real estate has never been more accessible, so seize the opportunity and secure your financial future.

Frequently Asked Questions

Can you do a DSCR loan on Texas?

Yes, DSCR loans are available for properties in Texas.

How do I qualify for a DSCR loan?

You need to meet specific eligibility criteria, including minimum credit score, property type, and income verification requirements.

How much do you have to put down on a DSCR loan?

Typically, a down payment of at least 20% is required for DSCR loans.

What are the cons of a DSCR loan?

DSCR loans may have higher interest rates and stricter qualification requirements compared to traditional loans.

Who should consider a DSCR loan?

Real estate investors seeking to finance income-generating properties should consider DSCR loans.

What property types are eligible for DSCR loans in Texas?

Eligible properties include single-family residences, vacation rentals, and commercial or multifamily properties.