Passionately Committed To Helping You Build Generational Wealth Through Real Estate Ownership

Why, You Ask? Well, It's Because:

-

Housing Values Have Increased By An Average of 265% Over The Last 30 Years

-

The Average Homeowner has 40X More Wealth Than The Average Renter

-

The Majority of Our Wealthiest Americans Have 66% of their Wealth Invested in Real Estate

🔒Does not Affect Credit.

No SSN until you’re ready.

You Need a Tenacious,Competent,Patient,Honest,Committed,Motivated,Well Positioned,Easy Going,Personable,Intelligent, No Pressure,Eager To Help Mortgage Advocate Who Has Obsessively Over-Prepared and Knows Every Single Legal Trick In The Book to Help You Secure Below Market Average Rates and Terms

It sounds like a platitude doesn't it?

I mean, doesn't every lender say they have the best rates and terms?

Just like every car dealership says they have the best prices and every employer will tell you that theirs is the best place to work.

Truth is truth and lies are lies, that's what I always say. The difference with me is that I can back it up because me being here meeting you is all by design.

I don't tell people what they want to hear, I tell people the truth.

And the truth can be backed up with logic and data.... that's what sets it apart.

I'm not asking you to believe the words, I want you to understand the logic and data.

Because if you do, we'll both come to the same conclusion.

You'll be a smarter, more confident mortgage borrower and you'll save hundreds of thousands, if not, millions of dollars in mortgage interest over your lifetime.

WHAT WE ARE

cor·re·spond·ent len·der

/ˌkôrəˈspänd(ə)nt ˈlendər'/

noun

A correspondent lender is a type of lender that originates, underwrites, and funds mortgage loans in their own name, then sells the loans to other lenders. They act as an intermediary between borrowers and investors, and their role is similar to a combination of a retail lender and a mortgage broker.

If you went direct you very likely paid more than you could have for the same exact money, from the same exact place.

The 18 lenders in the logo carousel above are responsible for over $500 BILLION in loan volume after closing over 1 million Separate Mortgages in 2023.

Submiting an Application to Us is Like Submitting To All 18 of These Lenders PLUS an additional 120 or so.

We comparison shop with all 138 Lenders On Every Single File.

You do NOT pay extra for working with us, in fact, for most of these lenders I can get better pricing than you going direct.

As correspondent lenders we get significantly discounted pricing because we take over some of the responsibilities and we're funding with our own capital.

I'll tell you another secret; these 18 lenders, all in the top 50 in Loan Volume in the USA... very rarely have the best available pricing.

I can almost always save people money with smaller lenders that aggresively go after the big dogs.

But This Wasn't Enough For Me.

Saving A Point Or Two On Your Loan Is Great and Well Worth My Effort.

But of You Can't Get Approved At All, What Good Does It Do?

I sought solutions, deep in my cave, obsessing knowing that there was more that I could do.

I won't be able to help everyone, approval is not guaranteed...

But who could use $50,000 - $100,000 in free cash to purchase a home?

I had a suspision that it would help push some people over the edge.

City of Pompano Beach First Time Homebuyer Program

City of Orlando Down Payment Assistance Program

Hallandale Beach Community Redevelopment Agency (HBCRA) First Time Homebuyer Program

Taylor County SHIP First Time Homebuyers Down Payment Assistance Program

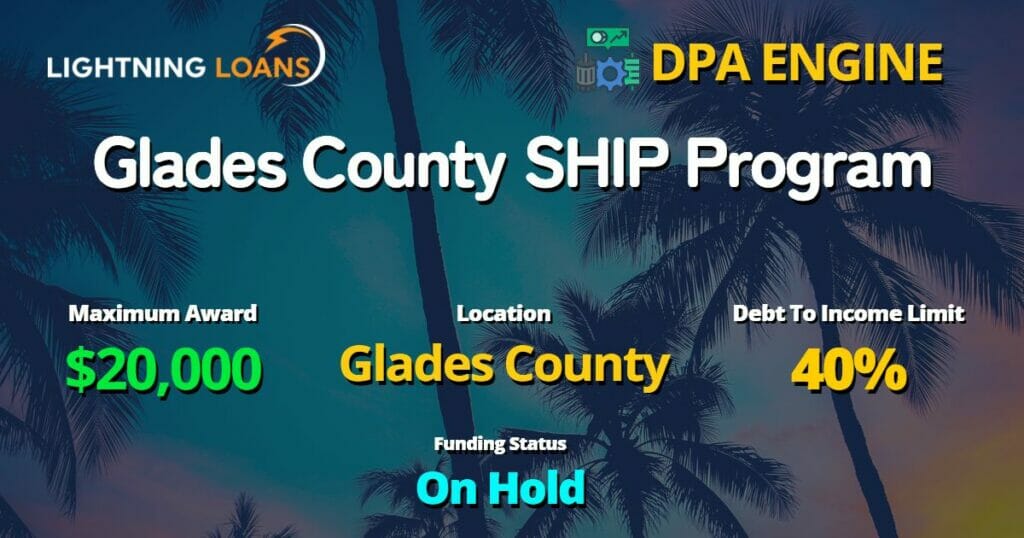

Glades County SHIP Program

Collier County SHIP Purchase Assistance Program

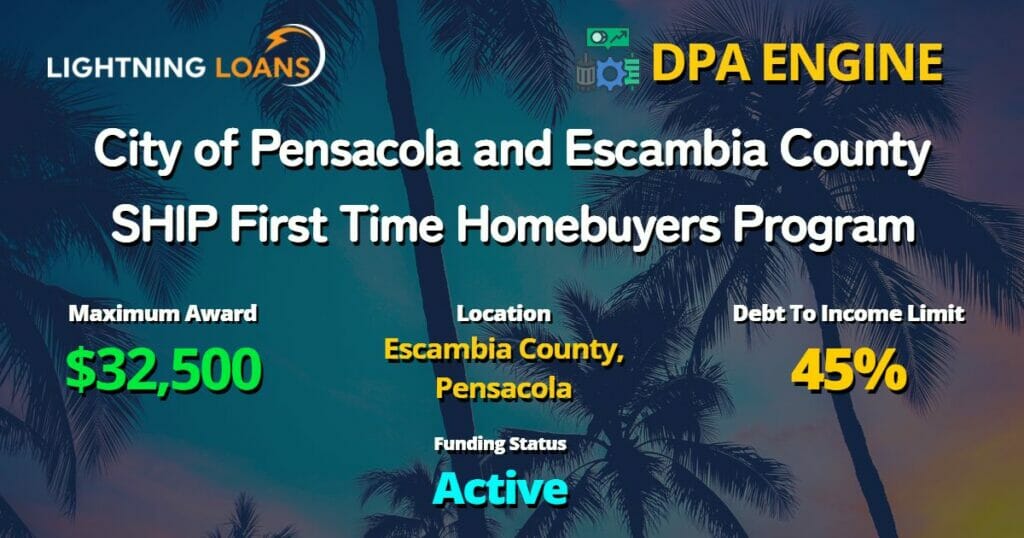

City of Pensacola and Escambia County SHIP First Time Homebuyers Program

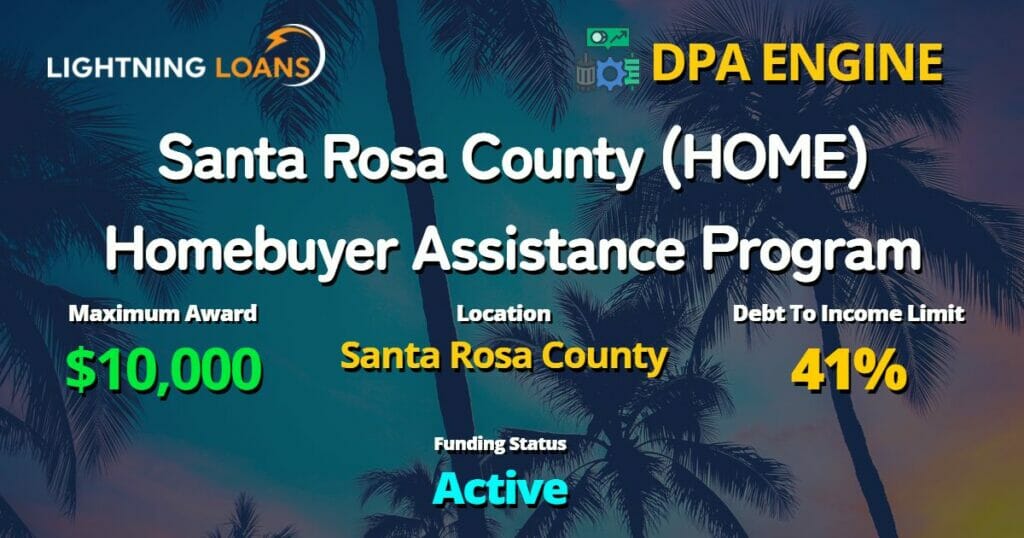

Santa Rosa County (HOME) Homebuyer Assistance Program

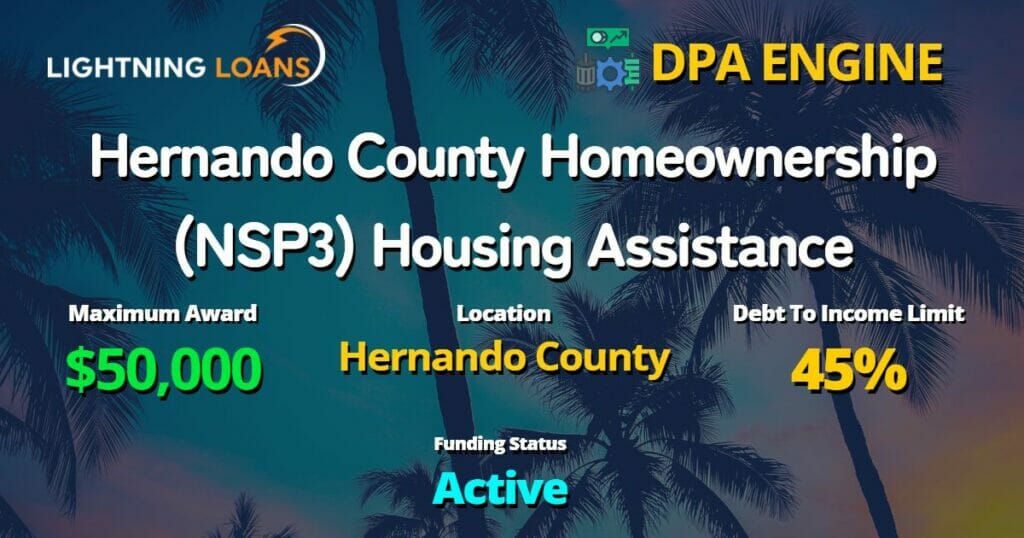

Hernando County Homeownership (NSP3) Housing Assistance

The DPA Rabbit Hole Lead Me To Find 4 or 5 Different Ways To Finance Up To 105% Of The Purchase Price For Some Borrowers. Enought To Cover The Entire Down Payment and Most Of The Closing Costs. (It Won't Work For Everyone)

In my conversations with prospects in Miami I discovered that there a lot of entreprenuers.

In early conversations they confidently tell me their income and I don't think twice about it.

Until it's time to look at their tax returns.

It turns out that the income I could use to qualify them was often times a small fraction of what they thought, felt and said they made.

But with 138 lenders, someone had to have a solution, right?

What about about for Real Estate Investors? Those are my people! Investing and Investors is what got me into the industry the first time around all the way backl in 2004. I come accross smart investors that are doing all the right things. But because of how rental income is calculated on the conventional side (discounted 25%) after 3 or 4 properties they have trouble buying more or cashing out through refi's.

A Mortgage Partner Who Fights for You and is Unusually Prepared For The Unexpected

Clear, concise, and tailored guidance to secure the perfect financing solution, no matter your unique situation.

Everything you need to achieve your residential, investment, or commercial property goals without the lending headaches, qualification anxiety, or unnecessary costs…

Even if the mortgage process seems daunting, time is tight, and everyone around you is content with the status quo.

When you partner with me, you’re not just another file on a lender’s desk. You’re a valued client with unique needs, and I’m here to ensure those needs are met every step of the way.

🔒Does not Affect Credit.

No SSN until you’re ready.

Read What Our Happy Clients Have to Say

Don't Wait, Secure Your Perfect Mortgage Today

FAQ

ask us

anything

How much do I need for a down payment?

The real answer is “it depends on your unique situation.”

First time home buyers who ask this question first often have a nagging concern that they do not have enough, that they need to save up more and that homeownership is something that needs to be postponed into the future because of this lack of funds.

but most undervalue their current position…

First Time Home Buyers are being given the world right now.

There is a multitude of Down Payment Assistance Programs, Grants, 2nd Mortgage with no payments in lieu of of a down payment.

If you’re income is at 80% of the MSA, you’re going to qualify for most programs.

And in some counties 80% of the MSA is a surprisingly high income.

at the other end of the spectrum…

Real Estate Investors who ask this question first are often looking for no money down programs to purchase flips or rentals.

There are no zero down deals for Real Estate Investors.

It’s a program that doesn’t exist.

If you look hard enough you will find people that say they can do it.

Every one of those programs I’ve seen are a con, please be careful.

Investors or “Non Owner Occupied” should plan for 25% of the purchase price if you have 15% it’s worth a conversation but it would depend on a few things.

The lowest down payment would be buying 1 – 4 Units and living in one of the units while renting out the rest.

Owner occupied loan cost significantly less because you’re home is the last thing you’ll let go of if financial disaster strikes.

Technically, there is a way to do it on Commercial Real Estate.

You can, technically, finance up to 100% CLTV if the seller is willing to hold a large SECOND Mortgage.

But its highly unlikely that any seller would accept the terms… it would be crazy to hold a large second mortgage when you can just sell to someone else.

If it’s your dad or an uncle or someone close, they may do it.

Most people are somewhere in the middle of these two extremes.

If you have a lot to put down we’ll do a cost analysis.

Something you can reflect on while you shop for a home and decide how much to keep in the bank.

Maybe we do a HELOC Second so you always have access to a portion of the equity.

Or Look at 10 – 20 Year Options so you can pay if off as soon as possible.

If you don’t have a lot to put down there are some Grants and Down Payment Assistance Programs that I can very quickly determine your eligibility for.

We also have to remember about closing costs.

That other lender may have told you 5% down but did they mention closing costs?

Technically, closing costs and down payment are two different things.

In Florida closing costs are roughly 4% if the purchase price plus the cost of prepaids and points, if you choose to buy down the rate.

It’s one of those double talk marketing word games that we at Lightning Loans refuse to play.

I know what you mean when you say down payment and I’ll always provide a complete answer.

All these words to say what I really mean:

It depends…

With a bit of info I can give a lot of answers, fill out this form and let’s get started.

How does your mortgage process work?

- Needs Analysis

- Application

- Loan Offer/ Disclosures

- Underwriting

- Stipulations

- Closing Disclosures

- Funding

- Stand by until Im needed again…

That’s for those who got through the Down Payment Section… some questions don’t have direct answers because of the vastness of our offerings…

This one does have a direct answer… Total Time for entire process is 21 – 45 Days depending on the loan type and how quickly we recieve documentation after it’s requested.

What documents do I need to provide to apply for a mortgage?

The most accurate information will come if you provide 2 years Tax Returns, Recent Pay Stub, Bank Statements and Retirement Account Statements

But the newer laws in the mortgage industry state that I am to assume that the Residential Mortgage Application is 100% correct and provide a Loan Estimate based off of only app info.

To Apply, you don’t need any documentation.

Once we get to processing/ underwriting that’s when documentation request start coming in.

It can be a little overwhelming but, no worries, we’re here to help.

Our online portal makes it very easy to stay organized.

You’ll drag an drop a few times and be done with it.

How long does the mortgage process take?

The timeline can vary depending on factors such as the type of loan, the complexity of your situation, and how quickly you provide the necessary documents.

On average, the process typically takes 21-45 days from application to closing.

We’ll work efficiently to ensure a timely closing while keeping you informed every step of the way.

What are your mortgage rates?

Mortgage rates can fluctuate daily and depend on various factors, such as your credit score, loan-to-value ratio, and the type of loan you choose.

We work with over 130 lenders to secure the most competitive rates for our clients.

Complete our application, and we’ll provide you with a personalized rate quote based on your unique situation.

Do you offer refinancing options?

Yes, we offer a variety of refinancing options to help you lower your monthly payments, reduce your interest rate, or access your home’s equity.

Whether you’re looking for a rate-and-term refinance or a cash-out refinance, we can help you find the best solution for your needs.