-

Table of Contents

- South Carolina’s New Law Targets Wholesaling with Strict Regulations

- Understanding Wholesaling in Real Estate

- The Mechanics of Wholesaling

- The Need for Regulation

- South Carolina’s New Wholesaling Law

- Key Provisions of the Law

- Implications for Real Estate Investors

- Increased Compliance Costs

- Greater Accountability

- Potential Market Shifts

- Case Studies: Impact of Similar Regulations in Other States

- Illinois

- Oklahoma

- Statistics: The State of Wholesaling in South Carolina

- Expert Opinions on the New Law

- Support from Consumer Advocates

- Mixed Reactions from Real Estate Professionals

- Investor Concerns

- Conclusion: Navigating the Future of Wholesaling in South Carolina

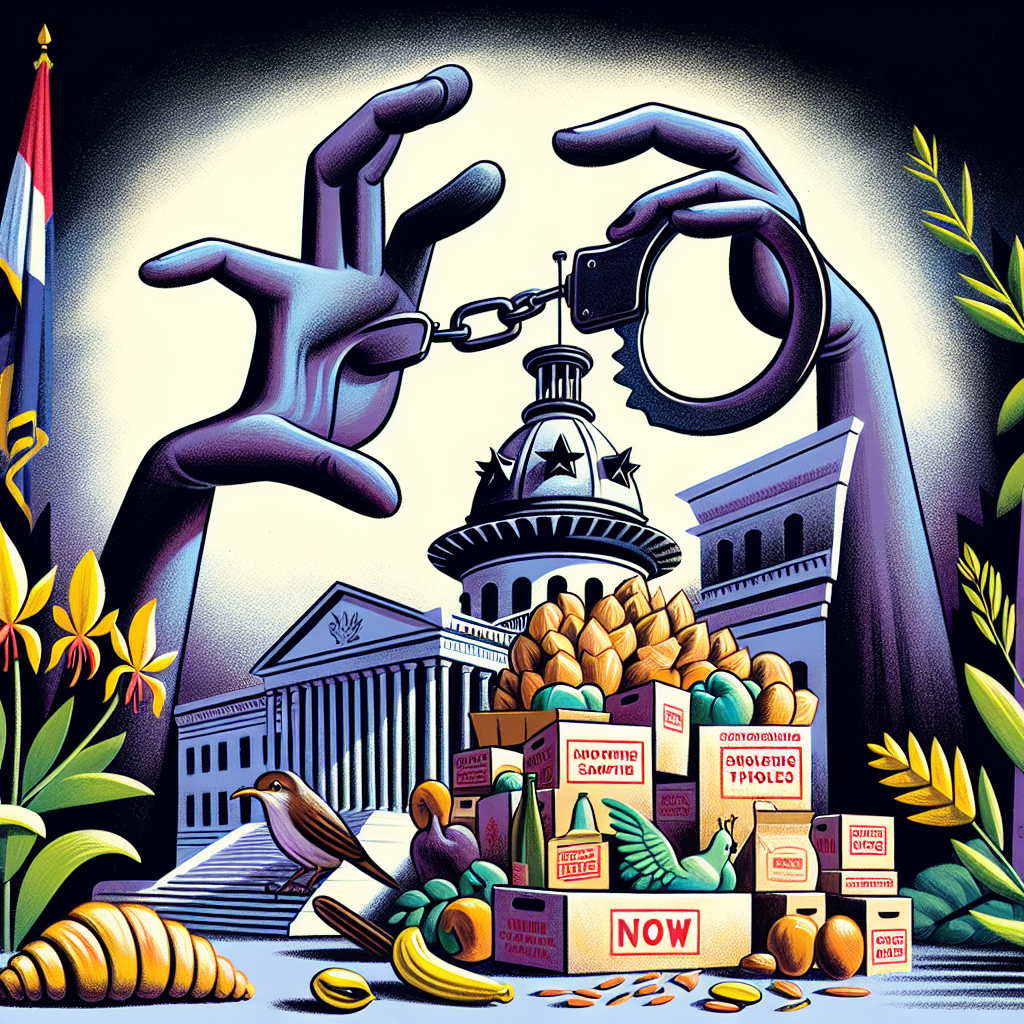

South Carolina’s New Law Targets Wholesaling with Strict Regulations

In recent years, the real estate market has seen a surge in wholesaling activities, a practice where investors contract properties at a low price and then sell the contract to another buyer for a profit. While this strategy can be lucrative, it has also raised concerns about transparency and ethical practices. In response, South Carolina has introduced new legislation aimed at regulating wholesaling activities within the state. This article delves into the specifics of the new law, its implications for real estate investors, and the broader impact on the housing market.

Understanding Wholesaling in Real Estate

Wholesaling in real estate involves a middleman who identifies a property, secures it under contract, and then sells that contract to another buyer, often an investor or a rehabber. The wholesaler makes a profit by charging a fee for facilitating the transaction. This practice has gained popularity due to its low entry barriers and potential for high returns.

The Mechanics of Wholesaling

To better understand the new regulations, it’s essential to grasp the basic mechanics of wholesaling:

- Finding a Property: Wholesalers typically look for distressed properties or motivated sellers willing to sell below market value.

- Securing a Contract: The wholesaler negotiates a purchase agreement with the seller, often including an assignment clause that allows the contract to be transferred to another buyer.

- Finding a Buyer: The wholesaler then markets the contract to potential buyers, usually investors looking for a good deal.

- Assigning the Contract: Once a buyer is found, the wholesaler assigns the contract to them for a fee, which is their profit.

The Need for Regulation

While wholesaling can be a legitimate investment strategy, it has also attracted criticism and scrutiny. Some of the primary concerns include:

- Lack of Transparency: Sellers may not fully understand that they are dealing with a wholesaler rather than a direct buyer, leading to potential misunderstandings and disputes.

- Ethical Concerns: Some wholesalers use aggressive or misleading tactics to secure contracts, exploiting sellers in distress.

- Market Impact: The influx of wholesalers can drive up property prices, making it harder for traditional buyers to compete.

South Carolina’s New Wholesaling Law

In response to these concerns, South Carolina has enacted new legislation aimed at regulating wholesaling activities. The law, which came into effect in 2023, introduces several key provisions designed to increase transparency and protect consumers.

Key Provisions of the Law

The new law includes the following major provisions:

- Licensing Requirements: Wholesalers must now obtain a real estate license to operate legally in South Carolina. This ensures that they adhere to the same ethical and professional standards as licensed real estate agents.

- Disclosure Obligations: Wholesalers are required to disclose their status as a wholesaler to both the seller and the buyer. This transparency helps prevent misunderstandings and ensures that all parties are aware of the nature of the transaction.

- Contractual Clarity: The law mandates that all contracts used in wholesaling transactions include clear language about the assignment of the contract and the wholesaler’s role in the deal.

- Penalties for Non-Compliance: Wholesalers who fail to comply with the new regulations face significant penalties, including fines and potential revocation of their real estate license.

Implications for Real Estate Investors

The new law has significant implications for real estate investors in South Carolina. While it aims to protect consumers and increase transparency, it also introduces new challenges for wholesalers.

Increased Compliance Costs

Obtaining a real estate license involves time and money, including pre-licensing education, exam fees, and ongoing continuing education requirements. These costs may deter some would-be wholesalers from entering the market.

Greater Accountability

With the new disclosure and contractual clarity requirements, wholesalers must be more diligent in their dealings. This increased accountability can help build trust with sellers and buyers but also requires more careful management of transactions.

Potential Market Shifts

The new regulations may lead to a shift in the market dynamics. Traditional real estate agents, who are already licensed and familiar with regulatory requirements, may find it easier to compete with wholesalers. Additionally, the increased transparency may lead to more informed decision-making by sellers and buyers.

Case Studies: Impact of Similar Regulations in Other States

South Carolina is not the first state to introduce regulations targeting wholesaling. Examining the impact of similar laws in other states can provide valuable insights into the potential outcomes in South Carolina.

Illinois

In 2019, Illinois enacted a law requiring wholesalers to obtain a real estate license. The law aimed to curb unethical practices and increase transparency. Since its implementation, the state has seen a reduction in complaints related to wholesaling, suggesting that the regulations have had a positive impact on consumer protection.

Oklahoma

Oklahoma introduced similar regulations in 2020, requiring wholesalers to disclose their status and obtain a license. The law has led to increased professionalism in the wholesaling industry, with many wholesalers opting to become licensed real estate agents. This shift has improved the overall reputation of the industry and increased trust among consumers.

Statistics: The State of Wholesaling in South Carolina

To understand the potential impact of the new law, it’s helpful to examine the current state of wholesaling in South Carolina. While comprehensive data on wholesaling activities is limited, several key statistics provide insight into the market:

- Real Estate Market Growth: South Carolina’s real estate market has experienced steady growth in recent years, with home prices increasing by an average of 5% annually.

- Wholesaling Popularity: Anecdotal evidence suggests that wholesaling has become increasingly popular in South Carolina, particularly in urban areas like Charleston and Columbia.

- Consumer Complaints: The South Carolina Real Estate Commission has reported a rise in complaints related to wholesaling, highlighting the need for regulatory intervention.

Expert Opinions on the New Law

The introduction of the new wholesaling law has sparked a range of opinions from industry experts, real estate professionals, and consumer advocates.

Support from Consumer Advocates

Consumer advocates have largely welcomed the new regulations, arguing that they will protect vulnerable sellers and increase transparency in the real estate market. They believe that the licensing requirements will weed out unethical wholesalers and ensure that only qualified professionals engage in wholesaling activities.

Mixed Reactions from Real Estate Professionals

Real estate professionals have expressed mixed reactions to the new law. Some agents support the regulations, viewing them as a way to level the playing field and enhance the industry’s reputation. Others, particularly those involved in wholesaling, are concerned about the increased compliance costs and potential barriers to entry.

Investor Concerns

Real estate investors who rely on wholesaling as part of their investment strategy have voiced concerns about the new law. They worry that the licensing requirements and disclosure obligations will complicate transactions and reduce profit margins. However, some investors acknowledge that increased transparency could lead to more stable and trustworthy market conditions in the long run.

Conclusion: Navigating the Future of Wholesaling in South Carolina

South Carolina’s new law targeting wholesaling represents a significant shift in the state’s real estate landscape. By introducing licensing requirements, disclosure obligations, and contractual clarity, the law aims to protect consumers and increase transparency in the market. While these regulations present new challenges for wholesalers, they also offer an opportunity to enhance the professionalism and reputation of the industry.

As the law takes effect, real estate investors, wholesalers, and professionals will need to adapt to the new regulatory environment. By obtaining the necessary licenses, adhering to disclosure requirements, and maintaining ethical practices, they can continue to thrive in South Carolina’s evolving real estate market.

Ultimately, the success of the new law will depend on its enforcement and the willingness of industry participants to embrace the changes. If implemented effectively, the regulations have the potential to create a more transparent, ethical, and consumer-friendly real estate market in South Carolina.

In summary, South Carolina’s new wholesaling law marks a pivotal moment for the state’s real estate industry. By addressing concerns about transparency and ethical practices, the law aims to protect consumers and ensure that only qualified professionals engage in wholesaling activities. As the market adapts to these changes, stakeholders must navigate the new regulatory landscape with diligence and integrity, paving the way for a more trustworthy and stable real estate market in South Carolina.