Cash Out Without Refinancing!

Access Your Home Equity Without Losing Your Low Rate

You’ve Never Had More Equity.

🔒Does not Affect Credit. No SSN until you’re ready.

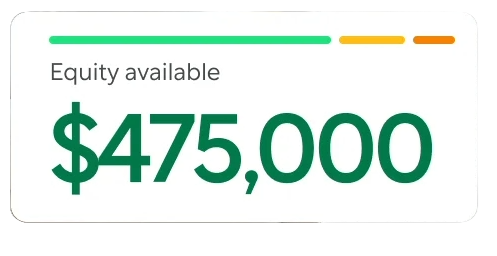

That’s $62,250 more than almost any other lender.

Up to 95% Loan to Value

Get Funded in 5 Days

🔒 Will not affect your credit.

Get the Cash You Need Without Leaving Home

- Apply with our 100% online application in minutes. With funding in as few as 5 days

- Borrow up to $400,000 using your home equity

- No need to wait for an in-person appraisal

- Get the funds you need now, and move forward with life

Tap Into Your Equity As Easy As...

Apply online within minutes.

No lengthy paperwork or in-person meetings needed with our streamlined online platform. Our loan experts are available to assist you at every step.

Choose Your Own Terms Online

This innovative tool allows you to custom-build your loan amount and repayment plan, selecting the terms that work best for your financial situation.

Get Funding Within 5 Days.

Quickly access your equity with funding available in as little as five days. Efficient and hassle-free, our process ensures you get the financial support you need without the wait.

🔒 Will not affect your credit.

Compare For Yourself

Explore the difference that sets us apart in the financial world. See how our innovative services and unmatched benefits distinguish us from the competition, ensuring you make an informed choice.

Experts at your service.

Meet the experts committed to providing you with exceptional financial solutions

FAQs

Application Process

What is a HELOC?

We have a fully digital online application process that will make streamline your experience. If you are not good with technology or prefer a human touch a loan officer is standing by to guide you on this journey.

Approval Process

How Much Paperwork is Required?

Once we have a completed mortgage application our technology will allow us to shop hundreds of lenders and thousands of loan programs. We call it a "Pricing Engine" and it allows us to consitently beat the big guys and local banks saving you thousands of dollars in the process.

Down Payments

Do I Need an Appraisal?

The answer to this question will vary depending on all the ciurcumstances. For example, if you are a 1st time home buyer with an income 120% or less of the median income for your area... there are 4 or 5 different ways to do it with 0% down. Click the button give us a bit of info and we can give you more accurate info specific to your situation,

Pre Approval

Why would I get a HELOC instead of refinancing?

Absolutely not! We can give you a very good idea without ANY paperwork or even pulling credit. We strongly recommed that you click the button on this page a submit an inquiry form so we can provide a quote tailored to you and your circumstances.

Not answered above?

If you would rather talk to a human and get your questions answers directly click the button below and give us a call.