-

Table of Contents

- Rent Trends: Areas with Increasing and Decreasing Rates

- Factors Influencing Rent Trends

- Areas with Increasing Rent Rates

- Urban Centers and Metropolitan Areas

- Tech Hubs

- Suburban Areas Near Major Cities

- Case Study: Miami’s Rental Market Boom

- Areas with Decreasing Rent Rates

- Rural Areas

- Regions Affected by Natural Disasters

- Post-Industrial Cities

- Case Study: Declining Rent Rates in Cleveland

- Impact of Government Policies on Rent Trends

- Rent Control

- Zoning Laws

- Housing Subsidies

- Future Outlook: Predicting Rent Trends

- Conclusion

Rent Trends: Areas with Increasing and Decreasing Rates

In recent years, the rental market has experienced significant fluctuations, influenced by various economic, social, and environmental factors. Understanding these trends is crucial for both renters and investors. This article delves into the areas with increasing and decreasing rent rates, providing valuable insights supported by examples, case studies, and statistics.

Factors Influencing Rent Trends

Several factors contribute to the rise and fall of rent prices in different regions. These include:

- Economic conditions

- Population growth or decline

- Employment opportunities

- Urban development and gentrification

- Natural disasters and climate change

- Government policies and regulations

Areas with Increasing Rent Rates

Urban Centers and Metropolitan Areas

Urban centers and metropolitan areas have consistently seen an increase in rent rates. Cities like New York, San Francisco, and Los Angeles are prime examples. The demand for housing in these areas remains high due to the concentration of job opportunities, cultural attractions, and amenities.

For instance, in New York City, the average rent for a one-bedroom apartment increased by 5% from 2021 to 2022. This trend is driven by the city’s robust job market and the influx of young professionals seeking vibrant urban lifestyles.

Tech Hubs

Tech hubs such as San Francisco, Seattle, and Austin have also experienced significant rent hikes. The tech industry’s growth has attracted a large number of high-income professionals, driving up demand for housing.

In San Francisco, the average rent for a one-bedroom apartment rose by 7% in 2022. Similarly, Austin saw a 6% increase, fueled by the relocation of major tech companies and startups to the city.

Suburban Areas Near Major Cities

The COVID-19 pandemic has accelerated the trend of remote work, leading many people to move from crowded urban centers to suburban areas. This shift has caused rent prices in suburban regions near major cities to rise.

For example, the suburbs of New York City, such as Jersey City and Hoboken, have seen rent increases of 4% and 5%, respectively. These areas offer a balance of proximity to the city and a more spacious living environment.

Case Study: Miami’s Rental Market Boom

Miami has emerged as a hotspot for rental market growth. The city’s appeal lies in its favorable climate, vibrant culture, and growing job market. From 2021 to 2022, Miami’s average rent for a one-bedroom apartment surged by 8%.

This increase is attributed to several factors:

- Increased migration from other states, particularly from the Northeast

- Expansion of the tech and finance sectors

- Development of luxury residential properties

Miami’s rental market boom serves as a testament to how a combination of economic growth, lifestyle appeal, and strategic urban development can drive up rent prices.

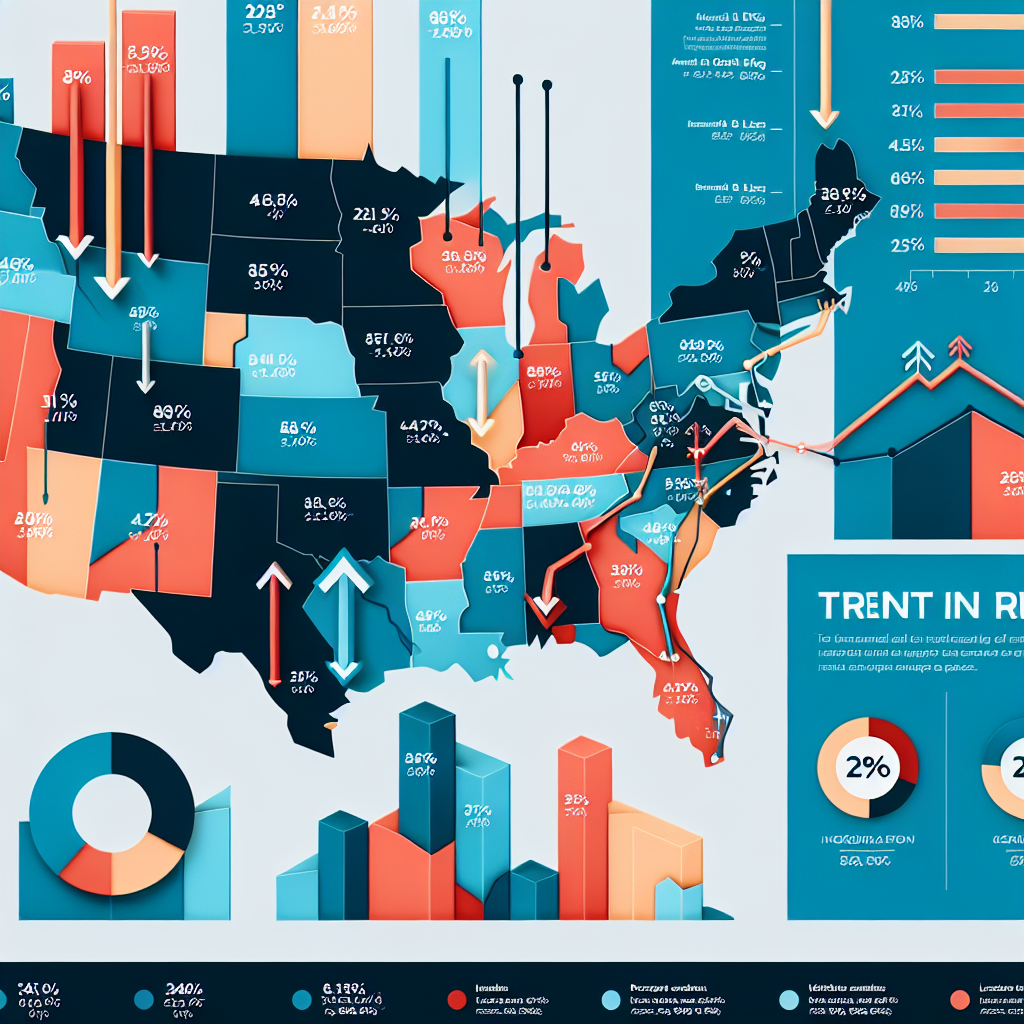

Areas with Decreasing Rent Rates

Rural Areas

Rural areas have generally seen a decline in rent rates. The lack of job opportunities, amenities, and infrastructure makes these regions less attractive to renters. As a result, landlords often lower rents to attract tenants.

For example, in rural parts of the Midwest, such as Iowa and Kansas, rent prices have decreased by 2% to 3% over the past year. The outmigration of young people seeking better opportunities in urban centers has contributed to this trend.

Regions Affected by Natural Disasters

Areas prone to natural disasters, such as hurricanes, wildfires, and floods, have experienced declining rent rates. The risk and uncertainty associated with living in these regions deter potential renters.

For instance, parts of Louisiana and Texas affected by hurricanes have seen rent prices drop by 3% to 4%. The damage to infrastructure and the ongoing threat of future disasters make these areas less desirable for long-term living.

Post-Industrial Cities

Post-industrial cities that have not successfully transitioned to new economic models often face declining rent rates. The loss of manufacturing jobs and population decline contribute to this trend.

Detroit is a notable example. Despite efforts to revitalize the city, the average rent for a one-bedroom apartment decreased by 2% in 2022. The city’s economic challenges and high vacancy rates continue to impact the rental market.

Case Study: Declining Rent Rates in Cleveland

Cleveland, Ohio, has experienced a steady decline in rent rates over the past few years. The city’s struggle to attract new industries and residents has led to a decrease in demand for rental properties.

From 2021 to 2022, Cleveland’s average rent for a one-bedroom apartment fell by 3%. Factors contributing to this decline include:

- High unemployment rates

- Population decline

- Limited economic diversification

Cleveland’s situation highlights the challenges faced by post-industrial cities in maintaining a stable rental market.

Impact of Government Policies on Rent Trends

Government policies and regulations play a significant role in shaping rent trends. Rent control measures, zoning laws, and housing subsidies can either stabilize or disrupt the rental market.

Rent Control

Rent control policies aim to protect tenants from excessive rent increases. While these measures can provide stability for renters, they may also discourage property owners from investing in maintenance and new developments.

In cities like San Francisco and New York, rent control has helped keep rent increases in check. However, critics argue that it can lead to a shortage of available rental units and reduced housing quality.

Zoning Laws

Zoning laws determine how land can be used and developed. Restrictive zoning can limit the supply of new housing, driving up rent prices. Conversely, relaxed zoning regulations can encourage the construction of new rental properties, potentially lowering rents.

For example, cities like Houston, which have less restrictive zoning laws, tend to have more affordable rent prices compared to cities with stringent zoning regulations.

Housing Subsidies

Government housing subsidies, such as Section 8 vouchers in the United States, provide financial assistance to low-income renters. These programs can help stabilize rent prices by increasing the affordability of rental housing.

However, the availability of subsidies often falls short of demand, leaving many eligible renters without assistance. This gap can contribute to rent increases in areas with high demand and limited supply.

Future Outlook: Predicting Rent Trends

Predicting future rent trends involves analyzing current data and considering potential economic, social, and environmental changes. Here are some key factors that could influence rent trends in the coming years:

- Economic Recovery: The pace of economic recovery post-pandemic will impact job markets and, consequently, rent prices. Regions with strong economic growth are likely to see rising rents.

- Remote Work: The continuation of remote work could sustain the demand for suburban and rural housing, potentially leading to increased rents in these areas.

- Climate Change: The increasing frequency of natural disasters may drive people away from high-risk areas, leading to declining rents in those regions.

- Urban Development: Investments in urban development and infrastructure can attract new residents and businesses, driving up rent prices in revitalized areas.

- Government Policies: Changes in government policies, such as new rent control measures or housing subsidies, will significantly impact rent trends.

Conclusion

The rental market is dynamic, influenced by a myriad of factors ranging from economic conditions to government policies. Urban centers, tech hubs, and suburban areas near major cities are currently experiencing rising rent rates due to high demand and economic growth. Conversely, rural areas, regions affected by natural disasters, and post-industrial cities are seeing declining rents due to various challenges.

Understanding these trends is essential for renters seeking affordable housing and investors looking to make informed decisions. By staying informed about the factors driving rent trends and monitoring changes in the market, individuals can better navigate the complexities of the rental landscape.

As we move forward, the interplay between economic recovery, remote work, climate change, urban development, and government policies will continue to shape rent trends. Staying attuned to these factors will be crucial for anticipating future changes in the rental market.