Delve into the intricate world of DSCR mortgage lenders with our comprehensive guide, designed for both seasoned investors and industry novices. Understanding DSCR loans and their key differentiators from conventional loans can significantly impact your investment strategies.

We’ll explore top DSCR mortgage lenders, highlighting essential features and evaluating crucial loan requirements to help you make informed decisions. Compare DSCR loans with hard money loans to discern which aligns best with your financial goals.

Discover the types of properties eligible for DSCR loans and determine if this financing option suits your needs. With actionable insights and clear, factual information, this article serves as an indispensable resource on DSCR loans.

Understanding DSCR Mortgage Lenders: An Overview

What is a DSCR Loan?

A Debt Service Coverage Ratio (DSCR) loan is a type of mortgage tailored specifically for real estate investors. Unlike conventional loans, the qualification for DSCR loans primarily depends on the cash flow generated by the property, rather than the borrower’s personal income.

For instance, if you’re investing in a rental property, the DSCR loan will consider the rental income in relation to the debt service. This ratio is used to assess the property’s ability to cover the loan payments. A higher DSCR indicates that the property generates sufficient income to cover the debt, typically making it a safer investment for lenders.

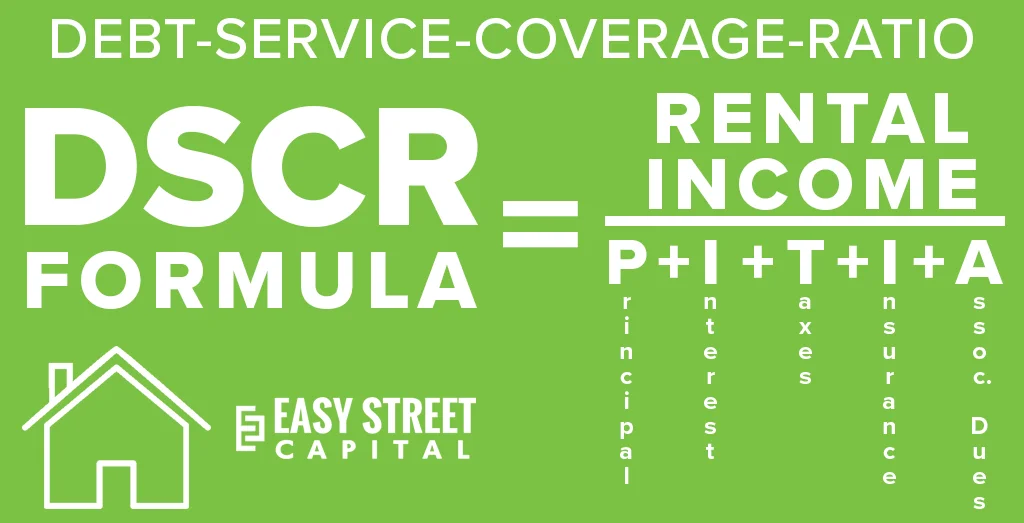

To calculate DSCR, divide the net operating income (NOI) by the total debt service. A DSCR of 1 means the property generates just enough income to cover the loan payments.

This focus on property income makes DSCR loans a practical choice for those with substantial rental income but who might not have a high personal income or robust credit profile.

- Property Income Focus: DSCR loans emphasize the income from the property rather than personal income.

- Calculation Method: The DSCR is calculated by dividing net operating income by total debt service.

- Investment Property: This type of loan is specifically designed for investment properties.

Key Differences from Conventional Loans

While both DSCR loans and conventional loans serve the purpose of purchasing or refinancing properties, they have distinct differences that cater to different types of borrowers and properties.

Conventional loans typically require extensive documentation of personal income, credit scores, and a lower debt-to-income ratio. In contrast, DSCR loans are more lenient in these areas, focusing instead on the income generated by the property.

- Qualification Criteria: Conventional loans rely heavily on personal income and credit scores. DSCR loans prioritize property income.

- Documentation: DSCR loans require less personal financial documentation compared to conventional loans.

- Flexibility: DSCR loans offer more flexibility for borrowers who might not meet the stringent requirements of conventional loans.

Consider the scenario where a borrower has a high-income generating rental property but has a lower personal income or slightly tarnished credit history. A DSCR loan would be a viable option for them, whereas they might struggle to qualify for a conventional mortgage.

Who Benefits from DSCR Loans?

DSCR loans are particularly advantageous for real estate investors looking to expand their portfolio. These loans provide a practical solution for those who may not fit the traditional borrower profile required by conventional lenders.

For example, an investor with multiple rental properties generating substantial rental income but with a less than stellar personal credit score could benefit significantly from a DSCR loan.

- Real Estate Investors: Ideal for those with significant rental income but varying personal income levels.

- Portfolio Expansion: Facilitates the expansion of real estate portfolios by leveraging rental income.

- Less Emphasis on Credit: Beneficial for borrowers with less-than-perfect credit scores.

Why limit growth due to personal financial constraints when the investment itself is profitable? DSCR loans offer an effective path for investors looking to maximize their returns while mitigating personal financial hurdles.

Common Misconceptions

Despite their growing popularity, there are several misconceptions about DSCR loans that could deter potential borrowers:

A common myth is that DSCR loans are only for high-value properties. However, these loans can be used for various property types and values, provided the property generates adequate rental income.

DSCR loans are not exclusive to high-value properties; they are available for any property that meets the income requirements.

Another misconception is that DSCR loans have unreasonably high-interest rates. While the rates might be slightly higher than conventional loans, the difference is often justified by the flexibility and ease of qualification.

- High-Value Property Myth: DSCR loans are not limited to high-value properties.

- Interest Rate Concerns: Rates are slightly higher but offset by flexible qualification criteria.

- Complexity: Despite being specialized, these loans are straightforward and accessible to qualified borrowers.

Understanding these myths and the reality behind DSCR loans can empower borrowers to make informed decisions, ensuring they take full advantage of the opportunities these unique mortgage options offer.

Top DSCR Mortgage Lenders in the Market

New Silver Lending

New Silver Lending stands out as a significant player in the DSCR mortgage market, offering tailored services for real estate investors. They focus on providing quick and efficient funding options that cater to the unique needs of their clients.

Unlike traditional lenders, New Silver Lending offers flexible loan terms and quicker processing times. This can make a real difference for investors who need to seize opportunities promptly in a competitive market.

New Silver Lending understands the urgency in real estate investments, providing loans that can be processed and approved within days rather than weeks.

Their DSCR loans are designed to support both residential and commercial properties, giving investors various opportunities to expand their portfolios.

- Loan Terms: Offers both short-term and long-term DSCR loans.

- Quick Funding: Streamlined processes to ensure fast approval and disbursement.

- Diverse Property Types: Funds both residential and commercial investments.

What makes New Silver Lending particularly attractive is their commitment to simplifying the borrowing process. Their streamlined application process minimizes paperwork and eliminates unnecessary hurdles.

Are you looking for a lender that values efficiency and flexibility? New Silver Lending could be the perfect partner for your next investment venture.

Kiavi

Kiavi, formerly known as LendingHome, has established itself as a reliable source for DSCR loans, focusing on providing real estate investors with the capital they need to grow their portfolios.

Kiavi’s DSCR loans are known for their competitive interest rates and flexible repayment options, making them an attractive choice for seasoned investors.

Kiavi’s emphasis on competitive interest rates and customer-centric loan products sets them apart in the DSCR lending space.

One of the key features of Kiavi’s offerings is the transparency in their loan processes, ensuring investors are aware of all terms and conditions from the outset.

- Competitive Rates: Offers some of the market’s most attractive interest rates.

- Flexibility: Provides various repayment options tailored to investor needs.

- Transparency: Clear and straightforward loan terms and conditions.

Kiavi also offers a range of support services to help investors make informed decisions, including robust customer service and detailed loan information.

Is transparency and competitive pricing important in your investment strategy? Kiavi could be the optimal choice.

Griffin Funding

Griffin Funding has garnered attention for its innovative approach to DSCR loans, particularly favoring investors seeking unique and bespoke lending solutions.

Their loan products are tailored to meet various investor requirements, whether for new purchases or refinancing existing investments.

Griffin Funding’s tailored DSCR loan solutions make them a preferred lender for investors with specific and unique needs.

One standout feature of Griffin Funding is their commitment to providing loans with fewer restrictions, which can be particularly advantageous for investors with diverse portfolios.

- Innovative Solutions: Customizable loan options for different investment needs.

- Flexibility: Fewer restrictions, allowing for a broader range of investment opportunities.

- Specialized Support: Dedicated support for complex investment scenarios.

Griffin Funding’s team is known for their expertise and willingness to go the extra mile to ensure their clients’ investment goals are met.

Do you need a lender that can offer bespoke solutions? Griffin Funding might just be the perfect fit for your portfolio.

Angel Oak

Angel Oak is a noteworthy lender in the DSCR mortgage market, known for their breadth of loan offerings and investor-friendly terms.

Their approach emphasizes flexibility and accessibility, particularly for investors who may struggle with traditional lending criteria.

Angel Oak caters to investors seeking flexible and accessible DSCR loans, especially those who may not meet conventional lender requirements.

Angel Oak offers a range of DSCR loan products, which can be utilized for various investment purposes, from purchasing new properties to refinancing existing ones.

- Broad Range: Offers multiple DSCR loan products for different investment needs.

- Flexible Terms: Terms designed to accommodate a variety of investor profiles.

- Accessibility: Loans available even for investors with unconventional financial backgrounds.

Their commitment to customer service also stands out, providing investors with the support needed to navigate the loan application and approval process effectively.

Are you looking for a flexible and accommodating lender? Angel Oak could provide the solutions you need to succeed in your investment endeavors.

Key Features to Look for in DSCR Loans

Loan Terms and Rates

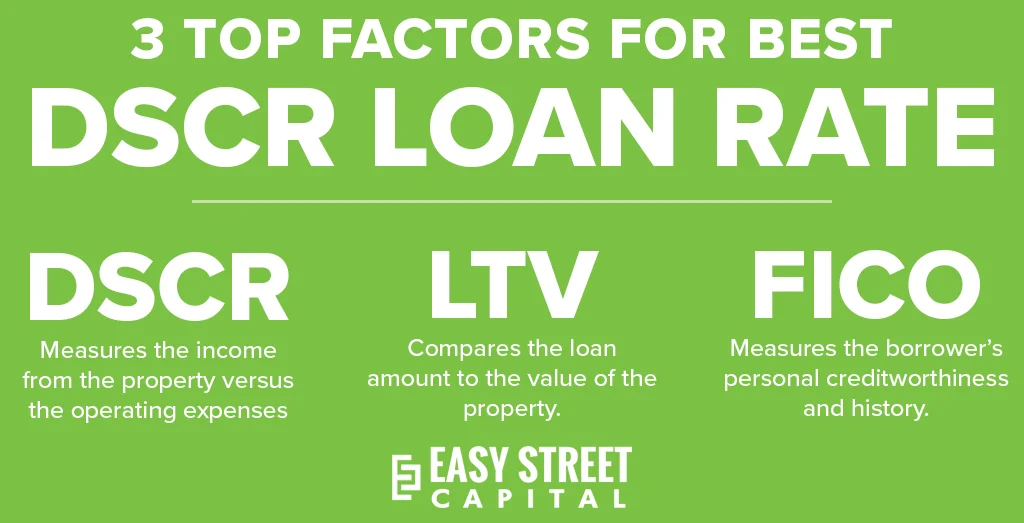

When considering DSCR loans, it is crucial to scrutinize the loan terms and interest rates offered by different lenders. The terms can significantly impact the overall cost of the loan and its feasibility for your investment strategy.

Investors should ask about the number of DSCR loans the lender has closed and how long they have been offering these loans. This provides insight into the lender’s experience and reliability.

Are you aware that prepayment penalties are common in DSCR loans? It’s important to understand these penalties as they can affect the flexibility of your investment. Some lenders might offer rate buy-down options, which can be beneficial if you plan to hold onto the property for a long time.

Moreover, a clear understanding of the interest rates is essential. Interest rates can vary based on the property’s location and condition. Knowing whether the lender offers fixed or variable rates will help you assess the risk associated with future rate changes.

Investors need to evaluate the overall cost of borrowing, including any hidden fees or charges that might not be immediately apparent.

Evaluating the lender’s property insurance requirements is also vital, as these can differ significantly from those for owner-occupied properties. In some cases, these requirements might end up being more costly.

- Prepayment Penalties: Understand the penalties for early repayment to avoid unforeseen costs.

- Interest Rates: Check if the rates are fixed or variable to gauge long-term cost implications.

- Property Insurance Requirements: Ensure you are aware of specific insurance obligations for investment properties.

Lastly, do not overlook the possibility of financing in an LLC or corporate entity. Some lenders offer this feature, which can provide additional asset protection and tax benefits.

Eligibility Criteria

The eligibility criteria for DSCR loans are less stringent compared to traditional loans, making them a popular choice among real estate investors with complex financial situations.

Lenders typically look for a debt service coverage ratio (DSCR) of 1.2 or more. This ratio indicates that the property’s income will cover the loan repayments and leave a cushion for other expenses. Understanding this requirement helps set realistic expectations about the income your property needs to generate.

Are you investing in a rental property? DSCR loans generally require the property to be a rental entity. Eligible properties often include single-family homes, multi-family units, 2-4 unit properties, planned unit developments (PUD), or condos.

- Debt Service Coverage Ratio: Aim for a DSCR of at least 1.2 to meet most lenders’ requirements.

- Eligible Properties: Ensure your property type qualifies for a DSCR loan, focusing on rental properties.

- Credit Score: Maintain a credit score of at least 640 to qualify for the best rates and terms.

While personal income information is not required, having a credit score of at least 640 is often necessary. This criterion helps lenders evaluate your ability to manage debt responsibly, ensuring they are lending to reliable borrowers.

Are you looking to finance high-end properties? The loan amount must fall within the lender’s limits, which typically max out around $1 million or $2 million, though some lenders may offer up to $5 million. Knowing the loan limits will help align your property investments with available financing options.

Application Process

The application process for DSCR loans is streamlined compared to traditional loans, primarily because personal income documentation is not required.

Lenders often have dedicated teams to handle DSCR loan applications, including processing and underwriting. This specialization can lead to quicker approvals and closings, a significant advantage for investors looking to act swiftly in the market.

Have you considered the ease of simultaneous property purchases? DSCR loans allow for the acquisition of multiple properties at once, providing a considerable advantage to investors aiming to expand their portfolios rapidly.

The simplified documentation process is a significant benefit, reducing the time and effort required to secure financing.

Additionally, many lenders offer online application systems, making it convenient for investors to submit their applications and track progress without the need for frequent in-person visits.

- Dedicated Teams: Look for lenders with specialized teams for DSCR loans to ensure a smoother process.

- Simultaneous Purchases: Take advantage of the ability to finance multiple properties simultaneously.

- Online Applications: Utilize online systems for ease and efficiency in the application process.

Ultimately, selecting a lender with a well-established, efficient application process can save time and reduce the stress associated with securing financing for investment properties.

Additional Benefits

DSCR loans offer several additional benefits that make them attractive to real estate investors. Understanding these advantages can help investors fully leverage the potential of DSCR loans for their investment strategies.

One of the most significant benefits is the quicker loan closing and application process. Since personal income documentation is not required, the process is expedited, enabling investors to act swiftly on lucrative deals.

Are you a new investor? DSCR loans provide an opportunity for new investors to enter the real estate market more easily. The less stringent requirements mean that even those with complex financial situations can secure financing.

Another advantage is the ability to purchase an unlimited number of properties. This feature is particularly beneficial for investors looking to rapidly expand their portfolios without the constraints of traditional loan limits.

- Quicker Loan Closing: Benefit from faster approvals and closings due to simplified documentation requirements.

- New Investor Opportunities: DSCR loans are accessible to new investors looking to break into the real estate market.

- Portfolio Expansion: Finance an unlimited number of properties, allowing for rapid portfolio growth.

The lack of personal income verification also means less documentation, simplifying the loan process and reducing the administrative burden on investors.

Investors who wish to buy and hold rental properties, as well as those looking to trade, can consider DSCR loans as a viable financing option.

Lastly, the ability to finance properties in an LLC or corporate entity offers additional benefits, such as asset protection and potential tax advantages. This flexibility makes DSCR loans a versatile tool for various investment strategies.

Evaluating DSCR Loan Requirements

Minimum DSCR Ratio

Understanding the Minimum Debt Service Coverage Ratio (DSCR) is pivotal for real estate investors aspiring to secure DSCR loans. The DSCR is a monetary metric that lenders utilize to gauge an investment property’s ability to cover its debt obligations.

Lenders often look for a DSCR of at least 1.2, meaning the property’s income must be 1.2 times greater than the mortgage payments. This criterion ensures the property generates sufficient income to minimize the risk of default.

However, some lenders, such as Visio Lending, offer “No DSCR Loans” in hot markets where rents haven’t yet caught up with property values. This flexibility can be advantageous for investors eyeing properties in appreciating areas.

“If you are purchasing an investment property in a hot market where the rents have not caught up to the home prices, you will not be able to cover the monthly debt payments with rental income, especially due to high DSCR loan interest rates.” – Visio Lending.

In essence, balancing the property’s income and debt service obligations is crucial. How do investors achieve this balance effectively?

Investors can increase their down payment or charge higher rent to improve their DSCR. Figuring in additional income streams, such as pet fees or amenities like washers and dryers, can also elevate rental income and enhance the DSCR.

Property Eligibility

Eligibility of the investment property plays a central role in qualifying for a DSCR loan. Only properties generating rental income are considered. This includes residential units such as single-family homes, duplexes, triplexes, and fourplexes.

The minimum property value requirement is typically set around $150,000. If your property falls below this threshold, a conventional loan might be a more suitable option.

“Only investment properties are eligible for Debt Service Coverage Ratio (DSCR) mortgage; that means the real estate property needs to generate rental income on at least one of the units.”

If you are living in one unit and renting out another, as seen in duplexes, the rental income from the rented unit must cover the mortgage payments to qualify.

- Residential 1-4 units: Commonly accepted property types.

- Minimum property value: Often $150,000.

- Rental income: At least one unit must generate rental income.

Credit Score Requirements

A minimum credit score is a standard requirement for DSCR loans. Most lenders require a minimum credit score of 680. Higher scores can secure better interest rates and terms.

Lenders will also assess your credit history for significant credit events such as foreclosures, bankruptcies, or past-due payments. These factors can influence their decision.

However, eligibility for a DSCR loan is not solely predicated on personal credit scores, as the property’s income can offset some personal financial shortcomings.

For investors aiming to enhance their credit profiles, maintaining a good mix of credit accounts, timely payments, and low credit utilization is essential.

Loan Amount Limits

The loan amount limits are another crucial factor when applying for a DSCR loan. The minimum loan amount is generally around $75,000, while the maximum can go up to $3,000,000.

For higher loan amounts, demonstrating sufficient property income and a robust DSCR is necessary. Conversely, if the loan amount doesn’t meet the minimum requirement, exploring alternative financing options might be prudent.

- Minimum loan amount: Typically $75,000.

- Maximum loan amount: Commonly up to $3,000,000.

Ensuring your investment meets these financial prerequisites is essential to secure favorable DSCR loan terms. With the right understanding and preparation, real estate investors can significantly enhance their chances of securing the desired financing.

Comparing DSCR Loans and Hard Money Loans

Definition and Differences

Understanding the fundamental differences between DSCR loans and hard money loans is crucial for investors. Essentially, hard money loans are asset-based lending options provided by private lenders, using a property as collateral. These loans are often short-term, designed for real estate investors who need quick access to funds.

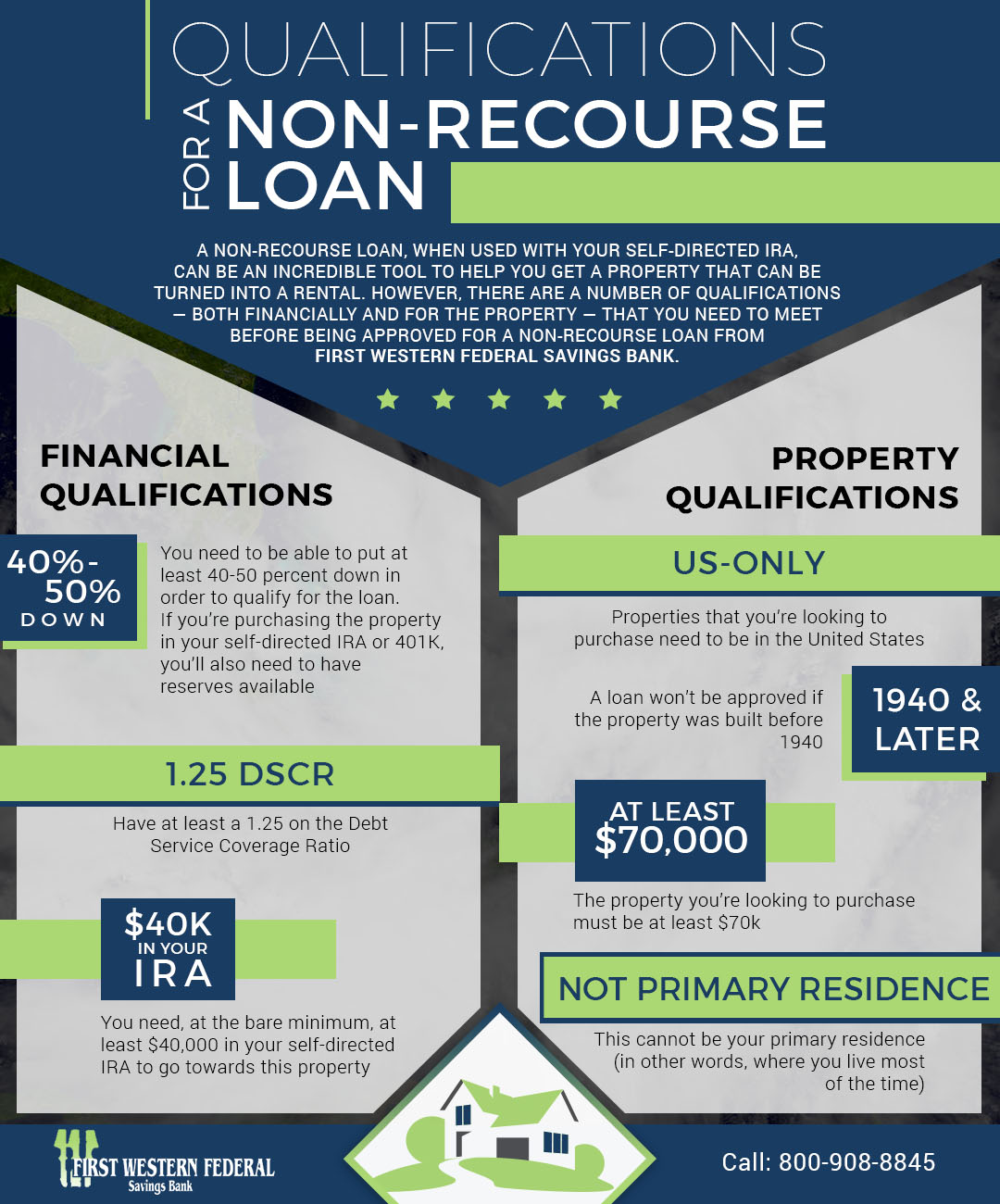

DSCR loans, or Debt-Service Coverage Ratio loans, contrast significantly. While they too can be used for real estate investments, DSCR loans are based on the rental income or cash flow of the property rather than the asset’s value alone. This means lenders consider whether the property’s cash flow can cover the debt obligations.

Unlike hard money loans, DSCR loans are usually long-term, commonly with terms extending up to 30 years. They also tend to have lower interest rates compared to hard money loans. This form of lending has gained popularity due to its reliance on rental income rather than the borrower’s personal income, making it easier to qualify for.

To summarize:

- Hard money loans: Short-term, asset-based, private lenders.

- DSCR loans: Long-term, income-based, various lenders.

“Debt-Service Coverage Ratio (DSCR) loans are not necessarily hard money loans. This is because they are provided by a variety of lenders, not only hard money lenders.” – Transcript

Pros and Cons

When considering DSCR loans and hard money loans, it’s essential to evaluate their respective pros and cons.

For hard money loans, the advantages include quick approval processes and less stringent credit requirements. They are ideal for investors needing fast financing for property deals. However, the drawbacks are substantial: higher interest rates and short repayment terms can increase financial pressure.

- Fast approval: Ideal for urgent funding needs.

- Less stringent credit checks: Easier qualification process.

- Higher interest rates: Significant financial cost.

- Short terms: Quick repayment can be challenging.

In contrast, DSCR loans have their own set of benefits and limitations. They offer longer repayment terms and lower interest rates, making them suitable for long-term investments. These loans are also easier to qualify for if the property cash flow is strong. On the downside, DSCR loans require thorough income verification, which can be time-consuming.

- Longer terms: Easier repayment structure.

- Lower interest rates: Cost-effective for investors.

- Income-based qualification: Simplifies approval based on property cash flow.

- Income verification: Detailed and time-consuming process.

“They are easier to qualify for than an agency or bank loan and have lower interest rates than hard money loans for financing an investment property.” – Transcript

Suitability for Investors

Which type of loan suits an investor better? This typically depends on their specific needs and financial situation.

Hard money loans are particularly suitable for investors who require immediate funds to seize a real estate opportunity quickly. They are also beneficial for those with lower credit ratings or those embarking on a short-term investment, such as house flipping.

DSCR loans are tailored for rental property investors. These loans are well-suited for those looking to invest in properties that generate steady rental income. Given their long-term nature and reliance on property cash flow, they are ideal for investors focused on building a rental portfolio.

In essence, the suitability of each loan type can be summarized as:

- Hard money loans: Best for quick fund access, short-term investments, lower credit requirements.

- DSCR loans: Ideal for rental property investments, long-term financial planning, income-based qualification.

Is the property intended for rental income generation or a quick sale? This fundamental question determines the appropriate loan type.

Market Trends

Current market trends shed light on the popularity and evolving preferences for DSCR and hard money loans among investors.

Hard money loans have traditionally dominated the market for quick real estate transactions and house flipping. Their rapid approval process continues to attract investors needing immediate liquidity.

However, there has been a notable shift towards DSCR loans as the rental property market flourishes. With increasing rental demand and a rise in long-term investment strategies, DSCR loans are gaining traction due to their favorable interest rates and qualifications based on property income.

The adoption of technology in lending processes has also influenced these trends. With tools like DSCR calculators, investors can now easily assess loan terms and eligibility, making DSCR loans more accessible and appealing.

“This DSCR Calculator makes it easy to workout DSCR Ratio, and it also estimate maximum loan amount and monthly repayments.” – Transcript

Understanding these trends helps investors make informed decisions in a competitive real estate market.

Types of Properties Eligible for DSCR Loans

Single-Family Homes

Single-family homes are a popular choice among real estate investors using DSCR loans. These properties are freestanding residential buildings intended for one family. They often include a backyard and have no shared walls with neighbors.

Why are single-family homes attractive for DSCR loans? They offer privacy, tend to appreciate in value, and provide stability in rental income. Since these homes can cater to long-term renters, they ensure a steady cash flow, which is essential for meeting the DSCR loan requirements.

Example: A three-bedroom house in a suburban neighborhood can be rented to a family who prefers a quiet and private living environment. This setup ensures consistent rental income, making the property a secure investment.

“Single-family homes provide a reliable investment opportunity due to their consistent demand and potential for long-term rental income.”

Multi-Family Units

Multi-family units, such as duplexes, triplexes, and fourplexes, can also be financed through DSCR loans. These properties contain multiple separate housing units within one building or several buildings within one complex.

Investing in multi-family units allows for multiple streams of rental income from a single property. Higher rental income potential and reduced per-unit cost for maintenance are significant advantages.

- Duplex: A property with two separate living units, each with its own entrance.

- Triplex: A building divided into three distinct units.

- Fourplex: A residential building containing four separate apartments.

Example: A triplex in a city center can house three different families or tenants, maximizing the rental income for the owner.

Condos and PUDs

Condos (condominiums) and Planned Unit Developments (PUDs) are also eligible for DSCR loans under specific conditions. Condos are individual units within a multi-unit property, whereas PUDs include a broader range of properties with shared amenities and governing associations.

Condos have lower maintenance responsibilities for the owner since the exterior maintenance and common areas are managed by a homeowners association (HOA). In contrast, PUDs offer greater flexibility, combining elements of single-family homes and condos.

“Investing in a condo can be ideal for those who prefer lower maintenance responsibilities and enjoy shared amenities like a pool or gym.”

- Condos: Best for investors looking for low-maintenance properties with shared amenities.

- PUDs: Ideal for those who want more control over their property but still appreciate community amenities.

Example: A two-bedroom condo in a downtown area with amenities such as a pool, gym, and concierge services can attract high-end renters willing to pay a premium for convenience.

Commercial Properties

Commercial properties, including office buildings, retail spaces, and mixed-use buildings, can also be financed using DSCR loans. These properties are used for business purposes rather than residential living.

Investing in commercial properties offers the potential for higher rental income due to the nature of business leases, which often run longer than residential leases.

What types of commercial properties can we consider?

- Office Buildings: Spaces leased to businesses for administrative activities.

- Retail Spaces: Properties leased to businesses for selling products, such as shops and boutiques.

- Mixed-Use Buildings: Properties combining residential and commercial units, often in high-demand urban areas.

Example: Owning a retail space in a bustling commercial district can provide significant rental income from established businesses looking for prime locations.

Is a DSCR Loan Right for You?

Benefits of DSCR Loans

DSCR loans, or Debt Service Coverage Ratio loans, provide several advantages for real estate investors. One notable benefit is their ability to offer flexibility in loan structuring. Investors often find these loans easier to customize compared to traditional loans.

Another advantage is the focus on cash flow rather than personal income. Lenders primarily assess the property’s income-generating potential instead of the borrower’s personal finances. This can be especially beneficial for those with variable income sources.

DSCR loans also typically feature faster approval times. Because lenders focus on the property’s cash flow, the underwriting process can be more streamlined.

Consider the following benefits:

- Higher Loan Amounts: DSCR loans often allow for larger loan amounts based on the property’s income.

- Improved Cash Flow Management: Focusing on the property’s revenue ensures you maintain positive cash flow.

- Non-Recourse Options: Some DSCR loans offer non-recourse terms, protecting personal assets.

“For help optimizing a DSCR ratio, check out our DSCR calculator.” – Transcript

Investors aiming to balance and optimize their debt-to-income ratios will find DSCR loans particularly advantageous.

Ideal Candidates

Determining if you’re the right candidate for a DSCR loan involves assessing your investment profile. Real estate investors who prioritize cash flow over personal income should consider these loans.

DSCR loans are ideal for investors with income-generating properties. For instance, commercial properties, rental properties, and multifamily buildings commonly qualify for DSCR loans due to their revenue streams.

Moreover, those with less stable personal incomes, such as self-employed individuals, may benefit significantly. DSCR loans prioritize property performance over personal financial status, making them accessible to a broader range of investors.

Consider the following ideal candidates:

- Experienced Real Estate Investors: Those familiar with managing rental incomes and property revenues.

- Self-Employed Individuals: Entrepreneurs and freelancers whose incomes vary.

- Owners of High-Yield Properties: Properties generating substantial and consistent rental income.

Evaluating your investment strategy and financial situation can help determine if a DSCR loan aligns with your objectives.

Application Process

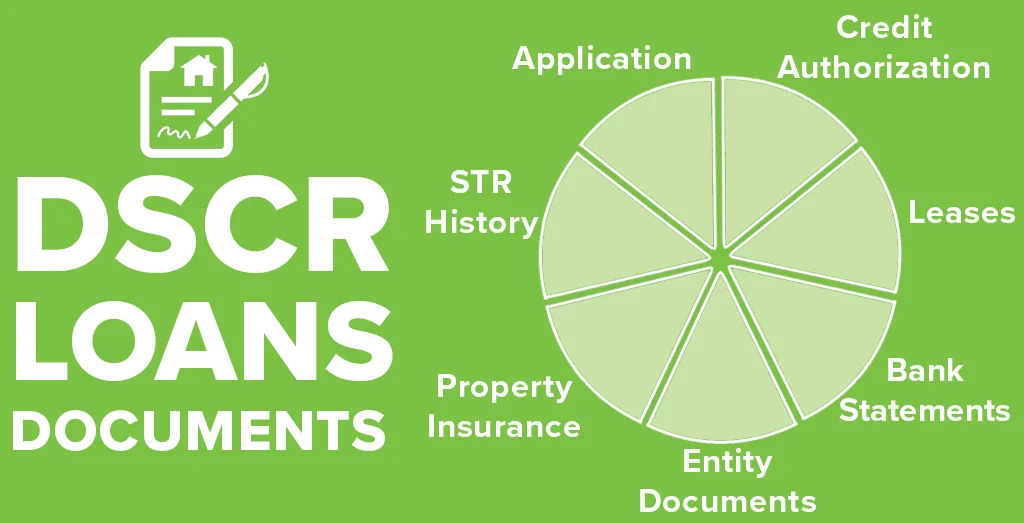

The application process for DSCR loans, while streamlined, requires attention to detail. To begin, gather documentation that highlights your property’s performance. This includes rental income statements and financial projections.

Start by researching reputable DSCR loan lenders. As the transcript suggests, “When comparing DSCR loan lenders, here are some considerations.” Evaluate their terms, rates, and reputations.

Following this, submit your application, providing necessary documentation. Be prepared to demonstrate the property’s income potential, as this is a critical assessment factor.

The general steps include:

- Preparation: Gather all required documents, including financial statements and rental income reports.

- Research: Compare different DSCR loan lenders based on their terms and reliability.

- Submission: Complete and submit your application, ensuring all information is accurate.

During the review, lenders will evaluate your property’s DSCR ratio. Utilizing resources like a DSCR calculator can assist in optimizing your ratio, increasing your approval chances.

Potential Drawbacks

While DSCR loans offer numerous benefits, investors must also consider potential drawbacks. One primary concern is the focus on property income. If your property struggles to generate a consistent income, approval might be challenging.

Another potential issue is the higher interest rates associated with these loans. Since DSCR loans are often riskier for lenders, they may come with higher interest rates compared to traditional loans.

Investors might also face strict eligibility criteria. Ensuring the property meets the required DSCR ratio can sometimes be challenging.

Consider the following drawbacks:

- Income Dependency: Approval hinges on the property’s consistent income generation.

- Higher Interest Rates: DSCR loans might feature higher rates due to increased lender risk.

- Eligibility Criteria: Meeting specific DSCR ratios can be demanding for some properties.

Balancing these potential drawbacks with the benefits is essential. An in-depth assessment of your property’s performance and future income projections can help determine if DSCR loans suit your investment strategy.

Conclusion

The comprehensive exploration of DSCR mortgage lenders underscores their pivotal role in the real estate landscape. With a distinct edge over conventional loans, DSCR loans cater exceptionally well to investors seeking to leverage rental income potential. Top lenders like New Silver Lending, Kiavi, Griffin Funding, and Angel Oak offer a spectrum of options that balance competitive terms with investor-friendly conditions.

Understanding the intrinsic features, eligibility criteria, and application processes enhances your ability to make informed decisions. The nuanced comparison between DSCR and hard money loans further illuminates the unique benefits and limitations, guiding you toward the optimal financing solution. Whether investing in single-family homes, multi-family units, or commercial properties, DSCR loans provide tailored opportunities to meet diverse investment goals.

Ultimately, aligning your investment strategy with the benefits of DSCR loans can propel your real estate endeavors forward. Delve deeper into the specifics, engage with top lenders, and evaluate your eligibility to unlock the potential of DSCR financing. Embark on this journey to capitalize on the robust financial mechanisms designed to fuel your success in the dynamic property market.

Frequently Asked Questions

Who is the national DSCR lender?

There are several prominent national DSCR lenders including New Silver Lending, Kiavi, Griffin Funding, and Angel Oak.

Who qualifies for a DSCR loan?

Typically, investors with a minimum DSCR ratio, sufficient credit score, and eligible property type qualify for a DSCR loan.

Can I live in a home bought with a DSCR loan?

No, DSCR loans are primarily for investment properties and not intended for owner-occupied homes.

How much down payment is needed for a DSCR loan?

Down payment requirements for DSCR loans generally range from 20% to 25% of the property’s purchase price.

What are the key differences between DSCR loans and conventional loans?

DSCR loans focus on a property’s income-generating potential, whereas conventional loans rely on the borrower’s personal income and credit.

Which types of properties are eligible for DSCR loans?

Eligible properties for DSCR loans include single-family homes, multi-family units, condos, PUDs, and commercial properties.