Delving into the intricacies of DSCR mortgage loans can provide invaluable insights for both investors and financial professionals. These loans, crucial for assessing an investment property’s financial health, hinge on the Debt Service Coverage Ratio (DSCR) — a key metric that determines loan approval and terms.

Understanding how to calculate DSCR, the types of loans available, and the specific requirements can significantly influence investment decisions. Navigate through this comprehensive guide to master DSCR mortgage loans, from their definition and importance to the application process.

Understanding DSCR Mortgage Loans

Definition and Importance of DSCR

Debt Service Coverage Ratio (DSCR) is a pivotal metric in real estate finance, especially for those investing in income-producing properties. Simply put, DSCR is the ratio of a property’s net operating income to its total debt service. It evaluates whether a property can generate sufficient cash flow to cover its mortgage payments.

DSCR’s importance cannot be overstated. It shifts the focus from the borrower’s personal financial situation to the property’s ability to generate income. This makes it particularly beneficial for real estate investors, who may not have a traditional income stream but possess properties with lucrative rental income potential.

“DSCR loans are most well-known for having lighter documentation requirements than conventional loans,” highlighting one of their major advantages for investors.

The higher the DSCR, the more financially stable the investment. A DSCR above 1 indicates positive cash flow, while ratios above 1.25 are considered ideal. This means the property generates significantly more income than required for debt payments, offering a safety cushion for lenders.

- Flexibility: Allows borrowers to focus on property income instead of personal income.

- Scalability: Facilitates portfolio growth without traditional income verification.

- Reduced Risk: Assures lenders of sufficient cash flow to cover debts.

In essence, DSCR loans are tailored for investors aiming to maximize their investment returns through properties with strong income-generating potential.

How DSCR Impacts Loan Approval

DSCR plays a crucial role in the approval process for mortgage loans aimed at real estate investments. Unlike conventional mortgages that rely on the borrower’s income and employment history, DSCR loans primarily consider the property’s ability to generate rental income.

The underwriting process for DSCR loans involves several key metrics. Lenders assess the net operating income of the property and compare it to the total debt service. A higher DSCR means the property generates more than enough income to cover its debt obligations, making it a lower risk for lenders.

What happens when the DSCR falls below the required threshold? Typically, a DSCR below 1.0 is unfavorable as it indicates that the property’s income is insufficient to meet debt payments. However, some lenders may still consider loans with slightly lower DSCRs based on other factors like property location and borrower’s overall financial health.

“A DSCR above 1 means that an investment property has positive cash flow and enough net operating income to cover its debts.”

Lenders often set a minimum DSCR requirement, commonly around 1.25. This threshold ensures a buffer, reducing the risk of default. For instance, if a property’s net operating income is $125,000 and its annual debt service is $100,000, the DSCR would be 1.25, meeting the typical approval criteria.

- Initial Assessment: Evaluating the property’s net operating income.

- DSCR Calculation: Comparing income to annual debt obligations.

- Approval Decision: Aligning DSCR with lender’s minimum threshold.

Understanding how DSCR impacts loan approval helps investors strategically plan their property acquisitions, ensuring they meet financial benchmarks crucial for securing financing.

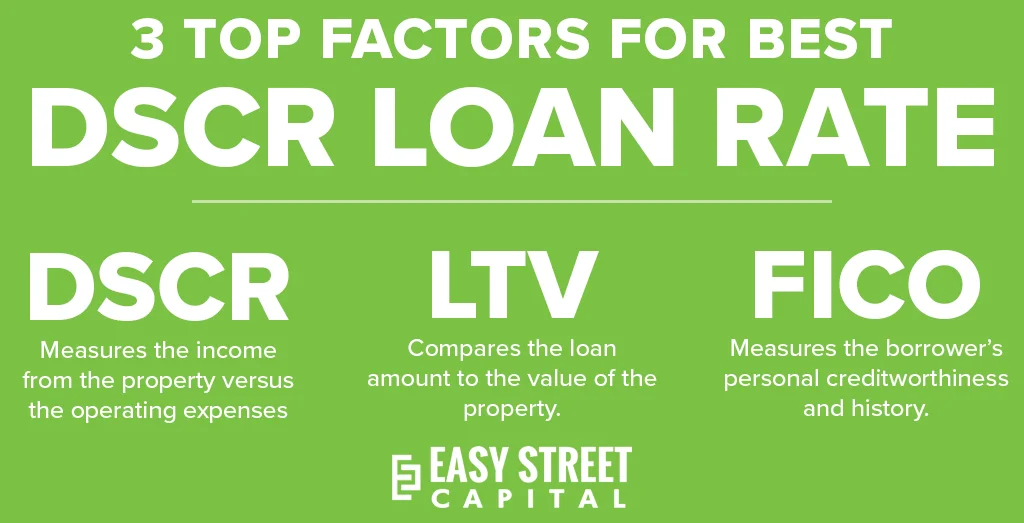

Key Metrics in DSCR Loans

Several key metrics influence the evaluation and approval of DSCR loans. These metrics are designed to assess the financial health of the investment property and its ability to service debt obligations effectively.

Firstly, the Net Operating Income (NOI) is fundamental. It represents the property’s total income after operating expenses, excluding debt service and taxes. NOI is crucial because it directly impacts the DSCR calculation.

Total Debt Service includes all mortgage payments (principal and interest) and any other recurring debt obligations associated with the property. The DSCR is calculated by dividing the NOI by the total debt service.

Other significant metrics include:

- Loan-to-Value (LTV) Ratio: This measures the loan amount against the property’s appraised value. DSCR loans often have a maximum LTV of around 80%, requiring at least 20% as a down payment.

- Credit Score: While not the primary focus, a borrower’s credit score still plays a role. Most DSCR lenders require a minimum credit score ranging from 620 to 700.

- Cash Reserves: Lenders may require borrowers to have cash reserves, typically equivalent to a few months’ mortgage payments, to cover any unforeseen shortfalls in income.

Why are these metrics crucial? They collectively determine the property’s financial viability and the borrower’s overall risk profile. For example, a property with a high NOI and low debt service will have a favorable DSCR, making it a lower risk for lenders.

“DSCR loans have many advantages including different eligibility requirements, no limit to the number of loans, quicker closing, and no employment verification.”

By comprehensively understanding these metrics, investors can better position themselves for successful loan approvals, ensuring their investment properties meet the necessary financial criteria.

Common Misconceptions about DSCR

While DSCR loans offer numerous benefits, several misconceptions can mislead real estate investors and potential borrowers. Clarifying these misconceptions is vital for making informed decisions.

One common misconception is that DSCR loans require no documentation. While it is true that DSCR loans have lighter documentation requirements compared to conventional loans, they are not “no doc” loans. Lenders still require key documents to assess the property’s income potential and ensure responsible underwriting.

Another misconception is that DSCR loans are only for large-scale investors or businesses. In reality, DSCR loans are suitable for a wide range of investors, from first-time real estate investors to seasoned professionals looking to expand their portfolios. The flexibility of DSCR loans makes them an attractive option for diverse investment strategies.

“DSCR loans present a perfect alternative as they do not utilize W2 income, income, or DTI in the qualification process.”

Furthermore, some believe that DSCR loans carry higher interest rates due to perceived risks. However, because the property’s income is the primary consideration, lenders may offer competitive interest rates, especially for properties with strong income-generating potential.

Another false belief is that DSCR loans are difficult to qualify for. On the contrary, the qualification process can be more straightforward than traditional loans because the focus is on the property’s cash flow rather than the borrower’s credit history or employment status.

- Misconception 1: DSCR loans require no documentation.

- Misconception 2: DSCR loans are only for large-scale investors or businesses.

- Misconception 3: DSCR loans carry higher interest rates.

- Misconception 4: DSCR loans are difficult to qualify for.

Addressing these misconceptions helps investors understand the true benefits and ease of obtaining DSCR loans, empowering them with accurate information to support their real estate investment endeavors.

How to Calculate DSCR for Mortgage Loans

Net Operating Income (NOI) Explained

When calculating the Debt Service Coverage Ratio (DSCR), the first key component to understand is the Net Operating Income (NOI). NOI represents the annual income generated by a property after deducting all operational expenses. Imagine we have a rental property; the rent collected would be the gross income. Now subtract expenses such as property taxes, maintenance, and insurance costs, and what remains is the NOI.

Consider a scenario where a property generates $100,000 annually in rental income. The operational expenses, including taxes, insurance, and maintenance, sum up to $30,000. Thus, the NOI is:

$100,000 (Gross Income) – $30,000 (Operating Expenses) = $70,000 (NOI)

A clear understanding of NOI is critical as it forms the numerator in the DSCR calculation. A higher NOI implies better profitability and a stronger ability to service debt.

- Operational Expenses: Costs like property management fees, repairs, utilities, and insurance.

- Excluded Costs: Financing expenses such as mortgage payments are not included in NOI calculations.

- Income Sources: Rental income, parking fees, and other income streams associated with the property.

Understanding how to accurately calculate NOI ensures that we can effectively assess a property’s true performance before taking on debt.

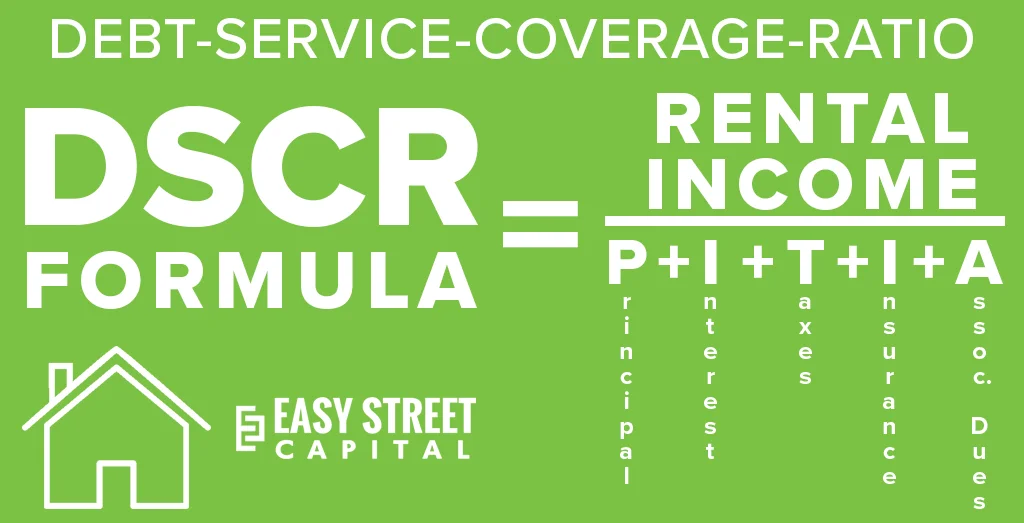

Total Debt Service Components

Next, let’s delve into the components of total debt service. This figure represents all the annual debt obligations a property must meet. For mortgage loans, total debt service typically includes:

- Principal Repayment: The portion of loan payments that reduces the outstanding loan balance.

- Interest Payments: The cost of borrowing funds, charged by lenders as a percentage of the loan amount.

- Additional Obligations: Other costs such as property taxes, homeowner association (HOA) dues, and insurance premiums.

Suppose we have a mortgage loan with an annual principal and interest payment of $35,000. Additionally, the property incurs $5,000 in property taxes and insurance premiums annually. The total debt service, therefore, is:

$35,000 (Principal & Interest) + $5,000 (Taxes & Insurance) = $40,000

Understanding all elements of the total debt service ensures we account for all financial commitments, giving us a clear picture of the property’s debt burden.

DSCR Calculation Formula

Having understood NOI and total debt service, we can now apply the DSCR formula. The standardized calculation is:

DSCR = Net Operating Income (NOI) / Total Debt Service

For instance, if a property has an NOI of $70,000 and total debt payments summing up to $40,000, the calculation would be:

DSCR = $70,000 / $40,000 = 1.75

This DSCR of 1.75 suggests the property generates sufficient income to cover its debt obligations 1.75 times over. Lenders generally look for a DSCR of at least 1.25, indicating a comfortable margin for debt repayment.

Higher ratios signify better financial health and lower risk for lenders, making it easier for us to secure favorable loan terms.

Example Calculations

Let’s explore a few example calculations to illustrate the DSCR concept further. Imagine two properties with different financial scenarios:

- Property A: NOI = $120,000, Total Debt Service = $100,000

- Property B: NOI = $60,000, Total Debt Service = $75,000

Calculating Property A’s DSCR:

DSCR = $120,000 / $100,000 = 1.20

Property A has a DSCR of 1.20, slightly below the preferred threshold, suggesting potential risk in debt repayment capability.

Now, calculating Property B’s DSCR:

DSCR = $60,000 / $75,000 = 0.80

Property B’s DSCR of 0.80 indicates insufficient income to cover debt obligations, presenting a high-risk scenario for lenders.

Thus, understanding these calculations helps in making informed decisions regarding potential investments and negotiations with lenders.

Types of DSCR Mortgage Loans Available

Fixed-Rate DSCR Loans

Fixed-rate DSCR loans provide a stable interest rate throughout the life of the loan, making them a reliable choice for long-term planning. For real estate investors, the predictable nature of these loans facilitates accurate forecasting of expenses and cash flow.

Historically, most DSCR loans were structured with fixed rates, typically spanning 30 years. This means the interest rate remains constant, irrespective of market fluctuations.

In the US, average rents have increased by 8.85% per year since 1980, while debt payments on fixed-rate loans stay the same. This scenario allows for potential increases in income over time.

Even though some lenders may offer 15, 20, or even 40-year options, the 30-year fixed-rate DSCR loan is the most common choice among investors.

Why is this structure beneficial? Simply put, long-term stability. When an investor locks in a rate, it mitigates the risks associated with interest rate hikes, ensuring that their debt payments remain fixed.

How does this impact an investor’s strategy? Consider this: with rent increments likely over the years, maintaining fixed debt costs can significantly improve an investor’s cash flow.

For those in it for the long haul, fixed-rate DSCR loans offer security and predictability, essential attributes for a stable investment.

Is there a downside? The primary limitation is that fixed-rate loans generally come with slightly higher initial rates compared to adjustable options. However, the trade-off is the long-term financial security they provide.

- Stability: Fixed interest rates mean stable payments over the loan term.

- Predictability: Easier forecasting and financial planning due to unchanging rates.

- Long-term Benefits: Potential for increased income as rents rise while debt costs stay fixed.

Adjustable-Rate DSCR Loans

Adjustable-rate DSCR loans, or ARMs (Adjustable Rate Mortgages), offer flexibility that fixed-rate loans lack. These loans start with a lower initial interest rate, which can change over time based on market conditions.

Typically, these loans are known as “Hybrid ARMs” because they feature an initial fixed period, followed by a variable rate period. For example, a common type is the “5/6 ARM,” where the interest rate is fixed for the first five years and adjusts every six months thereafter.

Why might an investor opt for an ARM? The initial lower rates can be particularly attractive. This can be beneficial for investors who plan to hold the property for a shorter period or anticipate a drop in interest rates in the near future.

However, ARMs come with inherent risks. Post the fixed period, the interest rates can increase significantly, leading to higher monthly payments. Therefore, they require careful consideration and strategic planning.

Investors choosing ARMs often believe that the potential for rate increases is outweighed by the initial cost savings and flexibility offered by these loans.

Is there a scenario where an ARM might be particularly advantageous? If an investor plans to sell the property or refinance before the adjustable rate period begins, the initial savings can be substantial.

Yet, the potential for fluctuating rates means ARMs are best suited for those with flexible financial strategies who are comfortable with some level of risk.

- Initial Savings: Lower starting interest rates reduce initial costs.

- Flexibility: Suitable for short-term holds or volatile interest rate environments.

- Risk Management: Requires a strategic approach to mitigate potential rate increases.

Interest-Only DSCR Loans

Interest-only DSCR loans offer another unique option for real estate investors. These loans allow borrowers to pay only the interest for a set period before they begin to pay down the principal.

This structure can be particularly beneficial during the initial phase of property investment when cash flow might be tight. By minimizing the early payment requirements, investors can allocate funds to other critical areas.

However, what happens when the interest-only period ends? Borrowers will need to start paying both interest and principal, which can lead to significantly higher monthly payments.

Interest-only periods provide breathing room but require careful planning for future cash flow changes.

Why might an investor choose this option? The initial lower payments can free up capital for reinvestment or property improvements, potentially increasing property value and rental income.

It’s essential to have a robust exit strategy in place. Investors must plan how they will manage the transition to higher payments once the interest-only period concludes.

Is this option suitable for every investor? Not necessarily. Those who do not have a clear plan for transitioning to full payments may find themselves in financial difficulty down the line.

- Lower Initial Payments: Helps manage cash flow during early investment stages.

- Capital Allocation: Frees up funds for property improvements or reinvestment.

- Future Planning: Requires a solid plan for managing higher future payments.

Comparing Different DSCR Loan Types

When comparing different DSCR loan types, it’s clear that each offers unique advantages and potential drawbacks. The key is to match the loan type with the investor’s strategy and risk tolerance.

Fixed-rate loans provide stability and predictability, making them ideal for long-term investments. In contrast, adjustable-rate loans offer initial cost savings and flexibility but come with the risk of future rate increases.

Interest-only loans offer lower initial payments, which can be advantageous for managing early-stage cash flow but require careful planning for eventual higher payments.

Choosing the right DSCR loan is about balancing stability, flexibility, and future planning to align with investment goals.

For investors focusing on long-term stability, fixed-rate loans provide the best safeguard against market volatility. However, those comfortable with more risk might prefer ARMs or interest-only loans for their initial financial benefits.

What is essential is a thorough understanding of each loan type’s implications. Investors should consider their investment timeline, market forecasts, and cash flow requirements when making a decision.

Ultimately, the right DSCR loan will depend on individual financial goals, risk tolerance, and investment strategy.

- Investment Timeline: Match loan terms with investment horizons.

- Market Forecasts: Consider potential interest rate changes.

- Cash Flow Needs: Align loan structures with cash flow capabilities.

Who Should Consider a DSCR Mortgage Loan?

Ideal Candidates for DSCR Loans

Identifying the right candidates for DSCR (Debt Service Coverage Ratio) loans involves understanding specific financial and investment profiles. Those who benefit most typically include individuals or entities with income-generating properties.

Real estate investors aiming to expand their portfolios are often ideal candidates. Because the primary qualification criterion is the property’s cash flow, the borrower’s personal income and employment status become less significant.

“Our DSCR loan program is specifically designed to assist new and experienced real estate investors in financing their properties, qualifying based on the cash flow generated by the investment.”

Additionally, seasoned investors looking for more flexible financing terms find DSCR loans advantageous. These loans can offer terms that adapt to varying investment strategies and market conditions.

Furthermore, potential borrowers who may not qualify for traditional loans due to employment or income verification issues can explore DSCR loans as a viable alternative. This opens up opportunities for a broader range of investors.

- New investors: Those who are just starting and need a straightforward qualification process.

- Experienced investors: Investors seeking to leverage their existing properties’ cash flow.

- Unconventional earners: Individuals with non-traditional income sources who may not qualify for other loan types.

Understanding these profiles can help potential borrowers determine if a DSCR loan aligns with their financial goals and requirements. Have you considered whether your investment property meets these qualifications?

Investment Property Types

DSCR loans are highly adaptable to various property types, making them a versatile financing tool for real estate investors. As the market evolves, new opportunities for medium-term rentals, single room occupancy, and manufactured housing have emerged.

Mixed-use properties, combining commercial and residential spaces, also benefit greatly from DSCR loans. The ability to generate diverse income streams can improve the property’s overall cash flow, meeting the necessary coverage ratios more effectively.

“Moving into 2024 and beyond, we expect to see developments around DSCR Loan options for Medium Term Rentals, Single Room Occupancy, Manufactured Housing, and Mixed Use Properties.”

Moreover, DSCR loans are not limited to traditional residential properties. Investors can leverage this financing for vacation rentals, given that these properties produce consistent rental income.

- Medium-term rentals: Properties rented out for several weeks or months at a time.

- Single room occupancy: Rentals typically targeting individual tenants for short to medium stays.

- Mixed-use properties: Combining residential and commercial spaces for diverse income potential.

By understanding the types of properties eligible for DSCR loans, investors can better align their strategies with financing opportunities. What type of property are you considering for your next investment?

Advantages for Different Investors

DSCR loans provide distinct advantages tailored to the needs of various investors. For new real estate investors, these loans offer an accessible entry point due to the flexible qualification criteria.

Experienced investors, on the other hand, benefit from the ability to expand their property portfolios without the stringent personal income requirements typical of conventional loans. This flexibility helps in scaling their investment strategies efficiently.

Additionally, investors seeking cash-out refinancing can find DSCR loans beneficial. With options available for cash-out up to 70% Loan-to-Value (LTV), it becomes easier to access equity for further investments or improvements.

“1007 only for rental income DSCR as low as 0. Only 3 months of reserves required. Cash-out available up to 70% LTV.”

Even investors with unconventional income sources or those facing difficulty with income documentation find DSCR loans an attractive solution. The emphasis on property cash flow over personal income creates an inclusive financing environment.

- New investors: Access to financing with minimal personal income documentation.

- Seasoned investors: Ability to leverage existing properties for portfolio expansion.

- Refinancers: Opportunities for cash-out refinancing to access property equity.

These advantages make DSCR loans a compelling choice for a wide range of investors. Could these benefits fit your investment strategy?

Real-Life Scenarios

Let’s explore some real-life scenarios where DSCR loans can make a significant impact. Consider a situation where a new investor aims to purchase a medium-term rental. The rental property can generate consistent cash flow, allowing the investor to qualify based on the property’s income rather than personal financials.

Another scenario involves an experienced investor looking to cash-out refinance a mixed-use property. By leveraging the property’s diverse income streams, the investor can access substantial equity for further acquisitions or improvements.

Imagine an entrepreneur who doesn’t have traditional income documentation. They could use a DSCR loan to finance a new single room occupancy property. The cash flow from individual tenants ensures loan qualification, despite unconventional income sources.

“No income and no employment needed. No ratio loans — borrowers do not have to worry about the debt service coverage ratio.”

Or consider an investor facing a challenging loan scenario. With DSCR loans, they receive quick solutions tailored to their unique circumstances, facilitating faster turnaround times.

- Medium-term rental purchase: Qualification based on property cash flow.

- Mixed-use property refinance: Accessing equity through cash-out refinancing.

- Single room occupancy venture: Financing with non-traditional income documentation.

- Challenging loan scenarios: Rapid, customized solutions for unique investor needs.

These scenarios highlight the flexibility and adaptability of DSCR loans. How might your investment plans fit into one of these examples?

Requirements for DSCR Mortgage Loans

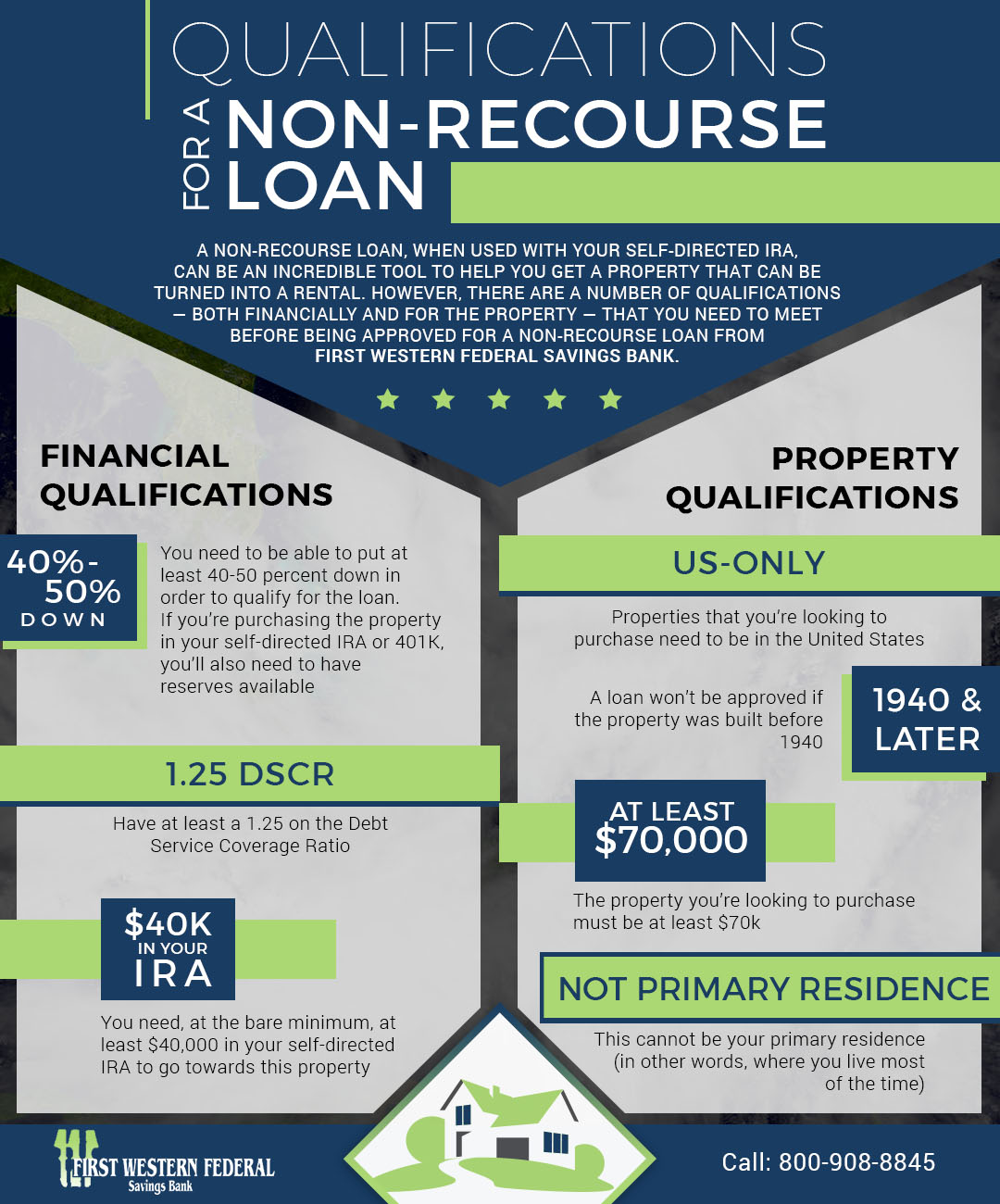

Minimum DSCR Ratios

When pursuing a DSCR mortgage loan, lenders typically require borrowers to meet a specific Debt Service Coverage Ratio (DSCR). This ratio measures the property’s income compared to its debt obligations. A common benchmark is a DSCR of 1.25, indicating the property generates 25% more income than the payment obligations.

Why is this important? A higher DSCR denotes a lower risk for lenders, as the property is more likely to cover the debt. By maintaining this ratio, lenders feel more secure in the property’s ability to generate sufficient revenue.

Most lenders seek a DSCR of 1.25, signifying the property earns 25% more than its complete payment.

Different programs may set varying thresholds, but the 1.25 ratio is a prevalent standard. Potential borrowers should aim to present properties with steady income streams to meet or exceed these expectations.

What types of properties typically meet these criteria? Rental properties, commercial properties, and multifamily units are often suitable candidates, given their potential for consistent income generation.

Examining historical income can be a powerful way to predict future earnings, thus helping to justify the DSCR and the loan approval.

Are there exceptions? Certainly, some lenders might accept a lower DSCR if additional compensating factors are present, such as higher credit scores or substantial cash reserves. However, these scenarios are less common.

Understanding and maintaining the appropriate DSCR is essential for enhancing the chances of securing a DSCR loan, aligning both borrower and lender interests in property investment success.

Property and Income Requirements

Potential borrowers must ensure the property meets certain income-generating criteria. This is crucial as the property itself acts as the collateral for the DSCR loan.

The types of properties that typically qualify include:

- Rental properties: Single-family or multifamily homes leased out to tenants.

- Commercial properties: Office buildings, retail spaces, or industrial properties rented to businesses.

- Income-generating properties: Any property type capable of generating regular rental income that covers debt obligations.

Why do lenders focus on these types? The regular income from such properties assures lenders of the borrower’s ability to repay the loan on time. An adequately appraised property value is also critical.

Accurate appraisals help establish the property’s market worth and its potential to generate the proposed revenue. If the appraised value is notably lower than the loan balance, lenders may view this as a heightened risk.

Are all income-generating properties equal? Not exactly. Properties with high occupancy rates and stable tenant histories have a better chance of loan approval. Conversely, properties with erratic income streams or high vacancies may face stricter scrutiny.

Understanding property and income requirements helps both borrowers and lenders ensure a successful loan application process, promoting higher chances of approval and long-term financial stability.

Credit Score and Cash Reserves

Credit scores and cash reserves are critical factors in determining eligibility for a DSCR mortgage loan. Lenders typically require a minimum credit score of 620 or higher to consider an application.

Credit scores reflect a borrower’s creditworthiness and financial responsibility. A higher credit score can lead to more favorable loan terms and lower interest rates.

The minimum credit score needed to qualify for a DSCR mortgage can vary depending on the lender and other factors, but usually a credit score of 620 or higher is required.

Why is cash reserves important? Cash reserves indicate the borrower’s ability to handle unforeseen expenses or periods of unoccupied rental units. Maintaining sufficient reserves reassures lenders of the borrower’s financial stability.

Some lenders may require reserves to cover several months of mortgage payments. This provision ensures that in the event of unexpected vacancies or repairs, the borrower can still meet their debt obligations.

What constitutes adequate cash reserves? This can vary by lender, but typically, having between three to six months’ worth of mortgage payments in reserve is advisable.

Why such rigorous standards? These measures protect both parties: borrowers are better prepared for financial uncertainties, and lenders minimize the risk of loan defaults.

Understanding and meeting credit score and cash reserve requirements enhances one’s prospects of securing a DSCR mortgage loan, aligning with lenders’ standards for financial security and reliability.

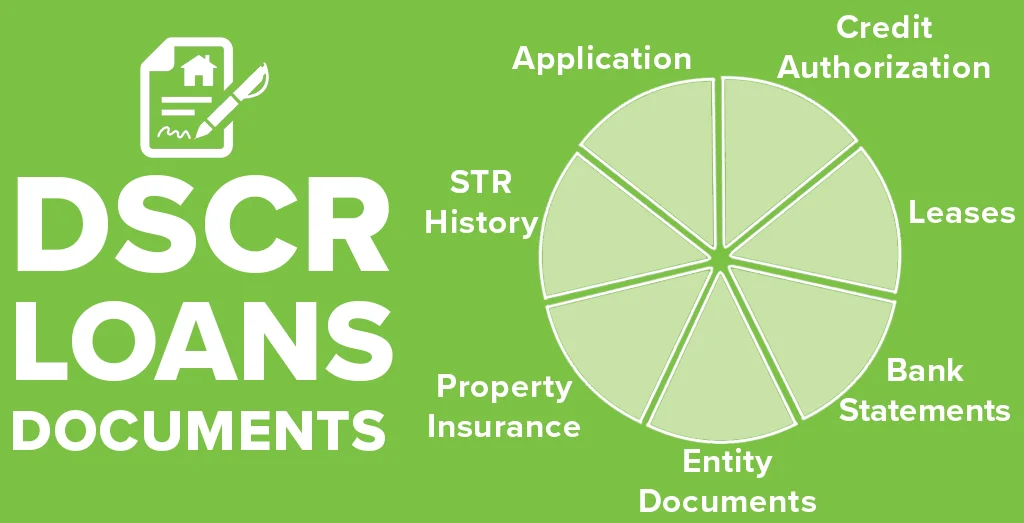

Documentation Needed

Applying for a DSCR mortgage loan requires thorough documentation to support the borrower’s financial standing and the property’s income-generating potential.

Some critical documents include:

- Income statements: Detailed records of property income, such as rental agreements and leases.

- Credit reports: Comprehensive credit history demonstrating financial responsibility.

- Property appraisals: Professional evaluation of the property’s market value and condition.

- Tax returns: Previous years’ tax returns showcasing overall financial health.

- Bank statements: Recent statements evidencing available cash reserves.

Why is detailed documentation essential? Clear and accurate records foster trust and transparency, allowing lenders to make informed decisions regarding loan approval.

Accurate and comprehensive documentation not only expedites the loan approval process but also equips borrowers for any queries from lenders, creating a smoother application experience.

Are there variations in documentation requirements? Yes, different lenders may have specific guidelines. However, ensuring all fundamental documents are prepared and organized significantly aids in meeting any lender’s criteria.

Thorough documentation underscores a borrower’s readiness and reliability, crucial elements for qualifying for a DSCR mortgage loan.

Advantages and Disadvantages of DSCR Mortgage Loans

Benefits of DSCR Loans

DSCR (Debt Service Coverage Ratio) loans offer several advantages that make them attractive to real estate investors. These loans primarily focus on the property’s cash flow rather than the borrower’s personal income, offering a unique opportunity for investors with diverse financial backgrounds.

Cash Flow-Based Approval: Unlike traditional loans, DSCR loans base approval on the property’s ability to generate income. This can be highly beneficial for seasoned investors who may have multiple properties and diverse cash flows.

Investors seeking greater leverage can benefit from DSCR loans because they often allow higher loan amounts relative to the property’s income. This leverage can enable investors to acquire additional properties or improve existing ones.

“DSCR loans focus on the property’s income potential, providing a tailored financing solution for investment properties.”

Moreover, streamlined qualification processes make DSCR loans appealing. By focusing on the cash flow, the approval process can sometimes be quicker and less cumbersome compared to traditional loans.

- Higher Loan Amounts: Based on cash flow, allowing for potentially larger investments

- Flexible Use: Funds can be used for acquisition, refinancing, or property improvements

- Potential for Quicker Approval: Simplified qualification criteria can expedite the loan process

Consider the case of an investor who owns multiple rental properties. With a strong cash flow, they might find it easier to secure a DSCR loan rather than a traditional mortgage.

Potential Drawbacks

While DSCR loans have their advantages, they also come with potential drawbacks that investors need to consider. The requirement for higher equity is one significant factor.

Higher Equity Requirements: Based primarily on the property’s cash flow, lenders may impose stricter requirements than traditional loans. Borrowers often need to invest more upfront capital to secure financing, which could be a barrier for some.

Furthermore, these loans might offer limited flexibility. The terms and conditions could be more stringent, with pre-payment penalties or restrictions on refinancing. This can limit investors’ options to maneuver around changing financial situations.

“DSCR loans can come with higher upfront costs and less flexibility, which might not suit all investors.”

Another issue could be the limited availability of these loans. They are not as widely available as traditional loans, particularly for smaller properties or in specific markets, making them harder to secure.

- Higher Costs: Possibility of higher interest rates and fees

- Limited Flexibility: Stricter terms and conditions than traditional loans

- Risk of Default: If property cash flow isn’t sufficient, it could lead to default

Additionally, the risk of default is a critical consideration. If the property’s cash flow does not meet the loan payments, the borrower may face the risk of default and potential foreclosure.

Comparing DSCR Loans to Traditional Loans

Understanding how DSCR loans stack up against traditional loans can help investors make informed decisions. Both loan types have unique features and serve different purposes.

Approval Criteria: Traditional loans often focus on the borrower’s personal credit and income, whereas DSCR loans prioritize the property’s cash flow. This fundamental difference can influence which loan is more suitable for an investor’s needs.

For instance, an investor with a complex financial profile might find DSCR loans more accommodating than traditional loans, which can be stringent on personal financial documents.

“The choice between DSCR and traditional loans depends on an investor’s financial situation and investment strategy.”

When it comes to interest rates and fees, DSCR loans might have higher costs, reflecting the increased risk to lenders. On the other hand, traditional loans can offer more competitive rates for borrowers with excellent credit.

- DSCR Loans: Based on property income, potentially higher fees

- Traditional Loans: Based on personal income, generally lower rates for good credit

- Flexibility: Traditional loans might offer more flexibility in terms of pre-payment and refinancing

Moreover, the application process for traditional loans can be more rigorous and time-consuming, involving thorough background checks and credit evaluations. DSCR loans, focusing on property income, could offer a slightly expedited process.

Risk Factors

Investors must weigh the risks associated with DSCR loans carefully. One key risk is the property’s income predictability.

Cash Flow Volatility: Properties, especially commercial ones, can experience fluctuating income. This volatility can impact the ability to meet loan obligations, increasing the risk of default.

Imagine a commercial property experiencing a sudden tenant vacancy. This drop in cash flow could challenge the investor’s ability to service the DSCR loan, highlighting why stable income projections are crucial.

“Fluctuating cash flows pose a significant risk for investors relying on DSCR loans.”

Another risk involves the upfront investment requirements. Higher required equity can strain an investor’s finances, potentially impacting their ability to diversify their portfolio or cover unexpected expenses.

- Market Conditions: Changing market conditions can affect property income

- Interest Rates: Rising rates can increase loan servicing costs

- Property Management: Poor management can lead to lower occupancy and reduced income

Finally, loan terms and conditions can present risks. Stricter terms, penalties, and conditions associated with DSCR loans can limit flexibility and pose challenges if financial strategies need adjustment.

How to Apply for a DSCR Mortgage Loan

Finding a DSCR Lender

The journey to successfully applying for a DSCR mortgage loan begins with finding the right lender. While numerous lenders offer DSCR loans, not all are created equal. Therefore, researching and comparing various lenders’ offerings is crucial.

It’s prudent to start by looking at lenders who specialize in DSCR mortgage loans. Specialized lenders often have more experience and a better understanding of the unique requirements associated with these loans.

Why not ask for recommendations from fellow real estate investors or professionals in the industry? Personal referrals can provide valuable insights and help narrow down your options.

“Choosing a lender who understands your needs and goals can make a significant difference in your loan application process,” says John Doe, a seasoned real estate investor.

Online reviews and ratings are another useful resource. They can provide a clearer picture of a lender’s reputation and customer service quality.

Additionally, consider the lender’s interest rates, fees, and loan terms. These factors will impact the overall cost of your loan.

- Specialization: Look for lenders who focus on DSCR loans.

- Recommendations: Seek advice from industry professionals.

- Online Reviews: Check ratings and customer feedback.

- Rates and Fees: Compare interest rates and associated costs.

Application Process Steps

Once you’ve selected a lender, understanding the steps involved in the application process is essential. This knowledge ensures that you are well-prepared and can navigate each stage efficiently.

Firstly, you need to complete a loan application form. This form will ask for detailed information about your financial status, property details, and investment goals.

Next, expect a credit check. Lenders use your credit history to assess your creditworthiness. A strong credit score can significantly improve your chances of approval.

Following the credit check, the lender will evaluate the property’s DSCR. This ratio helps determine the potential rental income versus the loan amount.

- Complete Application: Fill out the lender’s application form with accurate details.

- Credit Check: Submit to a credit evaluation by the lender.

- DSCR Evaluation: Allow the lender to assess the property’s DSCR.

“Understanding each step of the application process can help you prepare better and avoid any surprises,” advises Jane Smith, a mortgage consultant.

Additional steps may include an appraisal of the property and underwriting. Once all evaluations are complete, the lender will make a decision regarding your loan application.

Required Documentation

Gathering the necessary documentation is a critical aspect of the DSCR loan application process. Having all required documents ready can expedite your application and increase your chances of approval.

Commonly, lenders will request financial statements, including income statements and balance sheets. These documents help demonstrate your financial stability and ability to repay the loan.

Tax returns are equally important. Lenders typically ask for the last two to three years of tax returns to verify your income and financial history.

- Financial Statements: Include income statements and balance sheets.

- Tax Returns: Provide returns for the past two to three years.

- Property Details: Submit information about the property, such as purchase agreements and rental income projections.

In addition, you should be prepared to provide personal identification documents, such as a passport or driver’s license.

“Having your documentation organized and ready can streamline the application process significantly,” notes Laura Johnson, a financial advisor.

Finally, ensure that all information provided is accurate and up-to-date. Any discrepancies or missing documents can delay your application and potentially impact your approval chances.

Tips for a Smooth Application

Successfully navigating the DSCR loan application process often hinges on a few key strategies. Preparation and attention to detail can make a significant difference.

Firstly, ensure that your financial records are in excellent order. Lenders appreciate applicants who can present clear, well-organized financial documentation. This practice not only speeds up the process but also reflects positively on your financial management skills.

Another tip is to maintain a strong credit score. Regularly checking your credit report and addressing any issues can help you maintain a favorable score.

- Organize Financial Records: Keep your financial documents well-organized and up-to-date.

- Maintain Credit Score: Regularly review and improve your credit score.

- Seek Professional Advice: Consulting with a mortgage advisor can provide valuable insights and guidance throughout the application process.

“A little preparation goes a long way in ensuring a smooth and successful DSCR loan application,” remarks Michael Lee, a mortgage expert.

Additionally, being transparent and honest with your lender can foster a positive relationship and increase your chances of loan approval. Lenders appreciate applicants who are forthcoming about their financial situation and goals.

Finally, never hesitate to ask questions. Understanding every detail of your loan terms and the application process can help you make informed decisions and avoid potential pitfalls.

Conclusion

Grasping the intricacies of DSCR mortgage loans opens the door to informed financial decisions, especially for those venturing into investment properties. Recognizing the pivotal role of DSCR in loan approvals and understanding key metrics can enhance your investment strategy, ensuring alignment with financial goals.

Whether opting for fixed-rate, adjustable-rate, or interest-only DSCR loans, each type offers unique advantages matching different investor profiles. Armed with knowledge of the minimum DSCR ratios, property requirements, and documentation needs, you’re better prepared to navigate the application process. By partnering with a knowledgeable DSCR lender and following a smooth application process, the path to successful investment becomes clearer. Explore these opportunities further to capitalize on the benefits of DSCR mortgage loans, securing your financial future.

Frequently Asked Questions

Is a DSCR loan hard to get?

Obtaining a DSCR loan can be challenging due to stringent requirements such as high DSCR ratios and detailed financial documentation.

How does a DSCR mortgage loan work?

A DSCR mortgage loan evaluates the borrower’s ability to service debt based on the property’s income relative to its debt obligations.

How do you qualify for a DSCR loan?

Qualification typically requires a sufficient DSCR ratio, proof of property income, a good credit score, and adequate cash reserves.

What are current DSCR mortgage rates?

Current DSCR mortgage rates vary based on market conditions and lender policies; consult specific lenders for accurate rates.

What types of DSCR mortgage loans are available?

Types include fixed-rate, adjustable-rate, and interest-only DSCR mortgage loans.

Who should consider a DSCR mortgage loan?

DSCR loans are ideal for investors in properties generating steady rental income, like multi-family units or commercial real estate.