-

Table of Contents

- From $15K/Year and Living with Mom to 5 Real Estate Deals in 5 Years with Minimal Investment

- The Starting Point: $15K/Year and Living with Mom

- Identifying the Problem

- The Turning Point: Discovering Real Estate

- Educating Himself

- First Steps: Minimal Investment Strategies

- House Hacking

- Wholesaling

- Partnering with Investors

- Scaling Up: The First Deal

- Finding the Right Property

- Financing the Deal

- Executing the Flip

- Building Momentum: Subsequent Deals

- Buy and Hold Strategy

- BRRRR Method

- Case Study: The Fourplex

- Overcoming Challenges

- Key Takeaways and Lessons Learned

- Conclusion

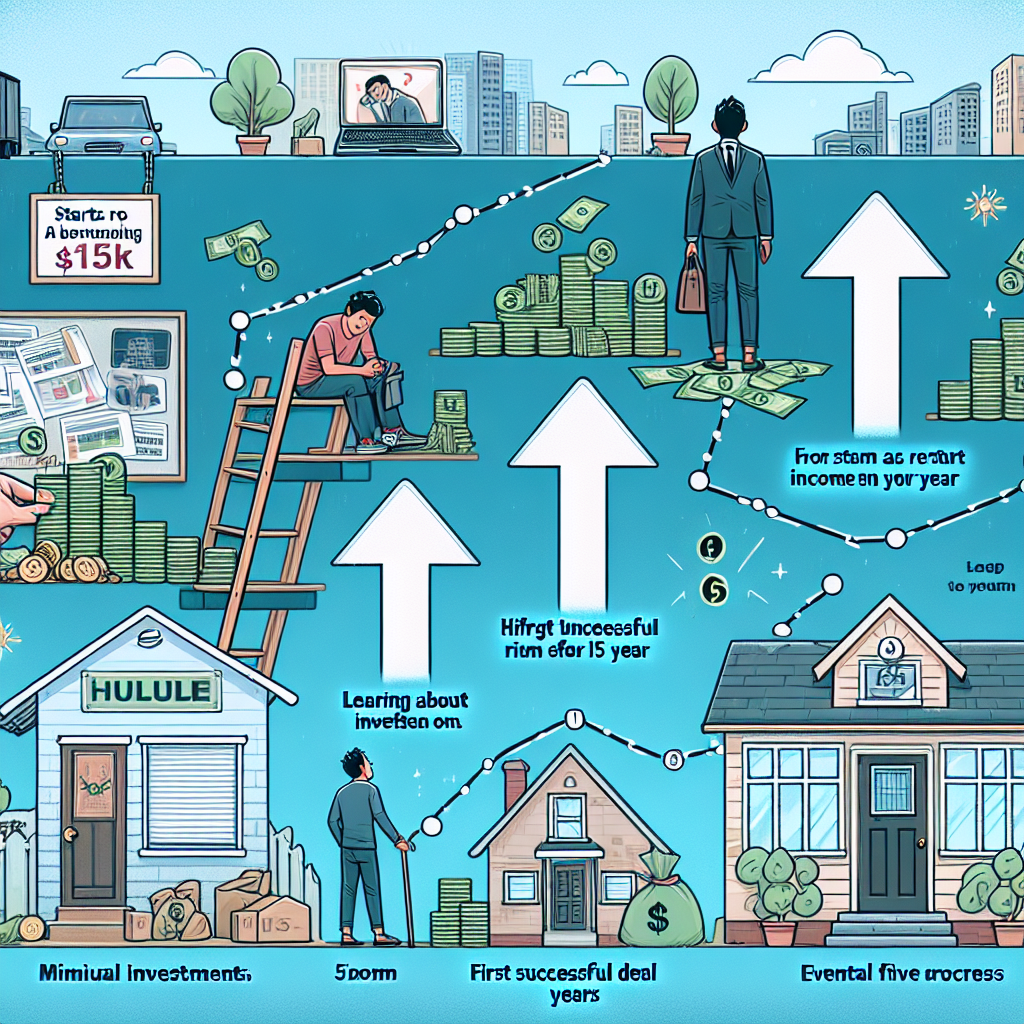

From $15K/Year and Living with Mom to 5 Real Estate Deals in 5 Years with Minimal Investment

In today’s world, financial independence and success often seem like distant dreams, especially for those starting from humble beginnings. However, the story of transforming a modest income into a thriving real estate portfolio is not just a fairy tale. This article delves into the journey of an individual who went from earning $15,000 a year and living with their mom to closing five real estate deals in five years with minimal investment. By exploring strategies, case studies, and actionable insights, we aim to provide a roadmap for aspiring real estate investors.

The Starting Point: $15K/Year and Living with Mom

Many people find themselves in a financial rut, earning a low income and struggling to make ends meet. Our protagonist, let’s call him John, was no different. Earning just $15,000 a year and living with his mom, John felt the weight of financial constraints. However, he had a burning desire to change his circumstances and achieve financial freedom.

Identifying the Problem

John’s situation was not unique. According to the U.S. Census Bureau, the median personal income in the United States was around $35,977 in 2020. Many individuals earn even less, making it challenging to save and invest. John realized that to break free from this cycle, he needed to find a way to generate additional income and build wealth.

The Turning Point: Discovering Real Estate

John’s journey took a significant turn when he discovered the potential of real estate investing. Real estate has long been considered a reliable avenue for wealth creation, offering both passive income and capital appreciation. However, the common misconception is that substantial capital is required to get started. John decided to challenge this notion.

Educating Himself

Before diving into real estate, John dedicated time to educating himself. He read books, attended seminars, and followed industry experts. Some of the resources that helped him include:

- “Rich Dad Poor Dad” by Robert Kiyosaki

- “The Millionaire Real Estate Investor” by Gary Keller

- Podcasts like “BiggerPockets Real Estate Podcast”

- Online courses and webinars

By immersing himself in knowledge, John gained a solid understanding of real estate fundamentals, investment strategies, and market trends.

First Steps: Minimal Investment Strategies

With limited funds, John had to be creative in his approach. He explored several minimal investment strategies that allowed him to enter the real estate market without a substantial upfront capital.

House Hacking

House hacking involves purchasing a multi-unit property, living in one unit, and renting out the others. This strategy allows the owner to offset their living expenses with rental income. John found a duplex in a growing neighborhood and used an FHA loan, which required a lower down payment, to finance the purchase. By renting out the second unit, he covered his mortgage payments and even generated a small profit.

Wholesaling

Wholesaling is another strategy that requires minimal investment. It involves finding distressed properties, getting them under contract, and then selling the contract to an investor for a fee. John leveraged his networking skills to find motivated sellers and built relationships with local investors. By acting as a middleman, he earned assignment fees without ever owning the properties.

Partnering with Investors

John also explored partnerships with experienced investors. He offered his time and effort in exchange for a share of the profits. This approach allowed him to learn from seasoned professionals while minimizing his financial risk. By partnering on deals, John gained valuable experience and built a reputation in the real estate community.

Scaling Up: The First Deal

After successfully implementing minimal investment strategies, John was ready to take on his first significant deal. He identified a distressed property in a promising neighborhood that had the potential for substantial appreciation.

Finding the Right Property

John used various tools and resources to find the right property:

- Real estate listing websites like Zillow and Realtor.com

- Networking with real estate agents and wholesalers

- Driving for dollars – physically scouting neighborhoods for distressed properties

He eventually found a fixer-upper that was priced below market value due to its condition. John saw the potential for a profitable flip and decided to move forward.

Financing the Deal

Financing was a critical aspect of this deal. John explored several options:

- Hard money loans – short-term loans from private lenders based on the property’s value

- Private money lenders – individuals willing to invest in real estate for a higher return

- Home equity line of credit (HELOC) – leveraging the equity in his duplex

John secured a hard money loan with favorable terms, allowing him to purchase the property and fund the necessary renovations.

Executing the Flip

With financing in place, John focused on executing the flip. He hired a reliable contractor and closely monitored the renovation process. Key improvements included:

- Updating the kitchen and bathrooms

- Installing new flooring and fixtures

- Enhancing curb appeal with landscaping

The renovation was completed on time and within budget. John listed the property and received multiple offers, ultimately selling it for a significant profit.

Building Momentum: Subsequent Deals

With the success of his first deal, John gained confidence and momentum. He reinvested his profits into subsequent deals, gradually scaling up his portfolio.

Buy and Hold Strategy

John diversified his approach by incorporating a buy and hold strategy. He purchased rental properties in emerging markets with strong rental demand. This strategy provided him with a steady stream of passive income and long-term appreciation.

BRRRR Method

The BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) became a cornerstone of John’s strategy. He would buy distressed properties, rehab them to increase their value, rent them out to generate income, refinance to pull out equity, and repeat the process. This method allowed him to recycle his capital and rapidly expand his portfolio.

Case Study: The Fourplex

One of John’s notable deals was a fourplex in a growing urban area. He used the BRRRR method to acquire and renovate the property. The steps included:

- Buying the fourplex at a discount due to its condition

- Rehabbing each unit to attract quality tenants

- Renting out all units to generate positive cash flow

- Refinancing to pull out equity for future investments

This deal not only provided John with substantial rental income but also increased his net worth through property appreciation.

Overcoming Challenges

John’s journey was not without challenges. Real estate investing comes with its share of risks and obstacles. Some of the challenges he faced included:

- Market fluctuations – Navigating changes in property values and rental demand

- Financing hurdles – Securing favorable loan terms and managing debt

- Property management – Dealing with tenant issues and maintenance

John tackled these challenges by staying informed, adapting his strategies, and seeking advice from mentors and industry experts.

Key Takeaways and Lessons Learned

John’s journey from earning $15,000 a year and living with his mom to closing five real estate deals in five years offers valuable lessons for aspiring investors:

- Education is crucial: Invest time in learning about real estate fundamentals, strategies, and market trends.

- Start small: Minimal investment strategies like house hacking, wholesaling, and partnerships can help you get started with limited funds.

- Leverage financing options: Explore various financing options, including hard money loans, private lenders, and HELOCs, to fund your deals.

- Diversify your approach: Incorporate different strategies like buy and hold, flipping, and the BRRRR method to build a robust portfolio.

- Stay resilient: Real estate investing comes with challenges. Stay informed, adapt your strategies, and seek advice from experienced investors.

Conclusion

John’s transformation from earning $15,000 a year and living with his mom to closing five real estate deals in five years with minimal investment is a testament to the power of determination, education, and strategic planning. By leveraging minimal investment strategies, securing creative financing, and staying resilient in the face of challenges, John achieved financial independence and built a thriving real estate portfolio. Aspiring investors can draw inspiration from his journey and apply these lessons to their own path to success.

Real estate investing is not reserved for the wealthy; it is accessible to those willing to learn, take calculated risks, and persistently pursue their goals. With the right mindset and strategies, anyone can turn their financial dreams into reality.