-

Table of Contents

- Saudi Developer Announces $300M Investment in U.S. Luxury Real Estate

- The Saudi Developer: A Profile

- Details of the $300M Investment

- New York

- Los Angeles

- Miami

- Market Trends and Demand for Luxury Real Estate

- Case Studies: Successful International Investments in U.S. Real Estate

- Chinese Investment in Manhattan

- Middle Eastern Investment in Beverly Hills

- European Investment in Miami

- Implications for the U.S. Real Estate Market

- Challenges and Considerations

- Future Outlook

- Conclusion

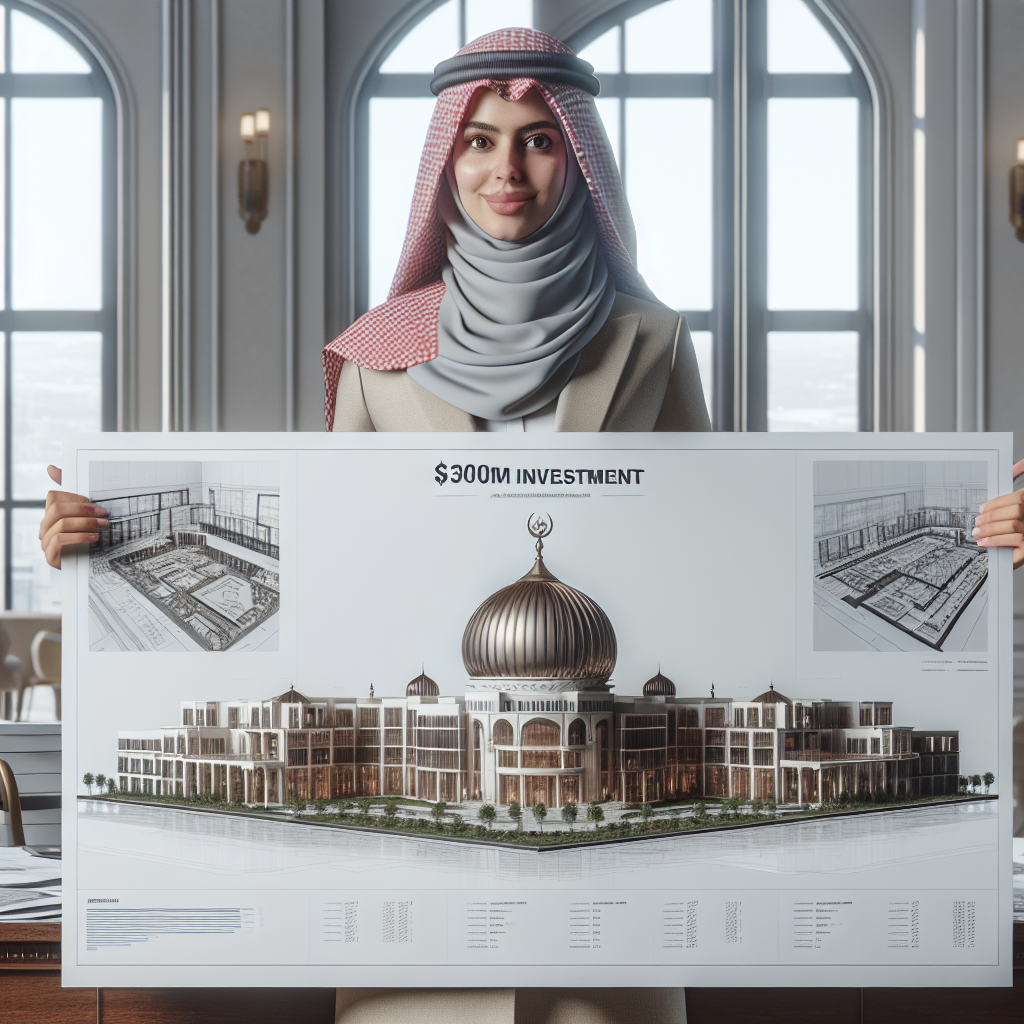

Saudi Developer Announces $300M Investment in U.S. Luxury Real Estate

In a significant move that underscores the growing interest of international investors in the U.S. real estate market, a prominent Saudi developer has announced a $300 million investment in luxury real estate across the United States. This strategic investment aims to capitalize on the robust demand for high-end properties and the stable economic environment in the U.S. This article delves into the details of this investment, its potential impact on the U.S. real estate market, and the broader implications for international real estate investments.

The Saudi Developer: A Profile

The Saudi developer behind this substantial investment is a well-established entity in the Middle Eastern real estate market. Known for its high-end residential and commercial projects, the developer has a track record of delivering luxury properties that cater to affluent clients. The company’s portfolio includes iconic developments in major cities across Saudi Arabia and the broader Gulf region.

Details of the $300M Investment

The $300 million investment will be allocated to various luxury real estate projects in key U.S. cities, including New York, Los Angeles, and Miami. These cities have been chosen for their strong real estate markets, high demand for luxury properties, and potential for significant returns on investment.

New York

New York City, with its iconic skyline and status as a global financial hub, is a prime target for luxury real estate investments. The Saudi developer plans to invest in high-end residential properties in Manhattan, focusing on areas such as Tribeca, SoHo, and the Upper East Side. These neighborhoods are known for their exclusivity, high property values, and appeal to wealthy buyers.

Los Angeles

Los Angeles, with its glamorous lifestyle and thriving entertainment industry, is another key market for luxury real estate. The investment will target upscale neighborhoods such as Beverly Hills, Bel Air, and Malibu. These areas are synonymous with luxury living and attract high-net-worth individuals from around the world.

Miami

Miami’s vibrant culture, beautiful beaches, and favorable tax environment make it an attractive destination for luxury real estate investments. The Saudi developer plans to invest in waterfront properties and high-rise condominiums in areas like South Beach, Brickell, and Key Biscayne. These locations offer stunning views, premium amenities, and a high quality of life.

Market Trends and Demand for Luxury Real Estate

The U.S. luxury real estate market has shown remarkable resilience and growth, even amid economic uncertainties. Several factors contribute to the strong demand for high-end properties:

- Wealth Accumulation: The increasing wealth of high-net-worth individuals and ultra-high-net-worth individuals has driven demand for luxury real estate. These buyers seek exclusive properties that offer privacy, security, and premium amenities.

- Urbanization: Major cities like New York, Los Angeles, and Miami continue to attract affluent buyers due to their cultural, economic, and lifestyle offerings.

- Investment Potential: Luxury real estate is often seen as a safe and lucrative investment. High-end properties tend to appreciate in value over time, providing substantial returns for investors.

- Global Appeal: The U.S. remains a preferred destination for international buyers seeking stable and secure real estate investments. The country’s strong legal framework and transparent property market are significant draws.

Case Studies: Successful International Investments in U.S. Real Estate

Several international investors have successfully ventured into the U.S. luxury real estate market, reaping significant rewards. Here are a few notable examples:

Chinese Investment in Manhattan

In recent years, Chinese investors have made substantial investments in Manhattan’s luxury real estate market. One prominent example is the acquisition of the Waldorf Astoria Hotel by Anbang Insurance Group for $1.95 billion in 2014. This landmark deal highlighted the strong interest of Chinese investors in iconic U.S. properties and set the stage for further investments in the luxury real estate sector.

Middle Eastern Investment in Beverly Hills

Middle Eastern investors have also made their mark on the U.S. luxury real estate market. In 2016, Qatar’s sovereign wealth fund acquired a 9.9% stake in the iconic Empire State Building. Additionally, Middle Eastern buyers have been active in Beverly Hills, purchasing high-end properties and contributing to the area’s reputation as a global luxury real estate hotspot.

European Investment in Miami

European investors have shown a keen interest in Miami’s luxury real estate market. In 2019, a European investment group purchased a penthouse in the prestigious One Thousand Museum condominium for $20 million. This transaction underscored Miami’s appeal to international buyers seeking premium properties with world-class amenities and stunning views.

Implications for the U.S. Real Estate Market

The $300 million investment by the Saudi developer is expected to have several positive implications for the U.S. real estate market:

- Increased Demand: The influx of capital from international investors will drive demand for luxury properties, potentially leading to higher property values and increased competition among buyers.

- Economic Growth: The investment will contribute to economic growth by creating jobs in construction, real estate, and related industries. It will also generate tax revenue for local governments.

- Market Stability: The presence of international investors can enhance market stability by diversifying the buyer base and reducing reliance on domestic buyers.

- Enhanced Property Development: The investment will support the development of new luxury properties, contributing to the overall growth and modernization of the U.S. real estate market.

Challenges and Considerations

While the investment presents numerous opportunities, there are also challenges and considerations that need to be addressed:

- Regulatory Environment: International investors must navigate the complex regulatory environment in the U.S., including property laws, tax regulations, and foreign investment restrictions.

- Market Volatility: The real estate market can be subject to fluctuations, and investors must be prepared for potential market downturns and economic uncertainties.

- Cultural Differences: Understanding and adapting to cultural differences in business practices and consumer preferences is crucial for successful investments.

- Political Climate: The political climate in both the U.S. and the investor’s home country can impact investment decisions and outcomes.

Future Outlook

The future outlook for international investments in U.S. luxury real estate remains positive. Several factors contribute to this optimistic perspective:

- Continued Wealth Growth: The global population of high-net-worth individuals is expected to continue growing, driving demand for luxury properties.

- Urbanization Trends: Major U.S. cities will remain attractive destinations for affluent buyers seeking urban lifestyles and investment opportunities.

- Technological Advancements: Advances in technology, such as virtual property tours and blockchain-based transactions, will facilitate international real estate investments.

- Global Connectivity: Improved global connectivity and ease of travel will make it easier for international buyers to explore and invest in U.S. properties.

Conclusion

The announcement of a $300 million investment in U.S. luxury real estate by a prominent Saudi developer marks a significant milestone in the global real estate market. This strategic move highlights the enduring appeal of the U.S. as a destination for high-end property investments and underscores the growing interest of international investors in the luxury real estate sector. As the market continues to evolve, the influx of international capital will play a crucial role in shaping the future of U.S. real estate, driving demand, and fostering economic growth. By understanding the trends, opportunities, and challenges associated with such investments, stakeholders can navigate this dynamic landscape and capitalize on the potential for substantial returns.