-

Table of Contents

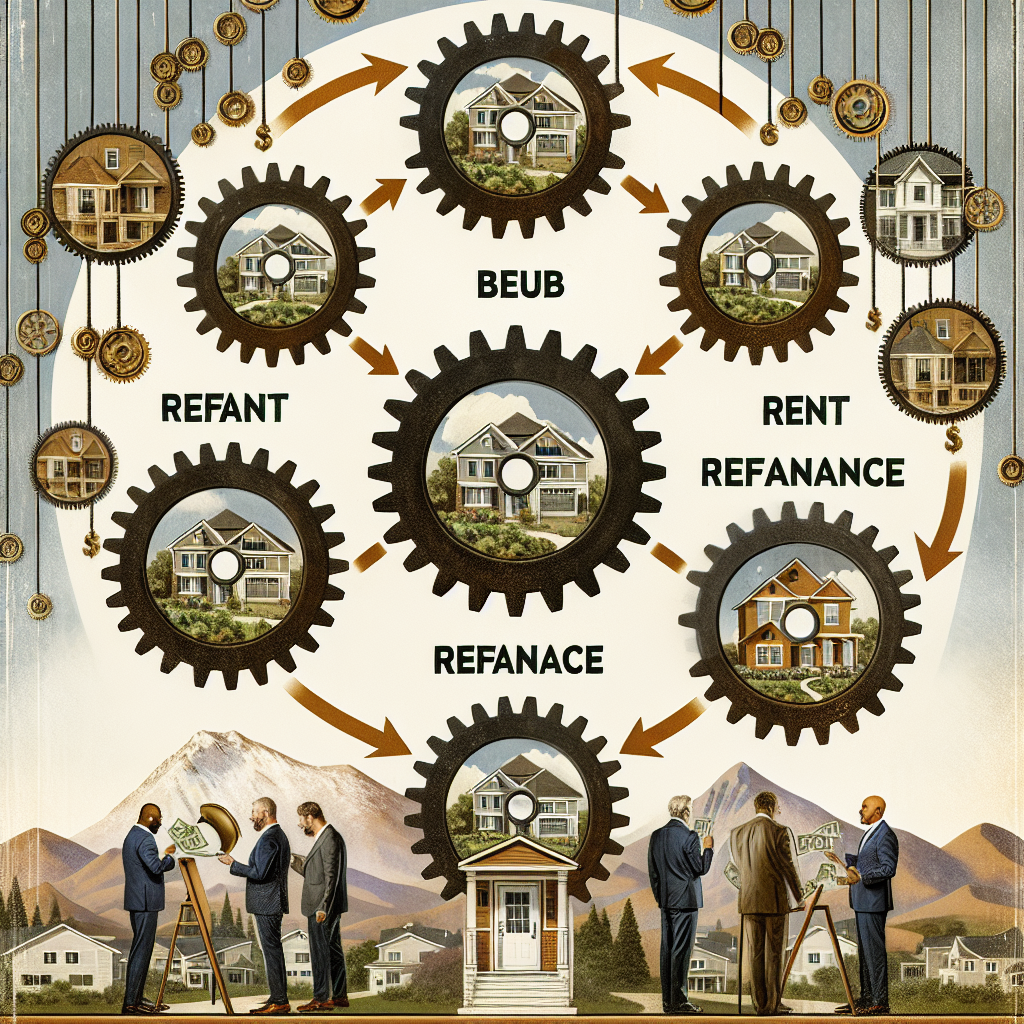

Mastering the BRRRR Method: Investing on Repeat

Real estate investing has long been a popular avenue for building wealth, and one strategy that has gained significant traction in recent years is the BRRRR method. BRRRR stands for Buy, Rehab, Rent, Refinance, and Repeat. This method allows investors to recycle their capital and grow their real estate portfolio efficiently. In this article, we will delve into the intricacies of the BRRRR method, providing valuable insights, examples, and case studies to help you master this powerful investment strategy.

Understanding the BRRRR Method

The BRRRR method is a systematic approach to real estate investing that involves five key steps:

- Buy: Acquiring a property at a below-market price.

- Rehab: Renovating the property to increase its value.

- Rent: Leasing the property to generate rental income.

- Refinance: Refinancing the property to pull out the increased equity.

- Repeat: Using the refinanced funds to purchase another property and repeating the process.

Each step is crucial to the success of the BRRRR method, and understanding how to execute each one effectively can significantly impact your investment returns.

Step 1: Buy

The first step in the BRRRR method is to buy a property at a below-market price. This often involves finding distressed properties, foreclosures, or properties in need of significant repairs. The goal is to purchase the property at a discount, allowing room for renovation costs and future appreciation.

Here are some tips for finding the right property:

- Network with real estate agents: Building relationships with local agents can help you gain access to off-market deals and distressed properties.

- Attend auctions: Foreclosure auctions can be a great source of discounted properties.

- Direct mail campaigns: Sending letters to property owners in targeted areas can uncover motivated sellers.

- Online platforms: Websites like Zillow, Redfin, and Realtor.com can help you identify potential investment properties.

Case Study: John, an experienced real estate investor, found a distressed property listed for $150,000 in a neighborhood where similar homes were selling for $250,000. After negotiating with the seller, he was able to purchase the property for $140,000, leaving ample room for renovations.

Step 2: Rehab

Once you have acquired the property, the next step is to rehab it. The goal of the rehab phase is to increase the property’s value through strategic renovations. This can include cosmetic updates, structural repairs, and modernizing outdated features.

Key considerations during the rehab phase:

- Budgeting: Create a detailed budget for the renovation, including labor, materials, and contingency funds.

- Hiring contractors: Work with reputable contractors who have experience with similar projects.

- Project management: Stay involved in the renovation process to ensure it stays on schedule and within budget.

- Value-adding improvements: Focus on renovations that will provide the highest return on investment, such as kitchen and bathroom upgrades.

Example: Sarah purchased a fixer-upper for $120,000 and allocated $30,000 for renovations. She focused on updating the kitchen, bathrooms, and flooring, which significantly increased the property’s value. After the rehab, the property was appraised at $200,000.

Step 3: Rent

With the property rehabbed and ready, the next step is to rent it out. Generating rental income is a crucial component of the BRRRR method, as it provides cash flow and helps cover the property’s holding costs.

Tips for successfully renting your property:

- Market research: Conduct thorough research to determine the market rent for similar properties in the area.

- Tenant screening: Implement a rigorous tenant screening process to ensure you select reliable and responsible tenants.

- Property management: Consider hiring a property management company to handle day-to-day operations, especially if you have multiple properties.

- Lease agreements: Use comprehensive lease agreements that clearly outline the terms and conditions of the rental.

Case Study: Mark rehabbed a property and listed it for rent at $1,800 per month. After conducting thorough tenant screenings, he found a reliable tenant who signed a one-year lease. The rental income covered the mortgage, taxes, and insurance, providing positive cash flow.

Step 4: Refinance

Once the property is rented and generating income, the next step is to refinance. Refinancing allows you to pull out the increased equity from the property, which can be used to fund future investments.

Key points to consider during the refinance process:

- Appraisal: Obtain an appraisal to determine the current market value of the property.

- Loan options: Explore different loan options, such as cash-out refinancing or home equity lines of credit (HELOC).

- Interest rates: Shop around for the best interest rates and loan terms.

- Loan-to-value ratio (LTV): Lenders typically allow you to borrow up to 75-80% of the property’s appraised value.

Example: After rehabbing and renting his property, John refinanced it with a new loan based on the appraised value of $250,000. With an 80% LTV, he was able to pull out $200,000, which he used to purchase another investment property.

Step 5: Repeat

The final step in the BRRRR method is to repeat the process. By using the funds from the refinance, you can purchase another property and start the cycle again. This allows you to build a portfolio of income-generating properties while continually recycling your capital.

Strategies for scaling your BRRRR investments:

- Leverage partnerships: Consider partnering with other investors to pool resources and share risks.

- Expand your network: Build relationships with lenders, contractors, and real estate professionals to streamline your investment process.

- Diversify locations: Explore different markets to find the best investment opportunities and mitigate risks.

- Monitor market trends: Stay informed about market trends and economic conditions that could impact your investments.

Case Study: Sarah successfully completed her first BRRRR project and used the refinanced funds to purchase two additional properties. By repeating the process, she was able to build a portfolio of five rental properties within three years, generating substantial passive income.

Benefits of the BRRRR Method

The BRRRR method offers several advantages for real estate investors:

- Capital efficiency: By recycling your capital through refinancing, you can grow your portfolio without constantly needing new funds.

- Equity growth: Strategic renovations increase the property’s value, allowing you to build equity quickly.

- Cash flow: Rental income provides a steady stream of cash flow, helping to cover expenses and generate profits.

- Portfolio diversification: Repeating the process allows you to diversify your investments across multiple properties and locations.

Challenges and Risks

While the BRRRR method can be highly profitable, it is not without its challenges and risks:

- Market fluctuations: Changes in the real estate market can impact property values and rental demand.

- Renovation costs: Unexpected renovation costs can eat into your budget and reduce your overall returns.

- Tenant issues: Dealing with problematic tenants can lead to vacancies, legal issues, and additional expenses.

- Financing hurdles: Securing favorable loan terms and interest rates can be challenging, especially for new investors.

Mitigating these risks requires careful planning, thorough research, and a proactive approach to property management.

Conclusion

The BRRRR method is a powerful strategy for real estate investors looking to build wealth and grow their portfolios. By following the steps of Buy, Rehab, Rent, Refinance, and Repeat, you can efficiently recycle your capital and generate substantial returns. While there are challenges and risks associated with this method, careful planning, diligent research, and strategic execution can help you overcome them and achieve success.

Key takeaways from mastering the BRRRR method include:

- Finding the right property at a below-market price is crucial for success.

- Strategic renovations can significantly increase the property’s value.

- Generating rental income provides cash flow and covers holding costs.

- Refinancing allows you to pull out equity and fund future investments.

- Repeating the process enables you to build a diversified portfolio of income-generating properties.

By understanding and implementing the BRRRR method, you can create a sustainable and profitable real estate investment strategy that allows you to invest on repeat.