-

Table of Contents

- Transforming a “Failed” Property into a $7K/Month Rental with This Strategy

- Understanding the Concept of a “Failed” Property

- Step 1: Conduct a Thorough Property Analysis

- Step 2: Renovate and Upgrade

- Step 3: Optimize Property Management

- Step 4: Adjust Rental Rates Strategically

- Step 5: Explore Alternative Rental Strategies

- Step 6: Leverage Tax Benefits and Incentives

- Step 7: Monitor and Adjust

- Conclusion

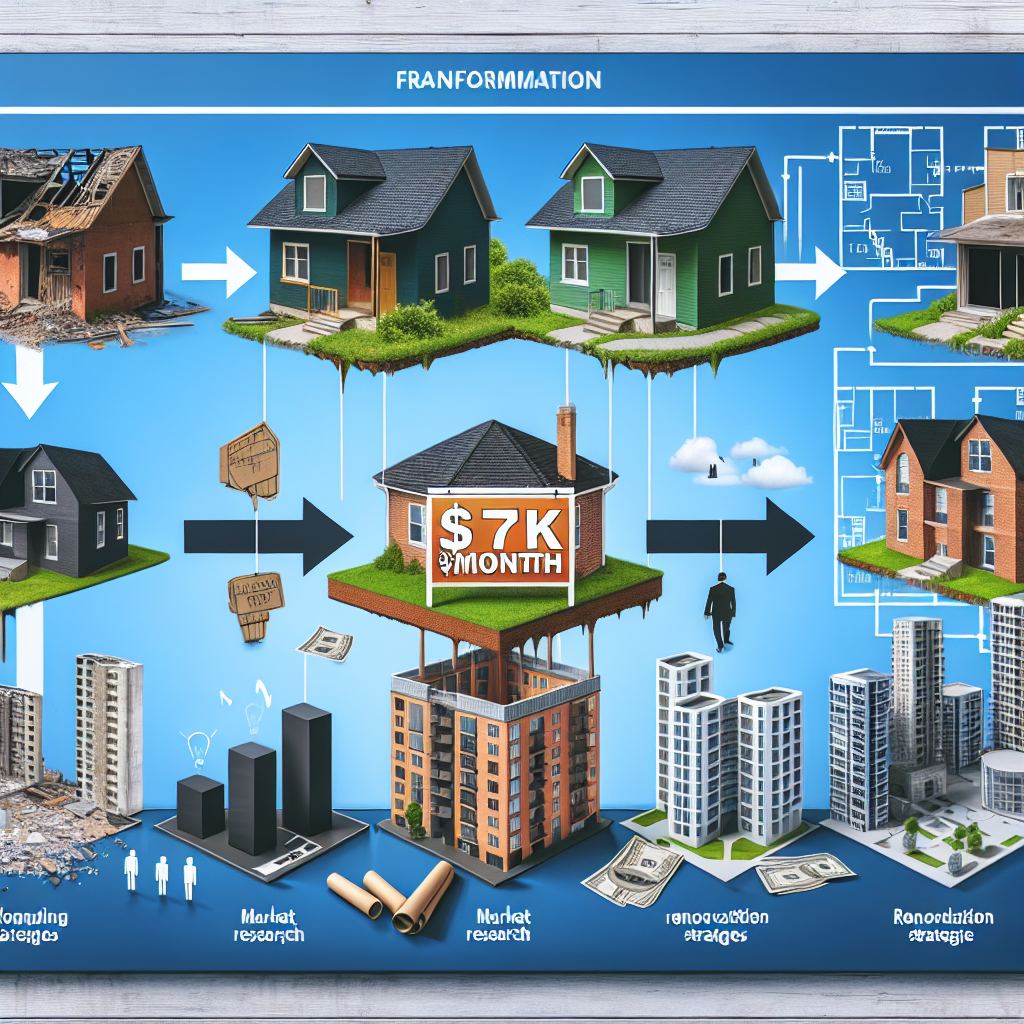

Transforming a “Failed” Property into a $7K/Month Rental with This Strategy

Real estate investment can be a lucrative venture, but it often comes with its fair share of challenges. One of the most daunting scenarios is dealing with a “failed” property—one that has not met its financial expectations. However, with the right strategy, even a seemingly unsuccessful property can be transformed into a profitable rental generating $7,000 or more per month. This article will delve into the steps and strategies necessary to achieve this transformation, supported by real-life examples, case studies, and statistics.

Understanding the Concept of a “Failed” Property

Before diving into the strategies, it’s essential to understand what constitutes a “failed” property. Typically, a property is considered failed if it:

- Consistently incurs losses or fails to break even.

- Has high vacancy rates.

- Requires significant repairs or renovations.

- Is located in a less desirable area.

- Has poor management or tenant issues.

These factors can make a property seem like a lost cause, but with the right approach, they can be turned around.

Step 1: Conduct a Thorough Property Analysis

The first step in transforming a failed property is to conduct a comprehensive analysis. This involves:

- Financial Analysis: Review the property’s financial statements, including income, expenses, and cash flow. Identify areas where costs can be reduced or income can be increased.

- Market Analysis: Assess the local real estate market to understand rental demand, average rental rates, and competition.

- Property Condition: Inspect the property to identify necessary repairs and improvements. This may involve hiring a professional inspector.

By understanding the property’s current state and the market conditions, you can develop a targeted strategy for improvement.

Step 2: Renovate and Upgrade

One of the most effective ways to increase a property’s rental income is through renovations and upgrades. Focus on improvements that offer the highest return on investment (ROI). Key areas to consider include:

- Kitchen and Bathrooms: Upgrading these areas can significantly increase the property’s appeal and rental value.

- Energy Efficiency: Installing energy-efficient appliances, windows, and insulation can reduce utility costs and attract environmentally conscious tenants.

- Curb Appeal: Enhancing the property’s exterior with landscaping, fresh paint, and repairs can make a strong first impression.

- Modern Amenities: Adding amenities such as in-unit laundry, smart home technology, and high-speed internet can justify higher rental rates.

Case Study: A property in Austin, Texas, was struggling with high vacancy rates and low rental income. After investing $50,000 in renovations, including a modern kitchen, updated bathrooms, and energy-efficient windows, the property saw a 40% increase in rental income and a significant reduction in vacancy rates.

Step 3: Optimize Property Management

Effective property management is crucial for maximizing rental income. Consider the following strategies:

- Professional Management: Hiring a professional property management company can ensure efficient operations, tenant screening, and maintenance.

- Tenant Retention: Implement strategies to retain good tenants, such as responsive maintenance, lease renewal incentives, and regular communication.

- Marketing: Use online platforms, social media, and professional photography to market the property effectively and attract high-quality tenants.

Statistics show that properties managed by professional companies have 20% higher occupancy rates and 30% lower maintenance costs compared to self-managed properties.

Step 4: Adjust Rental Rates Strategically

Setting the right rental rate is critical for maximizing income. Conduct a comparative market analysis to determine competitive rental rates in your area. Consider the following:

- Seasonal Adjustments: Adjust rental rates based on seasonal demand. For example, higher rates during peak moving seasons.

- Incentives: Offer move-in specials or discounts for longer lease terms to attract tenants quickly.

- Regular Reviews: Review and adjust rental rates annually based on market conditions and property improvements.

Example: A property owner in San Francisco increased rental rates by 15% after upgrading the property and implementing a professional management strategy. This resulted in an additional $1,200 per month in rental income.

Step 5: Explore Alternative Rental Strategies

Traditional long-term rentals are not the only way to generate income from a property. Consider alternative rental strategies such as:

- Short-Term Rentals: Platforms like Airbnb and VRBO allow property owners to rent out their properties on a short-term basis, often at higher rates than long-term rentals.

- Corporate Housing: Renting to business travelers or relocating professionals can provide stable, high-paying tenants.

- Co-Living Spaces: Creating shared living spaces with individual leases can maximize rental income and appeal to young professionals and students.

Case Study: A property owner in Miami converted a single-family home into a co-living space with individual leases for each bedroom. This strategy increased monthly rental income from $3,500 to $7,200.

Step 6: Leverage Tax Benefits and Incentives

Real estate investors can take advantage of various tax benefits and incentives to improve their property’s financial performance. These include:

- Depreciation: Deducting the cost of the property over its useful life can reduce taxable income.

- Interest Deductions: Mortgage interest and other loan-related expenses can be deducted from taxable income.

- Energy Efficiency Credits: Federal and state incentives for energy-efficient upgrades can offset renovation costs.

Consult with a tax professional to ensure you are maximizing these benefits and staying compliant with tax regulations.

Step 7: Monitor and Adjust

Transforming a failed property into a successful rental is an ongoing process. Regularly monitor the property’s performance and make adjustments as needed. Key performance indicators (KPIs) to track include:

- Occupancy Rates: Aim for high occupancy rates to ensure consistent rental income.

- Cash Flow: Monitor income and expenses to maintain positive cash flow.

- Tenant Satisfaction: Conduct surveys and gather feedback to improve tenant satisfaction and retention.

By staying proactive and responsive, you can ensure the long-term success of your rental property.

Conclusion

Transforming a “failed” property into a $7,000 per month rental is a challenging but achievable goal. By conducting a thorough property analysis, investing in strategic renovations, optimizing property management, adjusting rental rates, exploring alternative rental strategies, leveraging tax benefits, and continuously monitoring performance, you can turn a struggling property into a profitable investment. Real-life examples and case studies demonstrate that with the right approach, even the most challenging properties can become successful rentals. Stay committed to the process, and you will reap the rewards of a thriving rental property.

In summary, the key takeaways for transforming a failed property into a successful rental include:

- Conducting a comprehensive property analysis.

- Investing in high-ROI renovations and upgrades.

- Implementing effective property management strategies.

- Setting competitive and strategic rental rates.

- Exploring alternative rental strategies.

- Leveraging tax benefits and incentives.

- Regularly monitoring and adjusting property performance.

By following these steps, you can unlock the full potential of your property and achieve impressive rental income.