Refinancing your rental property loan offers significant financial advantages. From lowering interest rates to increasing rental income, the benefits can transform your investment strategy.

In this comprehensive guide, we explore the steps to refinancing, key requirements, and tips to choose the best lender. Dive in to maximize your financial benefits and steer clear of common pitfalls.

Understanding the Benefits of Refinancing Your Rental Property Loan

Lowering Your Interest Rate

Reducing the interest rate on your mortgage is one of the top advantages of refinancing. A lower rate typically results in a lower monthly payment. This can free up extra funds that can be utilized for dealing with maintenance issues or enhancements to your rental property.

Imagine upgrading the kitchen appliances or enhancing the curb appeal of your rental property. Refinancing at a lower rate could make these improvements feasible. It’s equivalent to getting a discount on your financing—an opportunity to invest more in your property while saving money.

“Refinancing at a lower interest rate can reduce your monthly mortgage payments, increase your rental income, and provide funds for property upgrades.”

When you secure a lower rate, you’re effectively reducing the cost of borrowing money. This can have a significant impact on your overall financial health. Are you using the extra funds to pay off the mortgage sooner, or perhaps setting them aside for future investments?

Adjusting Your Mortgage Term

Switching from a 30-year mortgage to a 15-year mortgage can be a strategic move. By shortening the loan term, you can build equity more quickly. This is particularly advantageous if you manage multi-unit properties and rely on rental income to expedite equity accumulation.

Consider the scenario of owning a duplex with consistent rental income. Refinancing to a shorter term could mean a higher monthly payment but also faster equity growth. Is this approach aligned with your financial goals?

- Accelerated Equity Building: A shorter term helps in accumulating equity more rapidly.

- Potential Savings: You could save significant amounts on interest over the life of the loan.

However, it’s crucial to ensure that you can handle the increased monthly payments, especially during vacancies. A solid financial cushion is vital for managing any unforeseen situations.

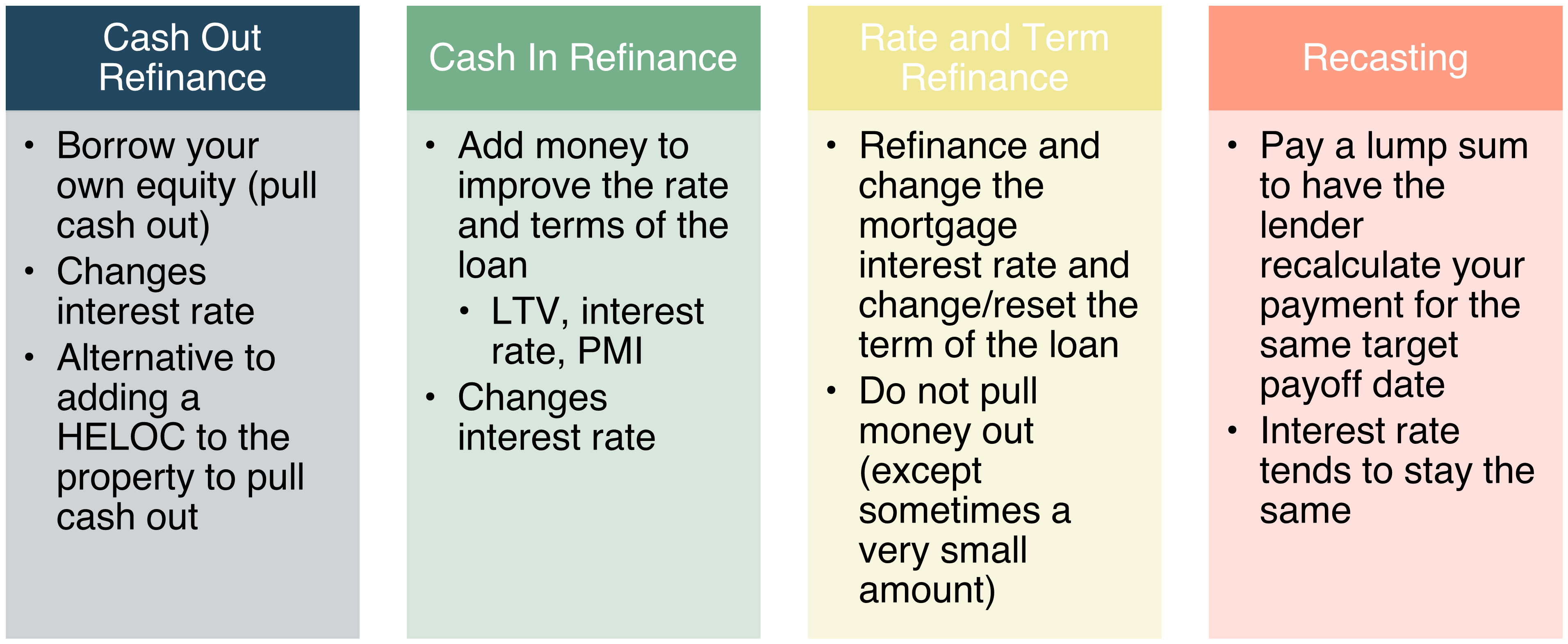

Tapping Into Home Equity

If your property has appreciated in value, you may have built substantial equity. A cash-out refinance allows you to borrow against this equity and reinvest in your property. This can mean modernizing the interiors, adding new amenities, or even expanding the property.

Consider using the additional funds to upgrade appliances, improve landscaping, or renovate kitchens and bathrooms. These enhancements not only increase the property’s value but also justify higher rental rates.

“Leveraging home equity through cash-out refinancing can finance significant property improvements, potentially increasing rental income.”

- Property Upgrades: Modernize and enhance the appeal of your rental units.

- Increased Rental Potential: Well-maintained properties attract quality tenants and command higher rents.

This strategy can be particularly beneficial if the improvements lead to higher rental income. Does upgrading your property align with your investment strategy?

Increasing Rental Income

Refinancing can directly impact your rental income. By securing lower interest rates and utilizing funds for property improvements, you can position your rental property competitively in the market.

Rental properties that are well-maintained and modernized often attract higher-paying tenants. The funds from a refinance can be used to undertake these necessary upgrades, making your property more attractive.

- Enhanced Property Value: Upgraded properties can charge premium rents.

- Higher Tenant Retention: Quality improvements can lead to longer tenant stays.

Moreover, paying off smaller mortgages faster through refinancing can leave you with a clear rental income stream. How would an increase in rental income transform your financial standing?

By strategically refinancing, you can unlock hidden potential in your rental properties, setting the stage for enhanced profitability and sustained growth.

Steps to Successfully Refinance Your Rental Property

Building Equity in Your Property

One of the foundational steps in refinancing your rental property is ensuring you have built sufficient equity. Most lenders require a minimum of 20% equity in the property, although some programs may accept as low as 15%. This equity acts as a cushion against the loan and reduces the lender’s risk.

Think of equity as the portion of your property that you own outright. It’s calculated by subtracting the outstanding loan balance from the property’s current market value.

Accumulating equity can occur through the appreciation of property value over time or paying down the existing mortgage. For instance, if your property is worth $500,000 and you owe $400,000, you have $100,000 in equity, which is 20%.

Why is equity crucial? It not only affects your eligibility for refinancing but also the loan terms you’ll receive. Higher equity can translate into better interest rates and more favorable conditions.

Are there strategies to build equity faster? Yes, consider making extra mortgage payments towards the principal or undertaking improvements that boost the property’s market value.

An important consideration is avoiding an “underwater” mortgage, where the property’s value is less than the loan balance. If you find yourself in this situation, explore special refinance programs that some lenders might offer.

Property owners need to keep an eye on the housing market trends. Periods of property value appreciation can significantly impact your equity standings.

Ultimately, the more equity you have, the stronger your application will be. Consequently, building and maintaining equity is a paramount step in the refinancing journey.

Gathering Necessary Documentation

Preparing to refinance your rental property involves gathering extensive documentation. This paperwork is crucial for lenders to assess your financial health and the property’s viability.

What specific documents are needed? Here’s a detailed list:

- Proof of Income: Recent pay stubs or employment verification documents are required to confirm your income.

- Tax Returns: Generally, lenders request at least two years of tax returns to verify employment history and income.

- Personal Details: Information like your full name, address, social security number, and date of birth is necessary for a credit check.

- Explanatory Letters: If there are gaps in income or negative marks on your credit history, you may need to provide explanatory letters to your lender.

- Homeowners Insurance Policy: Proof of sufficient insurance coverage to protect the property is also mandatory.

- Recorded Deed: This document shows your legal claim to the property and is a necessity for refinancing.

Having these documents ready can streamline the refinancing process. Missing paperwork or incomplete information can result in delays or even rejection of your application.

For those with properties previously rented out, remember that lenders might allow a portion of the rental income to be considered part of your income. Specifically, up to 75% of the rent could be included.

Accuracy and completeness cannot be overstated. Ensuring your documentation is thorough and exact can facilitate a smoother approval process, allowing you to move forward efficiently.

Comparing Refinance Rates

Securing the best refinance rate is a critical step in the refinancing process. Rates can significantly affect your monthly payments and overall loan cost.

What factors should you consider when comparing rates from different lenders? Here are some key elements:

“Lower interest rates can equate to substantial savings over the life of the loan.”

First, look at the interest rates different lenders offer. Even a slight difference in rates can result in considerable savings. For example, a 0.5% lower rate on a $300,000 loan could save you thousands over the term.

Next, consider the loan terms. Some lenders might offer better rates for shorter terms, while others might be more favorable over longer periods. Evaluate what works best for your financial strategy.

In addition, pay attention to closing costs. Some lenders may have lower interest rates but higher closing costs, offsetting the benefits. It’s essential to get a detailed estimate and understand all potential charges.

How can you effectively compare rates? Utilize online tools and platforms to view rate comparisons, but also speak directly with lenders. Building relationships with loan officers can sometimes yield better deals, especially if you have a good standing with your current lender.

Don’t overlook customer service. A lender’s reputation and support can make the refinancing journey smoother. Look for reviews and testimonials to gauge this aspect.

Finally, negotiate. If you find a better rate elsewhere, don’t be afraid to ask your preferred lender to match or beat it. Refinancing is a competitive market, and lenders often have some flexibility to retain or gain your business.

Applying for Refinancing

Once you’ve built your equity, gathered your documents, and compared rates, the final step is applying for refinancing. This step requires detailed attention to ensure a successful application.

Start by contacting your chosen lender. Initiate the process by filling out their application form. The accuracy of the information provided is crucial, as any discrepancies can delay or jeopardize the approval.

What comes next? Submit the required documents you’ve prepared. Ensure they are up-to-date and accurately reflect your financial situation and property status.

After submission, maintain regular communication with the lender. Respond promptly to any inquiries or requests for additional information. This proactive approach can keep the process moving smoothly.

Prepare for a possible appraisal. Lenders often require an appraisal to confirm the property’s value and the market rent. Be ready to accommodate the appraiser and provide any necessary information.

- Initial Application: Complete the lender’s application form with accurate details.

- Document Submission: Provide all the necessary financial and property documents.

- Appraisal Coordination: Arrange for and cooperate with the appraisal process.

Once the lender has all the required information, they will review your application. This review process includes evaluating your financial health, the property’s value, and your creditworthiness.

If everything checks out, the lender will issue a loan approval. Review the terms and conditions carefully before proceeding. Ensure you fully understand your new loan’s structure, including payments, rate, and term.

The final stage includes signing the loan documents and completing any final requirements set by the lender. After all formalities, you’ll successfully refinance your rental property, hopefully with better terms and savings.

Key Requirements for Refinancing a Rental Property Loan

Equity Requirements

To refinance a rental property loan, having adequate equity is crucial. Lenders generally look for a loan-to-value (LTV) ratio that does not exceed 75%. This means you will need at least 25% equity in your property. For instance, if your property is worth $400,000, you should have no more than a $300,000 loan balance to meet the equity requirement.

Why do lenders emphasize equity? Equity acts as a cushion, reducing the lender’s risk should property values decline. It demonstrates that you have invested a significant amount into the property, which aligns your interests with those of the lender.

“As a general rule, most lenders want to see a loan-to-value ratio (LTV) that’s lower than 75%, meaning you’d need to have at least 25% equity in your property.”

Meeting the LTV criteria is essential, but it isn’t just about numbers. Your property needs to undergo a professional appraisal to affirm its current market value. The appraisal process, which typically involves a thorough inspection, ensures that your property is worth what you claim it to be.

In some cases, lenders might accept a broker price opinion (BPO); however, an actual appraiser’s assessment is usually insisted upon. This appraisal not only validates your equity but also reassures the lender of the property’s condition and marketability.

Securing an accurate appraisal requires preparation. Ensuring the property is well-maintained and addressing any noticeable issues beforehand can positively influence the appraisal outcome, thereby supporting your refinancing application.

Debt-to-Income Ratio

Lenders scrutinize the debt-to-income (DTI) ratio meticulously when considering refinancing applications for rental properties. This ratio compares your monthly debt payments to your gross monthly income, reflecting your ability to manage monthly payments.

While primary residences might allow a DTI of up to 50% under certain conditions, the threshold for rental properties is stricter. Typically, lenders cap the DTI ratio at around 43% due to the perceived higher risk associated with investment properties.

The rationale behind this stricter requirement is simple: lenders perceive investment properties as inherently riskier. Given the potential for tenant vacancies or fluctuating rental income, the lower DTI limit provides an additional layer of financial security.

- Monthly Mortgage Statements: Lenders will require statements for both the property you’re refinancing and any additional properties you own to verify your monthly obligations.

- Current Leases: These documents can sometimes substitute tax returns, particularly if you’ve recently acquired or renovated the property.

Effectively managing your DTI ratio involves careful financial planning. Ensuring all rental properties are occupied and generating consistent income, and maintaining a balanced portfolio can positively impact this crucial metric.

Credit Score Minimums

Credit scores play a pivotal role in the refinancing process for rental properties. Generally, lenders require a higher credit score for investment properties than for primary residences. Typically, a minimum credit score of around 620-640 is expected; however, a higher score can significantly improve your refinancing options.

Why is your credit score so crucial? The credit score indicates your creditworthiness and financial discipline. A higher credit score demonstrates a history of managing debt responsibly, which reassures lenders of your reliability.

To enhance your credit score, consider the following tips:

- On-Time Payments: Ensure all debt obligations, including mortgages and credit cards, are paid promptly.

- Credit Utilization: Keep your credit card balances low relative to your credit limits.

- Debt Management: Avoid taking on unnecessary new debt, which can negatively impact your score.

By improving your credit score, you not only meet minimum requirements but also potentially secure more favorable refinancing terms, such as lower interest rates.

Proof of Cash Reserves

Another critical criterion for refinancing a rental property loan is demonstrating sufficient cash reserves. Lenders want to see that you have adequate funds to cover several months of mortgage payments, further mitigating their risk.

Cash reserves are essentially a safety net, ensuring that you can continue making payments even if rental income temporarily ceases or unexpected expenses arise. Typically, lenders require proof of reserves for at least two to six months of mortgage payments.

- Recent Bank Statements: Lenders will review your latest bank statements to verify your financial stability and cash reserves.

- Retirement Accounts: Funds in retirement accounts like 401(k)s can sometimes count towards your reserves, provided no restrictions exist on accessing these funds during emergencies.

Maintaining healthy cash reserves not only enhances your creditworthiness but also provides peace of mind, ensuring you are well-prepared for any financial contingencies.

How to Choose the Best Refinance Lender for Your Rental Property

Evaluating Lender Offers

One of the crucial steps in selecting the best refinance lender for your rental property involves evaluating lender offers thoroughly. By comparing terms, interest rates, and additional costs from various lenders, you gain a comprehensive understanding of your options.

Have you considered the importance of comparing at least three offers? It enables you to identify the best refinancing terms suitable for your financial situation.

“Getting pre-approved by at least three lenders gives you an idea about your range of choices,” says Tom Schneider, VP of product management at Pathway Homes.

It’s essential to ask about origination fees and other closing costs before you apply. Many lenders who offer lower interest rates compensate by charging higher origination fees, and vice versa.

Would you prefer lower interest rates or minimized upfront costs? Knowing your preferences can help determine the right offer for you.

Lastly, understand that rental property mortgages usually come with higher interest rates than primary residences, which could influence your decision.

Considering Your Current Lender

Many rental property owners overlook the potential benefits of refinancing with their current lender. However, this option can often be advantageous.

Since your lender is already familiar with your payment history and financial situation, you might qualify for more favorable terms or expedited processing.

Additionally, continuing with your current lender can streamline the process. Why change lenders if your current one can offer competitive terms?

Nevertheless, it’s still essential to compare external offers to ensure you’re receiving the best possible deal.

Did you know that some lenders offer loyalty discounts to long-term clients? Inquiring about such incentives can be beneficial.

Checking Customer Reviews

Customer reviews can provide valuable insights into a lender’s reliability and service quality. Why not leverage the experiences of others to inform your decision?

Look for feedback on aspects like customer service, transparency, and satisfaction. How well does the lender handle inquiries and resolve issues?

Online platforms and financial forums are great places to find honest reviews from fellow rental property owners.

What do previous clients say about the lender’s responsiveness and professionalism? Assessing these reviews can help ease the uncertainty in your decision-making process.

“Researching reviews ensures you choose a lender that meets your expectations,” says an industry expert.

Understanding Fees and Costs

When refinancing, understanding the associated fees and costs is paramount to making an informed decision.

Did you know that higher appraisal fees are typical for rental properties compared to primary residences?

This is because lenders need additional reports about your rental income and comparable rentals in the area.

Additionally, origination fees can vary significantly between lenders. Have you asked about these fees in your discussions with potential lenders?

Lastly, while specialized lenders may charge higher rates because they cater to a niche market, they often work faster. Is speed a priority in your refinancing needs?

Considering all these factors will help you make a choice that aligns with your financial goals and circumstances.

Common Pitfalls to Avoid When Refinancing Your Rental Property

Ignoring Closing Costs

It’s essential to be aware that refinancing your rental property isn’t free. There are various costs involved that you need to consider. These include closing costs and lender fees. Often, property owners overlook these expenses, which can lead to financial surprises down the line.

Imagine expecting to save money with a lower interest rate but ending up paying a significant amount upfront. This scenario highlights the importance of understanding all costs associated with refinancing.

Closing costs can include charges for a new property survey or appraisal. These fees can add up, potentially offsetting the benefits of refinancing.

“You’ll have to pay some money upfront. Like any other mortgage, you’ll have to cover closing costs and lender fees.”

It’s advisable to have a detailed breakdown of all expected costs. This way, you can make an informed decision about whether refinancing is indeed a financially sound move.

Wouldn’t it be frustrating to think you’re saving money only to find out that the closing costs are eating into those supposed savings? Be sure to factor in every expense to get a clear picture of the financial impact.

- Closing Costs: Charges associated with finalizing the mortgage, including lender and third-party fees.

- Lender Fees: Costs imposed by the lender, which might include application fees and origination fees.

- Property Survey/Appraisal: Necessary evaluations of the property’s value, paid out of your pocket.

Always obtain a comprehensive estimate of these costs before proceeding. Understanding these fees will prevent unpleasant surprises later.

Not Shopping Around

Another critical mistake is not shopping around for the best refinancing deal. Why settle for the first offer when better options might be available? By comparing different offers, you ensure you’re getting the best terms possible.

Refinancing deals can vary significantly between lenders. One might offer lower interest rates, while another provides better loan terms. It’s crucial to evaluate all aspects before deciding.

Think of it as choosing a contractor for a renovation project. Wouldn’t you want to compare quotes and services before making a choice? The same logic applies to refinancing your rental property.

“Be sure to factor in all the costs of refinancing a loan, including a change in interest rates, and make sure it’ll save you money.”

Use online tools and consult with multiple lenders. This approach will give you a broad perspective on what different institutions are offering.

- Interest Rates: Compare to find the most favorable rates.

- Loan Terms: Ensure terms align with your financial goals.

- Additional Fees: Beware of hidden fees that could affect your financial standing.

Why risk missing out on a better deal by not exploring your options? Shopping around can significantly impact your overall savings and financial health.

Overlooking Loan Terms

Understanding the terms of your new loan is crucial. Refinancing without thoroughly reviewing these terms can lead to future financial strain. The loan’s interest rate, payment schedule, and any penalties for early repayment are critical factors to consider.

For instance, a lower interest rate might seem attractive, but if the loan has a long term, you could end up paying more in interest over time. It’s essential to balance the interest rate with the loan term.

Loan terms can also include prepayment penalties. These penalties can be costly if you decide to pay off your loan early, thus affecting your financial planning.

- Interest Rate: A lower rate isn’t always better; consider the overall cost over the loan’s life.

- Prepayment Penalties: Fees charged for paying off the loan early.

- Payment Schedule: Ensure the monthly payments fit your budget.

Why overlook these details when they can have a profound impact on your long-term financial health? Always review and understand all loan terms before finalizing your refinancing decision.

Underestimating Future Financial Needs

Lastly, failing to anticipate future financial needs can lead to challenges down the road. When refinancing, it’s important to consider how your financial situation might change.

Imagine planning for a child’s education or an unexpected medical expense. Would your refinanced loan’s terms accommodate such changes? Being proactive about future financial needs can help you avoid refinancing pitfalls.

Consider the stability of your rental income. Will it be enough to cover the new loan payments if the market fluctuates or if the property remains vacant?

“It will take time to build back up the equity you used.”

Build a financial cushion to cover unexpected expenses. This cushion can provide security and ensure that you are prepared for any economic changes.

- Emergency Fund: Set aside funds to cover unforeseen expenses.

- Income Stability: Evaluate the reliability of your rental income.

- Future Expenses: Anticipate costs such as education, healthcare, or major repairs.

By considering your future financial needs, you can make a more informed decision about refinancing your rental property, avoiding unnecessary stress and potential financial difficulties.

Maximizing the Financial Benefits of Your Refinance

Using Equity for Improvements

Refinancing a rental property offers an excellent opportunity to tap into the property’s equity for making significant improvements. The equity you’ve built up can be used to upgrade the property, which, in turn, can attract higher-paying tenants.

Consider the long-term benefits of investing in renovations.

“Quality improvements can significantly increase the property’s value and rental income potential.”

By upgrading kitchens, bathrooms, or adding energy-efficient features, you not only enhance tenant satisfaction but also potentially increase your property’s market value.

Which improvements should be prioritized? Think about which upgrades will provide the highest returns. For instance, kitchens and bathrooms often yield the greatest return on investment. Additionally, consider installing modern amenities that cater to the needs of prospective tenants.

- Upgraded Appliances: Tenants appreciate modern, energy-efficient appliances, which can also lower utility costs.

- Enhanced Security: Installing advanced security systems can make the property more attractive to tenants.

- Landscaping: Curb appeal matters. Well-maintained lawns and appealing outdoor spaces can draw in potential renters.

It is crucial to note that, using equity for improvements can be a strategic move to maximize the financial benefits of your refinance by boosting both property value and rental income.

Boosting Rental Income

One of the primary goals of refinancing a rental property is to improve cash flow. By refinancing, you can lower your mortgage payments, freeing up more cash each month.

But how can this surplus be used to boost rental income? First, consider

“reinvesting the savings into property upgrades.”

If your property is more attractive and functional, you can justify higher rent, thereby increasing your monthly income.

Also, think about market dynamics. Are rental rates in your area on the rise? If so, a well-timed refinance can help you capitalize on these trends. By analyzing market conditions, you can make informed decisions that align with your financial goals.

- Market Analysis: Examine local rental rates and trends to determine the right time for a refinance.

- Tenant Retention: Ensure that your property improvements contribute to tenant satisfaction and retention.

- Rent Adjustment: Regularly review and adjust rent to stay competitive and maximize income.

Boosting rental income through refinancing involves not just saving on mortgage payments, but also strategically reinvesting those savings in ways that attract and retain tenants.

Paying Off High-Interest Debt

Refinancing can be an effective strategy for managing your financial portfolio, especially when dealing with high-interest debts. Why not use the equity from your rental property to pay off high-interest loans?

High-interest debts, such as credit card balances or personal loans, can be burdensome. By using the proceeds from a refinance, you can consolidate these debts into a lower interest rate mortgage.

“This approach not only simplifies your financial obligations but also reduces the amount of interest paid over time.”

For instance, if your credit card debt carries a 20% interest rate, refinancing your rental property at a lower mortgage rate can save you substantial sums of money.

- Interest Savings: Lower mortgage rates mean you pay less interest overall.

- Debt Consolidation: Combine multiple high-interest debts into a single, manageable payment.

- Financial Simplification: Fewer bills to pay each month, reducing financial stress.

Utilizing refinance proceeds to pay off high-interest debt can be a smart move to optimize your financial situation and enhance cash flow.

Investing in Additional Properties

Refinancing can also provide the capital needed to expand your rental property portfolio. Have you considered using your refinance savings to invest in additional properties?

By refinancing your current rental property, you might have access to liquid cash that can serve as a down payment for a new investment. This strategy can diversify your income sources and potentially increase your overall earnings.

Why stop at just one property when you can have multiple income streams?

“Real estate investments can offer stable and predictable cash flows through rental income.”

Investing in additional properties not only helps grow your wealth but also provides financial security.

- Down Payment: Utilize the cash from refinancing as a down payment for new properties.

- Diversification: Spread risk by owning multiple rental properties.

- Income Growth: Additional properties mean more rental income streams.

Consider the potential of using refinance proceeds to invest in new real estate opportunities, thereby maximizing the financial benefits of your refinancing effort.

FAQs About Refinancing Your Rental Property Loan

Can You Refinance with Low Equity?

When considering refinancing with low equity, it’s essential to understand the implications. Many lenders require a minimum amount of equity, usually around 20%, to approve a refinance. However, there are options available for those with less equity.

For instance, some lenders offer FHA streamline refinancing, which doesn’t demand a high equity stake. This can be beneficial for rental property owners who may not have substantial equity built up.

“Low equity doesn’t necessarily bar you from refinancing; alternative programs might still make it feasible.”

Additionally, high loan-to-value (LTV) loans can also be an option. These loans permit refinancing even with a smaller equity amount, albeit often at a higher interest rate.

Consider the following:

- Consult various lenders: Different lenders have varying requirements and might offer more flexible terms.

- Improve your credit score: A higher credit score could help you qualify for better rates, even with low equity.

- Look for government programs: Programs like HARP (Home Affordable Refinance Program) may assist in refinancing with low equity.

Ultimately, while low equity can pose challenges, it is not an insurmountable barrier to refinancing your rental property.

What Are the Costs Involved?

Refinancing a rental property comes with several costs that property owners should be prepared to cover. These costs can include:

- Application Fees: Fees charged by the lender to process your refinance application.

- Origination Fees: These are fees for creating a new loan, often amounting to about 1% of the loan amount.

- Appraisal Fees: The cost of having the property’s value assessed, which can be a few hundred dollars.

In addition, there might be title search and insurance fees, recording fees, and potentially, prepayment penalties if you’re paying off the original loan early.

“Understanding the breakdown of refinancing costs can help in budgeting effectively.”

Keep in mind, some lenders might offer no-closing-cost refinancing, but this often translates into a higher interest rate over the loan’s life. It’s crucial to compare these options and determine which is more financially viable in the long run.

When planning to refinance, it’s essential to include these potential costs in your financial calculations to avoid unexpected expenses.

How Long Does the Process Take?

The refinancing process timeline can vary widely, but typically it can take anywhere from 30 to 45 days from start to finish. Several factors influence this timeline, including:

- Documentation preparation: Gathering necessary documents like tax returns, proof of income, and property details can take time.

- Appraisal scheduling: An appraisal is often required and scheduling this can add days to the process.

- Lender processing times: Different lenders have varying speeds of processing and underwriting approvals.

“Prepare for potential delays by staying organized and maintaining clear communication with your lender.”

Sometimes, external factors such as market conditions and lender workloads can also affect the timeline. If refinancing is time-sensitive, it’s advisable to communicate your timeline clearly with your lender from the outset.

By being proactive and prepared, rental property owners can streamline the refinancing process and expedite approval.

Can You Refinance Multiple Properties?

Refinancing multiple rental properties is indeed possible, and many property owners opt for it to take advantage of better rates or terms. However, it comes with its set of challenges and considerations.

First, lenders will closely scrutinize your financial health. This includes checking credit scores, debt-to-income ratios, and overall financial stability.

- Equity in each property: Lenders may require a minimum equity amount in each property you’re refinancing.

- Cash reserves: Having adequate cash reserves can make lenders more comfortable with refinancing multiple loans.

- Investment strategy: A clear and profitable investment strategy can also bolster your refinancing application.

“Consider refinancing properties through the same lender to simplify the process.”

Additionally, managing multiple refinance loans can be logistically challenging. It’s advisable to work with a financial advisor or a mortgage broker who can help navigate the complexities.

Ultimately, refinancing multiple properties can be a strategic move to enhance your rental business’s profitability and long-term financial health.

Conclusion

Refinancing your rental property loan unlocks numerous opportunities, from lowering interest rates to leveraging home equity for improvements. Embracing this financial strategy can increase your rental income, facilitate debt management, and even pave the way for investing in additional properties.

Successfully navigating the refinancing process requires building equity, securing necessary documentation, and meticulously comparing lender offers. By understanding key requirements like credit score minimums and debt-to-income ratios, and by avoiding common pitfalls, you can maximize the benefits. Ready to take the next step? Explore lenders, assess your financial landscape, and leverage the newfound potential in your investment portfolio today.

Frequently Asked Questions

Is it a good idea to refinance a rental property?

Refinancing a rental property can be beneficial if it lowers your interest rate, reduces monthly payments, or frees up equity for other investments.

Can an investment property be refinanced?

Yes, investment properties can be refinanced, provided you meet lender requirements such as having sufficient equity and a good credit score.

How much equity do you need to refinance a rental property?

Typically, lenders require at least 20% equity in your rental property to approve a refinance.

How much does it cost to refinance an investment property?

Refinancing costs can range from 2% to 5% of the loan amount, including appraisal, origination, and closing fees.

Can you refinance with low equity?

Refinancing with low equity can be challenging, but some lenders offer options like FHA or VA loans that may have more flexible requirements.

How long does the refinancing process take?

The process typically takes between 30 to 45 days, depending on the lender and complexity of your financial situation.