-

Table of Contents

- Mortgage Approval 101: A Step-by-Step Guide to Securing Your Loan

- Understanding Mortgage Basics

- Types of Mortgages

- Step 1: Assess Your Financial Health

- Check Your Credit Score

- Calculate Your Debt-to-Income Ratio (DTI)

- Step 2: Determine Your Budget

- Consider Your Down Payment

- Estimate Your Monthly Payments

- Step 3: Get Pre-Approved

- Gather Necessary Documents

- Submit Your Application

- Step 4: Shop for a Mortgage

- Compare Interest Rates and Fees

- Consider Loan Terms

- Step 5: Submit Your Mortgage Application

- Complete the Loan Application

- Pay for an Appraisal

- Step 6: Underwriting and Approval

- Provide Additional Documentation

- Receive Conditional Approval

- Step 7: Closing the Loan

- Review the Closing Disclosure

- Attend the Closing Meeting

- Conclusion

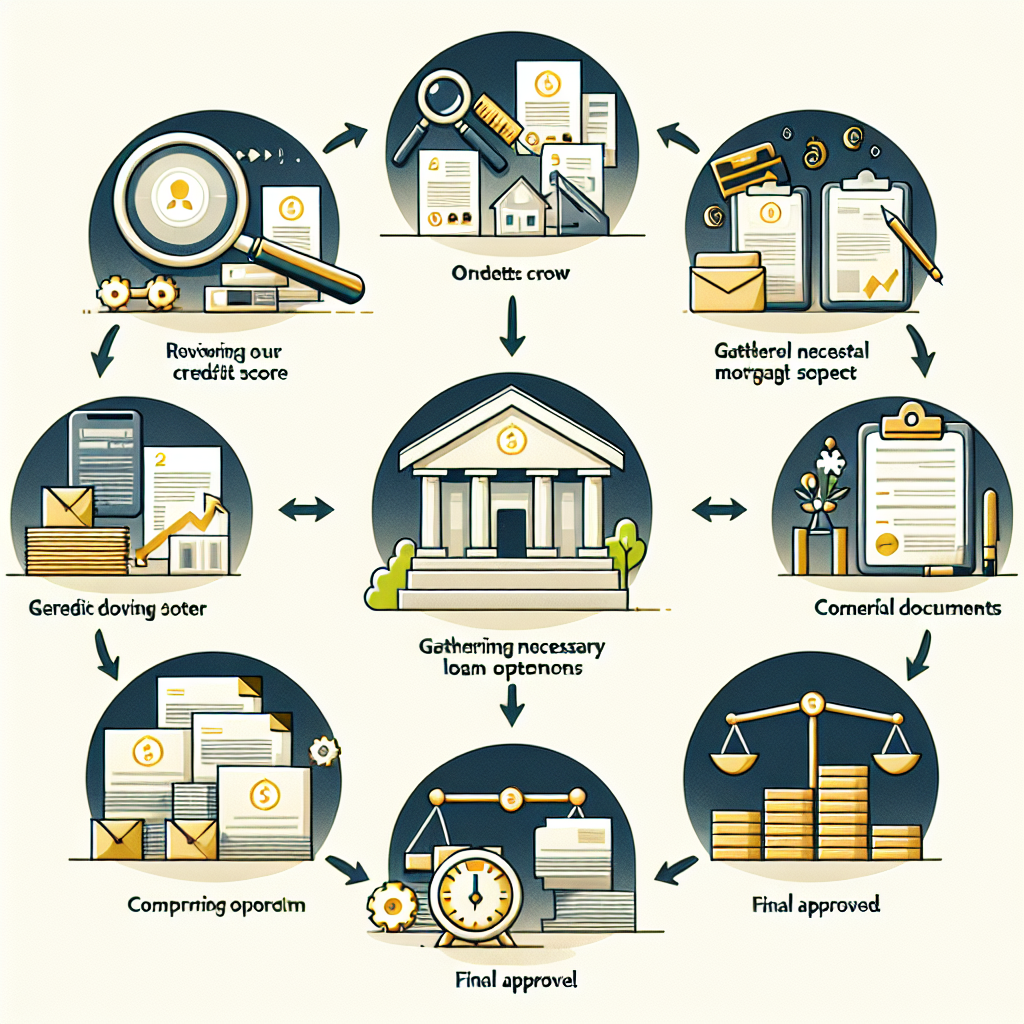

Mortgage Approval 101: A Step-by-Step Guide to Securing Your Loan

Securing a mortgage is a significant milestone in the journey to homeownership. However, the process can be complex and daunting, especially for first-time buyers. This comprehensive guide will walk you through each step of the mortgage approval process, providing valuable insights, examples, and tips to help you navigate the journey with confidence.

Understanding Mortgage Basics

Before diving into the approval process, it’s essential to understand the basics of mortgages. A mortgage is a loan used to purchase real estate, where the property itself serves as collateral. The borrower agrees to repay the loan over a specified period, typically 15 to 30 years, with interest.

Types of Mortgages

There are several types of mortgages available, each with its own set of terms and conditions:

- Fixed-Rate Mortgage: The interest rate remains constant throughout the loan term, providing predictable monthly payments.

- Adjustable-Rate Mortgage (ARM): The interest rate is initially fixed for a specified period, then adjusts periodically based on market conditions.

- FHA Loan: Insured by the Federal Housing Administration, these loans are designed for low-to-moderate-income borrowers and require a lower down payment.

- VA Loan: Available to veterans and active-duty military personnel, these loans are guaranteed by the Department of Veterans Affairs and often require no down payment.

- Jumbo Loan: These loans exceed the conforming loan limits set by the Federal Housing Finance Agency and are used for high-value properties.

Step 1: Assess Your Financial Health

The first step in securing a mortgage is to assess your financial health. Lenders will evaluate your financial situation to determine your eligibility and the terms of your loan.

Check Your Credit Score

Your credit score is a critical factor in the mortgage approval process. It reflects your creditworthiness and influences the interest rate you’ll receive. A higher credit score can lead to better loan terms.

To check your credit score:

- Request a free credit report from the three major credit bureaus: Equifax, Experian, and TransUnion.

- Review your report for errors and dispute any inaccuracies.

- Take steps to improve your score, such as paying down debt and making timely payments.

Calculate Your Debt-to-Income Ratio (DTI)

Lenders use your debt-to-income ratio (DTI) to assess your ability to manage monthly payments. Your DTI is calculated by dividing your total monthly debt payments by your gross monthly income.

For example, if your monthly debt payments total $1,500 and your gross monthly income is $5,000, your DTI is 30%.

Most lenders prefer a DTI of 43% or lower. To improve your DTI:

- Pay off existing debts.

- Increase your income through a raise or additional employment.

Step 2: Determine Your Budget

Before applying for a mortgage, it’s essential to determine how much you can afford to borrow. This will help you narrow down your property search and avoid overextending yourself financially.

Consider Your Down Payment

Your down payment is the initial amount you pay toward the purchase of your home. It affects the size of your mortgage and your monthly payments. A larger down payment can lead to lower monthly payments and better loan terms.

Common down payment options include:

- 20% Down Payment: This is the traditional standard and can help you avoid private mortgage insurance (PMI).

- 3.5% Down Payment: Available for FHA loans, this option is suitable for buyers with limited savings.

- 0% Down Payment: Available for VA loans, this option is ideal for eligible veterans and military personnel.

Estimate Your Monthly Payments

Use an online mortgage calculator to estimate your monthly payments based on different loan amounts, interest rates, and down payment percentages. Consider additional costs such as property taxes, homeowners insurance, and maintenance expenses.

Step 3: Get Pre-Approved

Getting pre-approved for a mortgage is a crucial step in the homebuying process. It demonstrates to sellers that you are a serious buyer and provides a clear picture of your borrowing capacity.

Gather Necessary Documents

To get pre-approved, you’ll need to provide your lender with various financial documents, including:

- Proof of income (pay stubs, tax returns, W-2 forms)

- Bank statements

- Proof of assets (investment accounts, retirement accounts)

- Identification (driver’s license, Social Security number)

Submit Your Application

Once you’ve gathered the necessary documents, submit your pre-approval application to your chosen lender. The lender will review your financial information and provide a pre-approval letter stating the loan amount you qualify for.

Step 4: Shop for a Mortgage

With your pre-approval in hand, it’s time to shop for the best mortgage terms. Different lenders offer varying interest rates, fees, and loan terms, so it’s essential to compare multiple options.

Compare Interest Rates and Fees

Interest rates can significantly impact the total cost of your mortgage. Even a small difference in rates can lead to substantial savings over the life of the loan. Additionally, consider the fees associated with each loan, such as origination fees, closing costs, and prepayment penalties.

Consider Loan Terms

Loan terms, such as the length of the loan and the type of interest rate, can affect your monthly payments and overall cost. Common loan terms include:

- 15-Year Fixed-Rate Mortgage: Higher monthly payments but lower total interest paid over the life of the loan.

- 30-Year Fixed-Rate Mortgage: Lower monthly payments but higher total interest paid over the life of the loan.

- 5/1 ARM: Fixed interest rate for the first five years, then adjusts annually based on market conditions.

Step 5: Submit Your Mortgage Application

Once you’ve selected a lender and mortgage product, it’s time to submit your formal mortgage application. This step involves providing detailed information about your financial situation and the property you’re purchasing.

Complete the Loan Application

Your lender will provide a loan application form, often referred to as the Uniform Residential Loan Application (URLA). You’ll need to provide information about:

- Your employment history

- Your income and assets

- Your debts and liabilities

- The property you’re purchasing

Pay for an Appraisal

Your lender will require an appraisal to determine the property’s market value. The appraisal ensures that the loan amount does not exceed the property’s value. You’ll typically be responsible for the appraisal fee, which can range from $300 to $500.

Step 6: Underwriting and Approval

After submitting your application, your lender will begin the underwriting process. During this stage, the lender will thoroughly review your financial information and the property’s details to assess the risk of lending to you.

Provide Additional Documentation

The underwriter may request additional documentation or clarification on certain aspects of your application. Be prepared to provide any requested information promptly to avoid delays.

Receive Conditional Approval

If the underwriter is satisfied with your application, you’ll receive conditional approval. This means that your loan will be approved once you meet specific conditions, such as providing additional documentation or resolving any outstanding issues.

Step 7: Closing the Loan

The final step in the mortgage approval process is closing the loan. This involves signing the necessary paperwork and paying any closing costs.

Review the Closing Disclosure

Three days before closing, you’ll receive a Closing Disclosure (CD) outlining the final terms of your loan, including the interest rate, monthly payments, and closing costs. Review the CD carefully to ensure that all terms are accurate and match your expectations.

Attend the Closing Meeting

At the closing meeting, you’ll sign the loan documents and pay any required closing costs. These costs can include:

- Origination fees

- Appraisal fees

- Title insurance

- Property taxes

- Homeowners insurance

Once all documents are signed and funds are transferred, you’ll receive the keys to your new home.

Conclusion

Securing a mortgage is a multi-step process that requires careful planning and preparation. By understanding the basics of mortgages, assessing your financial health, getting pre-approved, shopping for the best terms, and navigating the underwriting and closing stages, you can successfully secure a loan and achieve your dream of homeownership.

Remember, each step in the process is crucial, and taking the time to thoroughly prepare can lead to better loan terms and a smoother homebuying experience. With this guide, you’re well-equipped to embark on your journey to securing a mortgage and purchasing your new home.