-

Table of Contents

- Housing Crisis: Boomers Hoard, Millennials Struggle, Gen Z Thrives with Redfin’s Chen Zhao

- The Baby Boomer Effect: Hoarding Properties

- Reasons for Property Hoarding

- Impact on the Housing Market

- Millennials: The Struggle for Homeownership

- Financial Barriers

- Case Study: The Urban Millennial

- Millennials’ Response to the Crisis

- Gen Z: Thriving with Innovation

- Embracing Technology

- Case Study: Redfin’s Chen Zhao

- Gen Z’s Financial Strategies

- The Role of Policy and Regulation

- Incentives for Downsizing

- Affordable Housing Initiatives

- Regulating the Rental Market

- Conclusion

Housing Crisis: Boomers Hoard, Millennials Struggle, Gen Z Thrives with Redfin’s Chen Zhao

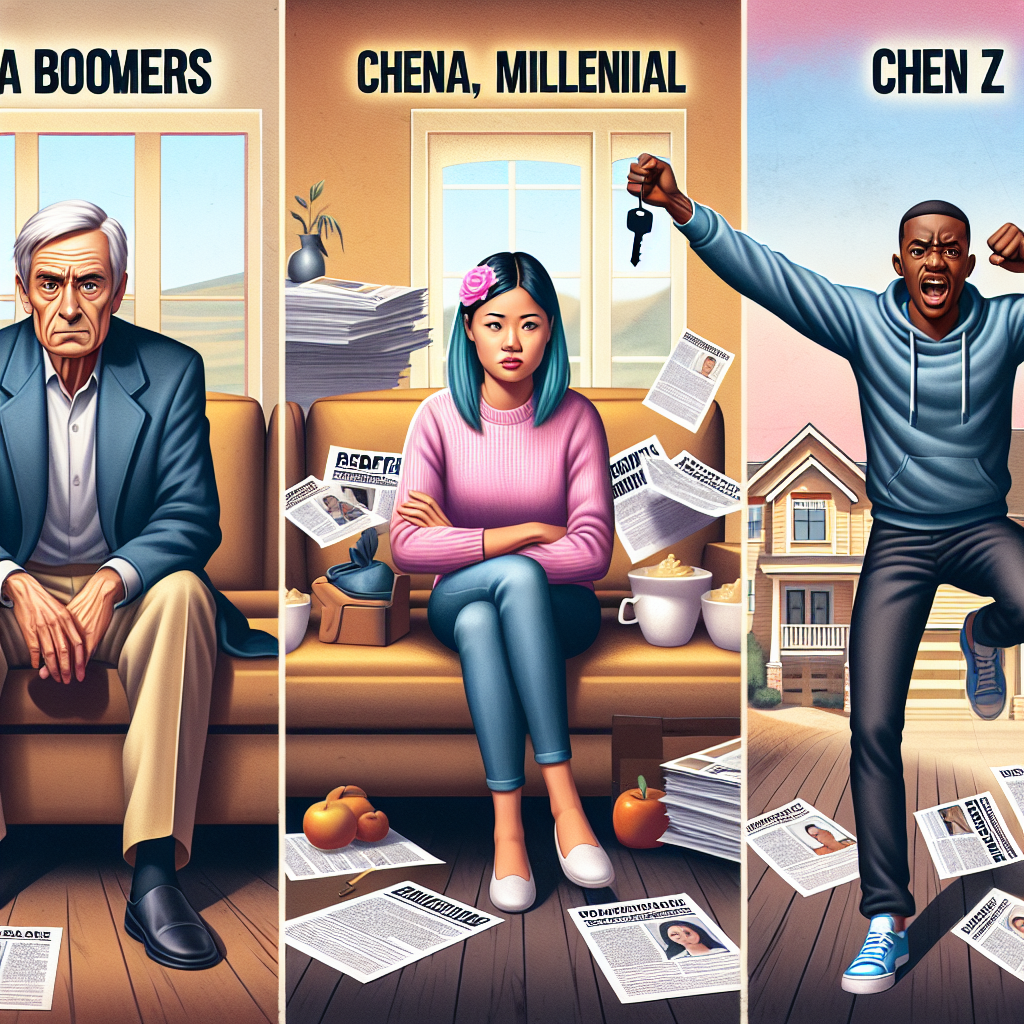

The housing market has been a topic of intense debate and concern for decades. As the dynamics of the market shift, different generations experience varying degrees of success and hardship. Baby Boomers, Millennials, and Gen Z are all navigating the housing landscape in unique ways. This article delves into the housing crisis, examining how Baby Boomers are hoarding properties, Millennials are struggling to find affordable homes, and Gen Z is finding innovative ways to thrive, with insights from Redfin’s Chen Zhao.

The Baby Boomer Effect: Hoarding Properties

Baby Boomers, born between 1946 and 1964, have had a significant impact on the housing market. As they age, many Boomers are choosing to stay in their homes longer, leading to a shortage of available properties for younger generations. This phenomenon, often referred to as “property hoarding,” has several implications for the housing market.

Reasons for Property Hoarding

- Emotional Attachment: Many Boomers have lived in their homes for decades and have a strong emotional attachment to their properties.

- Financial Security: Owning a home provides financial security, especially in retirement. Selling a home can be risky if the proceeds are not managed well.

- Low Inventory: The lack of available homes on the market makes it difficult for Boomers to find suitable downsizing options.

Impact on the Housing Market

The decision of Boomers to stay put has led to a significant reduction in the number of homes available for sale. According to a study by Freddie Mac, Baby Boomers are responsible for about 1.6 million homes being kept off the market. This shortage has driven up home prices, making it more challenging for younger generations to afford homes.

Millennials: The Struggle for Homeownership

Millennials, born between 1981 and 1996, are facing numerous challenges in their quest for homeownership. Despite being the largest generation in the workforce, many Millennials find it difficult to purchase homes due to several factors.

Financial Barriers

- Student Loan Debt: The average Millennial carries significant student loan debt, which affects their ability to save for a down payment.

- Stagnant Wages: Wage growth has not kept pace with the rising cost of living, making it harder for Millennials to accumulate wealth.

- High Home Prices: The shortage of available homes has driven up prices, putting homeownership out of reach for many Millennials.

Case Study: The Urban Millennial

Consider the case of Sarah, a 30-year-old marketing professional living in San Francisco. Despite earning a decent salary, Sarah struggles to save for a down payment due to high rent and student loan payments. She represents many urban Millennials who find themselves priced out of the housing market in major cities.

Millennials’ Response to the Crisis

In response to these challenges, many Millennials are delaying homeownership or seeking alternative living arrangements. Some are moving to more affordable cities, while others are opting for co-living spaces or renting indefinitely. According to a report by the Urban Institute, the homeownership rate for Millennials is about 8 percentage points lower than that of previous generations at the same age.

Gen Z: Thriving with Innovation

Gen Z, born between 1997 and 2012, is entering the housing market with a different set of expectations and strategies. Unlike Millennials, Gen Z is leveraging technology and innovative solutions to navigate the housing crisis.

Embracing Technology

- Online Platforms: Gen Z is using online platforms like Redfin to find and purchase homes. These platforms offer transparency and ease of use, making the home-buying process more accessible.

- Virtual Tours: Virtual tours and 3D walkthroughs allow Gen Z buyers to explore properties remotely, saving time and money.

- Blockchain Technology: Some Gen Z buyers are exploring blockchain technology for secure and transparent real estate transactions.

Case Study: Redfin’s Chen Zhao

Chen Zhao, an economist at Redfin, has been instrumental in helping Gen Z navigate the housing market. Zhao’s research highlights how Gen Z is using data-driven approaches to make informed decisions. For example, Redfin’s data shows that Gen Z buyers are more likely to use online tools to compare home prices and neighborhood statistics, giving them an edge in a competitive market.

Gen Z’s Financial Strategies

Gen Z is also adopting innovative financial strategies to achieve homeownership. Many are turning to gig economy jobs to supplement their income, while others are investing in cryptocurrencies and stocks to build wealth. Additionally, Gen Z is more likely to seek financial education and advice, helping them make smarter financial decisions.

The Role of Policy and Regulation

Government policies and regulations play a crucial role in shaping the housing market. To address the housing crisis, policymakers need to consider the unique challenges and needs of each generation.

Incentives for Downsizing

One potential solution is to offer incentives for Baby Boomers to downsize. This could include tax breaks or subsidies for moving into smaller homes or retirement communities. By freeing up larger homes, more properties would become available for younger buyers.

Affordable Housing Initiatives

To help Millennials and Gen Z, governments can invest in affordable housing initiatives. This could involve building more affordable housing units, offering down payment assistance programs, or implementing rent control measures to keep housing costs in check.

Regulating the Rental Market

With many Millennials and Gen Z opting to rent, it’s essential to regulate the rental market to ensure fair practices. This could include measures to prevent rent gouging, improve tenant rights, and encourage the development of high-quality rental properties.

Conclusion

The housing crisis is a complex issue that affects different generations in unique ways. Baby Boomers’ decision to stay in their homes has contributed to a shortage of available properties, driving up prices and making it difficult for Millennials to achieve homeownership. However, Gen Z is finding innovative ways to navigate the market, leveraging technology and adopting new financial strategies.

To address the housing crisis, policymakers must consider the needs of all generations and implement solutions that promote a balanced and equitable housing market. By offering incentives for downsizing, investing in affordable housing, and regulating the rental market, we can create a more sustainable and inclusive housing landscape for everyone.

Ultimately, the insights from Redfin’s Chen Zhao highlight the importance of data-driven approaches and innovative solutions in tackling the housing crisis. As we move forward, it’s crucial to continue exploring new strategies and technologies to ensure that everyone has access to safe, affordable, and comfortable housing.