-

Table of Contents

- Single-Family Home Rentals Poised for Significant Growth

- Changing Demographics and Lifestyle Preferences

- Economic Factors Influencing Rental Demand

- Case Studies: Successful Single-Family Rental Markets

- Phoenix, Arizona

- Atlanta, Georgia

- Dallas-Fort Worth, Texas

- Statistics Highlighting the Growth of Single-Family Home Rentals

- Implications for Investors

- Implications for Renters

- Future Outlook for Single-Family Home Rentals

- Conclusion

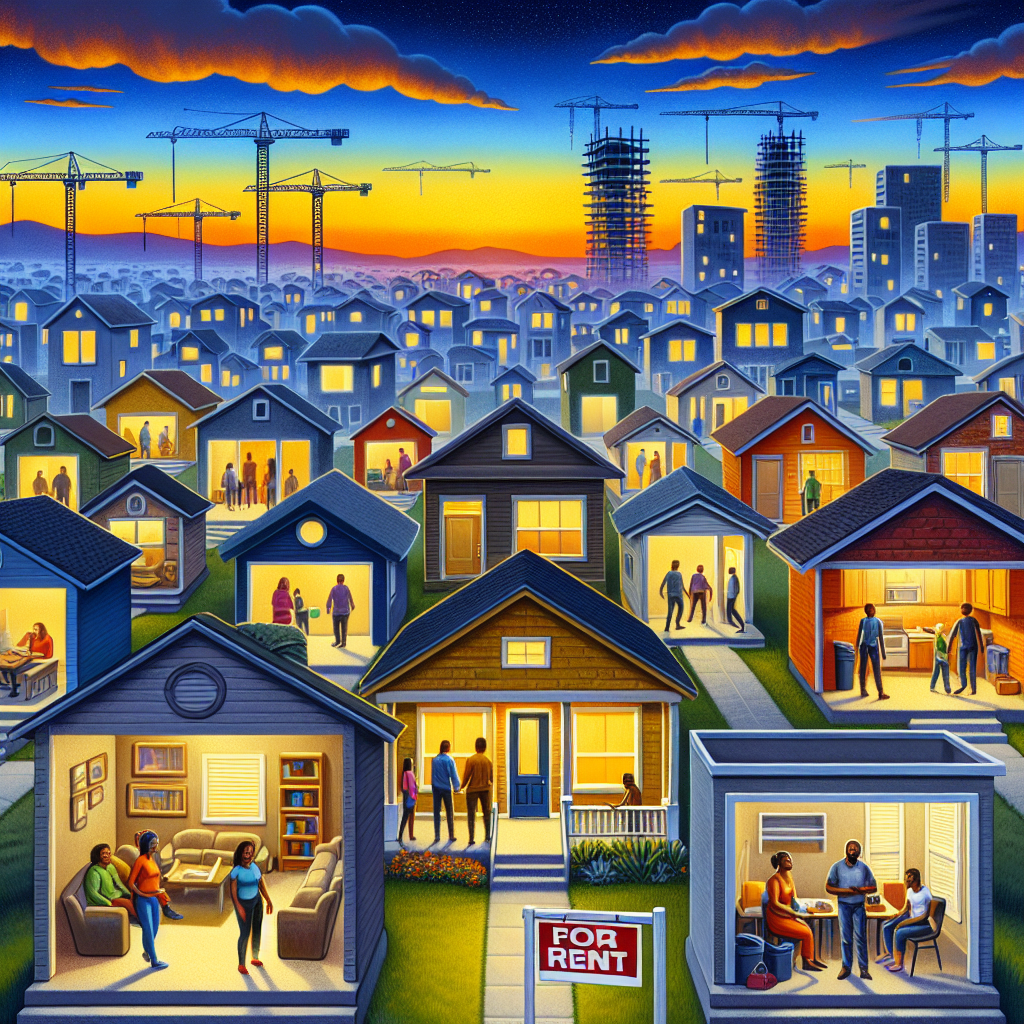

Single-Family Home Rentals Poised for Significant Growth

The real estate market is constantly evolving, and one of the most notable trends in recent years is the significant growth in single-family home rentals. This shift is driven by a variety of factors, including changing demographics, economic conditions, and evolving consumer preferences. In this article, we will explore the reasons behind this trend, examine relevant statistics, and discuss the implications for investors, renters, and the housing market as a whole.

Changing Demographics and Lifestyle Preferences

One of the primary drivers of the growth in single-family home rentals is the changing demographics and lifestyle preferences of the population. Several key demographic groups are contributing to this trend:

- Millennials: As the largest generation in the workforce, millennials are delaying homeownership due to factors such as student loan debt, high housing prices, and a desire for flexibility. Many prefer the convenience and lower financial commitment of renting.

- Baby Boomers: Some baby boomers are downsizing from larger homes to smaller, more manageable rental properties. This allows them to free up equity, reduce maintenance responsibilities, and enjoy a more flexible lifestyle.

- Gen Z: The youngest generation is entering the rental market with a preference for urban living and a reluctance to commit to long-term homeownership. They value experiences over possessions and prioritize mobility.

Economic Factors Influencing Rental Demand

Economic conditions also play a significant role in the increasing demand for single-family home rentals. Several economic factors are at play:

- Housing Affordability: The rising cost of homeownership, including high property prices and mortgage rates, has made it difficult for many individuals and families to purchase homes. Renting provides a more affordable alternative.

- Job Market Volatility: Economic uncertainty and job market volatility have led some individuals to prefer renting over buying. Renting offers greater flexibility in case of job relocation or changes in financial circumstances.

- Investment Opportunities: Investors are increasingly recognizing the potential for strong returns in the single-family rental market. This has led to an influx of capital and the development of new rental properties.

Case Studies: Successful Single-Family Rental Markets

Several markets across the United States have seen significant growth in single-family home rentals. Let’s take a closer look at a few examples:

Phoenix, Arizona

Phoenix has experienced a surge in single-family home rentals due to its strong job market, affordable cost of living, and attractive climate. The city has seen an influx of new residents, many of whom prefer renting over buying. As a result, investors have been actively developing and acquiring rental properties to meet the growing demand.

Atlanta, Georgia

Atlanta’s diverse economy and relatively low cost of living have made it a popular destination for renters. The city’s robust job market, particularly in industries such as technology and healthcare, has attracted a steady stream of new residents. Single-family home rentals have become an attractive option for families and young professionals seeking more space and amenities.

Dallas-Fort Worth, Texas

The Dallas-Fort Worth metroplex has seen significant growth in single-family home rentals due to its strong economy, job opportunities, and affordable housing market. The region’s population has been steadily increasing, driving demand for rental properties. Investors have responded by developing new rental communities and acquiring existing homes to convert into rentals.

Statistics Highlighting the Growth of Single-Family Home Rentals

Several statistics underscore the significant growth of single-family home rentals in recent years:

- According to the U.S. Census Bureau, the number of single-family rental households increased by 31% from 2010 to 2020, compared to a 15% increase in multifamily rental households.

- A report by the Urban Institute found that single-family rentals accounted for 35% of all rental housing in the United States in 2020, up from 31% in 2006.

- Data from CoreLogic shows that single-family rental prices increased by 7.5% year-over-year in 2021, reflecting strong demand and limited supply.

- The National Rental Home Council (NRHC) reported that institutional investors owned approximately 300,000 single-family rental homes in 2020, a significant increase from previous years.

Implications for Investors

The growth of single-family home rentals presents several opportunities and challenges for investors:

- Opportunities: Investors can benefit from strong rental demand, potential appreciation in property values, and attractive returns on investment. The single-family rental market offers diversification and stability, particularly in high-demand areas.

- Challenges: Investors must navigate competition from other buyers, rising property prices, and potential regulatory changes. Effective property management and maintenance are crucial to ensuring tenant satisfaction and maximizing returns.

Implications for Renters

For renters, the growth of single-family home rentals offers several advantages and considerations:

- Advantages: Renters can enjoy the benefits of living in a single-family home, such as more space, privacy, and access to outdoor areas. Renting provides flexibility and lower financial commitment compared to homeownership.

- Considerations: Renters may face rising rental prices due to strong demand and limited supply. It’s important to carefully evaluate lease terms, property conditions, and landlord reputation before committing to a rental property.

Future Outlook for Single-Family Home Rentals

The future outlook for single-family home rentals remains positive, with several trends likely to shape the market:

- Continued Demand: Demographic shifts, economic factors, and changing lifestyle preferences are expected to sustain strong demand for single-family home rentals.

- Technological Advancements: Technology will play a key role in the management and marketing of rental properties. Innovations such as smart home technology, online leasing platforms, and virtual tours will enhance the rental experience for both landlords and tenants.

- Regulatory Changes: Policymakers may introduce regulations to address housing affordability and tenant protections. Investors and landlords will need to stay informed and adapt to any changes in the regulatory landscape.

- Sustainability and Green Living: There is a growing emphasis on sustainability and energy efficiency in the housing market. Single-family rental properties that incorporate green features and sustainable practices may attract environmentally conscious renters.

Conclusion

The growth of single-family home rentals is a significant trend in the real estate market, driven by changing demographics, economic conditions, and evolving consumer preferences. This trend presents opportunities and challenges for investors, renters, and the housing market as a whole. By understanding the factors driving this growth and staying informed about market developments, stakeholders can make informed decisions and capitalize on the potential of the single-family rental market.

As we look to the future, the demand for single-family home rentals is expected to remain strong, supported by demographic shifts, economic factors, and technological advancements. Investors and landlords who adapt to these trends and prioritize tenant satisfaction will be well-positioned to succeed in this dynamic and growing market.