-

Table of Contents

- From Student Debt to Global Wealth: Achieving Financial Freedom Abroad

- The Burden of Student Debt

- Statistics on Student Debt

- Exploring Opportunities Abroad

- Countries with Lower Living Costs

- Countries with Higher Salaries

- Tax Benefits for Expatriates

- Foreign Earned Income Exclusion (FEIE)

- Tax Treaties

- Case Studies: Success Stories of Financial Freedom Abroad

- Case Study 1: Sarah’s Journey to Financial Freedom in Thailand

- Case Study 2: John’s High-Earning Career in Singapore

- Case Study 3: Emily’s Tax-Free Earnings in the UAE

- Strategies for Achieving Financial Freedom Abroad

- Create a Budget

- Build an Emergency Fund

- Pay Off High-Interest Debt First

- Invest for the Future

- Challenges and Considerations

- Cultural and Language Barriers

- Legal and Visa Requirements

- Healthcare and Insurance

- Tax Implications

- Conclusion

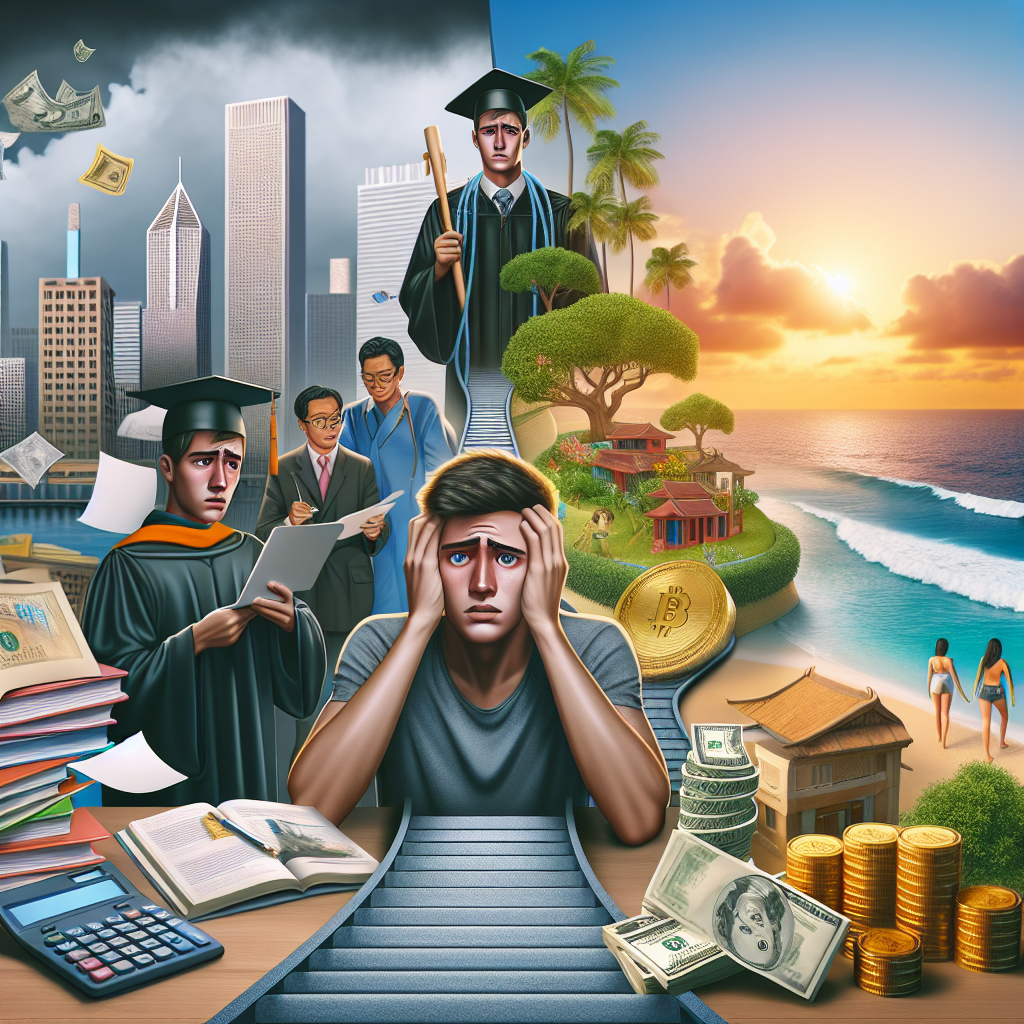

From Student Debt to Global Wealth: Achieving Financial Freedom Abroad

Student debt is a growing concern for many young adults, particularly in countries like the United States where the cost of higher education has skyrocketed. However, the dream of financial freedom is not unattainable. By exploring opportunities abroad, individuals can not only manage their student debt but also build substantial wealth. This article delves into the strategies and opportunities available for achieving financial freedom by leveraging global opportunities.

The Burden of Student Debt

Student debt has become a significant financial burden for many graduates. According to the Federal Reserve, the total student loan debt in the United States reached $1.7 trillion in 2021. This debt can hinder financial progress, delaying milestones such as buying a home, starting a family, or saving for retirement.

Statistics on Student Debt

- As of 2021, approximately 45 million Americans have student loan debt.

- The average student loan debt per borrower is around $37,000.

- Nearly 70% of college graduates have student loan debt.

These statistics highlight the pervasive nature of student debt and the need for effective strategies to manage and overcome it.

Exploring Opportunities Abroad

One viable solution to managing student debt and achieving financial freedom is to explore opportunities abroad. Many countries offer favorable conditions for expatriates, including lower living costs, higher salaries, and tax benefits. By taking advantage of these opportunities, individuals can accelerate their journey to financial freedom.

Countries with Lower Living Costs

Living in a country with a lower cost of living can significantly reduce expenses, allowing individuals to allocate more funds towards paying off debt and saving. Some popular destinations with lower living costs include:

- Thailand: Known for its affordable lifestyle, Thailand offers a high quality of life at a fraction of the cost in Western countries.

- Mexico: With its vibrant culture and low cost of living, Mexico is an attractive destination for expatriates.

- Portugal: Portugal offers a relatively low cost of living compared to other European countries, making it an appealing option for those seeking financial freedom.

Countries with Higher Salaries

In addition to lower living costs, some countries offer higher salaries, particularly in certain industries. By working in these countries, individuals can increase their income and accelerate their debt repayment and wealth-building efforts. Examples of such countries include:

- Switzerland: Known for its high salaries and strong economy, Switzerland is an attractive destination for professionals in finance, technology, and healthcare.

- Singapore: With its booming economy and high demand for skilled professionals, Singapore offers lucrative job opportunities in various sectors.

- United Arab Emirates: The UAE, particularly Dubai and Abu Dhabi, offers tax-free salaries and high earning potential for expatriates.

Tax Benefits for Expatriates

Many countries offer tax benefits to expatriates, which can further enhance their financial situation. By taking advantage of these benefits, individuals can reduce their tax liability and allocate more funds towards debt repayment and savings.

Foreign Earned Income Exclusion (FEIE)

The Foreign Earned Income Exclusion (FEIE) allows U.S. citizens living abroad to exclude a certain amount of their foreign-earned income from U.S. taxes. As of 2021, the exclusion amount is $108,700. This can significantly reduce the tax burden for expatriates, allowing them to save more and pay off debt faster.

Tax Treaties

Many countries have tax treaties with the United States that prevent double taxation. These treaties can provide additional tax benefits for expatriates, further enhancing their financial situation. It is essential to consult with a tax professional to understand the specific benefits available under these treaties.

Case Studies: Success Stories of Financial Freedom Abroad

To illustrate the potential of achieving financial freedom abroad, let’s explore some real-life success stories of individuals who have managed to overcome student debt and build wealth by leveraging global opportunities.

Case Study 1: Sarah’s Journey to Financial Freedom in Thailand

Sarah, a recent college graduate with $50,000 in student loan debt, decided to move to Thailand to teach English. With a lower cost of living and a decent salary, she was able to save a significant portion of her income. Within five years, Sarah paid off her student loans and built a substantial emergency fund. She now enjoys a comfortable lifestyle and continues to save for her future.

Case Study 2: John’s High-Earning Career in Singapore

John, a software engineer with $80,000 in student loan debt, accepted a job offer in Singapore. With a higher salary and lower taxes, he was able to accelerate his debt repayment. Within three years, John paid off his student loans and started investing in the stock market. Today, he has a diversified investment portfolio and is on track to achieve financial independence.

Case Study 3: Emily’s Tax-Free Earnings in the UAE

Emily, a nurse with $60,000 in student loan debt, moved to Dubai for a lucrative job opportunity. With tax-free earnings and a high salary, she was able to pay off her student loans within four years. Emily now enjoys a debt-free lifestyle and has started investing in real estate to build long-term wealth.

Strategies for Achieving Financial Freedom Abroad

While moving abroad can provide significant financial benefits, it is essential to have a well-thought-out strategy to achieve financial freedom. Here are some key strategies to consider:

Create a Budget

Creating a budget is crucial for managing expenses and maximizing savings. By tracking income and expenses, individuals can identify areas where they can cut costs and allocate more funds towards debt repayment and savings.

Build an Emergency Fund

An emergency fund provides a financial safety net in case of unexpected expenses. It is essential to build an emergency fund before aggressively paying off debt or investing. A good rule of thumb is to save three to six months’ worth of living expenses.

Pay Off High-Interest Debt First

High-interest debt, such as credit card debt, can significantly hinder financial progress. It is essential to prioritize paying off high-interest debt before focusing on other financial goals. This can save money on interest payments and accelerate the journey to financial freedom.

Invest for the Future

Investing is a crucial component of building long-term wealth. By investing in a diversified portfolio of assets, individuals can grow their wealth over time and achieve financial independence. It is essential to understand the risks and rewards of different investment options and seek professional advice if needed.

Challenges and Considerations

While moving abroad can provide significant financial benefits, it is essential to consider the potential challenges and plan accordingly. Some key considerations include:

Cultural and Language Barriers

Living in a foreign country can present cultural and language barriers. It is essential to research and understand the local culture and language to ensure a smooth transition and successful integration.

Legal and Visa Requirements

Each country has its own legal and visa requirements for expatriates. It is crucial to understand and comply with these requirements to avoid legal issues and ensure a smooth relocation process.

Healthcare and Insurance

Access to healthcare and insurance can vary significantly between countries. It is essential to research and understand the healthcare system in the destination country and obtain adequate health insurance coverage.

Tax Implications

Living abroad can have complex tax implications, particularly for U.S. citizens who are subject to worldwide taxation. It is essential to consult with a tax professional to understand the tax obligations and benefits of living abroad.

Conclusion

Achieving financial freedom is a realistic goal, even for those burdened with student debt. By exploring opportunities abroad, individuals can take advantage of lower living costs, higher salaries, and tax benefits to accelerate their journey to financial independence. While there are challenges to consider, careful planning and a well-thought-out strategy can pave the way to a debt-free and prosperous future. The success stories of individuals like Sarah, John, and Emily demonstrate that with determination and the right opportunities, financial freedom is within reach.

In summary, moving abroad can be a powerful strategy for managing student debt and building wealth. By leveraging global opportunities, creating a budget, building an emergency fund, paying off high-interest debt, and investing for the future, individuals can achieve financial freedom and enjoy a fulfilling and prosperous life.