Understanding rental property loan down payments is crucial for any potential real estate investor. This guide dives into minimum requirements, the role of credit scores, and compares them with primary residence loans, ensuring you’re well-prepared.

Explore strategies to reduce your down payment, including house hacking and government-backed loans. Learn how larger down payments can lower borrowing costs and calculate your affordable rental property budget with innovative financing options like HELOC and private lenders.

Understanding Rental Property Loan Down Payments

Minimum down payment requirements

When considering the purchase of a rental property, it is essential to understand the minimum down payment requirements. Typically, conventional investment property loans require a down payment of at least 15% of the property’s purchase price. This is notably higher than the down payment for primary residences. Why is this so?

The elevated down payment stems from the higher risk associated with investment properties. Lenders view these properties as riskier because they are not the owner’s primary residence, which increases the likelihood of default.

“Since this property isn’t your primary residence, the likelihood that you will default on the loan is higher. One way lenders tend to compensate for this higher risk factor is by expecting a larger down payment.”

While 15% is the minimum, many investors choose to pay more. A larger down payment can reduce borrowing costs by lowering the loan-to-value (LTV) ratio, which can result in more favorable interest rates and lower overall fees.

- 15% Conventional Loan: This is the standard minimum down payment for a conventional loan for an investment property.

- 20% for Lower Costs: Many opt to pay 20% to avoid mortgage insurance premiums and reduce monthly payments.

- Government-Backed Loans: For those using house-hacking strategies, government-backed loans may allow for lower down payments.

The choice of down payment amount should align with your financial strategy and investment goals as an aspiring real estate investor.

Factors influencing down payment

Various factors influence the amount required for a down payment on a rental property loan. These include:

Credit Score: A higher credit score can lower the required down payment. For instance, a score of 700 is typically necessary unless you plan to put down 25% or more.

Debt-to-Income (DTI) Ratio: This measures your monthly debt payments against your income. A lower DTI ratio, ideally below 45%, can positively influence your down payment requirements.

Loan Program: Different loan programs have varying down payment stipulations. Conventional loans generally require more than government-backed loans.

Property Type: Multifamily properties or those used for house hacking may have different requirements compared to single-family homes.

Let’s break down these factors further:

- Credit Score: Aim for a score of at least 700. For the best rates, try to improve your score to 780 or higher.

- Debt-to-Income Ratio: Ensure your DTI ratio is no higher than 45% to enhance your loan approval chances.

- Loan Program: Choose a loan program that aligns with your financial situation and property type.

- Property Type: Consider how the type and intended use of the property will influence your down payment.

Understanding these factors can help you better prepare for the financial requirements of investing in rental properties.

Comparison with primary residence loans

Buying a rental property differs significantly from purchasing a primary residence, especially regarding down payment requirements. Primary residences often have lower down payment requirements because they pose less risk to lenders. Conversely, rental properties, seen as higher-risk investments, demand heftier down payments.

For primary residences, loans like FHA may offer down payments as low as 3.5%. VA loans can even provide 0% down for qualified individuals. However, these low-down-payment options are generally unavailable for investment properties.

Why such a difference?

“While you may be able to buy your primary home with little or no money down, you’ll typically need to put down at least 15% if you want to purchase a rental property.”

Here are some common down payment differences:

- Primary Residence: Often 3.5% to 5% down, depending on the loan type.

- Investment Property: Typically at least 15% down for conventional loans.

- Government-Backed Loans: Not usually applicable to investment properties without house hacking.

The disparity highlights the importance of preparing a more substantial down payment for rental property investments.

Importance of credit score and DTI ratio

Among the critical factors in securing a rental property loan, credit score and debt-to-income (DTI) ratio stand out. A high credit score often equates to better loan terms and potentially lower down payments. Conversely, a low credit score might require a larger down payment to mitigate lender risk.

For example, a credit score of 700 is generally the minimum required unless you plan to make a significantly larger down payment. Improving your score to 780 or higher can unlock the best rates available.

Why is the DTI ratio significant?

“The percentage of your gross monthly income that is used to pay your monthly debt can’t exceed 45%.”

Lenders use the DTI ratio to gauge your ability to manage monthly debt payments. A lower DTI ratio, ideally under 45%, can improve your chances of loan approval and may influence the required down payment.

Consider the impact:

- Credit Score: Higher scores can result in lower down payments and better loan terms.

- DTI Ratio: A low DTI ratio indicates financial stability and can favorably impact down payment requirements.

- Loan Terms: Both factors significantly influence the terms and conditions of your loan, including the interest rate and fees.

By maintaining a high credit score and a low DTI ratio, aspiring real estate investors can position themselves favorably in the eyes of lenders.

Strategies to Reduce Your Rental Property Down Payment

House Hacking

One effective strategy to lower your down payment is house hacking. By living in one unit of a multi-family property and renting out the others, you can offset your mortgage costs. This method not only reduces your initial investment but also provides a steady income stream.

Imagine purchasing a triplex where you occupy one unit. The rental income from the other two units can cover a significant portion of your mortgage. It’s a practical approach to minimize your financial burden.

House hacking allows you to qualify for residential loans, which typically have lower down payment requirements compared to commercial loans. A smaller down payment means more of your capital remains free for other investments.

“Living in one unit and renting out the rest can make property ownership significantly more affordable.” – Real Estate Expert

Additionally, house hacking provides tax benefits. The expenses related to the rental units, including mortgage interest and property maintenance, are often tax deductible.

Consider this: would you prefer to drain your savings for a large down payment, or use house hacking to start building equity with a smaller upfront cost?

Government-backed Loans

Government-backed loans, such as FHA and VA loans, offer another opportunity to reduce your down payment. These loans are designed to support borrowers with limited funds, making them ideal for real estate investors.

FHA loans, for instance, allow down payments as low as 3.5%. This is significantly less than the usual 20% required for conventional investment property loans.

- FHA Loans: Offer low down payments and are available to individuals with less-than-perfect credit.

- VA Loans: Provide zero down payment options for veterans and active-duty service members.

These loans typically have more lenient credit requirements, making them accessible to a broader range of investors. However, they come with mortgage insurance premiums, which should be factored into your overall investment strategy.

Investment Property Types

Choosing the right type of investment property can also help you reduce your down payment. Certain property types are viewed more favorably by lenders, which can translate into lower down payment requirements.

For example, purchasing a duplex instead of a single-family home allows you to generate rental income from one unit while living in the other. This dual-purpose setup often qualifies for lower down payment options.

- Multi-family properties: These provide higher income potential and lower financial risk, leading lenders to offer better terms.

- Turnkey properties: These are move-in ready and require less immediate investment, making them attractive to lenders.

Exploring different property types can reveal opportunities that align with your financial goals and reduce your initial outlay.

Avoiding Large Down Payments

Several methods can help you avoid making large down payments on rental properties, enabling you to invest without depleting your savings.

First, consider partnering with other investors. By pooling resources, you can share the financial burden of the down payment. This collaborative approach opens up possibilities for investing in properties that might be unaffordable independently.

Another approach is to seek out private lenders or hard money loans. These can provide short-term financing with lower upfront costs, though higher interest rates are a trade-off.

“Collaborating with other investors can significantly reduce the individual financial burden.” – Investment Advisor

Additionally, leveraging seller financing can allow you to negotiate more flexible down payment terms directly with the property owner.

Finally, consider improving your personal financial profile. Enhancing your credit score and reducing your debt-to-income ratio can make lenders more willing to offer favorable terms, including lower down payments.

Conventional Loan Down Payments for Rental Properties

Credit score requirements

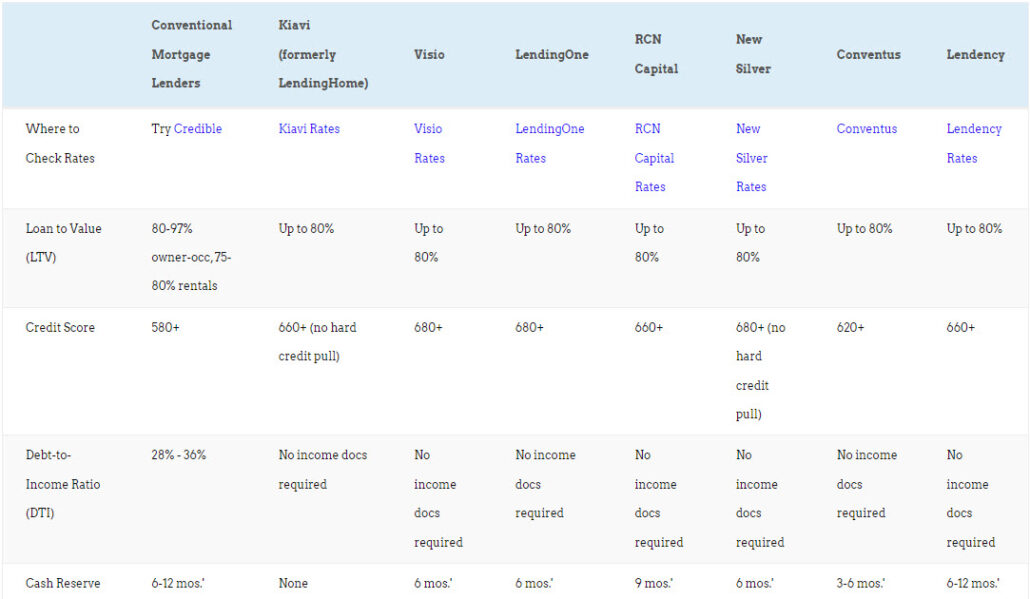

To qualify for a 15% down payment on a conventional loan for a one-unit investment property, a credit score of at least 700 is typically required. However, there are circumstances where you may qualify with a lower score.

For instance, if you have minimal debt or a high income, a credit score as low as 680 might suffice. In such cases, your debt-to-income (DTI) ratio needs to be 36% or lower to ensure eligibility.

Minimal debt and high income can sometimes offset the requirement for a higher credit score.

When dealing with investment properties with two to four units, the down payment requirements become stricter. Generally, a 25% down payment is needed, regardless of other financial factors.

- One-unit investment property: Minimum 700 credit score for 15% down payment

- Two to four-unit investment property: 25% down payment required

It’s essential to consult your lender to understand the specific credit score requirements for different scenarios.

Debt-to-income ratio

The debt-to-income ratio (DTI) is a critical factor in determining your eligibility for a conventional loan. This ratio compares your monthly debt payments to your monthly income, providing lenders with an insight into your financial stability.

A DTI ratio of 36% or lower is generally required when your credit score is below 700 but above 680. This threshold ensures that you can handle additional debt from the new mortgage.

Lenders need assurance that investment property mortgages will not overly strain your finances.

For borrowers with higher credit scores, the DTI ratio requirements may be more flexible, but it is always beneficial to aim for a lower ratio to enhance your application strength.

- Calculate your DTI: Compare your total monthly debt payments to your gross monthly income.

- Strive for a lower DTI: Aim for 36% or lower to improve eligibility.

- Review your finances: Adjust your financial strategies to reduce debt and increase income where possible.

Managing and improving your DTI ratio can significantly boost your chances of securing a loan under favorable terms.

Loan-to-value ratio

The loan-to-value (LTV) ratio is another crucial metric for conventional loans on rental properties. This ratio compares the loan amount to the appraised value of the property.

For a one-unit investment property, an LTV ratio of 85% is permissible provided you meet the necessary down payment requirements and credit score thresholds. For two to four-unit properties, the required down payment results in a lower LTV ratio, around 75%.

- One-unit property: Up to 85% LTV with 15% down payment

- Two to four-unit property: 75% LTV with 25% down payment

The LTV ratio influences the loan amount you can secure relative to the property’s value, impacting both the risk to lenders and your financial commitment.

Lenders prefer lower LTV ratios as they reduce the risk of default, encouraging borrowers to invest more upfront and maintain property value through responsible ownership.

Impact on interest rates

The interest rates on conventional loans for rental properties are typically higher than those for primary residences. This is due to the increased risk of default and foreclosure associated with investment properties.

Your credit score and down payment amount directly influence the interest rate offered by lenders. Higher credit scores and larger down payments generally lead to lower interest rates.

A strong financial profile translates to lower interest rates and reduced overall borrowing costs.

It’s important to shop around and compare rates from multiple lenders to find the most competitive terms for your investment property mortgage. Consider factors such as:

- Credit score: Higher scores often mean lower rates.

- Down payment: Larger down payments can significantly reduce interest rates.

- Loan term: Shorter loan terms might offer better rates but come with higher monthly payments.

By carefully evaluating these factors, potential borrowers can optimize their loan terms and secure the best possible interest rates for their investment property.

Government-Backed Loans: A Path to Lower Down Payments

FHA loans

Federal Housing Administration (FHA) loans are designed to assist **first-time homebuyers** and those with lower credit scores. These loans are insured by the FHA, which allows lenders to offer more favorable terms.

One of the primary benefits of FHA loans is their lower down payment requirements. For eligible buyers, the down payment could be as low as 3.5% of the purchase price. This makes achieving homeownership more accessible.

Another advantage of FHA loans is their more flexible underwriting standards. While traditional loans might require higher credit scores, FHA loans are accessible to those with credit scores as low as 580. This opens the door for many aspiring homeowners.

FHA loans also allow for higher debt-to-income ratios. This means even if a significant portion of your income goes towards existing debt, you may still qualify for an FHA loan.

“The FHA program is an excellent starting point for those who need a bit of financial flexibility,” says John Smith, a seasoned mortgage advisor.

Considering an FHA loan for a rental property requires meeting specific occupancy requirements. Generally, the property must be your primary residence for at least a year before you can rent it out.

It is crucial to note that, FHA loans can significantly lower the barrier to homeownership with **lower down payments**, **flexible credit standards**, and **higher debt allowances**.

VA loans

VA loans are tailored exclusively for veterans, active-duty service members, and certain members of the National Guard and Reserves. These loans are backed by the Department of Veterans Affairs.

A standout feature of VA loans is the potential for zero down payment. This benefit can be a game-changer, especially for first-time homebuyers who may struggle to save a large sum upfront.

VA loans also tend to offer competitive interest rates, often lower than those of conventional loans. This can result in significant savings over the life of the loan.

Moreover, private mortgage insurance (PMI) is not required for VA loans, even with no down payment, further reducing monthly costs.

“VA loans are a fantastic way for eligible veterans and service members to take advantage of their service benefits,” says Jane Doe, a financial consultant specializing in veterans’ affairs.

Eligible veterans interested in rental properties must initially occupy the property as their primary residence. However, once that requirement is met, they have the flexibility to rent it out.

- No down payment: Eliminates the need to save a large amount upfront.

- No PMI: Reduces monthly mortgage expenses.

- Low interest rates: Offers long-term cost savings.

It is crucial to note that, VA loans provide a substantial advantage in minimizing initial costs and making homeownership more accessible for veterans.

Occupancy requirements

When considering government-backed loans for rental properties, understanding the occupancy requirements is crucial. These requirements ensure that the primary goal of these loans—homeownership—is preserved.

FHA loans require the borrower to occupy the property as their primary residence for at least one year. After this period, converting the property into a rental is permitted.

VA loans also impose an occupancy requirement. Borrowers must occupy the property as their primary residence within 60 days of closing and intend to stay there for a reasonable time.

Meeting these requirements is essential not just for loan approval but also for maintaining loan benefits and avoiding penalties.

“Occupancy requirements are designed to ensure that these loans fulfill their purpose of promoting homeownership,” explains Richard Roe, a regulatory compliance expert.

Once these initial residency periods are met, homeowners have the flexibility to rent out their property. This flexibility can be a strategic financial move, helping to cover mortgage payments and potentially generating additional income.

Understanding these requirements helps in planning your home purchase and future rental strategies effectively. How can you use these rules to your advantage?

Benefits and limitations

Government-backed loans offer numerous benefits, making homeownership more accessible, especially for veterans and first-time homebuyers. But, they also come with certain limitations that potential borrowers should be aware of.

The most significant benefit is the lower down payment requirement. For many, saving a large sum for a down payment is a daunting task. FHA and VA loans reduce this burden significantly.

Another benefit is the more lenient credit requirements. Traditional loans often require high credit scores, but government-backed loans offer more flexibility, allowing those with less-than-perfect credit to qualify.

However, these loans are not without limitations. They often have stricter property standards. Homes purchased with FHA or VA loans must meet specific safety and livability criteria, which can sometimes complicate the buying process.

“It’s important to weigh both the pros and cons of government-backed loans. They can be a great option, but they aren’t right for everyone,” advises Mary Major, a housing market analyst.

Additionally, while FHA loans offer lower down payments, they require mortgage insurance premiums (MIP), which can add to the monthly costs.

- Lower down payments: Reduce the upfront cost barrier.

- Lenient credit requirements: Make loans accessible to more people.

- Strict property standards: Ensure safety but may limit property choices.

- Mortgage insurance premiums: Increase monthly expenses for FHA loans.

Weighing these benefits and limitations can help you make an informed decision. How will these factors impact your home buying journey?

Advantages of Making a Larger Down Payment

Lower Borrowing Costs

One of the most compelling reasons to make a larger down payment on a rental property is the potential for lower borrowing costs. When lenders see a significant down payment, they often view the borrower as less risky.

This perception of reduced risk can translate into a lower interest rate on your mortgage. A lower interest rate means you will pay less in interest over the life of the loan, significantly reducing your total borrowing costs. Consider it a win-win scenario: you pay less to borrow money and gain more financial stability.

“An investment property can be a steppingstone to a brighter financial future.”

Real estate investors with substantial savings should leverage this advantage. Lower borrowing costs also mean you can reallocate those saved funds to other investments or emergency repairs, ensuring your rental property remains profitable and well-maintained.

Moreover, a lower interest rate can make it easier to budget for other expenses related to property management. This alignment of lower borrowing costs with other financial goals can make your investment property a more attractive prospect, enhancing your long-term financial health.

Savings on Insurance

Insurance premiums on rental properties can be another area where a larger down payment proves beneficial. Insurance companies often offer better rates to property owners who have more equity in their property.

Why is this the case? More equity typically means less risk for the insurer. Therefore, if you’re able to make a larger down payment, you might enjoy lower insurance premiums, adding another layer of savings to your investment.

“It’s essential to do your research on funding opportunities ahead of time.”

- Lower-risk assessment: Insurance companies may view properties with higher down payments as lower risk, translating to reduced premiums.

- Increased property equity: More equity in your property can mean better coverage options at lower rates.

- More competitive quotes: With more money invested upfront, you might receive more favorable insurance quotes from multiple providers.

These insurance savings can enhance your profitability, allowing you to reinvest in your property or expand your real estate portfolio. These financial benefits are integral to the long-term health of your investments.

Reduced Monthly Payments

Another significant benefit of a larger down payment is the reduction in monthly mortgage payments. When you put more money down upfront, the total amount financed is lower, which leads to smaller monthly payments.

Reduced monthly payments can free up cash flow, enabling you to handle unexpected expenses or invest in additional properties. This financial flexibility is especially crucial for real estate investors, as it allows for more strategic decision-making and investment opportunities.

“Make sure you can afford the monthly mortgage payments.”

This reduction in monthly payments can also provide a buffer during times of vacancy. If your property is unoccupied for a period, lower monthly payments can make it easier to manage the financial strain until you secure new tenants.

- Enhanced cash flow: Lower monthly payments mean you have more disposable income for other investments.

- Ability to cover vacancies: Reduced payments can provide a financial cushion during tenant turnover.

- Ease of budgeting: Smaller monthly payments make it simpler to manage and forecast expenses.

Ultimately, reduced monthly payments translate into a more predictable and stable investment, which is invaluable for long-term financial planning.

Long-term Financial Benefits

By making a larger down payment, investors can reap long-term financial benefits that compound over time. The immediate savings on interest rates and insurance premiums, coupled with reduced monthly payments, can significantly impact a property’s overall profitability.

In addition to these immediate savings, having more equity in your property can open doors to better refinancing options in the future. With higher equity, you may qualify for lower interest rates or more favorable loan terms, further enhancing your investment’s financial health.

“Budget more money than you think you need for routine and emergency repairs.”

Moreover, greater equity can also provide a safety net during economic downturns. If property values decline, those who have made larger down payments are less likely to owe more on their mortgage than the property is worth, reducing the risk of negative equity.

- Refinancing opportunities: More equity means better options for refinancing at lower rates.

- Financial resilience: Higher equity can offer protection against market fluctuations and downturns.

- Improved cash flow: Long-term savings can enhance your overall financial strategy and growth potential.

These long-term benefits make a compelling case for opting for a larger down payment on rental properties, ensuring that your investment remains robust and profitable over time.

Calculating How Much Rental Property You Can Afford

Debt-to-income ratio

When evaluating your financial capability for purchasing rental properties, lenders give significant attention to your debt-to-income ratio (DTI). This ratio aids in assessing how much debt you carry relative to your income. The formula is straightforward: lenders divide your total monthly debt payments by your gross monthly income.

For instance, if your monthly debt payments amount to $2,000 and your gross monthly income is $6,000, your DTI ratio would be 33.33%. Different loan programs have varying DTI limits that you must consider.

Why is DTI important? A lower DTI ratio indicates that you have more financial stability and thus, a higher chance of securing a loan.

Lenders usually prefer a DTI ratio of 36% or lower for rental property loans, though some programs may allow higher thresholds.

Prospective buyers must keep an eye on their DTI if they aim to qualify for multiple rental property loans. DTI serves as an essential benchmark in evaluating your affordability.

Ongoing expenses

Understanding and planning for ongoing expenses is crucial when determining how much rental property you can afford. These expenses go beyond the initial purchase costs and can significantly impact your overall budget.

Several costs need to be factored in:

- Landlord insurance: Protection against property damage or tenant-related issues.

- Property taxes: Annual charges depending on your property’s assessed value.

- Maintenance and repairs: Regular upkeep and potential unexpected repairs.

- Property management fees: Costs incurred if you hire a property manager.

- Vacancies: Potential loss in income during periods when the property is unoccupied.

- Utilities: If these are covered within the rent, consider monthly utility costs.

By meticulously calculating these ongoing expenses, you can better assess your financial readiness for rental property investments.

Loan qualification

Securing a loan is a pivotal step in purchasing rental properties. Various factors determine your loan qualification, and understanding them can streamline the process.

Rental income: Lenders typically add 75% of your expected rental income to your gross monthly income. They estimate rental income based on the property’s history or market rents in your area.

Multiple mortgages: If you are financing multiple properties, be aware that lenders like Fannie Mae allow up to 10 properties financed with conventional loans. Financial advisors can provide tailored guidance on managing multiple loans.

It’s essential to secure favorable loan terms to enhance your investment’s profitability and sustainability.

Having a strong credit score and a clear financial strategy can significantly improve your chances of loan approval, positioning you effectively in the rental property market.

Affordability calculations

To determine precisely how much rental property you can afford, a detailed affordability calculation is necessary. This calculation balances your income, expenses, and potential rental income.

Here are the steps involved:

- Assess your gross monthly income: Include all income sources.

- Calculate your total monthly debt: Add up all existing debt payments.

- Estimate the potential rental income: Use market rents or the property’s rental history.

- Determine your DTI ratio: Factor in the new loan payment.

- Account for ongoing expenses: Incorporate all regular property-related expenses.

By comprehensively evaluating these elements, you can strategically plan your rental property investments.

How accurate are your affordability calculations? Regularly reviewing and adjusting them ensures you are making informed and financially sound decisions.

Creative Financing Options for Rental Property Down Payments

HELOC

Home Equity Line of Credit (HELOC) offers real estate investors a practical solution for financing down payments. When you have substantial equity in your primary residence, a HELOC allows you to leverage that value.

Instead of selling your home to free up funds, you can tap into your home’s equity. Borrowing against this equity avoids disrupting current living arrangements and provides access to funds quickly.

If you have at least 15% equity in your primary residence, you could use your home equity to buy an investment property.

Investors often prefer a HELOC over other loan types due to its flexibility. The line of credit is reusable, meaning you can borrow, repay, and borrow again within the draw period.

This method is particularly advantageous for those looking to diversify their investment portfolio. Utilizing a HELOC can ease the financial burden of a significant down payment.

However, one must consider the potential rise in interest rates. A HELOC typically has a variable interest rate, which can fluctuate over time.

Can you think of other innovative ways to leverage existing assets? HELOC provides an excellent foundation, but it’s essential to explore all options.

Private lenders

Private lenders provide loan opportunities tailored to real estate investors. These lenders offer an alternative to traditional banks, with more flexible terms.

Unlike conventional lenders, private lenders secure the debt through the property as collateral, making the process smoother for borrowers.

Private lenders tend to offer more flexible funding solutions for investment properties than other types of lenders.

Finding private lenders typically involves connecting within local real estate groups. Networking can reveal numerous financing possibilities.

Private lenders often extend their services to include down payment loans, offering investors additional financial support.

- Flexibility: Private lenders can tailor loan terms to suit specific investment needs.

- Speed: Loan approval and funding processes are usually faster than traditional options.

- Networking: Engaging in real estate groups can help identify potential lenders.

Have you tapped into your local real estate community yet? The connections made there can be invaluable.

Self-directed IRA

Self-directed IRAs offer a unique avenue for securing down payments for rental properties. This retirement account type allows investors to diversify beyond traditional assets.

With a self-directed IRA, you can invest in real estate, providing an opportunity to use retirement funds strategically.

It’s an innovative approach—using funds already set aside for the future to yield current returns without severe penalties.

- Diversification: Expands investment options beyond stocks and bonds.

- Control: Gives investors greater control over retirement funds.

- Tax benefits: Enjoy tax-deferred or tax-free growth depending on the IRA type.

Are you familiar with the rules and regulations governing self-directed IRAs? It’s crucial to comply with guidelines to avoid penalties.

Group investing

Group investing, or real estate syndication, allows multiple investors to pool resources for a single property. This method mitigates individual financial burden and spreads risk.

Investors collectively fund the down payment, leveraging combined capital for larger investments.

Group investing is ideal for those who may not have enough funds individually but can contribute as part of a larger pool.

The connections you make in this group can help you find property leads and financing possibilities.

This approach fosters collaboration and facilitates access to more lucrative investment opportunities.

- Pooling Resources: Collective investment reduces individual contributions.

- Risk Distribution: Spreads risk among multiple investors.

- Access to Bigger Deals: Enables investment in high-value properties.

Have you considered partnering with other investors for your next property purchase? The collective effort can open doors to extraordinary opportunities.

Conclusion

Securing a rental property loan demands a strategic approach, especially when navigating down payment requirements and the influence of credit scores and debt-to-income ratios. By leveraging techniques such as house hacking, exploring government-backed loans, and considering creative financing options, investors can significantly reduce their initial financial burden. These strategies enable potential property owners to break into the rental market with fewer upfront costs, making real estate investment more accessible.

Ultimately, making informed decisions about down payments can lead to lower borrowing costs, reduced monthly payments, and long-term financial stability. With a thorough understanding of the available options and their benefits, you’re well-equipped to make the best choices for your investment goals. Ready to take the next step in your rental property journey? Dive deeper into our resources and start planning your financial future today.

Frequently Asked Questions

Can I put less than 20% down on an investment property?

Yes, but it often requires higher interest rates and stricter qualification criteria. Government-backed loans like FHA might allow lower down payments.

What is the 2% rule for investment property?

The 2% rule suggests that the monthly rent should be at least 2% of the purchase price to be considered a good investment.

Can you write off a down payment on rental property?

No, down payments are considered capital costs and are not tax-deductible. However, you can write off mortgage interest and other expenses.

How much down payment for a 200k house?

For a rental property, a typical down payment is 20-25%, so approximately $40,000-$50,000 on a $200,000 property.

What are the minimum down payment requirements for rental properties?

Minimum down payments usually range from 15-25%, depending on the type of loan and the lender’s requirements.

How does credit score impact down payment on rental properties?

A higher credit score can lower your down payment requirements and secure better interest rates.