The Unknown Strength of Reporting Rent to Credit

- Building credit backwards: One of the best things about rent reporting is that it can help you build your credit records in the past.

- Responsibility with money: It lets you show that you are responsible with money even if you don’t have standard credit lines.

Rent reporting is a game-changer for credit, but not enough people use it. This is a great chance for people who have been good roommates but have never had credit before. It shows lenders that you have been careful with your money, even if you have never had a credit card or loan before.

How Important It Is to Have a Good Credit Report

- Depth and Complexity: Rent reporting gives your credit record more depth and makes it stronger.

- Effects over time: Multiple trade lines with a past of at least 24 months can hurt your creditworthiness in a big way.

A good credit report is like a resume that covers all the bases. It tells lenders not only who you are now, but also what your financial situation has been like for a long time. Here, rent reporting really shines. It can give your credit report more depth and complexity, making you more appealing to lenders. This is especially true for something as important as a mortgage.

The Mortgage Point of View: Beyond the Credit Score

- Evaluation of the whole: Lenders take into account more than just your credit score.

- Talking about Power: If you have a good credit background, it can help you get better loan terms and interest rates.

Your credit score is just the tip of the iceberg when it comes to mortgages. If you pay your rent on time, it can help your credit score and make you a more attractive choice for a mortgage. It can also help you get a better deal on interest rates and other loan terms.

Don’t Wait Until the Last Minute to Report Rent to Your Credit Bureau

- Take Action: The sooner you start, the better your chances will be in the long run.

- First-time buyers of a home: There are special programs, but why settle for less if you can plan ahead?

As a loan officer, it hurts my heart when clients don’t think about their credit until the last minute. This is especially true for first-time homebuyers, who may be able to get a loan with easier terms but could get much better terms if they had a better credit rating. Now is the time to act, even if you don’t need to buy a home right away.

The Long-Term Benefits of Reporting Rent to Credit

- Financial Freedom: Reporting your rent is an investment in your future money.

- Choices in Life: A good credit score gives you more options in life, from the type of home you can buy to the types of loans you can get.

Rent reporting isn’t just a tool; it’s an investment in your financial future. By reporting your rent now, you’re not just improving your credit score; you’re also building a financial picture that will make you an attractive borrower for years to come. Take action right now, and let your rent help you get out of debt.

Rent Reporting Services

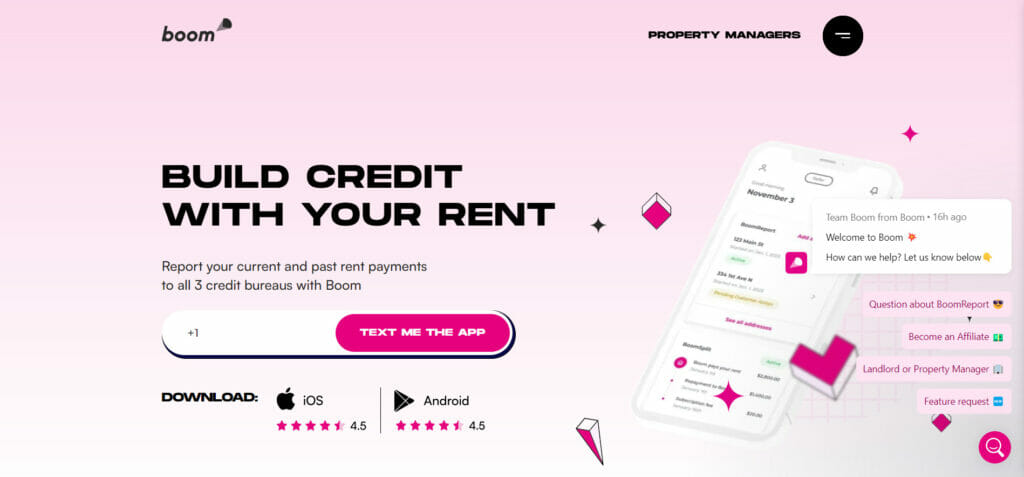

1. Boom Pay APP

As a loan officer, I’m always on the lookout for tools that can help my clients improve their creditworthiness, and I recently came across Boom Pay. This app has quickly become a game-changer for several reasons, and here’s why I think it’s an excellent resource for anyone looking to build or improve their credit score.

Reporting to All Three Credit Bureaus

One of the standout features of Boom Pay is that it reports to all three major credit bureaus—Experian, Equifax, and TransUnion. This is a significant advantage over other rent reporting services, which often report to only one or two bureaus. Reporting to all three ensures a more comprehensive impact on your credit profile.

Speed and Efficiency

Boom Pay’s technology verifies user data in less than 24 hours for the majority of its users. This quick turnaround means that your credit report could be updated within as few as 10 days from the time of checkout. The app also continues to verify and report your payments on a monthly basis if you opt for ongoing reporting.

Affordability

Boom Pay offers the most affordable pricing I’ve seen in the rent reporting space. A one-time $10 enrollment fee covers verification costs. Ongoing reporting is priced at just $2 per month or $24 annually. For those interested in reporting up to 24 months of past rent payments, there’s a one-time fee of $25. This affordability makes it accessible for a broad range of renters.

No Landlord Involvement

One of the hurdles with some rent reporting services is the need for landlord involvement. Boom Pay eliminates this barrier by syncing to your bank transactions to verify rent payments. This feature makes the process smoother and less intrusive.

Versatility in Payment Types

Boom Pay is compatible with almost all types of rent payments, except for cash, money orders, and cashier’s checks. Whether you use Zelle, Venmo, Cash App, check, ACH, or a property management portal, Boom Pay has you covered.

No Impact on Credit Score

Enrolling in Boom Pay doesn’t require a hard or soft credit pull, ensuring that your credit score won’t be negatively impacted just for signing up.

Additional Features

- Split Your Rent: For a small fee, Boom Pay allows you to split your rent into installments, improving your cash flow.

- Track Your Credit Score: The app offers a feature to track your credit score, which is invaluable when you’re planning significant financial moves like buying a car or home.

Future Offerings

Boom Pay plans to introduce a feature that allows users to find their next rental, tapping into a community of over 6 million active users.

In summary, from a loan officer’s perspective, Boom Pay offers a comprehensive, efficient, and affordable solution for renters to build and improve their credit scores. Its features are designed with the user’s convenience and financial growth in mind, making it a highly recommended tool for anyone looking to enhance their financial profile.

2. Rent Reporters

What I like about Rent Reporters is that they go back 48 months.

Since its inception in 2012, RentReporters has assisted more than 40,000 tenants in reporting their timely rent payments to credit bureaus. The company claims that users typically see an average credit score boost of 40 points. After verifying your details, you can expect to notice a change in your credit score within a span of 3 to 5 days.

If you’re dissatisfied with the initial results after your rent history has been reported, RentReporters offers a refund policy. You can reach out to them within 48 hours to get a full refund. It’s worth noting that if you opt for a refund, your payment history will be retracted from your credit report.

To utilize RentReporters’ services, they will need to get in touch with your landlord to confirm your payment history. However, there’s generally no cause for concern, as most landlords are willing to provide this information to support your credit-building efforts.

Rent Reporters Pricing

RentReporters offers a comprehensive service aimed at helping tenants improve their credit scores by reporting on-time rent payments to credit bureaus. Their pricing structure is designed to be affordable and offers two main plans to choose from, each with its own set of features and benefits.

Monthly Plan – $9.95 per month

- Initial Signup Fee: $94.95

- Free Credit Score: Access to your credit score without any additional charges.

- Credit Score Monitoring: Keep track of changes to your credit score.

- Credit Specialist: Consult with a credit specialist for personalized advice.

- 24 Months of Rent History: Your last 24 months of rent payments will be added to your credit report.

- Monthly Updates: On-time rent payments are updated monthly to the credit bureaus.

- Financial Tips: Receive tips to manage your finances better.

Annual Plan – $7.95 per month

- Initial Signup Fee: $94.95

- Free Credit Score: Access to your credit score without any additional charges.

- Credit Score Monitoring: Keep track of changes to your credit score.

- Credit Specialist: Consult with a credit specialist for personalized advice.

- 24 Months of Rent History: Your last 24 months of rent payments will be added to your credit report.

- Monthly Updates: On-time rent payments are updated monthly to the credit bureaus.

- Financial Tips: Receive tips to manage your finances better.

Additional Features

- Expedited Reporting with RentCheck: This feature allows RentReporters to automatically verify your rent payments without needing to contact your landlord.

- Spouse and Roommate Discount: Spouses and roommates can avail themselves of a $50 discount on the service.

Both plans require an initial signup fee of $94.95, which covers the cost of verifying and reporting up to 24 months of your rent payment history. After that, the monthly or annual fee covers ongoing services, including monthly updates to credit bureaus, access to a credit specialist, and financial tips to help you manage your finances better.

By offering these two plans, RentReporters provides flexibility for tenants looking to improve their credit scores, whether they’re interested in a short-term commitment or a more extended engagement.

RentReporters has garnered impressive reviews across multiple online platforms, indicating a high level of customer satisfaction and effectiveness of their service. With a 4.8-star rating on Google based on over 700 reviews, and a 4.7-star rating on Facebook from more than 270 reviews, the company has consistently received positive feedback from its user base.

Google Reviews – 4.8 Stars

The 4.8-star rating on Google is particularly noteworthy given the volume of reviews, which exceeds 700. This suggests that a large number of customers have been satisfied enough to take the time to leave a positive review. High ratings on a platform as widely used as Google lend significant credibility to the service.

Facebook Reviews – 4.7 Stars

Similarly, the 4.7-star rating on Facebook, based on over 270 reviews, indicates a high level of customer satisfaction. Facebook is another platform where customers can freely express their opinions, making this high rating another testament to the company’s quality of service.

Common Themes in Reviews

- Simplicity and Speed: Many customers have highlighted how straightforward and quick the RentReporters process is. This ease of use is crucial for people who may not be familiar with how credit reporting works.

- Exceptional Customer Service: Reviews frequently mention the excellent customer service provided by RentReporters. Whether it’s consultation with a credit specialist or assistance during the setup process, the team appears to go above and beyond to help their clients.

- Effectiveness: A recurring theme in the reviews is the effectiveness of the service in actually improving credit scores. Many users report seeing a tangible increase in their credit scores within a short period, which speaks volumes about the service’s efficacy.

In summary, the high ratings and positive reviews across multiple platforms suggest that RentReporters is delivering on its promise to help people improve their credit scores through rent reporting. The reviews indicate not only the effectiveness of the service but also the ease of use and quality of customer service, making it a well-rounded offering in the rent reporting space.

3. Rental Kharma

Rental Kharma is a service designed to help renters build their credit history by reporting their rent payments to credit bureaus. The company focuses on both past and ongoing rent payments, aiming to provide a comprehensive credit-building solution for renters. Here’s how it works:

Past & Ongoing Reporting

- Rental Kharma adds all your past rental payment history at your current residence to your TransUnion and Equifax credit reports.

- The average score increase is 40 points when you report your past history.

- Quick results are seen for past payment history.

- Older rentals tend to see even better results, as indicated by customer reviews.

- The service continues to build your credit score into the future.

- Renters who report two years of past history and one year of ongoing payments see an average increase of 100+ points.

Easy to Get Started

- It Starts with You: You begin by completing their easy registration process. This involves confirming that you qualify for their service and providing some basic information about yourself and your rental. You can either call to get started or do it yourself through their system.

- Leave the Rest to Us: After processing your information, Rental Kharma will contact your landlord or property manager to verify your rent payments. Every month, they will confirm your ongoing payments with them.

- Now What?: All you have to do is sit back and watch your credit score increase. With improved credit, you can focus on achieving your financial goals, such as buying a home or a car, or getting approved for a credit card.

Mission

Rental Kharma was founded to address a significant issue: over 100 million Americans struggle with their credit and are denied access to traditional, non-predatory financial products. The company aims to provide a sustainable and simple way for renters to establish and build credit history through their most significant monthly payment: rent.

Additional Information

- Calculate Your Score Increase: The website offers a feature where you can calculate your potential score increase based on how long you’ve been renting at your current residence.

- Statistics:

- Over 85,000 members served

- 40-point average initial score increase

- 5 points on average continue to build credit score each month

- 90-day satisfaction guarantee

- Contact Information:

- Address: 225 South Jefferson Ave, Cookeville, TN 38501

- Phone: 720-307-1466

- Fax: 720-368-5060

- Email: support@rentalkharma.com

By offering a straightforward and effective way to report rent payments to credit bureaus, Rental Kharma serves as a valuable tool for renters looking to improve their financial standing.

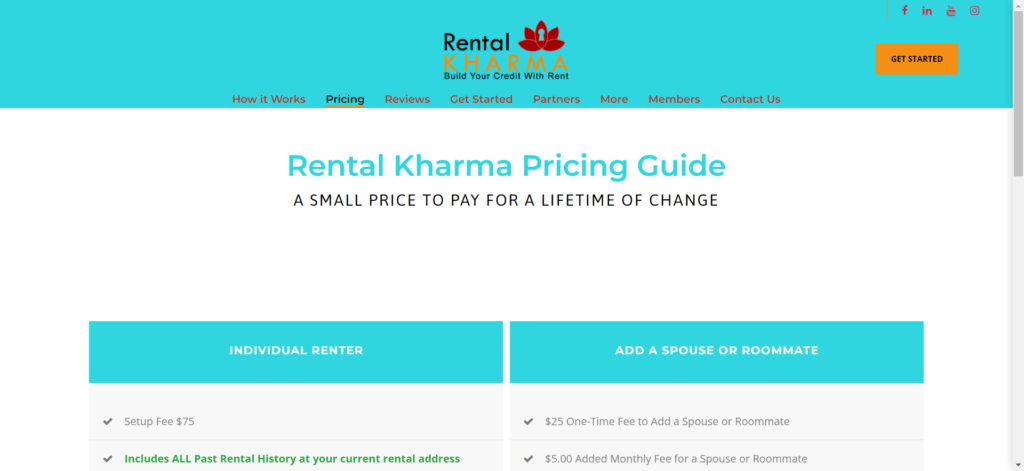

Rental Kharma Pricing

Rental Kharma Pricing Guide: A Comprehensive Overview

Rental Kharma offers a straightforward pricing model designed to make credit-building accessible for renters. The service aims to provide a lifetime of change for a small initial investment, followed by a manageable monthly fee. Here’s a breakdown of their pricing:

For Individual Renters

- Setup Fee: $75

- This one-time fee covers the inclusion of all your past rental history at your current rental address into your credit report.

- Ongoing Reporting Fee: $8.95 per month

- This fee starts 30 days after the initial setup and is essential for keeping your account open and current.

- No Contract: Rental Kharma operates without requiring a long-term contract, offering flexibility to its users.

- No Credit Check: The service does not require a credit check for enrollment, making it accessible to those with low or no credit history.

- Cancel Anytime: You have the freedom to cancel the service at any point without penalties.

For Adding a Spouse or Roommate

- One-Time Fee: $25

- This is a one-time charge for adding a spouse or a roommate to your account.

- Added Monthly Fee: $5.00

- An additional $5.00 per month will be charged for the ongoing reporting of the spouse’s or roommate’s rent payments.

Getting Started is Easy

- The service prides itself on a simple and straightforward registration process. You can either call to initiate the service or do it yourself through their online system.

In summary, Rental Kharma offers a cost-effective way to build and improve your credit score through rent reporting. With a one-time setup fee and a modest ongoing monthly charge, it aims to make credit-building an attainable goal for renters. The flexibility of no long-term contracts and the option to cancel anytime further add to its appeal.

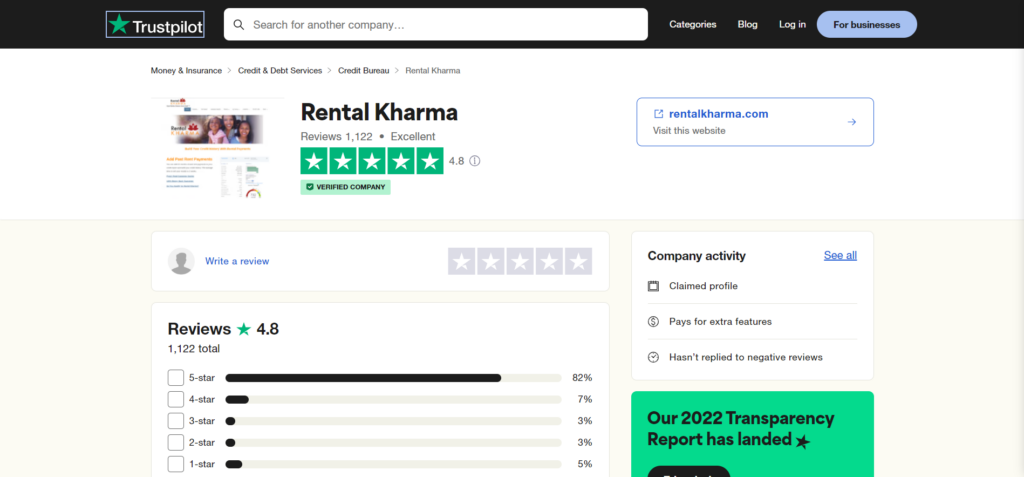

Comprehensive Overview of Rental Kharma’s Trust Pilot Reviews

Rental Kharma enjoys a stellar reputation on Trust Pilot, boasting a 4.8 out of 5-star rating based on 1,122 reviews. The reviews overwhelmingly highlight the company’s exceptional customer service and effectiveness in helping customers build their credit scores. Below are some key takeaways from the reviews:

Customer Service Excellence

- Aly: Multiple reviews mention Aly’s prompt service and willingness to go “above and beyond” to answer questions and improve customers’ credit.

- Rachel: She is frequently cited for her politeness, efficiency, and thoroughness. Even landlords have complimented her demeanor.

- Chloe: Praised for her step-by-step guidance and comprehensive explanations, Chloe is noted for making the customer experience smooth and informative.

Efficiency and Speed

- Quick Results: Many reviewers have mentioned seeing a rapid increase in their credit scores, some within just a few days.

- Fast Setup: Customers like Eric Patton and Myron Boykin appreciated the quick and efficient setup process, often completed within 15 minutes.

Effectiveness in Credit Building

- Score Increase: Doug Roberts was able to buy a new home thanks to the credit score increase he experienced using Rental Kharma.

- Rental History: Vasha was stressing about not having any rental history and found Rental Kharma to be a solution, thanks to Rachel’s guidance.

Additional Features

- Ongoing Support: Reviewers like Randy Brown appreciate the ongoing support and monthly updates that help them continue to build their credit scores.

- Satisfaction Guarantee: The 90-day satisfaction guarantee is another feature that gives customers peace of mind.

Overall Experience

- Ease of Use: The service is often described as easy to use, with multiple reviewers mentioning the straightforward registration process.

- Trustworthiness: Reviews like the one from PRINCE ⚡️ emphasize the company’s reliability and integrity.

In summary, Rental Kharma’s Trust Pilot reviews paint a picture of a company that is not only effective in helping people build their credit but also excels in customer service. The reviews suggest that the company is well worth the investment for anyone looking to improve their financial standing.

4. Self.inc New Rent Reporting Add On Service

A Comprehensive Overview of Self.inc Rent Reporting Service: A Loan Officer’s Perspective

Self.inc is not just another credit-building service; it’s a pioneer in the industry. One of the first services to introduce creative tradeline solutions, Self.inc has been a game-changer for many looking to build or improve their credit scores. Here’s why I find their approach particularly compelling.

The Genius Behind the Model

Self.inc operates on a unique model that’s essentially a win-win for everyone involved. They provide you with a real loan, but here’s the kicker: this loan is technically a Certificate of Deposit (CD) opened in your name. You then enter into a payment arrangement for 12, 24, or 36 months to pay back that CD. The brilliance of this model is that it reports to credit bureaus as a personal loan, adding depth and complexity to your credit profile, which is something I often emphasize to my clients.

The Savings Element

What sets Self.inc apart is the savings component. After completing your payment arrangement, you get back a significant portion of the money you’ve paid in. For example, if you opt for a 24-month plan at $25 a month, you’d pay around $600. At the end of the program, you get back about $500 in cash. You’re not just paying off a loan; you’re essentially saving money. This dual benefit of building credit while saving is a unique feature that makes Self.inc stand out.

Additional Rent Reporting

For an additional $6.95 per month, Self.inc will also report your rent payments to the credit bureaus. This is an excellent add-on, especially for those who are already responsible with their rent payments but haven’t seen it reflect on their credit scores.

Comprehensive Reporting

Self.inc reports to all three major credit bureaus—Experian, TransUnion, and Equifax. This comprehensive reporting is crucial for anyone looking to make a significant impact on their credit profile.

Pricing and Plans

The service offers various plans to fit different budgets, starting from $25 per month for 24 months. Each plan comes with an admin fee of $9 and varying interest rates. The flexibility in pricing makes it accessible for a wide range of people.

Reviews and Customer Satisfaction

Self.inc has stellar reviews, boasting a 4.9 rating on the App Store and a 4.7 rating on Google Play. These high ratings indicate a high level of customer satisfaction and effectiveness of the service.

Security and Trust

With 256-bit AES encryption and SOC 1 type 2 compliance, Self.inc ensures that your data is secure, which is a critical factor I always consider when recommending services to clients.

Final Thoughts

From a loan officer’s perspective, Self.inc offers a comprehensive, secure, and innovative platform for credit building. Its unique model of providing a real loan that doubles as a saving mechanism sets it apart from other services. The additional rent reporting feature for just $6.95 is the cherry on top for those looking to maximize their credit-building efforts. It’s a well-rounded service that I often recommend for those serious about improving their financial health.