Delving into the intricacies of DSCR mortgage rates isn’t just for financial buffs—it’s essential knowledge for anyone involved in real estate financing. By understanding DSCR (Debt Service Coverage Ratio), borrowers can make more informed decisions, ensuring their investments are both strategic and lucrative.

This article explores the key factors influencing DSCR rates, historical trends, and how they compare to other loan types. Moreover, we’ll examine current market influences and provide forecasts for 2024, equipping you with the insights needed to navigate the financial landscape effectively.

Understanding DSCR Mortgage Rates: An Overview

Key Factors Influencing DSCR Mortgage Rates

Understanding the complexities behind DSCR mortgage rates is essential for real estate investors, financial advisors, and mortgage brokers. There are several factors at play that determine these rates.

Firstly, the strength of the Debt Service Coverage Ratio (DSCR) itself is a significant determinant. The better the cash flow from your property, the more favorable the rate you can secure. Our DSCR Calculator can help estimate this.

Your real estate investing experience also affects DSCR mortgage rates. Lenders often reward experienced investors with lower rates, whereas first-time investors might face slightly higher rates.

Another critical factor is your credit score. Higher credit scores typically lead to better rates, and the loan amount you can borrow (Loan to Value, or LTV) is also influenced by your credit score. As LTV increases, so does the interest rate.

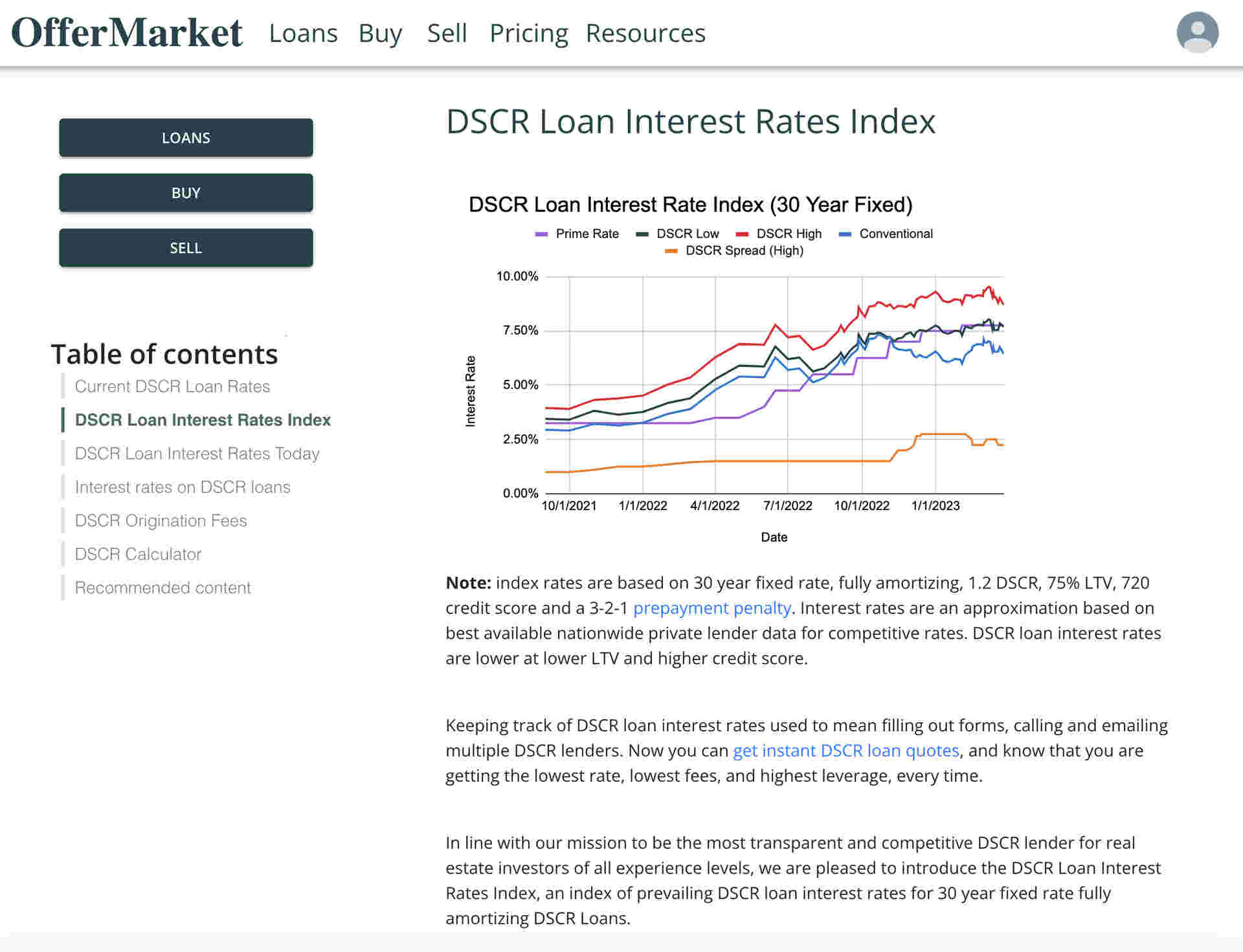

“DSCR loan interest rates are lower at lower LTV and higher credit score.”

Finally, external economic factors such as the performance of the fixed income markets and the 5 Year US Treasury rates play a crucial role. These market conditions can widen or narrow the spread, directly impacting your DSCR mortgage rate.

Historical Trends in DSCR Mortgage Rates

To comprehend current DSCR mortgage rates, it is beneficial to look at historical trends. Historically, DSCR loan rates are correlated to the 30-year conventional fixed-rate mortgage.

For instance, in May 2024, the 5 Year Treasury yield decreased by 12 basis points, whereas in April 2024, it increased by 28 basis points. Such fluctuations are typical and demonstrate the sensitivity of DSCR rates to economic data.

Analyzing past trends, we observe that DSCR mortgage rates increase with the perceived risk and fear of inflation. Economic weaknesses also contribute to higher rates, as lenders require higher compensation for assumed risks.

Conversely, periods of economic stability often result in more favorable DSCR mortgage rates. Thus, keeping abreast of economic indicators such as monthly CPI reports and job reports can offer valuable insights for forecasting DSCR mortgage trends.

“As perceived risk and fear of inflation increases, DSCR loan interest rates increase.”

Importance of DSCR in Real Estate Financing

DSCR stands for Debt Service Coverage Ratio, a key metric in real estate financing. It measures the cash flow available to pay current debt obligations, thus acting as a gauge of financial health for investment properties.

For investors, a strong DSCR indicates that the property generates sufficient income to cover its debt, making it a more attractive investment. Lenders also view a higher DSCR favorably, often resulting in lower interest rates.

- Higher DSCR: Implies more cash flow to cover debt, leading to better loan terms and lower rates.

- Lower DSCR: Suggests higher risk, potentially resulting in higher interest rates and less favorable loan terms.

Thus, maintaining a robust DSCR is critical for real estate investors seeking competitive mortgage rates.

Comparing DSCR Mortgage Rates with Other Loan Types

DSCR mortgage rates are often compared with other loan types to determine their relative attractiveness. When compared to conventional loans, DSCR loans tend to have a premium over the 30-year fixed-rate mortgage.

This premium varies based on the health of the fixed income markets and specific borrower attributes such as credit score, LTV, and property type. For example, DSCR loans are priced at a premium to the 30-Year Conventional Fixed Rate Mortgage rate.

- Credit Spread: DSCR mortgage rates include a credit spread, reflecting the risk premium over the 5 Year US Treasury rate.

- Flexibility: DSCR loans may offer more flexibility for investors with varying property types and investment experience levels.

- Loan Terms: Conventional loans might offer better rates but often come with stricter qualification criteria.

Comparing DSCR mortgage rates to other loan types helps investors make informed decisions based on their specific financial situation and investment goals.

Current DSCR Loan Rates and Market Influences

Impact of US Treasury Rates on DSCR Loans

In the context of DSCR loans, the 5-Year US Treasury yield, currently at 4.64%, is a pivotal pricing benchmark. This yield is often referred to as the “risk-free rate” and substantially influences the interest rates on DSCR loans.

The volatility of the 5-Year US Treasury yield is noteworthy. For instance, it has increased by 0.8% since January 2024, only to decrease by 0.3% from its peak in mid-October 2023. This fluctuation directly impacts DSCR loan rates, which have seen similar movements.

What drives these shifts in Treasury yields? Primarily, it is the market’s expectations regarding inflation and Federal Reserve policy.

The 5-Year US Treasury has risen sharply over the past two months due to stronger-than-expected labor market data, robust retail sales, and higher-than-expected inflation figures.

Why is this important? Because as Treasury yields climb, the cost of borrowing for DSCR loans increases, making them more expensive for real estate investors and other borrowers. Understanding these dynamics helps predict future DSCR loan rates.

As such, the stability of DSCR loan rates is intrinsically linked to the broader economic landscape and the Federal Reserve’s monetary policy.

Recent Trends in DSCR Loan Rates

The landscape of DSCR loan rates has been notably unpredictable. Over recent months, we have observed rates ranging between 7.25% and 8.5%. These rates are expected to persist through the end of 2024.

This period of fluctuation can be attributed to several factors, including market expectations of Federal Reserve rate cuts, which were initially anticipated but now seem unlikely for 2024.

Additionally, economic indicators such as inflation data, labor market strength, and retail sales have played crucial roles in shaping these interest rates.

- Inflation Data: Higher-than-expected inflation figures have underscored concerns about persistent inflation.

- Labor Market Strength: An unexpectedly strong labor market has further influenced rate expectations.

- Retail Sales: Robust retail sales figures have signaled economic resilience, affecting loan rate trends.

Given these factors, real estate investors and financial analysts must remain vigilant, monitoring economic data closely to anticipate future rate movements.

Economic Factors Affecting DSCR Rates

Several economic factors exert significant influence over DSCR loan rates. Chief among these are inflation, Federal Reserve policies, and economic growth indicators.

The unpredictable nature of inflation has led to substantial volatility in DSCR loan rates. The Federal Reserve’s response to inflation, primarily through interest rate adjustments, directly impacts these rates.

Recent commentary from Federal Reserve officials indicates a lack of confidence in rate cuts for 2024, contributing to the higher rate environment.

The overall health of the economy, as measured by GDP growth and labor market conditions, also plays a crucial role. For instance, a stronger labor market and robust GDP growth can result in higher DSCR loan rates due to increased borrowing costs.

Moreover, the regional banking crisis that started in early 2023 has further complicated the economic landscape. This crisis, characterized by bank failures and liquidity concerns, continues to influence DSCR loan rates.

As 2024 progresses, these economic factors will remain pivotal in shaping the interest rates for DSCR loans, necessitating careful observation and analysis from all stakeholders.

Forecast for DSCR Loan Rates in 2024

Looking ahead to 2024, the outlook for DSCR loan rates remains highly uncertain. Various factors contribute to this uncertainty, including persistent inflation, Federal Reserve policies, and economic performance.

Current forecasts suggest that DSCR loan rates will remain in the range of 7.25% to 8.5% throughout 2024. This prediction accounts for ongoing economic volatility and the Federal Reserve’s cautious stance on rate cuts.

- Inflation Control: The Federal Reserve’s success or failure in addressing inflation will be a critical determinant.

- Economic Indicators: Continued monitoring of labor market strength, retail sales, and GDP growth will provide insights into potential rate adjustments.

- Banking Sector Stability: The health of the regional banking sector, particularly in light of the ongoing crisis, will also influence DSCR loan rates.

As we expect continued volatility, real estate investors and financial analysts should prepare for a dynamic interest rate landscape, adjusting their strategies accordingly.

How to Calculate DSCR Mortgage Rates

Components of DSCR Mortgage Rate Calculation

To accurately calculate DSCR mortgage rates, understanding the key components involved is essential. The first major component is the Loan-To-Value (LTV) Ratio. This ratio compares the loan amount to the value of the rental property. A lower LTV ratio generally results in a lower interest rate.

Another critical factor is the Debt-Service-Coverage-Ratio (DSCR). This ratio measures the rental income against the property’s expenses. Typically, a higher DSCR correlates with a lower mortgage rate. For optimal rates, properties should aim for a DSCR of over 1.25x.

The Credit Score of the borrower also plays a significant role. A higher credit score can lead to significantly lower DSCR loan interest rates. For example, a credit score above 760 could mean a 2-3% lower interest rate compared to a score of 620.

“The three biggest factors that determine DSCR loan mortgage rates are LTV, DSCR, and Credit Score.”

Additional factors such as prepayment penalties, loan purpose, and interest-only options further influence the DSCR mortgage rate. Loans with higher and longer prepayment penalties tend to have lower rates. For instance, a “5/4/3/2/1” prepayment structure typically results in a lower interest rate.

- LTV Ratio: Lower LTV ratios lead to lower interest rates.

- DSCR: Higher DSCR values result in more favorable rates.

- Credit Score: Better credit scores reduce interest rates.

- Prepayment Penalties: Longer prepayment penalties typically lower interest rates.

Role of US Treasury in DSCR Rates

The US Treasury plays a pivotal role in determining DSCR mortgage rates. DSCR loans frequently track the 5-Year Treasury Bond. As a point of comparison, similar to conventional loans, DSCR loans include a spread that reflects the higher risk associated with rental property mortgages.

This spread between the Treasury bond rate and the DSCR mortgage rate is typically between 300 and 400 basis points (3.0% to 4.0%). The absence of government-subsidized support for DSCR loans, unlike conventional loans, results in a relatively higher spread.

For real estate investors and mortgage brokers, understanding the interaction between the DSCR mortgage rates and the Treasury bond rates is crucial. This comprehension aids in predicting potential rate fluctuations and making informed investment decisions.

“DSCR Loan mortgage rates generally track to the 5-Year Treasury Bond.”

- Tracking Treasury Bonds: DSCR rates often follow the 5-Year Treasury Bond rates.

- Risk Reflection: The spread accounts for the higher risk of rental property mortgages.

- Unsubsidized Loans: DSCR loans carry a higher spread due to the lack of government subsidies.

Understanding Borrower Credit Spread

The credit spread for borrowers is a critical element in the calculation of DSCR mortgage rates. This spread is reflective of the additional risk assumed by the lender. Factors such as borrower creditworthiness, property characteristics, and market conditions influence this spread.

A borrower with a high credit score typically enjoys a lower credit spread, which leads to a lower DSCR mortgage rate. Conversely, a borrower with a lower credit score will face a higher credit spread, resulting in a higher mortgage rate.

“Good credit can lower your DSCR Loan interest rate drastically.”

Beyond credit scores, other factors such as loan purpose, prepayment penalties, and the interest-only structure of the loan can affect the borrower’s credit spread. For instance, loans designed for long-term investment with structured prepayment penalties tend to offer reduced spreads.

- Creditworthiness: Higher credit scores result in lower spreads.

- Market Conditions: The broader economic environment impacts spreads.

- Loan Structure: Features like prepayment penalties influence the spread.

Practical Examples of DSCR Rate Calculation

To bring these concepts into focus, consider a practical example. Suppose a rental property has a current DSCR of 1.3x, an LTV ratio of 70%, and the borrower has a credit score of 780. Given these factors, the DSCR mortgage rate might start around 6.0%, reflecting a strong credit profile and a healthy DSCR.

Another example involves a property with a lower DSCR of 1.1x, an LTV of 80%, and a borrower credit score of 650. In this case, the interest rate could be around 9.0%, indicating the higher risk perceived by the lender.

Adjusting for prepayment penalties, let us assume a loan structure with a “5/4/3/2/1” prepayment penalty. This would typically reduce the interest rate by approximately 100 basis points compared to a loan without such penalties.

“DSCR Loans are loans from private lenders that are based primarily on the investment property rather than personal credit.”

By analyzing these factors in practical scenarios, real estate investors and financial planners can better estimate the potential rates for their DSCR loans and make more informed decisions.

- Property 1: DSCR: 1.3x, LTV: 70%, Credit Score: 780 – Approximate Rate: 6.0%

- Property 2: DSCR: 1.1x, LTV: 80%, Credit Score: 650 – Approximate Rate: 9.0%

- Prepayment Penalty: Structured as 5/4/3/2/1 – Potential Rate Reduction: 100 basis points

Factors Affecting DSCR Loan Interest Rates Today

Impact of Credit Score on DSCR Rates

A borrower’s credit score is one of the foremost determinants of DSCR loan interest rates. Lenders scrutinize credit scores to assess the creditworthiness of a borrower. Higher scores typically signal lower risk, translating to more favorable interest rates.

Why do credit scores hold so much weight? Imagine you are lending money to a friend. Would you not feel more comfortable lending to someone who has always paid you back on time?

Lenders view high credit scores as an indication of reliable and responsible financial behavior, leading to lower interest rates on DSCR loans.

Conversely, lower credit scores often result in higher interest rates. This practice compensates for the perceived risk borne by the lender. For instance, a borrower with a score below 650 might face significantly higher rates than one with a score above 750.

How does this affect real estate investors? Maintaining an excellent credit score could mean the difference between affording that dream property and settling for a less desirable option.

- Higher Credit Scores: Often result in lower interest rates.

- Lower Credit Scores: Typically lead to higher interest rates due to increased lender risk.

It’s clear that managing one’s credit score is crucial in securing favorable DSCR loan terms. By understanding this, prospective borrowers can better prepare and optimize their financial strategies.

Influence of Loan-to-Value (LTV) Ratios

Loan-to-Value (LTV) ratios directly influence DSCR loan interest rates. The LTV ratio compares the loan amount to the appraised value of the property. Lenders use this ratio to gauge risk exposure.

Would you lend a large sum against an asset that doesn’t cover its value? A lower LTV ratio suggests less risk for lenders, which often results in lower interest rates.

Borrowers with lower LTV ratios are more likely to secure competitive DSCR loan rates, reflecting reduced lender risk.

High LTV ratios, on the other hand, signal higher risk. Therefore, lenders might impose higher interest rates to mitigate the potential loss.

For real estate investors, understanding LTV ratios can be pivotal. By contributing a larger down payment, investors can lower their LTV ratio and potentially secure more favorable loan terms.

- Lower LTV Ratios: Typically result in lower interest rates due to reduced risk.

- Higher LTV Ratios: Often lead to higher interest rates as lenders offset their increased risk.

Manipulating the LTV ratio to your advantage can be an effective strategy to lower your borrowing costs. Prospective borrowers and financial advisors should factor this in when planning investments.

Effect of Borrower Experience

A borrower’s track record in managing similar loans significantly impacts DSCR loan interest rates. Experience in the field assures lenders of the borrower’s capability to handle financial obligations efficiently.

Consider the sports analogy: Would you bet on an experienced athlete or a rookie? Similarly, lenders prefer experienced borrowers who have successfully managed previous loans.

Lenders often offer better DSCR loan rates to experienced borrowers, reflecting their trust in the borrower’s proven ability to manage loans effectively.

Inexperienced borrowers may face higher interest rates as lenders compensate for the uncertain risk profile. Real estate investors with substantial portfolios often enjoy more favorable terms compared to novices.

- Experienced Borrowers: Tend to receive lower interest rates due to demonstrated reliability.

- Inexperienced Borrowers: May incur higher interest rates to account for perceived risk.

For prospective borrowers, building a history of successful investments can significantly influence loan terms. This experience can be a key differentiator in competitive lending environments.

Role of Loan Amount in Interest Rate Determination

The amount of the loan sought is another crucial factor in determining DSCR loan interest rates. Generally, larger loans may attract higher rates due to the increased risk to the lender.

Imagine setting out on a road trip. Would you be more cautious with a larger vehicle compared to a smaller one? Similarly, lenders exercise greater caution with substantial loan amounts.

Large loans often come with higher interest rates, reflecting the lender’s increased risk and potential exposure.

Conversely, smaller loans might attract lower interest rates as lenders face reduced risk. However, this is not always a straightforward correlation and can depend on other factors such as credit score and LTV ratio.

- Large Loan Amounts: May lead to higher interest rates due to increased lender risk.

- Small Loan Amounts: Often result in lower interest rates, assuming other factors are favorable.

Understanding the implications of loan size can help prospective borrowers plan better. Real estate investors and financial advisors should consider the relationship between loan amounts and interest rates when structuring their investments.

DSCR Origination Fees: What You Need to Know

Understanding Origination Fees

It is crucial to comprehend the concept of origination fees when considering DSCR loans. These fees, often referred to as “points,” are typically a percentage of the loan amount. For instance, if a private lender charges 2 points on a $200,000 loan, the origination fee amounts to $4,000.

Origination fees encompass more than just the initial cost. They include various charges such as underwriting, processing, and servicing fees. Therefore, it is essential not to be misled by a seemingly low origination fee. An accurate understanding of the lender’s fee structure can prevent hidden costs down the line.

Are you aware that origination fees can significantly impact the overall cost of your DSCR loan? This highlights the importance of thoroughly evaluating and comparing loan offers from multiple lenders to ensure you are not overpaying.

“Origination fees are a key component in determining the total cost of your DSCR loan. It is vital to understand and evaluate these correctly to avoid unexpected financial burdens.” – Financial Expert

One effective strategy to manage origination fees is to ask for a detailed breakdown from your lender. This allows you to see exactly what you are being charged for and why.

By fully understanding origination fees, real estate investors and mortgage applicants can make more informed decisions, enhancing their financial planning and investment outcomes.

Typical Costs Associated with DSCR Loans

When applying for a DSCR loan, it is important to be aware of the various costs involved. Apart from origination fees, lenders may charge additional costs that can add up quickly.

Common costs associated with DSCR loans include:

- Underwriting Fee: This fee covers the cost of evaluating and verifying your loan application and financial information.

- Processing Fee: Charged for handling the paperwork and other administrative tasks required to process your loan.

- Servicing Fee: This fee is for the ongoing management and servicing of your loan after it has been issued.

Moreover, some lenders may offer the option to “buy down” the interest rate by paying additional fees at closing. These are often called closing fees or points. By paying an extra point, borrowers can lower their mortgage rate by approximately 0.50%, resulting in significant savings over the loan term.

Understanding these typical costs helps in preparing a more accurate budget and avoiding unexpected expenses. It also aids in negotiating better terms with your lender.

It is crucial to note that, being well-informed about the costs associated with DSCR loans empowers investors and mortgage applicants to manage their finances effectively.

Comparing Fees Across Lenders

One of the most effective ways to save on DSCR origination fees is to compare fees across multiple lenders. Every lender has a unique fee structure, and the differences can be substantial.

Start by obtaining quotes from various lenders. This can often be done quickly; for instance, getting DSCR loan quotes in two minutes or less is possible. These quotes will help you compare the overall cost of the loan, including origination and other associated fees.

Why is it crucial to compare lenders? It’s because some lenders might offer lower origination fees but higher processing or servicing fees. By comparing the holistic cost, one can identify the most cost-effective option.

Remember to read the fine print! Some low-fee offers might hide additional costs that can increase the loan’s total expense.

“Comparing loan offers from different lenders is an essential step in securing the best deal on your DSCR loan. This ensures you are getting the best combination of rates and fees.” – Mortgage Advisor

Investors and financial planners should consider using online tools and resources to compare fees efficiently. These tools can simplify the process and provide a clearer picture of the best available options.

Ultimately, taking the time to compare fees across lenders can result in substantial savings and better loan terms.

Tips for Minimizing Origination Fees

Minimizing origination fees can significantly reduce the overall cost of your DSCR loan. Here are several strategies to help:

- Negotiate with Lenders: Don’t hesitate to negotiate origination fees. Lenders often have some flexibility and may reduce fees to secure your business.

- Compare Multiple Offers: As previously mentioned, comparing fees from various lenders allows you to select the most cost-effective option.

- Look for Discounts: Some lenders offer discounts on origination fees for specific borrower profiles or during promotional periods.

- Understand All Fees: Ensure you understand all the fees you are being charged. This transparency helps in negotiating and avoiding unnecessary costs.

- Ask for a Detailed Breakdown: Request a detailed fee breakdown from your lender to see where you might cut costs. This can also help in identifying any hidden fees.

For real estate investors and mortgage applicants, these tips can be invaluable in managing and reducing the costs associated with DSCR loans.

Finally, staying informed about the various ways to minimize origination fees ensures better financial planning and can lead to significant savings over the loan term.

Using DSCR Calculators for Accurate Loan Assessment

Benefits of DSCR Calculators

DSCR calculators serve as invaluable tools for real estate investors, financial analysts, and mortgage brokers. By providing a clear assessment of a property’s debt service coverage ratio (DSCR), these calculators enable stakeholders to make informed decisions regarding loan approval and investment suitability.

One of the primary benefits is that DSCR calculators offer an objective measure of the financial viability of a property. This ensures that the property’s income can adequately cover its debt obligations, thus minimizing the risk for lenders and investors.

Another significant advantage is the sensitivity analysis these calculators offer. By adjusting variables such as credit score, loan amount, and interest rates, users can see how different factors impact the DSCR, facilitating more nuanced decision-making.

For instance, based on the transcript, it’s clear that credit score plays a crucial role in the DSCR calculation. A higher credit score can lead to better loan terms and a higher loan-to-value (LTV) ratio. Conversely, a lower credit score may result in stricter DSCR requirements and reduced loan amounts.

Many rental property investors do not realize how sensitive DSCR loan quoting is to credit score. Some of the capital providers that buy our loans require a DSCR of 1.2 for borrowers with a credit score below 720.

The ability to model various scenarios with a DSCR calculator helps in planning and optimizing investment strategies. It allows investors to identify potential pitfalls ahead of time and adjust their approaches accordingly.

Additionally, DSCR calculators can aid in loan comparison by providing a standardized metric to evaluate different loan options. This comparative analysis can help investors and brokers to select the best possible financing for their needs.

In essence, the use of DSCR calculators brings transparency, accuracy, and strategic foresight to the loan assessment process, making them an indispensable tool in the real estate and financial sectors.

How to Use a DSCR Calculator

Using a DSCR calculator effectively involves understanding the key inputs and interpreting the results accurately. Let’s walk through the process step-by-step:

- Gather Financial Data: Collect all relevant financial data for the property, including rental income, operating expenses, and existing debt obligations.

- Input Key Variables: Enter the collected data into the calculator. This typically includes monthly rental income, annual operating expenses, and the total loan amount.

- Adjust Loan Parameters: Modify variables such as interest rate and loan term to see how they affect the DSCR. This step is crucial for sensitivity analysis.

- Review the DSCR Result: The calculator will provide a DSCR value, which represents the ratio of the property’s net operating income to its debt obligations.

- Interpret the Results: A DSCR greater than 1 indicates that the property generates enough income to cover its debt. Conversely, a DSCR below 1 suggests that the property may struggle to meet its debt obligations.

Consider using the calculator provided by MyPerfectMortgage to determine your DSCR accurately. Their tool is specifically designed to handle the complexities involved in real estate loans.

Use our handy DSCR Calculator to determine DSCR for your next rental property purchase or refinance.

By following these steps, investors and financial analysts can ensure they are making sound, data-driven decisions. Are you ready to optimize your next real estate investment? Try using a DSCR calculator to see how it can benefit you.

Common Mistakes to Avoid

When using DSCR calculators, certain common mistakes can lead to inaccurate assessments and poor investment decisions. It’s essential to be aware of these pitfalls to maximize the tool’s effectiveness.

One frequent error is inputting incorrect financial data. Accurate rental income and expense figures are crucial for a reliable DSCR calculation. Double-checking these numbers can save you from potential miscalculations.

Another common mistake is ignoring the impact of credit score. As highlighted by the transcript, credit score significantly influences DSCR requirements and loan terms. Always factor in the borrower’s credit score and adjust the calculator’s parameters accordingly.

Investors often overlook the importance of sensitivity analysis. Failing to adjust variables like interest rates and loan terms can result in a misleading DSCR. Regularly testing different scenarios can provide a more comprehensive risk assessment.

- Neglecting Operating Expenses: Underestimating operating expenses can artificially inflate the DSCR, leading to a false sense of security.

- Misunderstanding DSCR Thresholds: Different lenders have varying DSCR thresholds. Ensure you are using the correct minimum DSCR required by your lender.

- Overlooking Loan-to-Value Ratio: The LTV ratio can affect the loan amount and terms. Ensure it aligns with the calculated DSCR for accurate assessment.

By avoiding these common mistakes, you can leverage DSCR calculators to make informed, strategic decisions that enhance your real estate investments. Always strive for accuracy and thoroughness in your loan assessments.

Recommended DSCR Calculators

Selecting a reliable DSCR calculator is essential for accurate loan assessment. Here are a few recommended tools that cater to real estate investors, financial analysts, and mortgage brokers:

- MyPerfectMortgage DSCR Calculator: This calculator is tailored for rental property purchases and refinancing. It allows users to input detailed financial data and adjust various loan parameters to see their impact on the DSCR.

- OfferMarket DSCR Calculator: Known for its user-friendly interface, this calculator provides quick and accurate DSCR calculations. It’s particularly useful for real estate agents posting free for sale listings.

- DSCR Loan Wisconsin Calculator: Specifically designed for the Wisconsin rental property market, this tool is ideal for local investors looking to assess their DSCR accurately.

Each of these calculators offers unique features and advantages, ensuring that you can find one that meets your specific needs. Whether you’re a seasoned investor or a financial analyst, utilizing a recommended DSCR calculator can streamline your loan assessment process.

Take advantage of our Fix and Flip loans with Advanced Draws and learn about the tri-merge credit report to further optimize your financial strategies.

Are you ready to enhance your real estate decision-making? Try one of these recommended DSCR calculators and see how they can help you achieve more accurate and strategic loan assessments.

The Future of DSCR Mortgage Rates: Predictions and Insights

Economic Indicators to Watch

The performance of DSCR mortgage rates can be significantly influenced by various economic indicators. Recently, the job market has been a critical factor. For instance, in early May 2024, the US Bureau of Labor Statistics reported fewer new jobs than anticipated, with nonfarm payrolls rising by only 175,000 compared to the expected 243,000.

This shortfall in job creation has implications for mortgage rates. Market experts argue that substantial rate cuts are likely only if the job market continues to show signs of stress. Reflecting this sentiment, traders reduced yields, leading to lower mortgage rates on both conventional and rental loans.

Another crucial indicator is the Consumer Price Index (CPI). The CPI report released on May 15th, 2024, showed a 0.3% month-over-month increase, less than the projected 0.4%. This slight improvement in inflation metrics contributed to a decrease in rates. Although the year-over-year headline CPI was 3.4%, in line with predictions, any alignment or betterment of such expectations can positively or negatively affect mortgage rates.

On the flip side, rates can also be affected by other less predictable factors. For instance, hawkish comments from Federal Reserve officials or weak demand at Treasury auctions can create volatility, as seen when mortgage rates ticked up in late May 2024 despite no significant adverse economic data.

The interaction between job reports, inflation metrics, and external financial comments creates a complex environment for predicting DSCR mortgage rates.

Understanding these indicators helps investors and analysts make informed predictions about rate movements. Always keeping an eye on similar reports and metrics can provide valuable insights into potential future trends.

Expert Predictions for DSCR Rates

Market experts often base their predictions on the principles of supply and demand, economic indicators, and historical data. With recent trends and data, several forecasts for DSCR mortgage rates emerge.

Firstly, there’s a belief that if the job market remains weak, we might see prolonged periods of low rates. As evidenced in May 2024, a weaker-than-expected job report significantly influenced rates downward, demonstrating the reaction of traders and lenders to economic stress.

Conversely, should inflationary pressures persist or worsen, rates might not fall as anticipated. Although the recent CPI data showed a slight deceleration in inflation, any unpredictable spikes could lead mortgage rates to remain stable or even increase.

Experts also predict that Federal Reserve policies and comments will continue to play a pivotal role. Hawkish stances or unexpected policy changes can create immediate rate movements, often irrespective of other economic data.

We should also consider that external geopolitical events, shifts in global financial markets, or significant legislative changes can impact these predictions. Active monitoring and rapid response to these varied influences are crucial.

- Weak Job Market: Prolonged periods of low rates due to economic stress.

- Inflation Trends: Potential rate stability or increases if inflation persists.

- Federal Reserve Policies: Significant impact on immediate rate movements.

- Geopolitical Events: External factors influencing market stability and rates.

Are these predictions inevitable? No, but they provide a framework for what could happen based on current data and trends.

Potential Impacts of Regulatory Changes

Regulatory changes can have profound effects on DSCR mortgage rates. Legislation aimed at financial stability, housing affordability, or market liquidity can each alter the landscape for these rates.

For example, if new regulations were introduced to increase housing affordability, this might involve incentives for lower mortgage rates, thereby driving rates down. Conversely, stricter financial regulations intended to ensure market stability could lead to higher rates if lenders perceive increased risks or costs.

Recent changes in Treasury auction demands have shown how regulatory and financial shifts can cause rate volatility. Reduced demand at large Treasury auctions, often influenced by fiscal policies, was a factor in the rate increases observed in late May 2024.

Moreover, any changes in tax policies affecting real estate investments could influence the attractiveness of DSCR loans. For instance, tax incentives for real estate investors might drive higher demand for DSCR loans, potentially leading to more competitive, lower rates.

Another potential area of impact is environmental legislation. Policies encouraging sustainable or green building practices might create new loan products or incentives affecting the DSCR loan market.

Regulatory changes act as both a stabilizing force and a source of uncertainty in mortgage markets.

Understanding the potential regulatory impacts requires close attention to legislative developments, fiscal policy announcements, and broader government objectives, all of which can shape the trajectory of DSCR mortgage rates.

Strategies for Borrowers in a Volatile Market

Navigating a volatile market requires borrowers to adopt strategic approaches. One effective strategy is to lock in rates when they are favorable. Given the fluctuating nature of economic indicators and regulatory impacts, securing a good rate can protect borrowers from future increases.

Another strategy is to maintain financial flexibility. This can be achieved by having contingency plans and reserves to weather periods of rate increases or economic downturns. Flexibility allows borrowers to adjust their strategies quickly in response to market changes.

Borrowers could also benefit from diversifying their investment portfolios. Diversification can mitigate risks associated with DSCR mortgage rate volatility. By spreading investments across different asset classes or geographic regions, the impact of adverse rate movements on a single investment can be reduced.

Regularly reviewing and adjusting loan terms can also be crucial. Periodic reassessment of loan structures, refinancing opportunities, or alternative financing options can help borrowers stay competitive and minimize costs.

- Rate Locking: Secure favorable rates when possible to mitigate future risks.

- Financial Flexibility: Maintain reserves and contingency plans to adapt to market changes.

- Diversification: Spread investments to reduce the impact of rate volatility.

- Loan Review: Regularly assess and adjust loan terms for optimal financial health.

What proactive steps will you take? In a market characterized by uncertainty, strategic planning and adaptability are key to navigating the future of DSCR mortgage rates successfully.

Conclusion

Understanding DSCR mortgage rates is crucial for real estate investors aiming to make informed financing decisions. By grasping the intricacies of key factors like US Treasury rates, credit scores, and loan-to-value ratios, investors can better navigate the complex landscape of DSCR loans. Historical trends and the current economic climate provide valuable insights, helping borrowers anticipate rate fluctuations and plan strategically.

As we look to the future, staying attuned to economic indicators and expert predictions is essential. Leveraging tools such as DSCR calculators can offer precise loan assessments, enabling more effective financial planning. For those considering DSCR loans, now is the time to delve deeper, minimize origination fees, and maximize investment returns. Continue exploring our resources to stay ahead in the dynamic real estate market and optimize your investment strategies.

Frequently Asked Questions

What is the current interest rate for DSCR loans?

Current interest rates for DSCR loans fluctuate based on market conditions, typically ranging from 5% to 8%.

Do DSCR loans require 20% down?

DSCR loans generally require a minimum down payment of 20%, though requirements may vary by lender.

What is a good DSCR ratio for a loan?

A good DSCR ratio is typically 1.25 or higher, indicating a strong ability to cover debt obligations.

What is the minimum DSCR for a mortgage?

The minimum DSCR for a mortgage often starts at 1.0 but can vary depending on the lender and loan type.

How do US Treasury rates affect DSCR mortgage rates?

US Treasury rates influence DSCR mortgage rates by serving as a benchmark for lenders, impacting the overall interest rates.

What factors most influence DSCR mortgage rates?

Key factors include credit score, Loan-to-Value (LTV) ratios, borrower experience, and prevailing market conditions.