-

Table of Contents

- Economic Boom, Housing Doom: The Hidden Costs of Growth on Real Estate

- The Economic Boom: A Double-Edged Sword

- Increased Demand for Housing

- Gentrification and Displacement

- Case Studies: The Impact of Economic Growth on Housing Markets

- San Francisco, USA

- London, UK

- Shanghai, China

- The Social and Economic Consequences of Rising Housing Prices

- Increased Income Inequality

- Social Displacement

- Homelessness

- Strategies for Mitigating the Hidden Costs of Economic Growth on Real Estate

- Affordable Housing Initiatives

- Community Land Trusts

- Tenant Protections

- Conclusion

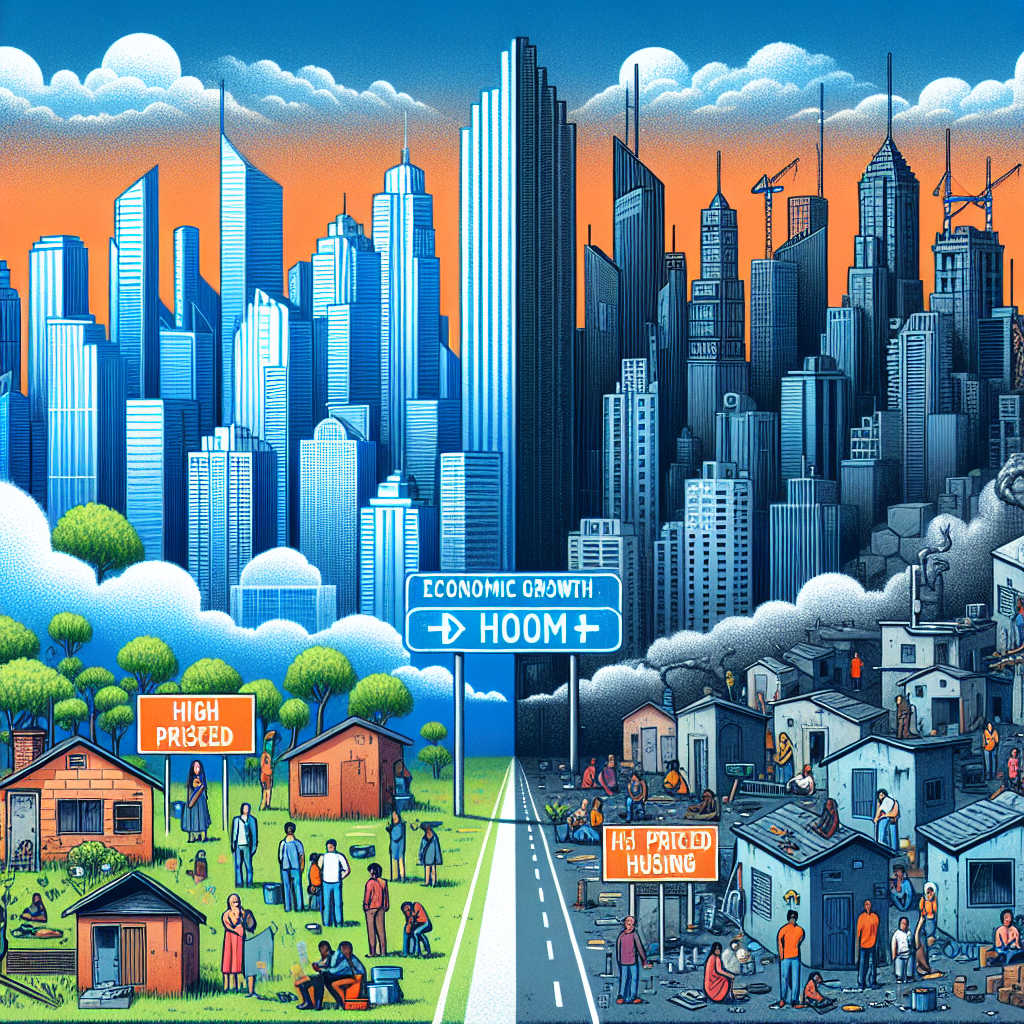

Economic Boom, Housing Doom: The Hidden Costs of Growth on Real Estate

Economic growth is often celebrated as a sign of prosperity and progress. However, this growth can come with hidden costs, particularly in the real estate sector. While a booming economy can lead to increased job opportunities, higher wages, and improved infrastructure, it can also result in skyrocketing housing prices, gentrification, and a widening gap between the rich and the poor. This article delves into the complex relationship between economic growth and the real estate market, exploring the hidden costs that often accompany periods of rapid economic expansion.

The Economic Boom: A Double-Edged Sword

Economic booms are characterized by rapid growth in GDP, low unemployment rates, and increased consumer spending. These periods of prosperity can lead to significant improvements in the quality of life for many people. However, they can also create challenges, particularly in the housing market.

Increased Demand for Housing

One of the most immediate effects of an economic boom is an increase in demand for housing. As more people move to urban areas in search of job opportunities, the demand for housing in these areas skyrockets. This increased demand can lead to higher housing prices, making it difficult for many people to afford a home.

- Increased migration to urban areas

- Higher demand for housing

- Rising housing prices

Gentrification and Displacement

Gentrification is another consequence of economic growth. As more affluent individuals move into previously low-income neighborhoods, property values rise, and long-time residents may be forced to move due to increased rent and property taxes. This displacement can have significant social and economic consequences for the affected communities.

- Rising property values

- Increased rent and property taxes

- Displacement of long-time residents

Case Studies: The Impact of Economic Growth on Housing Markets

To better understand the hidden costs of economic growth on real estate, let’s examine a few case studies from different parts of the world.

San Francisco, USA

San Francisco is a prime example of a city experiencing the hidden costs of economic growth. The tech boom has brought significant wealth to the area, but it has also led to skyrocketing housing prices and widespread gentrification.

- Median home prices in San Francisco have increased by over 200% in the past decade.

- Many long-time residents have been displaced due to rising rent and property taxes.

- The city has seen a significant increase in homelessness as a result of the housing crisis.

London, UK

London has also experienced the hidden costs of economic growth. The city’s booming financial sector has attracted a large number of high-income individuals, leading to increased demand for housing and rising property prices.

- Property prices in London have increased by over 50% in the past decade.

- Many low-income residents have been forced to move to more affordable areas outside the city.

- The city has seen a rise in the number of “ghost homes” – properties owned by wealthy individuals who do not live in them full-time.

Shanghai, China

Shanghai is another city that has experienced the hidden costs of economic growth. The city’s rapid economic expansion has led to a significant increase in housing prices, making it difficult for many residents to afford a home.

- Housing prices in Shanghai have increased by over 150% in the past decade.

- Many residents have been forced to move to more affordable areas outside the city.

- The city has seen a rise in the number of “ghost cities” – large developments that remain largely unoccupied.

The Social and Economic Consequences of Rising Housing Prices

The hidden costs of economic growth on real estate extend beyond rising housing prices and gentrification. These changes can have significant social and economic consequences for affected communities.

Increased Income Inequality

Rising housing prices can contribute to increased income inequality. As property values rise, wealthier individuals benefit from increased equity, while low-income individuals struggle to afford housing. This can lead to a widening gap between the rich and the poor.

- Wealthier individuals benefit from increased property values.

- Low-income individuals struggle to afford housing.

- Widening gap between the rich and the poor.

Social Displacement

Gentrification and rising housing prices can lead to social displacement, as long-time residents are forced to move to more affordable areas. This displacement can disrupt social networks and community cohesion, leading to a loss of social capital.

- Disruption of social networks

- Loss of community cohesion

- Loss of social capital

Homelessness

Rising housing prices can also contribute to an increase in homelessness. As housing becomes less affordable, more individuals and families may find themselves without a place to live.

- Increased housing prices

- Decreased affordability

- Increase in homelessness

Strategies for Mitigating the Hidden Costs of Economic Growth on Real Estate

While the hidden costs of economic growth on real estate can be significant, there are strategies that can help mitigate these effects. By implementing policies and programs that promote affordable housing and protect vulnerable communities, cities can ensure that the benefits of economic growth are more equitably distributed.

Affordable Housing Initiatives

One of the most effective ways to mitigate the hidden costs of economic growth on real estate is to promote affordable housing initiatives. These initiatives can help ensure that low- and middle-income individuals have access to affordable housing, even in areas experiencing rapid economic growth.

- Inclusionary zoning policies

- Subsidized housing programs

- Rent control measures

Community Land Trusts

Community land trusts (CLTs) are another effective strategy for promoting affordable housing and protecting vulnerable communities. CLTs are nonprofit organizations that acquire and hold land for the benefit of the community, ensuring that it remains affordable in perpetuity.

- Nonprofit organizations acquire and hold land

- Land remains affordable in perpetuity

- Benefits the community as a whole

Tenant Protections

Implementing tenant protections can also help mitigate the hidden costs of economic growth on real estate. These protections can help ensure that renters are not unfairly displaced and that they have access to safe and affordable housing.

- Rent control measures

- Eviction protections

- Tenant rights education

Conclusion

While economic growth can bring significant benefits, it can also come with hidden costs, particularly in the real estate sector. Rising housing prices, gentrification, and increased income inequality are just a few of the challenges that can accompany periods of rapid economic expansion. By implementing policies and programs that promote affordable housing and protect vulnerable communities, cities can help ensure that the benefits of economic growth are more equitably distributed. Ultimately, a balanced approach to economic growth and real estate development can help create more inclusive and sustainable communities.