If you’re considering property investment in Michigan, understanding DSCR loans is crucial. DSCR loans offer unique advantages over traditional mortgage options, tailored for savvy investors.

Our comprehensive guide delves into the distinct features of DSCR loans, from eligibility requirements to competitive rates. Discover why more investors prefer DSCR loans for their financial flexibility and faster processing.

Ready to explore Michigan’s top DSCR loan lenders and their offerings? Navigate the application process with confidence and secure the best terms for your investment properties. Let’s dive in.

Understanding DSCR Loans in Michigan: A Comprehensive Guide

What is a DSCR Loan?

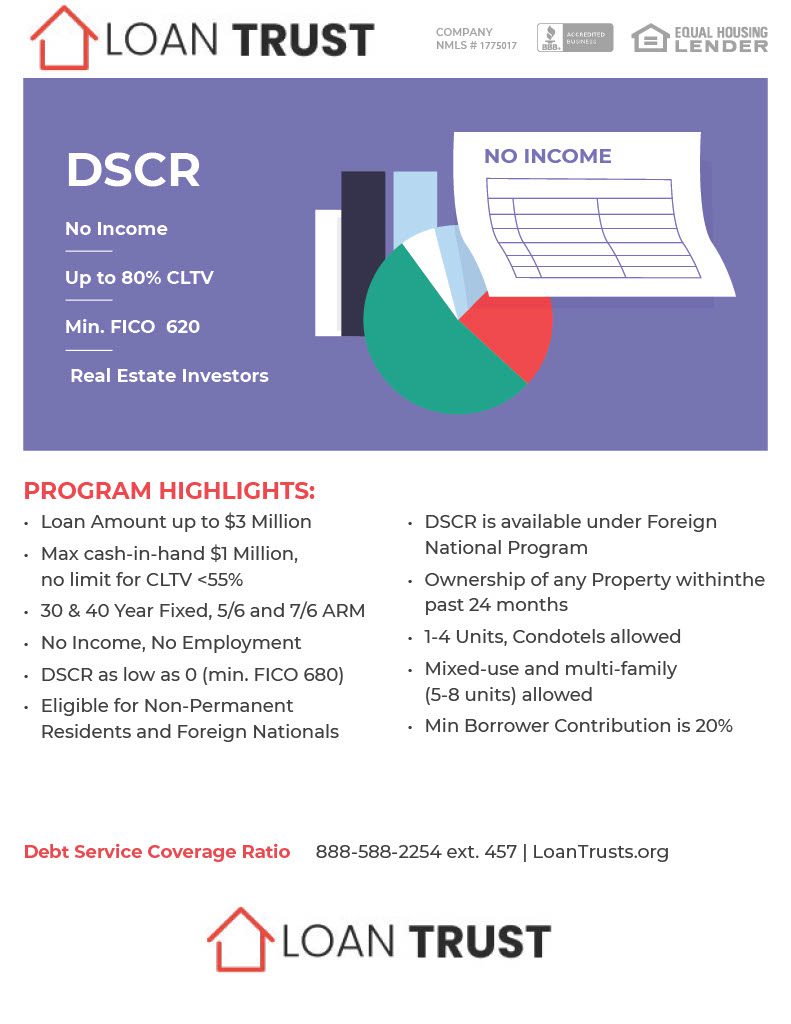

A Debt Service Coverage Ratio (DSCR) loan is a financial product designed explicitly for real estate investors, property developers, and entrepreneurs. This type of loan primarily focuses on the income-generating potential of a real estate investment rather than the borrower’s personal income.

DSCR loans serve the needs of investors who might find it challenging to meet the stringent requirements of traditional mortgages. With DSCR loans, lenders evaluate the property’s ability to produce sufficient income to cover the debt, measured by the debt service coverage ratio.

A DSCR loan is immensely beneficial for investors with ample down payment or equity but insufficient documentable income.

For real estate investors in Michigan, DSCR loans present an opportunity to finance rental properties, commercial buildings, or other income-generating properties. They make it possible to capitalize on opportunities within the dynamic Michigan real estate market.

Moreover, DSCR loans are part of the non-qualified mortgage (non-QM) category, known for their more flexible approval procedures. This flexibility extends to various borrower profiles, including self-employed individuals who may not have traditional employment verification documents.

- Income Focus: DSCR loans emphasize rental income over personal income.

- Flexibility: Available to a wide range of borrowers, including those with non-traditional income.

- Investment Suitability: Ideal for financing rentable properties.

How DSCR Loans Differ from Traditional Mortgages

Traditional mortgages rely heavily on the borrower’s documented income, credit score, and employment history. These factors play a less critical role in DSCR loans, which focus on the property’s ability to generate income.

One significant difference is the approval process. While traditional loans require extensive documentation, such as W-2s and pay stubs, DSCR loans demand evidence of the property’s income potential.

Down payments are crucial in DSCR loans. Michigan DSCR loans typically require a minimum down payment of 20%, with higher down payments required for properties with lower DSCRs. The down payment mitigates the lender’s risk by ensuring that the borrower has a significant investment in the property.

Minimum down payments of 20% are mandatory, with higher requirements for properties with lower DSCRs.

Additionally, the flexibility of DSCR loans stands out. They are much more accommodating for borrowers who may not meet the rigorous criteria of traditional loans, thereby offering an accessible financing option for real estate investors.

- Documentation: Traditional mortgages require extensive documentation of personal income and employment.

- Focus: DSCR loans prioritize the property’s income-generating capacity.

- Flexibility: More lenient eligibility requirements compared to traditional loans.

Key Components of DSCR Loans

Understanding the key components of DSCR loans can help investors make informed decisions. The predominant factor in DSCR loans is the Debt Service Coverage Ratio itself, which measures the property’s ability to cover its own debts through rental income.

The higher the DSCR, the lower the risk for the lender. For instance, a DSCR of 1.25 means that the property’s income is 25% higher than its debt obligations, indicating a safer investment. Lower DSCRs may necessitate higher down payments to offset the increased risk.

Another essential component is the interest rate. According to Lightning Docs, the average interest rate for DSCR loans in Michigan’s long-term rental market was 8.51% in the first quarter of 2024. This rate reflects the unique risk profile of DSCR loans compared to traditional mortgages.

Credit score requirements for DSCR loans are generally more lenient. While a good credit score can facilitate better loan terms, it is not as critical as in traditional loans. Instead, lenders concentrate on the property’s income potential.

- DSCR: Measures the property’s ability to cover its debts with rental income.

- Interest Rates: Typically higher than traditional mortgages due to the specialized nature of DSCR loans.

- Credit Requirements: More lenient, focusing on property income rather than the borrower’s creditworthiness.

Why Choose DSCR Loans for Investment Properties

For Michigan real estate investors, DSCR loans offer several compelling advantages. Primarily, they allow investors to leverage their properties’ income potential rather than their personal financial history. This opens doors for those who may struggle to qualify for traditional loans.

The flexibility of DSCR loans is particularly beneficial in the unpredictable real estate market. Investors can secure financing without the stringent requirements of conventional mortgages, allowing them to act swiftly on promising opportunities.

Furthermore, DSCR loans are purpose-built for rental and income-generating properties. This specialization ensures that the loan terms and conditions are optimized for real estate investments, making it easier for investors to expand their portfolios.

DSCR loans empower investors to leverage their properties’ income potential rather than personal financial history.

In the context of the Michigan real estate market, DSCR loans provide a strategic advantage. They enable investors to navigate and capitalize on the unique opportunities presented by Michigan’s dynamic and diverse market.

- Income-Based: Focus on property income rather than personal financial history.

- Flexibility: Less stringent approval processes than traditional mortgages.

- Specialization: Tailored for rental and income-generating properties.

Key Benefits of Michigan DSCR Loans for Investors

No Personal Income Requirement

One of the most distinctive advantages of DSCR loans is the lack of a personal income requirement. Unlike traditional loans, where your income plays a crucial role in the approval process, DSCR loans primarily hinge on the property’s ability to generate income.

This approach offers enhanced flexibility for real estate investors. By focusing on the property’s revenue, rather than your personal income, it becomes feasible to secure financing even if you have a non-traditional income source.

Consider an investor who derives income from multiple rental properties. Traditional lending criteria might not favor their income structure. However, DSCR loans, by emphasizing property income, provide a more adaptable and inclusive financing solution.

“DSCR loans offer a distinctive and adaptable option tailored to the needs of real estate investors, making them a valuable tool in an investor’s arsenal.”

Are you an investor with a diversified portfolio? DSCR loans can be particularly beneficial, allowing you to leverage your property’s income potential to secure further investments.

This unique feature empowers investors, regardless of their personal income sources, to expand their investment opportunities.

Unlimited Loan Quantity

Another compelling benefit of DSCR loans is the ability to secure an unlimited number of loans. While traditional loans may restrict the number of mortgages an investor can possess, DSCR loans break this barrier.

This feature is especially advantageous for investors aiming to broaden their property portfolio. Imagine the potential of owning multiple properties without the constraints of traditional lending restrictions!

Why limit your growth potential? With DSCR loans, investors can continuously expand their investments, tapping into new markets and opportunities.

- Portfolio Diversification: Continue to add properties to your portfolio, increasing your investment return potential.

- Strategic Investments: Take advantage of emerging markets by securing multiple loans for different properties.

- Scalability: Scale your investment strategy without the typical limitations imposed by personal income.

These advantages make DSCR loans a powerful tool for ambitious investors looking to maximize their property holdings and achieve substantial growth.

Faster Closing Process

Investors often seek quick and efficient financing solutions. DSCR loans typically offer a faster closing process compared to conventional loans.

This accelerated process stems from the simplicity of the application. By not requiring extensive personal income verification, DSCR loans streamline the approval and closing stages.

Consider how valuable time is when securing an investment deal. A faster closing process means you can capitalize on opportunities promptly, reducing the risk of losing potential investments.

Moreover, the time saved during the closing process can be redirected towards managing and growing your investment portfolio. How does a streamlined, efficient financing process impact your investment strategy?

With DSCR loans, the emphasis is on quick, effective actions, enabling investors to stay competitive in a fast-paced market.

No Employment Verification

The advantage of no employment verification is another key benefit of DSCR loans. Real estate investors often have complex or non-traditional employment situations, which can complicate traditional loan applications.

By eliminating the need for employment verification, DSCR loans provide an easier path to financing, focusing solely on the property’s income-generating capacity.

“The application process for DSCR loans is often more straightforward than traditional loans since it doesn’t necessitate personal income verification.”

For investors, this means a significant reduction in the paperwork and scrutiny typically involved in the loan approval process. How does this flexibility benefit your investment plans?

This feature is particularly useful for seasoned investors with multiple revenue streams or those in entrepreneurial roles. It aligns perfectly with the dynamic nature of real estate investing.

Ultimately, DSCR loans offer a streamlined, efficient pathway to financing, tailored to the unique needs of real estate investors.

Eligibility Requirements for DSCR Loans in Michigan

Minimum DSCR Threshold

The minimum Debt Service Coverage Ratio (DSCR) threshold for obtaining a DSCR loan in Michigan is not as stringent as one might expect. Despite the common belief that properties must generate a DSCR greater than 1.0, this is not always the case. Properties that do cash flow positively result in better loan terms for the borrower, such as lower interest rates and reduced down payment requirements.

For applicants with properties that do not meet this positive cash flow criterion, lenders are still willing to provide DSCR loans. This leniency highlights the flexibility of DSCR loans compared to traditional financing options. Would a traditional bank consider such favorable terms?

Understanding these nuances can be essential for potential applicants, especially those who might feel discouraged by their property’s current financial performance. It is crucial to explore all your options and seek advice from an expert in DSCR loans to navigate these varied requirements.

Credit Score Requirements

Credit scores play a significant role in determining eligibility and the terms of DSCR loans. Unlike traditional loans, DSCR lenders demonstrate considerable flexibility regarding credit scores. While a higher score can secure more favorable terms, borrowers with lower credit scores still have access to DSCR loans.

When considering a DSCR loan, a higher credit score often translates to lower interest rates and reduced down payment requirements. Conversely, lower scores typically necessitate larger down payments and might attract higher interest rates. This balance ensures that DSCR loans remain accessible to a broad range of applicants.

“Borrowers with lower scores will often require larger down payments and/or higher interest rates.” – DSCR Loan Expert

The adjustable criteria allow individuals to work around their financial situations, making DSCR loans a viable option for those who may not qualify under traditional lending criteria. Isn’t this adaptability a significant advantage?

Down Payment Criteria

Down payment requirements for DSCR loans are another critical factor potential applicants need to consider. While the general rule of thumb is a down payment of at least 20% of the property’s purchase price, several factors can influence this amount.

For instance, a lower credit score might lead to a higher down payment requirement. Similarly, properties that do not produce positive cash flow will likely necessitate a larger down payment. On the flip side, properties with positive cash flow and applicants with higher credit scores may benefit from reduced down payment percentages.

- 20% baseline: Most lenders set a minimum down payment of 20%.

- Credit score influence: Lower scores can increase the down payment requirement.

- Cash flow consideration: Non-cash-flowing properties require more upfront investment.

These variances underscore the importance of assessing one’s financial situation and property details thoroughly before applying. How does your property and credit profile stack up against these criteria?

Flexibility Compared to Traditional Loans

One of the standout advantages of DSCR loans is their flexibility compared to traditional mortgage options. Traditional lenders typically adhere to rigid criteria, leaving little room for negotiation or adjustment based on individual circumstances.

DSCR loans, however, offer a more adaptable framework. For example, properties not generating positive cash flow can still qualify for financing. This flexibility extends to credit scores and down payment requirements as well. Isn’t it refreshing to have loan options that cater to a wider range of applicants?

Traditional loans often set high standards that can be challenging for many potential homeowners to meet. DSCR loans break down these barriers by providing more lenient conditions. This inclusive approach ensures that more applicants have access to the funds needed to secure their desired properties.

- Income-generating property: While traditional loans may require this, DSCR loans are more flexible.

- Credit scores: Lower scores can still secure DSCR loans, unlike many conventional mortgages.

- Down payment: Requirements vary more significantly, offering applicants the chance to negotiate terms based on their unique situations.

In sum, DSCR loans provide a level of flexibility that significantly benefits potential borrowers, especially those who might struggle to meet the stringent criteria of traditional loans. Why not consider this adaptable option for your financing needs?

Competitive Rates for DSCR Loans in Michigan

Current DSCR Loan Rates

Understanding the current Debt Service Coverage Ratio (DSCR) loan rates is crucial for real estate investors looking to finance their properties effectively. As of now, DSCR loan rates in Michigan typically range between 4.5% and 6%, but these can vary depending on several factors.

Current trends indicate a slight increase in rates from previous years due to economic conditions and market demands. Monitoring these rates regularly can help investors make informed decisions.

For example, comparing rates from various lenders can uncover competitive offers that might save investors thousands over the loan term. Moreover, keeping an eye on the Federal Reserve’s policies and economic outlooks provides insights into potential rate changes.

Interest rates offered by different lenders can significantly impact overall costs. Hence, being aware of current market conditions and rates is vital for any savvy investor.

Despite the fluctuations, real estate investors can still find favorable DSCR loan rates by leveraging their financial health and presenting strong business cases to lenders.

“The interest rates for DSCR loans may not be as low as traditional loans, but understanding and leveraging these rates effectively can lead to profitable investments.” – Financial Expert

It’s worth noting that rates may slightly differ across lenders, so thorough research is advisable to secure the best deal.

Why not start by reviewing local lender offerings to see where Michigan stands in the current market?

Factors Influencing Rates

Several key factors influence the rates for DSCR loans in Michigan. Understanding these can aid real estate investors in negotiating better terms.

Firstly, the borrower’s credit score plays a pivotal role. Higher credit scores often translate into lower interest rates, reflecting the reduced risk to the lender.

- Credit Score: A higher score can lead to lower rates.

- Property Type: Commercial properties may attract different rates compared to residential ones.

- Loan Amount: Larger loan amounts can impact interest rates, sometimes offering slight reductions.

- Loan Term: The length of the loan term can affect the interest rate, with shorter terms often having lower rates.

- Economic Conditions: Broader economic factors and Federal Reserve policies invariably influence DSCR loan rates.

Additionally, the type and value of the property being financed can affect the rates. For instance, commercial properties might have different rates compared to residential properties.

The loan amount is another critical factor. Larger loans might secure slightly lower rates as they represent more substantial business opportunities for lenders.

“A comprehensive understanding of these factors can empower investors to negotiate more favorable loan terms.” – Mortgage Advisor

Incorporating these aspects into your loan application strategy can enhance your chances of securing better rates.

How prepared are you to leverage these factors for a better deal?

Comparison with Traditional Loan Rates

DSCR loans and traditional loans, such as conventional mortgages, differ significantly in their rate structures.

Typically, traditional loans may offer lower interest rates compared to DSCR loans, reflecting the difference in risk perception by lenders.

Comparing the two:

- Risk Assessment: DSCR loans focus on property income rather than personal income, leading to higher rates due to perceived higher risk.

- Rate Stability: Traditional loans might offer fixed rates, providing stability over the loan term, whereas DSCR loans may have more variable rates.

- Qualification Criteria: DSCR loans might have more flexible qualifications related to property income, while traditional loans require rigorous personal income verification.

It’s essential to note that while traditional loans can seem attractive due to lower rates, the flexibility and unique qualifications of DSCR loans provide substantial benefits for real estate investors.

Traditional loans can sometimes offer fixed rates, giving borrowers rate stability over the loan term. However, DSCR loans focus on property income rather than borrower income, which can ease the qualification process for investors with strong property cash flows but less stable personal income.

Comparing the benefits and drawbacks of each loan type is vital in selecting the most suitable financing option.

“While traditional loans may tempt with lower rates, DSCR loans offer unique advantages that can outweigh the cost difference.” – Real Estate Analyst

Have you considered which loan type aligns better with your investment strategy?

How to Secure the Best Rates

Securing the best rates for DSCR loans involves strategic planning and effective negotiation. Here are some proven tips:

Firstly, improving your credit score can directly impact the interest rates offered. Paying off outstanding debts and ensuring timely payments can boost your score.

- Enhance Credit Score: Pay off debts and maintain timely payments.

- Demonstrate Strong Cash Flow: Showcase the property’s income stability to lenders.

- Shop Around: Compare offers from multiple lenders to find competitive rates.

- Negotiate Terms: Don’t hesitate to negotiate terms and seek rate reductions based on your financial health and investment plan.

- Consider Professional Advice: Consulting with a mortgage broker can provide insights and access to better rates.

A strong property cash flow can also be persuasive. Lenders are more likely to offer favorable rates if the property demonstrates reliable income generation.

Additionally, comparing offers from multiple lenders can reveal the most competitive rates available. Don’t hesitate to negotiate terms; lenders may be willing to reduce rates based on your financial health and investment strategy.

Lastly, seeking advice from mortgage brokers or financial advisors can provide you with valuable insights and access to exclusive rate offers.

“By taking proactive steps, real estate investors can significantly increase their chances of securing the best DSCR loan rates.” – Mortgage Specialist

Wouldn’t securing the best rate dramatically enhance your investment returns?

Applying for a DSCR Loan in Michigan: Step-by-Step Guide

Initial Application Steps

Starting your journey towards a DSCR loan in Michigan requires some preliminary steps.

Firstly, it is essential to determine your eligibility for a DSCR loan. Understanding the Debt Service Coverage Ratio (DSCR) is crucial, as it gauges your ability to generate sufficient income to cover your debt payments.

Once you have assessed your eligibility, the next step is to prepare initial information such as your financial history, the purpose of the loan, and details of the property you intend to purchase or refinance. This preliminary preparation ensures that you are ready to furnish any required documentation promptly.

After gathering your initial information, you can decide whether to directly contact a loan officer or begin the online application process.

Many applicants prefer to speak directly with a loan officer to gain a comprehensive understanding of the process and resolve any immediate queries they might have.

Remember, being well-prepared right from the start can significantly streamline your application process, saving you both time and effort.

Required Documentation

Gathering the necessary documentation is an integral part of the DSCR loan application process.

Essential documents typically include:

- Personal Identification: Valid ID such as a driver’s license or passport.

- Financial Statements: Recent bank statements and other financial documents that outline your current financial status.

- Credit Report: A comprehensive credit report detailing your credit history and score.

- Income Proof: Pay stubs, tax returns, and other proof of income to demonstrate your financial stability.

- Property Details: Information regarding the property you intend to purchase or refinance, including valuation and purchase agreements.

Ensuring that these documents are complete and up-to-date can significantly accelerate your application process.

Potential delays can often be attributed to missing or outdated documentation, so take the time to double-check everything before submission.

Do you have all the required documents at hand before you contact a loan officer or start filling out an online application?

Contacting Loan Officers

Reaching out to a loan officer can be an invaluable step in the DSCR loan application process.

Our dedicated team is readily available to guide you through each step, making the entire experience seamless and stress-free.

By contacting us directly at 800-555-2098, you can speak with an expert who will provide personalized assistance, answer your queries, and ensure you understand all aspects of the loan application process.

“Our experts will guide you through the application process, answer your questions, and provide the support you need.”

Have you decided to contact a loan officer yet? Doing so can provide much-needed clarity and save you valuable time.

Personalized guidance often makes the difference between a smooth application process and one fraught with challenges.

Online Application Process

For those who prefer a more digital approach, the online application process for a DSCR loan is designed to be user-friendly and efficient.

To begin, simply fill out the online form available on our website. The form will typically require basic details such as personal information, financial history, and property-related data.

Upon submission, your application will be promptly reviewed by our team, initiating the journey toward securing your DSCR loan.

“Alternatively, you can simply fill out the form below to initiate your application. We’ll promptly review your information and kickstart the journey to securing the DSCR loan that suits your investment needs.”

The online application process offers the convenience of applying from the comfort of your home, allowing you to manage your time more effectively.

Moreover, the digital approach often results in quicker processing times, as it allows for faster data transfer and communication.

Have you considered starting your application online to take advantage of this efficient process?

DSCR Loans vs. Traditional Loan Types: A Comparative Analysis

Income Documentation Differences

When comparing DSCR loans to traditional loan types, one of the most prominent differences lies in the income documentation requirements.

Traditional loans, such as those backed by Fannie Mae and Freddie Mac, necessitate extensive income documentation. Borrowers must provide proof of steady employment, pay stubs, tax returns, and other financial statements to qualify. This process can be time-consuming and challenging, especially for real estate investors whose income may not be consistent or easily documented.

In contrast, DSCR (Debt Service Coverage Ratio) loans focus on the income generated by the property itself. This means that investors are assessed on the rental income their property can produce rather than their personal income. Therefore, investors who might not have strong personal income documentation can still secure financing if the property income is sufficient to cover the debt service.

“Personal Income Not Required: Unlike other loan types, DSCR loans assess a property’s rental income rather than the borrower’s personal income to establish eligibility. This means that even if the borrower’s income falls short, they can still acquire an investment property.”

Furthermore, DSCR loans do not require employment verification. This lack of need for traditional income documentation simplifies the application process, allowing investors to focus on their property investments rather than proving their financial standing.

Real estate investors often face hurdles when traditional lending standards do not accommodate their unique income structures. DSCR loans offer a solution by eliminating the need for extensive personal income documentation and instead rely on the property’s potential to generate income.

Interest Rate Comparisons

Interest rates are a critical factor for any borrower. Traditional loans typically offer lower interest rates, often supported through government-backed programs like those from Fannie Mae and Freddie Mac. These rates can make traditional loans more financially attractive at first glance.

DSCR loans, on the other hand, come with slightly higher interest rates. Rates can be anywhere from 1% to 3% higher than those of traditional loan counterparts. The higher rates are a trade-off for the flexibility and fewer documentation requirements offered by DSCR loans.

Despite the higher rates, the benefits provided by DSCR loans can outweigh the cost difference for many investors, especially those looking to finance multiple properties or streamline their application process.

It’s essential to weigh the higher interest rates against the flexibility DSCR loans offer, such as not being limited by personal income documentation and the ability to quickly close deals.

“Expedited Closing Process: DSCR loans usually boast shorter closing timelines compared to conventional mortgages, thanks to simplified documentation requirements. This streamlines the loan approval and property acquisition procedure.”

Investors must ask themselves: Is the higher interest rate justified by the simplicity and efficiency of the DSCR loan process? For many, the answer is yes, particularly if the investment property is anticipated to generate substantial rental income.

When considering interest rates, it’s important to take a holistic view and examine how the terms of each loan type will impact your overall investment strategy.

Down Payment Requirements

Down payment requirements are another area where DSCR loans and traditional loans have notable differences. For traditional loans, the down payment can vary widely based on the loan program and borrower qualifications, with a minimum often set at around 20% for investment properties.

DSCR loans typically require a similar down payment, but the exact percentage can depend on both the actual DSCR (Debt Service Coverage Ratio) and the borrower’s credit score. This means that investors with higher DSCR values or better credit scores might benefit from lower down payment requirements.

Even though both loan types generally have similar down payment standards, DSCR loans’ reliance on property income rather than personal income can provide a strategic advantage for investors.

For example, an investor with a high DSCR may be able to secure better terms even without traditional income verification, making it easier to leverage funds for larger or multiple investments.

Additionally, the flexibility in down payment requirements means investors can allocate their funds more strategically, potentially increasing their portfolio’s profitability.

The ability to invest in multiple properties simultaneously without being constrained by personal debt-to-income ratios further enhances DSCR loans’ appeal for investors.

Suitability for Different Investors

Which type of loan is better suited for different investors? Traditional loans tend to favor individuals with strong, verifiable personal incomes and conventional employment situations. These loans work well for those who can meet the stringent documentation and verification requirements.

However, real estate investors often encounter challenges with traditional loans due to their unique income structures. DSCR loans are particularly suitable for investors whose primary earnings come from rental properties. By prioritizing property income over personal income, DSCR loans provide the necessary flexibility to support non-traditional income sources.

Additionally, DSCR loans allow investors to:

- Purchase Multiple Properties: Since personal debt-to-income ratios are not considered, investors can acquire several properties simultaneously without hindrance.

- Avoid Employment Verification: Focus on property income alone eliminates the need for employment verification, making the process quicker and less burdensome.

- Streamline Closing: Simplified documentation requirements lead to faster closing timelines, allowing investors to act swiftly in competitive markets.

“No Limit on Loan Quantity: In contrast to traditional mortgages, which often restrict the number of rental properties a borrower can purchase, DSCR loans typically permit borrowers to obtain as many loans as necessary.”

Investors should consider their financial situation and investment goals when choosing between DSCR and traditional loans. While traditional loans offer lower interest rates, DSCR loans provide unmatched flexibility and suitability for income-generating properties.

Ultimately, DSCR loans empower investors to capitalize on their properties’ income potential, making them an attractive alternative to conventional loan types for those with non-traditional income sources.

Exploring Michigan DSCR Loan Lenders and Their Offerings

Top DSCR Loan Lenders in Michigan

When considering DSCR loans, it’s vital to recognize the top lenders in Michigan who provide competitive offerings and exemplary services. Among them, a few stand out due to their reputations and loan products.

For instance, Quicken Loans has emerged as a leader, offering tailored DSCR loans to meet diverse investor needs. How do they maintain this status? Simple: through exceptional customer service and flexible terms.

“Our DSCR loans are designed to empower real estate investors by providing the necessary capital to grow their portfolios,” says a spokesperson from Quicken Loans.

Similarly, United Wholesale Mortgage (UWM) offers favorable rates and terms that appeal to seasoned investors and newcomers alike. Their streamlined online application process gets you started quickly.

- Quicken Loans: Known for excellent customer service and flexible term options

- United Wholesale Mortgage: Competitive rates and efficient application process

- Flagstar Bank: Offers a range of loan products with attractive terms

Each of these lenders brings unique strengths to the table, helping investors secure the best possible financing for their projects. Would you prefer an established lender with a comprehensive service range or a contender with cutting-edge online tools?

Identifying top lenders is just the beginning. Examining their specific terms and conditions will provide a clearer picture of which lender might suit your needs best.

Loan Terms and Conditions

Understanding loan terms and conditions is crucial when selecting a DSCR loan lender. Many investors overlook this step, potentially missing hidden fees or unfavorable terms.

For example, prepayment penalties can significantly impact overall loan costs if an investor plans to repay the loan early. Can you afford to be tied down by such penalties?

Interest rates and amortization schedules also play a critical role. A lower interest rate might seem attractive, but how does it affect your monthly payments and the total loan cost over time?

“We aim to provide transparent and fair loan terms that align with our clients’ investment strategies,” says a representative from UWM.

Here are some key terms and conditions to consider:

- Interest Rates: Compare fixed vs. adjustable rates for long-term affordability

- Prepayment Penalties: Understand any fees for early repayment

- Amortization Period: Longer periods might lower monthly payments but increase total cost

Each lender’s terms can vary, so meticulous comparison is essential. How much detail do you need to make an informed decision?

In addition to standard terms, exploring any special programs and offers can enhance overall loan benefits.

Special Programs and Offers

Many lenders offer special programs and incentives to attract real estate investors. These can range from lower interest rates to reduced fees or special financing options for certain property types.

For instance, Flagstar Bank frequently provides promotional rates and other incentives for new borrowers. Are these promotional rates a better deal than standard loan offerings?

“Special programs are designed to give investors an edge in a competitive market,” highlights a Flagstar Bank loan officer.

Common special programs might include:

- Promotional Interest Rates: Temporary lower rates to reduce initial costs

- Reduced Closing Costs: Discounts on fees associated with securing the loan

- Special Financing Options: Unique terms for properties like multi-family units

Considering these programs can provide significant savings and advantages. Do these incentives align with your investment strategy?

To fully leverage these benefits, choosing the right lender becomes paramount.

How to Choose the Right Lender

Selecting the right DSCR loan lender requires a comprehensive evaluation of several critical factors. This process can significantly influence the success of your real estate investments.

Start by assessing the lender’s reputation and reviews. A lender with positive feedback from other investors typically signals reliability and quality service. How important is a lender’s track record to you?

Next, consider the lender’s specific loan products and how they align with your needs. Are they offering the flexibility and terms that match your investment strategy?

“Trust and alignment with clients’ goals are at the heart of our lending philosophy,” states a Quicken Loans advisor.

Essential factors to evaluate include:

- Reputation and Reviews: Insights into the lender’s reliability and service quality

- Loan Products: Variety and flexibility of loan options available

- Customer Service: Quality of support and communication from the lender

Balancing these factors will guide you toward a lender who not only meets your financial needs but also supports your long-term investment goals. Are you ready to make an informed choice?

Conclusion

Deciphering the dynamics of DSCR loans in Michigan unveils a landscape ripe with opportunities for savvy investors. With benefits such as no personal income requirements, rapid closing processes, and greater flexibility, DSCR loans emerge as potent tools for diversifying investment portfolios. The key components like minimum DSCR thresholds and competitive rates provide an advantageous edge over traditional mortgages.

Choosing DSCR loans for investment properties in Michigan not only ensures financial leverage but also aligns with the strategic goals of seasoned and novice investors alike. The comparative analysis with traditional loan types underscores the value proposition of DSCR loans, particularly in easing income documentation and offering favorable down payment terms.

As you explore top DSCR loan lenders in Michigan, consider their unique programs and competitive rates to secure the best deals. Embark on your investment journey by understanding the application process and leveraging these insights for optimal financial growth. Dive deeper into this realm and unlock the full potential of your real estate investments in Michigan.

Frequently Asked Questions

Is it hard to get a DSCR loan?

Getting a DSCR loan can be easier than traditional loans due to relaxed income verification requirements.

Who is eligible for a DSCR loan?

Eligibility typically includes meeting a minimum DSCR threshold, a satisfactory credit score, and a required down payment.

How much do you need down for a DSCR loan?

Down payment requirements for DSCR loans usually start around 20%, but this can vary by lender.

What are the cons of a DSCR loan?

Cons may include higher interest rates and larger down payment requirements compared to traditional loans.

What key benefits do DSCR loans offer for Michigan investors?

Benefits include no personal income requirement, unlimited loan quantity, faster closing, and no employment verification.

How do DSCR loan rates compare to traditional loan rates?

DSCR loan rates may be higher due to the lower risk profile for lenders.